Beruflich Dokumente

Kultur Dokumente

2.BMMF5103 - EQ Formattedl May 2012

Hochgeladen von

thaingtCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2.BMMF5103 - EQ Formattedl May 2012

Hochgeladen von

thaingtCopyright:

Verfügbare Formate

BMMF5103/MAY2012-F/AA-HUTECH

PART A INSTRUCTIONS: 1. THERE ARE TWO (2) QUESTIONS IN THIS PART. 2. ANSWER BOTH QUESTIONS.

Question 1 a. For each case listed below, explain whether it should (or should not) be included in the calculation of the relevant cash flows for a project. i) The disposal value of a previously purchased machine which may be replaced by a proposed project. ii) Money that a firm has committed to spend regardless of whether a project is accepted or rejected. iii) Costs incurred as a result of past decisions. [6 marks] b. You are currently evaluating a new project for your company. The project requires an initial investment in equipment of RM90,000 and an investment in working capital of RM10,000 at the beginning (t = 0). The project is expected to produce sales revenues of RM120,000 for three years. Manufacturing costs are estimated to be 60% of the revenues. The asset is depreciated over the projects life using straight-line depreciation method. At the end of the project (t = 3), you can sell the equipment for RM10,000. The corporate tax rate is 30% and the cost of capital is 15%. Should you accept the project? Why? [10 marks] c. The market value of Chakrawala Corporation' s common stock is RM20 million and the market value of its risk-free debt is RM5 million. The beta of the company' s common stock is 1.25 and the market risk premium is 8%. If the Treasury bill rate is 5%, what is the company' s cost of capital? (Assume no taxes.) [4 marks] [TOTAL: 20 MARKS]

BMMF5103/MAY2012-F/AA-HUTECH

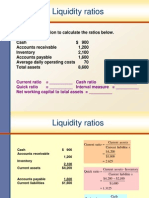

Question 2 a. Your firm has a current ratio of 1.0x. What would you do in order to improve the liquidity of your firm? [4 marks] b. Assuming that everything else remains the same, briefly discuss the effect of an increase in a companys debt ratio to its return on equity. [4 marks] c. The financial ratios and financial statements of BintangTerang Bhd. are given below: BintangTerang Bhd. Key Ratios Industry Actual Average 2010 Current Ratio 1.3 1.0 Quick Ratio 0.8 0.75 Days Sales Outstanding 23 days 30 days Inventory Turnover 21.7 19 Debt Ratio 64.7% 50% Times Interest Earned 4.8 5.5 Gross Profit Margin 13.6% 12.0% Net Profit Margin 1.0% 0.5% Return on total assets 2.9% 2.0% Return on Equity 8.2% 4.0%

Actual 2011 (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x)

Income Statement BintangTerang Bhd. For the Year Ended December 31, 2011 Sales Revenue RM100,000 Less: Cost of Goods 87,000 Sold Gross Profits RM13,000 Less: Operating 11,000 Expenses Operating Profits RM2,000 Less: Interest Expense 500 Net Profits Before Taxes RM1,500 Less: Taxes (40%) 600 Net Profits After Taxes RM900

BMMF5103/MAY2012-F/AA-HUTECH

Balance Sheet BintangTerang Bhd. As at December 31, 2011 Assets Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Stockholders Equity Total Liabilities & Stockholders Equity RM 1,000 8,900 4,350 RM14,250 RM35,000 13,250 21,750 RM36,000 RM 9,000 6,675 RM15,675 4,125 RM19,800 1,000 15,200 RM16,200 RM36,000

Liabilities & Stockholders Equity

You are required: i) Calculate the key ratios of the company in 2011.

ii) Compare the companys financial ratios in 2011 to that of 2010, the industry average and briefly discuss the findings. [12 marks] [TOTAL: 20 MARKS]

BMMF5103/MAY2012-F/AA-HUTECH

PART B INSTRUCTIONS: 1. THERE ARE FIVE (5) QUESTIONS IN THIS PART. 2. ANSWER THREE (3) QUESTIONS ONLY.

