Beruflich Dokumente

Kultur Dokumente

Taxation Gross Income

Hochgeladen von

Christine DautOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxation Gross Income

Hochgeladen von

Christine DautCopyright:

Verfügbare Formate

COMPENSATION INCOME

TAXABLE SALARY AND WAGES NON TAXABLE Contributions for SSS, GSIS, PHIC, HDMF and labor union dues which were deducted from income to arrive at net pay Earned by a MWE (Statutory Minimum Wage) None Subsidized meals and lodging (if for the employers benefit) The employee accounts or liquidates the expenses (with proper documentations) An ordinary and necessary expense in the conduct of the business None None None

HONORARIA FIXED OR VARIABLE ALLOWANCE Not liquidated by the employee For personal purpose

COMMISSION FEES TIPS AND GRATUITIES Subject to withholding tax if the tip is accounted to the employer (Centralized) Not subject to withholding tax if not accounted to the employer, but still taxable HAZARD OR EMERGENCY PAY PENSION AND RETIREMENT PAY

earned by a MWE Retirement pay from SSS/GSIS and Complied with BIR requisites: o The retirement program is approved by the BIR o Reasonable benefit plan o Employed for at least 10 years o Should be 50 years old and above o Availed for the first time Separation pay (separation is not a result of the employees action) PRIVATE EMPLOYEES: Monetized unused vacation and sick leave up to 10 days GOVERNMENT EMPLOYEES: Monetized value of unused vacation and sick leave credits Terminal leave Bonuses and other benefits up to P30,000 (13th /14th/15th month, mid-year/productivity/christmas bonuses, loyalty awards)

SEPARATION PAY If separation is a result of voluntary action by the employee VACATION AND SICK LEAVE Used vacation and sick leave with pay

13TH MONTH AND OTHER BENEFITS Taxable for any amount exceeding P30,000 Other benefits may include: o 14th and 15th month pay, if any o Christmas bonus o Productivity bonus o Performance bonus o Loyalty awards o Mid-year bonus o De minimis benefits in excess of the prescribed ceiling FRINGE BENEFITS: Supervisory or Managerial positions subject to Fringe Benefit Tax (FBT) a Final tax Rank and File subject to Normal Tax OVERTIME PAY PROFIT SHARING INSURANCE PREMIUM Paid by the employer If the insurance policy have its EMPLOYEE OR HIS FAMILY as the beneficiary DAMAGES If the damage happens through the course of work Damages for the loss of profit FORMS OF COMPENSATION OTHER THAN CASH Shares of Stock Employee stock option

Deminimis benefit Amount received up to the ceiling prescribed by the tax law

If earned by a MWE None Premium paid by employer (if EMPLOYER is the beneficiary)

Actual, moral, exemplary damages (damages for the loss of earning capacity) VALUATION FMV of Stock on the date when the service is rendered FMV of stock less option (purchase) price (at date of grant)

Cancellation of debt Amount of debt cancelled/condoned (The employer is a creditor of the employee) REMINDER: MINIMUM WAGE EARNERS (MWE) are tax exempted ONLY for Statutory Minimum Wage (SMW), overtime pay, holiday pay, night differential and hazard pay. If a MWE earns income in addition to these (except for income subject to FINAL TAX), his/her entire income shall be taxable.

PROFESSIONAL / BUSINESS INCOME

TYPES OF BUSINESS OPERATION MANUFACTURING/MERCHANDISING SERVICE TAXABLE TELEGRAPH & CABLE SERVICES OF FOREIGN CORPORATION Revenue from services/messages originating in the Philippines regardless of place of collection RENTAL INCOME ALL non-refundable amounts shouldered by the lessee Deposit/prepayments o non-refundable o w/o restrictions in its use o w/ acceleration clause (only if the lessee violates the clause) LEASEHOLD IMPROVEMENTS If the improvements will be retained by the lessor after the term of the lease contract Taxable to the lessor for the book value of improvement at the end of lease term or at pretermination of contract o Outright method o Spread-out method COMPUTATION OF GROSS INCOME Gross sales (net of discounts and allowances) Cost of sales Gross receipts (net of discounts and allowances) Cost of service NON TAXABLE Revenue from services/messages originating OUTSIDE the Philippines, regardless of place of collection Refundable deposits Advances with restriction in its use

If the improvements are not to be retained by the lessor after the term of the lease contract

