Beruflich Dokumente

Kultur Dokumente

2014 Tax Guide

Hochgeladen von

streettalk700Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2014 Tax Guide

Hochgeladen von

streettalk700Copyright:

Verfügbare Formate

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

There are only three things in life you cant avoid: death, taxes and an angry wife. The bad news is that it is that time of the year again to deal with taxes, the good news is that you dont have to worry about a lot of tax surprises. The American Taxpayer Relief Act of 2012 enacted on Jan. 2, 2013, made many existing tax laws permanent and extended other provisions through 2013. The following guide is a list of tips, traps and suggestions to help you as you prepare your taxes. As always, we highly recommend a qualified and competent CPA to file your taxes while it may be more expensive than filing taxes on your own, the tax and time savings are generally worth it. Note: Every year or so, some temporary tax provisions are renewed by Congress. In recent years, however, lawmakers have let the laws expire and then renewed them retroactively. In 2013, fifty-five tax provisions expired on Dec. 31, 2013. While this doesn't affect your 2013 tax return, it could mean upcoming changes to tax planning for 2014. Good Organization Makes The Process Easier You are going to need: All 1099s, K-1s, and W-2s Last years tax return Receipts Mortgage Interest Statements Cost basis on investments Know details on income from rental properties Realized Capital Gain/Loss Statements

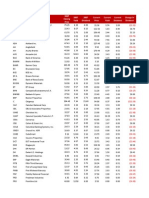

Married Filing Jointly

Head Of Household

Individual Taxpayers

Married Taxpayers Filing Separate

Here is an Income Tax Organizer to get you started. You can use it to get all your information together rather you are doing it yourself or preparing to use a CPA. To get all of the right forms that you will need to file your return go the Internal Revenue Service website directly. You can find all the forms on the home page. Okay, now that you have everything ready to go lets review some of the important information that you need to know. Page | 1

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

The American Taxpayer Relief Act of 2012 (ATRA) has created planning challenges for individuals who earn $200,000 or more. Youll need to navigate financial landmines when it comes to tax-savings strategies. Depending on your earnings you could be subject to new Medicare taxes on wages and net investment income along with higher tax rates on ordinary income, dividends and capital gains. The potential phase-out of itemized deductions is another tax obstacle to deal with now. Singles who earn more than $400,000 and married couples filing jointly who earn more than $450,000 will be hit the hardest as they face a top marginal tax rate of 39.6% up from 35% in 2012. On top of that is the .9% Medicare surtax on earned income in excess of $250,000 if married filing jointly, $200,000 for single filers. Another blow to this group is the increase to long-term capital gain and dividend tax rates from 15% to 20%. In addition, a 3.8% Medicare tax on net investment income has the potential to bring the rates to 23.8% - a total increase over 2012 of 59%. Also, the phase-out of itemized deductions has returned. Called the Pease Limitation, it reduces total itemized deductions by 3% of excess income over certain AGI thresholds, up to a maximum of an 80% of the amount of itemized deductions allowable in a taxable year. Those with adjusted gross incomes of $250,000 (individual), $300,000 for married couples will trigger the reduction. The formula is complicated and should be discussed with a qualified tax advisor to discuss both the impact to you and any strategies that may be available. Ostensibly, those who make $400,000 or more are going to hurt the most by ATRA. Other Stealth Taxes: However, even if your income is below $200,000, below is a list of phase-outs for certain popular tax deductions and credits (meaning that you can lose these credits if your income (Modified Adjusted Gross Income) is below the levels listed below (the range denotes that you lose a portion of the tax benefit once you hit the minimum number in the range and lose it completely once you hit the larger number): Tax Benefit Phase-Out Range (single filers) Phase-Out Range (joint filers) Child Tax Credit $75,000-plus $75,000-plus American Opportunity Credit (College) $80,000 to $90,000 $160,000 to $180,000 Lifetime Learning Credit (College) $52,000 to $64,000 $108,000 to $128,000 Adoption credit $197,880 to $237,880 $197,880 to $237,880 Tuition deduction (College) $65,000 to $80,000 $130,000 to $155,000 Student loan interest deduction $60,000 to $75,000 $125,000 to $155,000 Retirement Savings Credit $17,750 to $29,500 $35,500 to $59,000 Note: If you want to know more about these tax-breaks, some are listed later in this Guide, please call us. Financial planning is complicated for those who make between $200,000 and $450,000 (or even lower for some tax benefits) as a series of income events may trigger investment surcharges and phase-out of itemized deductions. One should work jointly with a knowledge financial planner and tax advisor to create a strategy to alleviate or postpone triggers. Although this is not easy, it can be a very exercise. Page | 2

