Beruflich Dokumente

Kultur Dokumente

4QFY14E Results Preview: Institutional Research

Hochgeladen von

Gunjan ShethOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4QFY14E Results Preview: Institutional Research

Hochgeladen von

Gunjan ShethCopyright:

Verfügbare Formate

INSTITUTIONAL RESEARCH

4QFY14E Results Preview

INDUSTRIES COVERED AND CONTRIBUTING ANALYSTS

INDUSTRY Autos Banks & NBFCs ANALYST Sorabh Talwar Darpin Shah Shivraj Gupta Sameer Narang Abhinav Sharma Ankur Kulshrestha Himanshu Shah Harsh Mehta Madhu Babu Satish Mishra Meeta Shetty, CFA Adhidev Chattopadhyay EMAIL ID sorabh.talwar@hdfcsec.com darpin.shah@hdfcsec.com shivraj.gupta@hdfcsec.com sameer.narang@hdfcsec.com abhinav.sharma@hdfcsec.com ankur.kulshrestha@hdfcsec.com himanshu.shah@hdfcsec.com harsh.mehta@hdfcsec.com madhu.babu@hdfcsec.com satish.mishra@hdfcsec.com meeta.shetty@hdfcsec.com adhidev.chattopadhyay@hdfcsec.com PHONE NO. +91-22-6171-7321 +91-22-6171-7328 +91-22-6171-7324 +91-22-6171-7327 +91-22-6171-7331 +91-22-6171-7346 +91-22-6171-7325 +91-22-6171-7329 +91-22-6171-7316 +91-22-6171-7334 +91-22-6171-7338 +91-22-6171-7317

Capital Goods, Power Cement, Metals & Mining Education, Media, Telecom FMCG IT Services Oil & Gas, Chemicals & Fertilisers, Sugar Pharmaceuticals Real Estate, Ports, Retail

11 April 2014

4QFY14E RESULTS PREVIEW

Autos : Demand weakness continues

For autos the quarter remained a mixed bag. While there was some demand traction in tractors and 2Ws (rural plays), PVs and CVs remained weak. CVs were the most impacted given weak demand and high discounts. Excise duty cut failed to cheer the demand, at least so far. We expect excise cut driven demand to be more back ended and visible in 1QFY15. In 2Ws while scooters registered a strong growth, motorcycles remained weak. PV sales remain discounts/promotion driven. Recent launches from Maruti (Celerio), Honda (new City) and Ford (EcoSport) did well. Demand continues to remain muted given slowdown in industrial activity, inflation and fuel prices, which dampened consumer sentiments. We believe any demand recovery will be post election only and has to be driven by improvement in broad macros. Hero MotoCorp (BUY, TP Rs 2,372), M&M (BUY, TP Rs 1,182) and Tata Motors (BUY, SOTP Rs 463) remain preferred picks in autos.

CVs : We expect AL and Tata Motors (standalone) to report losses on lower sales. However, Tata Motors (consolidated) will benefit with strong volume growth for JLR and currency movement. Strong performance of 2Ws for Eicher will help negate weakness in CVs. We expect margins to deteriorate QoQ given adverse currency, higher discounts/incentives to push sales, inventory loss on excise duty reduction and marginal rise in commodity prices. Margins for the CV players is expected to remain weak given demand weakness and high discounting while margins for 2Ws should remain flat QoQ. M&M will witness margin dilution given full year impact of MTBL merger in the current quarter. Eicher is expected to report robust margins led by strong standalone (RE) performance.

Margins to moderate QoQ

Key management commentary to watch for

Bajaj Auto : FY15 volumes/margins guidance, updates on new launches, forex hedges on exports, RE60 launch (for export and domestic market). Hero MotoCorp : FY15 volumes/margin guidance, update on export plans and new launches. Maruti Suzuki : Channel inventory, discounts and new launches, FY15 volume/margin guidance, forex hedges. M&M : FY15 Auto/tractor guidance, update on Ssangyong, new launches. Tata Motors : Update on forex hedges (JLR operations), volume guidance for MHCVs and PVs, inventory levels, discounts.

2

Sector outlook

We expect auto companies in our coverage universe to report ~15% earnings growth over 4Q last year led by ~11% revenue growth and ~90bps margin expansion. 2Ws : We expect both Hero MotoCorp and Bajaj Auto to report revenue growth YoY. While we expect Hero MotoCorps margin to improve QoQ, Bajaj Auto will witness a marginal drop in margins sequentially given weak demand and currency. PVs : We expect MSIL to report strong earnings growth YoY led by better margins. While higher tractor contribution will benefit M&M, MTBL merger will be earnings dilutive in the quarter.

