Beruflich Dokumente

Kultur Dokumente

F 709

Hochgeladen von

Bogdan PraščevićOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F 709

Hochgeladen von

Bogdan PraščevićCopyright:

Verfügbare Formate

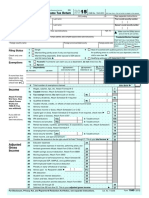

Form

709

United States Gift (and Generation-Skipping Transfer) Tax Return

Information

OMB No. 1545-0020

about Form 709 and its separate instructions is at www.irs.gov/form709.

(For gifts made during calendar year 2013)

Department of the Treasury Internal Revenue Service 1 Donors first name and middle initial 4 Address (number, street, and apartment number)

See instructions.

2013

2 Donors last name

3 Donors social security number 5 Legal residence (domicile) 7 Citizenship (see instructions)

6 City or town, state or province, country, and ZIP or foreign postal code

Part 1General Information

8 9 10 11a b 12

If the donor died during the year, check here

and enter date of death

Yes

No

If you extended the time to file this Form 709, check here Enter the total number of donees listed on Schedule A. Count each person only once. Have you (the donor) previously filed a Form 709 (or 709-A) for any other year? If "No," skip line 11b Has your address changed since you last filed Form 709 (or 709-A)? . . . . . . . . . . . . . . . . . . . . . . .

Gifts by husband or wife to third parties. Do you consent to have the gifts (including generation-skipping transfers) made by you and by your spouse to third parties during the calendar year considered as made one-half by each of you? (see instructions.) (If the answer is Yes, the following information must be furnished and your spouse must sign the consent shown below. If the answer is No, skip lines 1318.) . . . . . . . . . . . . . . . . . . . . Name of consenting spouse 14 SSN . . . . . . Were you married to one another during the entire calendar year? (see instructions) . . . . . . . . . If 15 is No, check whether married divorced or widowed/deceased, and give date (see instructions) Will a gift tax return for this year be filed by your spouse? (If Yes, mail both returns in the same envelope.) . .

13 15 16 17 18

Consent of Spouse. I consent to have the gifts (and generation-skipping transfers) made by me and by my spouse to third parties during the calendar year considered as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent.

Consenting spouses signature

Date

19 1 2 3 4 5 6

Have you applied a DSUE amount received from a predeceased spouse to a gift or gifts reported on this or a previous Form 709? If Yes, complete Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . . Enter the amount from Schedule A, Part 4, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Enter the amount from Schedule B, line 3 . . . . . . . . . . . . . Total taxable gifts. Add lines 1 and 2 . . . . . . . . . . . . . . . Tax computed on amount on line 3 (see Table for Computing Gift Tax in instructions) Tax computed on amount on line 2 (see Table for Computing Gift Tax in instructions) Balance. Subtract line 5 from line 4 . . . . . . . . . . . . . . .

Part 2Tax Computation

7 8 9 10 11 12 13 14 15 16 17 18 19 20

Applicable credit amount. If donor has DSUE amount from predeceased spouse(s), enter amount from Schedule C, line 4; otherwise, see instructions . . . . . . . . . . . . . . Enter the applicable credit against tax allowable for all prior periods (from Sch. B, line 1, col. C) Balance. Subtract line 8 from line 7. Do not enter less than zero . . . . . . . . . . . .

Enter 20% (.20) of the amount allowed as a specific exemption for gifts made after September 8, 1976, and before January 1, 1977 (see instructions) . . . . . . . . . . . . . . Balance. Subtract line 10 from line 9. Do not enter less than zero Applicable credit. Enter the smaller of line 6 or line 11 . Credit for foreign gift taxes (see instructions) . . . Total credits. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Attach check or money order here.

Balance. Subtract line 14 from line 6. Do not enter less than zero . . . Generation-skipping transfer taxes (from Schedule D, Part 3, col. H, Total) . Total tax. Add lines 15 and 16 . . . . . . . . . . . . . .

