Beruflich Dokumente

Kultur Dokumente

Pipeline Magazine Example

Hochgeladen von

Peter FormanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pipeline Magazine Example

Hochgeladen von

Peter FormanCopyright:

Verfügbare Formate

contents Pipeline Magazine | February 2014

NEWS: Regional

NEWS: International

New Abu Dhabi concessions

could be reservoir-specific

Maersk gets 40% of

Repsols Kurdistan block

Companies vying for a share of Abu Dhabis

energy concessions could be working

according to reservoir-specific terms

Maersk Oil gets approval for a non-operating

interest in two blocks in Kurdistan Region of Iraq

10

12

Petrofac wins consultancy

work from Petronas

Petrofac-RNZ has been awarded a five-year

engineering services contract in Malaysia

17

Total has acquired a 40 per cent interest in

two shale gas exploration licenses in the UK

16 Total is the first energy

major to frack in UK

FEATURES: FEATURES:

The energy industry may never see an oil

and gas boom such as that in East Africa

with its promise of handsome returns

20

WHO DARES, WINS

Education and Training 24

Drilling

Claxton talks about the innovative solution it

provided for a drilling schedule change in Oman

Process Automation

Power Generation

Honeywell provides a case study of a

process migration project it successfully

completed for Dolphin Energy

Eaton reveals the tailored solutions

needed at each stage of the oil

and gas value chain to meet power

management challenges

33

36

28

18

40

BP talk exclusively about what the British

oil giant is doing to attract the right people

in the region. Lukoil also explains how they

created a world class training centre in Iraq

A new industry taking shape

around natural gas

Pipeline Magazine speaks exclusively

to Emerson Process Managements

vice president of oil and gas, Larry

Irving, about why he thinks that a

new industry will take shape in the

region around natural gas

The latest news on the 11th Oil

Barons Charity Ball taking place on 28

th

February 2014

EXCLUSIVE INTERVIEW:

THE OIL BARONS CHARITY BALL:

GEO FOCUS: EAST AFRICA

4

www.pipelineme.com

Pipeline JUNE/2013

REGIONAL NEWSMAP

NEWS: Regional

www.pipelineme.com

[MOROCCO]

Longreach finds gas shows

Longreach Oil & Gas has found gas

shows with its first exploration well,

Koba-1, in the Sidi Moktar licence

onshore Morocco. In a statement,

Longreach said that the well had been

drilled to a Total Depth (TD) of 3,100

meters and that it had encountered

potential Lower Liassic sandstone

reservoir with gas shows of over 10 per

cent. Dennis Sharp, executive chairman,

commented: This is a positive start to

our operated exploration campaign in

the Essaouira Basin, onshore Morocco,

which is most encouraging. We are

evaluating all of the available data in

order to determine the testing program

for the well. We look forward to gaining

a fuller understanding of the result of

the Koba well. The Koba structure is

the first prospect to be drilled as part of

Longreachs exploration well programme.

[EGYPT]

Petroceltic lowers

2014 production

target to 20m bpd

Irish independent Petroceltic International has

forecasted that it will produce somewhere

between 20 and 22 million bpd in 2014,

considerably less than the 25.2 million bpd it

made in 2013 as part of its 2014 guidance. It

is thought the reduction is due to a slowdown

in drilling in Egypt due to budget constraints

stemming from delays in debt recovery from

the Egyptian government.

[LIBYA]

British energy worker murder

in Libya sends shockwaves

The brutal murder in late December, of a

British energy industry contractor and his

New Zealand partner on a beach 65 km

west of the Libyan capital, Tripoli, has sent

shockwaves across foreign companies

operating in the country. Purported pictures

posted online in the aftermath of the incident

which took place near the oil export terminal

complex of Mellitah, show that Mark De

Salis and Lynn Howie were having a picnic.

De Salis is said to have been working as a

power manager for First Engineering to bring

in power generators to the Libyan capital.

The incident calls into question the safety of

foreign workers employed in Libya.

[ALGERIA]

Endress+Hauser solidifies

UAE and Algeria presence

Endress+Hauser is aiming to open up

what it calls important growth markets

in the Middle East and Northern Africa by

establishing its own subsidiaries in the UAE

and Algeria. The two new sales centres

build upon the German firms existing

presence through local representative

Descon Automation Control Systems for

the UAE market and Symes, its long-time

representative in Algeria located in Annaba.

5

www.pipelineme.com

Pipeline JUNE/2013

[SAUDI ARABIA]

Larsen & Toubro

wins major Saudi

Aramco order

Indian EPC contractor Larsen & Toubro

(L&T) has won a major order from Saudi

Aramco to construct 55 km of 230kV

double circuit overhead transmission line

and underground cabling to meet future

power demand at the Berri oil field in

eastern part of Saudi Arabia. The project

will be completed in 26 months. The

project will see the replacement of the

existing 115kV electrical power supply

system with the new 230kV power system

at the Abu Ali Plants to overcome existing

electrical system deficiencies and to meet

the future electrical demand load required

by the Berri field to maintain production

at 250,000 bpd to support Karan and

Arabiyah fields.

[OMAN]

Oman Drydock

targets LNG

carrier and

jackup market

The Oman Drydock Company (ODC) has

outlined its plans to expand its capabilities

for the jackup drilling rig, FPSO vessels

and LNG carrier (LNGC) markets. ODC

marketing director, Johnny Woo said the

company has ambitious expansion plans for

the upcoming year with its ability to handle

all ship sizes. Our expansion into LNGC

will further be strengthened by our new

license to support the French engineering

firm Gaztransport & Technigaz (GTT) which

specialises in cargo containment systems

for high-end liquefied natural gas carriers,

he said. ODC can provide repair and

conversion services to jack up drilling rigs,

drill ships and FPSOs.

[UAE]

Drydocks

to build

biggest ever

jackup rig

Drydocks World in Dubai has signed

an agreement with Drill One Capital for

building the Dubai Expo 2020 NS mega

jackup rig. Gusto MSC which is one of our

major partners in this project has designed

the CJ 80 rig and the rig will be the first

of this design to be built and will be the

largest jackup rig ever built. Designed to be

operated in harsh environments including

the Norwegian Sector of the North Sea at a

maximum water-depth of 175m with a 25m

air-gap, the rig is another ground-breaking

project among the growing portfolio of new

build projects for the offshore oil & gas

being implemented by Drydocks World.

www.pipelineme.com

[KUWAIT]

AMEC wins

$418 million

KOC consultancy

contract

AMEC has been awarded a renewed

contract by the Kuwait Oil Company (KOC)

to provide project management consultancy

services for a portfolio of major upstream

projects in Kuwait. The five-year call-off

contract is worth approximately US$418

million. It follows the companys delivery

of two previous five-year contracts held

since 2004. Under the new contract,

AMEC will provide the same services as

the previous contracts, ranging from front

end engineering design (FEED), Project

Management Consultancy (PMC) services,

engineering, construction management and

training of Kuwaiti engineers.

Publisher:

Nick Pomeroy

Sales Director:

Scott Woodall

Sales Manager:

Raed Kaedbey

Editor:

Julian Walker

Staff Writer:

Emran Hussain

Contributors:

Ian Anderson

Gardiner Henderson

Vladimir Spiridonov

Marketing Manager:

Katie Breslin

Art & Design:

Alden Guevarra

Jezreel Araos

Subscriptions:

subscriptions@reflexpublishingme.com

Advertising:

PO Box 500643, Dubai, UAE

Tel: +971 4 3910830

Fax: +971 4 3904570

sales@reflexpublishingme.com

www.pipelineme.com

Follow us on

twitter.com/pipelinetweets

Advertising:

sales@reflexpublishingme.com

Marketing:

marketing@reflexpublishingme.com

Editorial:

editorial@reflexpublishingme.com

Design:

design@reflexpublishingme.com

Printed by:

Masar Printing & Publishing

For information on submissions, please contact

the editorial team at the address above.