4QFY14E RESULTS PREVIEW

4QFY14E : Autos universe

COMPANY Amara Raja Ashok Leyland Bajaj Auto Balakrishna Inds Eicher Motors Exide Industries Hero Motocorp M&M Maruti Suzuki Suprajit Engg Tata Motors Wabco India CMP (Rs) 398 24 2,022 498 6,328 123 2,207 1,021 1,960 71 431 1,910 TP (Rs) 376 18 2,122 608 5,853 119 2,372 1,182 1,962 59 463 1,831 RECO* NEU SELL NEU BUY NEU NEU BUY BUY NEU BUY BUY NEU NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 9.0 8.6 8.0 30.2 50.2 10.4 21.9 14.6 65.1 97.3 123.2 1.3 663.5 2.8 19.5 51.3 8.7 16.8 13.0 68.8 105.6 108.9 1.4 638.8 2.6 37.3 47.5 7.7 17.2 15.4 61.5 104.9 127.9 1.1 560.0 2.4 EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 1.5 1.5 1.1 1.1 10.7 2.7 2.3 1.9 8.9 12.4 15.5 0.2 100.9 0.4 -1.0 11.4 2.3 1.7 1.4 9.0 13.8 13.5 0.3 105.7 0.4 2.0 8.4 1.6 1.7 2.0 8.5 12.7 13.3 0.2 83.3 0.5 EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 16.8 17.4 13.9 3.6 21.3 25.5 10.4 12.8 13.7 12.7 12.6 18.1 15.2 13.9 -5.0 22.1 26.4 9.9 10.9 13.1 13.1 12.4 18.5 16.5 13.9 5.3 17.6 20.6 9.9 13.3 13.8 12.1 10.4 16.3 14.9 19.0 APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.9 1.0 0.6 -0.8 8.2 1.4 1.3 1.1 5.3 8.2 9.0 0.1 42.7 0.3 -2.6 9.0 1.2 1.0 1.2 5.2 9.3 6.8 0.1 48.2 0.2 0.2 7.7 0.8 1.0 1.5 5.7 8.0 11.5 0.1 38.1 0.3 4Q FY14E 5.6 (0.3) 28.4 14.6 47.5 1.3 26.4 13.9 29.8 1.1 14.9 14.4 Adj. EPS 3Q 4Q FY14 FY13 5.6 3.5 (1.0) 31.3 12.8 35.6 0.9 26.3 15.8 22.5 1.2 15.7 10.7 0.1 26.5 8.8 36.3 1.7 28.8 15.1 38.0 1.0 12.4 14.7

Source : Company, HDFC sec Inst Research * Last published

4QFY14E RESULTS PREVIEW

Banks : Subdued earnings, hope lingers

Net earnings remain under pressure for PSBs; PVT Banks growth rate moderates : We expect PAT of our coverage PSBs to decline ~19% YoY on lower base (~20% YoY fall in 4QFY13). The continued (since last 6 quarters) PAT de-growth is on the back of higher opex and other provisions (loan loss and MTM). PAT growth of PVT Banks under our coverage is expected to moderate further from 15.5% in 3QFY14 (vs. 20+% in previous quarters) to 12% YoY led by slowing revenue growth and high NPA provisions. On aggregate basis, we expect PAT to decline ~7% YoY vs. ~12% YoY decline in 3QFY14. NII growth bottoming out for PSBs : PSBs are expected to report 2nd consecutive quarter of double digit NII growth (~15% vs. 11% in 3QFY14), compared to lower single digit growth witnessed in the past 5 quarters. Improving NII growth of PSBs is expected on theback of marginal improvement / stable QoQ margin. Led by QoQ margin compression in AXIS and ICICIBC, we expect PVT Banks NII growth to moderate at 15% YoY vs. earlier quarter 20+% YoY growth. Stable headline asset quality; though stress addition to remain elevated : Sale of NPAs to ARCs and higher reductions is likely to keep headline asset quality stable for PSBs. We expect aggregate GNPA of PSBs to increase marginally by ~2% QoQ. However, slippages are expected to remain elevated at 2.9% ann. vs. 3.1% in 3QFY14 and 2.9% in 4QFY13. Further, we expect coverage ratio (PCR) for select PSBs to improve keeping credit cost elevated at 1.1% ann. Within, PVT Banks, we expect net QoQ addition to GNPA level for AXIS, ICICI and IIB while expect sequential improvement in FED and SIB banks asset quality. Opex one amongst many differentiators : Relatively slower revenue growth (13.7% YoY vs. ~17.6% YoY in 3QFY14) of PVT Banks is likely to get compensated by tight control over opex (14% YoY vs. ~17% YoY in 3QFY14), thus maintaining C/I ratio at ~42%. On other hand, PSBs opex are expected to remain on the higher side owing to high pension and wage bill, keeping C/I ratio elevated at ~50%+. Business growth moderate in 4Q; CASA ratio to decline QoQ : 4QFY14 loan growth is expected to be moderate at 5% QoQ (unlike historical phenomenon of strong QoQ growth). On YoY basis, we expect, loan growth of ~16%, driven by 17% growth by PVT banks and ~ 16% by PSBs. LDR is expected to remain elevated at 79% for PSBs (ex: SBI at ~75%) and for PVT (ex: ICICI) at 82%.

