Beruflich Dokumente

Kultur Dokumente

General Knowledge Today - 79

Hochgeladen von

niranjan_meharOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

General Knowledge Today - 79

Hochgeladen von

niranjan_meharCopyright:

Verfügbare Formate

Articles from General Knowledge Today

Reserve Bank of India

2011-04-28 08:04:59 GKToday

In 1926, the Royal Commission on Indian Currency and Finance which is also known as the Hilton-Young Commission recommended the creation of a central bank. The idea was twofold: 1. To separate the control of currency and credit from the government 2. To augment banking facilities throughout the country. The Reserve Bank of India Act of 1934 established the Reserve Bank as the banker to the central government and set in motion a series of actions culminating in the start of operations on April 1, 1935. RBI was started with a Share Capital of ` 5 crore , divided into shares of ` 100 each fully paid up. In the beginning, entire capital was owned by the private shareholders. The British Government of India held shares of nominal value (` 2, 20,000) only. The Central office of RBI initially was Kolkata. It was shifted to Mumbai in 1937. But, since function of the Bank was of public nature, the RBI act of 1934 had provided the appointment of the Governor and two deputy Governors by the Central Government. In 1949, RBI was nationalized and since then, its role and functions have undergone numerous changesas the nature of the Indian economy has changed. Important Landmarks In 1926, the Royal Commission on Indian Currency and Finance recommended creation of a central bank for India. In 1927, a bill to give effect to the above recommendation was introduced in the Legislative Assembly, but was later withdrawn due to lack of agreement among various sections of people. In 1933, the White Paper on Indian Constitutional Reforms recommended the creation of a Reserve Bank. A fresh bill was introduced in the Legislative Assembly. In 1934, the Bill was passed and received the Governor General's assent In 1935, Reserve Bank commenced operations as India's central bank on April 1 as a private shareholders' bank with a paid up capital of rupees five crore. In 1942 Reserve Bank ceased to be the currency issuing authority of Burma

(now Myanmar). In 1947, Reserve Bank stopped acting as banker to the Government of Burma. In 1948, Reserve Bank stopped rendering central banking services to Pakistan. In 1949, the Government of India nationalized the Reserve Bank under the Reserve Bank (Transfer of Public Ownership) Act, 1948. In 1949, Banking Regulation Act was enacted. In 1951, India embarked in the Planning Era. In 1966, the Cooperative Banks came within the regulations of the RBI. Rupee was devaluated for the first time. In 1969, Nationalization of 14 Banks was a Turning point in the history of Indian Banking. In 1973, the Foreign Exchange Regulation act was amended and exchange control was strengthened. In 1974, the Priority Sector Advance Targets started getting fixed. In 1975, Regional Rural Banks started In 1985, the Sukhamoy Chakravarty and Vaghul Committee reports embarked the era of Financial Market Reforms in India. In 1991, India came under the Balance of Payment crisis and RBI pledged Gold to shore up reserves. Rupee was devaluated. In 1991-92, Economic Reforms started in India. In 1993, Exchange Rate became Market determined. In 1994, Board for Financial Supervision was set up. In 1997, the regulation of the Non Banking Financial Companies (NBFC) got strengthened. In 1998, Multiple Indicator Approach for monetary policy was adopted for the first time. In 2000, the Foreign Exchange Management Act (FEMA) replaced the erstwhile FERA. In 2002, The Clearing Corporation of India Ltd Started operation. In 2003, Fiscal Responsibility and Budget Management Act (FRBMA) enacted. In 2004, Liquidity Adjustment Facility (LAF) started working fully. In 2004, Market Stabilization Scheme (MSS) was launched. In 2004 Real Time Gross Settlement (RTGS) started working. In 2006, Reserve Bank of India was empowered to regulate the money, forex, G-Sec and Gold related security markets. In 2007, Reserve bank of India was empowered to regulate the Payment systems. In 2008-09, world under the grip of Global Financial Slowdown, RBI Proactive. India on the path of recovery. RBI plays a major role in developing India rising as a economic superpower. Structure of RBI: The Reserve Bank of India is wholly owned by the Government of India. Its structure is simply represented by the following:

1. 2. 3. 4. 5. 6.

