Beruflich Dokumente

Kultur Dokumente

Review Questions - CH 6

Hochgeladen von

bigbadbear3Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Review Questions - CH 6

Hochgeladen von

bigbadbear3Copyright:

Verfügbare Formate

Ch.

1. It is characteristic of foreign exchange dealers to: A) bring buyers and sellers of currencies together but never to buy and hold an inventory of currency for resale. B) act as market makers, willing to buy and sell the currencies in which they specialize. C) trade only with clients in the retail market and never operate in the wholesale market for foreign exchange. D) All of the above are characteristics of foreign exchange dealers. 2. In the foreign exchange market, ________ seek all of their profit from exchange rate changes while ________ seek to profit from simultaneous exchange rate differences in different markets. A) wholesalers; retailers B) central banks; treasuries C) speculators; arbitrageurs D) dealers; brokers 3. A ________ transaction in the interbank market is the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates. A) spot B) forward-forward C) swap D) futures 4. Most foreign exchange transactions are through the U.S. dollar. If the transaction is expressed as the foreign currency per dollar this known as ________ whereas ________ are expressed as dollars per foreign unit. A) European terms; indirect B) American terms; direct C) American terms; European terms D) European terms; American terms 5. The following is an example of an American term foreign exchange quote: A) $20/ B) 0.85/$ C) 100/ D) none of the above

Ch. 6

Use the table t to answ wer followin ng question n(s).

6. Refer R to Tabl le 6.1. The cu urrent spot rate r of dollar rs per pound d as quoted in n a newspap per is __ _______ or ________. A) 1.4484/$; $0.690 04/ B) $1.4481/; 0.690 06/$ 04/$ C) $1.4484/; 0.690 D) 1.4487/$; $0.690 03/ R to Tabl le 6.1. The one-month fo orward bid p rice for dollars as denom minated in 7. Refer Ja apanese yen is: A) -20. B) -18. C) 129.74/$. D) 129.62/$. 8. Refer R to Tabl le 6.1. The ask price for the t two-year r swap for a British poun nd is: A) $1.4250/. B) $1.4257/. 0. C) -$230 D) -$238 8. 9. Refer R to Tabl le 6.1. Accor rding to the information i provided in the table, th he 6-month y yen is se elling at a fo orward _____ ____ of appr roximately _ ________ pe er annum. (U Use the mid r rates to o make your calculations s.) A) discou unt; 2.09% B) discou unt; 2.06% C) premi ium; 2.09% D) premi ium; 2.06% 10. Given G the following exch hange rates, which w of the e multiple-ch hoice choices represents a potentially pr rofitable inte ermarket arbi itrage oppor rtunity (and w with $1,000,000, how m much rofit you can n make)? pr 129.87/$ 1.1226/$ 0.00864 4/ A) 115.69/ B) 114.96/ C) $0.8908/ D) $0.0077/

2

Ch. 6

AK 1. B 2. C 3. C 4. D 5. A 6. C 7. D 8. B 9. C 10. B

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Mid-Term I Review QuestionsDokument7 SeitenMid-Term I Review Questionsbigbadbear3100% (1)

- Review Questions - CH 7Dokument2 SeitenReview Questions - CH 7bigbadbear3Noch keine Bewertungen

- Review Questions - CH 3Dokument2 SeitenReview Questions - CH 3bigbadbear30% (2)

- Review Questions - CH 4Dokument1 SeiteReview Questions - CH 4bigbadbear3Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Crisk MGMTDokument39 SeitenCrisk MGMTRavi GuptaNoch keine Bewertungen

- Rippling Metrics RedactedDokument17 SeitenRippling Metrics RedactedScott GalvinNoch keine Bewertungen

- A Study On Consumer Perception Towards e CommerceDokument8 SeitenA Study On Consumer Perception Towards e CommerceRaheema Abdul Gafoor100% (1)

- Rochmah Sucita Anggraini: Personal ProfileDokument1 SeiteRochmah Sucita Anggraini: Personal ProfileTia Yustika EnchancersNoch keine Bewertungen