Outlook

Banking indices have outperformed the broader indices by ~14% in the past six months with strong outperformance by PSBs (avg ~15%). While PVT banks have outperformed the broader indices by ~13%. Despite the recent run up and outperformance by PSBs, they continue to trade at attractive valuations. We believe with gradual improvements in the economy, worst of twin deficit behind us and supportive measure by the regulator, makes us positive on the banking sector. Our top picks are ICICIBC, AXSB and FB (PVT Banks) and SBIN, PNB and BOB amongst PSBs.

4QFY14E RESULTS PREVIEW

4QFY14E : Financials universe

COMPANY Allahabad Bank Bank of Baroda Bank of India Canara Bank Oriental Bank PNB SBI South Indian Bank Union Bank of India Axis Bank Federal Bank ICICI Bank IndusInd Bank ING Vysya Bank Yes Bank CMP (Rs) 95 787 238 284 233 783 2,028 24 152 1,504 98 1,247 512 611 447 TP (Rs) 95 879 254 305 259 881 2,179 28 156 1,664 116 1,341 567 723 475 RECO NEU BUY NEU NEU BUY BUY BUY BUY NEU BUY BUY BUY BUY BUY NEU 4Q FY14E 13.7 31.5 28.9 23.7 13.0 10.3 130.0 3.6 20.6 31.0 5.7 44.1 7.7 4.4 7.3 NII (Rs bn) 3Q FY14 13.4 30.6 27.2 22.3 12.3 9.4 126.4 3.5 19.6 29.8 5.5 42.6 7.3 4.2 6.7 NII (Rs bn) 3Q FY14 6.7 4.6 6.8 21.6 18.2 4.6 9.4 4Q FY13 10.6 28.1 24.8 20.9 12.1 11.7 110.8 3.3 19.8 26.6 4.8 38.0 6.6 4.2 6.4 4Q FY14E 9.8 23.2 22.6 16.6 9.2 28.9 82.7 2.3 14.0 29.0 3.9 44.4 6.7 3.0 7.0 PPOP(Rs bn) 3Q 4Q FY14 FY13 10.1 7.7 22.0 21.4 15.9 8.6 27.0 76.2 2.2 12.6 26.2 3.6 44.4 6.5 2.7 6.1 21.8 20.8 17.0 9.5 28.5 77.6 2.1 16.8 28.0 3.7 36.0 5.4 2.8 6.3 4Q FY14E 2.7 9.3 6.7 5.6 1.9 9.2 25.9 1.3 4.5 17.7 2.1 25.8 3.7 1.8 4.4 APAT (Rs bn) 3Q 4Q FY14 FY13 3.3 1.3 10.6 5.9 4.1 2.2 7.6 22.3 1.4 3.5 16.0 2.3 25.3 3.5 1.7 4.2 10.7 7.6 7.3 3.1 11.3 33.0 1.5 7.9 15.6 2.2 23.0 3.1 1.7 3.6 4Q FY14E 4.9 21.3 10.4 12.1 6.4 25.5 37.8 1.2 7.2 37.8 2.4 22.4 7.0 9.4 12.2 Adj. EPS 3Q FY14 6.0 24.3 9.1 8.9 7.5 20.9 32.7 1.1 5.5 34.2 2.7 21.9 6.6 8.9 11.6 Adj. EPS 3Q FY14 3.3 6.5 2.9 11.6 12.4 21.8 13.3 4Q FY13 2.5 24.4 12.7 16.4 10.6 32.0 48.2 1.1 13.2 33.2 2.6 20.0 5.9 11.0 10.1

COMPANY IDFC LIC Housing Finance M & M Financial PFC REC Shriram City Union Shriram Trans Fin

CMP (Rs) 125 268 246 196 243 1,220 782

TP (Rs) 122 287 260 238 269 1,433 830

RECO NEU BUY NEU BUY NEU BUY NEU

4Q FY14E 6.6 5.2 8.7 22.1 18.5 4.9 9.4

4Q FY13 6.5 3.0 6.6 17.5 14.1 4.6 8.9

4Q FY14E 7.3 5.2 5.2 21.7 18.5 3.1 7.7

PPOP(Rs bn) 3Q 4Q FY14 FY13 7.2 8.6 4.5 4.3 21.4 17.5 2.9 7.3 4.1 4.7 17.3 14.3 3.0 7.5

