Beruflich Dokumente

Kultur Dokumente

Fred Tam F-1 Trader System Signals

Hochgeladen von

priyakedOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fred Tam F-1 Trader System Signals

Hochgeladen von

priyakedCopyright:

Verfügbare Formate

Fred Tam F-1 Trader System

www.iqn.in

Fred Tam F-1 Trader System is incorporated into WinQuote in order to power your trading decisions. It provides automatic buy / sell signals and being a trend trading system it works well in a trending market. If this system is used with discipline can produce 80-90% success rate. Everyone knows how difficult it is to trade the volatile markets and with Fred Tam Trader System trading the volatile market is not difficult anymore. We recommend to use this system to volatile markets with very good liquidity. Whether you are an intra-day trader (day trader), swing trader, long-term position trader you can make use of this system in your trading decision. We try to explain though some examples how you can make this system work for you irrespective your trading pattern. Important tips to use Fred Tam Trader system 1. 2. 3. 4. 5. Trade intra-day trades in the direction of long term trend Trade the markets with good liquidity Trade the volatile markets Use of stop loss Change of smoothening factor (periods) depending the trading system

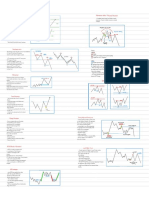

Picture-1 How to get the Trade Signals on the WinQuote Right click on the Chart -> Go to Studies -> Trade Signal -> Fred Tam F-1 Trader System and there you are to view the automatic signals in the form of arrows. Blue ( ) indicates the Buy Signal and Red ( ) Sell Signal. The signal can generate for any intervals. One needs to decide which interval to choose depending on the trading style. In order to generate better result we use the smoothening factor (period). This smoothening factor needs to be increased as and when you decrease the interval. To change the smoothening factor one need to use the Fred Tam F-1 Trader System Parameter window. Simply double click on the arrow or right click on the arrow and a parameter window will be displayed on the chart (see Picture 2). In order to generate trade signal alerts Tick ( ) the Popup Window Minder. Interval Daily Hourly 30-Minute 15-Minute 5-Minute 1-Minute Picture-2 Recommended Smoothening Factor (Period) Buy Sell Trading Style 2 5 7-8 10 12-13 15-16 2 5 7-8 10 12-13 15-16 Position Trading Trade Valid for 2-3 days Trade Valid for 1-2 days Intra-day / Day trading Intra-day / Day trading Intra-day / Day trading

The periods are recommended based on our own analysis and trader can change them as per their trading style

Buy and Sell Signals along with Stop Losses No trading system can generate 100% results and this very fact makes necessary to use the stop loss. We try to explain how we can use the stop loss with the following examples.

Sell Signal and Stop Loss Sell signal is generated anytime during the specified interval. An arrow forms on top of the candle whenever a sell signal is generated. Trader can immediately take a trade or wait for some time before taking a trade. Once the trade is taken it is important to protect this trade with a stop loss. A simple stop loss method is used in this case to identify the stop loss level. Stop loss = Highest price between the current sell signal and previous buy signal. (STOP as pointed out in the Picture). This is an initial stop loss when the trade is taken. Liquidation of position is left to the decision of the trader, using trailing stop loss or using a minimum of 2:1 (Profit / Risk) ratio is recommended.

Picture-3

Buy Signal and Stop Loss Buy signal is generated anytime during the specified interval. An arrow forms at the bottom of the candle whenever a buy signal is generated. Trader can immediately take a trade or wait for some time before taking a trade. Once the trade is taken it is important to protect this trade with a stop loss. A simple stop loss method is used in this case to identify the stop loss level. Stop loss = Lowest price between the current buy signal and previous sell signal. (STOP as pointed out in the Picture). This is an initial stop loss when the trade is taken. Liquidation of position is left to the decision of the trader, using trailing stop loss or using a minimum of 2:1 (Profit / Risk) ratio is recommended. Picture-4

What is trailing stop loss A stop-loss level set above or below the current price that adjusts as the price fluctuates. For a long position, a trailing stop would be set below the current price and would rise as the price advances. Should the price decline and reach the trailing stop, then a stop-loss would be triggered and the position closed. As long as the price remains above the trailing stop, the position is held.

