Beruflich Dokumente

Kultur Dokumente

Outlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings Affirmed

Hochgeladen von

api-231665846Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Outlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings Affirmed

Hochgeladen von

api-231665846Copyright:

Verfügbare Formate

Research Update:

Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

Primary Credit Analyst: Maria J Redondo, London (44) 20-7176-7094; maria.redondo@standardandpoors.com Secondary Contacts: Moritz Kraemer, Frankfurt (49) 69-33-999-249; moritz.kraemer@standardandpoors.com Maxim Rybnikov, London (+44) 207 176 7125; maxim.rybnikov@standardandpoors.com

Table Of Contents

Overview Rating Action Rationale Outlook Key Statistics Related Criteria And Research Ratings List

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 1

1294573 | 300051529

Research Update:

Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

Overview

In our view, Finland's persistent subpar growth rate reflects deep structural demographic and economic imbalances that hamper the government's efforts to achieve fiscal consolidation. We consider that there are downside risks to growth and policy implementation. We are therefore revising the outlook on our long-term sovereign credit ratings on Finland to negative from stable. We are affirming our 'AAA/A-1+' long- and short-term foreign and local currency ratings on the Republic of Finland.

Rating Action

On April 11, 2014, Standard & Poor's Ratings Services revised its outlook on the Republic of Finland to negative from stable. At the same time, we affirmed our 'AAA/A-1+' long- and short-term foreign and local currency sovereign credit ratings on Finland.

Rationale

The outlook revision reflects our view of Finland's protracted economic stagnation, with average GDP per capita growth over the past decade of close to zero. We now view GDP growth in 2013 as markedly more negative than we had previously anticipated at -1.4%, rather than -0.5% (see "Ratings On Finland Affirmed At 'AAA/A-1+'; Outlook Stable," published Oct. 18, 2013, on RatingsDirect). We have also lowered our growth assumptions for 2014-2016 to 1% on average, from an already low 1.4% previously. Furthermore, we believe that the economy remains vulnerable to any slowdown of economic activity in the euro area or among other major trading partners, such as Russia. In our view, weak labor market conditions, an adverse demographic profile, and subdued investment activity will likely continue to hamper domestic demand. We expect that fragile external demand will continue to limit Finland's underperforming export sector. Falling terms of trade and rising unit labor costs have diminished the competitiveness of Finland's tradable sector. We believe that in such an environment the risks to Finland's economic and fiscal performance are increasingly on the downside. The moderate pace of policy implementation addressing structural deficiencies might also hinder the

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 2

1294573 | 300051529

Research Update: Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

delivery of fiscal targets over the medium term. Our ratings on Finland continue to be supported by its innovative and wealthy economy. We estimate its per-capita income at around $47,900 in 2014. Furthermore, net general government debt is low at an estimated 20% of GDP in 2014, supported by large amounts of liquid assets. The ratings also reflect Finland's high degree of institutional and governance effectiveness, and its membership of the European Economic and Monetary Union (EMU or eurozone). This bestows Finnish borrowers, including the government, with enhanced access to international capital markets and permits domestic banks to access liquidity from the European Central Bank (ECB), benefitting from the ECB's monetary flexibility as an issuer of a floating reserve currency. These strengths are somewhat constrained by Finland's weaker external performance, as depressed global demand and decreasing competitiveness have led to current account deficits since 2011 and expected for 2014-2017. Moreover, structurally weaker growth and pressure from increasing social and health costs challenge Finland's track record of a prudent fiscal policy stance. The large share of central government bonds held by nonresidents, estimated at close to 90%, also constitutes a rating weakness in our opinion, as nonresident investors have often shown themselves to be more volatile than domestic investors. Finland's traditional wood and paper industry, accounting for over 2% of GDP in 2013, faces cost pressures, and its electronics industry's output (just over 1% of GDP) has contracted substantially, in part reflecting Nokia's decline. In our opinion, it remains uncertain whether other sectors, such as the broader information and technology sector and the chemical industry, can compensate for the output loss in these sectors. Nevertheless, the collective wage agreement to cap salary increases agreed last year might provide some prospects for recovering cost competitiveness lost in recent years. Weak economic growth, an aging population, and deficiencies at the municipal level have weighed on the general government balance. Accordingly, we expect Finland's gross general government debt to surpass 60% of GDP in 2015, from 34% in 2008. As a result of consolidation measures implemented since 2013, we estimate that the general government deficit will recede to 2% of GDP this year, down from 2.1% in 2013, in spite of the prevailing weak economic conditions. Despite the deterioration in public finances, Finland's government balance sheet is strong, primarily because of its holdings of publicly mandated defined-benefit pension assets, and we have factored this strength into our analysis. We anticipate general government debt, net of pension and liquid assets, will exceed 21% of GDP in 2017. The banking system appears well-capitalized and is dominated by pan-Nordic banks (see "Banking Industry Country Risk Assessment: Finland," published Jan. 3, 2014). In our assessment, the system does not pose a significant contingent liability to the Finnish government. In light of continuing downward pressures to growth and to fiscal targets, the government decided on March 25, 2014, further measures aimed at delivering

