Beruflich Dokumente

Kultur Dokumente

Brief Guidelines and Procedures

Hochgeladen von

Aj de CastroOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Brief Guidelines and Procedures

Hochgeladen von

Aj de CastroCopyright:

Verfügbare Formate

Objectives

The objective of the firm is to establish and maintain a system of quality control to provide it with reasonable assurance that: (a) The firm and its personnel comply with professional standards and applicable legal and regulatory requirements; and (b) Reports issued by the firm or engagement partners are appropriate in the circumstances.

Brief Guidelines and Procedures

On Individual Client Accounting/Audit In our practice of audit, we implement those quality control procedures which are, in the context of the policies and procedures of the firm, appropriate to the individual audit. Our audit is then enhanced through timely communications throughout the audit process. We see to it that the professional competent of our assistants performing work delegated to them is considered when deciding the extent of direction, supervision and review appropriate for each assistant. Any delegation of work to assistants would be in a manner that provides reasonable assurance that such work will be performed with due care by persons having the degree of professional competence required in the circumstances. We assess the risks in an audit in a way that the higher the risk, the more persuasive the audit evidence needs to be to provide reasonable assurance on the audit and to mitigate that risk to an acceptable level. We exercise professional skepticism throughout the audit in gathering and objectively evaluating the competency and sufficiency of audit evidence obtained. Our methodology encompasses the following workflow: Risk assessment Obtain an understanding ofthe entity and its environment, including internal control (i.e., evaluate the design and implementation of relevantcontrols) Perform risk assessment procedures and related Activities Identify and assess risks of material misstatement

Design audit responses to address the assessed risks of material misstatement Testing Test operating effectiveness of selected controls Plan and perform substantive procedures Completion Perform completion procedures, including overall review of financial statements Document significant findings and issues Consider if audit evidence obtained is sufficient and appropriate Form an audit opinion Communicate to the audit committee, or those charged with governance, our responsibilities under applicable auditing standards, an overview of the planned scope and timing of the audit, and significant findings from the audit. Direction We see to it that our assistants to whom the work is delegated receives the appropriate direction. Direction involves informing assistants of their responsibilities and the objectives of the procedures they are to perform. It also involves informing them of matters, such as the nature of the entity's business and possible accounting or auditing problems that may affect the nature, timing and extent of audit procedures with which they are involved. Supervision Supervision means directing the efforts of professionals who are involved in accomplishing the objectives of the audit and determining whether those objectives have been met. Elements of supervision include instructing and guiding professionals, keeping informed of significant issues, reviewing the work performed, resolving issues, and agreeing onappropriate conclusions. It is closely related to both direction and review and may involve elements of both. Personnel carrying out supervisory responsibilities perform the following functions during the audit: (a) monitor the progress of the audit to consider whether: (i) assistants have the necessary skills and competence to carry out their assigned tasks; (ii) assistants understand the audit directions; and

(iii) the work is being carried out in accordance with the overall audit plan and the audit programme; (b) become informed of and address significant accounting and auditing questions raised during the audit, by assessing their significance and modifying the overall audit plan and the audit programme as appropriate; and (c) resolve any differences of professional judgement between personnel and consider the level of consultation that is appropriate. Review It is our policy that performance review for each assistant be based on a timely and objective evaluation of individual performance. The work performed by each assistant needs to be reviewed to consider whether: (a) the work has been performed in accordance with the audit programme; (b) the work performed and the results obtained have been adequately documented; (c) all significant audit matters have been resolved or are reflected in audit conclusions; (d) the objectives of the audit procedures have been achieved; and (e) the conclusions expressed are consistent with the results of the work performed and support the audit opinion. The following need to be reviewed on a timely basis: (a) overall audit plan and the audit programme; (b) assessments of inherent and control risks, including the results of tests of control and the modifications, if any, made to the overall audit plan and the audit programme as a result of tests of control; (c) documentation of the audit evidence obtained from substantive procedures and the conclusions drawn therefrom, including the results of consultations; and (d) financial statements, proposed adjustments in financial statements arising out of the auditor's examination, and the auditor's proposed observations/report. The process of reviewing an audit may include, particularly in the case of large complex audits, requesting personnel not otherwise involved in the audit to perform certain additional procedures before issuing the auditor's report.