Trading in the direction of the long term trend If you are position trader this trader system gives you 80-90% success rate. Position traders need to you use the daily chart interval with a period buy 2 and Sell 2. If you are an intra-day trader you need to trade in the direction of trend on the daily chart. For example: If the daily chart interval with a period 2-2 is showing a buy signal, which means the market is going to remain bullish for few days. Trading in the direction of market trend on daily chart is recommended which means one need to trade all buy signals generated on intra-day charts and ignore the sell signals. If the daily chart interval with a period 2-2 is showing a sell signal, which means the market is going to remain bearish for few days. Trading in the direction of market trend on daily chart is recommended which means one need to trade all sell signals generated on intra-day charts and ignore the buy signals. This way one This way one can achieve better success even if you are doing intra-day trading using Fred Tam Trader System. We tried to explain in Picture 5 and 6 below.

Picture-5

Picture-6 If you are using the hourly, 30-minute, 15 Minute charts we recommend to trade in the direction of daily chart trend and if you are using 5-minute and 1-minute charts we recommend to trade in the direction of hourly chart trend.

Why need to use the smoothening factor with different interval Using the smoothening factor (period) as and when you change the interval is important in order to achieve better and clear signals. We tried to explain in the following example.

Picture 7

Picture 8

Das könnte Ihnen auch gefallen

- The StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsVon EverandThe StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsBewertung: 5 von 5 Sternen5/5 (1)

- 4 Simple Volume Trading StrategiesDokument49 Seiten4 Simple Volume Trading StrategiesCharles Barony25% (4)

- The Master Swing Trader Toolkit: The Market Survival GuideVon EverandThe Master Swing Trader Toolkit: The Market Survival GuideNoch keine Bewertungen

- Welcome To The "Introduction To Short-Term Breakout Trading" SeminarDokument27 SeitenWelcome To The "Introduction To Short-Term Breakout Trading" Seminarlordwall69Noch keine Bewertungen

- HowToUseVolumeAndTechnicalsToImproveReliability PDFDokument5 SeitenHowToUseVolumeAndTechnicalsToImproveReliability PDFJay JobanputraNoch keine Bewertungen

- The 21 Irrefutable Truths of TradingDokument176 SeitenThe 21 Irrefutable Truths of Tradingnagylaci85% (13)

- The New High: New Low Index: Stock Market’s Best Leading IndicatorVon EverandThe New High: New Low Index: Stock Market’s Best Leading IndicatorBewertung: 4 von 5 Sternen4/5 (5)

- Gap Trading TechniquesDokument19 SeitenGap Trading Techniquesapi-3763249100% (22)

- Trend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingVon EverandTrend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingBewertung: 5 von 5 Sternen5/5 (1)

- Scalp Trading Methods Kevin HoDokument4 SeitenScalp Trading Methods Kevin HoBen YeungNoch keine Bewertungen

- Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationVon EverandPring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationNoch keine Bewertungen

- Trading Strategies DuncanDokument68 SeitenTrading Strategies DuncanSeventy70100% (1)

- Envelope Trend Trading SystemDokument3 SeitenEnvelope Trend Trading Systemmangelbel6749Noch keine Bewertungen

- Advanced Charting Techniques for High Probability Trading: The Most Accurate And Predictive Charting Method Ever CreatedVon EverandAdvanced Charting Techniques for High Probability Trading: The Most Accurate And Predictive Charting Method Ever CreatedBewertung: 3 von 5 Sternen3/5 (7)

- 3 TIMELESS Setups That Have Made Me TENS of MILLIONS! - QullamaggieDokument28 Seiten3 TIMELESS Setups That Have Made Me TENS of MILLIONS! - QullamaggieFerris To100% (1)

- Find A Trend With The Partial RetraceDokument8 SeitenFind A Trend With The Partial RetraceVibhats VibhorNoch keine Bewertungen

- Trading: The Best of The BestDokument35 SeitenTrading: The Best of The BestjonnhlNoch keine Bewertungen

