Beruflich Dokumente

Kultur Dokumente

FM09-CH 24

Hochgeladen von

namitabijweCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FM09-CH 24

Hochgeladen von

namitabijweCopyright:

Verfügbare Formate

Ch.

25: Financial Statements and Cash Flow Analysis

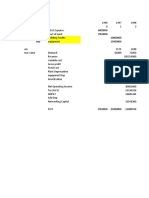

CHAPTER 24 FINANCIAL STATEMENTS AND CASH FLOW ANALYSIS Problem 1 Sources Internal funds Net profit Add: Depreciation (90,000 - 67,500) 15% Debenture Total Uses Investment Land Machinery Dividend Increase in working capital Total (Rs) 157,500 22,500 180,000 240,000 420,000 45,000 48,000 112,500 87,000 292,500 127,500 420,000

Note: Share capital has increased due to bonus issue which does not affect funds. Bonus issue causes a notional transfer from reserve and surplus to share capital. Problem 2 19X2 Assets Cash Debtors Stock Prepaid expenses Plant and machinery Goodwill Total Equities Creditors Provision for depreciation Debentures Premium on debentures issue Share capital Share premium Reserves and surplus Total (Rs) 82,000 104,000 112,000 22,000 380,000 36,000 736,000 30,000 100,000 102,000 12,000 190,000 30,000 272,000 736,000 19X1 (Rs) 22,000 24,000 60,000 14,000 360,000 40,000 520,000 14,000 60,000 102,000 18,000 90,000 0 236,000 520,000 Change (Rs) 60,000 80,000 52,000 8,000 20,000 -4,000 216,000 16,000 40,000 0 -6,000 100,000 30,000 36,000 216,000

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Statement of Changes in Financial Position: Working Capital Basis Sources Profit Add: Depreciation Add: Goodwill written off Less: Debenture premium written off Funds from operations Share capital Share premium Total Uses Plant & Machinery Dividend (66,000 - 36,000) Increase in working capital Total (Rs) 66,000 40,000 4,000 -6,000 104,000 100,000 30,000 234,000 20,000 30,000 50,000 184,000 234,000

Schedule for Changes in Working Capital 19X2 (Rs) 82,000 104,000 112,000 22,000 320,000 30,000 290,000 19X1 (Rs) 22,000 24,000 60,000 14,000 120,000 14,000 106,000 Change (Rs) 60,000 80,000 52,000 8,000 200,000 16,000 184,000

Cash Debtors Stock Prepaid expenses Total Creditors Increase in Working Capital

Statement of Changes in Financial Position: Cash Basis (Rs) Sources Profit 66,000 Add: Depreciation 40,000 Add: Goodwill written off 4,000 Less: Debenture premium written off -6,000 Funds from operation 104,000 Less: Increase in current assets 140,000 Add: Increase in current liabilities 16,000 Cash from operation Share capital Share premium Total Uses Plant & Machinery Dividend Increase in cash Total -20,000 100,000 30,000 110,000 20,000 30,000 50,000 60,000 110,000

Ch. 25: Financial Statements and Cash Flow Analysis

Problem 3 Statement of Changes in Financial Position Sources Net profit Add: Depreciation Add: Provision for doubtful debts Less: Gain on sale of machine Less: Gain on sale of investment Long-term investment Sale of machine Total Uses Purchase of machine Purchase of Building Cash dividend Loan adjustment Increase in working capital Total

(Rs) 27,500 5,750 500 -1,000 -2,500 30,250 12,500 3,000 45,750 10,000 7,500 13,250 2,500 33,250 12,500 45,750

Problem 4 M COMPANY Statement of changes in working capital Sources Profit before tax Less: Tax provision Add: Depreciation Internal funds Share capital Sale of other non-current assets Long-term debt Total Uses Purchase of fixed assets [165,000 - (150,000 - 15,000)] Cash dividend Increase in working capital Total

(Rs) 42,000 21,000 15,000 36,000 18,000 9,000 45,000 108,000 30,000 9,000 69,000 108,000

Statement of Changes in Cash Flow Statement of Changes in Cash Flow Sources Profit before tax Less: Tax paid (9,000 + 21,000 - 15,000) Add: Depreciation Add:

(Rs) 42,000 15,000 15,000 42,000 9,000

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Increase in bills payable Decrease in marketable securities Less: Increase in debtors Increase in stocks Decrease in creditors Decrease in cash used from operation Sale of other non-current assets Share capital Long-term debt Total Uses Purchase of fixed assets Cash dividend Decrease in Cash Total

6,000 15,000 9,000 60,000 -27,000 9,000 18,000 45,000 45,000 30,000 9,000 39,000 6,000 45,000

Schedule for Changes in Working Capital 19X1 19X2 (Rs) (Rs) Current Assets Cash 15,000 9,000 Marketable securities 15,000 21,000 Debtors 30,000 45,000 Stock 36,000 45,000 Total Current liabilities Creditors Bills payable Accrued expenses Tax payable Total NWC 96,000 60,000 15,000 6,000 9,000 90,000 6,000 120,000 0 24,000 6,000 15,000 45,000 75,000

Change

-6,000 6,000 15,000 9,000 24,000 -60,000 9,000 0 6,000 -45,000 69,000

Problem 5 J B SONS COMPANY Statement of Sources & Uses of Funds Sources Net earnings Add: Depreciation Total Uses Payment of loan Fixed assets [65,000 - (60,000 - 10,000)] Cash dividend

(Rs) 5,000 10,000 15,000 10,000 15,000 3,000 28,000

Ch. 25: Financial Statements and Cash Flow Analysis

Decrease in working capital Total

13,000 15,000

Working Capital Changes 19X1 Current assets Current liabilities Working capital 40,000 30,000 10,000 19X2 35,000 38,000 -3,000 Change -5,000 8,000 -13,000

Problem 8 Changes in Cash flow (Rs) Sources Profit before depreciation & taxes Less: Tax Increase in stock Increase in bills receivable Add: Decrease in debtors Decrease in creditors Cash from operation Share capital: 5,000 x Rs 15 Plus: Bank balance Total cash inflow Bank overdraft Total Uses Purchase of fixed assets Cash dividend Total 240,000 -137,500 -140,000 -7,500 45,000 80,000 80,000 75,000 180,000 335,000 67,500 402,500 370,000 32,500 402,500

Note: Cash dividend includes tax on dividend which is also an outflow from the companys point of view.

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Problem 7 PANDIT SONS LIMITED Statement of Sources & Uses of Funds Sources Net income Add: Depreciation Add: Loss on sale of machine Less: Gain on sale of investment Internal funds Share capital (150 + 60) Debenture Sale of investment Sale of machinery Total Uses Purchase of machine Purchase of building Cash dividend Increase in working capital Total

(Rs) 40 130 5 -12 163 210 250 52 15 690 175 400 29 604 86 690

Change in Working Capital 19X2 (Rs) Current assets Current liabilities Total 666 150 516 19X1 (Rs) 530 100 430 Change (Rs) 136 50 86

Notes: 1. Retained earnings have increased by Rs 11,000 while net earnings are Rs 40,000. It is implied that cash dividend of Rs 29,000 is paid. 2. The total depreciation charged during the year is Rs 130,000 (income statement). The change in accumulated depreciation is Rs 125,000. Thus the difference, Rs 5,000, is the accumulated depreciation on the machinery that was sold during the year. The proceeds from the machine were Rs 15,000 and a loss of Rs 5,000 was incurred. Thus the book value of the machine was Rs 20,000, and its original cost was Rs 25,000. 3. The balance of machinery at the end of 19X2 is Rs 500,000. The balance at the beginning was Rs 350,000. After the sale of machinery which had original cost of Rs 25,000, the balance at the end should have been Rs 325,000. Thus new machinery worth Rs 175,000 (Rs 500,000 - Rs 325,000) was acquired during the year.