QUALITY ASSURANCE FRAMEWORK Effectiveness To conduct a quality audit that achieves the desired result that is consistent with the firms objectives and when the process is capable, efficient and consistent with objectives. To operate at a function that all financial data are verifiable. Efficiency To conduct an audit in a manner that the personnel delegated to each audit engagement has the necessary skills and competence and obtains the necessary knowledge about the clients business , that each audit engagement is planned accordingly, and the risk is being assessed to design an audit procedure necessary to provide a reliable audit opinion. Comparability To conduct an audit in a manner that is consistent with the applicable financial reporting framework and adhering to any changes therein to achieve comparability among reports that users desire. Communication To conduct an audit where the auditor communicates the results of the assessment process to give credibility to the service or product for its users. Audit committee To conduct an audit where the partners meet regularly with audit committees to discuss aspects of the audit, communicate information on topics required under professional standards, provide business insights and share the results of the findings of the auditors. a. Operations audit To study a specific unit of an organization for the purpose of measuring its performance. b. Financial reporting To determine whether the financial statements of an entity are fairly presented in accordance with the applicable financial reporting framework. c. Compliance To review an organizations procedures to determine whether the organization has adhered to specific procedures, rules or regulations.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- MAS - First Pre-Board 2014-15 With SolutionsDokument6 SeitenMAS - First Pre-Board 2014-15 With SolutionsAj de CastroNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- ToaDokument14 SeitenToaAj de CastroNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- BALIUAG UNIVERSITY CPA REVIEW 2014-15 STANDARD COST AND VARIANCE ANALYSISDokument10 SeitenBALIUAG UNIVERSITY CPA REVIEW 2014-15 STANDARD COST AND VARIANCE ANALYSISAj de CastroNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Auditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashDokument5 SeitenAuditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashAj de CastroNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Financial Instruments NaDokument6 SeitenFinancial Instruments NaAj de CastroNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Persons Who Give Contribution To SociologyDokument4 SeitenPersons Who Give Contribution To SociologyAj de Castro100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Baliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillDokument7 SeitenBaliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillAj de CastroNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- NFJPIA Christmas Photo Contest RulesDokument7 SeitenNFJPIA Christmas Photo Contest RulesAj de CastroNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- QuestionnaireDokument1 SeiteQuestionnaireAj de CastroNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Direct and Absorption Costing 2014Dokument15 SeitenDirect and Absorption Costing 2014Aj de CastroNoch keine Bewertungen

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDokument34 SeitenChapter I - Definitions SEC. 22. Definitions - When Used in This TitleAj de CastroNoch keine Bewertungen

- Seize A Partner .And Never Be .: RightDokument1 SeiteSeize A Partner .And Never Be .: RightAj de CastroNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Auditing Theory - Solution ManualDokument21 SeitenAuditing Theory - Solution ManualAj de CastroNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Accounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SDokument1 SeiteAccounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SAj de CastroNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Safeguards in An Accounting EnvironmentDokument2 SeitenSafeguards in An Accounting EnvironmentAj de CastroNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Rizal NotesDokument2 SeitenRizal NotesAj de CastroNoch keine Bewertungen

- Finish PreDokument2 SeitenFinish PreAj de CastroNoch keine Bewertungen

- Day 0 and Day 1 schedule for JPIA conferenceDokument4 SeitenDay 0 and Day 1 schedule for JPIA conferenceAj de CastroNoch keine Bewertungen

- Task Delegation MycDokument2 SeitenTask Delegation MycAj de CastroNoch keine Bewertungen

- Ccabeg Case Studies Accountants Public PracticeDokument20 SeitenCcabeg Case Studies Accountants Public PracticeAj de CastroNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Multicolore PDFDokument1 SeiteMulticolore PDFAj de CastroNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- NFJPIA Region 3 Council Election RulesDokument10 SeitenNFJPIA Region 3 Council Election RulesAj de CastroNoch keine Bewertungen

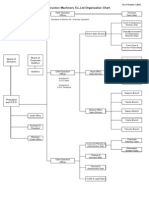

- Itochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsDokument1 SeiteItochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsAj de CastroNoch keine Bewertungen

- Business Ethics and Social ResponsibilityDokument17 SeitenBusiness Ethics and Social ResponsibilityAj de CastroNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Environmental Accounting Reaction PaperDokument3 SeitenEnvironmental Accounting Reaction PaperAj de CastroNoch keine Bewertungen

- Hybrid Varieties PDFDokument1 SeiteHybrid Varieties PDFAj de CastroNoch keine Bewertungen

- VB CodeDokument7 SeitenVB CodeAj de CastroNoch keine Bewertungen

- Estimator PDFDokument4 SeitenEstimator PDFAj de CastroNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Masinag Protocol For Palay PDFDokument1 SeiteMasinag Protocol For Palay PDFAj de CastroNoch keine Bewertungen

- HSWA Main Sections Summary For NEBOSH CertificateDokument4 SeitenHSWA Main Sections Summary For NEBOSH CertificateParashuram PatilNoch keine Bewertungen

- Measuring Liquidity Risk in BankingDokument14 SeitenMeasuring Liquidity Risk in BankingMuhammad AsifNoch keine Bewertungen

- Appraisal Right SlidesDokument39 SeitenAppraisal Right SlidesRyan A. SuaverdezNoch keine Bewertungen