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 3

1294573 | 300051529

Research Update: Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

central government revenue increases and expenditure cuts totaling 2.3 billion over 2015-2018. We understand that the impact of the immediate measures is frontloaded to 2015, when the government expects a 1.6 billion reduction of its fiscal deficit. The government has complemented its consolidation package with a growth package entailing 1.9 billion assets sales, of which 1.3 billion will be used to pay down debt and 0.6 billion will be invested in growth-enhancing projects. We understand that over the current parliamentary term (2011-2015), the government would have provided a structural consolidation package totaling 6.8 billion. We expect that some of the key reforms to bring public finances onto a sustainable path, such as the labor and the social and health care services reforms, will only take effect toward the end of our forecast period. For instance, we understand that the government has planned the latter reform taking effect from January 2017. Meanwhile, protracted subdued growth, low employment rates, and higher costs related to an aging population will continue to weigh on government expenditure over the medium term. Moreover, the success of the structural package hinges on continuing efforts by the next government following parliamentary elections in early April 2015. We believe that Finnish policymakers will remain committed to pursuing fiscal and structural reforms, and that policymaking will remain prudent, transparent, and consensus-based. On this basis, we do not anticipate any substantial deviation to current policies as a result of prime minister Jyrki Katainen's resignation next June, although we cannot rule out some measures may stall in the run-up to next parliamentary elections. Finland's external debt is growing. Net of official reserves and financial sector external assets, we project will reach 193% of current account receipts (CARs) this year, before trending downward. This contrasts with its favorable net external asset position following nearly two decades of current account surpluses (a trend which ended in 2010) and substantial net foreign direct investment and portfolio equity outflows. We have factored this into our analysis, according to our criteria, because net external liabilities estimated at 28% of current account receipts (CARs) in 2014 are much lower than the narrow external debt position, at 193% of CARs. We expect that the current account will remain in deficit over the next few years, gradually trending toward balance as external demand improves. We have factored in short-term external debt by remaining maturity, which will exceed 300% of CARs this year. We view this level, stemming primarily from external liabilities of the financial sector, as high, according to our criteria.

Outlook

The negative outlook reflects our view that there is at least a one-in-three chance that we will lower the ratings within the next 24 months should no clear signs emerge that Finland's negative economic and fiscal debt trends are being reversed. Should we lower the long-term ratings, it would most likely be by one notch.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 4

1294573 | 300051529

Research Update: Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

We could revise the outlook to stable if we observed compelling evidence of competitiveness and broad-based economic growth returning to Finland. An outlook revision to stable would also depend on swift progress in comprehensive reform that we considered effectively addressed Finland's structural impediments and rising government debt burden.