Question 1 a. A wealthy art collector has decided to endow her favorite art museum by establishing funds for an endowment which would provide the museum with RM1,000,000 per year for acquisitions into perpetuity. The art collector will give the endowment upon her fiftieth birthday, 10 years from today. She plans to accumulate the endowment by making annual end-of-year deposits into an account. The rate of interest is expected to be 6 percent in all future periods. How much must the art collector deposit each year to accumulate to the required amount? [6 marks] b. Latifah has just received (i.e. t = 0) an annual bonus of RM1,500. Her annual bonuses are expected to grow at 5 percent for the next 5 years. How much will Latifah have at the end of the fifth year if she invests her bonuses (including the most recent bonus, i.e. in Year 5) in a project paying 8 percent per year? [6 marks] c. Assume you have a choice between two deposit accounts. Account I has an annual percentage rate of 7.50 percent but the interest is compounded monthly. Account II has an annual percentage rate of 7.30 percent and the interest is compounded weekly. Which account will you choose? Why? [4 marks] d. In an amortized loan, why does the principal portion of each payment grow over the life of the loan, while the interest portion of each payment decreases over the life of the loan? [4 marks] [TOTAL: 20 MARKS]

BMMF5103/MAY2012-F/AA-HUTECH

Question 2 a. Given the following expected returns and standard deviations of assets I, II, III, and IV, which asset should a risk-averse investor select? Why? Asset I II III IV Expected Return 10% 16% 14% 12% Standard Deviation 5% 10% 9% 8% [5 marks] b. Calculate the expected value, standard deviation of returns, and coefficient of variation for Asset A based on the information given below: Asset A Probability 0.25 0.55 0.20

Possible Outcomes Pessimistic Most likely Optimistic

Returns (%) 5 10 13 [6 marks]

c.

Briefly explain how diversification reduces risk. [4 marks]

d.

Given the following data for a stock: beta = 1.5; risk-free rate = 4%; market rate of return = 12%; and the expected rate of return of the stock = 15%. Is the stock overpriced or underpriced? Explain. [5 marks] [TOTAL: 20 MARKS]

BMMF5103/MAY2012-F/AA-HUTECH

Question 3 a. Compute the current value of a share of common stock of a company whose most recent dividend was RM2.50 and is expected to grow at 3 percent per year for the next 5 years, after which the dividend growth rate will increase to 6 percent per year indefinitely. Assume 10 percent required rate of return. [6 marks] b. You are considering to purchase the stock of Tambunan Tea Bhd. You expect it to pay a dividend of RM3 in 1 year, RM4.25 in 2 years, and RM6.00 in 3 years. You expect to sell the stock for RM100 in 3 years. If your required rate of return for the stock is 12 percent, how much would you pay for the stock today? [4 marks] c. Discuss THREE key differences between common stocks and bonds. [5 marks] d. As a rational investor, what would you do if you find that the expected return of a stock is above its required rate of return? Explain. [5 marks] [TOTAL: 20 MARKS]

Question 4 a. What are some of the advantages and disadvantages of using the internal rate of return (IRR) method in evaluating a project? [6 marks] b. A firm owns a building with a book value of RM150,000 and a market value of RM250,000. If the building is utilized for a project, what would be the opportunity cost (ignore the taxes). Explain your answer. [4 marks] c. The cost of a new machine is RM250,000. The machine has a 3-year life and zero salvage value. If the cash flow each year is equal to 40% of the cost of the machine, calculate the payback period for the project. [4 marks]

BMMF5103/MAY2012-F/AA-HUTECH

d.

Luanti Corp. is considering investing in a new project. The project will need an initial investment of RM2,400,000 and will generate RM1,500,000 (before-tax) cash flows for three years. If the tax rate is 20 percent, calculate the internal rate of return (IRR) for the project. [6 marks] [TOTAL: 20 MARKS]

Question 5 a. Moralee Inc.s bonds have an 8.25 percent coupon and pay interest annually. The face value is RM1,000 and the current market price is RM1,004.60 per bond. The bonds mature in 17.5 years. What is the yield to maturity of the bond? [6 marks] b. Tuaran Fruits Bhd. has a 7 percent coupon bond outstanding that matures in 13.5 years. The bond pays interest semiannually. What is the market price per bond if the face value is RM1,000 and the yield to maturity is 14.78 percent? [6 marks] c. Miri' s Tools has a 9-year, 7 percent annual coupon bond outstanding with a RM1,000 par value. Bintulu' s Tools has a 10-year, 6 percent annual coupon bond with a RM1,000 par value. Both bonds currently have a yield to maturity of 6.5 percent. If the market yield increases to 6.75 percent, which bond will experience more price changes? No calculation is needed, simply justify your answer. [4 marks] d. Damais bonds have a face value of RM1,000 and a current market price of RM1,047.20. The bonds have a 6 percent coupon rate. What is the current yield on these bonds? [4 marks] [TOTAL: 20 MARKS]

QUESTIONS END HERE

Das könnte Ihnen auch gefallen

- 2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013Dokument9 Seiten2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013theatresonicNoch keine Bewertungen

