Beruflich Dokumente

Kultur Dokumente

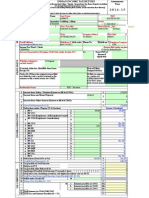

Property Tax Calculation and Payment Form for East Delhi

Hochgeladen von

imachieverOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Property Tax Calculation and Payment Form for East Delhi

Hochgeladen von

imachieverCopyright:

Verfügbare Formate

M.P. (C.L.)Job 15681,00,00023-3-2013www.mcdonline.gov.

in

yh uxj f fnY

i w oh Z

EAST DELHI MUNICIPAL CORPORATION

Penal Provisions in DMC (Amendment) Act, 2003 exist for Wrong Calculation and Concealment of Facts

Zone ______________________ Ward No. ___________________ Colony Name _______________ Receipt No. _________________ Date of Receipt ______________

www.mcdpropertytax.in

e ux

SELF ASSESSMENT PROPERTY TAX FORM F.Y. 2013-14

1. 2.

Ledger Folio No. Registration No./UPIC

Please enter the Ledger Folio No. of the Property being Assessed, if available (write N/A if not available)

Unique identification Code/Property ID No. {Mandatory for all existing registered online users. Please fill your Registration No. starting with (0708)}

3.

Type of Property* If Type of Property is ResidentialPlotted, then please tick one option

Please refer to Annexure-A. Choose only one option. Kothi/Vacant Plot Builder Floor

Please Tick in the box if the property is a Janta Flat (Applicable only for Residential DDA. Refer to Annexure-B for details on categorisation) 4. 5. Type of Owner* Property Owners/Details* Please refer to Annexure-C. Choose only one option. Name of Property Owner/s (If more than 2 owners for the same property then please attach Annexure for the same) Gender M/F Type of Rebate (If applicable) 1. Senior Citizen (60 yrs. or more) 2. Owned by Women/Woman to the extent of her own share 3. Physically Challenged 4. Ex-servicemen Age (as on 30th June of Current Financial Year)

Name (First Name, Middle Name, Surname)/Name of Company/ Organisation etc.*

6.

Property Identification Details* Property/House Number* Address* Colony Name* (Refer to the Help/Tax Guide) Category* Zone Name*

Enter the property detail/address for which the tax is being paid. If your Colony Name is not in the Help/Tax Guide, then please enter the Highest Neighbouring Colony and its Category. Enter the Name of your Colony in Address column.

Colony Serial No.*

Pin Code

7.

Correspondence Address Property/House Number Address Pin Code Phone No. Email *-This is a mandatory section/field which has to be filled and cannot be left blank Mobile No.

8. 8A. 8B. 8C.

Plot/Land/Kothi/Bungalow/Farm House details Area of Plot/Land* (in Sq. metres) 1 Sq. yard = 0.8361 Sq. metre, 1 Sq. foot = 0.0929 Sq. metre Built-Up/Constructed area on the Ground Floor* (in Sq. metres) Percentage Area Built-Up/Constructed* (8B divided by 8A) x 100

Note : If 8C is 25% or more and the balance area of the plot is not being used for any profitable/commercial activity, then go to Point 9 otherwise continue to 8D 8D. 8E. Unit Area Value* (Refer to Annexure-D) Vacant Land Use Factor* (Refer to Annexure-H) (i) (ii) 8F. Occupancy Factor* (Refer to Annexure-I) (i) (ii) 8G. 8H. 8I. 8J. 9. Annual Value* (8A 8B) x 8D x 8E (ii) x 8F (ii) x 0.3 Rate of Tax %* (Refer to Annexure-E) Exemption Category, if applicable (Refer to Annexure-L) Vacant Land Annual Tax (8G x 8H x 8I) divided by 100 Building Details and Tax Calculation

Unit Covered Age Factor* Area Area* (Refer Value* (in Sq. Annex.-F) Rs./Sq. metres) metres 1 Sq. yard = Year of Age (Refer 0.8361 Sqm. Const. Factor Annex.- 1 Sq.foot = D) 0.0929 Sq. metres

Rs. Factor ID Use Factor Type Factor

Rs.

* Applicable for all type of built up properties. Enter each floor details in separate lines. Attach Annexure if required. * While Calculating if any value is BLANK, then replace with 1 (one).

Structure Factor* (Refer Annex.-G) Use Factor* (Refer Annex.-H) Factor Use Factor ID Occupancy Factor* (Refer Annex.-I) Type Flat Factor Annual Value* Rate of Exemption Annual Tax (Refer (9B x 9C x 9E x 9F x Tax % (9L x 9M x Category Annex.-J) 9H x 9J x 9K) (Refer 9N Divided (If AppliAnnex.- cable) Refer by 100) E) Annex.-L Factor (if not applicable put value as 1)

Floor No.*

9A

9B

9C

9D

9E

9F

9G

9H

9I

9J

9K

9L

9M

9N

9O

(Floor Number : Basement = 1, Ground Floor = 0, First Floor = 1, Second Floor = 2, Third floor = 3 etc. Consider Mezzanine as a floor) 10. 12. Total Annual Value* (Total of 8G and 9L) Rebate Calculation 11. Total Annual Tax (Total of 9O and 8J)

Rebate applicable for Single property upto 200 Sq. metres covered area (on pro-rata basis) owned by Senior Citizen, Woman and Physically Challenged or Ex-servicemen which is Self Occupied for Residential use.