4Q FY14E 4.5 3.9 3.2 15.1 12.6 1.4 3.3

APAT (Rs bn) 3Q 4Q FY14 FY13 5.0 5.3 3.3 1.6 15.4 12.3 1.3 3.0 3.2 3.3 12.9 9.6 1.3 3.6

4Q FY14E 2.9 7.6 5.7 11.4 12.8 24.1 14.5

4Q FY13 3.5 6.3 5.4 9.8 9.7 22.7 15.7 5

4QFY14E RESULTS PREVIEW

Capital Goods : The burden of expectations

Despite no visible change in economic fundamentals, stocks under our coverage have gone up 10-40% in last three months on the hopes of a domestic capex revival, driven by a stable govt. at the centre P/E valuations (in most cases) have reached/surpassed 2010 highs. We believe that current valuations leave little room for upside and hence are cautious on the sector. We expect L&T to report order inflow in the range of Rs 220-230bn. 4QFY14 numbers are not comparable YoY as the co. has demerged the hydrocarbon business. We build in EBITDA margin of 12.4%. Companys FY15 guidance and detailed numbers of hydrocarbon business will be key monitorables. We expect flattish numbers for Thermax and order inflows of Rs 1214bn. Managements commentary on order inflow trajectory for FY15 will be keenly watched out for. Crompton Greaves should report a big jump in YoY profits due to low base in 4QFY13. We expect a PAT of Rs 1.6bn for standalone business and EBITDA margin of 2.1% for the overseas subsidiaries. Voltas should report a steady quarter. Signs of improvement in MEP business and sustainability of high margin and growth in the consumer durable segment will be the key monitorables. Cummins should report a flattish PAT YoY. Managements FY15 guidance and margin performance during the quarter will be keenly watched out for.

COMPANY Crompton Greaves Cummins India Larsen & Toubro Thermax Voltas

CMP (Rs) 175 568 1,314 759 167

TP (Rs) 98 458 1,134 636 121

RECO* NEU NEU NEU NEU SELL

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 37.7 33.5 33.9 11.0 198.4 14.9 14.6 10.0 143.9 10.1 11.1 11.5 202.9 14.7 15.9

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.3 1.7 0.8 1.9 24.5 1.6 0.8 1.8 16.7 0.9 0.6 1.9 24.5 1.7 0.8

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 6.2 5.0 2.3 17.0 12.4 10.7 5.5 17.5 11.6 9.0 5.7 16.8 12.1 11.4 4.9

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 1.06 0.62 0.25 1.49 16.55 1.18 0.63 1.47 11.36 0.67 0.58 1.39 17.69 1.15 0.57

4Q FY14E 1.7 5.4 17.9 9.9 1.9

Adj. EPS 3Q 4Q FY14 FY13 1.0 0.4 5.3 12.3 5.6 1.7 5.0 19.2 9.7 1.7

Source : Company, HDFC sec Inst Research * Last published

4QFY14E RESULTS PREVIEW

Cement : Regional divergence sharpens

Fortunes of companies in 4QFY14 will differ sharply. While cement prices in North have remained strong followed by closure of Binani Cement in the peak season, prices in South continued their weak streak due to strong volume push by AP cement cos. On an average, cement prices would have stayed flat in 4Q, masking the sharp divergence between the two large producer regions . No significant changes to cost structure on variable level are anticipated, with higher freight costs likely to be offset by lower energy costs.

CMP (Rs) 1,389 212 289 2,825 68 60 5,613 214 2,246 TP (Rs) 1,134 160 300 3,416 58 51 5,440 166 1,840 NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 30.3 26.9 29.1 25.7 8.0 80.2 11.4 36.8 17.0 9.0 58.3 21.9 7.1 71.2 10.3 31.6 13.2 8.7 47.9 25.5 6.7 76.7 11.9 39.1 14.6 9.3 53.9

YoY trends for EBITDA/t will show sharp divergence: Companies with exposure to South with see their EBITDA/t decline 13-50% while others will register significant (10-50%) improvement. Given the weak demand scenario, we are cautious on large caps which are trading at higher end of their historical trading ranges. At current valuations Birla Corp and Grasim are our top picks.