Key Statistics

Table 1

Republic of Finland - Selected Indicators

2007 Nominal GDP (US$ bil) GDP per capita (US$) Real GDP growth (%) Real GDP per capita growth (%) Change in general government debt/GDP (%) General government balance/GDP (%) General government debt/GDP (%) Net general government debt/GDP (%) General government interest expenditure/revenues (%) Oth dc claims on resident non-govt. sector/GDP (%) CPI growth (%) Gross external financing needs/CARs +use. res (%) Current account balance/GDP (%) Current account balance/CARs (%) Narrow net external debt/CARs (%) Net external liabilities/CARs (%) 246 46,644 5.3 4.9 (1.4) 5.3 35.2 1.5 2.8 81.5 1.6 207.9 4.3 7.5 92.3 53.1 2008 272 51,309 0.3 (0.2) (0.1) 4.4 33.9 4.9 2.7 86.0 3.9 223.7 2.6 4.6 81.5 4.5 2009 239 44,946 (8.5) (9.0) 7.0 (2.5) 43.6 8.0 2.6 93.7 1.6 352.1 1.8 3.9 146.6 (15.4) 2010 237 44,235 3.4 2.9 6.7 (2.5) 48.8 9.9 2.6 95.4 1.7 358.3 1.5 3.1 138.9 (43.8) 2011 262 48,809 2.8 2.4 3.0 (0.7) 49.3 14.9 2.6 96.8 3.3 376.1 (1.5) (3.0) 134.8 (37.0) 2012 247 45,754 (1.0) (1.5) 4.0 (1.8) 53.6 16.5 2.6 99.1 3.2 502.8 (1.4) (2.9) 179.8 (37.9) 2013e 257 47,339 (1.4) (1.8) 3.3 (2.1) 57.0 18.2 2.8 102.0 2.2 461.8 (1.1) (2.2) 186.9 (33.2) 2014f 261 47,857 0.5 0.0 5.2 (2.0) 59.1 19.9 2.9 104.0 1.8 376.4 (1.7) (3.4) 193.2 (28.5) 2015f 263 47,956 1.2 0.8 4.5 (2.0) 61.9 21.1 3.3 105.6 1.8 359.2 (1.2) (2.3) 195.3 (25.5) 2016f 273 49,617 1.4 0.9 3.7 (2.0) 63.8 21.9 3.4 107.5 1.8 321.4 (0.9) (1.6) 189.5 (22.4) 2017f 282 50,963 1.5 1.0 2.3 (1.5) 64.1 21.3 3.5 109.4 1.8 319.1 (0.9) (1.7) 184.6 (19.6)

Other depository corporations (dc) are financial corporations (other than the central bank) whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private- sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. CARs--Current account receipts. The data and ratios above result from S&Ps own calculations, drawing on national as well as international sources, reflecting S&Ps independent view on the timeliness, coverage, accuracy, credibility, and usability of available information.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 5

1294573 | 300051529

Research Update: Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

Related Criteria And Research

Related Criteria

Sovereign Government Rating Methodology And Assumptions, June 24, 2013 Methodology For Linking Short-Term And Long-Term Ratings For Corporate, Insurance, And Sovereign Issuers, May 7, 2013 Criteria For Determining Transfer And Convertibility Assessments, May 18, 2009

Related Research

Sovereign Defaults And Rating Transition Data, 2012 Update, March 29, 2013 Sovereign Ratings And Country T&C Assessments, March 28, 2014 Banking Industry Country Risk Assessment: Finland, Jan. 3, 2014 Emerging Markets Sovereign Debt Report 2014: Borrowing To Remain Broadly Unchanged This Year, Feb. 27, 2014 Sovereign Risk Indicators, March 24, 2014, (Interactive version also available at http://www.spratings.com/sri ) Ratings On Finland Affirmed At 'AAA/A-1+'; Outlook Stable, Oct. 18, 2013 In accordance with our relevant policies and procedures, the Rating Committee was composed of analysts that are qualified to vote in the committee, with sufficient experience to convey the appropriate level of knowledge and understanding of the methodology applicable (see 'Related Criteria And Research'). At the onset of the committee, the chair confirmed that the information provided to the Rating Committee by the primary analyst had been distributed in a timely manner and was sufficient for Committee members to make an informed decision. After the primary analyst gave opening remarks and explained the recommendation, the Committee discussed key rating factors and critical issues in accordance with the relevant criteria. Qualitative and quantitative risk factors were considered and discussed, looking at track-record and forecasts. The chair ensured every voting member was given the opportunity to articulate his/her opinion. The chair or designee reviewed the draft report to ensure consistency with the Committee decision. The views and the decision of the rating committee are summarized in the above rationale and outlook.

