Beruflich Dokumente

Kultur Dokumente

AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Preview

Hochgeladen von

scottshear1Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Preview

Hochgeladen von

scottshear1Copyright:

Verfügbare Formate

NOTE: The last page of this should be printed in landscape orientation.

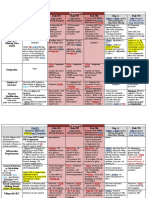

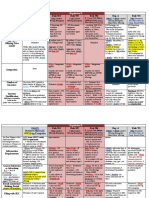

Registration Forms:

Form S-3 Large seasoned Shelf Registration S-2 Seasoned S-1 SB-1&2 Reg S-K Reg S-X Reg C Requirements Large, seasoned cos that have been reporting for at least 1 year and meet float test public cos w/ min $700m float (stock held by non-officers) Requires only transaction-specific disclosure; may incorporate, by reference, registrant-specific info (10K & all other 34 Act reports). Rule 415 S-3 companies can file a short RS for all future securities that may be offered w/in 2 years. Rationale: they already have steady stream of info to mkts and this reduces costs. Reporting cos that have been filing periodic reports for at least 3 years Annual report must accompany the streamlined prospectus May incorporate by reference any info in the annual report & other periodic filings. Most detailed set of instructions Usually used by cos that dont qualify for other forms (e.g., IPO) No incorp by reference. Small biz issuers with annual revenues of less than $25m and public float of less than $25m. SB-1 allows annual regis of up to $10m in sec sold for cash; SB-2 has no limit. Details non-financial filings required under 33 and 34 Acts by various Registration Forms. Note: Franchard held that Reg S-K is not exhaustive list of required material disclosures. Details financial filings required under 33 and 34 Acts. Procedural & mechanical rules for # of copies, where filed, etc. for RS.

Materiality:

1. 2. 3. 4. 5. Historical events: material if substantial likelihood that a reasonable shh would consider it important in deciding how to vote. (TSC) or if alters total mix of information avail to shh/investor Uncertain contingent/future events: Materiality = Probability x magnitude: probability that it will occur * magnitude of harm if it occurs. (Basic) Truth on the market defense (Wieglos, 7th Cir.) MS or omission may be immaterial if correcting info was circulating in the marketplace, known by investors, and affecting securitys price; use w/ EMH and total mix of info definition of materiality. Rule 408: RS must contain all material info, even that other than that required in the registration forms, to make RS as a whole not misleading. Process for thinking about disclosure: A. Is there a duty to disclose: 1) Line item required disclosure? (Reg S-K) 2) Material under Rule 408 or Franchard concept such that disclosure is required?

Soft info and Forward Looking Statements:

1. 2. 3. Soft info: predictions of future mkt values, projections, opinions, forward looking statements. Duty to disclose soft info: arises from overall obligation that announcements not be generally misleading Management Discussion & Analysis (MD&Z): Reg S-K, Item 303

4.

A. Purpose: to give meaningful look at short & long-term analysis of biz of corp through eyes of mgmt B. Required: known trends C. Encouraged: optional forward-looking disclosure anticipating future trends, less predictable impact of a known event, etc FORWARD LOOKING STATEMENTS are encouraged and protected by: A. Statutory safe harbor (33 Act 27A, 34 Act 21E). Covers forward-looking statements re: earnings (e.g., MD&A) if: 1) Identified as forward-looking AND accompanied by cautionary statement identifying risk factors; OR 2) Forward-looking statement is immaterial; OR a) Materiality standard for MD&A under Item 303: a) reasonably likely to occur (lower threshold han 50% prob) and b) if cannot determine whether reasonably likely, then must disclose full magnitude. 3) P fails to prove forward-looking statement made w/ actual knowledge B. Bespeaks caution doctrine: Judicial doctrine covering forward-looking statements by any person (whether or not in SEC filings); allows summary judgment to weed out frivolous cases 1) Statement not material if statement cautions and generally describes possible risk factors a) Requires precise cautionary info; Boilerplate cautionary language insufficient.. . 2) Cts less likely to protect sophisticated investors if statements include words of caution (Kaufman v. Trump) C. SEC Rules 175 and 3b-6: Covers forward-looking statement by issuer in SEC filings 1) Statement not fraudulent, unless shown to be w/o reasonable basis or in absence of good faith basically a recklessness standard. (not necessary to ID risk factors)