PASSIVE INCOME

TAXABLE FINAL TAX INTEREST INCOME Interest on regular peso bank deposits 20% Expanded foreign currency deposit (if resident citizen or resident alien) FT of 7.5% Interest on BSP prescribed investments (terminated before 5 years) o 4 to <5 FT of 5% o 3 to <4 FT of 12% o <3 FT of 20% NORMAL TAX Interest income earned by lending business or simply lending a money Interest income received by a resident citizen from sources OUTSIDE the Philippines NON TAXABLE Interest on government bonds Interest on BSP prescribed investments (w/ maturity of 5 years or more) Interest on expanded foreign currency deposit (if non resident citizen or alien) Interest income earned by members of Cooperative Interest income earned by Phil. National Red Cross Interest income on Pag-ibig Mortgage Certificates Interest on the price of a land under a tenantpurchaser agreement as part of CARP

DIVIDENDS VALUATION OF TAXABLE DIVIDENDS 1. Cash Dividend Face Value 2. Property Dividend FMV of the property at date of declaration 3. Scrip FMV of the scrip dividend 4. Share Dividend - FMV of stocks (w/ change on interest from the corporation) 5. Liquidating Dividend - Liquidating dividend less cost of share Dividends received from Domestic corporation if the recipient are: Resident citizen/alien and non resident citizen FT of 10% Non resident alien FT of 25% Non resident foreign corporation FT of 20% ROYALTY From books/musical/literary 10% From mining/patent/franchising and the like 20% PRIZES AND WINNINGS Prizes of more than P10,000 20% Winnings, regardless of amount received 20%

Dividends received by a resident citizen from a foreign corporation (OUTSIDE the Philippines) Dividends received by a non resident citizen and aliens from resident foreign corporation(up to the extent of percent of its operation WITHIN the Phil)

Pure Liquidating Dividend o Liquidating Dividend = Cost of share just a return of capital Pure Share Dividend o FMV of stocks (w/o change on interest from the corporation) Dividends received from Domestic corporation by a o Domestic corporation o Resident foreign corporation Dividends received by a taxpayer other than a resident citizen from resident foreign corporation(up to the extent of percent of its operation OUTSIDE the Phil)

Royalty received by a resident citizen from sources OUTSIDE the Philippines Prizes amounting to P10,000 and below Prizes received from OUTSIDE the Philippines PHILIPPINE LOTTO Prizes from sports if under Phil Olympic Sports Commission (POSC) Prizes received from religious, charitable, scientific, educational, literary and civic org if the awardee did not join voluntarily and has no future obligation to render any service

REMINDER: INDIVIDUAL TAXPAYER Resident Citizen NRC and aliens

EARNED W/IN Final tax Final tax

EARNED W/OUT Normal tax Not taxable

OTHER SOURCES OF INCOME

TAXABLE BAD DEBT RECOVERY To the extent of amount benefited from tax (tax benefit rule) TAX REFUND To the extent of amount benefited from tax (tax benefit rule) DAMAGES Damages for the loss of unrealized/anticipated profit Interest earned from non taxable damages, if any Moral and exemplary damages as a result of BREACH OF CONTRACT ANNUITY Amount received in excess of the premium paid PROCEEDS FROM LIFE INSURANCE Proceeds of Life Insurance received NOT as a result of DEATH less total amount of insurance premiums paid or purchase price The amount mentioned will be taxable to: o The insured person, if no other beneficiary o Beneficiaries, other than the insured person ILLEGAL SOURCES Amount illegally obtained Embezzled Fund COOPERATIVES are subject to all final taxes on passive income and capital gains Value Added Tax Income derived from its transactions with non-members NON TAXABLE Amount not deducted from net income

Amount not deducted from net income Income tax , business tax and transfer taxes Surcharges and penalty Amounts received through Accident or Health Insurance or under Workmens Compensation Act Moral, exemplary damages for out-of-court settlement Physical injury, sickness Return of lost capital or lost earning capacity Amount received as a return of premium Amount of proceeds received by the beneficiaries upon DEATH of the insured