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Itemize Your Deductions While it is easier to take the standard deduction you could wind up saving a significant amount of tax dollars by itemizing, especially if you: Are self-employed, Own a home, Live in a high-tax area. Qualified expenses exceed the 2013 standard deduction of $6100 for singles and $12,200 for couples

Qualified Deductions

Mortgage Interest Mortgage Points Interest Expense Business Use Of A Car Business Entertainment Expenses Educational Expenses Employee Business Expenses Charitable Donations Misc. Expenses That Exceed 2% Of AGI Home Office Expenses Tax Preparation Expenses Investment Management Fees Medical Expenses Exceeding 10% Of AGI Exemption For Unreimbursed Medical Expenses For Individuals 65 Or Older That Exceed 7.5% Of AGI (Through 2016 Only) Casualty, Disaster and Theft Loss State Sales Taxes

The list to the right list some of the more common qualified deductions. However, in many cases there are special rules for the utilization of the deduction. The link below will direct you to the IRS document which discusses these in detail. Also note on the second link that the business deductions are treated differently depending on whether you are self-employed or are an employee. IRS Tax Topics Itemized Deductions Tax Tips for the Self-Employed

Dont Forget Dependents Enter all Taxpayer Identification Numbers (usually Social Security Numbers) for your children and other dependents on your return. Otherwise, the IRS will deny the: Personal exemption of $3,900 for each dependent, and; The $1,000 child tax credit for each child under age 17.

Attention Divorcees: Only one of you can claim your children as dependents. The IRS has been checking closely lately to make sure spouses arent both using their children as a deduction. The $1,000 child tax credit begins to phase out at $110,000 for married couples filing jointly and at $75,000 for heads of households. New Parents: If you became proud new parents in 2013, congratulations. Make sure that you have filed for a Social Security Card as you will need it. Most hospitals will have done this automatically for you. However, if you DO NOT have a number by the tax filing deadline, the IRS says you should file for an extension. What To Do If You Cant File On Time If you cant finish and file your return on time, make sure you file a Form 4868 by April 15th, 2014. This form will give you a six-month extension through the final filing date of October 15th, 2014. Please note that this is an extension of Page | 3

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

time for filing your return, your taxes are still due on April 15th failure to pay the full amount could lead to IRS interest and penalties. IMPORTANT: On the Form 4868 you will need to make a reasonable estimate of your tax liability for 2013 and pay any balance due with your request. Requesting an extension in a timely manner is especially important if you owe any tax. A late filing and payment could lead to a late-filing penalty of 4.5% per month of the tax owed and a late-payment penalty of 0.5% a month of the tax due. The maximum late filing penalty is 22.5% and the late-payment penalty tops out at 25%. Reinvested Dividends This isnt a tax deduction but it can save money. Make sure that if you reinvest dividends into a stock (DRIP) or a mutual fund that you increase the cost basis accordingly. Failing to do so could lead to a double taxation of the dividends. Job Hunting & Moving Related Expenses In todays economy it probably will not be surprising if you had job hunting costs recently. The table to the right lists the various items that can be deducted not only from looking for a job but also moving to take a job. Military Reservists Travel Expenses All members of the National Guard or military reserve can deduct the costs of travel from drills or meetings. To qualify for the deduction: Drill Or Meeting must be 100 miles, or further, from home AND overnight.

