Beruflich Dokumente

Kultur Dokumente

IRS Fines Ron Paul's Campaign For Liberty

Hochgeladen von

tshoesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IRS Fines Ron Paul's Campaign For Liberty

Hochgeladen von

tshoesCopyright:

Verfügbare Formate

~

IRS

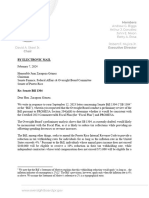

Department of Treasury Internal Revenue Service Ogden UT 84201-0074

Notice

CP1411

Tax period Notice date Employer '0 number To contact us Page 1 of 4

1 AT 0.406 701

070140.275979.57248.3142

--December31, 20t2 March 24, 2014 _ Phone 1-877-829-5500

\'"1111'1'"1'1'1'

1","1'11'

III"

111111 '1111111111'11111",n I,

CAMPAiGN r.o~ LIBeRTY U,MPAIGN fOR LIBERTY PO BOX 104 LAKE JACKSON TX 77566-0104

070140

Message about your December 31, 2012, Form 990

We charged you a penalty for incomplete filing

We sent you a request asking for missing or incomplete information regarding your Form 990. Without this information, your relurn is considered incomplete. Because you did not respond, you were charged a penalty. (Internal ~evenue Code Section 6652(c)).

Billing Summary

Penaity Amount you owe 12,900.00 $12,900.00

......................................................................................

CAIJPAIGN F()R.lIlJ[RTY CAMPAIGN FOR Li8ERIY

.

Notice

Continuedon back...

-----.---_.

---

PO BOX 104 lAKf {AC-(SmrTr

Notice date

-EmjJloyefIDTiWnber-

71SCii;O104-

IRS Payment

INfeRNAL REVENUESERVICE OGDEN UT 84201-0074 Make your check or money order payable to the United States Treasury. Write your Employer ID numberU ' the tax peliod (December 31,2012), and the form number (990) on your payment and any (Orrespondence. Amount due by April 14, 2014

$12,900.00

11'1111'11111,11"1111111111111'11"1

,1"111 '1111'1111' 111'1 1,111

262730467 TT CAMP 67 2 201212 670 00001290000

Notice

CPI411

Tax period

Notice date

December31,2012

Employer 10 number

Page 2 of 4

"'4=====

What you need to do immediately

Provide the requested information Send the incomplete/missing information described in the" About your return" section below, along with the contact voucher at the end 01 the notice, Send us the amount due 01 $12,900.00 by April 14, 2014, to avoid inlereslCharges. If Form 990 was filed incompletely for reasons beyond your control If you're unable to provide the information due to circumstances beyond your control, send us a signed expianation with any supporting documentation, along with the contact voucher at the end of lhis notice.

If we don't hear from you

If we don't receive your payment of $12,900.00 by April 14, 2014, interest will accrue on the penalty charge until you pay rhe amount due in full. You can pay electronically by visiting www.irs.govle-pay or by calling 1-800-555-4477. Paying electronically through the [Iectronic Federal Tax Payment System (EFTPS)is convenient, free and secure.

__

_-

_-

__

._-_._---- ----

__

__

_--

_- ..-

__

.._----

_-_

.

CP 1411

V,&!/J

. ~<ii\\

(AM;>I\IGN FOot lI8EI(T'( ~AMr~~~roRlIBERTY

Notice

--IRS---------------.--lM2JACKsON

-N-o-tic-e-d-at-e----March 24, 2014 iXn\66{iTf)'-- ..~----Employer 10 number _-----

Contact information

INTERNAL REVENUE SERVICE OGDEN lIT 84201-0074

1 1",' 1111 II" 111'1111 ,1 II 'II" " " '

II your address has changed, please call1-811.829-5500 or visit www.irs.90V. n Please check here if you've included any correspondence, Write your Employer ID number _, the tax period (December 31, 2012), and the form number (990) on any correspondence.

n a_m. n p.m.

S~I hme tv cail

n

Secol\(br~ Phone

Bell timp 10 (aU

;I.rI'..

n p.m.