COMPANY ACC Ambuja Cement Birla Corp Grasim Industries India Cements Jaiprakash Asso Shree Cement The Ramco Cements UltraTech Cement

RECO SELL SELL BUY BUY NEU NEU NEU SELL SELL

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 3.9 2.6 4.5 6.0 1.1 14.2 0.9 9.1 4.9 1.5 12.1 2.9 0.3 10.4 1.4 7.5 2.7 1.6 7.6 5.1 0.6 15.8 1.7 8.9 4.2 1.7 12.0

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 13.0 9.8 15.3 23.5 13.9 17.7 7.5 24.8 28.8 17.1 20.8 13.2 4.2 14.6 13.5 23.5 20.5 17.8 16.0 20.1 9.6 20.6 14.1 22.9 28.8 18.7 22.3

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.4 2.8 4.4 4.0 0.6 5.2 -0.6 -0.2 2.6 0.2 6.6 3.2 0.2 3.3 0.0 -1.9 1.1 0.3 3.7 4.9 0.7 6.1 0.3 1.8 2.7 1.0 7.3

4Q FY14E 12.7 2.6 8.4 57.2 -2.0 -0.1 75.5 0.7 24.1

Adj. EPS 3Q 4Q FY14 FY13 14.8 23.3 2.1 2.1 36.2 0.0 -0.8 32.2 1.1 13.4 3.2 9.4 66.9 0.9 0.8 78.7 4.1 26.4

Source : Company, HDFC sec Inst Research

4QFY14E RESULTS PREVIEW

Chemicals & Fertilisers : Cycle turning

Recent positive policy actions in fertilisers

CCEA has approved the NBS for complex fertilisers for FY15. Barring potash (-18% reduction), subsidies for other nutrients are unchanged. This will lead to stable farmgate price/margins. In Feb14, CCEA approved an increase in fixed subsidy for urea players by Rs 350/t; we see this as strong positive.

Q4 is a lean quarter. More than the results the following events will be keenly watched

Chambal Fertilisers : Losses in software division and profitability in IPP linked urea. Outlook for trading in FY15 Deepak Fertilisers : Chemical segment margins and TAN volumes GSFC : Impact of anone modernisation project on chemicals margins and caprolactam-benzene spread outlook Coromandel international : Outlook of excess channel inventory and guidance for capacity utilisation PI Industries : Growth guidance for custom synthesis biz and new molecule launches Rallis India : Guidance on new molecule launches UPL : Guidance for FY15

We sense a turnaround for the sector over the next one year

There are multiple triggers for fertiliser sector; (1) Profit decline is over, the worst is behind us (2) Hope for positive policy actions (3) Improving fundamentals [INR, RM prices, channel inventory, receivables] (4) Attractive valuations [value/ time correction is nearing an end].

COMPANY Deepak Fertilisers PI Industries Rallis India UPL Chambal Fertilisers Coromandel Int GSFC

CMP (Rs) 119 258 170 212 44 222 56

TP (Rs) 110 260 182 234 51 264 56

RECO* NEU BUY NEU BUY BUY BUY NEU

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 7.4 10.1 6.6 3.8 3.1 30.5 15.1 22.0 14.9 3.6 4.0 26.5 23.6 27.6 14.6 3.3 2.8 28.2 15.4 20.8 17.0

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.9 1.4 0.7 0.5 0.3 5.8 1.4 1.5 1.2 0.6 0.6 4.7 2.3 2.2 1.4 0.4 0.3 5.4 1.3 0.8 1.3

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 12.2 13.7 10.6 12.5 10.7 19.1 9.0 7.0 8.2 17.3 13.9 17.6 9.9 8.0 9.4 12.5 9.9 19.0 8.1 4.0 7.5

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.5 0.7 0.3 0.2 0.2 2.8 0.3 0.6 0.7 0.4 0.3 2.5 0.9 0.9 1.0 0.2 0.1 3.0 0.2 0.1 0.6

Adj. EPS (Rs/sh) 4Q 3Q 4Q FY14E FY14 FY13 5.4 8.1 3.3 1.8 1.0 6.3 0.8 2.3 1.7 2.7 1.5 5.6 2.2 3.3 2.5 1.5 0.6 6.8 0.6 0.5 1.5

