Beruflich Dokumente

Kultur Dokumente

CPT Scanner (Paper1) June+Dec 09

Hochgeladen von

Ankit GadaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CPT Scanner (Paper1) June+Dec 09

Hochgeladen von

Ankit GadaCopyright:

Verfügbare Formate

SCANNERS FOR CPT

http://cahelpers.in

SCANNERS FOR CPT

http://cahelpers.in

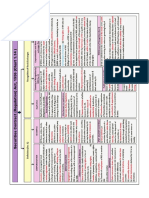

Appendix 2009 - June Paper - 1 : Fundamentals of Accounting

Chapter 1 : Accounting : An Introduction Unit 1 : Meaning and Scope of Accounting [1] Rs. 5000 paid as rent of office premises in an/a ____ (a) Event (b) Transaction (c) Both (d) None. [2] Which of the following is correct ? Owners Equity is (a) (Current Asset + Fixed Asset) + (Current Liabilities + Long term Liabilities) (b) (Current Asset + Fixed Asset) (Current Liabilities + Long term Liabilities) (c) (Current Asset Fixed Asset) (Current Liabilities + Long term Liabilities) (d) None of the above. [3] If owners capital is Rs. 50,000 liability is Rs. 30,000 and fixed assets is Rs. 70,000, then what is the value of current assets ? (a) Rs. 10,000 (b) Rs. 40,000 (c) Rs. 80,000 (d) Rs. 1,00,000 Unit 2 : Accounting Concepts, Principles and Conventions [4] Provision for discount is made due to concept of (a) Conservatism (b) Matching (c) Both (a) and (b) (d) Materiality [5] The three fundamental accounting assumptions are (i) Accrual (ii) Conservatism (iii) Going Concern (iv) Consistency (v) Matching

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix 2009 - June

(a) (ii), (iii) and (iv) (b) (i), (iii) and (iv) (c) (ii), (iv) and (v) (d) (iii), (iv) and (v) [6] Debtors - Rs. 50,000. A provision for bad debt is created @ 5% according to which concept ? (a) Conservatism (b) Matching (c) Accrual (d) Dual Aspect [7] Outstanding expenses is included in Profit & Loss A/c at the year end according to which concept ______ (a) Matching (b) Full disclosure (c) Accrual (d) Going Concern Chapter 2 Accounting Process Unit 1 : Basic Accounting Procedures Journal Entries [8] Unexpired expense is______ account. (a) Real (b) Nominal (c) Personal (d) Representative Personal [9] Rs. 1500 withdrawn for personal use should be debited to______ (a) Expense Account (b) Purchases Account (c) Sales Account (d) Drawings Account [10] Narration is given along with journal entry : (a) To signify the impact of entry on profitability (b) To disclose the profit or loss of the transaction. (c) To give a precise explanation for proper understanding of the entry. (d) To secretly understanding the inner meaning of entries. [11] Goods worth Rs. 10,000 were withdrawn by the proprietor for his personal use. The account to be credited is (a) Sales A/c (b) Drawings A/c

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix : (Paper 1) Fundamentals of Accounting

[12]

[13]

[14]

[15]

[16]

[17]

(c) Purchases A/c (d) Expenses A/c Unit 2 : Ledgers Purchase Return Account always shows a ______ balance. (a) Debit (b) Credit (c) Either (a) or (b) (d) None A opened an account with Rs. 5,000 on 3/12/09. He deposited Rs. 1,000 on 7/12/09. He withdraw Rs. 2,000 on 15/12/09 and deposited a cheque of Rs. 10,000 on 20/12/09. What is the balance on 31/12/09 (a) Rs. 18,000 (b) Rs. 14,000 (c) Rs. 4,000 (d) None Unit 3 : Trial Balance Trial Balance creates ______ accuracy. (a) Principle (b) Arithmetical (c) Clerical (d) None. Unit 4 : Subsidiary Books Following are not subsidiary books : (a) Sales book (b) Cash book (c) Purchase book (d) Bills Receivable Book Purchase of furniture on credit should be recorded in______ (a) Purchase book (b) Sales book (c) Cash book (d) Journal Unit 5 : Cash Books Interest received of Rs. 100 was recorded as interest paid. What will be the effect on cash balance? (a) Cash will reduce by 100. (b) Cash will increase by 200.

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

10

CPT Appendix 2009 - June

(c) Cash will reduce by 200. (d) No effect on cash balance. [18] What will be the effect when return inward is wrongly entered as return outward ? (a) Gross Profit is increased by Rs. 100. (b) Gross Profit is decreased by Rs. 100. (c) Gross Profit is increased by Rs. 200. (d) Gross Profit is decreased by Rs. 200. [19] Total of sales book was understated by Rs. 200. Rectification entry will be : (a) Sales A/c Debit, Suspense A/c Credit (b) Suspense A/c Debit, Sales A/c Credit (c) Debtor A/c Debit, Sales A/c Credit (d) Sales A/c Debit, Debtors A/c Credit [20] Sale of old furniture is erraneously entered in sales book. Rectification entry will be : (a) Debit Sales A/c, Credit Furniture A/c (b) Debit Furniture A/c, Credit Sales A/c (c) Debit Debtor A/c, Credit Furniture A/c (d) Debit Sales A/c, Credit Debtor A/c Chapter 3 : Bank Reconciliation Statement [21] Bank Reconciliation statement is : (a) A part of Pass Book (b) A statement prepared by bank. (c) A cash book related to cash column (d) A statement prepared by customers. Chapter 4 : Inventories [22] In conditions of inflation, which method will lead to the lowest value of stock ? (a) FIFO (b) LIFO (c) Average price method (d) Weighted average pricing method. Chapter 5 : Depreciation Accounting [23] Price of the computer = Rs. 50,000 Residual value = Rs. 10,000 Hours worked for the year = 6000 hrs.