- YTC PAT Vol 2 P73Dokument1 SeiteYTC PAT Vol 2 P73sarma jNoch keine Bewertungen

- Triple Screen Trading SystemDokument22 SeitenTriple Screen Trading Systemalrog2000Noch keine Bewertungen

- 10 Must-Know Bar Patterns for Price Action TradersDokument14 Seiten10 Must-Know Bar Patterns for Price Action Traderssal8471100% (2)

- The Super Scalper StrategyDokument10 SeitenThe Super Scalper StrategyEchal Boneless100% (1)

- Qullamaggie's Laws of SwingDokument5 SeitenQullamaggie's Laws of SwingLuca Dalessandro100% (2)

- Tape Reading 10 TipsDokument4 SeitenTape Reading 10 TipsAnupam Bhardwaj100% (1)

- 2B Reversal Pattern PDFDokument5 Seiten2B Reversal Pattern PDFdityoz1288Noch keine Bewertungen

- Jeff Cooper 7set UpDokument170 SeitenJeff Cooper 7set Upanalystbank67% (3)

- The Trade Price Method 1.2Dokument84 SeitenThe Trade Price Method 1.2Nadzif Hasan100% (1)

- Van Tharp PDF Documents DownloadDokument1 SeiteVan Tharp PDF Documents DownloaddeepakNoch keine Bewertungen

- The Little Book of Currency Trading. by Kathy Lien.: Predicting Is Really Hard, Especially About The Future!Dokument14 SeitenThe Little Book of Currency Trading. by Kathy Lien.: Predicting Is Really Hard, Especially About The Future!RajaNoch keine Bewertungen

- 1-to-1 Pinbar Scalping Forex StrategyDokument9 Seiten1-to-1 Pinbar Scalping Forex StrategyNithiyanantham BcomcaNoch keine Bewertungen

- A Complete Trading SystemDokument15 SeitenA Complete Trading Systemsajarnitsa100% (1)

- Inside Bar TradingDokument165 SeitenInside Bar TradingBhavik PatelNoch keine Bewertungen

- 4 Advanced Gap Trading TacticsDokument27 Seiten4 Advanced Gap Trading Tacticschandra36975% (8)

- Trading SystemDokument7 SeitenTrading Systemac.wirawan320950% (2)

- Dan Zanger Trading Rules PDFDokument4 SeitenDan Zanger Trading Rules PDFljhreNoch keine Bewertungen

- Summary of Market PracticesDokument39 SeitenSummary of Market Practicesdatsno100% (1)

- 4H Box Breakout StrategyDokument15 Seiten4H Box Breakout StrategyzagamotoNoch keine Bewertungen

- Darvas Technical Filter Plus PDFDokument32 SeitenDarvas Technical Filter Plus PDFAlvinNoch keine Bewertungen

- Pyramiding by Nick RadgeDokument6 SeitenPyramiding by Nick RadgeThe Chartist100% (3)

- The Simple Strategy - Markus HeitkoetterDokument107 SeitenThe Simple Strategy - Markus HeitkoetterAnil Kumar82% (11)

- Price ActionDokument26 SeitenPrice Actionwealthyjoe100% (4)

- Trade With Deadly AccuracyDokument1.210 SeitenTrade With Deadly AccuracyAnonymous rPnAUz47Fe50% (4)

- The 30-Minute Breakout StrategyDokument15 SeitenThe 30-Minute Breakout StrategyMohd Yazel Md SabiaiNoch keine Bewertungen

- Candlestick Quick Reference Guide - 001Dokument20 SeitenCandlestick Quick Reference Guide - 001Bv Rao100% (2)

- Price and Volume AnalystDokument21 SeitenPrice and Volume Analystlaozi222100% (2)

- Vsa BasicsDokument20 SeitenVsa BasicsRavikumar Gandla100% (2)

- Position Sizing SummaryDokument2 SeitenPosition Sizing Summaryeyeguy100% (3)

- Trading NR7 SetupDokument24 SeitenTrading NR7 Setupsangram2483% (6)