Security definition:

1. Howey test factors: A. Investment for profit, not for commodity or service B. Commonality of interest: Horizontal (b/w other investors) required by some cir; others require only vertical (w/ manager) C. Profits: Primary motivation of investment must be expected returns from earnings, not additional contributions D. Efforts of others: Profits must derive predominantly from managerial efforts (Koscot) Alternately: Economic Realities test: A. Not stock security when investment carries none of normal indicia and characteristics of stock (United Housing Foundation) Notes A. Family resemblance test: (Reves) Rebuttable presumption that notes are securities unless falls into exempt category, such as: (see outline) B. Consider factors such as: motivation of seller/buyer, plan of distribution, reasonable expectations of investing public, other factors that reduce risk. C. Note: commercial notes w/ maturity under 9 months are NOT securities See special distinctions for bank instruments, real estate, etc.

2. 3.

4.

Resales of Restricted Securities or Resales by Control Persons

1. 2(11) Underwriter definition includes these groups which arent covered under 4(1) and MUST find additional transaction exemption to resell: A. Agent for issuer acts for issuer in connection w/ distribution (Chinese Benevolent) B. One who purchases from issuer with view to distribute Investment intent established if hold for more than 3 years C. Distribution for control persons Distirubtion (by broker, dealer) for control persons (those who direct mgmt/policies of issuer through ownership, position, etc Rule 405)

Reliance? Damages

Limitations /Repose

2) D can show P knew alleged MS was false. No reliance required; except 1 year after earnings statement released, Ps have to prove reliance under 11(a) Measured damages - max dam = public offering price (POP) mkt share price when suit is brought - actual dam = amt paid for security not exceeding POP market price - key: never liable for more than POP * # of shares issued; commencement of suit stops loss of defendants b/c sets market price for dam formula 11(e) w/ negative loss causation defense W/in 1 year of discovery of violation; no later than 3 years after sale 13

Prospectus

No prospectus whatsoever. See FN2. Conditioning the market prohibited: Any hype/publicity that may contrib to conditioning the public or arousing interest (Carl Loeb, SEC Rel. 3844) Timely corporate disclosures permitted. Rule 135: Barebones info: amt & type of securities, manner & purpose of offering. Prohibited: Identification

of prospective UWs, offering price. (Chris-Craft).

No prospectus that does not comply w/ 10 (5(b)(1))

Prospectus defined in 2(10) as basically any selling effort in writing or radio or TV No 10(a) prospectus avail since RS not yet effective.

No prospectus (writing) unless it is a statutory prospectus that complies w/ 10(a). Thus, 10(a) prospectus must accompany or precede: written

offers; supplementary sales lit (e.g., free writing); written confirmations; delivery of securities

Prelim prospectus allowed 10(b) and Rule 430: Contains sae info as final prospectus but omits info on offering price and UW arrangements. Cannot hyperlink to other written materials. Summary prospectus allowed- Rule 431 (rarely used)

10(a) prospectus can be: 1) Rule 434 2-step prospectus: prelim prospec & term sheet; or 2) Rule 430: prelim prospect that is amended then declared effective Delivery obligations: See outline for prospec. delivery oblig. under 4(3) & Rule 174. If prospec. used 9 mo after eff. date, info in prospec. cant be more than 16 mo old. 10(a)(3) Correction of incorrect disclosure: if material but

minor, sticker can be used on prospec. w/ new info; if fundamental, must amend RS and wait for SEC to declare effective

Research reports by broker/dealers:

1. Rule 137: Nonparticipants Dealer who is NOT part of UW group may continue to publish & distrib info, opinions, or recommed. in its regular course of biz IF: registrant files reports under 13 or 15(d) of 34 Act AND dealer does not receive any consideration 2. Rule 138: Issuers other securities Participating UW may publish opinion & info relating solely to X if registrant is permitted to use Form S-2 and is registering Not-X. A. X = one of (nonconvertible preferred stock, debt, common stock) 3. Rule 139: Participants - Dealer or UW (participants or not) acting in regular course of biz may publish info, recommend., or opinions if issuer qualifies to use Form S-3. If doesnt qualify for Form S-3, then allowed under other conditions... see outline

Info releases

Modified tombstone Ad permitted Free writing (sales lit) if accompanied or preceded by statutory prospectus. - 2(10)(b) general info about security, by whom order will be executed, price - identifying statement allowed under Rule 134 See E&E p.131 Roadshows: so long as no written materials other than prelim prospectus is distributed. FN2: Rule 403A allows RS to be declared effective even if contains prospectus that omits info on price, UW syndicate (required for post-effective prospectus); such info must later be disclosed later under Rules 424(b)(1), (4), or 497

10

Das könnte Ihnen auch gefallen

- Securities Regulation Outline SummaryDokument11 SeitenSecurities Regulation Outline SummaryGang GaoNoch keine Bewertungen

- Securities Regulation OutlineDokument50 SeitenSecurities Regulation OutlineTruth Press Media100% (1)

- SecReg Outline 1 - Stern DetailedDokument127 SeitenSecReg Outline 1 - Stern Detailedsachin_desai_9Noch keine Bewertungen

- Sec Reg ChartDokument17 SeitenSec Reg ChartMelissa GoldbergNoch keine Bewertungen

- Secreg - Gun Jumping Exam SheetDokument5 SeitenSecreg - Gun Jumping Exam SheetRaj VashiNoch keine Bewertungen

- SECURITIES REGULATION SUMMARYDokument14 SeitenSECURITIES REGULATION SUMMARYzklvkfdNoch keine Bewertungen

- Fed Securities Laws - Rule OutlineDokument30 SeitenFed Securities Laws - Rule OutlineVirginia Crowson100% (12)

- Buckham Securities OutlineDokument58 SeitenBuckham Securities OutlineJonDoeNoch keine Bewertungen

- SECURITIES REGULATION TITLEDokument119 SeitenSECURITIES REGULATION TITLEErin Jackson100% (1)

- Securities Regulation Outline: Definition of a SecurityDokument27 SeitenSecurities Regulation Outline: Definition of a SecurityWaseem Barazi100% (2)

- Reach of Regulation: What Constitutes a "SecurityDokument33 SeitenReach of Regulation: What Constitutes a "SecurityErin Jackson100% (3)

- Securities Regulation HyposDokument46 SeitenSecurities Regulation HyposErin JacksonNoch keine Bewertungen

- Securities Regulation OutlineDokument67 SeitenSecurities Regulation OutlineSean Balkan100% (1)

- Securities Regulation OutlineDokument55 SeitenSecurities Regulation OutlineJosh SawyerNoch keine Bewertungen

- Attack Sec. RegDokument5 SeitenAttack Sec. RegTroyNoch keine Bewertungen

- Federal Securities LawsDokument1 SeiteFederal Securities LawsJulie GonzalezNoch keine Bewertungen

- Securities Regulation Outline #1Dokument50 SeitenSecurities Regulation Outline #1tuyaNoch keine Bewertungen

- Disclosure and Materiality Standards in Securities RegulationDokument22 SeitenDisclosure and Materiality Standards in Securities RegulationDaniel Novick100% (1)

- SECURITIES REGULATION COURSE EXAMINES EXEMPTIONS AND REGISTRATIONDokument127 SeitenSECURITIES REGULATION COURSE EXAMINES EXEMPTIONS AND REGISTRATIONErin Jackson100% (1)

- Secured Transactions ChecklistDokument6 SeitenSecured Transactions Checklistshacisa90% (10)

- Corp - Tax Law OutlineDokument61 SeitenCorp - Tax Law OutlineJustin BouchardNoch keine Bewertungen

- Secured Trans (Good Explanations)Dokument42 SeitenSecured Trans (Good Explanations)JasonGershensonNoch keine Bewertungen