12A.

If CA is less than 200 Sq. metres : Rebate Amount = Annual Tax (Total of 9O) x 0.3 (If Applicable) Rs. If CA is more than 200 Sq. metres : Rebate Amount = Annual Tax (Total of 9O) x 200 x 0.3 / Total Covered Area For taxpayer under One Time Tax payment Applicable rebate If CA is less than 200 Sq. metres : Rebate Amount = Annual Tax (15D) x 0.3 (if Applicable) If CA is more than 200 Sq. metres : Rebate Amount = Annual Tax (15D) x 200 x 0.3 / Total Covered Area Rs. Rs.

12B.

*-This is a mandatory section/field which has to be filled and cannot be left blank

(2)

13. 13A. 14. 14A.

Exemption Details Total Annual Value of Exempted Portion derived from (8G and 9L) Service Charges Rs.

Applicable for : Union Properties (Ref. Section 119 DMC Act.) or Public Charity Properties (refer Annexure-L). Rs.

Service Charge @ 75% of Property Tax (If a Union Property is situated in any approved or unauthorised regularized colonies) Service Charge @ 50% of Property Tax (If a Union Property is situated in any colonies other than above including urbanized villaged, unauthorized colonies, rural villages etc.) Service Charge @ 75% of Property Tax (Public charity properties as per section 115(1) (iv) Total Tax/Service Charge (14A or 14B or 14C + 16K below) (from here Proceed to 18M for payment details) (No Rebate is admissible on Service Charges)

14B.

Rs

14C. 14D.

Rs Rs.

15. 15A. 15B. 15C. 15D. 16.

One time tax payment

Applicable for Properties exempted under One Time Tax Payment Scheme whose use, Structure and ownership have not been changed since 1986 (Refer Section 116 H) Rs. Rs.

Rateable Value Amount on the basis of which the One Time Tax was paid Annual Value for the Purpose of Tax in Unit Area System (10 15A) Rate of Tax % (Refer to Annexure-E) Annual Tax { (15B x 15C) divided by 100} Arrears of Tax/Service Charges and Interest thereon

Rs.

Applicable if you have any arrears or interest to be paid. Interest is chargeable @1% per month or part of the month after the due date of each quarter in which the tax was due. Refer to Help/Tax guide for interest computation INTEREST PENALTY (Levied, if any) Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. TOTAL

YEAR 16A. 16B. 16C. 16D. 16E. 16F. 16G. 16H. 16I. 16 J. 16K. 17. 17A. Before 2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 Grand Total

AMOUNT

Payment Details for 2012-13 Receipt No. 17B. Receipt Date 17C. Amount Paid Rs.

*-This is a mandatory section/field which has to be filled and cannot be left blank

(3)

18. 18A. 18B. 18C. 18D. 18E.

Payment Details for 2013-14

Applicable for all

Total Annual Tax Calculated at 11 or 15D Rebate Amount (if applicable) Calculated at 12A or 12B Tax Amount (18A 18B) Nature of payment *(Please Tick one) Lump sum (Continue to Point 18E) Rs. Quarterly Payment (Continue to Point 18 I)

REBATES (Applicable if paying in Lump sum on or before 30th June, 2013, otherwise no Rebate is admissible) (a) (b) Lump sum Payment Rebate 15% of 18C Additional rebate on Lump sum payment in case of Cooperative Group Housing Societies only 20% of [18C 18E(a)] Additional rebate on Lump sum payment in case of only Municipal Corporations Aided Schools 90% of [18C 18E(a)] Rs. Rs.

(c)

Rs.

Total of Rebates (a + b + c) 18F. 18G. 18H. 18I. 18J. 18K. Interest for 2013-14 (applicable for payments after 30th June of current year) Tax Arrears (If payable) at 16 K Net Tax Payable 18C + 18F + 18G 18E Net Tax Payable if paying Quarterly (18C/4) + (18F + 18G) Net Tax Payable in Words* If paying Quarterly (Please Tick One) Mode of Payment* (Please Tick One) Rs. 1st Quarter ending 30 June, 2013 Cash 2nd Quarter ending 30 Sept., 2013 Cheque 3rd Quarter ending 31 Dec., 2013 Demend Draft

Rs. Rs. Rs. Rs. Rs.

4th Quarter ending 31 Mar., 2014

18L.

18M.