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix : (Paper 1) Fundamentals of Accounting

11

Estimated life of computer = 20,000 hrs. calculate the amount of depreciation (a) Rs. 15,000 (b) Rs. 12,000 (c) Rs. 20,000 (d) Rs. 24,000 [24] A machine was purchased for Rs. 50,000. Installation expenses amounted to Rs. 2,000 wages of Rs. 4,000 were paid on installation. The scrap value at the end of its useful life of 10 years is Rs. 6,000. Repairs of Rs. 6,000 was made after 6 months from the date of purchase. Calculate depreciation (a) Rs. 5,600 (b) Rs. 4,800 (c) Rs. 5,000 (d) None [25] Which method of depreciation is suitable when expenditure on repairs and maintenance, increases as the machine grows old ? (a) Reducing balance method (b) Straight line method (c) Machine hour rate method (d) Sinking fund Method. Chapter 6 : Preparation of Final Accounts of sole Proprietors [26] ______. is a summary of all assets and liabilities on a particular date. (a) Trial Balance (b) Profit and Loss Account (c) Balance Sheet (d) Funds Flow Statement [27] If the profit is 25% on sales, then what percentage of profit is on cost. (a) 33 % (b) 20 % (c) 40 % (d) 50 % [28] Sales = Rs. 3,00,000; G.P. on sales is 20 % Purchases = Rs. 2,40,000; Opening stock = Rs. 20,000 Find closing stock. (a) Rs. 20,000 (b) Rs. 24,000

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

12

CPT Appendix 2009 - June

(c) Rs. 16,000 (d) Rs. 12,000 [29] At the end of Trial Balance, the following adjustments are given stock destroyed - Rs. 20,000 Insurance claim received Rs. 16,000. The effect of the above adjustments will be shown in: (a) Trading Account (b) Profit and Loss Account (c) Balance Sheet (d) All of the above. [30] A surplus of revenue over its cost is known as ______ of business. (a) Capital (b) Profit (c) Asset (d) None [31] Net profit before the following Adjustments ....... = Rs. 1,80,000 Outstanding Salary . = Rs. 10,000 Prepaid insurance = Rs. 13,000 Calculate profit after adjustments. (a) Rs. 1,77,000 (b) Rs. 1,83,000 (c) Rs. 2,03,000 (d) None of the above. [32] Find out the corrected net profit; Profit before taking into account following adjustments was Rs.7,00,000 (i) Rs. 1,00,000 spent on purchase of motor car for business purpose, treated as expense in Profit & Loss A/c. (ii) Rs. 15,000 p.m. rent outstanding for the month of February and March not taken into account (a) Rs. 7,70,000 (b) Rs. 7,85,000 (c) Rs. 6,15,000 (d) Rs. 6,30,000 [33] Sales = Rs. 11,000, G.P. = 1/10th on cost closing stock before these Adjustments Rs. 1,00,000 closing stock after adjustment of sales will be (a) Rs. 1,10,000 (b) Rs. 90,000

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix : (Paper 1) Fundamentals of Accounting

13

(c) Rs. 89,000 (d) None [34] Bad debt recovered of Rs. 2000 which were previously written off as bad debt will be credited to ______ A/c (a) Bad Debt A/c (b) Debtor A/c (c) Bad debt recovered A/c (d) Suspense A/c Chapter 7 : Accounting for Special Transactions Unit 1 : Consignment [35] Consignment Account is a : (a) Real Account (b) Nominal Account (c) Trading Account (d) Personal Account [36] Account Sales includes ; (a) Sales made (b) Stock left with consignee (c) Commission earned (d) All of above. [37] A sends 1000 units @ Rs. 56 to be sold on consignment basis. Consignor expenses amounted to Rs. 1000. 50 units were cost in transit. Find the new price per unit. (Loss is unavoidable). (a) Rs. 50 per unit (b) Rs. 60 per unit (c) Rs. 58.95 per unit (d) Rs. 57 per unit [38] A consigned 1000 litres of coconut oil @ Rs. 50 per lt. to B. The normal loss is estimated at 5%. The profit was fixed at 14% on the total cost. What is the sale price per litre ? (a) Rs. 57 (b) Rs. 60 (c) Rs. 70 (d) Rs. 55 Unit 2 : Joint Ventures [39] A and B entered into a joint venture. They agreed to share profits and losses equally. A purchased goods worth Rs. 16,000. Goods of Rs. 4,000 were destroyed by fire. Insurance claim of Rs. 3,000 is

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

14

CPT Appendix 2009 - June

received. B sold the rest of the goods for Rs. 20,000. A and B share profits equally As share of profits is : (a) Rs. 4,000 (b) Rs. 3,000 (c) Rs. 1,500 (d) None [40] A and B entered into joint venture. A supplied goods worth Rs. 7,000 and incurred expenses of Rs. 300. B sold the goods for Rs. 10,000 and incurred expenses of Rs. 500. What is the amount of final remittance ? (a) Rs. 8,400 (b) Rs. 7,900 (c) Rs. 8,900 (d) None of these. Unit 3 : Bills of Exchange and Promissory Notes [41] Ram drew a bill on Shyam on 15th April, 09 Shyam accepted the same on 17th April, 09 for 30 days after sight. What will be the due date of the bill ? (a) 18th May, 09 (b) 15th May 09 (c) 20th May, 09 (d) 17th May, 09 [42] Balance as per pass book Rs. 20,000 Rs. 4,000 were directly deposited by a customer into the bank. Then the balance as per cash book is : (a) Rs. 24,000 (b) Rs. 18,000 (c) Rs. 16,000 (d) Rs. 22,000 [43] X draws a bill on Y for Rs. 5,000 for 3 months. Before the due date Y sends 1/5th of the amount to X. Y requested X to draw a new bill for the balance amount plus interest @ 12% p.a. for 3 month. Find the amount of the new bill ? (a) Rs. 5,150 (b) Rs. 4,140 (c) Rs. 4,120 (d) Rs. 5,440