Gift and generation-skipping transfer taxes prepaid with extension of time to file . If line 18 is less than line 17, enter balance due (see instructions) . . . . . If line 18 is greater than line 17, enter amount to be refunded . . . . . .

Sign Here

Paid Preparer Use Only

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has any knowledge. May the IRS discuss this return with the preparer shown below (see instructions)? Yes No Signature of donor Preparers signature Date Date Check if self-employed Firm's EIN Phone no. Cat. No. 16783M Form 709 (2013) PTIN

Print/Type preparers name

Firms name Firms address

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the instructions for this form.

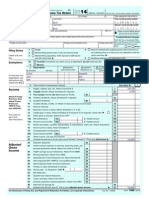

Form 709 (2013)

Page 2

SCHEDULE A

A B

Computation of Taxable Gifts (Including transfers in trust) (see instructions)

Does the value of any item listed on Schedule A reflect any valuation discount? If Yes, attach explanation

. . . . . . Yes No Check here if you elect under section 529(c)(2)(B) to treat any transfers made this year to a qualified tuition program as made ratably over a 5-year period beginning this year. See instructions. Attach explanation.

B Donees name and address Relationship to donor (if any) Description of gift If the gift was of securities, give CUSIP no. If closely held entity, give EIN

Part 1Gifts Subject Only to Gift Tax. Gifts less political organization, medical, and educational exclusions. (see instructions)

A Item number C D Donors adjusted basis of gift E Date of gift F Value at date of gift G For split gifts, enter 1/2 of column F H Net transfer (subtract col. G from col. F)

Gifts made by spouse complete only if you are splitting gifts with your spouse and he/she also made gifts.

Total of Part 1. Add amounts from Part 1, column H . . . . . . . . . . . . . . . . . . . . . . Part 2Direct Skips. Gifts that are direct skips and are subject to both gift tax and generation-skipping transfer tax. You must list the gifts in chronological order.

A Item number B Donees name and address Relationship to donor (if any) Description of gift If the gift was of securities, give CUSIP no. If closely held entity, give EIN C 2632(b) election out D Donors adjusted basis of gift E Date of gift F Value at date of gift G For split gifts, enter 1/2 of column F H Net transfer (subtract col. G from col. F)

Gifts made by spouse complete only if you are splitting gifts with your spouse and he/she also made gifts.

Total of Part 2. Add amounts from Part 2, column H . . . . . . . . . . . . . . . . . . . . . . Part 3Indirect Skips. Gifts to trusts that are currently subject to gift tax and may later be subject to generation-skipping transfer tax. You must list these gifts in chronological order.

A Item number B Donees name and address Relationship to donor (if any) Description of gift If the gift was of securities, give CUSIP no. If closely held entity, give EIN C 2632(c) election D Donors adjusted basis of gift E Date of gift F Value at date of gift G For split gifts, enter 1/2 of column F H Net transfer (subtract col. G from col. F)

Gifts made by spouse complete only if you are splitting gifts with your spouse and he/she also made gifts.

Total of Part 3. Add amounts from Part 3, column H . . (If more space is needed, attach additional statements.)

Form 709 (2013)

Form 709 (2013)

Page 3

Part 4Taxable Gift Reconciliation

1 2 3 Total value of gifts of donor. Add totals from column H of Parts 1, 2, and 3 . Total annual exclusions for gifts listed on line 1 (see instructions) . . . . Total included amount of gifts. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3

Deductions (see instructions) 4 Gifts of interests to spouse for which a marital deduction will be claimed, based on item numbers of Schedule A . . 5 6 7 8 9 10 11 Exclusions attributable to gifts on line 4 . . Marital deduction. Subtract line 5 from line 4 . Charitable deduction, based on item nos. . . . . . . . . . . . . . . . . . . less exclusions . . .

4 5 6 7 . . . . . . . . 8 9 10 11

Total deductions. Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . Subtract line 8 from line 3 . . . . . . . . . . . . . . . . . . . . . . Generation-skipping transfer taxes payable with this Form 709 (from Schedule D, Part 3, col. H, Total) Taxable gifts. Add lines 9 and 10. Enter here and on page 1, Part 2Tax Computation, line 1 . .