Job Hunting & Moving Expenses

Transportation Incurred As Part Of The Job Search, Including 56.5 Per Mile For Driving Your Own Vehicle Tolls And Parking Fees Food And Lodging If You Are Away From Home Overnight. Cab Fares Employment Agency Fees Costs Of Printing Resumes, Business Cards, Postage And Advertising If Your New Job Is More Than 50 Miles From Your Current Home You Can Deduct Moving Expenses

The following items can be deducted: Lodging 50% of the cost of meals. 56.5 cents per mile if driving your own vehicle. Parking Fees and Tolls Also, you may eligible for other allowances or per diems

Self Employed Individuals Being self-employed can be both a burden and joy. With self-employment comes freedom, responsibility, and with it a lot of expenses. Many self-employed individuals are not aware of some of the tax deductions, credits and write-offs to which they are entitled and the following page is only a brief listing. IMPORTANT: If you are self-employed I highly recommend hiring a good CPA. In the long run it could be one of the best investments you ever make particularly as your business gains traction. Page | 4

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Deductions For The Self Employed

Individual 401k-Plan (Must have NO full-time employees) Max Tax Deductible Contribution: $17,500 + 25% Of Net Income Simplified Employee Pension (SEP-IRA) Max Tax Deductible Contribution: Lesser Of 25% Of Income Or $51,000. (Note: An Equal Percentage Of Income Must Also Be Contributed To All Eligible Employees) Savings Incentive Match Plan For Employees (SIMPLE IRA) Max Tax Deductible Contribution: $12,000 + $2500 For Employees Over Age The Age Of 50. Defined Benefit Pension Plans Traditional Defined Benefit plans should also be considered for incomes over $200,000, especially if you have few or no employees and are nearing retirement age. Business Use Of Home Or Dwelling If Gross Income > Total Expenses Deduct 100% Of All Expenses Related To Business Use Of Your Home If Gross Income < Total Expenses Deduction is limited to the difference between your gross income and the sum of all business expenses you would pay if the business was not in your home. IMPORTANT: You must actually have a dedicated home office that is truly used for work. The living room couch with a laptop will not qualify. The IRS may require verification. Deducting Expenses Automobiles deduct the dollar value of business miles traveled. You can either deduct the actual expenses or take the standard mileage rate. (Important: KEEP A LOG) Depreciation Of Property, Plant & Equipment Things bought for the business that will last longer than one year can be depreciated if they meet the IRS guideline: The property must be owned and used, or held, to generate income. The property should have an estimated useful life of more than one year and should have a reasonable life expectancy. It also may not be purchased and disposed of in the same year. Subject to limitations, some property can be fully depreciated in the first year using IRS Section 179 Deductions. Certain repairs on property used for business may also be deducted. Page | 5

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Deductions For The Self Employed (Cont.)

Educational Expenses Any educational expense is potentially deductible. Taking courses, online or otherwise Buying Research Material Training Classes Seminars Other Potential Deductions Advertising Expenses Promotional Outlays Banking Fees Plane, Train Or Bus Fares Meals As Long As They Are Related To Business Health Insurance Premiums (Tax Credit) Baggage Fees Medicare Premiums For Part B & Part D, Plus Costs Of Medi-Gap

(Only If Not Eligible To Be Covered By Employer Subsidized Health Plan)

Important: Keep All Receipts, Travel & Mileage Logs and Other Expense Records. They will save you time and money if you are audited by the IRS. Long Term Tax Saving Strategies It is better to start thinking sooner, rather than later, about long term tax saving strategies. I am not an accountant, so I again implore that you should consider hiring one early on in your business venture. The following is a list of things to think about to reduce taxes, build wealth and shield assets from liability. Whole Life Insurance and Tax-Deferred Annuities Income Shifting Strategies (to children Employing Family Members) Adequate Business and Personal Liability Insurance Incorporation: Limited Liability Company Defined Benefit Pension Plans and Age Weighted Profit Sharing Plans Social Security and Payroll Tax Optimization Strategies Purchases Land & Buildings Through An LLC and Lease Them Back Page | 6