Ch. 25: Financial Statements and Cash Flow Analysis

Problem 8 ALPHA CO. Funds Flow Statement (Rs) Sources Funds from operation Sale of land Sale of machine Equity share capital Total Uses Purchase of investment Purchase of machinery Pref. share capital Interim dividend Increase in working capital Total 86,000 50,000 10,000 100,000 246,000 11,000 142,000 50,000 20,000 223,000 23,000 246,000

Funds from operations: General reserve Pre-acquisition profit P&L Depreciation Loss on sale of machine Goodwill written off Preliminary exp. written off Interim dividend

10,000 1,000 18,000 10,000 2,000 20,000 5,000 20,000 86,000

Statement of Changes in Working Capital 19X1 19X2 (Rs) (Rs) Current assets Sundry debtors 140,000 170,000 Stock 77,000 109,000 Bills receivable 20,000 30,000 Cash in hand 15,000 10,000 Cash at bank 10,000 8,000 Total Current liabilities Proposed dividend Sundry creditors Bills payable Liabilities for expenses Provision for taxation Total Working capital 262,000 42,000 25,000 20,000 30,000 40,000 157,000 105,000 327,000 50,000 47,000 16,000 36,000 50,000 199,000 128,000

Change (Rs) 30,000 32,000 10,000 -5,000 -2,000 65,000 8,000 22,000 -4,000 6,000 10,000 42,000 23,000

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Problem 9 C VICTORY LTD Statement of Sources & Application of Funds Sources Net profit Add: Depreciation Less: Tax Funds from operation Uses Purchase of machine Interim dividend Final dividend Increase in working capital Total (Rs) 65,530 24,600 -25,000 65,130 5,600 26,000 13,000 44,600 20,530 65,130

Schedule of Changes in Working Capital 19X1 (Rs) Current assets Cash at bank 2,500 Sundry debtors 87,490 Stock 111,040 Acquired stock 201,030 Total (A) Current liabilities Sundry creditors Bills payable Bank overdraft Provision for taxation Total (B) Working capital (A - B) 39,500 33,780 59,510 40,000 172,790 28,240

19X2 (Rs) 2,700 73,360 97,370 173,430 41,135 11,525 0 50,000 102,660 70,770

Change (Rs) 200 -14,130 -13,670 -22,000 -49,600 1,635 -22,255 -59,510 10,000 -70,130 20,530

Problem 10 BOMBAY INDUSTRIES Statement of Sources & Application of Funds Sources Income Add: Depreciation Funds from operations Share capital Profit from sale of land Total

57.80 8.40 66.20 40.00 15.60 121.80

Ch. 25: Financial Statements and Cash Flow Analysis

Uses Plant etc. Loan repaid Dividend paid Loss on marketable securities Increase in working capital Total

84.60 1.00 25.60 2.80 114.00 7.80 121.80

Schedule of Changes in Working Capital 19X1 Cash at bank Debtors Stock-in-trade Miscellaneous Total current assets Sundry creditors Provision for taxation Liabilities for expenses Total Working capital 44.60 10.80 44.00 30.20 129.60 40.40 10.80 2.60 53.80 75.80

19X2 47.80 17.00 67.20 8.00 140.00 43.20 12.20 1.00 56.40 83.60

Change 3.20 6.20 23.20 -22.20 10.40 2.80 1.40 -1.60 2.60 7.80

Notes: 1. The total proceeds from the purchase and sale of land are not known. Therefore, only profit made on these deals is taken as source of funds. 2. Loss on sale of marketable securities has been taken as use of funds since the proceeds from the sale are not known. Problem 11 PQ LMITED Statement of Sources & Uses of Cash Sources Net profit Add: Depreciation Debenture interest Increase in creditors Increase in doubtful debts Less: Gain on sale of machine Increase in debtors Increase in stock Cash from operations Sale of machine Profit on sale of property Debenture (net realisation) Increase in bank borrowings Total

(Rs) 76,500 27,900 7,000 11,800 3,300 -2,500 -50,000 -38,500 35,500 7,000 6,200 49,000 97,700 64,300 162,000

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Uses Dividend Purchase of plant Trade investment Debenture interest