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix : (Paper 1) Fundamentals of Accounting

15

[44] A draws a bill for Rs. 20,000 for 3 months on 1.1.09. Bill was discounted with a banker who charged Rs. 100 as discounting charges. At maturity the bill returned dishonoured. With what amount will the bank a/c be credited in the books of A ? (a) Rs. 19,000 (b) Rs. 20,000 (c) Rs. 20,100 (d) Rs. 19,900 Chapter 8 Partnership Unit 1 : Introduction to Partnership Accounts [45] A and B are partners having capital of Rs. 50,000 and Rs. 60,000 respectively. Interest on capital is given @ 5% p.a. Profits for the year before appropriation is Rs. 4,600 provide interest on capital out of profits. Increase allocated to partners is : (a) Rs. 3,000 and Rs. 2,500 (b) Rs. 2,090 and Rs. 2,509 (c) Rs. 2,500 and Rs. 2,091 (d) Rs. 600 and Rs. 300 [46] If there is no partnership deed then interest on capital will be charged at ....... p.a. (a) 6 % (b) 8 % (c) 9 % (d) NIL Unit 2 : Treatment of Goodwill in Partnership Accounts [47] When there is no Goodwill Account in the books and goodwill is raised, ______account will be debited. (a) Partners Capital A/c (b) Goodwill A/c (c) Cash A/c (d) Reserve A/c Unit 3 : Admission of New Partner [48] A and B share profits equally. They admit C with 1/7th share. The new profit sharing ratio of A and B is (a) 4/7, 1/7 (b) 3/7, 3/7 (c) 2/7, 2/7 (d) None

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

16

CPT Appendix 2009 - June

[49] A and B are partners C is admitted with 1/5th share C brings Rs.1,20,000 as his share towards capital. The total networth of the firm is: (a) Rs. 1,00,000 (b) Rs. 4,00,000 (c) Rs. 1,20,000 (d) Rs. 6,00,000 [50] A and B share profits in the ratio of 3:2. As capital is Rs. 48,000 Bs capital is Rs. 32,000. C is admitted for 1/5th share in profits. What is the amount of capital which C should bring ? (a) Rs. 20,000 (b) Rs. 16,000 (c) Rs. 1,00,000 (d) Rs. 64,000 Unit 4 : Retirement of a Partner [51] X, Y, Z are equal partners in a firm. Z retires from the firm. The new profit sharing ratio between X and Y is 1:2 Find the gaining ratio. (a) 3:2 (b) 2:1 (c) 4:1 (d) Only B gains by 1/3 Chapter 9 : Company Accounts Unit 1 : Introduction to Company Accounts [52] A ______is an artificial person created by law with a perpetual succession and a common seal. (a) Company (b) Partnership firm (c) Sole Proprietorship (d) Hindu Undivided Family [53] Right shares are issued to: (a) Promoters for the services (b) Holders of convertible debentures (c) Existing shareholders (d) All of the above. [54] Interest on calls-in-advance is paid at a rate of : (a) 8 % p.a. (b) 6 % p.a.

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

CPT Appendix : (Paper 1) Fundamentals of Accounting

17

(c) 5 % p.a. (d) None of these. [55] A company issued 20,000 preference shares at the rate of Rs. 100 each at 5 % premium and 2,00,000 equity shares at the rate Rs. 10 each at 10% premium. What is the net amount of securities premium ? (a) Rs. 1,00,000 (b) Rs. 2,00,000 (c) Rs. 2,40,000 (d) Rs. 3,00,000 [56] Share premium is utilized for this purpose : (a) For raising goodwill (b) For premium payable on redemption of preference share (c) For writing of capital losses. (d) For paying dividend. [57] X purchased the running business of A for Rs. 60,000. In place of cash he discharged the purchase consideration by issue of equity shares of Rs. 10 each at 20% premium. Find the number of shares to be issued ? (a) 6,000 (b) 7,500 (c) 5,000 (d) 8,000 [58] Reserve share capital means : (a) part of authorized capital to be called at beginning (b) portion of uncalled capital to be called only at liquidation (c) Over subscribed capital (d) Under subscribed capital [59]When full amount is due on any call but it is not received, then the shortfall is debited to (a) Calls in advance (b) Calls in arrear (c) Share capital (d) Suspense account Unit 4 : Issue of Debentures [60] 6000 debentures were discharged by issuing Equity Shares of Rs. 10 each at 20 % premium. Find the number of shares issued. (a) 50,000 (b) 60,000

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

18

CPT Appendix 2009 - June

(c) 5,000 (d) 6,000 Answer

1. 6. 11. 16. 21. 26. 31. 36. 41. 46. 51. 56. (b) (a) (c) (d) (d) (c) (a) (d) (c) (d) (d) (b) 2. 7. 12. 17. 22. 27. 32. 37. 42. 47. 52. 57. (b) (c) (b) (c) (b) (a) (a) (b) (c) (b) (a) (c) 3. 8. 13. 18. 23. 28. 33. 38. 43. 48. 53. 58. (a) (d) (b) (c) (b) (a) (b) (b) (c) (b) (c) (b) 4. 9. 14. 19. 24. 29. 34. 39. 44. 49. 54. 59. (a) (d) (b) (b) (c) (d) (c) (c) (b) (d) (b) (b) 5. 10. 15. 20. 25. 30. 35. 40. 45. 50. 55. 60. (b) (a) (b) (a) (a) (b) (b) (a) (b) (a) (d) (a)

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

http://cahelpers.in

Paper - 1 Fundamentals of Accounting

Chapter 1 : Accounting : An Introduction Unit 2 : Accounting Concepts, Principles and Conventions 2009 December