Cheque/DD Details (Applicable if you have chosen Cheque or DD in option 18L) Please make crossed Cheque/DD in favour of 'Commissioner, East Delhi Municipal Corporation'. Also write Owner Name, Phone Number and Property Address on back of Cheque/DD. (i) Number (ii) Date (v) Account Number (iii) Bank Name

Cheque/DD (iv) Branch Name

*DECLARATION & VERIFICATION : Certified that_______________________sq. mtr. area as per the Annual Property Tax Return has been carried out as Addition/Alteration/ Renovation in the year____________ . I certify that the particulars filled in this form are true and correct to the best of my knowledge and I am authorized to sign this form. I am aware of the penal provisions of the Delhi Municipal Corporation Act, 1957 (As amended) which are attracted on wilful suppression and submission of false and incorrect particulars. Name : __________________________________________________________________________________Date : _____________________ Signature : _____________________ *-This is a mandatory section/field which has to be filled and cannot be left blank

(4)

ANNEXURES A. Type of Property

Industrial Educational Institutions Recreational and Sports Purposes Agricultural Hazardous Buildings District Centre, Metropolitan City Centres & NonHierarchical Commercial Centres Malls Other Non-residential/Other Commercial Purposes Non-Govt. Hospitals (other than those run by GOI, GNCTD, Municipal Corporation)

Residential-Plotted

Residential Co-Op. Group Housing Society (CGHS)

Medical Institutions

ResidentialDDA Flats

Religious Institutions

Farm House

Public Charity (Section 115(1)(iv) All Shops/Offices and other non-residential units, Showrooms having Covered Area of 100 sq. mtrs. & above (including Warehouses from where goods are sold) Telecom Towers

Guest Houses/Lodges/ Inns/Paying Guest (PG) Houses

Baratghars, Auditorium, Exhibition Halls, Banquet Halls, Assembly Halls

Hotels, Motels and Restaurants having Bar facilities

Coaching Centres, Coaching more than 50 students

Hoardings/ Advertisements/Towers

Clubs

Restaurants without Bar facilities

PVRs, Multiplexes, Cinema Halls

Petrol Pumps/CNG Stations

Non-Govt. Schools (other Beauty Saloons/Parlour, than those run by GOI, Spa, gyms, Health GNCTD, Municipal Clubs, Yoga Centres Corporations

Govt. Company, Department/PSUs/ Autonomous Body, Public Authorities etc. of the Sector Undertaking (PSUs) State Governments Statutory Corporation/Body

Airports and Airports Properties

Union Properties (Section 119 of DMC Act)

B.

JANTA FLATS : Janta Flat will be applicable only for Type of Property = Residential DDA and Residential Group Housing. If the property is a Janta Flat then the following Categories will be applicable (as mentioned below) depending on the zone in which the Janta Flat is located. Zone in which Janta Flat is Located South and Central Zone West and Najafgarh Civil Lines, Shahdara (South), Shahdara (North), Narela and Rohini Category E F G Unit Area Value (Rs.) 270 230 200

C.

Type of Owner Partnership Firm Union (GOI/UT) excluding any entity having its own corporate personality State Govt. excluding any entity having its own corporate personality Govt. Companies/ Corporation/Statutory Body/ Autonomous Body/Entities having its own corporate personality Company Public Ltd. Others

Single Owner

Joint Owner Trust D.

Proprietorship Firm NGO

Government Entity PSUs

Company-Private LTD. HUF-Hindu Undivided Family

UNIT AREA VALUES Refer to the Help/Tax Guide to find out the Category of your Colony Category A 630 B 500 C 400 D 320 E 270 F 230 G 200 H 100

Unit Area Values : (in Rs. per Sq. metre)

(5)

E.

RATES OF TAX Refer to the Help/Tax Guide to find out the Category of your Colony Category 1. 2. 3. Residential Rate of Tax (%) Special Non-Residential i.e. (as Listed below the table) Special Non-Residential (other than those at (2) above i.e. Guest Houses, Inns, Lodges, Paying-guest (PG) Houses, Restaurants (other than those with bar facilities) Non-Residential Properties {other than those not included in (2) & (3) above} Govt. Company Autonomous Bodies, Public Sector Undertakings (PSUs), Statutory Corporation Properties etc., including Departments/PSUs/Authorities, etc. of the State Governments : (i) Residential (ii) Non-Residential 6. (i) (ii) Airports and Airports Properties : Land Covered with Built-up Area Open Area for Aircraft Movement (Runway, Taxiway, Apron, Aircraft Parking Stands) Open Area other than (ii) above 20 15 20 15 20 15 20 15 20 15 20 15 20 15 20 15 15 20 15 20 15 20 15 20 15 20 15 20 15 20 15 20 A 12 20 15 B 12 20 15 C 11 20 15 D 11 20 15 E 11 20 15 F 7 20 15 G 7 20 15 H 7 20 15

4. 5.

15

15

12

12

12

10

10

10

(iii)

7.