- Homework Economic - Topic 2.3Dokument13 SeitenHomework Economic - Topic 2.3Do Van Tu100% (1)

- Bmac5203 AssgDokument8 SeitenBmac5203 AssgMadhu SudhanNoch keine Bewertungen

- BMLW5103Dokument256 SeitenBMLW5103Thethanh Phamnguyen67% (3)

- CREDIT RISK MANAGEMENTDokument15 SeitenCREDIT RISK MANAGEMENTKhánh LinhNoch keine Bewertungen

- Ratio Analysis - Unit 2Dokument8 SeitenRatio Analysis - Unit 2T S Kumar Kumar100% (1)

- Exercises FS AnalysisDokument24 SeitenExercises FS AnalysisEuniceNoch keine Bewertungen

- Financial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingDokument55 SeitenFinancial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingLê NaNoch keine Bewertungen

- Supply Chain Management: Inventory Models - (Wisner Ch7 Pp. 222-234)Dokument26 SeitenSupply Chain Management: Inventory Models - (Wisner Ch7 Pp. 222-234)Guiliano Grimaldo FERNANDEZ JIMENEZNoch keine Bewertungen

- Chapter 7 Asset Investment Decisions and Capital RationingDokument31 SeitenChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNoch keine Bewertungen

- BÀi tập tài chínhDokument5 SeitenBÀi tập tài chínhlam nguyenNoch keine Bewertungen

- HW Assignment Week 8 Student ID 1567033Dokument2 SeitenHW Assignment Week 8 Student ID 1567033Lưu Gia BảoNoch keine Bewertungen

- Class 1Dokument4 SeitenClass 1skjacobpoolNoch keine Bewertungen

- Acme Corporation: Strategic Plan 2014-2016Dokument9 SeitenAcme Corporation: Strategic Plan 2014-2016Cathlene Tabangcura CarbonelNoch keine Bewertungen

- Practice Test Paper (Executive) - 1Dokument91 SeitenPractice Test Paper (Executive) - 1isha raiNoch keine Bewertungen

- FIN5FMA Tutorial Assessment Task 4 - PracticeDokument4 SeitenFIN5FMA Tutorial Assessment Task 4 - Practicemitul tamakuwalaNoch keine Bewertungen

- Internationalization Theories: Assignment OnDokument9 SeitenInternationalization Theories: Assignment OnRafael AnkonNoch keine Bewertungen

- Budgeting Case StudyDokument3 SeitenBudgeting Case StudystormspiritlcNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentAbdul Moiz YousfaniNoch keine Bewertungen

- FIN 485 Fixed Income Final ExamDokument4 SeitenFIN 485 Fixed Income Final Examtâm minhNoch keine Bewertungen

- Dire Dawa University: College of Business and Economic Department of ManagementDokument20 SeitenDire Dawa University: College of Business and Economic Department of ManagementEng-Mukhtaar CatooshNoch keine Bewertungen

- FAFDokument8 SeitenFAFShaminiNoch keine Bewertungen

- Final Exam AnsDokument8 SeitenFinal Exam AnsTien NguyenNoch keine Bewertungen

- Factors Influencing SME Loan Approval RatesDokument4 SeitenFactors Influencing SME Loan Approval RatesSmita NimilitaNoch keine Bewertungen

- 2.1 Spartan QuestionDokument1 Seite2.1 Spartan Questionসৈকত হাবীবNoch keine Bewertungen

- PM Quiz 6Dokument7 SeitenPM Quiz 6Daniyal NasirNoch keine Bewertungen

- Tugas Metpen 2Dokument2 SeitenTugas Metpen 2Fiqri100% (1)

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Dokument2 SeitenTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengNoch keine Bewertungen

- P2 November 2014 Question Paper PDFDokument20 SeitenP2 November 2014 Question Paper PDFAnu MauryaNoch keine Bewertungen

- Assignment 8 AnswersDokument6 SeitenAssignment 8 AnswersMyaNoch keine Bewertungen

- SLIM Sri LankaDokument93 SeitenSLIM Sri Lankabnsamy100% (1)

- Bbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesDokument8 SeitenBbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesSharon ChinNoch keine Bewertungen

- 344 Tasnims MID PaperDokument12 Seiten344 Tasnims MID PaperRedwan Ahmed ShifatNoch keine Bewertungen

- EBTM 3102 (A) (B)Dokument15 SeitenEBTM 3102 (A) (B)Ija MirzaNoch keine Bewertungen

- Chapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsDokument11 SeitenChapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsRavinesh Amit PrasadNoch keine Bewertungen