Central Board of Directors Committee of the central Board Board for Financial Supervision Board for Payment and Settlement Systems Subcommittees of the Central Board Local Boards. Central Board of Directors

RBI's business is overseen by Central Board of Directors, which delegates the functions to its committees and sub-committees. The Central Board of Directors is made up of the following: One Governor Four Deputy Governors (4 is the maximum number) Four Non-official Directors which are nominated by the Central Government. Each Non-official director represents the local Boards located in Delhi, Chennai, Kolkata and Mumbai representing 4 regions of India. Ten Non-official Directors nominated by the Reserve Bank of India. These 10 personalities have expertise in various segments of Indian Economy. One Representative of the central Government. Please note: The Central Board of Directors holds minimum 6 meetings every year. Out of which, at least 1 meeting every quarter is held. Though, typically the committee of the central board meets every week (Wednesday). Board for Financial Supervision The Board of Financial Supervision (BFS) was constituted in November 1994 as a committee of the Central Board of Directors of the Reserve Bank of India with an objective to undertake consolidated supervision of the financial sector comprising commercial banks, financial institutions and non-banking finance companies. The Financial Supervision functions are carried out by the Reserve Bank of India under the guidance of the Board for Financial Supervision (BFS). Board for Financial Supervision is chaired by the Governor of Reserve Bank. The chairman is supported by the 4 co-opted directors as members for a 2 year term. There is a Vice chairman of the board who is one of the Deputy Governors of the Bank. The Board meets typically every month. BFS Regulates and supervises commercial banks, Non-Banking Finance Companies (NBFCs), development finance institutions, urban co-operative banks and primary dealers. Some typical functions are: 1. Restructuring of the system of bank inspections

2. Introduction of off-site surveillance, 3. Strengthening of the role of statutory auditors and 4. Strengthening of the internal defenses of supervised institutions. Board for Payment and Settlement Systems Board for Payment and Settlement Systems was constituted by the Reserve Bank in 2005 as a Committee of its Central Board. The functions are to regulate and supervise the payment and settlement systems. It is chaired by the Governor of Reserve Bank of India and its members are all the four Deputy Governors and two Non-Official Directors of the Central Board. Some of the typical Functions of BPSS are as follows: 1. Lay down policies relating to the regulation and supervision of all types of payment and settlement systems. 2. Set standards for existing and future systems 3. Approve criteria for authorization of payment and settlement systems 4. Determine criteria for membership to these systems, including continuation, termination and rejection of membership. 5. With regard to the payment and settlement systems, BPSS is the highest policy making body in the country. Electronic, non-electronic, domestic and cross-border payment and settlement systems which affect the domestic transactions are regulated by BPSS. Sub-committees of the Central Board Includes those on Inspection and Audit; Staff; and Building. Focus of each subcommittee is on specific areas of operations.

Local Boards Local Boards are located in Chennai, Kolkata, Mumbai and New Delhi and represent the country's four regions. Local board members, appointed by the Central Government for four-year terms, represent regional and economic interests and the interests of co-operative and indigenous banks Departments, Regional Offices, Branches and Centers Reserve Bank of India has 26 departments which focus on policy issues in the Reserve Bank's functional areas and internal operations. There are 27 regional offices of RBI and branches which work as its operational arms and customer interfaces, headed by Regional Directors. Smaller branches / sub-offices are headed by a General Manager / Deputy General Manager. The training centers of RBI are as follows:

1. The Reserve Bank Staff College, Chennai 2. College of Agricultural Banking at Pune 3. Zonal Training Centres, located at regional offices, train non-executive staff. Apart from that following are RBI funded Research Institutions: 1. National Institute of Bank Management (NIBM) : Pune, 2. Indira Gandhi Institute of Development Research (IGIDR) : Mumbai 3. Institute for Development and Research in Banking Technology (IDRBT) Hyderabad. RBI's Subsidiaries RBI has following subsidiaries Deposit Insurance and Credit Guarantee Corporation,DICGC National Housing Bank Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL) NABARD

Das könnte Ihnen auch gefallen

- Reserve Bank of India: Central Board of Directors: 1Dokument5 SeitenReserve Bank of India: Central Board of Directors: 1Pranav SharmaNoch keine Bewertungen