2014 has seen an eventful first month of the year

with partial sanctions being lifted in Iran and new

horizons opening in Abu Dhabi with the expiring of

the 75-year oil-production agreement in mid-January.

Both set of events will help shape the regions oil and

gas landscape. International oil and gas companies vying

for a share of Abu Dhabis major oil and gas concessions

could well find themselves working according to tighter

reservoir-specific terms and we cover this likelihood on

p10, with exclusive comments from the UAEs Minister

of Energy Suhail Mohamed Al-Mazrouie.

In late January, limited sanctions against Iran from

the US and EU were lifted after the International

Atomic Energy Agency confirmed that Iran had stuck

to its part of the landmark deal agreed in November

to curb its nuclear ambitions. Although Irans

petrochemical industry is set to benefit from the six month relief, it is the countrys strategic oil

and gas sector that Iran is hoping will woo western oil majors, including BP, Eni, Shell and Total,

who had a closed-door meeting on the sidelines of the World Economic Forum in Davos.

In this issue of Pipeline Magazine we hear exclusively from Emerson Process Managements

vice president of oil and gas, how the end of easy oil is making the industry look to new types of

techniques to deal with the more complex ways to extract oil and gas in the future. Larry Irving

touches on the important part that shale gas will play and delves into the US firms long experience

on the shale gas side.

Education and training within the regions hydrocarbon industry is proving a significant challenge for

everyone within the sector and we hear from BPs head of graduate resourcing and its VP for human

resources for the Middle East about what it is doing in Oman and the UAE to attract the right local

talent. We also hear exclusively from Lukoils head of professional development at West Qurna-2 in

Iraq about the success the Russian oil major has had since it established its own training centre in

the previously war-torn country in late 2012.

Finally, we put a big focus on East Africa as we investigate the high stakes on offer in the oil and

gas boom taking place in countries on the east coast of Africa, which is set to become a major

international player on the world energy stage.

Next month sees the much-anticipated Oil Barons Charity Ball return for its 11th edition which will

be staged on Friday 28

th

February at the Meydan Racecourse, Dubai.

Julian Walker

Editor

Official Publication:

Audited by: BPA Worldwide

Audited Average Monthly

Circulation: 7,997

October - December 2012

For the latest industry news, features and interviews please check

out the Pipeline website www.pipelineme.com. Our monthly

Project Data and Rigs Data is also available online in

our research section. Do subscribe to our

twice-weekly e-newsletter.

Copyright 2014. All rights reserved.

Reproduction without permission is prohibited.

is a DMG World Media company

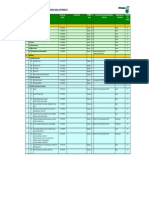

VISITOR BREAKDOWN - SENIORITY

ADIPEC 2013 CONFERENCES

5,801 DELEGATES I 253 SPEAKERS I 118 ORGANISATIONS

24%

17%

28%

31%

CEO / PRESIDENT /

VICE PRESIDENT

ENGINEER /

CONSULTANT /

OTHER

MANAGING DIRECTOR /

GENERAL MANAGER /

DIRECTOR

HEAD /

SUPERVISOR /

MANAGER

VISITOR BREAKDOWN RESPONSIBILITY

BRAND/ MARKETING / PR / EVENTS

BUSINESS DEVELOPMENT /

COMMERCIAL

LEGAL / CONSULTANT / ADVISOR

HUMAN RESOURCE /

TRAINING / RECRUITMENT

E&P / DRILLING /

OPERATIONS / TECHNICAL

GOVERNMENT RELATIONS

FACILITIES / EPC

/ MAINTENANCE

PURCHASING /

PROCUREMENT /

IMPORT & EXPORT

26%

19%

16%

10%

9%

9%

7%

4%

2013

FLOOR SPACE 35,000 SQM

NUMBER OF

COUNTRIES

REPRESENTED

108

2013 ATTENDEES

51,435

2013 EXHIBITORS

1,362

TOTAL

ATTENDEES

ATTENDEES

WHO MET THEIR

OBJECTIVES AT

THE SHOW

SHOW

ATTENDEES

WITH SOLE OR JOINT

PURCHASING

RESPONSIBILITY

ATTENDEES

EXPECTED TO MAKE A

PURCHASE AS A RESULT

OF THEIR PARTICIPATION

AT THE SHOW

WORTH OF

BUSINESS

CONDUCTED AT ADIPEC

51,435 93% 60% 53% $5BN

VISITOR

INCREASE 7% INCREASE 7% INCREASE 5% INCREASE 66% INCREASE 12%

8

www.pipelineme.com

ENERGY IN FOCUS

Pipeline FEBRUARY/2014

The Emerson logo is a trademark and a service mark of Emerson Electric Co. 2014 Emerson Electric Co.

Electronic marshalling eliminates the rework, the redesign and the headaches. With DeltaV

Electronic Marshalling, Emerson lets you make I/O changes where and when you need them without costly engineering

and schedule delays. Our new DeltaV CHARacterisation Module (CHARM) completely eliminates the cross-wiring from the

marshalling panel to the I/O card regardless of signal type so youre no longer held to predefined specifications. All those

wires, gone. All that time and engineering, gone. See how easy it can be by visiting www.IOonDemandCalculator.com

or call +971 4 811 8100.

YOU CAN DO THAT

Another I/O change? Great.

So another wiring schedule.

Another marshalling design.

And another cabinet...

Just make it all go away!

Visit the Fmerson CIobaI Users Fxchange in Stuttgart ApriI 1-3, 2014

NEWS: Regional

10

www.pipelineme.com

Pipeline FEBRUARY/2014

NEWS IN BRIEF

DNO completes farm-in of

offshore Tunisian blocks

Norwegian oil and gas company, DNO

International, announced completion of

the farm-in by its wholly-owned subsidiary

DNO Tunisia AS to the Sfax Offshore

Exploration Permit and the Ras El Besh

Concession in Tunisia. The move follows

a previous announced agreement with

Eurogas International Inc. and Atlas

Petroleum Exploration Worldwide Ltd.

DNO Tunisia now holds an 87.5 per cent

participating (100 per cent paying) interest

in the permit and the concession. It now

also has assumed operatorship and a

significant share of the existing cost pool.

GE to provide six Mega-

Structure power modules

to ZADCO

GE Oil & Gas has received a contract to

provide a turnkey turbomachinery solution

to Petrofac Emirates for the Upper Zakum

UZ750 field in Abu Dhabi, developed by

ZADCO (Zakum Development Company).

The turbomachinery equipment will

be delivered in the form of massive,

standalone, plug-and-play modules,

which will ship intact from GEs advanced

construction facility in Avenza, Italy, to an

artificial island located 50 miles offshore

of Abu Dhabi. Each module will weigh

more than 1,500 tonnes and be 44m long,

20m wide and 24m high. These six mega

structures will serve as the housing in

which a turbogenerator train is located that

will provide electric power to ZADCOs

oil production facilities, including pumps

and gas compressors, also on the island.

The advanced module design was most

recently deployed during the construction

of five massive systems developed for

Australias Gorgon field, one of the largest

and most complex gas fields in the

world. Like those made for Gorgon, these

modules will be assembled, commissioned

and tested ahead of shipment to the UAE

so that they can be simply and quickly

installed and ready for operation.

International oil and gas companies

vying for a share of Abu Dhabis major

oil and gas concessions could likely find

themselves working according to tighter

reservoir-specific terms, according to a

prominent industry commentator.

The existing 75-year concession

dating back to January 11, 1939 that saw

multinationals BP, Shell, Total, ExxonMobil

and Portugals Partex Oil & Gas help state-run

Abu Dhabi National Oil Company (ADNOC)

steadily develop its output capacity and

technological expertise, expired on January 9.