- ADXBreakoutScanning 04 2010Dokument6 SeitenADXBreakoutScanning 04 2010mcarv63Noch keine Bewertungen

- Trendlines and Channels-Draw A Manual Trend LineDokument3 SeitenTrendlines and Channels-Draw A Manual Trend LineAgus Empu Ranubayan100% (1)

- Price Action Scalper PDFDokument17 SeitenPrice Action Scalper PDFNei Winchester100% (3)

- ConnorsRSI Pullbacks GuidebookDokument46 SeitenConnorsRSI Pullbacks GuidebookBill Hunter80% (5)

- MTF Trend-Pullback Trading 20100228Dokument12 SeitenMTF Trend-Pullback Trading 20100228bluenemoNoch keine Bewertungen

- Turtle RulesDokument38 SeitenTurtle RulesTiago Nunes Barbi Costa100% (4)

- Buy The Fear Sell The Greed Chapter-1Dokument23 SeitenBuy The Fear Sell The Greed Chapter-1johar Mohammad100% (1)

- Price Action Trading.Dokument75 SeitenPrice Action Trading.Muhammed Saleem40% (5)

- Swing Trading System by TradehunterDokument21 SeitenSwing Trading System by Tradehunterjacs6401Noch keine Bewertungen

- Connors, Larry - Connors On Advanced Trading StrategiesDokument110 SeitenConnors, Larry - Connors On Advanced Trading Strategiespriyaked100% (2)

- Lecture 29Dokument7 SeitenLecture 29priyakedNoch keine Bewertungen

- GANN WD - (1931) The Human BodyDokument1 SeiteGANN WD - (1931) The Human BodyAjay KukrejaNoch keine Bewertungen

- Futures Rollover Report: Dy/ DXDokument14 SeitenFutures Rollover Report: Dy/ DXpriyakedNoch keine Bewertungen

- Sir 031213vixDokument3 SeitenSir 031213vixpriyakedNoch keine Bewertungen

- Scrapbook WebDokument22 SeitenScrapbook WebpriyakedNoch keine Bewertungen

- ABCDokument158 SeitenABCpriyaked100% (1)

- L Portfolio - Feb 2014Dokument5 SeitenL Portfolio - Feb 2014priyakedNoch keine Bewertungen

- Volatility Index: I TH I I I IDokument16 SeitenVolatility Index: I TH I I I ILokesh YadavNoch keine Bewertungen

- Carolan, Christopher - Put-Call-Ratios & How To Use ThemDokument4 SeitenCarolan, Christopher - Put-Call-Ratios & How To Use ThempriyakedNoch keine Bewertungen

- Impact of FII's On Indian Stock Markets: ManagementDokument5 SeitenImpact of FII's On Indian Stock Markets: ManagementpriyakedNoch keine Bewertungen

- L Portfolio - Feb 2014Dokument5 SeitenL Portfolio - Feb 2014priyakedNoch keine Bewertungen

- Impact of FII's On Indian Stock Markets: ManagementDokument5 SeitenImpact of FII's On Indian Stock Markets: ManagementpriyakedNoch keine Bewertungen

- India VIX Comp MethDokument2 SeitenIndia VIX Comp MethTelika RamuNoch keine Bewertungen

- wf06 249Dokument31 Seitenwf06 249priyakedNoch keine Bewertungen

- IftaDokument44 SeitenIftapriyakedNoch keine Bewertungen

- Crazeal VoucherDokument1 SeiteCrazeal VoucherpriyakedNoch keine Bewertungen

- Forecasting VolatilityDokument132 SeitenForecasting VolatilityPeter Pank100% (1)

- Ruchika Lifstyle InvitDokument1 SeiteRuchika Lifstyle InvitpriyakedNoch keine Bewertungen

- Sir 031213vixDokument3 SeitenSir 031213vixpriyakedNoch keine Bewertungen

- Flying Dutchman - India Still Stuck in A RutDokument24 SeitenFlying Dutchman - India Still Stuck in A RutpriyakedNoch keine Bewertungen