[1] What is the objective of conservatism ? (a) Take all incomes and losses (b) Anticipate losses but not profits (c) Take all losses (d) None of the above [2] Contingent liabilities are shown in footnote of Balance Sheet as per which concept ? (a) Materiality (b) Disclosure (c) Realization (d) Dual Aspect [3] Which of the following does not follow Dual Aspect ? (a) Increase in one asset, decrease in other. (b) Increase in both asset and liability (c) Decrease in one asset, decrease in other (d) Increase in one asset & capital [4] The Rule of Lower of Cost or Market Value is based on which concept? (a) Dual Aspect (b) Conservatism (c) Disclosure (d) Prudence

Unit 2 : Ledgers 2009 December

[8] Which of the following is known as Principal Books of Accounts? (a) Ledger (b) Journal (c) Trial Balance (d) Balance Sheet Unit 4 : Subsidiary Books 2009 December [9] The Balance of Sales Day Book is Rs. 25,000. Rs. 5000 were recovered from debtors. Then balance of Day Book will be transferred by which amount ? (a) Rs. 25,000 (b) Rs. 5,000 (c) Rs. 20,000 (d) Rs. 10,000 Unit 5 : Cash Books 2009 December [10] In three column Cash Book, when does contra entry occurs? (a) Withdrawal of cash from bank (b) Payment to creditors (c) Withdrawal of cash from bank for personal use (d) All of the above [11] What will be journal entry when cash is withdrawn from bank for personal use ? (a) Drawings A/C debit, Bank A/C credit (b) Cash A/C debit, Bank A/C credit (c) Bank A/C debit, Drawings A/C credit (d) Bank A/C debit, Capital A/C credit Unit 6 : Capital and Revenue expenditures and Receipts 2009 December [12] An old machinery is purchased for Rs. 10,000. Installation charges of Rs. 1,000 were incurred. Repairs to the old machinery = Rs. 7,000 Repairs Account will be debited by : (a) Rs. 7,000 (b) Rs. 8,000 (c) Nil (d) None of the above

Chapter 2 : Accounting Process Unit 1 : Basic Accounting Procedures Journal Entries 2009 December

[5] In case of bad debts, which account is credited ? (a) Bad debts Account (b) Creditors Account (c) Debtors Account (d) None of these [6] Proprietors Account is _________ Account. (a) Real (b) Nominal (c) Personal (d) None of these [7] Purchase of second-hand computer on credit by a cloth merchant will be recorded in : (a) Journal (b) Cash Book (c) Purchase Book (d) None of the above

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

2

http://cahelpers.in

Chapter 4 : Inventories 2009 December

[19] Calculate Closing Stock using FIFO Method : Particulars Units Rate Opening Stock 100 Rs. 50 Purchases 50 Rs. 40 Issue 125 (a) Rs. 5,000 (b) Rs. 1,000 (c) Rs. 1,250 (d) Rs. 6,250 [20] Cost of Goods Sold = (a) Opening Stock + Purchases - Closing Stock (b) Opening Stock - Sales + Closing Stock (c) Opening Stock - Purchases + Closing stock (d) None of these [21] Opening Stock = Rs. 6,000 Closing Stock = Rs. 8,000 Cost of Goods Sold = Rs. 87,000 Calculate the value of Purchases ? (a) Rs. 1,01,000 (b) Rs. 89,000 (c) Rs. 73,000 (d) Rs. 85,000 Chapter 5 : Depreciation Accounting

CPT Abridged Scanner : (Paper 1) Fundamentals of Accounting

Unit 8 : Rectification of Errors 2009 December

[13] Sale of old furniture is wrongly transferred to Sales Account. Which type of error is this ? (a) Error of Principle (b) Compensating Error (c) Error of Omission (d) Error of Commission [14] Sales for Rs. 5,000 was entered as purchase. The effect of this error will be : (a) G.P. will increase by Rs. 5,000 (b) G.P. will decrease by Rs. 5,000 (c) G.P. will decrease by Rs. 10,000 (d) G.P. will increase by Rs. 10,000

Chapter 3 : Bank Reconciliation Statement 2009 December

[15] The balance as per Cash Book is Rs. 10,000 Cheques for Rs. 2,000 were issued but not presented for payment. What would be the balance as per Pass Book ? (a) Rs. 10,000 (b) Rs. 2,000 (c) Rs. 12,000 (d) None of the above [16] The balance as per Cash Book (overdraft) is Rs. 1,500. Cheques for Rs. 400 were deposited but were not collected. The cheques issued but not presented were Rs. 100, Rs. 125, Rs. 50. Balance as per Pass Book is: (a) Rs. 1,100 (b) Rs. 1,625 (c) Rs. 2,175 (d) Rs. 1,375 [17] If the balance as per Pass Book is the starting point, so the treatment of undercasting of receipt side of Cash Book will be : (a) Added (b) Deducted (c) No treatment (d) None of these [18] The payment side of Cash Book is undercast by Rs. 250. If the starting point of BRS is the Overdraft Balance as per Pass Book, then what would be the treatment to reach to Overdraft Balance of Cash Book? (a) Add 250 (b) Less 250 (c) Add 500 (d) Less 500

2009 December

[22] A machinery is purchased for Rs. 10,000. On 1st April, 2005. Depreciation @ 10% p.a. is provided. Calculate the amount of difference in depreciation as per SLM and WDV basis in the year 2006-07. (a) Rs. 1,000 (b) Rs. 100 (c) NIL (d) Rs. 200 [23] A mine was taken on lease for Rs. 2,00,00,000. Its total production capacity is 4,00,000 mt. What will be the depreciation in 2007 if it produced 30,000 m.t. in 2007 ? (a) Rs. 10 lacs (b) Rs. 15 lacs (c) Rs. 50 lacs (d) None of these [24] A machine is purchased for Rs. 1,00,000. Installation charges of Rs. 10,000 were incurred. Depreciation @ 10% was provided on Straight Line Basis. The machine was sold for Rs. 60,000 after 5 years. Calculate the profit or loss on sale of machine. (a) Rs. 5,000 Loss (b) Rs. 5,000 Profit (c) Rs.60,000 Profit (d) Rs. 40,000 Loss