My hunch is that in allowing the

concession to expire, the faction in SPC

[Supreme Petroleum Council] favouring to split

the concession up on more reservoir-specific

seems to have prevailed. If that is right, the

company mix is likely to change too, industry

analyst Samuel Ciszuk told Pipeline Magazine.

About 60 per cent of Abu Dhabis oil

output is derived from the concessions

owned by ADNOC subsidiary Abu Dhabi

Company for Onshore Operations (ADCO).

In an attempt to retain a toehold in the

major OPEC producer, BP, Shell, Total and

ExxonMobil are all thought to have said

that they will pay Abu Dhabi 11 cents more

per barrel over what the emirate currently

charges for its Murban grade crude.

Abu Dhabis crude output in December

was 2.76 million bpd or just over 9 per cent

of OPECs daily global oil supply.

The decision making process to award the

concessions continues to be opaque even if

you ask the countrys top energy official.

The ministry is not concerned about this

so we cannot talk about it, we cannot declare

anything, the UAEs Minister of Energy,

Suhail Mohammed Al-Mazrouei told Pipeline

Magazine on the exhibition floor of last

months World Future Energy Summit (WFES)

in Abu Dhabi.

Pressed further on his expectations for

awarding the concessions the minister said:

My hope is that its fair and we maintain

talking to companies and everyone is happy...

we allow enough time for the newcomers to

look and see and I think thats fair.

In announcing the expiry of the

concession, ADNOCs director-general,

Abdulla Nasser Al Suwaidi stressed that

ADCO would continue to operate the

concession areas on ADNOCs behalf.

Ciszuk, a senior adviser to the Swedish

Energy Industry who has closely followed the

MENA regions oil and gas industry especially

in his previous roles with oil and gas

consultancies KBC and IHS, believes that this

is very much a temporary move by the SPC.

In any case, the government of Abu Dhabi

has now gone almost as far as possible

in strengthening its hand ahead of new

negotiations and bidding, having deprived the

IOCs of their owner role. IOCs [are] needed

for the growth plans, but right now Abu

Dhabi can wait longer than the IOCs, which

will continue to play ball on existing ongoing

work not to burn any bridges at this point,

he explained via e-mail.

New Abu Dhabi concessions could be

more reservoir-specific

HE Suhail Mohamed Faraj Al-Mazrouei,

UAE Minister of Energy at WFES

- Reduces installation cost

- No cot ol meh

- No cot lo| |nta|||ng meh

- |educed |aoou| cot

Save t|me. Save money.

- |ate| p|oect comp|et|on

- |otent|a| |ng|e coat app||cat|on

- |ewe| |nta||at|on day

- |e man hou|

jotun.com

Next gene|at|on |poxy |a|ve |||e ||otect|on

NEWS: Regional

12

www.pipelineme.com

Pipeline FEBRUARY/2014

The Kurdistan Regional Government (KRG)

has approved Maersk Oils acquisition of

a 40 per cent non-operating interest in

the Piramagrun and Qala Dze Production

Sharing Contracts (PSC) from Repsol

Oriente Medio S.A.

The Spanish oil firm will continue to operate

exploration activities and also hold a 40 per

cent interest. The KRG will hold the remaining

20 per cent share of each block.

The Piramagrun and Qala Dze blocks are

located approximately 150 km east of Erbil, the

regional capital of Kurdistan and cover an area

of approximately 2,747 sq km. During 2012,

Repsol undertook a significant 2D seismic

acquisition programme which identified a

number of drilling targets. In November 2013

work commenced on the Zewe-1 exploration

well and drilling in the Qala Dze PSC is

expected to begin in the early part of 2014.

Jakob Thomasen, CEO of Maersk Oil said:

Being present and active in one of the worlds

most promising and prolific exploration basins

is a fundamental part of Maersk Oils strategy.

We are on a journey to increase entitlement

production to 400,000 barrels of oil per day

by 2020. We expect our position in Kurdistan

Region of Iraq to help us sustain the target

production level beyond 2020.

Maersk buys into Repsol in Kurdistan

NEWS IN BRIEF

Kurdistan is all set to begin pumping its

own oil to the world via a new pipeline by

the end of January, according to a recent

communiqu by the Kurdistan Regional

Governments (KRGs) Ministry of Ministry

of Natural Resources (MNR).

Shipment of the crude from Iraqs semi-

autonomous region will pass through pipelines

in Turkey to the countrys oil export terminals at

Ceyhan on the Mediterranean coast.

At the time of going to press, the ministry

anticipated that an initial shipment of two

million barrels of oil would take place at the

end of January followed by an increase to 4

and 6 million barrels by the end of February

and March respectively. The expectation is to

ramp this up steadily to 10-12 million barrels

by the end of December.

The beginning of January saw initial

quantities of crude oil produced from the Tawke

field begin to flow through Kurdistans new

pipeline system to Ceyhan. The ministry said

that crude oil from Taq-Taq and other producing

fields will soon be added to the export system.

In a bid to allay uncertainties from foreign

buyers who fear they may be crossing the

wishes of Baghdad, the MNR has said that

prospective buyers can lift the crude shipments

from Ceyhan under similar terms to those used

by Iraqs State Oil Marketing Organisation

(SOMO) for oil exports from Kirkuk.

The move was always bound to anger

Baghdad which maintains that the KRG is

essentially smuggling the oil without its

knowledge or blessing.

The procedure of the ministry of natural

resources of Kurdistan province is considered

as a violation to the Iraqi constitution related to

the Iraqi natural resources, Baghdad said.

The Economist Intelligence Units energy

analyst, Peter Kiernan told Pipeline Magazine

that: There is little Baghdad can do about

this, although it appears that Iraq will have

access to the revenue stream from KRG

oil exports, so in this sense the central

government of Iraq is not completely shut

out of the process. This is the only way

Turkey and the KRG will have a chance of

ensuring Iraqi acquiescence to closer energy

ties between Irbil and Ankara. Nevertheless,

Iraq will still maintain a level of wariness

about these closer ties.

Kurdistan to independently pump oil

Abu Dhabi extends Inpexs

Upper Zakum concession

Japans Inpex Corporation has

announced that the government of Abu

Dhabi has extended its concession for

the offshore Upper Zakum oilfield by

more than 15 years to December 31,

2041. The fiscal terms and conditions

on the concession for the Upper Zakum

Oilfield have also been revised, Inpex

said. Currently, the development work

is carried out using the artificial islands

whilst the production capacity is

targeted at 750,000 bpd. Inpex expects

that the extension of the concession

should contribute to the long term

stable supply of energy to Japan.

Mubadala increases position

in Malaysia

Mubadala Petroleum has signed an

agreement with Shell to swap equity

in two exploration blocks offshore

Malaysia. Under the agreement, starting

January 1, 2014 Mubadala Petroleum

will gain a 20 per cent interest in the

deepwater Block 2B while Shell will gain

a 20 per cent interest in Block SK320.

Deepwater Block 2B is operated by Shell,

Mubadala Petroleum operates Block

SK320. PETRONAS Carigali Sdn Bhd is

a participant in both blocks. In addition,

the current exploration drilling campaign

in Block SK320 has yielded two new

gas discoveries, Pegaga and Sintok,

to add to the existing M5 discovery.

Algeria to double oil and gas

output in 10 years

Algeria is to double its oil and gas

production in a decade due to notable

exploration success in the past year

according to Youcef Yousfi, the countrys

energy minister. Algeria plans very

seriously to double its gas production,

AFP quoted him as saying. Yousfi also

said that shale gas would add to the

ambitious production target.