- Introduction of Reserve Bank of IndiaDokument9 SeitenIntroduction of Reserve Bank of IndiaAbeer Mansingh MahapatraNoch keine Bewertungen

- Reserve Bank of IndiaDokument22 SeitenReserve Bank of IndiaSrinivasarao KurraNoch keine Bewertungen

- Unit 2Dokument13 SeitenUnit 2Vicky KumarNoch keine Bewertungen

- Subject - Management of Financial Institutions: Class - Mba Iii PupDokument13 SeitenSubject - Management of Financial Institutions: Class - Mba Iii PupSikander BehalNoch keine Bewertungen

- BankingDokument49 SeitenBankingRitu BhatiyaNoch keine Bewertungen

- Rbi PDFDokument24 SeitenRbi PDFVandana SharmaNoch keine Bewertungen

- Reserve Bank of India Act, 1934: EstablishmentDokument4 SeitenReserve Bank of India Act, 1934: Establishmentagrawalvaibhav729Noch keine Bewertungen

- Reserve Bank of India-Central Bank of India: HistoryDokument22 SeitenReserve Bank of India-Central Bank of India: HistorymaggyfinNoch keine Bewertungen

- Banking Law Unit 2Dokument17 SeitenBanking Law Unit 2D. BharadwajNoch keine Bewertungen

- 1029 RBI As Watchdog of Indian Economic ScenerioDokument36 Seiten1029 RBI As Watchdog of Indian Economic ScenerioAnkur GuptaNoch keine Bewertungen

- RESERVE BANK OF INDIA Its Origin, Structure and Function - ReportDokument11 SeitenRESERVE BANK OF INDIA Its Origin, Structure and Function - ReportAnirban DebNoch keine Bewertungen

- Reserve Bank of India भारतीय रिरज़र्व बैंकDokument14 SeitenReserve Bank of India भारतीय रिरज़र्व बैंकRahul MittalNoch keine Bewertungen

- Role of RBI in Control of Credit - Economics Project Class 12 (2019-20)Dokument22 SeitenRole of RBI in Control of Credit - Economics Project Class 12 (2019-20)Anonymous JbDKaC78% (134)

- Rbi and Its Monetary PolicyDokument5 SeitenRbi and Its Monetary PolicyPravin NisharNoch keine Bewertungen

- Project Report On The Reserve Bank of IndiaDokument64 SeitenProject Report On The Reserve Bank of IndiaAtharv VartakNoch keine Bewertungen

- RBIDokument22 SeitenRBIआकाश स्व.Noch keine Bewertungen

- Reserve Bank of IndiaDokument10 SeitenReserve Bank of Indiadev sharmaNoch keine Bewertungen

- Project Role of RBI Word Doc.3Dokument66 SeitenProject Role of RBI Word Doc.3nilesh dhivreNoch keine Bewertungen

- Commerce Project Class 9Dokument19 SeitenCommerce Project Class 9Asir JoshuaNoch keine Bewertungen

- Introduction of Reserve Bank of IndiaDokument14 SeitenIntroduction of Reserve Bank of IndiaGirish Lundwani88% (42)

- Financial Markets & InstitutionsDokument385 SeitenFinancial Markets & InstitutionsMohammed ajaz AHMEDNoch keine Bewertungen

- Project of Banking Law: Central University of South BiharDokument12 SeitenProject of Banking Law: Central University of South BiharAnjali SinhaNoch keine Bewertungen

- Role of RBI Under Banking Regulation Act, 1949Dokument11 SeitenRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Working of RBI: Supervised By: DR - Anjana AttriDokument25 SeitenWorking of RBI: Supervised By: DR - Anjana AttriKajal ChaudharyNoch keine Bewertungen

- Role of RBI Under Banking Regulation Act, 1949Dokument5 SeitenRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Bfi RbiDokument32 SeitenBfi RbiLalit ShahNoch keine Bewertungen

- Roles & Functions of RBIDokument24 SeitenRoles & Functions of RBIAvanishNoch keine Bewertungen

- Reserve Bank of IndiaDokument21 SeitenReserve Bank of IndiaAcchu BajajNoch keine Bewertungen

- Indian Banking SystemDokument57 SeitenIndian Banking Systemsamadhandamdhar6109100% (1)