I' I., 111'1111'1111' 111'11' I',

67 2 201212

262730467

TT

Notice Tax period Notice date Employer 10 number Page 3 of 4

1 00

CPI411 December31. 2012 March 24. 2014

About your return

Schedule B. Schedule of Contributors. is a required attachment for Form 990. 990. EZ or 990.PF. All organizations must complete and attach Schedule 8 or certify they are not required to file a Schedule B, Guidelines for filing Schedule B can be found in Forms 990. 99HZ or 990.PF inslructions, Please complete a Schedule 8, If your organization is not required to attach Schedule B, please let us know,

070140

Payments credited to your account for tax period ending December 31. 2012 Penalties

Incomplete return

Our records show no payments, deposits, or credits for this account. Please call 1.877.829.5500 if our information is incorrect.

We are required by law to charge any applicable penalties,

De>uiption Amount

Total incomplete return

$12,900.00

We charged a penally because you didn't file a complete return, For Forms 990, 990[2, and 990PF, the penalty is: (1) 520 a day for e<lchday your return is late or incomplete, if your gross annual receipts are equal to or less than S1 million, The penalty may not be more than S10,000 or 5% of your gross annual receipts, whichever is less. (2) $100 a day for each day your return is l<lte or incomplete, if your gross annual receipts exceed \ 1 million, The penalty may not be more than 550,000. For all other forms, the penalty is $10 a day for e<lch day your return is late. The penalty may not be more than $5,000, To avoid this penalty in the future you should file your returns by the return due date, (Internal Revenue Code section 6652)

~-----_.-

Continued on back..,

Notice Tax period

Notice date

CP1411

December31, 2012 4 _

Employer 10 number

Page 4 of 4

Removal or reduction

of penalties

We understand that circumstances-such as economic hardship, a family member's death, or loss of financial records due to natural disaster-may make it difficult lor you to meet your taxpayer responsibility in a timely manner. II you would like us to consider removing or reducing any of your penalty charges, please do the following: Identify which penalty charges you would like us to reconsider (e.g., 2005 late filling penalty) . For each penalty charge, explain why you believe it should be reconsidered . Sign your statement and mail it to us. We'll review your statement and let you know whether we accept yoU! explanation as a reasonable cause to redoce or remove the penalty charge(s).

Removal of penalties due to erroneous written advice from the IRS

If you were penalized based on written advice Irom the IRS, we will remove tlie penalty if you meet the following criteria: II you asked the IRS for written advice on a specific issue You gave us complete and accurate inlormation You received written advice from us You relied on our written advice and were penalized based on that advice To request removal 01 penalties based on erroneous written advice from us, submit a completed Claim for Refund and Request for Abatement (Form 843) to the iRS service eenler where you filed your return. For a copy of the lorm or to find your iRS service cenrer, go to www.irs.govorcall1.877.829.5500.

Additional information

Visit www.irs.gov/cpI41i. For tax larIOS, instructions, and publications, visit www.irs.govorcall 1.800. TAX-FORM (1-800-829.3676) . Keep this notice lor your records. If you need assistance, please don't hesitate to contact us.

_-~~-----------.~ ----

Das könnte Ihnen auch gefallen

- Transfer NovDokument2 SeitenTransfer Novzelalem.workingNoch keine Bewertungen

- NWB87822 Online and Telephone Banking Business Application FormDokument10 SeitenNWB87822 Online and Telephone Banking Business Application FormKyle Robert100% (1)

- Security Deposit Agreement TemplateDokument2 SeitenSecurity Deposit Agreement TemplateMatheus MelloNoch keine Bewertungen

- Transfer Receipt 113356498Dokument1 SeiteTransfer Receipt 113356498Ridhwan100% (1)

- Business Purchase Letter of Intent TemplateDokument3 SeitenBusiness Purchase Letter of Intent TemplateGAURAV SHARMA0% (1)

- Assesment Notice 2017Dokument1 SeiteAssesment Notice 2017Shounak KossambeNoch keine Bewertungen

- Tax ClearanceDokument1 SeiteTax ClearanceAmbrose Ikwueme100% (1)

- NatWest Current Account Application Form Non UK EU ResDokument17 SeitenNatWest Current Account Application Form Non UK EU ResL mNoch keine Bewertungen

