Beruflich Dokumente

Kultur Dokumente

Nielsen-The Glass Is Half Full - Annual Grocery Report

Hochgeladen von

Ool4Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nielsen-The Glass Is Half Full - Annual Grocery Report

Hochgeladen von

Ool4Copyright:

Verfügbare Formate

The 75th Annual Report of the Grocery Industry

Glass

half

full

Grocers have weathered recessions before—

and smart operators this time will accentuate

the positive by helping shoppers eat well on a budget.

By Debra Chanil and Jenny McTaggart

24 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

T he “R” word has been top of mind for virtually

every grocer, supplier, and even consumer in the

supermarket supply chain, for many months now.

Rising food prices, the high cost of fuel, and a frag-

ile housing market are just a few of the concerns

feeding their anxiety. But while an economic recession in 2008 is proba-

bly unavoidable, there are plenty of positive actions creative grocers can

take to make the most of the situation.

That’s because, obvious as it sounds, it’s hard

pricing and promotion strategies, since

shoppers will be more budget-minded

than ever, and consequently low-price

formats will make for tougher competi-

tion, analysts say.

At the same time, grocers should be

careful not to lose sight of long-term

investments, even if their sales suffer tem-

porarily. Newer focuses for business strat-

egy, such as environmental sustainability,

health and wellness, and customer seg-

mentation, continue to offer a lot of

fit the dry grocery and frozen food core of the promise for the future, especially for those that

to get around the fact that, as in any recession, store, as well as fresh foods. don’t lose sight of that potential in the scramble to

people still have to eat. Smart retailers can and And all grocers should be rethinking their quell immediate flare-ups related to the recession.

will position themselves as problem solvers, instead Data from PROGRESSIVE

of just another draw on the wallet. G ROCER ’ S 75th Annual

Retail climate

The fundamental problem to solve is, of Report of the Grocery Indus-

course, how can I feed myself and my family with- Compared with a year ago, are you more or less optimistic about the try, our latest exclusive com-

out spending too much? retailing climate for supermarkets? pendium of retail research,

To help, industry experts suggest supermar- Total Chain Ind Whlslr reveals that supermarket

ket operators spruce up their prepared food More optimistic 45.9% 46.2% 45.7% 45.8% operators are certainly aware

programs, since consumers will be eating out of current and impending

Less optimistic 29.0 26.9 30.3 29.2

less but still looking for quick meal solutions. economic troubles—but

They also ought to consider in-store cooking No change 25.1 26.9 24.0 25.0 many of them aren’t expect-

demos to inspire shoppers to make more healthy SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008 ing disastrous impacts, not

meals at home for less—a tactic that can bene- by a long shot. In fact, 46

The bottom line

How do you view 2008 for your company? What kind of year was 2007?

Scale: 0=awful, 100=sensational

Total Chain Ind Whlslr Northeast Midwest South West 1-10 11-99 100+

2008 (forecast) 70.3 73.6 67.8 71.8 69.0 69.4 70.7 73.6 67.9 73.5 73.0

2007 70.9 74.0 68.0 73.9 70.5 70.1 72.0 71.8 68.0 74.6 74.6

2006 66.9 72.6 62.7 72.3 70.2 63.5 68.4 68.2 62.8 69.2 74.9

2005 65.2 66.6 63.6 69.9 65.4 65.5 63.6 66.4 63.0 66.1 72.2

2004 65.2 64.3 63.9 75.4 64.1 62.5 67.3 67.0 n/a 66.7 65.7

2003 61.8 58.0 59.6 68.1 60.1 60.1 61.7 61.8 n/a 58.3 67.0

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

✦ OPTIMISM, a rising commodity among supermarket operators over the past five years, is still relatively high, but has finally leveled off. After hitting a high of 70.9 in

2007, this index of overall company performance dropped back slightly to 70.3 in the forecast for 2008. 2007 was particularly strong for chains compared with inde-

pendents (74.0 vs. 68.0, respectively), and for operators in the South (72.0). However, with the exception of operators in the West, the index forecasting expectations

for 2008 declined for each segment.

www.progressivegrocer.com A H E A D O F W H AT ’ S N E X T Progressive Grocer • April 15, 2008 • 25

Annual Report

percent of executives PG surveyed in February 2008 Food stores, however, react at their own pace Yet it’s the higher-income consumers who are

said they’re more optimistic about the retailing cli- to economic forces. “In economic downturns, where more likely to trade down to a lower-priced store,

mate for supermarkets compared with a year ago. you have forces like high food and gas prices, credit since lower-income shoppers are probably already

One thing is for sure: The market is showing problems, and job cutbacks, supermarkets tend to frequenting a discounter, he reasons. The latter

signs that business is slowing shoppers are more likely to trade

down. On a scale of zero to Average supermarket performance measures down to lower-priced products

100, with 100 being “sensa- within a category. TNS Retail

tional,” retailers forecasted 2005 2006 2007 Forward’s February Shopper-

2008 would be at 70.3. While Sales volume ($ millions) $14.06 $14.68 $15.31 Scape survey found that rising

70.3 doesn’t sound so bad, it’s food prices are driving about half

Selling area (square feet) 32,396 33,398 33,300

slightly down from what they of shoppers to try to avoid buy-

expected for 2007—and in past No. of checkouts 9.1 9.3 9.3 ing food items that seem “just

Annual Reports, grocers tended No. of full-time equivalent employees 70 70 72 too expensive.”

to be rosier still about the year “The moral of the story is

to come. that supermarkets are going to

Average weekly sales want to market to lower-income

Sizing up the economy households differently than

Depending on what type of upper-income households,”

$ per store $270,385 $282,368 $294,423

data you look at, and whom you notes Badillo.

consult, you’ll encounter diver- $ per square feet 8.35 8.45 8.84 Past recessions provide

gent views on how supermarkets $ per checkout 30,043 30,362 31,658 strong indications of what’s to

will fare for the balance of this come, offers Ted Taft, manag-

$ per full-time equiv. employee 3,863 4,034 4,089

year if the economy takes a turn ing director of Meridian Con-

for the worse. $ per full-time equiv. employee hour 96.57 100.85 102.22 sulting Group, based in Wilton,