Farm Houses : (i) Residential (ii) Non-Residential 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

Special Non-Residential :Hotels, Motels, Restaurants (with bar facilities), all establishments Commercial Areas like District Centre, Metropolitan City Centres and Non-heirarchical Commercial Centres (as per Master Plan-2021) including commercial establishments popularly known as Malls, all Shops/Offices and other non-residential units, Showrooms having Covered Area of 100 sq. mtrs. and above (including Warehouses from where goods are sold). Hazardous Buildings, PVRs, Multiplexes, Cinema Halls, Non-Government Hospitals (other than those run by GOI, GNCTD, Municipal Corporations) Non-Government Schools (other than those run by GOI, GNCTD, Municipal Corporations), Clubs/Baratghars/Auditoriums/Exhibition Halls, Banquet Halls, Beauty Saloons/Parlours, Spa, Gyms, Health Clubs, Yoga Centres, Hoardings/Advertisements, all Towers, Coaching Centres coaching more than 50 students, Petrol Pumps, CNG Stations. F. AGE FACTOR Period of Construction Completion periodPre 31-03-1960 1-4-1960 to 31-3-1970 1-4-1970 to 31-3-1980 Structure Factor Factor 1 0.7 0.5 Description Buildings with load bearing roof Buildings with normal load bearing roof like tukri Buildings with temporary material for walls & roofs including Tin Sheds/Asbestos Sheet. Age Factor 0.5 0.6 0.7 S. No. 4. 5. 6. Period of Construction 1-4-1980 to 31-3-1990 1-4-1990 to 31-3-2000 1-4-2000 onwards Age Factor 0.8 0.9 1.0

S. No. 1. 2. 3. G.

Structure Type Pucca Semi Pucca Kutcha

(6)

H.

USE FACTOR Refer to the Help/Tax Guide for the Definition of the Use Factors

Use of Property Residential BusinessSelf Occupied/Tenanted IndustrialSelf Occupied/Tenanted Govt./Govt. aided Schools/Colleges Hotels3 Stars and above Towers Hoardings Public Purpose Public Utility Religious Institution Telecommunication Tower BusinessVacant (Periodical intimation after 3 months to be given) IndustrialVacant (Periodical intimation after 3 months to be given) Hazardous Buildings Workshops and Auto Repair Garages Restaurants Hotelsupto 2 stars/Motels Lodges/Inns Guest Houses/Paying Guest Houses Banquet Halls Recreation PurposeTheatres, Movie Halls, Assembly Halls, City Halls, Baratghars, Museums, Exhibition Halls, Auditorium, Swimming Pool etc. Sports PurposeGymnasium, Dance Halls, Club Rooms, Health and Sports Club, Bowling Alleys, Stadium, Recreation Piers etc. Use Factor Factor ID 1 4 3 1 10 10 10 1 2 1 2 2 32 2 33 4 3 4 4 4 4 4 3 35 36 37 38 39 40 34 28 29 30 31 22 23 24 25 26 27 Use of Property MercantileShops, Warehouses, STD Booths, Wholesale Traders, Transporters, Cold Storage etc. CollegesGovt. Collegesgetting UGC grants CollegesTrust Educational InstitutesFees upto Rs. 600 per month Educational InstitutesFees Rs. 601 to Rs. 1200 per month Educational InstitutesFees above Rs. 1200 per month Educational InstitutesGovt. University Medical Institutions run by Govt./Local Body/ESI/ Govt. Deptt. Medical Institutions run by Charitable Bodies/Trust/ Societies & not for Profit and Pvt. Clinics, Pathological/ Radiology/Diagnostic Labs, Corporation Institution Medical Educational Institutions run by (Govt./ Local Body/created by Act of Parliament or State Legislature or those charging fee equivalent to that of Govt. Medical Institutions e.g. AIIMS) Medical Educational Institutions (not covered in 33 above but approved by MCI/AICTE/AICVE and not charging Capitation Fee) Medical Educational Institutions (not covered by 33 & 34 above) SchoolsFees upto Rs. 600 per month SchoolsFees Rs. 601Rs. 1200 per month SchoolsFees above Rs. 1200 per month Vacant Landin use Vacant LandNo Use Use Factor 4 1 1 2 1 2 3 1 1 1 2

Factor ID 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

3 1 2 3 Relevant Use Factor 1

I.

OCCUPANCY FACTOR (S-Self Occupied, RRented)

Category Type S R S R S R Factor 1 2 1 1 1 2 Category Govt.Residential Self Occupied Govt.Residential Rented Govt.Non-Residential Self Occupied Govt.Non-Residential Rented FarmhouseNon Residential Self Occupied FarmhouseNon-Residential Tenanted Type S R S R S R Factor 1 1 1 1 1 1

ResidentialSelf Occupied ResidentialRented Non-ResidentialSelf Occupied Non-ResidentialRented FarmhouseResidential Self Occupied FarmhouseResidential Tenanted

J.

FLAT FACTOR

Applicable only for DDA/CGHS Flats and where total covered area is upto 100 sq. metres (on pro-rata basis). Area Upto 100 sq. metres Factor 0.9

(7)

K.

FARM HOUSE

Farm Houses which fall in the mentioned zones will have the Unit Area Value derived from the Category mentioned against it. Farm Houses are broken into 2 components i.e. Vacant land and the Built-up Area. Both have a different Categorization. Zone in which Farm Houses is Located South and Central Zone West and Najafgarh Civil Lines, Shahdara (South), Shahdara (North), Narela and Rohini Category for Built-up Area C D E Category for Vacant Land F G H

L.