- The Role of the Securities Act of 1933 and Key ConceptsDokument33 SeitenThe Role of the Securities Act of 1933 and Key ConceptsErin JacksonNoch keine Bewertungen

- Sec Reg Attack 2021 - NEWDokument28 SeitenSec Reg Attack 2021 - NEWmattytangNoch keine Bewertungen

- Securities Law Outline Spring 2006Dokument124 SeitenSecurities Law Outline Spring 2006himanshuNoch keine Bewertungen

- Art. 9 UCC Priority AnalysisDokument22 SeitenArt. 9 UCC Priority Analysistestacct00% (1)

- CHANGES AND COMPETITIONS IN SECURED TRANSACTIONSDokument10 SeitenCHANGES AND COMPETITIONS IN SECURED TRANSACTIONSAnonymous vXdxDlwKO89% (9)

- Secured-Transactions OutlineDokument43 SeitenSecured-Transactions Outlinea thayn100% (2)

- Secured Transactions: Attachment and PerfectionDokument8 SeitenSecured Transactions: Attachment and PerfectionJenna Alia100% (1)

- Acing BA OutlineDokument64 SeitenAcing BA OutlineStephanie PayanoNoch keine Bewertungen

- Statute of Frauds Contract RequirementsDokument1 SeiteStatute of Frauds Contract RequirementsZacharyParsons100% (4)

- Securities Regulations Law OutlineDokument32 SeitenSecurities Regulations Law Outlinetwbrown1220100% (1)

- Secured Transactions OutlineDokument46 SeitenSecured Transactions OutlineEric Shepherd100% (3)

- Sales OutlineDokument41 SeitenSales Outlineesquire1010100% (1)

- Secured TransactionsDokument174 SeitenSecured TransactionsLarry RogersNoch keine Bewertungen

- Secured Transactions Flow Chart (Collateral)Dokument10 SeitenSecured Transactions Flow Chart (Collateral)Kathleen Alcantara94% (16)

- International Business Transactions (Myers Rome Program) - Full Discursive Outline and Pre-Written Exam Introduction ParagraphsDokument12 SeitenInternational Business Transactions (Myers Rome Program) - Full Discursive Outline and Pre-Written Exam Introduction ParagraphsNicole DrysdaleNoch keine Bewertungen

- Secured Transactions OutlineDokument59 SeitenSecured Transactions OutlineGabby ViolaNoch keine Bewertungen

- Bankruptcy Outline: Secured Interests, Priorities, and Post-Judgment RemediesDokument42 SeitenBankruptcy Outline: Secured Interests, Priorities, and Post-Judgment RemediesNewton Patrick Cloonan Thurber100% (5)

- Federal Income Tax Outline 2021 AH FINALDokument71 SeitenFederal Income Tax Outline 2021 AH FINALAndrea Healy100% (1)

- Secured TransactionsDokument3 SeitenSecured TransactionsJon Leins100% (2)

- Sales Outline: "The Good Guy Always Wins"Dokument15 SeitenSales Outline: "The Good Guy Always Wins"zachroyusiNoch keine Bewertungen

- UCC OutlineDokument5 SeitenUCC Outlinesielynikam50% (2)

- Chart OutlineDokument29 SeitenChart OutlineKasem AhmedNoch keine Bewertungen

- Buyer Remedies ChartDokument1 SeiteBuyer Remedies Chartzmeth144100% (1)

- Professional Responsibility OutlineDokument6 SeitenProfessional Responsibility OutlineTiffany Brooks100% (1)

- Secured Transactions - ZinnickerDokument97 SeitenSecured Transactions - ZinnickerGreg BealNoch keine Bewertungen

- Remedie and Restitution NotesDokument128 SeitenRemedie and Restitution NotesShelby MathewsNoch keine Bewertungen

- Secured Transactions Spring 2010Dokument81 SeitenSecured Transactions Spring 2010Joshua Ryan Collums100% (1)

- Secured Transactions OutlineDokument27 SeitenSecured Transactions OutlineAlexandraMarie100% (6)

- ST OutlineDokument103 SeitenST Outlineam3ze100% (4)