30,000 78,000 47,000 7,000 162,000

Notes: 1. The difference between the freehold property at cost and at valuation is: 165,000 - 122,000 = Rs 43,000; it is a non-cash item. This amount is included in capital reserve. The balance: 49,200 - 43,000 = Rs 6,200 represent profit on sale of property. The total proceeds from the sale of property are not known. The profit, Rs 6,200 has been shown as the source of cash. 2. The accumulated depreciation after the sale of plant with accumulated depreciation of Rs 13,500 should have been: 107,600 - 13,500 = Rs 94,100. Since it is Rs 122,000, depreciation during the year is: 122,000 - 94,100 = Rs 27,900. 3. The value (gross) of plant after the sale of plant costing Rs 18,000 should have been: 223,000 - 18,000= Rs 205,000. Since it is Rs 283,000, plant worth Rs 78,000 would have been bought during the year. Problem 12 CD LIMITED Statement of Source & Disposition of Funds Sources Profit Add: Depreciation Loss on sale of fixture Debenture redemption premium Less: Profit on sale of machine tool Share capital Sale of machine tool Sale of fixture Uses Debenture redemption Freehold property Plant & machinery Fixtures Increase in working capital

(Rs) 42,000 19,000 1,000 1,000 1,000 62,000 70,000 3,000 2,000 137,000 42,000 20,000 39,000 10,000 111,000 26,000 137,000

10

Ch. 25: Financial Statements and Cash Flow Analysis

Current assets Stocks Debtors Bank balance Total Current liabilities Bank overdraft Creditors Proposed dividends Total Working capital

19X1 (Rs) 37,000 43,000 80,000 14,000 34,000 15,000 63,000 17,000 80,000

19X2 (Rs) 51,000 44,000 16,000 111,000 0 48,000 20,000 68,000 43,000 111,000

Change (Rs) 14,000 1,000 16,000 31,000 -14,000 14,000 5,000 5,000 26,000 31,000

11

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

CASES Case 24.1: Continental Equipment Company (CEC) The working capital position of the company shows increase during the year. The students are required to prepare Cash Flow and Funds Flow Statements for the company. The students must answer the following questions through their analysis: How has the company financed its working capital requirements? Which component significantly contributed to the increase in working capital requirements? What are its implications?

Statement of Changes in Financial Position Sources Net profit Add: Depreciation Add: Provision for tax Less: Tax paid Internal funds Share capital Share premium Total Uses Investment Fixed assets Redemption of debentures Cash dividend Decrease in working capital Total

(Rs) 347,000 140,000 293,000 173,000 607,000 580,000 120,000 1,307,000 120,000 1,140,000 150,000 100,000 1,510,000 -203,000 1,307,000

Notes: 1. Net profit is Rs 347,000. Reserve and surplus increase by Rs 247,000. Thus it is implied that Rs 100,000 cash dividend is distributed. 2. Tax paid is: Rs 180,000 + Rs 293,000 - Rs 300,000 = Rs 173,000. 3. Fixed assets acquired: Rs 18,00,000 - (Rs 8,00,000 - Rs 140,000) = Rs 11,40,000

12

Ch. 25: Financial Statements and Cash Flow Analysis

Case 24.2: Bharat Chemicals Ltd. The cash position of the company has increased in spite of increased inventory and decreased collections which show a discouraging trend. How has cash balance increased? The objective of this case is to strengthen the concepts cash flow and funds flow. The case requires preparation of Cash Flow and Funds Flow Statements for CEC. It shows the way the company has financed its working capital requirements, and the component which have significantly contributed to the increase in working capital requirements. The students must understand the implication of these changes. Statement of changes in cash position Sources & Uses Net loss Add: Depreciation Add: Amortisation of goodwill Add: Decrease in insurance Increase in bills payable Increase in interest payable Increase in accrued wages Less: Increase in debtors Increase in stock Decrease in creditors Cash used in operations Sale of plant Increase in cash

(Rs) -75,000 60,000 25,000 10,000 2,000 5,000 1,000 2,000 -25,000 -20,000 -30,000 -55,000 100,000 45,000

Notes: 1. The book value of plant after depreciation should have been Rs 600,000 - Rs 60,000 = Rs 540,000. Since it is actually Rs 440,000, it is inferred that plant worth Rs 100,000 has been sold.