Seismic acquisition of the blocks

NEWS: Regional

13

www.pipelineme.com

Pipeline FEBRUARY/2014

UK based Hydraulic tools manufacturer

Hi-Force recently announced that it will be

opening a brand new workshop within its

Dammam operation in Saudi Arabia.

The launch of the facility, due for completion

in early 2014 combined with the extensive stock

holding within the country, allows Hi-Force to offer

its customers a one stop solution for all of their

hydraulic tool requirements. In addition to supply

of Hi-Force products, the announcement of a

workshop facility allows for the repair and testing

of products as well as hand torque wrench and

hydraulic torque wrench calibration services.

Complete with a good stock of commonly

used spare parts, as well as highly skilled

technicians, the Hi-Force workshop in Dammam

is able to offer a first class guaranteed repair

service for all Hi-Force products as well as most

international competitor brands.

Also housed within the 100 sqm facility is

an extensive rental fleet of hydraulic torque

wrenches and bolt tensioners, available on both

a short and long term basis. The rental fleet

offers customers an economical alternative

to purchasing capital intensive specialised

equipment at short notice, or can even

serve as a stop gap whilst having their own

equipment serviced or repaired. The rental fleet

also allows Hi-Force representatives to offer

onsite demonstrations to customers, providing

a brief training on the safe and proper use

of the equipment, as well as highlighting its

various superior features and capabilities.

Country manager, K. Bala said: Saudi

represents a huge market for both Hi-Force

products and services. With the additional

investment of a fully fitted workshop by our

business partners, MSS, Hi-Force is now armed

with providing customers a complete service

including supply, rental, repair, testing and onsite

services which will help to secure our position

within the market and hopefully increase our

business levels across the country.

ADMA-OPCO has signed an engineering,

procurement & construction (EPC) contract

with the National Petroleum Construction

Company (NPCC) worth US$885 million for

the Lower Zakum Field, offshore Abu Dhabi.

The Lower Zakum Field is one of the largest

oilfields in the world and NPCC has been

awarded the first phase of Lower Zakum oil

lines replacement project, which consists of

approximately 90 km of oil pipelines replacement

and associated wellhead towers modification.

The project is the third major EPC contract

awarded to NPCC by ADMAOPCO within the

last 12 months, the earlier being the Umm Lulu

Package 1 and Umm Lulu Package 2 projects.

ADMA-OPCO said in a statement that this

deal fits its strategy of replacing aged oil

pipelines in the existing offshore fields with the

objective of mitigating potential environmental

risks; maximising asset lifetime and sustaining

the oil production capacity.

Ali Al-Jarwan, ADMA-OPCO CEO commented:

Its our pleasure to have NPCC with us in

this highly significant project which requires

maximum attention in terms of quality and HSE.

The project is part of ADMA-OPCOs Lower

Zakum plus 100 mbd programme aimed at

enhancing the oil production capacity from

Lower Zakum Field, which is part of its overall

scheme to raise the companys oil production

from the current 600,000 bpd to around one

million bpd by 2020.

ADMA signs $885m EPC with NPCC

NEWS IN BRIEF

Hi-Force to open repair and

testing workshop in Dammam

Hi-Force workshop facility

Cepsa and Cosmo sign

strategic partnership

Japans Cosmo Oil and Spanish

oil company Cepsa have signed a

Memorandum of Agreement forging a

strategic cooperation in the oil and gas

sector, both in the UAE and globally. Under

the memorandum, Cepsa and Cosmo

will work together to identify and develop

mutually beneficial opportunities for

securing new concessions, promoting their

exploration and production businesses, and

exploring synergies and prospects across

their refining, marketing, petrochemical,

power, and renewable energy units.

First petchems shipment

from western Saudi port

Almajdouie Logistics together with its

sister company RPL (Rabigh Petrochemical

Logistics Company LLC) handled the first

export shipment of petrochemical products

through King Abdullah Port (KAP) for Rabigh

Refining and Petrochemical Company

(PetroRabigh) on January 5, 2014. KAP is

located at King Abdullah Economic City

(KAEC) in Rabigh on the western coast

of Saudi Arabia. The shipment represents

the first export operation of the King

Abdullah port. The cargo, which consists

of 54 containers of polymer material,

was shipped on board a carrier heading

to Singapore. The port is an important

infrastructure investment which is, among

other things, aligned with Saudi Arabias

strategy of developing downstream

industries so as to drive value and job

creation, commented Jarmo T. Kotilaine, a

regional analyst. Group president Abdullah

Almajdouie stated: The start of new port

will ease the congestion at Jeddah Port and

Jeddah City but we have long way to go.

14

www.pipelineme.com

Pipeline FEBRUARY/2014

[PERU]

Repsol sheds

LNG assets,

sells to Shell

for $4.1bn

Repsol has

completed the sale of its liquefied

natural gas (LNG) assets with the

handover to Shell of assets in Peru

and Trinidad and Tobago. In October

2013, Repsol sold its stake in Spanish

firm Baha Bizkaia Electricidad (BBE)

to BP, which exercised a purchase

option over the asset. The deal gives

Shell an additional 7.2 million tonnes

per annum of directly managed LNG

volumes. It is expected to enhance

the Anglo-Dutch companys portfolio

with LNG being supplied in the

Atlantic from Trinidad & Tobago, and

in the Pacific from Peru.

INTERNATIONAL NEWSMAP

[GREENLAND]

Statoil buys

into new

Greenland

block

Statoil, along with

partners ConocoPhillips and Nunaoil,

has been awarded a block offshore

Greenlands northeast coast where

the Norwegian oil company will be

the operator. Awarded following the

East Greenland licence round, Block

6 is located in a frontier area offshore

Greenland which is geographically part

of North America but governed under

Danish authority. Statoil will hold 52.5

per cent, ConocoPhillips will have 35

per cent and Nunaoil will have 12.5 per

cent in the block. We recognise that

this is a challenging area, but it is also

potentially prospective. And we believe

that Arctic resources in the future will

become important to meeting the

worlds energy demand, said Runi M.

Hansen, Statoil country manager for

Greenland and the Faroes.

[BRAZIL]

Commercial declaration

made for offshore Brazil area

BG Group has confirmed that its

partner, Brazils state-run oil major

Petrobras - the operator of block

BM-S-9 in the pre-salt Santos Basin

- has submitted a Declaration of

Commerciality (DoC) to the Brazilian

National Agency of Petroleum,

Natural Gas and Biofuels (ANP),

for the oil and gas accumulations

in the Carioca area, offshore Brazil.

As part of the DoC, the consortium

has suggested that the new field

be named Lapa. The Lapa field is

located approximately 270 km off

the coast of So Paulo state, in

water depths of around 2,140m.

[UK]

North Seas

Orca field

begins gas

production

RWE Dea UK has

announced start of production from the

Southern North Sea gas field Orca. The

operator is GDF Suez E&P Nederland B.V.,

with RWE Dea as partner. The Orca field

will be developed by drilling three wells in

total. The first two development wells have

been drilled and completed in 2013. The

third producer is currently being drilled and

is expected to be completed in February.

Orca is the fourth of our UK projects

coming on stream within only 1.5 years,

said Dirk Warzecha, COO of RWE Dea AG.

NEWS: International

15

www.pipelineme.com

Pipeline FEBRUARY/2014

[AZERBAIJAN]

KBR bags Shah Deniz

contract from BP

KBR has been

awarded a contract

by BP Exploration to

provide engineering

and procurement services for the Shah

Deniz Stage Two project in the Caspian Sea.

The field lies some 70 km offshore in the

Azerbaijan sector of the Caspian Sea. The

contract is worth US$365 million and work

is thought to have begun in January and will

run through to 2018. The US firm will provide

engineering design and procurement support

services for an offshore complex consisting

of two bridge-linked fixed jacket platforms as

well as an onshore gas processing facility.