- Agency Relationships & LiabilityDokument75 SeitenAgency Relationships & LiabilityjryanandersonNoch keine Bewertungen

- Formation: SalesDokument44 SeitenFormation: SalesJun Ma100% (1)

- UCC CommonLawDokument3 SeitenUCC CommonLawOctavian Jumanca0% (1)

- Business Associations & Corporations OutlineDokument103 SeitenBusiness Associations & Corporations Outlinemtpangborn100% (3)

- Secured Transactions OutlineDokument121 SeitenSecured Transactions Outlinemaureen P100% (2)

- Sec Reg 2016 OutlineDokument101 SeitenSec Reg 2016 OutlineRyan MaloleyNoch keine Bewertungen

- First Amendment 2011Dokument62 SeitenFirst Amendment 2011DavidFriedmanNoch keine Bewertungen

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Von EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Noch keine Bewertungen

- Securities (Forbes) - NADokument75 SeitenSecurities (Forbes) - NAscottshear1Noch keine Bewertungen

- Securities (Forbes) - NADokument87 SeitenSecurities (Forbes) - NAscottshear1Noch keine Bewertungen

- Securities (Condon) - 2007-08Dokument69 SeitenSecurities (Condon) - 2007-08scottshear1Noch keine Bewertungen

- Securities (Condon) - NA (1) - 1Dokument125 SeitenSecurities (Condon) - NA (1) - 1scottshear1Noch keine Bewertungen

- Introduction to Securities Law and Key Regulatory AreasDokument119 SeitenIntroduction to Securities Law and Key Regulatory Areasscottshear1Noch keine Bewertungen

- Intellectual Perspectives and Key Concepts of Securities RegulationDokument113 SeitenIntellectual Perspectives and Key Concepts of Securities Regulationscottshear1Noch keine Bewertungen

- Securities (Cattanach and Wiens) - 2012-13 (2) - 1Dokument89 SeitenSecurities (Cattanach and Wiens) - 2012-13 (2) - 1scottshear1Noch keine Bewertungen

- Securities (Condon) - 2007-08Dokument69 SeitenSecurities (Condon) - 2007-08scottshear1Noch keine Bewertungen

- Securities (Condon) - 2007-08Dokument43 SeitenSecurities (Condon) - 2007-08scottshear1Noch keine Bewertungen

- Securities (Lastman) - 2012-13Dokument69 SeitenSecurities (Lastman) - 2012-13scottshear1Noch keine Bewertungen

- Securities (Lastman) - 2013-14 (1) - 2Dokument135 SeitenSecurities (Lastman) - 2013-14 (1) - 2scottshear1Noch keine Bewertungen

- Securities Regulation - 99331007Dokument26 SeitenSecurities Regulation - 99331007scottshear1Noch keine Bewertungen

- Introduction to Securities Law and Key Regulatory AreasDokument119 SeitenIntroduction to Securities Law and Key Regulatory Areasscottshear1Noch keine Bewertungen

- Securities (Lastman) - 2013-14 (1) - 2Dokument135 SeitenSecurities (Lastman) - 2013-14 (1) - 2scottshear1Noch keine Bewertungen

- Securities Outline - Fall 08 - Langevoort-PreviewDokument15 SeitenSecurities Outline - Fall 08 - Langevoort-PreviewFrederick DavisNoch keine Bewertungen

- Securities Regulation - Langevoort - Fall 2008-PreviewDokument12 SeitenSecurities Regulation - Langevoort - Fall 2008-Previewscottshear1Noch keine Bewertungen

- SecReg Outline 2008 PreviewDokument8 SeitenSecReg Outline 2008 PreviewErin JacksonNoch keine Bewertungen

- Securities Outline - Fall 08 - Langevoort-PreviewDokument15 SeitenSecurities Outline - Fall 08 - Langevoort-PreviewFrederick DavisNoch keine Bewertungen

- Securities Regulation Outline Spring 2008-PreviewDokument11 SeitenSecurities Regulation Outline Spring 2008-Previewscottshear1Noch keine Bewertungen