Many industry players and $ per household 84.60 89.26 91.98 Conn. “Eating at home is

watchers point to two recessions $ per capita 30.86 31.81 31.87 always something that picks up,

of the recent past—in 2001 and SOURCE: TDLINX; PROGRESSIVE GROCER MARKET RESEARCH, 2008

and that helps departments like

1990-91—for clues as to how prepared foods in grocery

this might all play out in the chains,” he says. “In fact, you

months ahead. hit the bottom, [but] with a lag,” says Badillo. could argue that supermarkets are much better

Frank Badillo, senior economist at TNS “When you factor in rising food prices, we expect prepared than the last time, because most of their

Retail Forward, based in Columbus, Ohio, that supermarkets should see negative inflation- prepared food programs are much more devel-

notes the current path of retail sales suggests adjusted sales growth in the second quarter, if not oped than 10 years ago.”

that if the economy is sliding into recession, the second half of the year.” Retailers surveyed by PG certainly seem poised

most retail channels appear to be faring more Badillo says consumer behavior is responsible to improve their meal solutions still further. In the

like they did in the 2001 recession than the for the lag in business impacts typically experienced Annual Report Marketing/Merchandising Strategies

1990-91 period. That means most retail chan- by supermarkets. “When it comes to grocery shop- Index, ready-to-eat meals moved to the No. 7 slot

nels can be expected to experience weak but ping, consumers tend not to change their habits as a priority, up from No. 9 last year.

positive inflation-adjusted growth—as opposed right away. A lot of this has to do with being famil- One major retailer that’s planning to serve more

to inflation wiping out any growth, as was com- iar with a certain store. People get used to a store’s meals is Minneapolis-based Supervalu. The com-

mon across channels in 1990-91. layout and don’t like to switch stores,” he observes. pany’s c.e.o., Jeff Noddle, told CNBC in an inter-

Consumers downsizing meals • Ground beef: +117 percent • Tilapia (+188 percent) vs. salmon (+105 per-

• Pasta: +83 percent cent): Tilapia has increased 83 percent when

THE ECONOMIC DOWNTURN is already causing • Quick and easy: +88 percent compared with salmon.

Americans to cut back on spending, according to data ✦ Page views in collections that house “make-at- ✦ Searches for inexpensive cuts of meat have

from Allrecipes, an online cooking community with home” versions of popular restaurant dishes such as increased significantly:

more than 35 million unique visitors annually. pizza, Chinese, and Indian-style have increased. • Meat loaf: 86 percent

Here are some of the findings that Allrecipes • Traffic to the pizza, Chinese, and Indian hubs has • Casserole: 30 percent

shared with PROGRESSIVE GROCER for the 75th Annual increased 79 percent over the past three • Pot roast: 24 percent

Report of the Grocery Industry. The data was released months. • Chili: 24 percent

in March: ✦ Searches for low-cost vs. their high-cost counter- Allrecipes has also witnessed increased traffic

✦ Traffic to traditionally low-cost ingredients, such as parts have increased significantly, 74 percent overall. to several of its cost-cutting meal idea pages,

ground beef, pasta, and quick and easy recipes, has • Ground beef (+107 percent) vs. steak (+83 per- including Budgeting Tips, Great Meal Ideas for

increased. These channels have almost doubled cent): Ground beef had a relative increase of 24 Under $10, and Basic Pantry Items that Produce

(increased by 90 percent) over the past three months. percent when compared with steak. 20 Great Meals.

26 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report 2007 supermarket sales

No. of % of Sales % of

stores total ($ millions) total

view last month that “Supervalu, like many retail- Supermarkets ($2 million or more) 34,967 100.00% $535,355 100.00%

ers, [is] delivering more meal solutions in a value-

Chain (11 or more stores) 28,637 81.90% 505,614 94.44%

priced way, so that people can pick up things that

are...ready to go or only need limited preparation, $2,000,0001 - $4,000,000 2,656 7.60 7,798 1.46

and bring them home.” $4,000,001 to $8,000,000 6,742 19.28 36,249 6.77

Indeed, many supermarkets are taking advan- $8,000,001 to $12,000,000 3,684 10.54 35,432 6.62

tage of the fact that the restaurant industry is tak-

ing a harder hit from the slowing economy. Accord- $12,000,001 to $20,000,000 5,224 14.94 77,686 14.51

ing to the NPD Group in Port Washington, N.Y., $20,000,001 to $30,000,000 4,956 14.17 112,721 21.06

foodservice posed no organic growth in 2007, and $30,000,001 to $40,000,000 2,189 6.26 69,764 13.03

total restaurant customer traffic was up barely 1

$40,000,001 to $50,000,000 1,241 3.55 51,089 9.54

percent. That’s due not only to the economy, ana-

lysts say, but also factors such as fewer women in the $50,000,001+ 1,945 5.56 114,875 21.46

work force in recent years.

As supermarkets jump into that breach for new Independent (10 or fewer stores) 6,330 18.10% $29,741 5.55%

opportunities to capture share-of-stomach dollars, $2,000,0001-$4,000,000 2,229 6.37 6,305 1.17

they would do well to make sure their meal solu- $4,000,001 to $8,000,000 3,631 10.38 18,074 3.37

tions address consumers’ topical health concerns.

$8,000,001 to $12,000,000 327 0.94 2,995 0.56

Judging by the findings in the Annual Report’s

Merchandising/Marketing Index, retailers seem to $12,000,001 to $20,000,000 122 0.35 1,749 0.33

be quite aware of that need. Health concerns as a $20,000,001 to $30,000,000 14 0.04 306 0.06

priority shifted up to No. 3 this year, while natural $30,000,001 to $40,000,000 4 0.01 117 0.02

foods and organics moved up to No. 9, compared

$40,000,001 to $50,000,000 2 0.01 86 0.02

with No. 12 last year.