Ratings List

Ratings Affirmed; CreditWatch/Outlook Action To Finland (Republic of) Sovereign Credit Rating AAA/Negative/A-1+ Transfer & Convertibility Assessment AAA Senior Unsecured AAA Short-Term Debt A-1+ From AAA/Stable/A-1+

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 6

1294573 | 300051529

Research Update: Outlook On Finland Revised To Negative On Subpar Growth Prospects; 'AAA/A-1+' Ratings Affirmed

Finnvera PLC Senior Unsecured

AAA

Additional Contact: SovereignEurope; SovereignEurope@standardandpoors.com

Complete ratings information is available to subscribers of RatingsDirect at www.globalcreditportal.com and at spcapitaliq.com. All ratings affected by this rating action can be found on Standard & Poor's public Web site at www.standardandpoors.com. Use the Ratings search box located in the left column. Alternatively, call one of the following Standard & Poor's numbers: Client Support Europe (44) 20-7176-7176; London Press Office (44) 20-7176-3605; Paris (33) 1-4420-6708; Frankfurt (49) 69-33-999-225; Stockholm (46) 8-440-5914; or Moscow 7 (495) 783-4009.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 7

1294573 | 300051529

Copyright 2014 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 8

1294573 | 300051529

Das könnte Ihnen auch gefallen

- Money Demand and Equilibrium RatesDokument23 SeitenMoney Demand and Equilibrium RatesJudithNoch keine Bewertungen

- Central Bank Balance Sheet Money SupplyDokument37 SeitenCentral Bank Balance Sheet Money SupplyIzzy Cohn0% (1)

- Sugar Methodology PDFDokument12 SeitenSugar Methodology PDFDeepak DharmarajNoch keine Bewertungen

- Republic of Poland Ratings Affirmed Outlook Stable: Research UpdateDokument8 SeitenRepublic of Poland Ratings Affirmed Outlook Stable: Research Updateapi-228714775Noch keine Bewertungen

- Latvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook StableDokument8 SeitenLatvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook Stableapi-228714775Noch keine Bewertungen

- Policy Easing To Accelerate in H1: China Outlook 2012Dokument21 SeitenPolicy Easing To Accelerate in H1: China Outlook 2012valentinaivNoch keine Bewertungen

- Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook StableDokument8 SeitenLithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook Stableapi-231665846Noch keine Bewertungen

- Moodys Iceland July 2013 NewDokument20 SeitenMoodys Iceland July 2013 NewTeddy JainNoch keine Bewertungen

- Full S&P Rating StatementDokument13 SeitenFull S&P Rating StatementFadia SalieNoch keine Bewertungen

- Romania Long Term OutlookDokument5 SeitenRomania Long Term OutlooksmaneranNoch keine Bewertungen

- Romania: Letter of Intent, Memorandum of Economic and FinancialDokument36 SeitenRomania: Letter of Intent, Memorandum of Economic and FinancialFlorin CituNoch keine Bewertungen

- Burundi Debt Sustainability AnalysisDokument16 SeitenBurundi Debt Sustainability AnalysisBharat SethNoch keine Bewertungen

- Ratings On Spain Affirmed at 'BBB-/A-3' Outlook Negative: Research UpdateDokument6 SeitenRatings On Spain Affirmed at 'BBB-/A-3' Outlook Negative: Research Updateapi-227433089Noch keine Bewertungen