- Central Bank of India (Eco Project)Dokument2 SeitenCentral Bank of India (Eco Project)Shivam TanejaNoch keine Bewertungen

- Reserve Bank of IndiaDokument9 SeitenReserve Bank of IndiaArun DalalNoch keine Bewertungen

- Good MorningDokument24 SeitenGood MorningManoj KumarNoch keine Bewertungen

- Madhusmita Kananika Pradhan Assgn - 1Dokument21 SeitenMadhusmita Kananika Pradhan Assgn - 1smartvicky4uNoch keine Bewertungen

- Reserve Bank of India WikipediaDokument11 SeitenReserve Bank of India WikipediaMradul YadavNoch keine Bewertungen

- Major Activities of RBIDokument9 SeitenMajor Activities of RBIPrateek GuptaNoch keine Bewertungen

- Blackbook ProjectDokument42 SeitenBlackbook ProjectTasbi KhanNoch keine Bewertungen

- Registration For Wiki Conference India 2011Dokument18 SeitenRegistration For Wiki Conference India 2011Jasjeet KaurNoch keine Bewertungen

- Assignment - Banking & InsuranceDokument4 SeitenAssignment - Banking & Insurancesandeep_kadam_7Noch keine Bewertungen

- RBI (Basic Info.)Dokument4 SeitenRBI (Basic Info.)Gowher MajidNoch keine Bewertungen

- CHAPTER 3 RBI and Monetary PolicyDokument27 SeitenCHAPTER 3 RBI and Monetary PolicyPraveen KumarNoch keine Bewertungen

- Reserve Bank of IndiaDokument10 SeitenReserve Bank of IndiasardeepanwitaNoch keine Bewertungen

- Samiksha Work Final PDFDokument78 SeitenSamiksha Work Final PDFSANKET ThakurNoch keine Bewertungen

- Lecture2 RBIDokument12 SeitenLecture2 RBIbackupsanthosh21 dataNoch keine Bewertungen

- History: The Old RBI Building in MumbaiDokument7 SeitenHistory: The Old RBI Building in MumbaiAkshay JainNoch keine Bewertungen

- Eco Project Rbi 2Dokument19 SeitenEco Project Rbi 2tusharNoch keine Bewertungen

- Hamdard Institue of Legal Studies AND RESEARCH (2019-24)Dokument13 SeitenHamdard Institue of Legal Studies AND RESEARCH (2019-24)Ambreen ShamsiNoch keine Bewertungen

- Role of The Reserve Bank of IndiaDokument51 SeitenRole of The Reserve Bank of Indiapadmavathi mandry100% (1)

- Of RbiDokument16 SeitenOf RbiMohit VinayakNoch keine Bewertungen

- Reserve Bank of IndiaDokument16 SeitenReserve Bank of IndiaAlpa GhoshNoch keine Bewertungen

- CH1 RbiDokument11 SeitenCH1 RbiAniketNoch keine Bewertungen

- Acfrogazzjejoc1moktw9rsas6fatyjvhtnbv3ad5faapd28rnkhgf Hfwmg4bcq Nsrwme8d H3v1it5h2txfkji0vyc4gkzfpj 5l87a1sbznawivaah2mkybogemycicm2k1pzoqgcnsycvfwDokument17 SeitenAcfrogazzjejoc1moktw9rsas6fatyjvhtnbv3ad5faapd28rnkhgf Hfwmg4bcq Nsrwme8d H3v1it5h2txfkji0vyc4gkzfpj 5l87a1sbznawivaah2mkybogemycicm2k1pzoqgcnsycvfwdilipkumar.1267Noch keine Bewertungen

- Unit - 1: Introduction To Indian Banking SystemDokument109 SeitenUnit - 1: Introduction To Indian Banking SystemDr. S. Nellima KPRCAS-CommerceNoch keine Bewertungen

- Rbi Lender of Last ResortDokument20 SeitenRbi Lender of Last ResortGarima AgrawalNoch keine Bewertungen

- Presented By:-: Manish GuptaDokument17 SeitenPresented By:-: Manish GuptaManish GuptaNoch keine Bewertungen

- Reserve Bank of India Act 1934 and RBIDokument8 SeitenReserve Bank of India Act 1934 and RBIαиgєl ѕєlєиαNoch keine Bewertungen