- Securities Macro OutlineSpring 2006-PreviewDokument21 SeitenSecurities Macro OutlineSpring 2006-PreviewMonica LewisNoch keine Bewertungen

- Human Right Note For BCADokument2 SeitenHuman Right Note For BCANitish Gurung100% (1)

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDokument2 SeitenGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNoch keine Bewertungen

- The Cochran Firm Fraud Failed in CA Fed. CourtDokument13 SeitenThe Cochran Firm Fraud Failed in CA Fed. CourtMary NealNoch keine Bewertungen

- Compare Q1 and Q2 productivity using partial factor productivity analysisDokument3 SeitenCompare Q1 and Q2 productivity using partial factor productivity analysisDima AbdulhayNoch keine Bewertungen

- Metadesign Draft PresentationDokument12 SeitenMetadesign Draft Presentationapi-242436520100% (1)

- LIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SDokument1 SeiteLIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SMohammad ShuaibNoch keine Bewertungen

- SHS Entrepreneurship Week 2Dokument12 SeitenSHS Entrepreneurship Week 2RUSSEL AQUINO50% (2)

- Supreme Court Dispute Over Liquidated DamagesDokument22 SeitenSupreme Court Dispute Over Liquidated DamagesShuva Guha ThakurtaNoch keine Bewertungen

- SC upholds conviction for forgery under NILDokument3 SeitenSC upholds conviction for forgery under NILKobe Lawrence VeneracionNoch keine Bewertungen

- AdvancingDokument114 SeitenAdvancingnde90Noch keine Bewertungen

- Injection Molding Part CostingDokument4 SeitenInjection Molding Part CostingfantinnoNoch keine Bewertungen

- TCS Connected Universe Platform - 060918Dokument4 SeitenTCS Connected Universe Platform - 060918abhishek tripathyNoch keine Bewertungen

- Sap CloudDokument29 SeitenSap CloudjagankilariNoch keine Bewertungen

- Community Based Tourism Development PDFDokument2 SeitenCommunity Based Tourism Development PDFGregoryNoch keine Bewertungen

- Quiz For ISO 9001Dokument4 SeitenQuiz For ISO 9001lipueee100% (1)

- Chyna Benson-Receptionist 2014Dokument1 SeiteChyna Benson-Receptionist 2014api-245316866Noch keine Bewertungen

- GodrejDokument4 SeitenGodrejdeepaksikriNoch keine Bewertungen

- Warning NoticeDokument3 SeitenWarning NoticeMD ALALNoch keine Bewertungen

- BUS835M Group 5 Apple Inc.Dokument17 SeitenBUS835M Group 5 Apple Inc.Chamuel Michael Joseph SantiagoNoch keine Bewertungen

- H4 Swing SetupDokument19 SeitenH4 Swing SetupEric Woon Kim ThakNoch keine Bewertungen

- OutSystems CertificationDokument7 SeitenOutSystems CertificationPaulo Fernandes100% (1)

- Bms Index Numbers GROUP 1Dokument69 SeitenBms Index Numbers GROUP 1SIRISHA N 2010285Noch keine Bewertungen

- Supply Chain Management: Session 1: Part 1Dokument8 SeitenSupply Chain Management: Session 1: Part 1Safijo AlphonsNoch keine Bewertungen

- Emcee Script For TestimonialDokument2 SeitenEmcee Script For TestimonialJohn Cagaanan100% (3)

- Roberto Guercio ResumeDokument2 SeitenRoberto Guercio Resumeapi-3705855Noch keine Bewertungen

- International Trade Statistics YearbookDokument438 SeitenInternational Trade Statistics YearbookJHON ALEXIS VALENCIA MENESESNoch keine Bewertungen

- Claim Form For InsuranceDokument3 SeitenClaim Form For InsuranceSai PradeepNoch keine Bewertungen

- Hire PurchaseDokument16 SeitenHire PurchaseNaseer Sap0% (1)

- Letter To Builder For VATDokument5 SeitenLetter To Builder For VATPrasadNoch keine Bewertungen

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDokument2 SeitenDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNoch keine Bewertungen