- Optimal Decisions Using Marginal AnalysisDokument9 SeitenOptimal Decisions Using Marginal AnalysisMsKhan0078Noch keine Bewertungen

- Module 1 Financial Analysis and ReportingDokument22 SeitenModule 1 Financial Analysis and ReportingJane Carla Borromeo100% (1)

- Indian Biscuit MarketDokument15 SeitenIndian Biscuit MarketRitushree RayNoch keine Bewertungen

- Examination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessDokument2 SeitenExamination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessJohn Carlos DoringoNoch keine Bewertungen

- Bloque 1 Inglés (TH and Voc)Dokument24 SeitenBloque 1 Inglés (TH and Voc)AnaNoch keine Bewertungen

- DELMIAWORKS Brochure 2019aDokument11 SeitenDELMIAWORKS Brochure 2019aVicente OrtizNoch keine Bewertungen

- GDS, RFPDokument7 SeitenGDS, RFPPavel CraciunNoch keine Bewertungen

- Continental Mini CaseDokument8 SeitenContinental Mini CaseZane BarryNoch keine Bewertungen

- Senior Buyer Purchasing in Boston MA Resume Anthony BarrassoDokument2 SeitenSenior Buyer Purchasing in Boston MA Resume Anthony BarrassoAnthonyBarrassoNoch keine Bewertungen

- Assignment 1 - Financial Accounting - January 21Dokument3 SeitenAssignment 1 - Financial Accounting - January 21Ednalyn PascualNoch keine Bewertungen

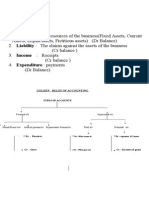

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDokument4 Seiten1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashNoch keine Bewertungen

- Reading 37 - Measures of LeverageDokument2 SeitenReading 37 - Measures of LeverageRach3chNoch keine Bewertungen

- Cost Leadership Strategy - NotesDokument2 SeitenCost Leadership Strategy - NotesKonrad Lorenz Madriaga UychocoNoch keine Bewertungen

- Branch Accounts Theory and Problems PDFDokument18 SeitenBranch Accounts Theory and Problems PDFketanNoch keine Bewertungen

- Forecasting Revenues and Cost To Be IncurredDokument7 SeitenForecasting Revenues and Cost To Be IncurredCharley Vill Credo100% (1)

- Information System in Organizations: Teori Sistem Informasi-2023Dokument32 SeitenInformation System in Organizations: Teori Sistem Informasi-2023Intan Imarmas Nababan578Noch keine Bewertungen

- Introduction To Marketing Management MNM1503Dokument27 SeitenIntroduction To Marketing Management MNM1503Melissa0% (1)

- Taller Monitoria Exame FinalDokument4 SeitenTaller Monitoria Exame FinalFelipeNoch keine Bewertungen

- Developing Marketing Strategies and Plans - Group 3Dokument26 SeitenDeveloping Marketing Strategies and Plans - Group 3Angel CabreraNoch keine Bewertungen

- Microsoft Power Point - Value Chain Analysis & Bench MarkingDokument23 SeitenMicrosoft Power Point - Value Chain Analysis & Bench MarkingDillip Khuntia100% (3)

- SCM Sunil Chopra Chapter 2 DISCUSSION QUESTION.Dokument11 SeitenSCM Sunil Chopra Chapter 2 DISCUSSION QUESTION.Seher NazNoch keine Bewertungen

- Case 10.4 - Expenditure CycleDokument20 SeitenCase 10.4 - Expenditure CycleMuhammad Fahmi Ramadhan17% (6)

- Chapter 02 The CPA ProfessionDokument11 SeitenChapter 02 The CPA ProfessionMinh Anh VũNoch keine Bewertungen

- 4305 IGCSE Accounting MSC 200907171Dokument18 Seiten4305 IGCSE Accounting MSC 200907171Simra RiyazNoch keine Bewertungen

- AFM - Module 3Dokument61 SeitenAFM - Module 3Abhishek JainNoch keine Bewertungen

- Midterm Exam in Aacp - PupDokument10 SeitenMidterm Exam in Aacp - PupmahilomferNoch keine Bewertungen