Source : Company, HDFC sec Inst Research * Last published

8

4QFY14E RESULTS PREVIEW

Education : Triggers persist, growth revival key

We estimate Navneet Education (NEL) to report standalone revenues of Rs 1.85bn, +11.5% yoy. We expect publication segment revenue to grow by 8% yoy and stationery segment to grow by 13%yoy. EBITDA is expected to grow by healthy 22% yoy to Rs 339mn owing to lower SG&A cost. PAT to grow by 38% yoy to Rs 184mn. In 9MFY14 NEL reported weak revenue growth of 8% and earnings were flat YoY. This is against the management guidance of 15% revenue/earnings growth. In 9MFY14, publication business revenue grew by 5.5% and EBIT grew by 5.9% YoY. Publication contributes ~60% of standalone revenues whereas the rest comes from stationery. Despite standard X syllabus change in Maharashtra state (60% of segment revenue), revenue growth was modest owing to high base and absence of government orders (~5% of segment revenue in FY13). In 9MFY14, stationery business revenue grew by healthy 14%. But, EBIT declined by 11% YoY owing to an increase in paper cost and notional forex loss on export receivables. However, these issues are behind us. We were foreseeing NEL as a rerating target led by multiple growth triggers in core publication business viz. syllabus change (common curriculum evolution), government orders for supplementary books, expansion in Andhra Pradesh and Delhi-NCR. Though the triggers persist, visibility remains dim. Management is hopeful of growth revival in FY15 led by confirmed government order of ~Rs 200mn to be executed in 1QFY15, syllabus change for more number of standards and increased contribution from Andhra Pradesh and Delhi-NCR, albeit on lower base. Maintain BUY with TP of Rs 68 @ 12x FY15E EPS. NEL is trading at an attractive 12.8x/10..8x FY14/15E EPS. Revival in growth could lead to further re-rating.

COMPANY Navneet Education

CMP (Rs) 60

TP (Rs) 68

RECO* BUY

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 1.85 1.33 1.7

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.3 0.3 0.3

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 18.3 19.6 16.7

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.2 0.1 0.1

4Q FY14E 0.8

Adj. EPS 3Q 4Q FY14 FY13 0.5 0.6

Source : Company, HDFC sec Inst Research * Last published

4QFY14E RESULTS PREVIEW

FMCG : Another subdued quarter

4QFY14 will prove to be yet another subdued quarter. Even as urban consumption continues to reel under pressure, benefits of election spending and good monsoon failed to stimulate rural volumes. HDFC securities expectation for volume growth is : Colgate (+9%), Dabur (+8%), Emami (+5%), HUL (+4%), ITC (0-1%) in cigarettes, Nestle (+2%), Pidilite (+10%) and Marico (5-6%). Furthermore, we expect a volume growth of 9-10% in paint companies (Asian Paints and Berger) in the domestic decorative paints segment. 4QFY14 has witnessed sharp rise in input cost (Copra, Palm oil, VAM, LLP, Milk, Coffee, etc), which led to cut in promotions and increased pricing actions. We will closely track the probable drought in parts of India due to El Nino.

CMP COMPANY Asian Paints Berger Paints Dabur India Emami Godrej Consumer Hind. Unilever ITC Marico Nestle India Pidilite (Rs) 542 232 181 460 864 618 344 212 4,881 327 TP (Rs) 500 225 1,155 192 490 742 560 380 215 4,500 305 RECO NEU NEU SELL BUY NEU SELL NEU BUY NEU SELL BUY NET SALES (Rs bn) 4Q FY14E 31.5 9.2 9.4 17.6 4.9 20.4 69.8 90.8 10.4 24.9 9.5 3Q FY14 34.5 10.3 8.9 19.1 5.8 19.8 72.2 87.3 12.0 22.6 10.7 4Q FY13 27.3 8.1 8.3 15.4 4.5 17.2 64.7 82.6 10.0 22.6 8.4 EBITDA (Rs bn) 4Q FY14E 4.5 1.0 1.8 3.0 1.2 3.1 10.8 30.4 1.3 5.7 1.4 3Q FY14 5.4 1.3 1.5 3.0 1.8 3.1 12.3 32.8 2.0 4.8 1.6 4Q FY13 3.9 0.9 1.7 2.7 1.0 2.8 9.7 27.1 1.2 5.4 1.2 EBITDA Margin (%) 4Q FY14E 14.3 11.0 19.0 17.4 24.2 15.1 15.5 33.5 12.1 22.8 14.2 3Q FY14 15.6 12.8 16.9 15.6 30.2 15.7 17.0 37.6 16.8 21.1 14.9 4Q FY13 14.4 10.9 20.3 17.7 22.2 16.2 15.0 32.8 12.0 23.9 14.2 APAT (Rs bn) 4Q FY14E 2.8 0.5 1.3 2.3 1.0 2.3 8.4 21.7 0.8 3.0 1.0 3Q FY14 3.3 0.8 1.1 2.4 1.5 2.0 9.6 23.9 1.4 2.8 1.0 4Q FY13 2.5 0.4 1.2 2.0 1.0 2.1 7.8 19.3 0.7 2.8 0.8 4Q FY14E 3.0 1.5 9.4 1.3 4.5 6.8 3.9 2.7 1.2 31.5 1.9 Adj. EPS 3Q FY14 3.4 2.4 9.5 1.4 6.7 5.8 4.4 3.0 2.1 28.5 2.0 4Q FY13 2.6 1.3 10.7 1.2 4.2 6.2 3.6 2.4 1.1 29.0 1.6

Post the recent run up in GCPL stock price, we downgrade the stock to SELL from NEUTRAL earlier. We believe, surge in palm oil prices and execution risks in international business will keep EBITDA margin under pressure. Also, earnings expectation factor in moderation of growth in select categories, but valuations completely ignores the emerging risks. Our preference for ITC (TP Rs 380/sh) and Dabur (TP Rs 192/sh) is clearly driven by earnings visibility.