S. No. 1. 2.

EXEMPTED PROPERTIES

Description AgriculturalSec. 115 (1)(i) Vacant land or building in village abadi occupied for residential purpose by any original owner or legal heir upto 200 Sq. mtrs. of covered space (on pro-rata basis) Exclusively used for public worshipSec. 115 (1)(iii) Used for Public CharitySec. 115 (1)(iv) Factor 0 0 S. No. 5. 6. 7. 0 8. 1 Description Land and Building exclusively used for burial/ cremation groundSec. 115 (1)(v) Heritage lands and buildingsSec. 115 (1)(vi) Owned by war widow/Gallantry Award winner being permanently used for self-residence and no portion is let out for any purpose whatsoeverSec. 115 (1)(vii) Land and building of Corporation as per section Sec. 115 (1)(viii) Factor 0 0 0

3. 4.

Section 115(1) : (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) vacant lands and buildings (other than dwelling houses) exclusively used for agricultural purposes in accordance with the guidelines prescribed in the bye-laws; vacant lands or buildings or portions thereof, exclusively used for the purpose of public worship; vacant land or buildings or portions thereof, exclusively occupied and used, with the approval of the Corporation, for the purpose of public charity as may be specified in the bye-laws or for the purpose of medical relief to, or education of the poor, free of charge; vacant land or buildings or portions thereof, exclusively occupied and used, with the approval of the Corporation, for the purpose of public charity as may be specified in the bye-laws or for the purpose of medical relief to, or education of the poor, free of charge; vacant lands or buildings exclusively used for the purpose of public burial or as cremation ground, or any other place used for the disposal of the dead, duly registered under this Act; such heritage lands or buildings as are specifically notified for exemption by the Corporation as also such premises as are so specified by the Archaeological Survey of India; vacant lands and buildings owned exclusively by war widows, gallantry award winners in Defence Forces, Police and Para-military Forces as also civilians who have received bravery awards of; the highest order from the Government including Annual Bravery Awards given by the President. Provided that the exemption shall be subject to the condition that (a) (b) (c) (ix) the premises in question is in self-occupation for residential use and no portion thereof is let out for any purposes, whatsoever; in case the person concerned has more than one property in Delhi, the exemption shall be applicable to only one property which is permanently used for self-residence; the benefit of exemption shall be limited to the life-time of the person concerned, except where the award has been granted posthumously, in which case the exemption will be granted to the widow of the gallantry award winner;

vacant lands and buildings owned by, or vested in, the Corporation but not leased out or rented out, and in respect of which is property tax, if levied, would, under the provisions of this Act, be leviable primarily on the Corporation. For the purpose of clause (iii) of Section 115(1) no portion of any vacant land building where any trade or business is carried on, or which is; used for residential purpose, or in respect of which any rent or income is derived, shall be deemed not to be exclusively used for public worship and such portion of such vacant land or building shall be assessed as a separate unit of assessment.

Explanation :

N.B. : Additional rebate of 2% of the tax payable after all eligible discounts u/s 114B and 123B(3) or other-wise as incentive for the tax payers filing the property tax returns online and making property tax payments online through the payment gateway provided on www.mcdpropertytax.in subject to maximum tax not exceeding Rs. 5,000/-.

(8)

Das könnte Ihnen auch gefallen

- Rudy Haynes - Deep Voice Mastery 2nd EdDokument36 SeitenRudy Haynes - Deep Voice Mastery 2nd EdIram Rana100% (2)

- Principles of Property Rating MR NonsoDokument44 SeitenPrinciples of Property Rating MR NonsoHenry100% (2)

- Individual Income Tax ReturnDokument2 SeitenIndividual Income Tax ReturnMNCOOhioNoch keine Bewertungen

- Frequently Asked Questions: Q. What Are The Common Exit Formalities After Resignation?Dokument12 SeitenFrequently Asked Questions: Q. What Are The Common Exit Formalities After Resignation?anshumaan upadhyay100% (1)

- Lucena Business Permit ApplicationDokument3 SeitenLucena Business Permit ApplicationAoi50% (4)

- 1995 Oldschool and Oldschool V Coll (VO) (1995) - Planning Permission PDFDokument8 Seiten1995 Oldschool and Oldschool V Coll (VO) (1995) - Planning Permission PDFsaul campbellNoch keine Bewertungen

- 11 DOF BLGF Local Revenue Generation and LGU ForecastingDokument20 Seiten11 DOF BLGF Local Revenue Generation and LGU ForecastingDilg Sadakbayan100% (2)

- Property Tax Form 2012-13Dokument6 SeitenProperty Tax Form 2012-13SachinVermaNoch keine Bewertungen

- PTR Form of North Delhi Municipal Corporation For 2014-15Dokument5 SeitenPTR Form of North Delhi Municipal Corporation For 2014-15rasiya49Noch keine Bewertungen