13

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Case 24.3: Bajaj Auto Ltd. Funds flow: The company has used substantial amount of funds to finance decrease in shareholders and increase in fixed assets. These huge needs are met by liquidating investments. (Rs crore) Sources Borrowings 18.04 Sale of investment 767.78 Release of working capital 45.42 Total 831.24 Uses Decrease in shareholders' funds 567.55 Increase in fixed assets 248.1 Increase in other assets 15.59 Total 831.24 The following comparative balance sheet, given below, provides a more details about the changes in various sources and applications of funds during the year. Comparative Balance Sheet (Rs crore) (Rs crore) I. SOURCES OF FUNDS 1. Shareholders' Funds Share Capital Reserves & Surplus Total 2. Loan Funds Secured Loans Unsecured Loans Total Total Funds II. APPLICATION OF FUNDS 1. Fixed assets Gross Block Less: Accumulated Depreciation Net Block Capital Work in Progress Net Fixed assets 2. Investments Total non-current assets 3. Current Assets, Loans & Advances Inventories Sundry Debtors Cash and Bank Balance Loans and Advances Total Current Assets Less: Current Liabilities & Provisions Current Liabilities Provisions Total Current Liabilities Net Current Assets 4. Misc. Exp. not w/o Total Assets Contingent Liabilities

2000

2001

Difference

119.39 3084.69 3204.08 101.58 394.09 495.67 3699.75

101.18 2535.35 2636.53 55.97 457.74 513.71 3150.24

-18.21 -549.34 -567.55 -45.61 63.65 18.04 -549.51

2041.15 1007.34 1033.81 80.44 1114.25 1952.36 3066.61 261.13 185.8 35.98 1890.46 2373.37 540.35 1200.32 1740.67 632.7 0.44 3699.75 451.8

2467.82 1127.89 1339.93 22.42 1362.35 1184.58 2546.93 253.44 120.72 21.34 1666.12 2061.62 467.55 1006.79 1474.34 587.28 16.03 3150.24 359.56

426.67 120.55 306.12 -58.02 248.1 -767.78 -519.68 -7.69 -65.08 -14.64 -224.34 -311.75 -72.8 -193.53 -266.33 -45.42 15.59 -549.51

14

Ch. 25: Financial Statements and Cash Flow Analysis

Cash flow: The given detailed cash flow statement is summarised below. (Rs crore) I. Cash Flow From Operating Activities (A) Net Profit before Tax & Extraord. Items (B) Adjustment For Depreciation Interest (Net) Dividend Received P/L on Sales of Assets P/L on Sales of Invest Prov. & W/O (Net) P/L in Forex Fin. Lease & Rental Chrgs Others Operating Profit before Working Capital Changes (C) Change in Working Capital Trade & 0th receivables Inventories Trade Payables Loans & Advances Change in Deposits Others Cash Generated from/(used in) Operations Less: Extraordinary items Net Cash From Operating Activities II. Cash Flow from Investing Activities Investment in Assets: Sale of Fixed Assets Capital WIP Sale of Investments Interest Received Dividend Received Others Net Cash Used in Investing Activities III. Cash Flow From Financing Activities Proceeds: Proceed from Short Term Borrowing Payments: Dividend Paid Others Net Cash Flow from Financing activities 2000 289.56 177.29 -108.12 -34.18 1.53 -24.96 6.57 0 -42.83 -63.32 -88.02 201.54 2001 825.23 145.31 -133.18 -37.84 -2.63 -143.34 13.38 0 -46.51 -289.24 -494.05 331.18

65.09 7.69 0 4.96 0 -73.26 4.48 206.02 0 206.02

28.66 -83.63 0 -105.1 0 118.55 -41.52 289.66 0 289.66

7.16 -397.93 786.08 113.25 34.18 70.9 613.64

7.63 -335.53 -358.13 133.96 37.84 156.2 -358.03

65.29

86.7

-118.92 -780.67 -834.3

-94.92 58.49 50.27

15

I. M. Pandey, Financial Management, 9th Edition, New Delhi: Vikas.

Cash Flow Summary Cash at Beginning of the year Net Cash from Operating Activities Net Cash Used in Investing Activities Net Cash Used in Financing Activities Net Inc/(Dec) in Cash Cash at End of the year

35.98 206.02 613.64 -834.3 -14.64 21.34

54.08 289.66 -358.03 50.27 -18.1 35.98

16

Das könnte Ihnen auch gefallen

- NOPAT Calculations Wacc CalculationDokument1 SeiteNOPAT Calculations Wacc CalculationRohit BhardawajNoch keine Bewertungen