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Other Potential Tax Credits The IRS has also indexed a few credits for 2013. Here are the updated amounts: Adoption Credit. The maximum credit allowable is $12,970. Phase outs apply for taxpayers with modified adjusted gross income (MAGI) over $194,580 and the credit is completely phased out for taxpayers with MAGI of more than $234,580. By way of explanation, your MAGI is generally your adjusted gross income (AGI), found at line 37 of your federal form 1040, with certain tax preference items like deductions for student loan interest and IRA contributions added back in. Child Tax Credit. The value (as outlined under 24(d)(1)(B)(i)) used to determine the amount of refundable credit is $3,000. American Opportunity Credit. The supercharged Hope Scholarship Credit, known as the American Opportunity Tax Credit will be limited to $2,500. Phaseouts apply for the credit beginning with MAGI over $80,000 ($160,000 for married taxpayers filing jointly). Earned Income Credit (EITC). The EITC numbers for 2013 are as follows: Personal Exemptions. The personal exemption amount is $3,900. PEP (personal exemption phase outs) apply. Standard Deduction Rates. The applicable standard deduction rates for 2013 are $12,200 for married taxpayers filing jointly; $8,950 for head of household; $6,100 for individual taxpayers and $6,100 for married taxpayers filing separate. For purposes of the standard deduction, the amount under 63(c)(5) for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,000 OR ($350 + the individuals earned income). The additional standard deduction amount for the aged or the blind is $1,200; that amount is increased to $1,500 if the taxpayer is single and not a surviving spouse. Itemized Deductions. The limitations on itemized deductions (the Pease limitations) kick in at $300,000 for married taxpayers filing jointly, $275,000 for head of household, $250,000 for single taxpayers and $150,000 in the case of a married individual filing separately. Alternative Minimum Tax (AMT). The applicable AMT thresholds for 2013 are $80,800 for married taxpayers filing jointly; $51,900 for individual taxpayers; and $40,400 for married taxpayers filing separate. Other related IRS adjustments: Rev Proc 2013-15. Affordable Care Act (ObamaCare) Penalties Beginning in 2014, absent a qualified exemption, you will be required to obtain health insurance. If you fail to comply, you will be subject to a penalty of 1.0% of your annual income or $95.00, whichever is greater. In 2015, the penalty increases to the greater of 2.0% of annual income or $325 per person. The following year it becomes the greater of 2.5% of income or $695 per person. After 2016, it will be indexed to the cost of living. Page | 7

Annual Tax Filing Tips, Traps And Information Guide

For Your 2013 Tax Filing

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

It should also be noted that the maximum penalty is capped at three times the per person penalty. For example, if you earn $28,500 in 2014, 1.0% of your income would equal $285. Therefore, if you earn more than this, your maximum penalty would remain the same. All penalties will be due and payable with your annual federal income tax return. Exemption From Non-Compliance Penalties 1. 2. 3. 4. 5. 6. 7. 8. 9. Youre uninsured for less than 3 months of the year; The lowest-priced coverage available to you would cost more than 8% of your household income; You dont have to file a tax return because your income is too low; Youre a member of a federally recognized tribe or eligible for services through an Indian Health Services provider; Youre a member of a recognized health care sharing ministry; Youre a member of a recognized religious sect with religious objections to insurance, including Social Security and Medicare; Your income is less than 133% of the federal poverty level Youre incarcerated, and not awaiting the disposition of charges against you; and Youre not lawfully present in the U.S.

Hardship Exemptions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. You were homeless; You were evicted in the past 6 months or were facing eviction or foreclosure; You received a shut-off notice from a utility company; You recently experienced domestic violence; You recently experienced the death of a close family member; You experienced a fire, flood, or other natural or human-caused disaster that caused substantial damage to your property; You filed for bankruptcy in the last 6 months; You had medical expenses you couldnt pay in the last 24 months; You experienced unexpected increases in necessary expenses due to caring for an ill, disabled, or aging family member; You expect to claim a child as a tax dependent whos been denied coverage in Medicaid and CHIP, and another person is required by court order to give medical support to the child. In this case, you do not have the pay the penalty for the child; As a result of an eligibility appeals decision, youre eligible for enrollment in a qualified health plan (QHP) through the Marketplace, lower costs on your monthly premiums, or cost-sharing reductions for a time period when you werent enrolled in a QHP through the Marketplace; and You were determined ineligible for Medicaid because your state didnt expand eligibility for Medicaid under the Affordable Care Act. Page | 8