- Dow SignalsDokument1 SeiteDow SignalspriyakedNoch keine Bewertungen

- India VIX Comp MethDokument2 SeitenIndia VIX Comp MethTelika RamuNoch keine Bewertungen

- Chadar Business StandardDokument1 SeiteChadar Business StandardAnup GuptaNoch keine Bewertungen

- Golden Cross - A Technical Signal Worth Its Weight in GoldDokument3 SeitenGolden Cross - A Technical Signal Worth Its Weight in GoldBrijesh KothariNoch keine Bewertungen

- Flying Dutchman - India Still Stuck in A RutDokument24 SeitenFlying Dutchman - India Still Stuck in A RutpriyakedNoch keine Bewertungen

- L Portfolio - Feb 2014Dokument5 SeitenL Portfolio - Feb 2014priyakedNoch keine Bewertungen

- The Wisdom of Wyckoff: Presented by Thomas Hamilton Special Risk Capital Management, LLCDokument39 SeitenThe Wisdom of Wyckoff: Presented by Thomas Hamilton Special Risk Capital Management, LLCAnkur100% (1)

- The Complete Guide To Comprehensive Fibonacci Analysis On Forex - Viktor Pershikov PDFDokument322 SeitenThe Complete Guide To Comprehensive Fibonacci Analysis On Forex - Viktor Pershikov PDFNisha Sharma83% (24)

- Eadlines: US Consumer Prices Rose 0.3% in JuneDokument16 SeitenEadlines: US Consumer Prices Rose 0.3% in JuneSeema GusainNoch keine Bewertungen

- An In-Depth Look at Stanley Druckenmillers Investing Strategy Fortune Magazine Interview 1988Dokument3 SeitenAn In-Depth Look at Stanley Druckenmillers Investing Strategy Fortune Magazine Interview 1988hohgch100% (2)

- The Engulfing Trader Handbook English VersionDokument26 SeitenThe Engulfing Trader Handbook English VersionJm TolentinoNoch keine Bewertungen

- Es070617 1Dokument3 SeitenEs070617 1RICARDO100% (1)

- Ichimoku Charting SystemDokument8 SeitenIchimoku Charting SystemIonel Leordeanu100% (3)

- Assignment#4 SECDokument5 SeitenAssignment#4 SECGabriel Matthew Lanzarfel GabudNoch keine Bewertungen

- BlockchainDecryptedFor2018 PDFDokument46 SeitenBlockchainDecryptedFor2018 PDFPunjena Paprika100% (1)

- Rakesh JhunjhunDokument11 SeitenRakesh JhunjhunRanjith Shankar HanbalNoch keine Bewertungen

- March 17, 2011 PostsDokument1.101 SeitenMarch 17, 2011 PostsAlbert L. PeiaNoch keine Bewertungen

- 11 Candlestick Reversal Patterns Every Trader Should KnowDokument12 Seiten11 Candlestick Reversal Patterns Every Trader Should KnowNelson Alfonzo100% (3)

- Top 10 Binary StrategyDokument17 SeitenTop 10 Binary Strategyleosena78100% (6)

- Understanding Crypto: Crypto Affairs of Pakistan SycapDokument17 SeitenUnderstanding Crypto: Crypto Affairs of Pakistan SycapNOUMAN AHMED BUTTNoch keine Bewertungen

- Volume AnalysisDokument3 SeitenVolume Analysisamar_pmishra4590Noch keine Bewertungen

- Price Is EverythingDokument73 SeitenPrice Is EverythingSuthan D'alvins100% (1)

- Introduction To Market Structures and Order Blocks: by Alex MwegaDokument13 SeitenIntroduction To Market Structures and Order Blocks: by Alex MwegaHenry Jura100% (5)

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDokument40 SeitenHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- My Trading PlanDokument4 SeitenMy Trading PlanEdrinanimous AnandezNoch keine Bewertungen

- Mock MCQ Test: Subject: Investment ManagementDokument14 SeitenMock MCQ Test: Subject: Investment ManagementAshlinJoel BangeraNoch keine Bewertungen

- Advanced Scalping TechniquesDokument136 SeitenAdvanced Scalping TechniquesBrandon Johnson95% (19)