Terminable Interest (QTIP) Marital Deduction. (see instructions for Schedule A, Part 4, line 4) If a trust (or other property) meets the requirements of qualified terminable interest property under section 2523(f), and: a. The trust (or other property) is listed on Schedule A, and b. The value of the trust (or other property) is entered in whole or in part as a deduction on Schedule A, Part 4, line 4, then the donor shall be deemed to have made an election to have such trust (or other property) treated as qualified terminable interest property under section 2523(f). If less than the entire value of the trust (or other property) that the donor has included in Parts 1 and 3 of Schedule A is entered as a deduction on line 4, the donor shall be considered to have made an election only as to a fraction of the trust (or other property). The numerator of this fraction is equal to the amount of the trust (or other property) deducted on Schedule A, Part 4, line 6. The denominator is equal to the total value of the trust (or other property) listed in Parts 1 and 3 of Schedule A. If you make the QTIP election, the terminable interest property involved will be included in your spouses gross estate upon his or her death (section 2044). See instructions for line 4 of Schedule A. If your spouse disposes (by gift or otherwise) of all or part of the qualifying life income interest, he or she will be considered to have made a transfer of the entire property that is subject to the gift tax. See Transfer of Certain Life Estates Received From Spouse in the instructions. 12 Election Out of QTIP Treatment of Annuities

Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter the item numbers from Schedule A for the annuities for which you are making this election

SCHEDULE B

Gifts From Prior Periods

If you answered Yes, on line 11a of page 1, Part 1, see the instructions for completing Schedule B. If you answered No, skip to the Tax Computation on page 1 (or Schedules C or D, if applicable). Complete Schedule A before beginning Schedule B. See instructions for recalculation of the column C amounts. Attach calculations.

A Calendar year or calendar quarter (see instructions) B Internal Revenue office where prior return was filed C Amount of applicable credit (unified credit) against gift tax for periods after December 31, 1976 D Amount of specific exemption for prior periods ending before January 1, 1977 E Amount of taxable gifts

1 2 3

Totals for prior periods

1 2 3

Amount, if any, by which total specific exemption, line 1, column D is more than $30,000 . . . . . . Total amount of taxable gifts for prior periods. Add amount on line 1, column E and amount, if any, on line 2. Enter here and on page 1, Part 2Tax Computation, line 2 . . . . . . . . . . . . . . .

(If more space is needed, attach additional statements.)

Form 709 (2013)

Form 709 (2013)

Page 4

SCHEDULE C

Deceased Spousal Unused Exclusion (DSUE) Amount

Provide the following information to determine the DSUE amount and applicable credit received from prior spouses. Complete Schedule A before beginning Schedule C.

A Name of Deceased Spouse (dates of death after December 31, 2010 only) B Date of Death C Portability Election Made? Yes No D If Yes, DSUE Amount Received from Spouse E F DSUE Amount Applied Date of Gift(s) by Donor to Lifetime (enter as mm/dd/yy Gifts (list current and for Part 1 and as prior gifts) yyyy for Part 2)

Part 1DSUE RECEIVED FROM LAST DECEASED SPOUSE Part 2DSUE RECEIVED FROM PREDECEASED SPOUSE(S)

TOTAL (for all DSUE amounts applied for Part 1 and Part 2) 1 2 3 4 Donors basic exclusion amount (see instructions) Total from column E, Parts 1 and 2 . . . . . Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3 4

Applicable credit on amount in line 3 (See Table for Computing Gift Tax in the instructions). Enter here and on line 7, Part 2Tax Computation . . . . . . . . . . . . . . . . . . . . .

SCHEDULE D

Computation of Generation-Skipping Transfer Tax

Note. Inter vivos direct skips that are completely excluded by the GST exemption must still be fully reported (including value and exemptions claimed) on Schedule D. Part 1Generation-Skipping Transfers

A Item No. (from Schedule A, Part 2, col. A) B Value (from Schedule A, Part 2, col. H) C Nontaxable Portion of Transfer D Net Transfer (subtract col. C from col. B)

Gifts made by spouse (for gift splitting only)

(If more space is needed, attach additional statements.)