- Oligopoly Practice QuestionsDokument2 SeitenOligopoly Practice QuestionsanirudhjayNoch keine Bewertungen

- BOQ SampleDokument11 SeitenBOQ SampleRakib Alam100% (1)

- Contract Law - Time Limits, Breach and Remedies - Duhaime - Org - Learn LawDokument5 SeitenContract Law - Time Limits, Breach and Remedies - Duhaime - Org - Learn LawMichael BenhuraNoch keine Bewertungen

- Natural Bodybuilding Federation of Ireland MembershipDokument1 SeiteNatural Bodybuilding Federation of Ireland MembershippatsyaherneNoch keine Bewertungen

- MGT 212 Appraising Foreign MarketsDokument26 SeitenMGT 212 Appraising Foreign MarketsjazonvaleraNoch keine Bewertungen

- No 14 AcceptanceDokument3 SeitenNo 14 Acceptanceproukaiya7754Noch keine Bewertungen

- General InformationDokument56 SeitenGeneral InformationLeelaram KhatriNoch keine Bewertungen

- Excess and Surplus Lines Laws in The United States - 2018 PDFDokument154 SeitenExcess and Surplus Lines Laws in The United States - 2018 PDFJosué Chávez CastellanosNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Construction Permits in Cambodia - PDF SeptemberDokument3 SeitenConstruction Permits in Cambodia - PDF SeptemberAnna Võ100% (1)

- Printing MaterialTender DocumentDokument90 SeitenPrinting MaterialTender DocumentShivaschan SaakhaNoch keine Bewertungen

- Order in The Matter of M/s. HBN Dairies & Allied LimitedDokument35 SeitenOrder in The Matter of M/s. HBN Dairies & Allied LimitedShyam SunderNoch keine Bewertungen

- 12633534446151743592898837913995Dokument7 Seiten12633534446151743592898837913995lakshmimurugesanNoch keine Bewertungen

- CIR v. Bicolandia DrugDokument4 SeitenCIR v. Bicolandia DrugMariano RentomesNoch keine Bewertungen

- Quality Manual Rev-27Dokument103 SeitenQuality Manual Rev-27sambhaji100% (1)

- Sigmacover 525: Curing table for dft up to 125 μm CuringDokument2 SeitenSigmacover 525: Curing table for dft up to 125 μm CuringEngTamerNoch keine Bewertungen

- Csap 141211Dokument68 SeitenCsap 141211Shiu LunNoch keine Bewertungen

- Bussiness LawDokument16 SeitenBussiness LawFatima AliNoch keine Bewertungen

- As 4878.8-2001 Methods of Test For Coated Fabrics Determination of Coating AdhesionDokument4 SeitenAs 4878.8-2001 Methods of Test For Coated Fabrics Determination of Coating AdhesionSAI Global - APACNoch keine Bewertungen

- EPCTender DocuDokument461 SeitenEPCTender DocuSHIVAM SINGHALNoch keine Bewertungen

- Law 0f ContractDokument102 SeitenLaw 0f Contracthamnahrico100% (2)

- Carpio, JDokument4 SeitenCarpio, JKennethAnthonyMagdamitNoch keine Bewertungen

- Powers AND Duties OF Controller OF Design: Chanakya National LAW University, PatnaDokument26 SeitenPowers AND Duties OF Controller OF Design: Chanakya National LAW University, Patnaanon_455458658Noch keine Bewertungen

- Auditing Financial StatementsDokument3 SeitenAuditing Financial StatementsMega Pop LockerNoch keine Bewertungen

- BOE Howard Co. v. Foose v. BOE Howard Co - Op.no.17-13Dokument11 SeitenBOE Howard Co. v. Foose v. BOE Howard Co - Op.no.17-13Parents' Coalition of Montgomery County, MarylandNoch keine Bewertungen

- Articles of IncorporationDokument3 SeitenArticles of IncorporationAllyza RenoballesNoch keine Bewertungen

- Mail My CVDokument13 SeitenMail My CVapi-3784571100% (1)

- Final Print 23113 QUALITY CONTROL IN OCCUPATION SAFTY, HEALTH AND ENVRIOMENTDokument125 SeitenFinal Print 23113 QUALITY CONTROL IN OCCUPATION SAFTY, HEALTH AND ENVRIOMENTARIF100% (1)

- Business Process Mapping: Improving Customer SatisfactionVon EverandBusiness Process Mapping: Improving Customer SatisfactionBewertung: 5 von 5 Sternen5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideVon Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideBewertung: 2.5 von 5 Sternen2.5/5 (2)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksVon EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksBewertung: 4 von 5 Sternen4/5 (1)

- Musings on Internal Quality Audits: Having a Greater ImpactVon EverandMusings on Internal Quality Audits: Having a Greater ImpactNoch keine Bewertungen

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekVon EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNoch keine Bewertungen