Annual Tax Filing Tips, Traps And Information Guide

For 2014 and Beyond

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Now that you are more prepared for your 2013 Tax Return filing, and are most likely depressed, it is time to think of better strategies going forward. Below are several tax-savings ideas that may help you in 2014 and beyond. 1) Targeted investment placement is more important than ever. Especially for those in the highest marginal tax bracket who will experience a bigger tax bite on dividend, investment income and capital gains. Ordinary income producing investments like taxable bonds, real estate investment trusts and high-yielding dividend stocks should be owned within tax-deferred accounts like IRAs and company retirement accounts. For those who earn less than $400,000, dividends will remain at a 15% tax rate however, those with adjusted gross incomes over $200,000 (single filers) and $250,000 (married filing jointly) can still face the 3.8% Medicare Contribution tax on net investment income. Mutual funds should be examined for tax efficiency to determine optimum placement (taxable vs. tax-deferred accounts). Your financial partner should be able to help you examine fund choices for tax-adjusted returns and potential capital gains exposure. Mutual funds with less favorable tax efficiencies should be purchased and held in tax-sheltered accounts if possible. Municipal bonds and master limited partnerships remain attractive in taxable accounts. Exchange-traded funds which are less expensive and generally more tax efficient than mutual funds would be preferable in taxable brokerage accounts. 2) Annuities and permanent life insurance should be considered. Generally, annuities allow for tax deferral of investment income and/or dividends and capital gains, which can be beneficial for high tax bracket individuals seeking favorable savings options once company retirement plan contributions have been maximized. Cash or permanent life insurance may be a greater consideration since a significant amount of wealth may be accumulated and sheltered from taxation. For those who require insurance, ATRA has made whole life insurance a more attractive option for individuals in high marginal tax brackets when compared to term coverage. 3) Begin or increase retirement plan contributions. If youre self-employed and do not have a retirement plan started, consider a SEP-IRA which I call an IRA with muscles. For 2013, an employer (you) may contribute to your employee (you again) the lesser of 25% of an employees gross compensation (20% of your net adjusted self-employment income) or $51,000. You may contribute up to the IRS tax filing deadline of April 15, 2014. SEP contributions for self-employed individuals are above-the-line deductions. They are deducted from gross income to arrive at adjusted gross income and do not need to be itemized so theyre effective for minimizing the bite of higher marginal taxes and possibly the 3.8% surtax. For maximum impact, consider a defined benefit plan or a Solo 401(k) if youre a business owner with stable cash flows (to maintain annual funding) or a high-income sole proprietor. Defined benefit plans are powerful; high earning selfemployed individuals can fund them with six figures annually (over $200,000). If youre an employee, look to increase your 401k or company retirement plan contributions going forward. For 2014 your annual funding limit is $17,500. Those 50 and older are able to make an additional $5,500 catch-up contribution. Contributions are considered above-the-line deductions as well. Page | 9