Emphasis on fresh foods is still far and away $50,000,001+ 1 0.00 109 0.02

the priority index leader, with both chains and By supermarket format:

independent retailers testifying to the importance

of perimeter departments. That trend isn’t likely No. of % of Sales % of

to go away any time soon, as the pro-health and eat- stores total ($ millions) total

at-home trends support the need for fresh fruits Supermarkets ($2 million or more) 34,967 100.00% $535,355 100.00%

and vegetables and other wholesome fresh foods.

Conventional 26,832 76.74 357,454 66.77

As the economy continues to make shoppers a

bit more cautious, however, they may trade down Supercenter (grocery & mass merch)* 3,038 8.69 141,708 26.47

in some fresh categories, by choosing lower-priced Supermarket-limited assortment 2,349 6.72 10,978 2.05

cuts of meat or skipping higher-priced baked Supermarket-natural/gourmet foods 2,119 6.06 17,667 3.30

goods, for example.

“People will still eat meat, but they might look Warehouse grocery stores 457 1.31 3,319 0.62

for a cut that’s a little less expensive per pound,” Military commissaries 172 0.49 4,229 0.79

notes Taft. “And that might impact other cate-

gories. We did some work with A1 Steak Sauce Other food formats:

years ago, and we found that consumers were using

certain condiments more to make up for the taste No. of % of Sales % of

of the lower-quality cuts of meat.” stores total ($ millions) total

As such, it may be interesting to see how center Convenience** 145,872 n/a $306,621 n/a

store sales will fare. While private label products

Grocery stores (under $2 million) 13,652 n/a 18,206 n/a

and frozen foods might gain, the gourmet cate-

gory could suffer, industry watchers say. Wholesale clubs 1,152 n/a 101,511 n/a

In TNS Retail Forward’s February Shopper- Military convenience stores 422 n/a 2,228 n/a

Scape survey, 24 percent of shoppers said they plan

*Supermarket-type items only **Excluding gas SOURCE: TDLINX; PROGRESSIVE GROCER MARKET RESEARCH, 2008

to buy fewer gourmet and specialty products,

because of rising food prices.

✦ TOTAL SALES for the supermarket industry increased by 7.2 percent to reach $535.4 billion in 2007.While this

Reports from the trenches jump exceeds the 4.3 percent gain earned in 2006, some of the new increase was driven by a net gain of 948

units, compared with a net loss of 31 units in 2006. It’s also likely that some of the increase came from retail

While no one can predict exactly how shopper

price increases, as the Bureau of Labor Statistics reported an overall increase in prices for food at home of 4.2

behavior will change in coming months, PG went

percent in 2007, compared with only 1.7 percent in 2006.

to retailers at the beginning of 2008 to find out

28 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

what changes they’d seen in shopping behavior and general merchandise (38.5 percent). Those fig- to change too drastically.

thus far, as a result of economic concerns. Pro- ures might be more reflective of more general trends Nearly 72 percent of supermarket operators

duce, dairy, and meat/seafood were among the in the industry, however, as grocers have lost cate- expect transaction size to increase in 2008. This

departments that had experienced increased traf- gory share over time to mass merchandisers and could be because they anticipate more shoppers

fic, they reported. As a segment, private label drug stores. will be stocking up during the fewer trips they’ll

products were also seeing gains. Looking at 2008, retailers said they expect be taking to cut down on fuel usage.

The overall departments that were hardest hit produce to be the top-shopped segment, fol- Grocers weren’t shy about sharing their per-

were center store (25.7 percent of retailers said traf- lowed by private label products. For the most spective on how current economic conditions are

fic had decreased), HBC/pharmacy (28.6 percent), part, though, they don’t expect traffic patterns affecting shopping behavior. “Customers are look-

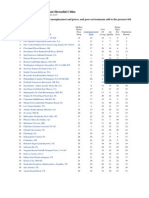

Merchandising/marketing strategies

How important are the following merchandising/marketing strategies to your company?

Score=percent of respondents rating strategy as 1 or 2 on a scale of 1-6, where 1=most important

Pres/ Buyer/ Sales/

top Retail/ mdsr/ adv/ Store

Total Chain Ind Whlslr exec ops cat mgr mktg mgr Northeast Midwest South West

Emphasis on fresh foods 77.8% 84.1% 77.7% 64.0% 77.1% 86.4% 75.0% 83.3% 76.4% 82.5% 82.0% 71.6% 69.8%

Community involvement 68.0 71.7 68.6 58.0 69.5 72.7 68.8 80.0 61.8 72.5 68.0 56.7 74.6

Health concerns 61.2 69.9 53.1 70.0 54.3 56.8 75.0 83.3 47.3 61.3 61.7 61.2 60.3

Private label 60.1 69.9 53.7 60.0 57.1 61.4 65.0 76.7 49.1 52.5 64.1 67.2 54.0

Hotter specials 59.8 61.9 58.3 60.0 57.1 52.3 67.5 60.0 63.6 62.5 63.3 56.7 52.4

Customer services 56.8 56.6 60.0 46.0 61.9 56.8 51.3 46.7 69.1 46.3 62.5 53.7 61.9

Ready-to-eat meals 53.3 62.8 45.1 60.0 49.5 52.3 60.0 66.7 43.6 56.3 54.7 52.2 47.6

Use of category management 52.7 59.3 45.1 64.0 40.0 56.8 70.0 56.7 45.5 55.0 52.3 53.7 49.2

Natural foods/organics 50.3 64.6 40.0 54.0 41.0 54.5 60.0 60.0 38.2 58.8 52.3 37.3 49.2

National brands 47.9 51.3 43.4 56.0 41.0 34.1 53.8 53.3 54.5 50.0 47.7 49.3 44.4

Newspaper inserts 45.0 47.8 46.9 32.0 47.6 31.8 43.8 43.3 61.8 31.3 51.6 43.3 50.8

Ethnic foods 44.7 57.5 36.6 44.0 40.0 38.6 55.0 63.3 34.5 46.3 45.3 37.3 49.2

Mailers/circulars 43.8 44.2 46.3 34.0 41.9 36.4 47.5 60.0 45.5 47.5 46.1 43.3 34.9