Colgate Palmolive 1,411

Source : Company, HDFC sec Inst Research

10

4QFY14E RESULTS PREVIEW

Media : Print to outshine broadcasters

Broadcasters : We estimate Zee to report a modest 10% yoy consolidated revenue growth. Ad revenues are expected to expand by 15% and subscription revenues by 6% owing to high base. EBITDA and earnings are expected to grow by 13% yoy. In GEC business, Zee registered healthy 20%+ ad growth in 3QFY14 led by festive demand and mega movie premiere of Chennai Express and an all-time high EBITDA margin of 40%. We expect ad growth to soften to 15% and GEC EBITDA margin of 34%. We expect Sun TV to report 11% yoy growth in revenue and 13% growth in earnings. We expect Sun to post 5% yoy growth in ad revenues after two quarters of decline. This is owing to increase in ad inventory due to reduction in content partners share from 8min/hr to 6min/hr and overall advertising at 14min/hr vs. 12min/hr earlier. Subscriptions to grow by healthy 25% yoy. We prefer Sun over Zee owing to the formers cheap valuation. Zee trades at 24x FY16E EPS vs. 16x for Sun. Cable distributors : We estimate Hathways standalone revenue and EBITDA to grow by 10/47% qoq. This is led by higher subscription income from digitsed subscribers and higher placement income due to

CMP (Rs) 400 279 TP (Rs) 457 290 RECO NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 5.2 10.6 5.1 11.9 4.7 9.6

expansion in new cities. But, monetization of digitised subscriber from LCOs remain a challenge and a key trigger for rerating. We expect Dish TV to register 1.4% qoq revenue growth and 12% EBITDA growth as 3QFY14 included onetime sports content costs. Subscription revenues are expected to grow by a meager 1% qoq led by increase in subscriber base (350k gross and 115k net additions) and flat ARPU of Rs 166. Dish has struggled to witness traction in subscribers and ARPU for the last several quarters, a key rerating trigger. Nevertheless, we remain positive on Dish TV owing to phase III/IV of digitisation. Improving compliance by MSOs should improve DTH industrys pricing power and provide boosts to ARPU. Print : Led by 12/16% ad revenue growth for Jagran and DB Corp respectively and modest rise in operating cost excluding newsprint, we estimate DB Corp to register 18% earnings growth. Jagrans (including Nai Dunia) earnings growth is expected to be a muted 4% due to lower other income. We maintain our TP of Rs 105 on Jagran, but downgrade it from BUY to Neutral post the 21% run up in last one month.

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 75.0 25.7 73.8 24.5 73.8 25.1 APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.0 2.0 1.9 2.1 1.8 1.8 Adj EPS (Rs) 4Q 3Q 4Q FY14E FY14 FY13 5.1 2.1 4.8 2.2 4.5 1.9

COMPANY Broadcasters Sun TV Zee Enter Cable distributors Dish TV India Hathway Cable Print DB Corp Jagran Prakashan

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 3.9 2.7 3.7 2.9 3.5 2.4

BUY NEU

50 243 294 103

64 235 350 105

BUY SELL BUY NEU

6.2 2.1 4.6 3.9

6.1 1.9 5.2 4.3

5.6 1.4 4.0 3.4

1.5 0.1 1.1 0.8

1.4 0.1 1.6 1.1

1.2 0.0 0.9 0.7

24.5 5.9 24.5 19.8

22.2 4.4 29.9 25.5

21.6 0.3 23.6 20.1

(0.2) (0.7) 0.6 0.4

(0.4) (0.7) 0.9 0.6

(0.4) (0.6) 0.6 0.4

(0.2) (4.4) 3.5 1.3

(0.4) (4.4) 5.2 1.9

(0.4) (3.6) 3.0 1.2

Source : Company, HDFC sec Inst Research

11

4QFY14E RESULTS PREVIEW

Metals & Mining : Improvement visible

Coal India Coal Indias production and dispatch volumes are expected to be 143 mmt and 133 mmt respectively, flat YoY. Realisations are expected to improve from the bottom set in 3QFY14 due to price hikes and cost pass through, coupled with incentives, which usually accrue in 4Q. However, we estimate moderation in incentive YoY due to lower excess supplies under FSA. EBITDA/t is likely to remain flat YoY. We remain positive on the stock and maintain BUY recommendation driven by mutliple triggers: solid valuation comfort, dividend yield and upside to volumes JSW Steel Marginal increase in steel prices during the quarter coupled with moderation in coking coal costs should see EBITDA/t improve to Rs7,869/t (vs. Rs 7,502 QoQ and Rs 6,840 YoY) . We remain cautious on the iron ore availability, which can upset the improving raw material environment. Maintain SELL. Volume surge continued in 4QFY14, partly on account of resumption of Essar pipeline. Coupled with price hikes in the quarter (December and February) NMDC should see realisation improvements as well. We remain positive on NMDC given its undemanding valuations and likelihood of higher volumes (though we prefer to wait before taking additional volumes from Essar pipeline into account).