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

Chapter 6 : Preparation of Final Accounts of sole Proprietors 2009 December

[25] Selling and distribution expenses does not comprise of : (a) Godown Rent (b) Bad Debts (c) Insurance for Stock of Finished Goods (d) Carriage Inward [26] There was a stock of Rs. 5,500, out of which stock of Rs. 500 was burnt due to fire and was disposed off for Rs. 200. Remaining goods were sold at 25% above cost price. Find net profit. (a) Rs. 6,250 (b) Rs. 7,200 (c) Rs. 6,575 (d) Rs. 5,950 [27] If profit is 25% on cost price then the profit on sale price will be : (a) 20% (b) 30% (c) 33 1/3% (d) 40% [28] If Purchases Account is not credited in case of goods lost in transit then which account can be credited ? (a) Goods Lost in Transit Account (b) Purchase Return Account (c) Trading Account (d) Sales Account [29] Opening Stock = Rs. 50,000 Purchases = Rs. 1,00,000 Purchase Return = Rs. 29,000 Sales = Rs. 2,00,000 Find the Gross Profit (a) Rs. 1,21,000 (b) Rs. 79,000 (c) Rs. 21,000 (d) None of the above [30] Postal Expenses Account is shown in : (a) P & L A/C (b) Trading A/C (c) Balance Sheet (d) Manufacturing A/C [31] Prepaid Expense of Financial Year relate with : (a) Previous Financial Year (b) Following Financial Year (c) Current Financial Year (d) None [32] Opening Capital = Rs. 5,00,000 Profits during the year = Rs. 1,00,000 Calculate the Average Capital of the year. (a) Rs. 55,000 (b) Rs. 3,00,000

http://cahelpers.in

3 (c) Rs. 9,167 (d) Rs. 50,000 [33] Goods in Transit but not taken in Closing Stock will be credited to: (a) Purchase A/C or Trading A/C (b) Supplier A/C (c) Goods in Transit A/C (d) Cash A/C Chapter 7 : Accounting for special Transactions

CPT Abridged Scanner : (Paper 1) Fundamentals of Accounting

Unit 1 : Consignment 2009 December

34] X sends goods to Y on consignment, but 15% of the goods were lost in transit. Such loss will be borne by : (a) Consignee (b) Consignor (c) Both (a) and (b) (d) Insurance company [35] Who is owner of the unsold stock left with the consignee ? (a) Consignee (b) Consignor (c) Co-venturer (d) Both (a) and (b) [36] The Consignor sends _____along with the consigned goods to the consignee. (a) Account Sales (b) Proforma Invoice (c) Both (d) None Unit 2 : Joint Ventures 2009 December [37] Which of the following is incorrect ? (a) Joint Venture is not based on going concern. (b) Joint Venture can be formed with minor. (c) A bill of exchange is a negotiable instrument. (d) Nothing charges are the expenses of drawee. [38] Joint venture is a ______ Account. (a) Personal (b) Real (c) Nominal (d) Capital [39] A and B entered into a Joint Venture. A bought goods for Rs. 6,00,000. He sold 80% of the goods for Rs. 5,60,000 and took the remaining goods at cost less 20%. Find the amount of profit. (a) Rs. 56,000 (b) Rs. 60,000 (c) Rs. 70,000 (d) None [40] When Memorandum Joint Venture Method is followed,. in Books of X, Joint Venture with Y A/C will be credited with _____, for amount received by X.

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

4 (a) Y (b) Sales (c) Debtor (d) Cash Unit 3 : Bills of Exchange and Promissory Notes 2009 December [41] When a bill is renewed, then entry will be : (a) No entry will be passed (b) Entries for cancellation of old bill and renewal of bill (c) Entry for renewal of bill (d) None of these [42] If a machine is purchased for Rs. 5,00,000 on 1st April, 2002 on hire-purchase basis, What is the average due date, if amount is repaid in 5 yearly annual instalments starting from 1st April, 2003. (a) 1.4.05 (b) 1.4.04 (c) 1.4.03 (d) 1.4.07 [43] A draws a bill for Rs. 10,000 on B for 2 months. He gets it discounted from bank @ 12%. They agreed to share the proceeds equally. How much amount is received by A ? (a) Rs. 5,000 (b) Rs. 4,900 (c) Rs. 4,000 (d) None of the above [44] In case of sudden holiday, maturity date falls on : (a) Next following day (b) Previous day (c) On the same day (d) None of the above [45] A bill not paid by drawee on due date is called ________. (a) Noting of bill (b) Dishonour of bill (c) Renewal of bill (d) Discounting of bill Unit 4 : Sale of Goods on Approval or Return Basis 2009 December [46] Sales = Rs. 1,06,000 Sales Return = Rs. 6,000 Out of Rs. 1,06,000, goods costing Rs. 10,000 were sent on approval for Rs. 12,000 which have not been approved yet. Calculate Net Sales. (a) Rs. 1,00,000 (b) Rs. 88,000 (c) Rs. 1,12,000 (d) Rs. 18,000

http://cahelpers.in

Chapter 8 : Partnership Unit 1 : Introduction to Partnership Account 2009 December