- Portugal 'BB/B' Ratings Affirmed Outlook Negative On Policy UncertaintyDokument9 SeitenPortugal 'BB/B' Ratings Affirmed Outlook Negative On Policy Uncertaintyapi-231665846Noch keine Bewertungen

- Pitchford Thesis Current Account DeficitDokument8 SeitenPitchford Thesis Current Account DeficitErin Taylor100% (2)

- Swedbank Economic Outlook June 2009Dokument37 SeitenSwedbank Economic Outlook June 2009Swedbank AB (publ)Noch keine Bewertungen

- STANDARD - PORTUGAL - 27april2010Dokument5 SeitenSTANDARD - PORTUGAL - 27april2010Maria Alvares RibeiroNoch keine Bewertungen

- Polish Banking Sector Outlook 2014: Brighter Prospects Ahead As Economic and Operating Pressures RecedeDokument16 SeitenPolish Banking Sector Outlook 2014: Brighter Prospects Ahead As Economic and Operating Pressures Recedeapi-228714775Noch keine Bewertungen

- Er 20120312 Bull PhatdragonDokument1 SeiteEr 20120312 Bull PhatdragonChrisBeckerNoch keine Bewertungen

- Nordic Region Out Look 2013Dokument15 SeitenNordic Region Out Look 2013Marcin LipiecNoch keine Bewertungen

- July 15 Market CommentaryDokument4 SeitenJuly 15 Market CommentaryIncome Solutions Wealth ManagementNoch keine Bewertungen

- 2013 March Ernst & Yang Report German EconomyDokument8 Seiten2013 March Ernst & Yang Report German Economygpanagi1Noch keine Bewertungen

- Fitch Rating BBBDokument3 SeitenFitch Rating BBBBisto MasiloNoch keine Bewertungen

- UK Research: How Long Can The UK Maintain Its AAA Rating?Dokument15 SeitenUK Research: How Long Can The UK Maintain Its AAA Rating?Daniel Archer-CoxNoch keine Bewertungen

- Rating Action:: Moody's Downgrades Italy's Government Bond Rating To Baa2 From A3, Maintains Negative OutlookDokument5 SeitenRating Action:: Moody's Downgrades Italy's Government Bond Rating To Baa2 From A3, Maintains Negative OutlookmichelerovattiNoch keine Bewertungen

- Mozambique Long-Term Rating Lowered To 'B' On High Debt Accumulation 'B' Short-Term Rating Affirmed Outlook StableDokument7 SeitenMozambique Long-Term Rating Lowered To 'B' On High Debt Accumulation 'B' Short-Term Rating Affirmed Outlook Stableapi-228714775Noch keine Bewertungen

- SA's 2013 National Budget focuses on fiscal disciplineDokument7 SeitenSA's 2013 National Budget focuses on fiscal disciplineBrilliant MycriNoch keine Bewertungen

- G P P C: Group of TwentyDokument13 SeitenG P P C: Group of Twentya10family10Noch keine Bewertungen

- Seb Merchant Banking - Country Risk Analysis 28 September 2016Dokument6 SeitenSeb Merchant Banking - Country Risk Analysis 28 September 2016Aylin PolatNoch keine Bewertungen

- Greece Ratings Affirmed at 'B-/B' Outlook Stable: Research UpdateDokument8 SeitenGreece Ratings Affirmed at 'B-/B' Outlook Stable: Research Updateapi-228714775Noch keine Bewertungen

- Er 20121130 Bull A Us Rba Rates DecemberDokument3 SeitenEr 20121130 Bull A Us Rba Rates DecemberBelinda WinkelmanNoch keine Bewertungen

- November Econ OutlookDokument13 SeitenNovember Econ OutlookccanioNoch keine Bewertungen

- Standard & Poors Outlook On GreeceDokument10 SeitenStandard & Poors Outlook On GreeceEuronews Digital PlatformsNoch keine Bewertungen