- Case Problem 3 Production Scheduling With Changeover CostsDokument3 SeitenCase Problem 3 Production Scheduling With Changeover CostsSomething ChicNoch keine Bewertungen

- Phuket Beach Case SolutionDokument8 SeitenPhuket Beach Case SolutionGmitNoch keine Bewertungen

- IBA Suggested Solution First MidTerm Taxation 12072016Dokument9 SeitenIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanNoch keine Bewertungen

- AXIS PD Report FormatDokument7 SeitenAXIS PD Report Formatvishal kharva100% (1)

- MAXS - SEC 17Q Q2 2022 - FinalDokument60 SeitenMAXS - SEC 17Q Q2 2022 - FinalMyie Cruz-Victor100% (1)

- Are Mergers The Only Solution To Revive Debt Driven BanksDokument3 SeitenAre Mergers The Only Solution To Revive Debt Driven BanksKIPKOSKEI MARKNoch keine Bewertungen

- FM09-CH 29 PDFDokument2 SeitenFM09-CH 29 PDFNaveen RaiNoch keine Bewertungen

- Case 27.1: Reliable Texamill Limited: PBF: IDokument2 SeitenCase 27.1: Reliable Texamill Limited: PBF: IMukul KadyanNoch keine Bewertungen

- FM09 CH 10 Im PandeyDokument19 SeitenFM09 CH 10 Im PandeyJack mazeNoch keine Bewertungen

- FM09-CH 21Dokument4 SeitenFM09-CH 21Mukul KadyanNoch keine Bewertungen

- Ch. 6: Beta Estimation and The Cost of EquityDokument2 SeitenCh. 6: Beta Estimation and The Cost of EquitymallikaNoch keine Bewertungen

- Gujarat, SMEDokument20 SeitenGujarat, SMEDeepak Pareek100% (1)

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDokument25 SeitenChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNoch keine Bewertungen

- FM09-CH 11Dokument5 SeitenFM09-CH 11Mukul KadyanNoch keine Bewertungen

- FM09-CH 05Dokument4 SeitenFM09-CH 05Mukul KadyanNoch keine Bewertungen

- CH 22: Lease, Hire Purchase and Project FinancingDokument7 SeitenCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNoch keine Bewertungen

- SFM May 2015Dokument25 SeitenSFM May 2015Prasanna SharmaNoch keine Bewertungen

- Indian Electricals Cost SheetDokument1 SeiteIndian Electricals Cost SheetPratul BatraNoch keine Bewertungen

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDokument1 Seite(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82Noch keine Bewertungen

- Model Grace CorporationDokument9 SeitenModel Grace CorporationEhtisham AkhtarNoch keine Bewertungen

- (GR1) TCDN - Case 4Dokument19 Seiten(GR1) TCDN - Case 4Thắng Vũ Nguyễn Đức100% (1)

- CASEDokument1 SeiteCASESanskar VyasNoch keine Bewertungen

- Solutions - Chapter 11Dokument3 SeitenSolutions - Chapter 11sajedulNoch keine Bewertungen

- Mercury AthleticDokument9 SeitenMercury AthleticfutyNoch keine Bewertungen

- RAROC ExampleDokument1 SeiteRAROC ExampleVenkatsubramanian R IyerNoch keine Bewertungen

- Numericals On Capital BudgetingDokument3 SeitenNumericals On Capital BudgetingRevati ShindeNoch keine Bewertungen

- LBODokument5 SeitenLBOPasala KalyanNoch keine Bewertungen

- TVM Practice Sums & SolutionsDokument15 SeitenTVM Practice Sums & SolutionsRashi Mehta100% (1)

- Ipcc Cost Accounting RTP Nov2011Dokument209 SeitenIpcc Cost Accounting RTP Nov2011Rakesh VermaNoch keine Bewertungen

- Chap 10 SolutionsDokument6 SeitenChap 10 SolutionsayeshadarlingNoch keine Bewertungen