- RefundDokument2 SeitenRefundJess AcostaNoch keine Bewertungen

- Proof of Available Funds Sample 2019Dokument1 SeiteProof of Available Funds Sample 2019Hazel LopezNoch keine Bewertungen

- Western Union Req FormDokument2 SeitenWestern Union Req FormSyed BD100% (1)

- British Ministry of Finance UkDokument5 SeitenBritish Ministry of Finance UkManish TiwariNoch keine Bewertungen

- Your Finance Agreement Arranged Through Right PDFDokument12 SeitenYour Finance Agreement Arranged Through Right PDFSchipor Danny MagdaNoch keine Bewertungen

- ReceiptDokument2 SeitenReceiptFlorinNoch keine Bewertungen

- 2020 Notice of Assessment - My Account PDFDokument1 Seite2020 Notice of Assessment - My Account PDFKeiner LanzaNoch keine Bewertungen

- Wells Fargo Wire Transfer FormDokument2 SeitenWells Fargo Wire Transfer FormProsper HarryNoch keine Bewertungen

- Charter Quote: Date: Wednesday, 06 Oct 2021 ATT: MR Frederic Laurent. Country: FranceDokument1 SeiteCharter Quote: Date: Wednesday, 06 Oct 2021 ATT: MR Frederic Laurent. Country: FranceLucrative MasomoNoch keine Bewertungen

- Agreement Between Carrier and ShipperDokument4 SeitenAgreement Between Carrier and ShipperUbuntu Linux100% (1)

- Pre-Payment Disclosure (This Is Not A Receipt) : Recipient Bank InformationDokument2 SeitenPre-Payment Disclosure (This Is Not A Receipt) : Recipient Bank InformationRoger PadronNoch keine Bewertungen

- Standard Charted Gambia LTD: VED CT ., 2019Dokument1 SeiteStandard Charted Gambia LTD: VED CT ., 2019Hector SchiavoneNoch keine Bewertungen

- Proof of FundsDokument1 SeiteProof of FundsAlan Yu100% (1)

- KRA Tax Compliance CertificateDokument1 SeiteKRA Tax Compliance Certificateyasmin contractingcoltdNoch keine Bewertungen

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDokument1 SeiteThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNoch keine Bewertungen

- Tax Clearance CertificateDokument1 SeiteTax Clearance CertificateRahul SahaniNoch keine Bewertungen

- United States V Steven Michael RubinsteinDokument9 SeitenUnited States V Steven Michael RubinsteinpunktlichNoch keine Bewertungen

- Wire Transfer Receipt 3Dokument1 SeiteWire Transfer Receipt 3namdrikaleleNoch keine Bewertungen

- Financial Intelligence Centre South AfricaDokument1 SeiteFinancial Intelligence Centre South AfricaShahab UllahNoch keine Bewertungen

- United Nations Organization Irrevocable Payment OrderDokument1 SeiteUnited Nations Organization Irrevocable Payment OrderYuenNoch keine Bewertungen

- Online Funds TransferDokument2 SeitenOnline Funds TransferKarthi kk mobileNoch keine Bewertungen

- Proof of Funds Letter Template 05Dokument1 SeiteProof of Funds Letter Template 05Dk KimNoch keine Bewertungen

- Schwab Bank Electronic Funds Transfer Enrollment FormDokument7 SeitenSchwab Bank Electronic Funds Transfer Enrollment FormcadeadmanNoch keine Bewertungen

- Bill of Lading MR SAMUELDokument1 SeiteBill of Lading MR SAMUELcharlesNoch keine Bewertungen

- Official Payment LetterDokument1 SeiteOfficial Payment LetterPanji Aji PradanaNoch keine Bewertungen

- Golf Estate Bank Transfer Receipt Scott HallidayDokument1 SeiteGolf Estate Bank Transfer Receipt Scott HallidayScott HallidayNoch keine Bewertungen

- Remitly Matteo MazzaDokument4 SeitenRemitly Matteo MazzahkbiguivgNoch keine Bewertungen

- MotorWelcome (SODY14PC01) PDFDokument10 SeitenMotorWelcome (SODY14PC01) PDFDimitris ElefsinaNoch keine Bewertungen