- Accounting 1 FinalDokument2 SeitenAccounting 1 FinalchiknaaaNoch keine Bewertungen

- Challenges in Universal BankingDokument2 SeitenChallenges in Universal BankingFreddy Savio D'souza0% (2)

- Mitchells Balance Sheet: Question 1)Dokument3 SeitenMitchells Balance Sheet: Question 1)Hamna RizwanNoch keine Bewertungen

- Linear Programming: Basic Concepts Solution To Solved ProblemsDokument4 SeitenLinear Programming: Basic Concepts Solution To Solved ProblemsVY HOÀNG THÁI NHƯ100% (1)

- BBFA2303 Take Home Exam - Eng & BM - Jan20Dokument10 SeitenBBFA2303 Take Home Exam - Eng & BM - Jan20AnnieNoch keine Bewertungen

- Freezing CompleteDokument14 SeitenFreezing CompleteKeat TanNoch keine Bewertungen

- Bangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Dokument43 SeitenBangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Rifat AnjanNoch keine Bewertungen

- Chapter 4 5 6Dokument4 SeitenChapter 4 5 6nguyen2190Noch keine Bewertungen

- UBFF 2013 BUSINESS FINANCE VALUING COMMON AND PREFERRED STOCKDokument2 SeitenUBFF 2013 BUSINESS FINANCE VALUING COMMON AND PREFERRED STOCKJason LimNoch keine Bewertungen

- IFM - Problem On BopDokument6 SeitenIFM - Problem On BopSatya KumarNoch keine Bewertungen

- Solutions ExtraDokument36 SeitenSolutions ExtraAkshay AroraNoch keine Bewertungen

- Tax 3 RevisionDokument10 SeitenTax 3 RevisionSoon Mei QiNoch keine Bewertungen

- MIGA - Week 2 Assignment Nestle'sDokument2 SeitenMIGA - Week 2 Assignment Nestle'sDharshini A/P KumarNoch keine Bewertungen

- SCM301m Quiz 2 KeyDokument15 SeitenSCM301m Quiz 2 KeyVu Dieu LinhNoch keine Bewertungen

- FIN201 Corporate Finance Unit GuideDokument11 SeitenFIN201 Corporate Finance Unit GuideRuby NguyenNoch keine Bewertungen

- BIT Pilani Financial Management Comprehensive Exam QuestionsDokument2 SeitenBIT Pilani Financial Management Comprehensive Exam QuestionsMohana KrishnaNoch keine Bewertungen

- Bài tập tuần 4 - Case Study SOCADokument2 SeitenBài tập tuần 4 - Case Study SOCAThảo HuỳnhNoch keine Bewertungen

- Case Study PresentationDokument10 SeitenCase Study PresentationSameer MiraniNoch keine Bewertungen

- The Finance Director of Stenigot Is Concerned About The LaxDokument1 SeiteThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNoch keine Bewertungen

- BITS Pilani Distance Learning Mid-Semester Test for Financial ManagementDokument2 SeitenBITS Pilani Distance Learning Mid-Semester Test for Financial ManagementrudypatilNoch keine Bewertungen

- BWFF2023 Financial Management ExamDokument21 SeitenBWFF2023 Financial Management ExamSkuan TanNoch keine Bewertungen

- P2 Financial Management June 2012Dokument9 SeitenP2 Financial Management June 2012Subramaniam KrishnamoorthiNoch keine Bewertungen

- Group Assignment Fm2 A112Dokument15 SeitenGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDokument6 SeitenFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNoch keine Bewertungen

- Accf 2204Dokument7 SeitenAccf 2204Avi StrikyNoch keine Bewertungen

- Authority letters for dividend warrant collectionDokument289 SeitenAuthority letters for dividend warrant collectionkayboiNoch keine Bewertungen

- Navneet Education Ltd. Research Report Prateek - SalampuriaDokument24 SeitenNavneet Education Ltd. Research Report Prateek - SalampuriaPrateek Salampuria100% (1)

- Orca - Share - Media1562481501011Dokument3 SeitenOrca - Share - Media1562481501011Sweetie Gildore LincunaNoch keine Bewertungen

- Chapter 20Dokument5 SeitenChapter 20Rahila RafiqNoch keine Bewertungen

- Cost & Management Accounting Dec 2020Dokument10 SeitenCost & Management Accounting Dec 2020Shivam mishraNoch keine Bewertungen

- Chapter 08 TestbankDokument25 SeitenChapter 08 TestbankBruce ChenNoch keine Bewertungen