- Rbi ProjectDokument37 SeitenRbi ProjectSupriya ThakurNoch keine Bewertungen

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- InitiateSingleEntryPaymentSummary17 06 2017 PDFDokument1 SeiteInitiateSingleEntryPaymentSummary17 06 2017 PDFniranjan_meharNoch keine Bewertungen

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDokument4 SeitenMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharNoch keine Bewertungen

- NSS 3-Reliable Low-Power Multiplier PDFDokument10 SeitenNSS 3-Reliable Low-Power Multiplier PDFThahsin ThahirNoch keine Bewertungen

- 09 Chapter4Dokument23 Seiten09 Chapter4niranjan_meharNoch keine Bewertungen

- Wand Hare 2015Dokument11 SeitenWand Hare 2015niranjan_meharNoch keine Bewertungen

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDokument4 SeitenMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharNoch keine Bewertungen

- Rls AlgorithmDokument15 SeitenRls Algorithmniranjan_meharNoch keine Bewertungen

- No ThanksDokument5 SeitenNo Thanksniranjan_meharNoch keine Bewertungen

- Without Applying Induction Motor Voltage SagDokument4 SeitenWithout Applying Induction Motor Voltage Sagniranjan_meharNoch keine Bewertungen

- Example16 SIMULINK PDFDokument11 SeitenExample16 SIMULINK PDFgomgomNoch keine Bewertungen

- 05676476Dokument8 Seiten05676476niranjan_meharNoch keine Bewertungen

- Simulationlab EE0405 PDFDokument78 SeitenSimulationlab EE0405 PDFDhondiram KakreNoch keine Bewertungen

- Original Image To Be SelectedDokument5 SeitenOriginal Image To Be Selectedniranjan_meharNoch keine Bewertungen

- Brahma Kadi GinaDokument4 SeitenBrahma Kadi GinaAswith R ShenoyNoch keine Bewertungen

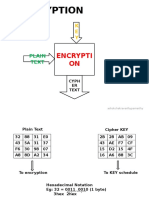

- Aes Encryption: Encrypti ONDokument12 SeitenAes Encryption: Encrypti ONniranjan_meharNoch keine Bewertungen

- Stores - ObsDokument4 SeitenStores - Obsniranjan_meharNoch keine Bewertungen

- The Importance of Hard Work in SuccessDokument1 SeiteThe Importance of Hard Work in Successniranjan_meharNoch keine Bewertungen

- PTC - Sustainability ReportDokument4 SeitenPTC - Sustainability ReportgavinilaaNoch keine Bewertungen

- Admission Schedule 201401132015Dokument2 SeitenAdmission Schedule 201401132015niranjan_meharNoch keine Bewertungen

- Research Activities Published Paper ICPS04Dokument6 SeitenResearch Activities Published Paper ICPS04Luiza DraghiciNoch keine Bewertungen

- Mysteries of The Sacred Universe - An OverviewDokument11 SeitenMysteries of The Sacred Universe - An Overviewniranjan_mehar100% (2)

- PTC Corporate Presentation-30!09!2012Dokument25 SeitenPTC Corporate Presentation-30!09!2012niranjan_meharNoch keine Bewertungen

- RasdfsDokument39 SeitenRasdfsKeyur GajjarNoch keine Bewertungen

- TeluguvDokument1 SeiteTeluguvniranjan_meharNoch keine Bewertungen

- 2013 2013 1 PB PDFDokument28 Seiten2013 2013 1 PB PDFImran ShahzadNoch keine Bewertungen

- Detailed Project Report Solar PVDokument19 SeitenDetailed Project Report Solar PVbakoolk100% (3)

- RulesDokument39 SeitenRulesniranjan_meharNoch keine Bewertungen

- Sri Yantra A DESTINEYDokument14 SeitenSri Yantra A DESTINEYsssmouNoch keine Bewertungen

- DO 198-18 (As of 12 February 2019)Dokument46 SeitenDO 198-18 (As of 12 February 2019)Akbar Tumale100% (2)

- Contractual Claims: Focusing OnDokument1 SeiteContractual Claims: Focusing OnIsuru Deshan WijewardanaNoch keine Bewertungen