- PTR Form For East Delhi Municipal Corporation 2014-15Dokument6 SeitenPTR Form For East Delhi Municipal Corporation 2014-15rasiya49Noch keine Bewertungen

- File ITR-1 Form for Individuals with Income from Salary and InterestDokument6 SeitenFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvNoch keine Bewertungen

- Filling of Online MCD Property TaxDokument3 SeitenFilling of Online MCD Property TaxVinod KumarNoch keine Bewertungen

- Please Print or Type All AnswersDokument2 SeitenPlease Print or Type All AnswerselktonclerkNoch keine Bewertungen

- Form ITR-1Dokument3 SeitenForm ITR-1Rajeev PuthuparambilNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16Pulkit Gupta100% (1)

- P.P.T On Duties - Responsibilities of DDO For GSTDokument30 SeitenP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNoch keine Bewertungen

- File TDS return online for property saleDokument3 SeitenFile TDS return online for property saleAnand JaiswalNoch keine Bewertungen

- Assessment Year Indian Income Tax Return SahajDokument7 SeitenAssessment Year Indian Income Tax Return SahajallipraNoch keine Bewertungen

- Tax ReturnDokument7 SeitenTax Returnsyedfaisal_sNoch keine Bewertungen

- TDS Rate Financial Year 13-14Dokument10 SeitenTDS Rate Financial Year 13-14Heena AgreNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16api-247505461Noch keine Bewertungen

- ITR Form 1Dokument7 SeitenITR Form 1gj29hereNoch keine Bewertungen

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDokument11 SeitenSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranNoch keine Bewertungen

- Form PDF 338116400010723Dokument9 SeitenForm PDF 338116400010723R c GuptaNoch keine Bewertungen

- Monthly VAT ReturnDokument34 SeitenMonthly VAT ReturnEdris MatovuNoch keine Bewertungen

- INDIVIDUAL INCOME TAX RETURN FORM ITR-1Dokument22 SeitenINDIVIDUAL INCOME TAX RETURN FORM ITR-1rahul srivastavaNoch keine Bewertungen

- 82202BIR Form 1702-MXDokument9 Seiten82202BIR Form 1702-MXRen A EleponioNoch keine Bewertungen

- For BIR Annual Income Tax Return Form 1702-MXDokument9 SeitenFor BIR Annual Income Tax Return Form 1702-MXJp AlvarezNoch keine Bewertungen

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialDokument10 SeitenSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarNoch keine Bewertungen

- Gross Total Income (1+2+3) 4: System CalculatedDokument8 SeitenGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNoch keine Bewertungen

- FORM 16 TAX DEDUCTION CERTIFICATEDokument3 SeitenFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNoch keine Bewertungen

- Local Body Tax in Pune Municipal Corporation (LBT in PMC) - 0Dokument20 SeitenLocal Body Tax in Pune Municipal Corporation (LBT in PMC) - 0nikhilpasariNoch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument10 SeitenITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNoch keine Bewertungen

- Integrated Goods and ServiceDokument33 SeitenIntegrated Goods and ServiceThiru VenkatNoch keine Bewertungen

- Indian Income Tax Return Assessment Year SahajDokument7 SeitenIndian Income Tax Return Assessment Year SahajSubrata BiswasNoch keine Bewertungen

- IT FormDokument8 SeitenIT Formapi-3829020Noch keine Bewertungen

- AY 2005-06 Saral Form 2DDokument2 SeitenAY 2005-06 Saral Form 2DVinod VarmaNoch keine Bewertungen

- SAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESDokument7 SeitenSAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESrajshri58Noch keine Bewertungen

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Dokument6 SeitenGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNoch keine Bewertungen

- RPT APPRAISAL & ASSESSMENT MODULE LOGINDokument44 SeitenRPT APPRAISAL & ASSESSMENT MODULE LOGINBen JNoch keine Bewertungen

- Filing Requirements for PAYE ReturnsDokument164 SeitenFiling Requirements for PAYE Returnsmulabbi brianNoch keine Bewertungen

- (Form) Change of Ownership Tenancy - Utilities Account Transfer FormDokument3 Seiten(Form) Change of Ownership Tenancy - Utilities Account Transfer FormJames YuNoch keine Bewertungen

- Akhtar Tax ReturnDokument7 SeitenAkhtar Tax Returnsyedfaisal_sNoch keine Bewertungen

- GST On Builders Write UpDokument8 SeitenGST On Builders Write UpAnonymous 66g6J7aNoch keine Bewertungen

- Building Notice Application Form for Runnymede Borough CouncilDokument2 SeitenBuilding Notice Application Form for Runnymede Borough CouncilglntaNoch keine Bewertungen

- IT Return 2011 2012Dokument3 SeitenIT Return 2011 2012swapnil6121986Noch keine Bewertungen

- Form PDF 663138420240723Dokument9 SeitenForm PDF 663138420240723Dr Sachin Chitnis M O UPHC AiroliNoch keine Bewertungen