- Democratic Republic of Congo Assigned 'B-/B' Foreign and Local Currency Ratings Outlook StableDokument7 SeitenDemocratic Republic of Congo Assigned 'B-/B' Foreign and Local Currency Ratings Outlook Stableapi-227433089Noch keine Bewertungen

- Outlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings AffirmedDokument9 SeitenOutlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings Affirmedapi-228714775Noch keine Bewertungen

- Moody's Downgrades Spain's Government Bond Ratings To A1Dokument4 SeitenMoody's Downgrades Spain's Government Bond Ratings To A1MuJQNoch keine Bewertungen

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDokument9 SeitenMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNoch keine Bewertungen

- Autumn Statement 2012Dokument4 SeitenAutumn Statement 2012Martin ForsytheNoch keine Bewertungen

- Budget PublicationDokument50 SeitenBudget PublicationAmit RajputNoch keine Bewertungen

- Chapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofDokument21 SeitenChapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofnavneetNoch keine Bewertungen

- Full S&P Rating StatementDokument13 SeitenFull S&P Rating StatementFin24Noch keine Bewertungen

- Q&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?Dokument11 SeitenQ&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?api-228714775Noch keine Bewertungen

- MinutesDokument11 SeitenMinutesTelegraphUKNoch keine Bewertungen

- March Market Outlook: Equities & Commodities Under PressureDokument8 SeitenMarch Market Outlook: Equities & Commodities Under PressureMoed D'lhoxNoch keine Bewertungen

- Ratings Articles en Us ArticleDokument4 SeitenRatings Articles en Us ArticlemarcelluxNoch keine Bewertungen

- A I: M: L I: Ttachment Oldova Etter of NtentDokument14 SeitenA I: M: L I: Ttachment Oldova Etter of Ntentoctavs99Noch keine Bewertungen

- State Bank of Pakistan Monetary Policy DecisionDokument2 SeitenState Bank of Pakistan Monetary Policy DecisionShahid JavaidNoch keine Bewertungen

- Country Intelligence Report 2Dokument34 SeitenCountry Intelligence Report 2Li JieNoch keine Bewertungen

- F F y Y: Ear Uls MmetrDokument4 SeitenF F y Y: Ear Uls MmetrChrisBeckerNoch keine Bewertungen

- Monetary Policy Statement September 2013 HighlightsDokument42 SeitenMonetary Policy Statement September 2013 HighlightsScorpian MouniehNoch keine Bewertungen

- Red Jun 2014Dokument38 SeitenRed Jun 2014hrnanaNoch keine Bewertungen

- Ratings On Italy Affirmed at 'BBB/A-2' Outlook Remains NegativeDokument7 SeitenRatings On Italy Affirmed at 'BBB/A-2' Outlook Remains Negativeapi-228714775Noch keine Bewertungen

- Global Insurance+ Review 2012 and Outlook 2013 14Dokument36 SeitenGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraNoch keine Bewertungen

- Romania 'BBB-_A-3' Ratings Affirmed_ Outlook Stab _ S&P Global Ratings_12.04.2024Dokument22 SeitenRomania 'BBB-_A-3' Ratings Affirmed_ Outlook Stab _ S&P Global Ratings_12.04.2024Florin BudescuNoch keine Bewertungen

- Ukraine Downgraded To 'B-' On Government's Lack of Strategy To Secure Foreign Currency Funding Outlook Remains NegativeDokument7 SeitenUkraine Downgraded To 'B-' On Government's Lack of Strategy To Secure Foreign Currency Funding Outlook Remains Negativeapi-228714775Noch keine Bewertungen

- The World Economy-27/04/2010Dokument2 SeitenThe World Economy-27/04/2010Rhb InvestNoch keine Bewertungen

- Snapshot of Bosnia and HerzegovinaDokument53 SeitenSnapshot of Bosnia and HerzegovinaDejan ŠešlijaNoch keine Bewertungen

- Standard & Poor's - AmericasDokument17 SeitenStandard & Poor's - AmericastoralberNoch keine Bewertungen