- Title XII Deposit (1962-2009)Dokument8 SeitenTitle XII Deposit (1962-2009)BreAmber100% (1)

- The Salient Features of The Participation of Workers in Management BillDokument1 SeiteThe Salient Features of The Participation of Workers in Management BillNikita SangalNoch keine Bewertungen

- EASA AD No.: 2012-0037Dokument2 SeitenEASA AD No.: 2012-0037IventNoch keine Bewertungen

- Appeal Memo Draft - DennisDokument12 SeitenAppeal Memo Draft - Dennismark_ortencioNoch keine Bewertungen

- Easa Part 145 Rev.01Dokument146 SeitenEasa Part 145 Rev.01airsor100% (1)

- Trademark 2014 SyllabusDokument8 SeitenTrademark 2014 SyllabusMaya Julieta Catacutan-EstabilloNoch keine Bewertungen

- Medicina en Odontolog A Manejo Dental de Pacientes Con Enfermedades Sist Micas 2a Ed 79 To 118 PDFDokument40 SeitenMedicina en Odontolog A Manejo Dental de Pacientes Con Enfermedades Sist Micas 2a Ed 79 To 118 PDFclaudeth1975Noch keine Bewertungen

- Import & Export DocumentationDokument6 SeitenImport & Export Documentationyasararafat12010Noch keine Bewertungen

- Chirinos Chávez, Jhon Pool, Loyaga Contreras, Elvis AntonyDokument330 SeitenChirinos Chávez, Jhon Pool, Loyaga Contreras, Elvis AntonyAna Flavia Roncal RuizNoch keine Bewertungen

- Création Des Sociétés Sportives (SA) : Réunion Avec Les Acteurs Du Football Professionnel MarocainDokument16 SeitenCréation Des Sociétés Sportives (SA) : Réunion Avec Les Acteurs Du Football Professionnel MarocainUss Eef100% (1)

- Banking Industry INDIANDokument26 SeitenBanking Industry INDIANektapatelbmsNoch keine Bewertungen

- Zoroastrian Society CaseDokument22 SeitenZoroastrian Society CaseResting MonkNoch keine Bewertungen

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDokument1 SeiteThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNoch keine Bewertungen

- Certificate of Conformity of The Factory Production Control: 1725 - CPR - M0007Dokument1 SeiteCertificate of Conformity of The Factory Production Control: 1725 - CPR - M0007Youl SilvaNoch keine Bewertungen

- Hattersley CatalogDokument64 SeitenHattersley CatalogMaaz Junaidi100% (1)

- Tradeonix 2.0: (An Updated Version of Tradeonix)Dokument17 SeitenTradeonix 2.0: (An Updated Version of Tradeonix)Panayiotis PeppasNoch keine Bewertungen

- Mckendrick Chapter 14Dokument5 SeitenMckendrick Chapter 14Eesha Sheikh AzmatNoch keine Bewertungen

- SSRN Id2621488Dokument26 SeitenSSRN Id2621488KARTIKEYA KOTHARINoch keine Bewertungen

- BCA 2010 Changes To Swimming Pool BarriersDokument62 SeitenBCA 2010 Changes To Swimming Pool Barriers040812tarzanNoch keine Bewertungen

- Local Governments DigestsDokument338 SeitenLocal Governments DigestsMabs NebresNoch keine Bewertungen

- AscTec Navigator - User Manual PDFDokument145 SeitenAscTec Navigator - User Manual PDFFairuzNoch keine Bewertungen

- Obligations For Scholarship Holders MENA Scholarship Programme (MSP)Dokument4 SeitenObligations For Scholarship Holders MENA Scholarship Programme (MSP)Nzar HamaNoch keine Bewertungen

- Agency Loan Agency Independent ContractDokument3 SeitenAgency Loan Agency Independent ContractShasharu Fei-fei LimNoch keine Bewertungen

- Fera and FemaDokument18 SeitenFera and Femadranita@yahoo.comNoch keine Bewertungen

- ProductDokument47 SeitenProductGiwrgo SeminiNoch keine Bewertungen

- Law CourseDokument4 SeitenLaw Courseeshu agNoch keine Bewertungen

- Equinox ContractDokument16 SeitenEquinox ContractAndrew Harrison LewisNoch keine Bewertungen