Form 709 (2013)

Form 709 (2013)

Page 5

Part 2GST Exemption Reconciliation (Section 2631) and Section 2652(a)(3) Election

Check here if you are making a section 2652(a)(3) (special QTIP) election (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3 4 5 6 7 8

H Generation-Skipping Transfer Tax (multiply col. B by col. G)

Enter the item numbers from Schedule A of the gifts for which you are making this election 1 Maximum allowable exemption (see instructions) . . . . . . . . . . . 2 3 4 5 6 Total exemption used for periods before filing this return . . . . . . . . . . . . . . . . . . . . .

Exemption available for this return. Subtract line 2 from line 1 .

Exemption claimed on this return from Part 3, column C total, below .

Automatic allocation of exemption to transfers reported on Schedule A, Part 3 (see instructions) . . . . . . Exemption allocated to transfers not shown on line 4 or 5, above. You must attach a Notice of Allocation. (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add lines 4, 5, and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 8

Exemption available for future transfers. Subtract line 7 from line 3

B Net Transfer (from Schedule D, Part 1, col. D) C GST Exemption Allocated D Divide col. C by col. B

Part 3Tax Computation

A Item No. (from Schedule D, Part 1) E Inclusion Ratio (Subtract col. D from 1.000) F Maximum Estate Tax Rate G Applicable Rate (multiply col. E by col. F)

40% (.40)

40% (.40)

40% (.40)

40% (.40) 40% (.40) 40% (.40)

Gifts made by spouse (for gift splitting only)

40% (.40) 40% (.40) 40% (.40) 40% (.40) 40% (.40) 40% (.40)

Total exemption claimed. Enter here and on Part 2, line 4, above. May not exceed Part 2, line 3, above . . . . . . .

Total generation-skipping transfer tax. Enter here; on page 3, Schedule A, Part 4, line 10; and on page 1, Part 2Tax Computation, line 16 . . . . . . . . . . . . . .

Form 709 (2013)

(If more space is needed, attach additional statements.)

Das könnte Ihnen auch gefallen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- United States Gift (And Generation-Skipping Transfer) Tax ReturnDokument5 SeitenUnited States Gift (And Generation-Skipping Transfer) Tax ReturnpdizypdizyNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- 709 Form 2005 SampleDokument4 Seiten709 Form 2005 Sample123pratus91% (11)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- F 706Dokument31 SeitenF 706Bogdan PraščevićNoch keine Bewertungen

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-310622354Noch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024, Professional EditionVon EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNoch keine Bewertungen

- 1040x2 PDFDokument2 Seiten1040x2 PDFolddiggerNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnHamzah B ShakeelNoch keine Bewertungen

- Submitting Your U.S. Tax Documents: Print, Sign, MailDokument5 SeitenSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- United States Gift (And Generation-Skipping Transfer) Tax ReturnDokument4 SeitenUnited States Gift (And Generation-Skipping Transfer) Tax ReturnHazem El SayedNoch keine Bewertungen

- F 1040Dokument2 SeitenF 1040Kevin RowanNoch keine Bewertungen

- FTF1301242185129Dokument3 SeitenFTF1301242185129Donna SchatzNoch keine Bewertungen

- Form 1040Dokument2 SeitenForm 1040Jessi100% (6)

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDokument5 SeitenU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNoch keine Bewertungen

- Form 1040Dokument2 SeitenForm 1040karthu48Noch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-173610472Noch keine Bewertungen

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDokument28 SeitenUnited States Estate (And Generation-Skipping Transfer) Tax ReturnsirpiekNoch keine Bewertungen

- F1040nre 2012 PDFDokument2 SeitenF1040nre 2012 PDFJohanna AriasNoch keine Bewertungen

- FTF1302745105156Dokument5 SeitenFTF13027451051562sly4youNoch keine Bewertungen

- Schauer 2013 Tax ReturnDokument3 SeitenSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument6 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Noch keine Bewertungen