[REPUBLIC OF

CONGO]

Qatar Petroleum

joins Total in Congo

Qatar Petroleum

International (QPI) has

been given a 15 per

cent capital holding by Total in its Total E&P

Congo assets which are mainly offshore

the Republic of Congo in West Africa. The

deal follows the signing of a framework

agreement in early May. The US$1.6 billion

dollar increase of Total E&P Congos capital

will consolidate its financial capacity at a

time when it is progressing the development

of the Moho Nord deep offshore project.

[GABON]

OMV buys into offshore Gabon fields

OMV has signed binding farm-in agreements

with London-listed independent exploration firm

Ophir Energy offshore Gabon in West Africa.

The move, part of OMVs next step in increasing

its exploration business in Sub-Saharan Africa,

follows the companys acquisition of an interest

offshore Madagascar earlier in the year. OMV

CEO Gerhard Roiss said: It is part of OMVs

strategy to build up new exploration business in

the region of Sub-Saharan Africa. The first step

has been taken with the entry into Madagascar

which is now followed by a new exploration

venture in Gabon. These projects are the basis for

long-term growth in the region.

[AUSTRALIA]

Worlds first coal

seam gas sent to

Aussie LNG project

BG Group has announced

that the Queensland

Curtis LNG (QCLNG)

project has received first gas from the Surat

Basin coal seam gas fields in Australia the

worlds first coal seam gas to LNG project.

Delivery of first gas onto Curtis Island, where

the liquefaction terminals are located marks the

successful completion of a two-year task to lay

more than 46,000 lengths of one-metre diameter

steel pipe over 540 km. Arrival of first gas onto

the island enables commissioning work to begin

on the first of two LNG production trains being

developed by the group as part of the integrated

QCLNG project. This commissioning work is

expected to begin in the first quarter of 2014.

NEWS: International

16

www.pipelineme.com

NEWS: International

Pipeline FEBRUARY/2014

Total is first energy major to frack in UK

French oil major Total has acquired a 40 per

cent interest in two shale gas exploration

licences in the UK, making it the first major

energy company to invest in hydraulic

fracturing or fracking in the country.

The interests in which Total will be the

operator, are in Petroleum Exploration &

Development Licences 139 and 140 in the

Gainsborough Trough area of the East Midlands

region of the UK covering an area of 240 km2.

Patrice de Vivis, Totals senior vice president

for Northern Europe, said: This opportunity

is an important milestone for Total E&P UK

and opens a new chapter for the subsidiary

in a promising onshore play. The Group is

already involved in shale gas projects in the

US, Argentina, China, Australia and in Europe

in Poland and in Denmark, and will leverage its

expertise in this new venture in the UK.

On completion of the transaction, Totals

partners in the project will be GP Energy

Limited (a subsidiary of Dart Energy Europe)

(17.5 per cent), Egdon Resources UK Ltd (14.5

per cent), Island Gas Ltd (IGas) (14.5 per cent)

and eCorp Oil & Gas UK Ltd (13.5 per cent).

IGas will be the operator of the initial

exploration programme, with Total

subsequently taking over operatorship as the

project moves towards development.

The UK government has been quick to talk

up the economic benefits of fracking saying

that nearly US$2 billion could be pumped back

into the economy from these operations.

UK Prime Minister David Cameron has been

on record saying: A key part of our long-term

economic plan to secure Britains future is to

back businesses with better infrastructure.

Thats why were going all out for shale.

It will mean more jobs and opportunities for

people, and economic security for our country.

The move by Total has sparked

environmental protests

17

Petrofacs Malaysian based engineering services business; RNZ

Integrated (M) Sdn Bhd also known as Petrofac-RNZ, has been

awarded a five-year umbrella design and engineering services

contract in Malaysia by Petronas Carigali Sdn Bhd (Petronas Carigali).

Under the scope of the competitively tendered contract, Petrofac-

RNZ will be providing a range of multi-discipline consultancy and

design services against specific scopes of work for Petronas

Carigalis assets in the region. The contract will be delivered by

the task-force teams from Petrofac-RNZs engineering centre in

Kuala Lumpur, whilst also being able to access the complementary

expertise from Petrofacs wider capability base.

Petrofac will provide a range of multi-discipline design services

Petrofac wins consultancy

work from Petronas

New oil and gas discoveries have been made by Statoil and its

partners in the North Sea.

Statoil, the operator on Block PL272, found gas in the Askja West

prospect and an oil discovery in the Askja East prospect offshore Norway.

The exploration wells 30/11-9 S and 30/11-9 A, drilled by the drilling

rig Ocean Vanguard, are located between the Oseberg and Frigg

fields and about 13 km southeast of the Statoil-operated Krafla/Krafla

West discoveries.

Statoil estimates the total volumes in Askja West and Askja East to be

in the range of 19 - 44 million barrels of recoverable oil equivalent.

Statoil makes new O&G finds

NEWS: International

www.pipelineme.com

Pipeline FEBRUARY/2014

18

www.pipelineme.com

Pipeline FEBRUARY/2014

INTERVIEW: EMERSON

T

he era of easy oil is behind us, notes

Irving, and the oil and gas industry

must look to new types of techniques,

which are more complex, to extract oil or

gas in the future.

Irving remarks: We have to do something

different.

The oil and gas industry is very important for

Emerson Process Management and in 2013 the

companys revenues were about US$8.5 billion,

of which oil and gas contributed around 42

per cent, making it by far the US rms largest

business segment.

The Middle East is paramount for us,

notes Irving. He also believes that the equation

on how to use elds and reservoirs in the

region will change in the future.

Middle East elds are very viable and there

is an abundance of oil. What we need to do

is change the techniques we use to extract it.

No longer will we be able to rely on the natural

pressure of the reservoir.

He argues that the industry must change the

technologies they use.

Natural gas

A real focus in the region revolves around the

moving of natural gas. Countries in the Middle

East are seriously investing in the infrastructure

needed to move and import natural gas in and

around the area.

Regasifcation is one such hot topic as the

region needs new multiple sources locally here

in places like the UAE, which you think would

have enough natural gas but they dont. So we

have new pipelines into the region and LNG

imports in the region, says Irving.

He feels this presents a huge opportunity

to be able to capture much of the natural gas

today that is either ared or reinjected. This

will allow the region to try and capitalise on

this and commercialise it.

According to Irving, Emerson has many

solutions for natural gas and the firm

provides multiple solutions to not only help

find natural gas but to help move it through

the pipelines and all the way through to the

point of consumption.

Natural gas is one of the largest growing

energy sources for the future. I see a whole

new industry forming around natural gas

opportunities as natural gas is going to be at the

forefront of generating their electricity, he says.

Shale gas experience

Shale gas is also playing an important role and

Emerson is doing a lot on the shale gas side.

Irving sees a shift coming from shale gas

development and drew an interesting contrast

between the conventional natural gas that is

seen in the Middle East, relative to what will

come based on Emersons shale gas experience.

Conventional reservoirs in the region

have seen very large volumes of natural gas

produced at a few wells. Producers have

been able to rely on traditional reservoirs

for a very long period of time. Shale is the

opposite, according to Irving.

You will need your economic return sorted out

in a two year period. The depletion rate in shale

year from year is very dramatic, he points out.

With shale you are in a perpetual drill cycle.

The only way to replace the dramatic depletion,

which could be as high as 70 per cent, is to drill

more wells. So it becomes a true manufacturing

process - you must be very good at doing the

same thing over and over again.

For the operator and producer, you will

need a repeatable engineering design and this

requires efciency and optimisation

Speed is of the essence, so speed to

drill, speed to bring online. These are the

main differences between conventional and

shale, he argues.

So instead of one unique highly engineered

well that you have today in the region you will

have multiple, repeatable wells in the future.

Emerson has automated thousands and

thousands of shale gas wells in the US.