- Transfer Receipt 26970922Dokument1 SeiteTransfer Receipt 26970922Kayla grantNoch keine Bewertungen

- FedEx Ship Manager - V.L. 19 Dec (S)Dokument10 SeitenFedEx Ship Manager - V.L. 19 Dec (S)sanagavarapuNoch keine Bewertungen

- Irrevocable Payment Order Via Atm Card: United Nations Organization Dear Email Owner/Fund BeneficiaryDokument1 SeiteIrrevocable Payment Order Via Atm Card: United Nations Organization Dear Email Owner/Fund BeneficiaryCristina CojocaruNoch keine Bewertungen

- Barclays Bank United Kingdom Re Confirmation of Payment FundDokument2 SeitenBarclays Bank United Kingdom Re Confirmation of Payment FundromizahNoch keine Bewertungen

- Movers and Packers Bill ReceiptDokument12 SeitenMovers and Packers Bill ReceiptGaurav ChoudharyNoch keine Bewertungen

- Military Leave Approval LetterDokument2 SeitenMilitary Leave Approval LetterMy love of LifeNoch keine Bewertungen

- Approval ContractDokument3 SeitenApproval Contractosas RichardNoch keine Bewertungen

- Froedtert Hospital Bill ExplanationDokument2 SeitenFroedtert Hospital Bill Explanationmr.perfectraviranjan222Noch keine Bewertungen

- Canada Inheritance and Death TaxDokument6 SeitenCanada Inheritance and Death TaxAbo Ahmed TarekNoch keine Bewertungen

- IRS Demand Letter - 14 July 2022Dokument2 SeitenIRS Demand Letter - 14 July 2022KPLC 7 NewsNoch keine Bewertungen

- Wire Deposit Form PDFDokument1 SeiteWire Deposit Form PDFphuiyeeNoch keine Bewertungen

- WF Approval LetterDokument6 SeitenWF Approval LetterSteve Mun GroupNoch keine Bewertungen

- Gmail - Booking Confirmation On IRCTC, Train - 12432, 02-Jun-2019, 1A, NZM - TCRDokument2 SeitenGmail - Booking Confirmation On IRCTC, Train - 12432, 02-Jun-2019, 1A, NZM - TCRBrinto VargheseNoch keine Bewertungen

- Congratulation Contact United Nations Office LondonDokument7 SeitenCongratulation Contact United Nations Office Londonmanjeet.singh837824Noch keine Bewertungen

- Change of Ownership OnlineDokument2 SeitenChange of Ownership OnlineFlorin Alexandru StoicaNoch keine Bewertungen

- Payment Proof Recent WeekDokument25 SeitenPayment Proof Recent WeekSrikanthrao SanthapurNoch keine Bewertungen

- Tracking, Track Parcels, Packages, Shipments DHL Express Tracking 2Dokument1 SeiteTracking, Track Parcels, Packages, Shipments DHL Express Tracking 2RAGHAV GOEL100% (1)

- DHL Document - HoneywellDokument5 SeitenDHL Document - HoneywellRavichanderNoch keine Bewertungen

- Bank LetterDokument1 SeiteBank LetterirfanNoch keine Bewertungen

- Direct DepositDokument1 SeiteDirect Depositapi-262393561Noch keine Bewertungen

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeVon EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNoch keine Bewertungen

- My Online Dating Experience: I Believe in My Success and Yours TooVon EverandMy Online Dating Experience: I Believe in My Success and Yours TooNoch keine Bewertungen

- US Internal Revenue Service: f9325Dokument2 SeitenUS Internal Revenue Service: f9325IRSNoch keine Bewertungen

- Tax Return Acceptance Receipt 2016Dokument2 SeitenTax Return Acceptance Receipt 2016anandrapakaNoch keine Bewertungen

- Unclaimed Financial Assets-Bill 2011-KenyaDokument31 SeitenUnclaimed Financial Assets-Bill 2011-KenyaelinzolaNoch keine Bewertungen

- FOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Dokument3 SeitenFOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Metro Puerto RicoNoch keine Bewertungen