Emphasis on new technology 43.5 51.3 36.6 50.0 43.8 45.5 48.8 46.7 27.3 48.8 38.3 52.2 38.1

Demos and sampling 42.6 46.0 39.4 46.0 37.1 34.1 58.8 53.3 36.4 43.8 44.5 34.3 46.0

Newspaper ads (ROP) 37.6 43.4 35.4 32.0 28.6 29.5 50.0 30.0 49.1 35.0 35.9 43.3 38.1

Radio advertising 27.2 39.8 19.4 26.0 22.9 27.3 35.0 30.0 20.0 25.0 22.7 35.8 30.2

Frequent shopper programs 26.9 32.7 21.7 32.0 21.0 29.5 38.8 20.0 18.2 32.5 24.2 22.4 30.2

Affinity merchandising 25.7 26.5 24.6 28.0 21.0 18.2 36.3 30.0 23.6 31.3 20.3 29.9 25.4

Electronic marketing 23.4 28.3 17.1 34.0 21.0 11.4 31.3 40.0 12.7 30.0 24.2 16.4 20.6

TV advertising 23.1 38.1 12.6 26.0 10.5 22.7 35.0 33.3 20.0 18.8 21.1 32.8 22.2

Self-service applications 20.1 30.1 14.3 18.0 15.2 18.2 32.5 16.7 12.7 22.5 21.9 13.4 20.6

Digital media 16.0 15.0 15.4 20.0 15.2 13.6 18.8 26.7 10.9 22.5 14.8 14.9 11.1

In-house mag. for customers 13.3 15.9 12.6 10.0 9.5 4.5 20.0 13.3 18.2 13.8 12.5 6.0 22.2

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

✦ AN EMPHASIS ON fresh foods continues to top the list of merchandising and marketing strategies among grocers, showing particular strength among chains and opera-

tors in the Midwest and South. Overall rankings have shifted a bit over the past year; while community involvement remains in second place, health concerns moved from

fifth to third place, private label jumped from sixth to fourth, and ready-to-eat meals moved from ninth to sixth place. On the decline were customer services (from fourth

to sixth place) and hotter specials (from third to fifth). Health concerns, private label, and natural foods/organics are much more of a priority among chains, while customer

services are the target of greater focus among independents.

30 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

ing for good values, not necessarily low prices,” Change in trips/transaction size

noted one respondent.

In 2007: In 2008 expected to:

“Economic conditions have increased theft,”

Stayed the Stay the

observed another retailer. Increased Decreased same Increase Decrease same

Not surprisingly, grocers’ opinions seemed to

differ based on the consumer demographics their Number of trips 30.7% 40.0% 29.3% 28.4% 40.0% 31.6%

stores serve. Transaction size 70.3 11.5 18.2 71.7 11.3 17.0

“My store is in a very affluent area, and most

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

shoppers aren’t fazed at all [by] price increases, and

are also willing to pay a premium for prepared

✦ SHOPPERS are expected to economize by purchasing more food for home consumption, thus increasing their

foods,” noted one independent executive.

transaction size, even if they trade down to private label and other lower-priced options. They may also cut back

Yet another operator claimed shoppers were “mov-

on the number of trips and travel to fewer stores to save on gas purchases.

ing away from frivolous items—specialty and gour-

met—to more basic products and private label.”

When asked to list the most dramatic shift in • Business is tied closely to the first two weeks • Fewer trips and larger transactions.

shopping behavior in the past six months they’d of the month, when [customers receive their] • Private label sales have grown at a record pace.

seen as a result of economic conditions, retailers assistance checks. • People are cherry-picking more than ever

had varied responses. These included: • Clean, well-lit stores with excellent service before.

• More people want to know how to cook and fair prices always win. • They’re complaining about rising food prices

things. • Coupon redemption has dramatically like they did back in the late ’70s and early

• Basket ring is up and customer count is increased. ’80s.

leveling off. • Declines in prepared foods and bakery.

Time to play it safe?

As grocers keep a closer watch on their shop-

Shopper traffic pers’ habits this year, some might also become more

How were the following departments affected, in terms of shopper traffic, by economic conditions in 2007? cautious about investing in growing their opera-

What do you expect for 2008? tions. “I think we’re already seeing retailers pretty

In 2007, In 2008, quickly adjusting their plans to ratchet back their

shopper traffic: shopper traffic is expected to: store openings,” says Badillo.

Stayed the Stay the Taft, on the other hand, notes that most retail-

Increased Decreased same Increase Decrease same ers “don’t want to cut back unless they absolutely

have to.” Regional players such as Harris Teeter

Produce 70.0% 8.5% 21.5% 77.6% 2.8% 19.6% and Food Lion have store growth in sight for 2008,

Dairy 66.4 9.1 24.5 61.7 5.3 33.0 although Wal-Mart and Tesco are among the com-

Private label 62.9 6.4 30.7 71.3 4.6 24.1 panies that have slightly scaled back their original

plans for expansion.

Meat/seafood 61.0 15.2 23.8 67.0 6.8 26.2

“In pockets of the country where there are a lot

Organic 56.1 12.8 31.1 59.9 9.4 30.7 of foreclosures, you may see more cutting back,”

Frozen food 54.7 14.4 30.9 62.1 7.8 30.1 suggests Taft.

Ethnic 52.3 8.4 39.3 51.4 6.4 42.2 Neil Stern, partner at retail analyst and consult-

ing firm McMillan/Doolittle, in Chicago, observes

Fresh bakery 50.5 17.6 31.9 54.7 9.7 35.6 that while the “quick things” to cut back on during

Center store 43.3 25.7 31.0 49.3 18.1 32.6 tough times are marketing and in-store labor, “You

Gourmet/specialty 42.3 18.9 38.8 46.1 12.4 41.5 can cut back on capital expenditures as well. What

all retailers have to do, though, is to balance short-

HBC/pharmacy 30.1 28.6 41.3 38.2 16.0 45.8

and long-term profitability. The reality is that shop-

GM 23.4 38.5 38.1 30.3 27.0 42.7 pers are still looking for somewhere to shop and

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008 companies are under pressure to deliver numbers.