[47] Interest on Drawings is : (a) Debited to P/L A/C (b) Credited to P/L A/C (c) Debited to Capital A/C (d) None Unit 3 : Admission of New Partner 2009 December [48] A and B share profits in the ratio of 3:4. C was admitted for 1/5th share. Calculate the new profit sharing ratio. (a) 3:4:1 (b) 12:16:7 (c) 16:12:7 (d) None of these [49] A and B carry on business and share profits and losses in the ratio of 3:2. Their respective capitals are Rs. 1,20,000 and Rs. 54,000. C is admitted for 1/3rd share in profit and brings Rs. 75,000 as his share of capital. Capitals of A and B to be adjusted according to Cs share. Calculate the amount refunded to A. (a) Rs. 30,000 (b) Rs. 32,000 (c) Rs. 15,000 (d) Rs. 28,000 [50] On account of admission, the assets are revalued and liabilities are reassessed in ________ Account. (a) Partners Capital A/C (b) Revaluation A/C (c) Realisation A/C (d) Balance Sheet [51] The opening balance of Partners Capital Account is credited with : (a) Interest on Capital (b) Interest on Drawings (c) Drawings (d) Share in Loss Unit 5 : Death of a Partner 2009 December [52] A, B and C are partners sharing profits in the ratio of 3:2:1. They had a Joint Life Policy of Rs. 3,00,000. Surrender value of JLP in Balance Sheet is Rs. 90,000. C dies. What is share of each partner in JLP ? (a) Rs. 1,05,000; Rs. 70,000; Rs. 35,000 (b) Rs. 45,000; Rs. 30,000; Rs. 15,000 (c) Rs. 1,50,000; Rs. 1,00,000; Rs. 50,000 (d) Rs. 1,95,000; Rs. 1,30,000; Rs. 65,000

CPT Abridged Scanner : (Paper 1) Fundamentals of Accounting

Courtesy: Shuchita Publications

CAhelpers

SCANNERS FOR CPT

Chapter 9 : Company Accounts Unit 1 : Introduction to Company Account 2009 December

[53] Equity shareholders have a right to : (a) Vote (b) 20% dividend (c) Have preference on redemption (d) All of the above [54] Equity shareholders are _____ of a company. (a) Bankers (b) Creditors (c) Debtors (d) Owners Unit 2 : Issue, forfeiture and Re-Issue of Shares 2009 December [55] The difference between Subscribed Capital and Called-up Capital is called: (a) Calls-in-arrear (b) Calls-in-advance (c) Uncalled capital (d) None of the above [56] A company issued 5,000 shares of Rs. 10 each at 20% premium payable as follows : Application Rs. 2, Allotment-Rs. 5 (including premium) and First and Final Call-Rs.5. A holder of 200 shares failed to pay the First and Final Call. His shares were forfeited. Calculate the amount to be credited to Share Forfeiture Account. (a) Rs. 1,000 (b) Rs. 1,400

http://cahelpers.in

5

CPT Abridged Scanner : (Paper 1) Fundamentals of Accounting

(c) Rs. 400 (d) None of these [57] At the time of forfeiture, Share Capital Account is debited with : (a) Face Value (b) Nominal Value (c) Paid-up Value (d) Called-up Value [58] Which statement is issued before the issue of shares ? (a) Prospectus (b) Memorandum of Association (c) Articles of Association (d) All of these Unit 3 : Redemption of Preference Shares 2009 December [59] Preference Shares can be issued for a maximum period of : (a) 20 years (b) 24 years (c) 25 years (d) None of these Unit 4 : Issue of Debentures 2009 December [60] A company issued 1,00,000 12% debentures of Rs. 100 each. Calculate the amount of interest on debentures. (a) Rs. 12,000 (b) Rs. 1,20,000 (c) Rs. 12,00,000 (d) None of these

Answer 1. 5. 9. 13. 17. 21. 25. 29. 33. 37. 41. 45. 49. 53. 57. (b) (c) (a) (a) (b) (b) (d) (b) (a) (b) (b) (b) (a) (a) (d) 2. 6. 10. 14. 18. 22. 26. 30. 34. 38. 42. 46. 50. 54. 58. (b) (c) (a) (c) (a) (b) (d) (a) (b) (c) (a) (b) (b) (d) (a) 3. 7. 11. 15. 19. 23. 27. 31. 35. 39. 43. 47. 51. 55. 59. (c) (a) (a) (c) (b) (b) (a) (b) (b) (a) (b) (c) (a) (c) (a) 4. 8. 12. 16. 20. 24. 28. 32. 36. 40. 44. 48. 52. 56. 60. (b) (a) (c) (b) (a) (b) (c) (a) (b) (d) (a) (b) (a) (a) (c)

Courtesy: Shuchita Publications

CAhelpers

Das könnte Ihnen auch gefallen

- No Objection Certificate: Client DetailsDokument1 SeiteNo Objection Certificate: Client DetailsPune DhuleNoch keine Bewertungen

- SIM-42 B Oriental Bank of Commerce Stock StatementDokument4 SeitenSIM-42 B Oriental Bank of Commerce Stock StatementkapilgsmNoch keine Bewertungen

- LAW MCQ DArshan KhareDokument162 SeitenLAW MCQ DArshan KhareGopi NaiduNoch keine Bewertungen

- Remedies and Relief Under Consumer Protection Act, 2019Dokument4 SeitenRemedies and Relief Under Consumer Protection Act, 2019Shivani AntilNoch keine Bewertungen

- Consumer Court - WikipediaDokument6 SeitenConsumer Court - WikipediaManoj Kumar SharmaNoch keine Bewertungen

- An Assignment On: Environmental Auditing & Eco - MarkDokument11 SeitenAn Assignment On: Environmental Auditing & Eco - MarkDeonandan kumarNoch keine Bewertungen

- Garnishee OrderDokument15 SeitenGarnishee OrderH B CHIRAG 1950311Noch keine Bewertungen

- WR CDS II 19 NameList Engl PDFDokument408 SeitenWR CDS II 19 NameList Engl PDFRohitNoch keine Bewertungen

- Drafting & Pleading: (Question Bank)Dokument49 SeitenDrafting & Pleading: (Question Bank)Gaurav KumarNoch keine Bewertungen

- Inter Law QB (3) - 117-141Dokument25 SeitenInter Law QB (3) - 117-141Shreyans JainNoch keine Bewertungen

- Residential Status Problems 2021-2022-1Dokument5 SeitenResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANoch keine Bewertungen

- Situational Problems (Banking)Dokument7 SeitenSituational Problems (Banking)Pranesh SharmaNoch keine Bewertungen