- Jino Jose M CVDokument3 SeitenJino Jose M CVJo JiNoch keine Bewertungen

- InstaBIZ 1Dokument14 SeitenInstaBIZ 1Sacjin mandalNoch keine Bewertungen

- The Effect of Economic Value Added FreeDokument15 SeitenThe Effect of Economic Value Added FreeSumant AlagawadiNoch keine Bewertungen

- Chapter 7 9eDokument37 SeitenChapter 7 9eRahil VermaNoch keine Bewertungen

- Insync Partnership DeedDokument5 SeitenInsync Partnership DeedAbhishek SinghNoch keine Bewertungen

- Rural Banking Sample Questions by Murugan-Sep 2021 ExamsDokument42 SeitenRural Banking Sample Questions by Murugan-Sep 2021 ExamsRajesh KumarNoch keine Bewertungen

- Assignment of Management of Working Capital On Cash ManagementDokument7 SeitenAssignment of Management of Working Capital On Cash ManagementShubhamNoch keine Bewertungen

- 2022-2023 Fillable ISFAADokument5 Seiten2022-2023 Fillable ISFAAKouassi Thimotée YaoNoch keine Bewertungen

- Business Environment 1 PDF PDFDokument35 SeitenBusiness Environment 1 PDF PDFDave NNoch keine Bewertungen

- Chapter 1 SolutionsDokument53 SeitenChapter 1 SolutionsMarwan YasserNoch keine Bewertungen

- SMU MBA Assignments 3rd Sem Finance ManagementDokument1 SeiteSMU MBA Assignments 3rd Sem Finance ManagementTenzin KunchokNoch keine Bewertungen

- 5 TH Sem Advanced Accounting PPT - 2.pdf382Dokument21 Seiten5 TH Sem Advanced Accounting PPT - 2.pdf382Azhar Ali100% (3)

- Abba Application FormDokument1 SeiteAbba Application FormAbbaNoch keine Bewertungen

- CMADDokument4 SeitenCMADSridhanyas kitchenNoch keine Bewertungen

- Fundamental AnalysisDokument26 SeitenFundamental Analysisaruncbe07Noch keine Bewertungen

- Swayam Siddhi College of Management and Research: Summer Internship Project Topic For Finance:-Provident FundDokument10 SeitenSwayam Siddhi College of Management and Research: Summer Internship Project Topic For Finance:-Provident Fundpranjali shindeNoch keine Bewertungen

- Nykaa NDDokument13 SeitenNykaa NDNIKETA MODINoch keine Bewertungen

- Advanced Camarilla Pivot Based TradingDokument1 SeiteAdvanced Camarilla Pivot Based TradingrajaNoch keine Bewertungen

- TSLA Stock Quote - Tesla Motors IncDokument2 SeitenTSLA Stock Quote - Tesla Motors IncBaikaniNoch keine Bewertungen

- Pre-Feasibility Study: Printing PressDokument25 SeitenPre-Feasibility Study: Printing PressMusa AfridiNoch keine Bewertungen

- Retail Company With Simple DCFDokument51 SeitenRetail Company With Simple DCFJames Mitchell100% (1)

- Rajya Sabha Unstarred Question No-1832 Loans Written OffDokument6 SeitenRajya Sabha Unstarred Question No-1832 Loans Written Offnafa nuksanNoch keine Bewertungen

- Dupont Analysis of Asian PaintsDokument3 SeitenDupont Analysis of Asian PaintsOM JD100% (1)

- Jaguar Land Rover PLC LX000000002046407490Dokument409 SeitenJaguar Land Rover PLC LX000000002046407490mehulssheth50% (2)

- Theory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™ PDFDokument401 SeitenTheory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™ PDFjez100% (1)

- Combined Defence Services Examination (II) 2016 11634644335 सं यु त रा से वा परा (II) 2016Dokument2 SeitenCombined Defence Services Examination (II) 2016 11634644335 सं यु त रा से वा परा (II) 2016Pratik SharwanNoch keine Bewertungen

- I M B M +® Æ I " T ( "' : H V™ T JDokument26 SeitenI M B M +® Æ I " T ( "' : H V™ T JPratik GazalwarNoch keine Bewertungen

- Quiz 2 Audtheo PDFDokument4 SeitenQuiz 2 Audtheo PDFCharlen Relos GermanNoch keine Bewertungen