- FM09-CH 16Dokument12 SeitenFM09-CH 16Mukul KadyanNoch keine Bewertungen

- Review Questions Principles of Cost Accounting - 070850Dokument7 SeitenReview Questions Principles of Cost Accounting - 070850Daniel JuliusNoch keine Bewertungen

- Working Capital Problem SolutionDokument10 SeitenWorking Capital Problem SolutionMahendra ChouhanNoch keine Bewertungen

- FM09-CH 15Dokument7 SeitenFM09-CH 15Mukul Kadyan100% (1)

- TVM Assignment MBA 2013 - 27 ..... NagendraDokument74 SeitenTVM Assignment MBA 2013 - 27 ..... NagendraNaga NagendraNoch keine Bewertungen

- Valuation ProblemsDokument5 SeitenValuation ProblemsAparna KalaskarNoch keine Bewertungen

- Case 1Dokument18 SeitenCase 1Amit Kanti RoyNoch keine Bewertungen

- Solved ProblemsDokument6 SeitenSolved ProblemsVarun DavuluriNoch keine Bewertungen

- FM09-CH 04Dokument4 SeitenFM09-CH 04Mukul KadyanNoch keine Bewertungen

- Bazg521 Nov25 AnDokument2 SeitenBazg521 Nov25 AnDheeraj RaiNoch keine Bewertungen

- Free Cash Flow To Equity (Fcfe)Dokument3 SeitenFree Cash Flow To Equity (Fcfe)Rahul lodhaNoch keine Bewertungen

- Chapter 2 - Solved ProblemsDokument26 SeitenChapter 2 - Solved ProblemsDiptish RamtekeNoch keine Bewertungen

- ONGC ValuationDokument34 SeitenONGC ValuationMoaaz AhmedNoch keine Bewertungen

- 4 - Estimating The Hurdle RateDokument61 Seiten4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- FM09-CH 03 PDFDokument14 SeitenFM09-CH 03 PDFGregNoch keine Bewertungen

- Neogi Chemical CoDokument10 SeitenNeogi Chemical Codpu_bansal83241Noch keine Bewertungen

- 0fa74module 1bDokument2 Seiten0fa74module 1bDev Sharma100% (1)

- PFA Vegetron CaseDokument14 SeitenPFA Vegetron CaseKumKum BhattacharjeeNoch keine Bewertungen

- Project Finance Test QuestionDokument18 SeitenProject Finance Test QuestionKAVYA GUPTANoch keine Bewertungen

- 2 - Time Value of MoneyDokument68 Seiten2 - Time Value of MoneyDharmesh GoyalNoch keine Bewertungen

- Ebit Eps AnalysisDokument11 SeitenEbit Eps Analysismanish9890Noch keine Bewertungen

- Joint Products & by Products: Solutions To Assignment ProblemsDokument5 SeitenJoint Products & by Products: Solutions To Assignment ProblemsXNoch keine Bewertungen

- Sugar Project QuestionDokument22 SeitenSugar Project QuestionAhisj100% (1)

- Kes 2 - EPPM3644 BBAE KL - CLEAR LAKE BAKERY - KUMP 3Dokument5 SeitenKes 2 - EPPM3644 BBAE KL - CLEAR LAKE BAKERY - KUMP 3Durga LetchumananNoch keine Bewertungen

- Practice Questions On Time Value of MoneyDokument7 SeitenPractice Questions On Time Value of MoneyShashank shekhar ShuklaNoch keine Bewertungen

- Baf Sem Vi Sample Multiple Choice QuestionsDokument26 SeitenBaf Sem Vi Sample Multiple Choice Questionsharesh100% (1)

- Dax CorporationsDokument1 SeiteDax CorporationsNazri YusofNoch keine Bewertungen

- Quiz 5Dokument8 SeitenQuiz 5Putin Phy0% (1)

- The Profit and Loss Appropriation AccountDokument4 SeitenThe Profit and Loss Appropriation AccountSarthak GuptaNoch keine Bewertungen

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Dokument4 SeitenFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteNoch keine Bewertungen

- Financial Management - I (Practical Problems)Dokument9 SeitenFinancial Management - I (Practical Problems)sameer_kini100% (1)

- Valuation of Meghna GroupDokument23 SeitenValuation of Meghna GroupFarzana Fariha Lima0% (1)