- Bill Pay Request Form (New)Dokument2 SeitenBill Pay Request Form (New)Anirudh VermaNoch keine Bewertungen

- Form No 16Dokument5 SeitenForm No 16Rabiul KhanNoch keine Bewertungen

- Introduction To TDS:-: Tax Deducted at SourceDokument3 SeitenIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14Noch keine Bewertungen

- Tenant Rent Record TemplateDokument8 SeitenTenant Rent Record TemplateWanjiNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Rental-Property Profits: A Financial Tool Kit for LandlordsVon EverandRental-Property Profits: A Financial Tool Kit for LandlordsNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransVon EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNoch keine Bewertungen

- Modernizing Local Government Taxation in IndonesiaVon EverandModernizing Local Government Taxation in IndonesiaNoch keine Bewertungen

- How To Buy A House For 1 Euro in Italy?: Practical bookVon EverandHow To Buy A House For 1 Euro in Italy?: Practical bookNoch keine Bewertungen

- Mapping Property Tax Reform in Southeast AsiaVon EverandMapping Property Tax Reform in Southeast AsiaNoch keine Bewertungen

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionVon EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNoch keine Bewertungen

- Court Hearing on Recovery SuitDokument23 SeitenCourt Hearing on Recovery SuitimachieverNoch keine Bewertungen

- Mark Information: Attorney of Record - None Correspondent - Not Found Domestic Representative - Not FoundDokument1 SeiteMark Information: Attorney of Record - None Correspondent - Not Found Domestic Representative - Not FoundimachieverNoch keine Bewertungen

- Appeal - Written Submissions Ver 2.0Dokument10 SeitenAppeal - Written Submissions Ver 2.0imachieverNoch keine Bewertungen

- Mark Information: Attorney of Record - None Correspondent - Not Found Domestic Representative - Not FoundDokument1 SeiteMark Information: Attorney of Record - None Correspondent - Not Found Domestic Representative - Not FoundimachieverNoch keine Bewertungen

- Additional Representation for Impresario Entertainment TrademarkDokument1 SeiteAdditional Representation for Impresario Entertainment TrademarkimachieverNoch keine Bewertungen

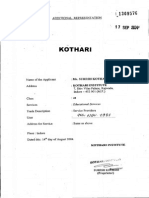

- Kothari: Quv 'TG &1Dokument1 SeiteKothari: Quv 'TG &1imachieverNoch keine Bewertungen

- Registration of "VertigoDokument1 SeiteRegistration of "VertigoimachieverNoch keine Bewertungen

- M M.RR ,: VertigoDokument1 SeiteM M.RR ,: VertigoimachieverNoch keine Bewertungen

- Lisepz004: Suresh Kothari Kothari Institute 7Dokument1 SeiteLisepz004: Suresh Kothari Kothari Institute 7imachieverNoch keine Bewertungen

- Additional Representation for Impresario Entertainment TrademarkDokument1 SeiteAdditional Representation for Impresario Entertainment TrademarkimachieverNoch keine Bewertungen

- Ejm F.NRL:R: Government of IndiaDokument1 SeiteEjm F.NRL:R: Government of IndiaimachieverNoch keine Bewertungen

- .J.Rrjjj:Y..E..R (J..: - :It/,It/': G, R' " FDokument2 Seiten.J.Rrjjj:Y..E..R (J..: - :It/,It/': G, R' " FimachieverNoch keine Bewertungen

- 1098 FormDIN1 HelpLWBVJWBVJSKBVSDJ, VBS, DVBBBBBBBBBBBBDokument8 Seiten1098 FormDIN1 HelpLWBVJWBVJSKBVSDJ, VBS, DVBBBBBBBBBBBBshankar_shrivastav018Noch keine Bewertungen

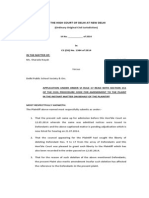

- In The High Court of Delhi at New DelhiDokument1 SeiteIn The High Court of Delhi at New DelhiimachieverNoch keine Bewertungen

- Letter To LiquidatorDokument1 SeiteLetter To LiquidatorimachieverNoch keine Bewertungen

- Trademark Renewal & Address ChangeDokument4 SeitenTrademark Renewal & Address ChangeimachieverNoch keine Bewertungen

- 1098 FormDokument2 Seiten1098 FormMahesh KannanNoch keine Bewertungen

- Trademark Renewal & Address ChangeDokument4 SeitenTrademark Renewal & Address ChangeimachieverNoch keine Bewertungen

- Ipindiaservices - Gov.in Eregister DocShowDokument1 SeiteIpindiaservices - Gov.in Eregister DocShowimachieverNoch keine Bewertungen

- Sharada Nayak - ApplicationDokument4 SeitenSharada Nayak - ApplicationimachieverNoch keine Bewertungen

- Fera SuggestionsDokument2 SeitenFera SuggestionsimachieverNoch keine Bewertungen