- Arrangement of Section in Income Tax Act 1961Dokument8 SeitenArrangement of Section in Income Tax Act 1961Jitendra VernekarNoch keine Bewertungen

- Special ContractsDokument13 SeitenSpecial ContractsAPURVA RANJANNoch keine Bewertungen

- Important Questions in Securities Laws For Cs Executive Group 2Dokument83 SeitenImportant Questions in Securities Laws For Cs Executive Group 2debanka100% (2)

- Letter To RBI On Customer Harassment by HDFC Bank On Fresh KYC Norms'Dokument4 SeitenLetter To RBI On Customer Harassment by HDFC Bank On Fresh KYC Norms'Moneylife FoundationNoch keine Bewertungen

- Income Tax Residential Status PDFDokument16 SeitenIncome Tax Residential Status PDFNagesha CSNoch keine Bewertungen

- Indemnity and Guarantee PPT LawDokument37 SeitenIndemnity and Guarantee PPT Lawshreeya salunkeNoch keine Bewertungen

- Memorial For AppellantsDokument31 SeitenMemorial For AppellantsKunwarbir Singh lohatNoch keine Bewertungen

- DDA LetterDokument2 SeitenDDA LetteranilperfectNoch keine Bewertungen

- Covering Letter To Society From Transferor TransfereeDokument1 SeiteCovering Letter To Society From Transferor TransfereeYogesh Govind100% (1)

- Powers & Duties of CCIDokument3 SeitenPowers & Duties of CCIKamakshi JoshiNoch keine Bewertungen

- Contract-II Case Review Of: Maharashtra National Law University, AurangabadDokument9 SeitenContract-II Case Review Of: Maharashtra National Law University, AurangabadSaurabh Krishna SinghNoch keine Bewertungen

- RbiDokument52 SeitenRbiAnonymous im9mMa5100% (1)

- MCQ IdtDokument30 SeitenMCQ IdtkartikNoch keine Bewertungen

- Individual Insolvency in The Insolvency & Bankruptcy Code - An OverviewDokument4 SeitenIndividual Insolvency in The Insolvency & Bankruptcy Code - An OverviewManvesh VatsNoch keine Bewertungen

- Hint: Certificate Is Valid, Moosa Goolam Ariff Vs Ebrahim Goolam AriffDokument13 SeitenHint: Certificate Is Valid, Moosa Goolam Ariff Vs Ebrahim Goolam AriffM Tariqul Islam MishuNoch keine Bewertungen

- Part C Contract 1Dokument6 SeitenPart C Contract 1Srini Vasa100% (1)

- Group Assignment Corporate LawDokument10 SeitenGroup Assignment Corporate Lawprafful nautiyalNoch keine Bewertungen

- New Notes For Hire Purchase SystemDokument4 SeitenNew Notes For Hire Purchase SystemhanumanthaiahgowdaNoch keine Bewertungen

- MCQs On Indian Partnership Act, 1932 Part 1Dokument11 SeitenMCQs On Indian Partnership Act, 1932 Part 1Piyush KandoiNoch keine Bewertungen

- Law Notes1Dokument4 SeitenLaw Notes1Mani Khan100% (1)

- Loan Documentation PDFDokument16 SeitenLoan Documentation PDFMuhammad Akmal HossainNoch keine Bewertungen

- Instructions Inmovable and Movable Property Ips and Aipr - 1 PDFDokument5 SeitenInstructions Inmovable and Movable Property Ips and Aipr - 1 PDFajeetNoch keine Bewertungen

- Questions On Value PF SupplyDokument4 SeitenQuestions On Value PF SupplyMadhuram SharmaNoch keine Bewertungen

- Syllabus For PS Group BDokument6 SeitenSyllabus For PS Group Brakesh kumarNoch keine Bewertungen

- A Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)Dokument8 SeitenA Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)archerselevatorsNoch keine Bewertungen

- Part C LCDokument16 SeitenPart C LCplannernarNoch keine Bewertungen

- Case Laws: 1) Balfour vs. BalfourDokument5 SeitenCase Laws: 1) Balfour vs. Balfourbabukothari0% (1)

- A Note On Amendment To The Payment of Bonus ActDokument3 SeitenA Note On Amendment To The Payment of Bonus Actjaskaran singhNoch keine Bewertungen

- The Indian Contract Act (Autorecovered)Dokument28 SeitenThe Indian Contract Act (Autorecovered)Rahul Rahul AhirNoch keine Bewertungen

- CA Final Securities Law Charts - by CA Swapnil PatniDokument13 SeitenCA Final Securities Law Charts - by CA Swapnil PatniAman JainNoch keine Bewertungen

- Hi FocusDokument11 SeitenHi FocusVinodh MNoch keine Bewertungen

- Recent Trends of BankingDokument33 SeitenRecent Trends of BankingMohd Aquib0% (1)

- Residential Status Scope of Total IncomeDokument4 SeitenResidential Status Scope of Total IncomedeepakadhanaNoch keine Bewertungen

- The Provincial Small Cause Court Act NotesDokument4 SeitenThe Provincial Small Cause Court Act NotesAnand BhushanNoch keine Bewertungen

- State of Madras v. Gannon DunkerleyDokument7 SeitenState of Madras v. Gannon DunkerleyMayank Jain100% (4)

- AGREEMENT For SALE of FLAT - Maharashtra Housing and Building LawsDokument8 SeitenAGREEMENT For SALE of FLAT - Maharashtra Housing and Building LawsSAIRAM1992Noch keine Bewertungen

- Law of Evidence - Sem 7-1 3Dokument86 SeitenLaw of Evidence - Sem 7-1 3Bratin SuinNoch keine Bewertungen

- PROCESS OF ISSUE OF NCDs ON PRIVATE PLACEMENT BASISDokument7 SeitenPROCESS OF ISSUE OF NCDs ON PRIVATE PLACEMENT BASISRachit SharmaNoch keine Bewertungen