- 0 - Kundan Kumar-Consumer Behavior Towards Digital Marketing in Flipkart-1Dokument78 Seiten0 - Kundan Kumar-Consumer Behavior Towards Digital Marketing in Flipkart-1Shubham DasNoch keine Bewertungen

- International Supply Chain Management HKT1.2023 (EN)Dokument8 SeitenInternational Supply Chain Management HKT1.2023 (EN)Thanh Trúc Nguyễn NgọcNoch keine Bewertungen

- 152 0404Dokument27 Seiten152 0404api-27548664Noch keine Bewertungen

- How Southwest Airlines Hedged Jet Fuel Price RiskDokument33 SeitenHow Southwest Airlines Hedged Jet Fuel Price RiskshintsurichanNoch keine Bewertungen

- GDokument10 SeitenGB HamzaNoch keine Bewertungen

- Factors To Consider When Starting A BusinessDokument19 SeitenFactors To Consider When Starting A BusinessHussam Eldein Eltayeb100% (1)

- Mall of IndiaDokument19 SeitenMall of IndiaBhupesh MaharaNoch keine Bewertungen

- Economics Questions From All The LecturesDokument46 SeitenEconomics Questions From All The LecturesDaria RybalkaNoch keine Bewertungen

- 02 Fixed Cost Manufacturing FinishedDokument6 Seiten02 Fixed Cost Manufacturing FinishedpankajNoch keine Bewertungen

- Homework 3Dokument3 SeitenHomework 3sharkfinnnNoch keine Bewertungen

- Banking and Accounting Ledger EssentialsDokument5 SeitenBanking and Accounting Ledger EssentialsMikaella Adriana GoNoch keine Bewertungen

- Financial Accounting: Accounting For Merchandise OperationsDokument84 SeitenFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNoch keine Bewertungen

- Final Audit Super 100 Questions - May 2023 ExamsDokument38 SeitenFinal Audit Super 100 Questions - May 2023 ExamskalyanNoch keine Bewertungen

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Dokument7 SeitenACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573Noch keine Bewertungen

- Market MicrostructureDokument15 SeitenMarket MicrostructureBen Gdna100% (2)

- HR Business Partner - CourseDokument55 SeitenHR Business Partner - Coursesaptaksamadder4Noch keine Bewertungen

- MBA 290 Strategic AnalysisDokument110 SeitenMBA 290 Strategic AnalysisLynette TangNoch keine Bewertungen

- Ind As Summary Charts by BdoDokument53 SeitenInd As Summary Charts by BdoJay PanwarNoch keine Bewertungen

- From Growth To Exit - The Equity Growth AcceleratorDokument33 SeitenFrom Growth To Exit - The Equity Growth AcceleratorTolga UlasNoch keine Bewertungen

- Ch#5 Strategy in M ChannelsDokument7 SeitenCh#5 Strategy in M ChannelsbakedcakedNoch keine Bewertungen

- Unit 3Dokument34 SeitenUnit 3Abdii DhufeeraNoch keine Bewertungen

- Cbse Accountancy Class XIi Sample Paper PDFDokument27 SeitenCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Operations and Supply Chain ManagementDokument22 SeitenOperations and Supply Chain ManagementPranali NagtilakNoch keine Bewertungen

- CIA Answers To Sample QuestionsDokument12 SeitenCIA Answers To Sample QuestionsAlexandru VasileNoch keine Bewertungen

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionVon EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionBewertung: 4.5 von 5 Sternen4.5/5 (2)

- A Place of My Own: The Architecture of DaydreamsVon EverandA Place of My Own: The Architecture of DaydreamsBewertung: 4 von 5 Sternen4/5 (241)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthVon EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNoch keine Bewertungen

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationVon EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationBewertung: 4 von 5 Sternen4/5 (18)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsVon EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- An Architect's Guide to Construction: Tales from the Trenches Book 1Von EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1Noch keine Bewertungen

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialVon EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialNoch keine Bewertungen

- Building Construction Technology: A Useful Guide - Part 1Von EverandBuilding Construction Technology: A Useful Guide - Part 1Bewertung: 4 von 5 Sternen4/5 (3)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Von EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Bewertung: 4.5 von 5 Sternen4.5/5 (86)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseVon EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseBewertung: 5 von 5 Sternen5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedVon EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedBewertung: 5 von 5 Sternen5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Engineering Critical Assessment (ECA) for Offshore Pipeline SystemsVon EverandEngineering Critical Assessment (ECA) for Offshore Pipeline SystemsNoch keine Bewertungen

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsVon EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)