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDokument2 Seiten1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986Noch keine Bewertungen

- F 1040Dokument2 SeitenF 1040Sue BosleyNoch keine Bewertungen

- 1040 NR EzDokument2 Seiten1040 NR EzElena Alexandra CărăvanNoch keine Bewertungen

- Alice Tax FormDokument6 SeitenAlice Tax FormShrey MangalNoch keine Bewertungen

- Chapter 10 MERGEDDokument10 SeitenChapter 10 MERGEDola69% (13)

- Week 2 Form 1040Dokument2 SeitenWeek 2 Form 1040Linda100% (2)

- Amended U.S. Individual Income Tax ReturnDokument2 SeitenAmended U.S. Individual Income Tax Returnmarxvera158Noch keine Bewertungen

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDokument3 SeitenForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandNoch keine Bewertungen

- Example Tax ReturnDokument6 SeitenExample Tax Returnapi-252304176Noch keine Bewertungen

- 2011 1040NR-EZ Form - SampleDokument2 Seiten2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Employer's Annual Federal Tax Return For Agricultural EmployeesDokument2 SeitenEmployer's Annual Federal Tax Return For Agricultural EmployeespdizypdizyNoch keine Bewertungen

- Amended U.S. Individual Income Tax ReturnDokument2 SeitenAmended U.S. Individual Income Tax ReturnJohnNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnadrianaNoch keine Bewertungen

- Chapter 12 TR Assignment Kelsey EwellDokument22 SeitenChapter 12 TR Assignment Kelsey Ewellapi-272863459Noch keine Bewertungen

- FTF1327867575806Dokument3 SeitenFTF1327867575806erzahler0% (1)

- Form 1041Dokument4 SeitenForm 1041topsytables50% (4)

- IRS Publication Form 706Dokument4 SeitenIRS Publication Form 706Francis Wolfgang UrbanNoch keine Bewertungen

- United States Additional Estate Tax Return: General InformationDokument4 SeitenUnited States Additional Estate Tax Return: General Informationdouglas jonesNoch keine Bewertungen

- f1040 PDFDokument3 Seitenf1040 PDFjc75aNoch keine Bewertungen

- Harriet Harper Estate Tax ReturnDokument31 SeitenHarriet Harper Estate Tax ReturnDerek Wilson100% (3)

- F 1040 SaDokument2 SeitenF 1040 Saljens09Noch keine Bewertungen

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Dokument2 SeitenIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- 2014 Federal 1040 (Esther)Dokument2 Seiten2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Form 1040Dokument3 SeitenForm 1040Peng JinNoch keine Bewertungen

- Return of Private Foundation: Line 16)Dokument13 SeitenReturn of Private Foundation: Line 16)diego76diegoNoch keine Bewertungen

- Resume of Srpeak4Dokument2 SeitenResume of Srpeak4api-25647173Noch keine Bewertungen

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532Noch keine Bewertungen

- Household Employment Taxes: Schedule H (Form 1040) 44Dokument2 SeitenHousehold Employment Taxes: Schedule H (Form 1040) 44api-253299751Noch keine Bewertungen

- NATH f1040Dokument2 SeitenNATH f1040Spencer NathNoch keine Bewertungen

- Scan 0001Dokument11 SeitenScan 0001Kimmie3050% (2)

- TaxDokument9 SeitenTaxKuan ChenNoch keine Bewertungen

- Untitled PDFDokument2 SeitenUntitled PDFjenny abbottNoch keine Bewertungen

- Glacier Tax User GuideDokument5 SeitenGlacier Tax User Guideinter4ever77Noch keine Bewertungen

- AlaAL ZAALIG2011Dokument5 SeitenAlaAL ZAALIG2011Ala AlzaaligNoch keine Bewertungen

- Ebook - Brainwave - EEG and TRDokument25 SeitenEbook - Brainwave - EEG and TRBogdan PraščevićNoch keine Bewertungen