- A Sinking Feeling in Your StomachDokument2 SeitenA Sinking Feeling in Your StomachimachieverNoch keine Bewertungen

- Power O F Attorney: I/We From-SocietaagricolacooperativaDokument1 SeitePower O F Attorney: I/We From-SocietaagricolacooperativaimachieverNoch keine Bewertungen

- ShowdocDokument3 SeitenShowdocimachieverNoch keine Bewertungen

- Stephen Covey - First Things FirstDokument64 SeitenStephen Covey - First Things FirstnguynphuthanhNoch keine Bewertungen

- 5 Ftts 1W: Trade & Merchandise Marks Act. 1958Dokument1 Seite5 Ftts 1W: Trade & Merchandise Marks Act. 1958imachieverNoch keine Bewertungen

- PDFDokument2 SeitenPDFimachieverNoch keine Bewertungen

- Tree 30Dokument4 SeitenTree 30imachieverNoch keine Bewertungen

- Uganda Local Government (Rating) Act 2005Dokument21 SeitenUganda Local Government (Rating) Act 2005African Centre for Media Excellence100% (4)

- HC Judgment Consolidates Petitions Challenging Electricity SurchargesDokument106 SeitenHC Judgment Consolidates Petitions Challenging Electricity SurchargesTalha MushtaqNoch keine Bewertungen

- Chapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Dokument75 SeitenChapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Anonymous lfw4mfCmNoch keine Bewertungen

- Housing Affordability Measure ExplainedDokument64 SeitenHousing Affordability Measure Explainedharsha13486Noch keine Bewertungen

- Zimbabwe Rural District Councils Act (Chapter 29:13)Dokument84 SeitenZimbabwe Rural District Councils Act (Chapter 29:13)Brian NyatsandeNoch keine Bewertungen

- Techniques Used for Rating Valuation of Commercial Properties in MinnaDokument82 SeitenTechniques Used for Rating Valuation of Commercial Properties in Minnajado4real007Noch keine Bewertungen

- Local Government Administration AssignmentDokument34 SeitenLocal Government Administration Assignmentgreeny83100% (1)

- Property Tax Calculations For BangaloreDokument7 SeitenProperty Tax Calculations For BangaloreNaveen KumarNoch keine Bewertungen

- Local Treasury Operations Manual: Book TwoDokument58 SeitenLocal Treasury Operations Manual: Book TwoAngelynne N. NieveraNoch keine Bewertungen

- Himachal Pradesh Municipal ActDokument247 SeitenHimachal Pradesh Municipal Actbalwant_negi7520Noch keine Bewertungen

- Guidelines For Property Value Assesment ShillongDokument8 SeitenGuidelines For Property Value Assesment ShillongAditya GuptaNoch keine Bewertungen

- Indemnity Bond SpecimenDokument3 SeitenIndemnity Bond SpecimenRahul Kumar100% (1)

- A Vida No Campo A Baixo CustoDokument270 SeitenA Vida No Campo A Baixo CustoAlex CardosoNoch keine Bewertungen

- BMC ActDokument551 SeitenBMC ActRatnesh DubeNoch keine Bewertungen

- Fundamental Principles Governing Real Property TaxationDokument5 SeitenFundamental Principles Governing Real Property TaxationgraceNoch keine Bewertungen

- Budget Related Policies and Rates Schedules for 2011/2012Dokument171 SeitenBudget Related Policies and Rates Schedules for 2011/2012r_mukuyuNoch keine Bewertungen

- Erkurheleni Electricity TariffDokument280 SeitenErkurheleni Electricity TariffclintlakeyNoch keine Bewertungen

- Municipal Councils Nagar Panchayats and Industrial Townships Act, 1965 (40 of 1965) PDFDokument267 SeitenMunicipal Councils Nagar Panchayats and Industrial Townships Act, 1965 (40 of 1965) PDFBodhiratan BartheNoch keine Bewertungen

- Valuation of Real PDokument5 SeitenValuation of Real PKowsalyaNoch keine Bewertungen

- Real Property TaxDokument6 SeitenReal Property TaxLiliNoch keine Bewertungen

- 2017-10 - Council Minutes October 2017Dokument58 Seiten2017-10 - Council Minutes October 2017The ExaminerNoch keine Bewertungen

- Mangoola Coal Operations Pty LTD V Muswellbrook Shire Council (2020) NSWLEC 66Dokument145 SeitenMangoola Coal Operations Pty LTD V Muswellbrook Shire Council (2020) NSWLEC 66Ian KirkwoodNoch keine Bewertungen

- 2020 Approved BudgetDokument843 Seiten2020 Approved BudgetAnonymous Pb39klJNoch keine Bewertungen

- House PropertyDokument2 SeitenHouse PropertyJimmy ShergillNoch keine Bewertungen

- Apportionment Methods for Service ChargesDokument8 SeitenApportionment Methods for Service ChargesatubNoch keine Bewertungen

- More About Percentages: Let 'S ReviewDokument23 SeitenMore About Percentages: Let 'S ReviewJason Lam LamNoch keine Bewertungen