So you can’t sacrifice all the long-term investments

✦ RETAILERS said the produce department saw the largest increase in shopper traffic in 2007, and is expected to to make the short-term numbers.”

repeat this feat in 2008. Private label is also likely to see a significant jump in 2008, driven by consumers looking According to the Annual Report’s Operational

for lower-priced items. Other departments featuring perishables (meat/seafood, fresh bakery) should also see Trends Forecast, energy/fuel costs is the operational

larger increases as shoppers make more purchases for more economical yet healthy eating at home. One excep- factor that’s expected to increase the most, hardly a

tion is dairy, which may suffer as a reaction to its large price increases in 2007. HBC and general merchandise surprise, since energy expenses have continued to

departments are most likely to see declines in traffic, as other retail channels that offer these items at lower

top retailers’ worry lists as well. The concern appears

prices are more likely to attract shoppers.

to be highest among West Coast respondents. Retail

32 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

Change in promotional activity

prices came in second, followed by labor-related want to keep a To what degree did your promotional activity change in 2007? What do you expect in 2008?

concerns such as benefit costs and wage costs. Cap- closer eye on their Scale: 100=increase, 50=stay the same, 0=decrease

ital expenditures aren’t expected to increase to a c o m p e t i t o r s’

level anywhere near these expenses. strategies. 2007 2008 (expected)

Price inflation is a huge concern for grocers, “Chains whose Expanded private label offerings 77.5 79.3

especially in light of the chain reaction that high reason for being is

More weekly specials 69.3 72.2

prices have at the retail level. more focused on

“There’s a lot of evidence of food inflation occur- low price will Volume discounts (value packs, etc.) 67.2 68.5

ring,” notes Stern, “and national brand manufactur- probably have an BOGO 62.1 66.9

ers have been trying to hold the line and not pass on advantage,” Circulars 61.2 62.6

price increases. But it’s starting to change now. It’s observes Taft.

tough for retailers to pass along these costs to the “Wal-Mart, which Fuel discounts/rewards 60.7 62.8

consumer during tough times. If this happens, has been outper- Loyalty discounts 59.2 64.9

you’ll see a real compression of margins.” formed by Target Increased couponing activity 56.7 65.2

for few years now, SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

Low-price competition is actually show-

The future doesn’t look too bright in this area, ing an uptick.”

✦ MORE than ever, expected increases in promotional activities are focused on attract-

unfortunately. One expert, Lester Brown, presi- At the begin- ing shoppers to the store via price appeal; hence, grocers expect to increase their efforts

dent of the Washington-based Earth Policy Insti- ning of the year, toward private label programs and more weekly specials. Even so, all promotional activi-

tute, predicts that almost a third of the U.S. grain the world’s largest ties are expected to see an increase in 2008.

crop next year may be diverted from the family retailer jumped at

dinner table to the family car as fuel, according to the chance to play

a report from the Reuters Global Agriculture and up its advantages during the slowing economy, by percent to 30 percent savings.

Biofuels Summit, which was held in January. announcing its own “economic stimulus plan for Now several industry reports are suggesting

Competition remains a serious consideration U.S. shoppers.” Wal-Mart rolled back prices on that Wal-Mart, as well as other one-stop-shop,

for grocers, too, and in light of the economy, they’ll thousands of items in a single week, providing 10 low-price formats, could come out on top this

year as penny-pinched shoppers look to con-

solidate trips and get the most out of each tank

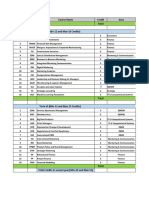

Operational trends forecast of gas.

How do you expect the following operational factors to change at your company in 2008?

A recent study by The Nielsen Company, for

example, finds that U.S. consumers are making

Scale: 100=increase, 50=no change, 0=decrease fewer shopping trips across most retail outlets.

Total Chain Ind Whlslr Northeast Midwest South West However, while shopping frequency across most

Energy/fuel costs 87.9 82.3 92.9 83.0 83.1 86.7 88.1 96.0 retail channels is flat or on the decline, super-

centers continue to show growth in shopping

Retail prices 86.4 77.9 92.3 85.0 83.8 87.1 83.6 91.3

frequency.

Benefit costs 80.8 73.9 84.6 83.0 78.1 82.8 76.1 84.9 “Long-term trends show us that all value retail-

Wage costs 79.4 69.5 88.3 71.0 75.0 81.6 76.9 83.3 ers—supercenters, warehouse clubs, and dollar

Competition 70.9 69.5 71.7 71.0 66.9 66.8 73.9 81.0 stores—are gaining in their quest to grab shop-

pers,” observes Todd Hale, s.v.p. of consumer &

Technology spending 67.6 65.0 70.0 65.0 64.4 67.6 64.9 74.6 shopper insights, Nielsen Consumer Panel Services,

% net profit 63.2 65.9 62.9 58.0 58.8 64.5 61.2 68.3 in Schaumburg, Ill. “Keep in mind, however, that

% gross margin 63.0 64.6 63.4 58.0 56.3 65.2 64.9 65.1 some U.S. grocers reported stronger same-store-

sales growth than supercenters or dollar stores in

Capital expenditures 47.8 40.3 54.6 41.0 49.4 47.7 47.0 63.0

2007. Proximity to shoppers and a healthy focus on

Employee turnover 47.0 37.6 50.9 55.0 40.0 47.7 51.5 63.0 convenience and value helped many of these grocers

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008 deliver solid results.”

Conventional supermarket operators would be

✦ WITH THE PRICE OF OIL topping $100 a barrel for the first time in 2007, it’s no surprise that energy/fuel costs wise to tout the fact that they can offer customers

top the list of expected increases among operational factors. Notice in particular the score from retailers in the great value during tough times, say Stern and others.