- Swedbank Economic Outlook Update, November 2015Dokument17 SeitenSwedbank Economic Outlook Update, November 2015Swedbank AB (publ)Noch keine Bewertungen

- Nedbank Se Rentekoers-Barometer Vir Mei 2016Dokument4 SeitenNedbank Se Rentekoers-Barometer Vir Mei 2016Netwerk24SakeNoch keine Bewertungen

- Rating Action:: Moody's Affirms Indonesia's Baa2 Rating, Maintains Stable OutlookDokument6 SeitenRating Action:: Moody's Affirms Indonesia's Baa2 Rating, Maintains Stable OutlookLian PutraNoch keine Bewertungen

- EIB Working Papers 2019/08 - Investment: What holds Romanian firms back?Von EverandEIB Working Papers 2019/08 - Investment: What holds Romanian firms back?Noch keine Bewertungen

- UntitledDokument3 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument22 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument7 SeitenUntitledapi-231665846Noch keine Bewertungen

- Ratings On Spain Raised To 'BBB/A-2' On Improved Economic Prospects Outlook StableDokument8 SeitenRatings On Spain Raised To 'BBB/A-2' On Improved Economic Prospects Outlook Stableapi-231665846Noch keine Bewertungen

- Ratings On Senegal Affirmed at 'B+/B' Outlook Stable: Research UpdateDokument7 SeitenRatings On Senegal Affirmed at 'B+/B' Outlook Stable: Research Updateapi-231665846Noch keine Bewertungen

- UntitledDokument11 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument19 SeitenUntitledapi-231665846Noch keine Bewertungen

- Euro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit RateDokument7 SeitenEuro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit Rateapi-231665846Noch keine Bewertungen

- UntitledDokument14 SeitenUntitledapi-231665846Noch keine Bewertungen

- Kingdom of Bahrain Ratings Affirmed at 'BBB/A-2' On Stable Growth Prospects Outlook StableDokument7 SeitenKingdom of Bahrain Ratings Affirmed at 'BBB/A-2' On Stable Growth Prospects Outlook Stableapi-231665846Noch keine Bewertungen

- Outlook On The United Kingdom Revised To Stable On Broadening Economic Recovery Ratings Affirmed at 'AAA/A-1+'Dokument9 SeitenOutlook On The United Kingdom Revised To Stable On Broadening Economic Recovery Ratings Affirmed at 'AAA/A-1+'api-231665846Noch keine Bewertungen

- UntitledDokument7 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument17 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument9 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument8 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument15 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument15 SeitenUntitledapi-231665846Noch keine Bewertungen

- Europe's Housing Market Recovery Is Not Yet On Solid Ground: Economic ResearchDokument30 SeitenEurope's Housing Market Recovery Is Not Yet On Solid Ground: Economic Researchapi-231665846Noch keine Bewertungen

- UntitledDokument17 SeitenUntitledapi-231665846Noch keine Bewertungen

- Key Considerations For Rating Banks in An Independent ScotlandDokument9 SeitenKey Considerations For Rating Banks in An Independent Scotlandapi-231665846Noch keine Bewertungen

- UntitledDokument8 SeitenUntitledapi-231665846Noch keine Bewertungen

- Which Emerging Market Banking Systems Could Suffer Most From Fed Tapering?Dokument15 SeitenWhich Emerging Market Banking Systems Could Suffer Most From Fed Tapering?api-231665846Noch keine Bewertungen

- UntitledDokument16 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument11 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument5 SeitenUntitledapi-231665846Noch keine Bewertungen

- UntitledDokument10 SeitenUntitledapi-231665846Noch keine Bewertungen

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveDokument11 SeitenInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-231665846Noch keine Bewertungen

- UntitledDokument15 SeitenUntitledapi-231665846Noch keine Bewertungen

- 2009 EE enDokument80 Seiten2009 EE enTara GorurNoch keine Bewertungen

- Political EnvironmentDokument13 SeitenPolitical EnvironmentChowdhury Mahin AhmedNoch keine Bewertungen