- CANDLESTICK CHART PATTERNSDokument33 SeitenCANDLESTICK CHART PATTERNSMd. Saiful Islam0% (1)

- TrendingDokument66 SeitenTrendingSunil Sunita100% (1)

- Boom and Crash 500Dokument18 SeitenBoom and Crash 500Pauline Chaza100% (6)

- Beginners Guide FXDokument6 SeitenBeginners Guide FXKhebz FxNoch keine Bewertungen

- Tutti: Structure and Time Momentum Shifts / Reversal StructureDokument1 SeiteTutti: Structure and Time Momentum Shifts / Reversal StructureMus'ab Abdullahi BulaleNoch keine Bewertungen

- What is a candlestick chartDokument14 SeitenWhat is a candlestick chartSmile EverNoch keine Bewertungen

- Elliott Wave Theory BasicsDokument7 SeitenElliott Wave Theory BasicsSarat KumarNoch keine Bewertungen

- Carter Favorite Set UpsDokument56 SeitenCarter Favorite Set UpsAndreas100% (2)

- Cycles in Time and MoneyDokument7 SeitenCycles in Time and MoneyNDameanNoch keine Bewertungen

- An Architect's Guide to Construction: Tales from the Trenches Book 1Von EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1Noch keine Bewertungen

- Markup & Profit: A Contractor's Guide, RevisitedVon EverandMarkup & Profit: A Contractor's Guide, RevisitedBewertung: 5 von 5 Sternen5/5 (11)

- A Place of My Own: The Architecture of DaydreamsVon EverandA Place of My Own: The Architecture of DaydreamsBewertung: 4 von 5 Sternen4/5 (241)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsVon EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsBewertung: 4.5 von 5 Sternen4.5/5 (6)

- The E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItVon EverandThe E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItBewertung: 4 von 5 Sternen4/5 (16)

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsVon EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedVon EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedBewertung: 5 von 5 Sternen5/5 (1)

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationVon EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationBewertung: 4 von 5 Sternen4/5 (18)

- Building Construction Technology: A Useful Guide - Part 1Von EverandBuilding Construction Technology: A Useful Guide - Part 1Bewertung: 4 von 5 Sternen4/5 (3)

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionVon EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionBewertung: 4.5 von 5 Sternen4.5/5 (2)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseVon EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseBewertung: 5 von 5 Sternen5/5 (3)

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialVon EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialNoch keine Bewertungen

- Engineering Critical Assessment (ECA) for Offshore Pipeline SystemsVon EverandEngineering Critical Assessment (ECA) for Offshore Pipeline SystemsNoch keine Bewertungen

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideVon Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideBewertung: 3.5 von 5 Sternen3.5/5 (7)

- Civil Engineer's Handbook of Professional PracticeVon EverandCivil Engineer's Handbook of Professional PracticeBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Woodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsVon EverandWoodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsBewertung: 1 von 5 Sternen1/5 (4)

- Nuclear Energy in the 21st Century: World Nuclear University PressVon EverandNuclear Energy in the 21st Century: World Nuclear University PressBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Building Construction Technology: A Useful Guide - Part 2Von EverandBuilding Construction Technology: A Useful Guide - Part 2Bewertung: 5 von 5 Sternen5/5 (1)

- Field Guide for Construction Management: Management by Walking AroundVon EverandField Guide for Construction Management: Management by Walking AroundBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Real Life: Construction Management Guide from A-ZVon EverandReal Life: Construction Management Guide from A-ZBewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyVon EverandThe Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyBewertung: 4 von 5 Sternen4/5 (1)

- Traditional Toolmaking: The Classic Treatise on Lapping, Threading, Precision Measurements, and General ToolmakingVon EverandTraditional Toolmaking: The Classic Treatise on Lapping, Threading, Precision Measurements, and General ToolmakingBewertung: 5 von 5 Sternen5/5 (2)

- Residential Construction Performance Guidelines, Contractor ReferenceVon EverandResidential Construction Performance Guidelines, Contractor ReferenceNoch keine Bewertungen