West—at 96.0, it’s more than eight points higher than the industry average rating of 87.9. Concern over increas- “Supermarkets need to emphasize or re-emphasize the

ing retail prices ranks second, at 86.4. As the Bureau of Labor Statistics forecasts pricing for food at home to value that’s inherent at shopping food retail,” notes

increase by 3.5 percent to 4.5 percent in 2008, independent operators are especially worried (their score of 92.3

Stern. “By that, I mean they should emphasize the

is 14.4 points higher than the 77.9 registered by their counterparts at chain operations). Further down on this

economy of putting a meal on the table—by buying

list, look for an increase in technology spending, as this trend rose from ninth to sixth place, driven by expected

increases among independents and operators in the West. ingredients at a retailer vs. buying meals at a restau-

rant. It’s more than just discounting; it’s also show-

34 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

ing consumers the value that is there.” At least one regional chain—Quincy, Mass.- despite the economy, we will keep working to

Adds Taft: “Grocers can talk about the positive based Stop & Shop—hyped its value offerings keep prices low and make sure we’re the store

features of the departments they have that are on the early in 2008, via a radio commercial featuring where you want to shop.”

firing line in terms of where the food dollar goes. Andrea Astrachan, v.p. of consumer of affairs at There’s no doubt that pricing and promotions

That includes frozen foods, prepared foods, and Stop & Shop and Giant-Landover. “Last year we will play a huge role in grocers’ strategies this year.

fresh departments like meat.” lowered thousands of prices,” she said, “[and] The Annual Report finds that 79.3 percent of gro-

Competitive threats

How much of a competitive threat is each of the following retail formats?

Score=percent of respondents rating threat as 1 or 2 on a scale of 1-6, where 1=most important

Total Chain Ind Whlslr Northeast Midwest South West

Wal-Mart 63.9% 62.8% 61.7% 74.0% 50.0% 71.9% 67.2% 61.9%

Chain supermarkets (11+ stores) 45.3 54.0 40.6 42.0 43.8 43.0 43.3 54.0

Supercenters (excl. Wal-Mart) 36.4 34.5 35.4 44.0 33.8 42.2 38.8 25.4

Independent supermarkets (1-10 stores) 27.2 26.5 29.7 20.0 31.3 25.0 23.9 30.2

Mass merchandisers (excl. Wal-Mart) 24.9 23.9 21.7 38.0 22.5 25.8 22.4 28.6

Wholesale membership clubs 24.6 28.3 18.3 38.0 20.0 19.5 20.9 44.4

Dollar/discount stores 20.1 14.2 22.3 26.0 20.0 19.5 32.8 7.9

Organic/natural food stores 18.3 22.1 17.1 14.0 18.8 16.4 9.0 31.7

Drug stores 16.3 11.5 17.7 22.0 22.5 14.8 14.9 12.7

Limited-assortment stores 15.4 12.4 13.7 28.0 15.0 14.1 19.4 14.3

Fast-food outlets 12.4 8.0 14.3 16.0 10.0 16.4 9.0 11.1

Smaller/convenience formats (i.e., Tesco) 9.8 14.2 7.4 8.0 13.8 10.2 9.0 4.8

Convenience stores 9.5 5.3 12.6 8.0 13.8 11.7 7.5 1.6

Online retailing 5.9 6.2 5.1 8.0 11.3 3.9 6.0 3.2

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

✦ HO-HUM, Wal-Mart once again tops the list of competitive threats—and with a lead close to 20 percentage points over the next competitor, it’s likely to stay on top for

some time to come.Aside from Wal-Mart, we see that chain operators consider other chains to be their toughest competition, while independents appear more scared

than chains by the predatory pricing of dollar/discount stores. Regionally, organic/natural food stores aren’t seen as much of a threat in the South, while clubs rank third as

a threat among retailers in the West (compared with sixth overall).

Impact of current economic conditions on shopper behavior

Total Chain Ind Whlsl Northeast Midwest South West

Shoppers are more price-conscious

in their product choices 62.7% 54.9% 70.9% 52.0% 62.5% 58.2% 64.1% 65.1%

Shoppers are conserving

or combining trips (more one-stop shopping)

due to increased gas prices 44.7 40.7 48.6 40.0 41.3 50.7 42.2 47.6

We are seeing shopping

patterns shift toward more

meals prepared at home 35.5 35.4 37.1 30.0 38.8 43.3 27.3 39.7

Other mentions 8.0 5.3 10.9 4.0 8.8 4.5 7.0 12.7

Multiple responses accepted

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

36 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

cers plan to expand their private label offerings, account for such a large chunk of grocers’ bills. vey said they’re pursuing sustainability initia-

72.2 percent will add more weekly specials, and Other green moves include composting waste and tives related to new buildings and remodels,

more than 60 percent will be rolling out volume dis- reselling it for customers’ use, switching cooking almost an identical match to the Annual Report’s

counts and more couponing activity. oils to biodiesel, packaging from renewable findings. What’s more, in FMI’s survey another

While 33.7 percent of respondents plan to invest resources, and recycling. 40 percent said they plan to go greener in their

in price/promotion optimization technology to The Food Marketing Institute noted in its operations in the next five years.

gain efficiencies in the year ahead, 47.6 percent Facts About Store Development 2007 report that

won’t do so, and 18.6 percent don’t want to say food retailers are embracing sustainability to Keeping score on suppliers

either way. reduce energy costs as they build new stores. As Last but not least, in another new area of the

many as 34 percent of respondents to FMI’s sur- Annual Report (or, more accurately, a revival of a

On the green scene

A new trend in operations that has gained Investing in price/promotion optimization technology?

lots of attention in the past year is sustainability

and the “greening” of supermarkets. In this year’s Invested in 2007: Plan to invest in 2008:

Annual Report, PG asked retailers for the first Total Chain Ind Whlsl Total Chain Ind Whlsl

time whether their companies are investing in Yes 32.1% 49.4% 25.5% 23.5% 41.5% 51.9% 37.8% 35.3%

environmental sustainability. While 50.9 per-

No 67.9 50.6 74.5 76.5 58.5 48.1 62.2 64.7

cent said no, a full third (37 percent) said yes.

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

Twelve percent offered no response, indicating

that there’s still an educational curve when it

comes to sustainability.