- Notes - Financial Statement AnalysisDokument61 SeitenNotes - Financial Statement AnalysisBel NochuNoch keine Bewertungen

- Assignment - Intangible AssetDokument5 SeitenAssignment - Intangible AssetJane DizonNoch keine Bewertungen

- Understanding Financial Ratios AnalysisDokument6 SeitenUnderstanding Financial Ratios AnalysismanuNoch keine Bewertungen

- (In Philippine Peso) : Total Current AssetsDokument2 Seiten(In Philippine Peso) : Total Current AssetsJoey WassigNoch keine Bewertungen

- FABM MID TERMS Exam PERFORMANCE TASKDokument3 SeitenFABM MID TERMS Exam PERFORMANCE TASKRaymond RocoNoch keine Bewertungen

- Key Lecture Concepts: Master Budget: Operational and Financial BudgetsDokument13 SeitenKey Lecture Concepts: Master Budget: Operational and Financial BudgetsaNoch keine Bewertungen

- Chapter 8Dokument31 SeitenChapter 8zara afridiNoch keine Bewertungen

- Auditing Non-Current Assets Activity 9Dokument4 SeitenAuditing Non-Current Assets Activity 9ERICK MLINGWANoch keine Bewertungen

- Chapter Fourteen: Mcgraw-Hill/IrwinDokument26 SeitenChapter Fourteen: Mcgraw-Hill/IrwinAdityaPutriWibowoNoch keine Bewertungen

- Gefran Relazione Finanziaria 2017 enDokument308 SeitenGefran Relazione Finanziaria 2017 enGopal HegdeNoch keine Bewertungen

- Module 6 - DisbursementsDokument27 SeitenModule 6 - DisbursementsSusan TalaberaNoch keine Bewertungen

- Cash Flow ProbDokument3 SeitenCash Flow Probbimbee 13Noch keine Bewertungen

- Summary, K EUR: Variable Production Cost Per Unit, EURDokument130 SeitenSummary, K EUR: Variable Production Cost Per Unit, EURPhan Thanh TùngNoch keine Bewertungen

- Chapter 1 Direct Reading GuideDokument10 SeitenChapter 1 Direct Reading GuideOsiris HernandezNoch keine Bewertungen

- Chapter 9 Cash Flow Analysis To Make Investment DecisionsDokument6 SeitenChapter 9 Cash Flow Analysis To Make Investment DecisionstyNoch keine Bewertungen

- Chapter 1 Partnership - Basic Concepts & FormationDokument20 SeitenChapter 1 Partnership - Basic Concepts & FormationmochiNoch keine Bewertungen

- The Book Rich Dad Poor DadDokument6 SeitenThe Book Rich Dad Poor Dadchemeleo zapsNoch keine Bewertungen

- Statement of Change in Financial Position-5Dokument32 SeitenStatement of Change in Financial Position-5Amit SinghNoch keine Bewertungen

- Troso Beauty Salon SampleDokument96 SeitenTroso Beauty Salon SampleayeerahcaliNoch keine Bewertungen

- Fin 520 NoteDokument10 SeitenFin 520 NoteEmanuele OlivieriNoch keine Bewertungen

- 80 FF 75 C 92 C 69 FFB 5Dokument71 Seiten80 FF 75 C 92 C 69 FFB 5deekshaNoch keine Bewertungen

- Ifrs VS Us GaapDokument1 SeiteIfrs VS Us GaapPratidina Aji WidodoNoch keine Bewertungen

- Profitability AnalysisDokument59 SeitenProfitability Analysisankursh8650% (4)

- Cap II Group I RTP Dec2023Dokument84 SeitenCap II Group I RTP Dec2023pratyushmudbhari340Noch keine Bewertungen

- Working Capital ManagementDokument7 SeitenWorking Capital ManagementTrideo RamNoch keine Bewertungen

- Economics of Architectural ConservationDokument6 SeitenEconomics of Architectural ConservationSmritika BaldawaNoch keine Bewertungen

- Acquired, Transferred and Intedrated KnowledgeDokument24 SeitenAcquired, Transferred and Intedrated KnowledgeHillary Murillo SilesNoch keine Bewertungen