There is no doubt that we have benets

from the shale revolution. It has been important

for North America to be able to provide greater

energy independence but eventually to become

an LNG exporter, which it will. This will impact

the world. It will have an effect on pricing

structures, remarks Irving.

Potential for shale in the region could be a

game changer, especially in Algeria. In Saudi

Arabia it is still very early days and the country

has around seven exploratory wells, but the

potential is there, according to Irving.

The development of shale gas in the region

ts quite nicely with the Middle East strategy to

use more natural gas to bring primary electricity

and to do it efciently, he rmly believes.

In conclusion Irving says: The next frontier

is to try and connect all the capabilities to the

business. How well we can connect the speed

of the operation to the market opportunities, that

are starting to move from long term contracts to

short term spot market opportunities.

Pipeline Magazine talks to Larry Irving, vice president of oil and gas

industry for Emerson Process Management about why he thinks that a new

industry will take shape around the region push for natural gas

NEW INDUSTRY TAKING SHAPE AROUND NATURAL GAS

Larry Irving, Emerson Process Management

For GCC Sales: sales@jesco.com.sa ; For international sales: jesco.sales@duferco.com

20

www.pipelineme.com

Pipeline NOVEMBER/2013

www.pipelineme.com

Pipeline FEBRUARY/2014 20

The energy industry may never see an oil and gas boom such as that in

east Africa with its promise of handsome returns. Emran Hussain finds

the stakes are high here, then again so are the rewards

EAST AFRICA

:

WHO DARES, WINS

In my opinion,

I think the east

coast of Africa is going to

become an enormous

international player

Charlie Benson, COO, Hayaat Group

In my opinion,

I think the east

coast of Africa is going to

become an enormous

international player

Charlie Benson, COO, Hayaat Group

T

he past few years have seen a urry of

activity among many companies in east

Africa some local but mostly foreign

drawn to the idyllic Indian Ocean shores of the

region which is some of the poorest anywhere

that continues to attract them.

But they come not in search of developing the

next tourist hotspot, as with much of the African

story in recent times, it is the vast oil and gas

potential lying beneath the soil and further

offshore east Africa.

In terms of hydrocarbons, the region should

be seen as part of a larger African narrative, the

continent produced some 12.4 per cent of the

worlds overall crude output in 2010, exported

20 per cent of global oil exports and 8.8 per

cent of the worlds proven oil reserves. All this

without even beginning to exploit the up and

coming east African region.

Natural gas deposits off the coast of east

Africa Kenya, Tanzania and Mozambique put

Nigeria, Africas largest energy producer, quite

easily in the shade.

This promises to be a blessing for the region

where average annual incomes are below

US$600 and life expectancy is less than 60

years. Other hurdles - which vary from country

to country that have until now been the

reason for outside investors to shun the region

have been a poor business climate that has

tended to be inward-looking coupled with the

lack of good infrastructure and logistics.

However one thing any new entrant to Africa

should expect, is the unexpected, says Charlie

Benson chief operating ofcer of Abu Dhabi

based multi-sector investment rm Hayaat

Group, a company that has recently entered the

east African upstream energy industry through

a 10 per cent acquisition of Australian company

Swala Energy which operates there.

So many things can happensome of the

challenges we have faced revolve around logistical

challenges in the areas that we are operating in

but that breeds opportunities, he explains.

He believes that it is for this very fact that

many businesses choose not to invest in Africa

but in the same breath says that many others do

for precisely this reason it is an opportunists

market for sure.

Massive growth potential

The good news is that the region has huge

growth potential, countries like Kenya, Tanzania,

Mozambique and Uganda are home to some

of the worlds fastest-growing economies. All

of these countries have either discovered vast

deposits of oil and gas in the last few years,

for the time being it is the latter that is drawing

a huge amount of attention from the likes of

Statoil, Shell and ExxonMobil.

Tanzania which has east Africas second

biggest economy, is expected to see its gas

resources grow vefold, the countrys energy

and minerals ministry said last August. The

country which is most famous for being home

to Mount Kilimanjaro and its vast Serengeti

planes, is estimated to currently hold 43.1

trillion cubic feet (tcf) of recoverable natural gas.

This latest announcement predicts that in the

coming two years alone, Tanzanias gas reserves

could rise to 200 tcf.

With plans to drill 17 new wells in the current

scal year running from July 2013 to June 2014

and costing nearly $700 million, Tanzania is on

course to nd more high-impact gas nds.

Going further south in neighbouring

Mozambique, the rosy outlook continues and

on an even bigger scale. Mozambiques prolic

offshore Rovuma basin which borders Tanzania

is said to hold 200 tcf of gas and in 2013 was

the setting for six major deals worth $9.3 billion

by exploration and production companies from

major gas importing countries China and India.

Ticking clock for LNG exports

With such major gas nds in the region, east

Africa is being billed as the third-largest natural

gas exporter in the world, a rather exclusive club

that includes major gas exporting nations such

as Russia, Qatar, Australia and soon the United

States on the back of its shale gas boom.

With natural gas growing in importance as

part of the global energy mix well into the

foreseeable future, east Africas gas boom

seems quite timely especially as gas derived

from the region is expected to be competitively

priced compared to other regions.

Consultants at Wood Mackenzie in 2012

estimated that east African liqueed natural gas

destined for the hugely lucrative Asian market

would likely be priced at $7 per million British

thermal units (BTUs) in order to break even

compared to LNG from Australia which would

require $10 per million BTUs.

Now that east Africa is seeing its gas

producing potential grow beyond its wildest

expectations, the next logical step is to export

the product, and quickly.

Statoil and Britains gas explorer, BG Group

that have considerable acreage in Tanzanias

GEO FOCUS: East Africa

21 Pipeline FEBRUARY/2014

offshore blocks have announced plans to build

a two-train LNG plant on the Tanzanian coast.

Italian oil and gas rm Eni and US independent

Anadarko Petroleum have similar plans to build

a LNG export facility in northern Mozambique.

However in both cases, the clock is

ticking as US shale gas exports are set to

begin in 2015 potentially causing a glut

in the already volatile global gas market,

driving down the price of the commodity.

Given that construction of these LNG

terminals which can usually take around

ve years has not even started, sufce to

say that any export of east African natural

gas in the future will begin at a lower than

expected price point.

Much like the rest of the continent, the

considerably higher logistics costs

compared to other more developed

parts of the world, are already

starting to make heads sweat.

If you look at where theyre

building the large LNG terminal

up in northern Mozambique

it is a relatively small town, right

up in the north of the country.

Just logistically investing the sums of money

that theyre talking about investing, depending

on who youre talking to, varies from anything

between $20 to $40 billion. Thats a huge

amount of challenges, Hayaat Groups Benson

tells Pipeline Magazine.

Benson does not rule out that

the challenging onshore logistical

landscape is a key reason why much

of the hydrocarbon nds in east

Africa have been offshore.

Youre carving through roads

for seismic [equipment], youre

having to cut through bush and

go into areas that are very

difcult to get the seismic

and drilling equipment into.

Whether thats the sole

reason, Im not

sure, he says, I

think its possibly

part of it.

Although

he concedes

that as his

company is

not directly involved in upstream activities, it

is hard to say.

Kenya oil boom

Kenyas success in east Africas hydrocarbon

bonanza has been mainly in signicant crude oil

discoveries allowing many industry watchers to

speculate an entry of the oil majors in this part

of the world.

Two new onshore discoveries for Africa-

focused UK oil and gas exploration company,

Tullow Oil in mid January, brought the revised

total of its discovered resources in that particular

block to 600 million barrels (mmbo). At the time

of this announcement, the company said that

reserves in its 10BB Block in the north of the

country could be in excess of 1 billion barrels.

Whats more, each of Tullows seven wells

drilled at the block thus far have resulted in

discoveries.