Investing in environmental sustainability?

The companies that are involved have been

experimenting with a wide array of initiatives, Total Chain Ind Whlslr Northeast Midwest South West

ranging from offering reusable bags and discour- Yes 37.0% 49.6% 29.7% 34.0% 45.0% 32.0% 28.4% 46.0%

aging plastic bags, to implementing LEED certi- No 50.9 35.4 62.3 46.0 41.3 53.9 56.7 50.8

fication in new stores and remodels, to investi-

No response/don’t know 12.1 15.0 8.0 20.0 13.7 14.1 14.9 3.2

gating solar energy.

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

Energy and lighting are two areas receiving par-

ticular attention, probably because these factors

Rating of manufacturers’ effectiveness

Score=percent of respondents rating strategy as 1 or 2 on a scale of 1-6, where 1=most effective

North-

Total Chain Ind Whlsl east South Midwest West 1-10 11-99 100+

No. of new items 29.3% 21.2% 35.4% 26.0% 30.0% 31.3% 25.0% 34.9% 35.6% 23.6% 22.3%

Performance requirements on deals/allowances 21.0 14.2 26.3 18.0 20.0 22.4 20.3 22.2 26.6 14.5 15.5

Efficiency of electronic communications 20.4 13.3 22.9 28.0 18.8 22.4 19.5 22.2 23.7 16.4 17.5

Usefulness of category mgmt. programs 19.5 18.6 20.0 20.0 13.8 26.9 15.6 27.0 20.9 16.4 19.4

Value of deals and offers 18.9 14.2 24.0 12.0 16.3 22.4 15.6 25.4 24.3 20.0 9.7

Number of deals and offers 18.6 11.5 24.0 16.0 16.3 19.4 18.0 22.2 24.3 20.0 8.7

Efficiency of sales visits 13.9 13.3 12.6 20.0 12.5 14.9 14.1 14.3 13.0 16.4 14.6

Training/education programs to support lines 11.8 8.8 14.3 10.0 13.8 10.4 10.2 14.3 14.7 10.9 7.8

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

Change in supplier relationships in past year

Total Chain Ind Whlsl Northeast South Midwest West 1-10 11-99 100+

Better now 32.0% 39.5% 27.6% 35.5% 31.3% 37.7% 27.9% 35.2% 27.3% 43.9% 36.2%

Worse now 22.9 9.9 29.4 22.6 14.1 17.0 31.7 22.2 29.1 14.6 13.0

Stayed the same 45.1 50.6 43.0 41.9 54.6 45.3 40.4 42.6 43.6 41.5 50.8

SOURCE: PROGRESSIVE GROCER MARKET RESEARCH, 2008

40 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Annual Report

section from reports past), PG asked grocers to cers had a lot to say. Some of the most telling among concerned about selling more products.

judge how effective their manufacturer partners the many responses were: • Better on-time delivery of seasonal product.

are in specific areas of the business. • Alignment of goals and strategies to the • Remember the independents.

Their responses revealed that some relation- customer level. • Offer more custom marketing plans instead of

ships are strained out there—and apparently, there’s • Availability of more delivery days, so as to cookie-cutter national plans.

plenty of room for improvement in communication obtain fresher stock in perishables. • Increase promotional allowances for buy-ins

and strategy. • To be able to visit with a “real” person. and display allowances.

Suppliers scored highest on the number of new • More help in merchandising instead of being • Fewer out-of-stocks. ■

product introductions they presented in 2007.

The other areas considered at least average in effec-

tiveness included performance requirements on METHODOLOGY

deals and allowances, and efficiency of electronic

PROGRESSIVE GROCER’S 75TH ANNUAL REPORT OF THE GROCERY

communications.

INDUSTRY is based primarily on an exclusive survey conducted among

The areas in which suppliers need the most

headquarters executives and store managers at supermarket chains, independents, and wholesalers. A

work, from the retailer’s point of view, include total of 338 responses are included in the final results. Presidents and other top executives represent

efficiency of sales visits, and providing training 31 percent of the total, followed by buyers/merchandisers/category managers, at 24 percent; store

and educational programs to support their lines managers, at 17 percent; retail/store operations executives, at 15 percent; and

and products. sales/advertising/marketing executives, at 13 percent. A total of 52 percent of respondents represent

About one-third (32 percent) of respondents independent operators with one to 10 stores, 17 percent have 11 to 99 stores, and 31 percent operate

said their supplier relationships are better now 100 stores or more. Regionally, 37 percent are headquartered in the Midwest, 24 percent are from the

than a year ago, and 45.1 percent said they’re Northeast, 20 percent are from the South, and 19 percent are from the West.

about the same. Almost 23 percent felt that their Additional store account and sales data was provided by TDLinx, a Nielsen Company, which main-

tains a national database of supermarket and other retail format locations. Consumer behavior data

relationships have worsened.

was provided by Nielsen from its Homescan panel of more than 125,000 households.

When asked to name one thing that would

make their relationships with suppliers better, gro-

42 • Progressive Grocer • April 15, 2008 A H E A D O F W H AT ’ S N E X T www.progressivegrocer.com

Das könnte Ihnen auch gefallen

- Learn Sanskrit - Lesson 1Dokument8 SeitenLearn Sanskrit - Lesson 1Swanand Raikar100% (8)

- Kambe Tsutomu - Bodhidharma. Stories From Chinese LiteratureDokument15 SeitenKambe Tsutomu - Bodhidharma. Stories From Chinese LiteraturenqngestionNoch keine Bewertungen

- Asimov - How Did We Find Out The Earth Is RoundDokument16 SeitenAsimov - How Did We Find Out The Earth Is RoundAlina GodeanuNoch keine Bewertungen

- The Apollo Spacecraft - Volume 2 - A Chronology Nov 8, 1962 - Sep 30, 1964Dokument298 SeitenThe Apollo Spacecraft - Volume 2 - A Chronology Nov 8, 1962 - Sep 30, 1964Ool4100% (1)

- Illicit Financial Flows From Africa GFI ReportDokument44 SeitenIllicit Financial Flows From Africa GFI Reportmpd20009Noch keine Bewertungen