- SB6 Backboard Grounding InstructionsDokument5 SeitenSB6 Backboard Grounding InstructionsBogdan PraščevićNoch keine Bewertungen

- F 1099 GDokument8 SeitenF 1099 GpdizypdizyNoch keine Bewertungen

- Tax-Sheltered Annuity Plans (403 (B) Plans) : For Employees of Public Schools and Certain Tax-Exempt OrganizationsDokument22 SeitenTax-Sheltered Annuity Plans (403 (B) Plans) : For Employees of Public Schools and Certain Tax-Exempt OrganizationsBogdan PraščevićNoch keine Bewertungen

- I 5300Dokument7 SeitenI 5300Bogdan PraščevićNoch keine Bewertungen

- ATOM Install Notes ReadmeDokument2 SeitenATOM Install Notes ReadmeBogdan PraščevićNoch keine Bewertungen

- Application To Use LIFO Inventory MethodDokument4 SeitenApplication To Use LIFO Inventory MethodBilboDBagginsNoch keine Bewertungen

- Liber (0242) Ccxxlii - Aha!Dokument24 SeitenLiber (0242) Ccxxlii - Aha!berbagi2014Noch keine Bewertungen

- Quarterly Federal Excise Tax Return: For Irs Use OnlyDokument7 SeitenQuarterly Federal Excise Tax Return: For Irs Use OnlyBogdan PraščevićNoch keine Bewertungen

- 2012 990xDokument12 Seiten2012 990xBrian DanzaNoch keine Bewertungen

- Jaynes HistoryDokument2 SeitenJaynes HistoryMichael CrowleyNoch keine Bewertungen

- Angela SashesDokument171 SeitenAngela SashesBogdan PraščevićNoch keine Bewertungen

- IRS Publication f712Dokument3 SeitenIRS Publication f712Francis Wolfgang UrbanNoch keine Bewertungen

- F 11 CDokument6 SeitenF 11 CBogdan PraščevićNoch keine Bewertungen

- F 637Dokument6 SeitenF 637Bogdan PraščevićNoch keine Bewertungen

- Status FormDokument3 SeitenStatus FormAbdul Latief FaqihNoch keine Bewertungen

- F 56Dokument2 SeitenF 56Bogdan PraščevićNoch keine Bewertungen

- F 211Dokument2 SeitenF 211Bogdan PraščevićNoch keine Bewertungen

- Che Guevara - Growth and ImperialismDokument60 SeitenChe Guevara - Growth and ImperialismMattyNoch keine Bewertungen

- Martial Arts - Bruce Lee's Training SecretsDokument3 SeitenMartial Arts - Bruce Lee's Training Secretsbrogan91% (34)

- Collection Information Statement For Wage Earners and Self-Employed IndividualsDokument6 SeitenCollection Information Statement For Wage Earners and Self-Employed IndividualspdizypdizyNoch keine Bewertungen

- Che Guevara On Development 1964Dokument37 SeitenChe Guevara On Development 1964Orejitas Kresse NiñoNoch keine Bewertungen

- Che Guevara - Afro-Asian ConferenceDokument13 SeitenChe Guevara - Afro-Asian Conferenceandu_mihai_1Noch keine Bewertungen

- Wilson, Robert Anton - The Illuminati PapersDokument5 SeitenWilson, Robert Anton - The Illuminati PapersJoel VandiverNoch keine Bewertungen

- Che Guevara - The Cadres PDFDokument10 SeitenChe Guevara - The Cadres PDFJiran HaNoch keine Bewertungen

- Che Guevara - Exceptional CaseDokument12 SeitenChe Guevara - Exceptional CaseMattyNoch keine Bewertungen

- Frfinbref 237011 enDokument3 SeitenFrfinbref 237011 enPatrik Svensson100% (1)

- Ang Giok Chip V Springfield GDokument6 SeitenAng Giok Chip V Springfield GLiDdy Cebrero BelenNoch keine Bewertungen