- Practical Problams - LawDokument12 SeitenPractical Problams - LawApurva JhaNoch keine Bewertungen

- Accounting For Amalgamation - ProblemsDokument8 SeitenAccounting For Amalgamation - ProblemsBrowse Purpose100% (1)

- The Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Dokument37 SeitenThe Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Uday TomarNoch keine Bewertungen

- Invoice Utkarsh-18-19Dokument31 SeitenInvoice Utkarsh-18-19Utkarsh KhandelwalNoch keine Bewertungen

- Income Tax Revision Notes December 2019-Executive-RevisionDokument114 SeitenIncome Tax Revision Notes December 2019-Executive-RevisionMeenaa BalakrishnanNoch keine Bewertungen

- Ty Bcom PDF Sample QuiestionsDokument49 SeitenTy Bcom PDF Sample QuiestionsAniket VyasNoch keine Bewertungen

- Question Paper Financial Accounting (MB131) : January 2005Dokument32 SeitenQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNoch keine Bewertungen

- Multiple Choice Quetions - Financial AccountingDokument4 SeitenMultiple Choice Quetions - Financial Accountingshabukr100% (4)

- Mock Full Book 02 BookDokument3 SeitenMock Full Book 02 Bookgoharmahmood203Noch keine Bewertungen

- Model Question Paper: Financial Accounting (CFA510)Dokument25 SeitenModel Question Paper: Financial Accounting (CFA510)akshayatmanutdNoch keine Bewertungen

- Accounting Changes and Error AnalysisDokument39 SeitenAccounting Changes and Error AnalysisIrwan Januar100% (1)

- Chapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDokument49 SeitenChapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDesiree De OcampoNoch keine Bewertungen

- Asset Management Similarities DifferencesDokument82 SeitenAsset Management Similarities DifferencesDiasso GuyNoch keine Bewertungen

- Acc406 - Aug 2021 - QDokument12 SeitenAcc406 - Aug 2021 - Qtengku rilNoch keine Bewertungen

- Chapter 2 Accounting For The Service BusinessDokument37 SeitenChapter 2 Accounting For The Service BusinessKristel100% (1)

- Activity-Based Costing: A Tool To Aid Decision Making: Chapter SevenDokument49 SeitenActivity-Based Costing: A Tool To Aid Decision Making: Chapter SevenFahim RezaNoch keine Bewertungen

- CPWD Book FormsDokument168 SeitenCPWD Book Formsovishalz100% (1)

- Fundamental Accounting Principles Volume 1 Canadian 15th Edition Larson Test BankDokument43 SeitenFundamental Accounting Principles Volume 1 Canadian 15th Edition Larson Test BankFranciscoRosariogdoma100% (16)

- Commerce Syllabus For UG Honours CourseDokument53 SeitenCommerce Syllabus For UG Honours CourseSamar SharmaNoch keine Bewertungen

- Special ExamDokument3 SeitenSpecial ExamAdoree Ramos50% (2)

- CPD Faqs 1418Dokument18 SeitenCPD Faqs 1418ranzel789Noch keine Bewertungen

- 2 Music Winter 2017Dokument10 Seiten2 Music Winter 2017amolvi7275Noch keine Bewertungen

- Chapter - 1 Accounting in ActionDokument19 SeitenChapter - 1 Accounting in ActionfuriousTaherNoch keine Bewertungen

- Pfa WordDokument3 SeitenPfa WordMAlouNoch keine Bewertungen

- Principles of Accounts Answers To X Ques PDFDokument51 SeitenPrinciples of Accounts Answers To X Ques PDFTandra Adams100% (1)

- Bryan T. Lluisma Fin3 BSA-4 TTH 5-6:30pmDokument3 SeitenBryan T. Lluisma Fin3 BSA-4 TTH 5-6:30pmBryan LluismaNoch keine Bewertungen

- Standards AllDokument59 SeitenStandards AllRatana KemNoch keine Bewertungen

- The Following Procedures Were Recently Installed by Raspberry Creek CompanyDokument1 SeiteThe Following Procedures Were Recently Installed by Raspberry Creek CompanyAmit PandeyNoch keine Bewertungen

- Flipkart India Private Limited: (700300) Disclosure of General Information About CompanyDokument215 SeitenFlipkart India Private Limited: (700300) Disclosure of General Information About CompanyAnshika GoelNoch keine Bewertungen

- Acowtancy F3 Notes PDFDokument437 SeitenAcowtancy F3 Notes PDFŞâh ŠůmiťNoch keine Bewertungen

- Accounting For Joint Products and by ProductsDokument13 SeitenAccounting For Joint Products and by ProductsSteffi CabalunaNoch keine Bewertungen

- Contemporary AuditingDokument9 SeitenContemporary AuditingRakshu joeNoch keine Bewertungen

- Algonquin Code of Business Conduct and EthicsDokument15 SeitenAlgonquin Code of Business Conduct and EthicsTricia PowersNoch keine Bewertungen

- Auditing Problems Lecture On Correction of ErrorsDokument6 SeitenAuditing Problems Lecture On Correction of Errorskarlo100% (3)

- Cash Flow Statement FormateDokument3 SeitenCash Flow Statement FormatesatyaNoch keine Bewertungen

- Financial Accounting and Reporting StandardsDokument1 SeiteFinancial Accounting and Reporting StandardsAllysa CapunoNoch keine Bewertungen

- Brewer, Introduction To Managerial Accounting, 3/eDokument11 SeitenBrewer, Introduction To Managerial Accounting, 3/eJoe BlackNoch keine Bewertungen

- Auditing Theory Cabrera ReviewerDokument49 SeitenAuditing Theory Cabrera ReviewerCazia Mei Jover81% (16)

- Laporan Keuangan PT KAIDokument135 SeitenLaporan Keuangan PT KAIrizal yusNoch keine Bewertungen

- Foreign LiteratureDokument6 SeitenForeign LiteratureMin Jee100% (3)