- Apollo 11 Mission Operations Report - NASADokument109 SeitenApollo 11 Mission Operations Report - NASAOol4100% (1)

- The Apollo Spacecraft. Volume 1 - A Chronology From Origin To November 7, 1962Dokument288 SeitenThe Apollo Spacecraft. Volume 1 - A Chronology From Origin To November 7, 1962Ool4100% (1)

- How Did Humans Evolve - Reflections On The Uniquely Unique Species Alexander 1990Dokument41 SeitenHow Did Humans Evolve - Reflections On The Uniquely Unique Species Alexander 1990Ool4Noch keine Bewertungen

- Environmental Impact of Proposed Chemplast Sanmar PVC PlantDokument55 SeitenEnvironmental Impact of Proposed Chemplast Sanmar PVC PlantOol4Noch keine Bewertungen

- Unfolding Disaster - A Study of Chemplast Sanmar's Toxic Contamination in Mettur, TamilnaduDokument33 SeitenUnfolding Disaster - A Study of Chemplast Sanmar's Toxic Contamination in Mettur, TamilnadulpremkumarNoch keine Bewertungen

- US State Department Declassified Transcripts - Indo Pak 1971 WarDokument253 SeitenUS State Department Declassified Transcripts - Indo Pak 1971 WarOol4100% (1)

- Harvard Report On Chemical Industry ClustersDokument56 SeitenHarvard Report On Chemical Industry ClustersOolchee1Noch keine Bewertungen

- Escala de Tiempo Geologico 2009 - INTERNATIONAL STRATIGRAPHIC CHART 2009Dokument1 SeiteEscala de Tiempo Geologico 2009 - INTERNATIONAL STRATIGRAPHIC CHART 2009edwardNoch keine Bewertungen

- Recycling Through The AgesDokument54 SeitenRecycling Through The AgesOol4Noch keine Bewertungen

- Ranking of US Most Stressed CitiesDokument2 SeitenRanking of US Most Stressed CitiesOol4Noch keine Bewertungen

- Scrap Tire Markets in The Unites StatesDokument105 SeitenScrap Tire Markets in The Unites StatesOol4100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Dokument64 SeitenPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNoch keine Bewertungen

- International StrategyDokument34 SeitenInternational StrategymanicatewatiaNoch keine Bewertungen

- Compensation Management at Tata Consultancy Services LTDDokument4 SeitenCompensation Management at Tata Consultancy Services LTDNishaant S Prasad0% (2)

- Rohit Summer ProjectDokument12 SeitenRohit Summer ProjectRohit YadavNoch keine Bewertungen

- XYZ Investing INC. Trial BalanceDokument3 SeitenXYZ Investing INC. Trial BalanceLeika Gay Soriano OlarteNoch keine Bewertungen

- Taxation 2nd PreboardDokument17 SeitenTaxation 2nd PreboardJaneNoch keine Bewertungen

- Pepcid AC - Group1 - AnalysisDokument2 SeitenPepcid AC - Group1 - AnalysisRini RafiNoch keine Bewertungen

- FDI in The Indian Retail SectorDokument4 SeitenFDI in The Indian Retail SectorE D Melinsani ManaluNoch keine Bewertungen

- CadburyDokument43 SeitenCadburyBabasab Patil (Karrisatte)Noch keine Bewertungen

- 1.supply Chain Management 1&2Dokument56 Seiten1.supply Chain Management 1&2Abdul Hafeez0% (1)

- Care2x Med e Tel 2014Dokument6 SeitenCare2x Med e Tel 2014Waldon HendricksNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Syed SameerNoch keine Bewertungen

- FA GP5 Assignment 1Dokument4 SeitenFA GP5 Assignment 1saurabhNoch keine Bewertungen

- Customer Journey MappingDokument1 SeiteCustomer Journey MappingPriyanka RaniNoch keine Bewertungen

- Current Org StructureDokument2 SeitenCurrent Org StructureJuandelaCruzVIIINoch keine Bewertungen

- Chapter 1 - Introduction To Management AccountingDokument32 SeitenChapter 1 - Introduction To Management Accountingyến lêNoch keine Bewertungen

- AISAN CanopyDokument46 SeitenAISAN CanopyAmirul AdamNoch keine Bewertungen

- SDLC ResearchgateDokument10 SeitenSDLC ResearchgateAlex PitrodaNoch keine Bewertungen

- Blockholder Trading, Market E Ciency, and Managerial MyopiaDokument35 SeitenBlockholder Trading, Market E Ciency, and Managerial MyopiamkatsotisNoch keine Bewertungen

- Electives Term 5&6Dokument28 SeitenElectives Term 5&6GaneshRathodNoch keine Bewertungen

- FinRep SummaryDokument36 SeitenFinRep SummaryNikolaNoch keine Bewertungen

- TCS India Process - Separation KitDokument25 SeitenTCS India Process - Separation KitT HawkNoch keine Bewertungen

- Stack Company Overview - Sept 2021Dokument12 SeitenStack Company Overview - Sept 2021Srinivas AnnamarajuNoch keine Bewertungen

- Hepm 3102 Project Leadership and CommunicationDokument11 SeitenHepm 3102 Project Leadership and CommunicationestherNoch keine Bewertungen

- Principles of Management Vansh Lamba GucciDokument10 SeitenPrinciples of Management Vansh Lamba Guccivansh lambaNoch keine Bewertungen

- Difference Between Verification and ValidationDokument3 SeitenDifference Between Verification and Validationsdgpass2585100% (1)

- 4PS and 4esDokument32 Seiten4PS and 4esLalajom HarveyNoch keine Bewertungen

- BSBA Financial Management CurriculumDokument3 SeitenBSBA Financial Management Curriculumrandyblanza2014Noch keine Bewertungen

- Group 6 Environmental ScanningDokument9 SeitenGroup 6 Environmental Scanningriza may torreonNoch keine Bewertungen

- Tan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Dokument2 SeitenTan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Barrymore Llegado Antonis IINoch keine Bewertungen