- Rule 67Dokument2 SeitenRule 67Dennis Aran Tupaz AbrilNoch keine Bewertungen

- Othello Trademark LawsuitDokument23 SeitenOthello Trademark LawsuitMark Jaffe0% (1)

- Dr. Jorge Rabadilla vs. CADokument3 SeitenDr. Jorge Rabadilla vs. CAAnaNoch keine Bewertungen

- COA Res 91-52Dokument2 SeitenCOA Res 91-52Kath Erine75% (4)

- Contract Law: For Other Uses, SeeDokument25 SeitenContract Law: For Other Uses, SeeJasonry BolongaitaNoch keine Bewertungen

- Stridhan and Woman'sDokument10 SeitenStridhan and Woman'sSanjeev PalNoch keine Bewertungen

- Cariño vs. Insular Government of The Philippine IslandsDokument6 SeitenCariño vs. Insular Government of The Philippine IslandsAmanda ButtkissNoch keine Bewertungen

- Sampling Materials For ShotcreteDokument2 SeitenSampling Materials For Shotcretesmanoj354Noch keine Bewertungen

- The Law of Evidence ProjectDokument19 SeitenThe Law of Evidence ProjectShubham GithalaNoch keine Bewertungen

- EJS - W (Draft)Dokument3 SeitenEJS - W (Draft)Louie VergaraNoch keine Bewertungen

- Amma v. T. Narayana Bhatta: Has The Recent DecisionDokument8 SeitenAmma v. T. Narayana Bhatta: Has The Recent DecisionRidz100% (1)

- Special Power Attorney TemplateDokument2 SeitenSpecial Power Attorney TemplateNoel Ephraim AntiguaNoch keine Bewertungen

- Dulay vs. Court of Appeals April 31, 1995Dokument6 SeitenDulay vs. Court of Appeals April 31, 1995Marianne Shen PetillaNoch keine Bewertungen

- Ac Enterprises V Frabelle Properties Corp.Dokument3 SeitenAc Enterprises V Frabelle Properties Corp.rhodz 88Noch keine Bewertungen

- HardenDokument10 SeitenHardenJan Nikka EstefaniNoch keine Bewertungen

- Castillo v. PascoDokument2 SeitenCastillo v. PascoDondon SalesNoch keine Bewertungen

- II. Administrative LawDokument48 SeitenII. Administrative Lawdnel13Noch keine Bewertungen

- Basic Parliamentary Procedure: Courtesy of University of Northern IowaDokument3 SeitenBasic Parliamentary Procedure: Courtesy of University of Northern IowaU-one FragoNoch keine Bewertungen

- OBLICON Midterms ReviewerDokument14 SeitenOBLICON Midterms ReviewerMichael LagundiNoch keine Bewertungen

- 43.1 Mercado-Fehr vs. Fehr DigestDokument2 Seiten43.1 Mercado-Fehr vs. Fehr DigestEstel Tabumfama100% (1)

- Supreme Court of The Australian Capital Territory Court of AppealDokument51 SeitenSupreme Court of The Australian Capital Territory Court of AppealToby VueNoch keine Bewertungen

- Swaminathan Offer Letter PDFDokument3 SeitenSwaminathan Offer Letter PDFElakkiyaNoch keine Bewertungen

- ANSWER KEY - ObligationsDokument2 SeitenANSWER KEY - Obligationssad nuNoch keine Bewertungen

- Macalincag v. ChangDokument1 SeiteMacalincag v. ChangGRNoch keine Bewertungen

- National Rice and Corn CorporationDokument1 SeiteNational Rice and Corn CorporationIda ChuaNoch keine Bewertungen

- Toledo v. Hyden DigestDokument2 SeitenToledo v. Hyden DigestEmelie Marie Diez100% (1)

- 6 - Holdings Lessee Information Sheet Maam AngieDokument2 Seiten6 - Holdings Lessee Information Sheet Maam AngieMickey MeowNoch keine Bewertungen

- Ocampo-Paule vs. CADokument2 SeitenOcampo-Paule vs. CARemelyn SeldaNoch keine Bewertungen