Exploration results to date from the rst

basin, amongst a chain of basins, have proven

that Tullows onshore acreage in northern Kenya

has the potential to become a signicant new

hydrocarbon province, said Angus McCoss,

Exploration director, Tullow Oil.

GEO FOCUS: East Africa

www.pipelineme.com

The programme of over 20 wells we have

planned across our licences over the next

twenty four months should materially add to

the 600 mmbo discovered to date through

a combination of exploration and appraisal.

With up to five other analogous basins being

tested during this programme, Tullow has the

opportunity to increase Kenyas resources

significantly beyond todays estimates.

His colleague and chief operating

officer, Paul McDade said: The results to

date are extremely positive for achieving

a commercial development from the

discoveries made in this basin. There is

clearly scope for the development to be

expanded if there is further exploration

success in other basins.

Enormous international player

In my opinion, I think the east coast of Africa is

going to become an enormous international player-

and it already has but in the fullness of time it

will become an international player within the gas

production market and hopefully the oil production

market without a shadow of a doubt, says Benson.

There is every indication that relatively small

energy players like Hayaat Group and Swala

Energy have just as much to gain as their local

counterparts and bigger international explorers

in east Africa. The international energy industry

may perhaps not see an energy boom such

as east Africa with its promise to handsomely

reward any company small or large, ever again

the stakes are high here but then again so

are the rewards.

22

www.pipelineme.com

BG Group is one of the leaders in east Africas offshore fields

Mauritius has taken significant steps

towards establishing itself as a centre for

Africa related international arbitration, and

the Mauritian government has repeatedly

demonstrated its commitment to achieving

this aim. This process began with the

adoption of the Mauritian International

Arbitration Act in 2008, which was

based on the UNCITRAL (United Nations

Commission on International Trade

Law) model arbitration law and thus in

conformity with international norms.

The Mauritian courts have a reputation for

impartiality and are generally regarded as being

supportive of arbitration, particularly since the

Act came into force. Mauritius is a member of

the New York Convention, and has a number of

bilateral investment treaties in place. Its status

as a regional offshore financial centre potentially

also simplifies enforcement of arbitral awards, as

companies will frequently hold assets in Mauritius.

African arbitration has, with the exception

of some West African OHADA arbitration,

generally been handled by the leading

international arbitration centres in London,

Paris and Singapore, and there appears to be

a clear demand for a regional arbitration hub.

Mauritius role as a major offshore jurisdiction

militates in its favour in this regard, and South

Africas relative underdevelopment as an

arbitration centre, together with its recent

revocation of many of its bilateral investment

treaties, may also help to make Mauritius the

most likely candidate for this role.

Key features of the Act include:

a provision giving defaull jurisdiclion

over appointments of arbitrators and

administrative matters to the Permanent

Court of Arbitration;

provisions expressly pernilling foreign

lawyers to act as both counsel and

arbitrators in Mauritius;

MAURITIUS TO BE

REGIONAL ARBITRATION

CENTRE FOR AFRICA

AFRICA OIL EXPORT DESTINATION 2007

ASIA IS A GROWING DESTINATION FOR AFRICAN OIL

AFRICA OIL EXPORT DESTINATION 2011

Source: Trade Map

Pipeline FEBRUARY/2014

GEO FOCUS: East Africa

Partner Nick Greenwood and senior associate Richard

Ellison in the Dispute Resolution group are at the London

ofce of global law rm Morgan Lewis

Worldwide Oileld Machine (WOM) is a globally recognized multinational established in 1980

with headquarters in Houston, Texas with group companies strategically located worldwide with

manufacturing facilities, engineering centers, sales ofces and assembling/testing facilities. The

WOM group of companies are all vertically integrated enhancing the quality control of each process

to supply the world with efciently manufactured products to support the oil and gas industry for

surface and subsea applications.

Magnum Technology Center is a wholly owned member of the WOM group of companies which

designs and manufactures complete equipment packages for Well Testing & Production and

Managed Pressure Drilling services for both onshore and ofshore applications. All packages are

designed to work seamlessly together whilst giving operators the exibility to adapt.

For further details please contact:

Mr Mahesh Mithran - General Manager

Mr Arun Joseph - Regional Sales Manager

Tel: +971 4 8163 600 Email: sales@womme.ae

For further details please contact:

Mr Brian Finnigan - General Manager

Mr John Sajeev - Technical Engineer/Sales

Tel: +971 4 8163 600 Email: sales@mtcltd.ae

Managed pressure Drilling Control Manifold in DNV skid WOM 3-1/16 15K Cement / Standpipe Manifold w/skid

24

www.pipelineme.com

Pipeline FEBRUARY/2014

Pipeline Magazine speaks to Lyle Andrews, head of graduate resourcing,

international locations at BP and Anand RV, vice president for human resources

for BPs Middle East and India operations about what one of the worlds largest oil

companies is doing to attract the right people in the Middle East

ATTRACTING THE RIGHT TALENT

T

he oil and gas industry is facing

a growing dilemma of how to

ensure that the next generation

of engineers are nurtured properly

and brought into an industry bracing

for the departure of a great number of

older engineers. This is known as the

great crew change and international

oil companies have recognised the

increasing cost of trying to deal with the

implications of the change.

BP is very aware of this and Andrews

feels: that the great crew change is very

important but there is a debate on how

much of an effect this will really have.

The main focus should be on nurturing

local talent as the days of over reliance on

expatriate expertise are coming to an end

and BP believes that companies need to

ensure they have robust procedures in place.

Andrews adds:I think for us at BP

there are resourcing needs in a number of

locations we operate in and the best way to

build up capability, regardless of the impact

of the great crew change, is to intervene in

the schools through improving educational

standards, encouraging people to take

the appropriate studies and then making

sure there are actual jobs and training

opportunities available within the industry.

This is why BP puts a lot of emphasise on

its graduate programme and over the last

four to five years has dramatically increased

the global number of graduates it takes in.

We are currently at a fairly stable 900

graduates per year. We try very hard to have

a top notch graduate programme that makes

sure we are getting the right intake that

supports our future needs, but also helps

us to grow the national capabilities of the

countrys youth, explains Andrews.

Historically, BP has found that it takes 15

years to develop a graduate to a level where they

are fully autonomous in their work. What BP is

trying to do through a more systematic approach

to training and development, is to compress the

time to say 10 years, Anand reveals.

We have launched a programme called

eXcellence, which is a very structured

development process that takes someone

through the rst 10 years of their career, he says.

The programme was launched around three

years ago and is now gaining momentum as it

takes a while within a large company to adopt

such a new approach.

Before this scheme was launched,

graduates would nish our course and then it

would be left to chance, but now people can

roll off our graduate programme and go straight

into this eXcellence scheme.

This scheme is all about on-the-job

development; it is about what experiences

someone needs to round off their career. It is

not prescriptive, but offers a lot of exibility,

notes Anand.

Local push

BP is pushing its eXcellence programme

in the Middle East, as there is a lot of young

talent in the region. BPs scheme is a great

selling proposition and when any young

person joins the oil giant, they have got a

clear career trajectory to follow.

Nationalisation is a growing issue for

countries in the region and BP feels that

a push for more Omanis and Emiratis

in the workforce will help the region as

governments across the region continue to

push for a stronger national workforce.

Oman is a key target area for BP. The

British oil giant is relatively new in the

Sultanate, and despite having only been

there for five years, the company has already

built up a promising Omani workforce.

We have already achieved a 70 per cent

ratio of Omanis in our workforce, which

shows that we are committed to investing in

the people of Oman, notes Anand.

This has been achieved through a number

Anand RV, BP Middle East and India Lyle Andrews, BP

FEATURE: Education and Training

25

www.pipelineme.com

Pipeline FEBRUARY/2014

26

www.pipelineme.com

Pipeline FEBRUARY/2014

of initiatives, including starting a graduate

development programme with universities in

Oman under which BP piloted a scholarship

programme to send a couple of Omanis to

the UK every year to study engineering.