- Economics 100 Quiz 1Dokument15 SeitenEconomics 100 Quiz 1Ayaz AliNoch keine Bewertungen

- Chapter 6: Government Influence On Exchange Rate Exchange Rate System Fixed Exchange Rate SystemDokument5 SeitenChapter 6: Government Influence On Exchange Rate Exchange Rate System Fixed Exchange Rate SystemMayliya Alfi NurritaNoch keine Bewertungen

- Revealing Forbidden FX StrategiesDokument55 SeitenRevealing Forbidden FX StrategiesAlejandro RamosNoch keine Bewertungen

- Final ProjectDokument195 SeitenFinal ProjectChDadriNoch keine Bewertungen

- Seminar 11. Saxo PDFDokument26 SeitenSeminar 11. Saxo PDFTraian ChiriacNoch keine Bewertungen

- GGP Reorganization 072010Dokument14 SeitenGGP Reorganization 072010Chris AllevaNoch keine Bewertungen

- Trends and Patterns of Fdi in IndiaDokument10 SeitenTrends and Patterns of Fdi in IndiaSakshi GuptaNoch keine Bewertungen

- Global Marketing Management EditedDokument293 SeitenGlobal Marketing Management EditedBerihu Girmay100% (1)

- Olteanu - 2012Dokument44 SeitenOlteanu - 2012Alejandra TinocoNoch keine Bewertungen

- Business Plan Sample Tranquility Day Spa PlanDokument28 SeitenBusiness Plan Sample Tranquility Day Spa Plankenyamontgomery50% (2)

- Dollar and PoundDokument2 SeitenDollar and PoundMainSqNoch keine Bewertungen

- Business Analysis ReportDokument13 SeitenBusiness Analysis Reporthassan_401651634Noch keine Bewertungen

- PWC Banking in Luxembourg 2018 PDFDokument48 SeitenPWC Banking in Luxembourg 2018 PDFpieoiqtporetqeNoch keine Bewertungen

- Analisis Butir Soal PTS Dan Pas Ganjil 2022-2023Dokument41 SeitenAnalisis Butir Soal PTS Dan Pas Ganjil 2022-2023mutiaraNoch keine Bewertungen

- EndesaDokument42 SeitenEndesasurya277Noch keine Bewertungen

- 2014 Y12 Chapter 5 - CDDokument22 Seiten2014 Y12 Chapter 5 - CDtechnowiz11Noch keine Bewertungen

- Shubani CO LogoDokument2 SeitenShubani CO LogoAnonymous lNwEvIgWqNoch keine Bewertungen

- Insider Trading 911..unresolved, by Lars SchallDokument36 SeitenInsider Trading 911..unresolved, by Lars Schalljkim3334270100% (2)

- British DX Club's Communication - 40th Anniversary IssueDokument68 SeitenBritish DX Club's Communication - 40th Anniversary IssueKasi XswlNoch keine Bewertungen

- Aberdeen First Israel Fund, Inc. (ISL)Dokument28 SeitenAberdeen First Israel Fund, Inc. (ISL)ArvinLedesmaChiongNoch keine Bewertungen

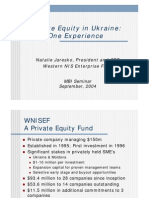

- WNISEF Experience in UkraineDokument21 SeitenWNISEF Experience in UkraineVitaliy HamuhaNoch keine Bewertungen

- Comparison of Germany and UAE EconomyDokument16 SeitenComparison of Germany and UAE EconomyVivek HindujaNoch keine Bewertungen

- Determinants of External Reserves in Developing EconomiesDokument138 SeitenDeterminants of External Reserves in Developing EconomiesAdewole Aliu OlusolaNoch keine Bewertungen

- Solutions Paper - EcoDokument4 SeitenSolutions Paper - Ecosanchita mukherjeeNoch keine Bewertungen

- 4-Risk Free RateDokument30 Seiten4-Risk Free RateAKSHAJ GOENKANoch keine Bewertungen