Annual Tax Filing Tips, Traps And Information Guide

For 2014 and Beyond

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

4) Simplified option for home office deduction now available. The home office deduction has been a challenge to figure out. The standard version is based on calculating the prorated expenses, including mortgage interest allocated to the portion of your home used as a home office deduction. The new simplified option offered by the IRS (began in 2013) can reduce record keeping dramatically. It limits deductions to $1,500 however the calculation is greatly simplified: Its based on $5 a square foot of home used for business, up to 300 square feet. Remember You must regularly use part of your home exclusively for business and you must show that you utilize your home as your principal place of business. See IRS Publication 587 for details. 5) Tax-loss harvesting can be effective. If youre subject to the 3.8% Medicare tax which is applied to the lesser of net investment income or modified adjusted gross income above $200,000 (single filers) or $250,000 (married filing jointly), tax loss harvesting is worth the effort. Selling capital losses to offset capital gains should be examined throughout the year to minimize your tax bill. 6) Consider a surgical Roth conversion process. If youre currently in the 25% marginal tax bracket and expecting to be at 28-39.6% marginal tax rates in the future, its worth formulating a schedule where a targeted amount of dollars is converted from a traditional IRA to a Roth conversion IRA every year. This process can minimize the eventual impact of adding to modified adjusted gross income which may trigger the 3.8% surtax on net investment income as withdrawals from Roth IRAs are tax free. Also, having the option to tap tax free accounts can allow for flexible, tax-effective distribution strategies through retirement. Best to work closely with your tax advisor to determine how much to carve from an IRA to convert each year. You dont want taxable IRA distribution to push you into a higher tax bracket or increase your chances of phasing out of itemized deductions. 7) Consider retire-smart distribution strategies. If you hold IRAs, company retirement accounts, annuities, stock options, brokerage accounts, planning a tax-effective strategy to re-create the paycheck in retirement can be extremely challenging, especially in the face of ATRA. Waiting to withdraw money from tax-deferred accounts until 70 (required minimum distribution age) and exhausting taxable accounts first can be a costly mistake. Working closely with a qualified financial planner and tax strategist before and during retirement to create a flexible distribution method will provide you the most tax-efficient bottom line results. 8) Social Security. If you are above age 62 (age 60 for surviving spouses), you can start to consider various Social Security Retirement Benefit Optimization Strategies. There are many strategies for couples or surviving spouses to maximize their combined Social Security Benefits (such as File and Suspend strategies). However, if you are still working and have not reached your Full Retirement Age (FRA), any claimed Social Security Benefit will begin to be reduced as your income surpasses $15,480 in 2014. Even after Full Retirement Age, 50% of your Social Security Benefit may be subject to income tax if your income is above $25,000 for an individual or $32,000 for a couple. Once your income surpasses $34,000 for an individual or $44,000 for a couple, 85% of your benefit will be subject to income tax. Through better planning, it may be possible to minimize some of the impact of this double taxation. As these Social Security issues can be complex, please consult your financial or tax advisor for more proactive planning in this area. 9) IRAs for Working Children. If you have a high school or college age child, you may want to consider establishing and funding a Roth IRA for them in their name. They are subject to a maximum contribution of the lesser of 100% of their annual salary or $5,500 in 2014. This may be a great way to teach them the benefit of saving and investing. Page | 10

Annual Tax Filing Tips, Traps And Information Guide

For 2014 and Beyond

By Lance Roberts, Richard Rosso, CFP and Scott Bishop, CPA, CFP

Disclaimer and Contact Information STA Wealth does not provide investment, tax, or legal advice. As stated above, we advise that you hire a competent certified public accountant in regards to your personal tax filing situation. We accept no responsibility or liability for any misuse, misinterpretation or misapplication of any of the statements made herein. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Again, each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliablewe cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Lance Roberts CEO / Chief Executive Office STA Wealth Management, LLC. Houston, Texas 77024 Email: lance@stawealth.com Twitter: @lanceroberts Blog: www.streettalklive.com Richard Rosso, CFP Senior Financial Advisor Clarity Financial LLC Houston, Texas 77007 Email: rrosso0710@gmail.com Twitter: @rr0710 Blog: http://myclarityfinancial.wordpress.com/ Scott Bishop, CPA, CFP Director Of Financial Planning STA Wealth Management, LLC Houston, Texas 77024 Linked-In: Scott Bishop Email: scott@stawealth.com

Page | 11

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Property Paras Book DigestDokument8 SeitenProperty Paras Book DigestMary Joyce Lacambra Aquino100% (3)

- GTA Introduction RIA ProDokument7 SeitenGTA Introduction RIA Prostreettalk700100% (2)

- Unified Framework For Fixing Our Broken Tax CodeDokument9 SeitenUnified Framework For Fixing Our Broken Tax Codestreettalk700Noch keine Bewertungen