Income derived by COOPERATIVES from transactions with its members

Gifts, bequest, devices, legacy Income earned by Philippine government or Foreign government within the Philippines Gain on sale of all kinds of INDEBTEDNESS (w/ maturity of more than 5 years) Income not directly related to education earned by GOVERNMENT/NON-STOCK AND NON-PROFIT educational institutions SENIOR CITIZENS with annual taxable income (NT) of P60,000 or less INVENTORS AND INVENTIONS: sale within 10 years from the date of first commercial sale Barangay Micro Business Enterprise (BMBE)

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Use of EnglishDokument4 SeitenUse of EnglishBelén SalituriNoch keine Bewertungen

- Guide For Overseas Applicants IRELAND PDFDokument29 SeitenGuide For Overseas Applicants IRELAND PDFJasonLeeNoch keine Bewertungen

- FIRE FIGHTING ROBOT (Mini Project)Dokument21 SeitenFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)

- Departmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedDokument37 SeitenDepartmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedGeorgina AlpertNoch keine Bewertungen

- Microsoft Word - Claimants Referral (Correct Dates)Dokument15 SeitenMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNoch keine Bewertungen

- Oracle FND User APIsDokument4 SeitenOracle FND User APIsBick KyyNoch keine Bewertungen

- Kaitlyn LabrecqueDokument15 SeitenKaitlyn LabrecqueAmanda SimpsonNoch keine Bewertungen

- Tradingview ShortcutsDokument2 SeitenTradingview Shortcutsrprasannaa2002Noch keine Bewertungen

- L1 L2 Highway and Railroad EngineeringDokument7 SeitenL1 L2 Highway and Railroad Engineeringeutikol69Noch keine Bewertungen

- Walmart, Amazon, EbayDokument2 SeitenWalmart, Amazon, EbayRELAKU GMAILNoch keine Bewertungen

- Final ExamSOMFinal 2016 FinalDokument11 SeitenFinal ExamSOMFinal 2016 Finalkhalil alhatabNoch keine Bewertungen

- Engine Diesel PerfomanceDokument32 SeitenEngine Diesel PerfomancerizalNoch keine Bewertungen

- Review of Related LiteratureDokument4 SeitenReview of Related LiteratureCarlo Mikhail Santiago25% (4)

- 48 Volt Battery ChargerDokument5 Seiten48 Volt Battery ChargerpradeeepgargNoch keine Bewertungen

- EnerconDokument7 SeitenEnerconAlex MarquezNoch keine Bewertungen

- SM Land Vs BCDADokument68 SeitenSM Land Vs BCDAelobeniaNoch keine Bewertungen

- Basic Vibration Analysis Training-1Dokument193 SeitenBasic Vibration Analysis Training-1Sanjeevi Kumar SpNoch keine Bewertungen

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDokument27 SeitenSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNoch keine Bewertungen

- Marine Lifting and Lashing HandbookDokument96 SeitenMarine Lifting and Lashing HandbookAmrit Raja100% (1)

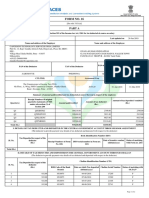

- Form16 2018 2019Dokument10 SeitenForm16 2018 2019LogeshwaranNoch keine Bewertungen

- Supergrowth PDFDokument9 SeitenSupergrowth PDFXavier Alexen AseronNoch keine Bewertungen

- Ingles Avanzado 1 Trabajo FinalDokument4 SeitenIngles Avanzado 1 Trabajo FinalFrancis GarciaNoch keine Bewertungen

- Hayashi Q Econometica 82Dokument16 SeitenHayashi Q Econometica 82Franco VenesiaNoch keine Bewertungen

- Rating SheetDokument3 SeitenRating SheetShirwin OliverioNoch keine Bewertungen

- Material Safety Data Sheet (According To 91/155 EC)Dokument4 SeitenMaterial Safety Data Sheet (According To 91/155 EC)Jaymit PatelNoch keine Bewertungen

- TSB 120Dokument7 SeitenTSB 120patelpiyushbNoch keine Bewertungen

- Escario Vs NLRCDokument10 SeitenEscario Vs NLRCnat_wmsu2010Noch keine Bewertungen

- Wiley Chapter 11 Depreciation Impairments and DepletionDokument43 SeitenWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇Noch keine Bewertungen

- Continue: Rudolf Bultmann Theology of The New Testament PDFDokument3 SeitenContinue: Rudolf Bultmann Theology of The New Testament PDFpishoi gerges0% (1)

- RYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersDokument28 SeitenRYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersSerban Sebe100% (4)