Furthermore, BP will be sending some

Omanis overseas to get development

training in other BP locations. They will go

and spend a year working in the US or in the

UK to understand how to operate an oil and

gas facility, and then come back ready to

operate the facility in their own country.

To aid BPs expansion in Oman, the firm

has set up a technicians training centre in

Oman. Over the next five years BP hopes to

train up to 150 local Omani technicians.

The Omani engineers will spend one year

at this facility and then another year working

in the US or in the UK to understand how to

operate an oil and gas facility, before coming

back for some final on the job training,

Anand explains.

Andrews empathises that the only way to

do this successfully is to take a long term

approach and develop the talent.

We are focused on an engagement

strategy now, Andrews points out.

For example, at ADIPEC last November,

BP invited six top students from Omani

universities studying relevant disciplines

and brought them to the show, where

they visited an ADCO facility and attended

technical presentations.

This enabled us to show them how

exciting this industry can be and helped

bring their studies to life, notes Anand.

A

s the global oil & gas industry

continues to modernise

operations around the world,

there is a growing understanding of the

responsibility that companies have to

the communities in which they operate.

Indeed, public and political opinion

and simple good practice necessitate

that companies accept a level of social

responsibility to improve the lives of the

great numbers of people who are directly

affected by the operations they carry out.

At Lukoil, we believe that fulfilling that

responsibility gives us a social license to

operate, without which we would lose

credibility and trust.

Underlying this growing understanding is

an ever-growing challenge: finding qualified,

trained employees to work at development

projects. Fortunately, this challenge gives

Lukoil a clear opportunity to fulfil our social

contract. By providing cutting-edge training

to residents, we can create a forward-

looking and uniquely skilled workforce that

will support the communities and countries

in which we work for years to come.

This commitment is currently best

exemplified through our involvement in our

active project at West Qurna-2, in Iraq.

Production at West Qurna-2 is slated to begin

in the rst half of 2014, and it is expected to

be one of the highest-producing oilelds in the

Middle East. It will require a highly trained and

committed workforce to ensure its success,

safety and efciency. To meet that need, the

company has established a state-of-the-art

Training Centre at Basrah, Iraq.

The Training Centre, located in the North

Rumaila area in the Basrah Province, was

designed to train local Iraqi personnel

to work at West Qurna-2. The training

programme lasts eighteen months in a

modular-type structure. It includes all

required technical disciplines in theory and

practice to cover work at various facilities of

West Qurna-2 in the areas of production, oil

and gas treatment, electrical and mechanical

equipment operation, and more.

However, the programmes benets are

not limited to building technical, site-specic

expertise. The course aims to develop a

holistic set of abilities; professional training

that may not otherwise be available to

these people that will endure beyond one

particular project. To that end, the programme

includes industrial and occupational safety

courses, environmental protection courses,

labor protection and leadership development

training, and hands-on training.

The Training Centre, which was rst opened

in December 2012, includes nine classrooms,

six laboratories (including three computer labs

and three language laboratories for English

language studies), a library, technical support

ofce, training workshop, administration

facilities, and instructor premises. The Centre

was also designed with students lives in

mind, and thus goes beyond functional training

purposes; a cafeteria and recreation area are

on site, and a fully equipped medical station is

available to provide necessary services.

The Centre is large enough for up to 350

students, and over 500 students have already

participated. The rst group of 170 students

completed their training in the summer of

2013; a second group of 150 students will

graduate this summer, and another 200

students will start the course in March-April

2014. All are residents of the Basra province,

again showcasing Lukoils commitment to

training and employing local talent.

Approximately 80 Operators from the first

group of 170 also went on for an additional

three-month hands-on training programme in

Singapore on real live processing facilities,

where they fine-tuned their practical skills

in an active plant that was constructed

specifically to train these specialist-operators

of major petroleum chemistry works.

Following the completion of their training

in the Iraqi Training Centre, all specialists are

sent to various infrastructure facilities of the

West Qurna-2 eld, where, under the guidance

of experienced engineering and technical

personnel, they will participate in the project

facilities start-up and further operation.

CREATING A TRAINING CENTRE IN IRAQ

By Vladimir Spiridonov, head of professional development department of the

West Qurna-2 Project operated by Lukoil

FEATURE: Education and Training

27

www.pipelineme.com

Pipeline FEBRUARY/2014

Pipeline FEBRUARY/2014 28

www.pipelineme.com

FEATURE: Drilling

In the oil and gas industry, drilling programmes are often subject to change

at very short notice which can present challenges to both field operators

and their service companies. Claxton has provided an innovative solution for

drilling schedule change at the West Bukha Field, Oman

INNOVATIVE SOLUTION FOR DRILLING

C

laxton feels it has devised an

innovative solution to the issue of

drilling-schedule changes that helped

a client in Oman to keep its programme on

track without compromising the preferred

well design.

DNO International ASA was drilling

offshore Oman when a short-notice change

in the drilling programme brought forward

the start of work on the West Bukha 4

well. The design for this well called for

the installation of four centralisers on the

conductor to provide structural integrity,

but only two were available at the time

of drilling. However, the schedule change

meant there was no time to order the

necessary additional platform centralisers

from Claxton before drilling began.

DNO could have opted not to install the

additional centralisers, but this was undesirable

owing to the fatigue damage that can result

from the movement of the conductor and

the damage to the platform guides that the

conductor repeatedly hitting them could cause.

Nick Dale, Claxtons business development

manager, Far East, explains: Usually, we

expect to install the platform centralisers at

the same time as the conductor system, but,

in this case we were unable to install a full

set, so we had to nd an alternative solution.

We suggested retrotting the additional

centralisers during drilling, as this would

enable the rig to move onto the well and start

operations while we designed and fabricated

the items in parallel.

Analysis of the well by Claxtons Acteon

sister company 2H Offshore had shown that

the conductor would require these additional

centralisers: one located approximately 10

metres subsea and the other in the splash zone.

Dale says, When faced with this kind of

problem, some operators develop their own

Pipeline FEBRUARY/2014 29

www.pipelineme.com

FEATURE: Enhanced Oil Recovery

F|cI 4M-25, Hcmriyc Free Zcne,

Fhc:e ||, FC 8cx 42l8l Shcrjch, U/E

I +9?l 6 526 9l66 F +9?l 6 526 9l6?

M-0l, Lu|u 8inI 8ui|cing,

FC 8cx l053l0 /Lu DhcLi, U/E

I + 9?l 2 645 0006 F + 9?l 2 645 8383

Emci|. infc@Ircn:c:icpipe|ine:.ccm Emci|. infc@Ircn:c:icpipe|ine:.ccm

F|pe||ne Fre-Comm|ss|on|ng Serv|ces

Equ|pment kento|s

Frocess Serv|ces

Chem|co| C|eon|ng Serv|ces

Decomm|ss|on|ng Serv|ces

Vo|ves Serv|c|ng S Iest|ng Serv|ces

bmb|||co| Iest|ng Serv|ces

N|trogen Serv|ces

in-house solutions. Unfortunately, these

may be simplistic or poorly engineered, and

can often corrode or fail quickly and thus

eventually require removal and replacement.

DNO decided to use our retrot solution

because it would deliver a well-engineered

design that could be installed off the critical

path to save both offshore rig time and costly

replacement in the longer term.

A comprehensive solution

Claxton in Dubai provided a complete packaged

solution, including platform and rig surveys;

design, analysis and fabrication of subsea and

surface retrot centralisers; and a full installation

package. Claxton also engaged and managed the

activities of third-party abseiling and diving teams

to assist with installation.

Mid-way through the drilling programme,