- AroundTheWorldIn8Pages Q1 2019 LVDokument41 SeitenAroundTheWorldIn8Pages Q1 2019 LVstreettalk700Noch keine Bewertungen

- Russell 3000 "Death Cross" Signals More Pain - 03/30/20Dokument11 SeitenRussell 3000 "Death Cross" Signals More Pain - 03/30/20streettalk700Noch keine Bewertungen

- Not All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20Dokument10 SeitenNot All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20streettalk700Noch keine Bewertungen

- S&P 500 Monthly Valuation Analysis & ReviewDokument14 SeitenS&P 500 Monthly Valuation Analysis & Reviewstreettalk700100% (1)

- SP500 ValuationDokument14 SeitenSP500 Valuationstreettalk700Noch keine Bewertungen

- The US Jobs Market - Much Worse Than The Official Data SuggestDokument14 SeitenThe US Jobs Market - Much Worse Than The Official Data Suggeststreettalk700100% (1)

- Lebowitz - Valuations Matter & The Virtuous CycleDokument26 SeitenLebowitz - Valuations Matter & The Virtuous Cyclestreettalk700100% (2)

- The Great ContaigionDokument9 SeitenThe Great Contaigionstreettalk700Noch keine Bewertungen

- Employment Trends in The U.S.Dokument16 SeitenEmployment Trends in The U.S.streettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Summer Market Outlook & ForecastDokument51 SeitenSummer Market Outlook & Forecaststreettalk700Noch keine Bewertungen

- Unconventional Policies and Their Effects On Financial Markets PDFDokument36 SeitenUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNoch keine Bewertungen

- Investor Intelligence Techical Analysis GuideDokument25 SeitenInvestor Intelligence Techical Analysis Guidestreettalk700Noch keine Bewertungen

- Lance Roberts - Economic & Investment Summit 2017 Opening PresentationDokument30 SeitenLance Roberts - Economic & Investment Summit 2017 Opening Presentationstreettalk700100% (5)

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDokument53 SeitenGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700Noch keine Bewertungen

- EmpDokument6 SeitenEmpdpbasicNoch keine Bewertungen

- RIA Economic & Investment Summit 2016Dokument55 SeitenRIA Economic & Investment Summit 2016streettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Psychology of Risk-Behavioral Finance PerspectiveDokument28 SeitenPsychology of Risk-Behavioral Finance Perspectivestreettalk700Noch keine Bewertungen

- Value Investor Forum Presentation 2015 (Print Version)Dokument29 SeitenValue Investor Forum Presentation 2015 (Print Version)streettalk700Noch keine Bewertungen

- Companies That Cut Dividends in 2008Dokument3 SeitenCompanies That Cut Dividends in 2008streettalk700Noch keine Bewertungen

- Valuations Suggest Extremely Overvalued MarketDokument9 SeitenValuations Suggest Extremely Overvalued Marketstreettalk700Noch keine Bewertungen

- Cycles and Possible OutcomesDokument6 SeitenCycles and Possible Outcomesstreettalk700Noch keine Bewertungen

- Lacy Hunt - Hoisington - Quartely Review Q1 2014Dokument5 SeitenLacy Hunt - Hoisington - Quartely Review Q1 2014TREND_7425Noch keine Bewertungen

- Modern Portfolio Theory 2Dokument21 SeitenModern Portfolio Theory 2streettalk700Noch keine Bewertungen

- Risk Revisited by Howard MarksDokument17 SeitenRisk Revisited by Howard Marksstreettalk700Noch keine Bewertungen

- Understanding The Bear CaseDokument17 SeitenUnderstanding The Bear Casestreettalk700Noch keine Bewertungen

- My Phillips Family 000-010Dokument138 SeitenMy Phillips Family 000-010Joni Coombs-HaynesNoch keine Bewertungen

- Audit Fraud MemoDokument16 SeitenAudit Fraud MemoManish AggarwalNoch keine Bewertungen

- Alcoholic Drinks in India (Full Market Report)Dokument58 SeitenAlcoholic Drinks in India (Full Market Report)Shriniket PatilNoch keine Bewertungen

- Din en Iso 15976Dokument8 SeitenDin en Iso 15976Davi Soares BatistaNoch keine Bewertungen

- Project IPC-IIDokument10 SeitenProject IPC-IIAkanksha YadavNoch keine Bewertungen

- WWW Judicialservicesindia Com Indian Evidence Act Multiple Choice Questions On Indian Evidence Act 13327Dokument20 SeitenWWW Judicialservicesindia Com Indian Evidence Act Multiple Choice Questions On Indian Evidence Act 13327Rekha SinhaNoch keine Bewertungen

- Annexure (1) Scope of Work of S4 HANA ImplementationDokument2 SeitenAnnexure (1) Scope of Work of S4 HANA Implementationmanishcsap3704Noch keine Bewertungen

- 4 - DeclarationDokument1 Seite4 - DeclarationSonu YadavNoch keine Bewertungen

- Travelling in The EUDokument2 SeitenTravelling in The EUJacNoch keine Bewertungen

- Chapter 15 Self Study SolutionsDokument22 SeitenChapter 15 Self Study SolutionsTifani Titah100% (1)

- Blank PdsDokument1 SeiteBlank PdsKarlo BillarNoch keine Bewertungen

- Sixth District Court: Ohio Redistricting DecisionDokument301 SeitenSixth District Court: Ohio Redistricting DecisionWOSU100% (4)

- Monzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsDokument1 SeiteMonzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsMaxNoch keine Bewertungen

- Sea Staff Employment Application FormDokument4 SeitenSea Staff Employment Application FormRifaldi WahyudiNoch keine Bewertungen

- Spark Notes - Julius Caesar - Themes, Motifs & SymbolsDokument3 SeitenSpark Notes - Julius Caesar - Themes, Motifs & SymbolsLeonis MyrtilNoch keine Bewertungen

- Strahlenfolter - Helmut Tondl - Brutal GefoltertDokument4 SeitenStrahlenfolter - Helmut Tondl - Brutal GefoltertUN-FolterlandNoch keine Bewertungen

- AmeriMex Blower MotorDokument3 SeitenAmeriMex Blower MotorIon NitaNoch keine Bewertungen

- Forensic Law ProjectDokument19 SeitenForensic Law ProjectHimanshu SinglaNoch keine Bewertungen

- 4 05A+WorksheetDokument3 Seiten4 05A+WorksheetEneko AretxagaNoch keine Bewertungen

- Has Islam Missed Its EnlightenmentDokument10 SeitenHas Islam Missed Its EnlightenmentT Anees AhmadNoch keine Bewertungen

- Case DigestsDokument12 SeitenCase DigestsMiguel Anas Jr.100% (1)

- Police Officer Cover Letter Minimalist - BlueDokument2 SeitenPolice Officer Cover Letter Minimalist - BlueRia Elrica DayagNoch keine Bewertungen

- 106 Lacanilao Vs CA Full TextDokument4 Seiten106 Lacanilao Vs CA Full TextEl SitasNoch keine Bewertungen

- SM-5 Audit Engagement Letter - FormatDokument2 SeitenSM-5 Audit Engagement Letter - FormatCA Akash AgrawalNoch keine Bewertungen

- Chris VoltzDokument1 SeiteChris VoltzMahima agarwallaNoch keine Bewertungen

- Samahan vs. BLR Case DigestDokument4 SeitenSamahan vs. BLR Case DigestBayoyoy NaragasNoch keine Bewertungen

- BS en 10028-4-2017Dokument18 SeitenBS en 10028-4-2017Ly KhoaNoch keine Bewertungen

- Evidence Case DigestDokument4 SeitenEvidence Case DigestBrenda de la GenteNoch keine Bewertungen

- York County Court Schedule Feb. 27, 2014Dokument11 SeitenYork County Court Schedule Feb. 27, 2014York Daily Record/Sunday NewsNoch keine Bewertungen