NMDC

COMPANY Coal India JSW Steel NMDC

CMP (Rs) 292 1,073 150

TP (Rs) 300 805 155

NET SALES (Rs bn) RECO * BUY SELL BUY 4Q FY14E 198.1 122.0 35.8 3Q FY14 169.3 119.6 28.2 4Q FY13 199.1 92.9 32.0

EBITDA (Rs bn) 4Q FY14E 68.2 24.2 23.7 3Q FY14 48.2 23.0 19.0 4Q FY13 70.1 16.6 17.5

EBITDA Margin (%) 4Q FY14E 34.4 19.8 66.1 3Q FY14 28.4 19.3 67.4 4Q FY13 35.2 17.8 54.6

APAT (Rs bn) 4Q FY14E 60.5 7.2 19.9 3Q FY14 38.9 6.5 15.7 4Q FY13 54.1 5.7 15.7 4Q FY14E 9.6 29.9 5.0

Adj. EPS 3Q FY14 6.2 27.0 4.0 4Q FY13 8.6 23.7 4.0

Source : Company, HDFC sec Inst Research * Last published

12

4QFY14E RESULTS PREVIEW

Oil & Gas : More steam left

BPCL : Quarterly results are not comparable as it depends on subsidy contribution from the govt and net subsidy sharing by OMCs for the year. Forex and inventory gain/loss can further distort quarterly results. Guidance on Mozambique and Brazil E&P assets is the key. Cairn India : We expect an exit production rate of ~190kbpd from Rajasthan fields for FY14. Production ramp-up plan and reserve updates will be keenly watched. ONGC : Quantum of subsidy sharing makes results incomparable. Production output in likely to remain flat QoQ. Production ramp-up guidance for ONGC and OVL is key. Reliance Industries : We expect GRM of ~US$ 9/bbl (+18% QoQ). KG D6 gas production should be ~13 mmscmd. Guidance on E&P assets is the key. Supreme court decision on gas pricing may remain an overhang.

COMPANY BPCL Cairn India ONGC Reliance Industries

CMP (Rs) 452 360 322 969

TP (Rs) 450 400 351 1,025

RECO* BUY BUY BUY BUY

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 676.4 647.7 663.1 49.5 224.1 50.0 208.5 43.6 219.2

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 51.8 (9.2) 65.8 37.1 116.8 82.5 35.9 123.2 76.2 28.9 106.2 78.3

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 7.7 (1.4) 9.9 75.1 52.1 8.5 71.8 59.1 7.4 66.3 48.5 9.3

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 30.1 (10.9) 48.0 27.7 53.3 58.1 28.8 71.3 55.1 25.6 33.9 55.9

Adj. EPS (Rs/sh) 4Q 3Q 4Q FY14E FY14 FY13 41.7 -15.1 66.3 14.5 6.2 18.0 15.1 8.3 17.1 13.4 4.0 17.3

972.9 1,035.2 842.0

Source : Company, HDFC sec Inst Research * Last published

13

4QFY14E RESULTS PREVIEW

Pharmaceuticals : US euphoria to continue

US will remain the key driver for our coverage universe in 4QFY14. Limited competition launches like gCymbalta and gNiaspan will continue the euphoria for Aurobindo, Torrent and Lupin. We expect Lupin to post US revenues (branded + generic) of US$ 240mn, up 19% YoY. The US branded segment will see some revival due to favorable season leading to revenues of US $30mn (from ~US$23mn in 3QFY14), but will continue to de-grow YoY (-40%) due to Antara genericisation. Aurobindo Pharma will continue its stellar growth in US revenues with 104% jump at US$160mn. Whereas Torrent pharmas US revenues would swell by 61% to US$ 27mn. Companies like Sun and DRL are expected to report flattish QoQ US revenues due to the lack of any significant launches and increasing competition, expect Sun to post US$ 410mn revenues (up 25% YoY). Increasing competition in gDacogen and gReclast will lead to marginal dip QoQ in US revenues at US$ 250mn (up 29% YoY). Cadilas US revenues will continue its much awaited traction at US$ 100mn revenues, up 60% YoY. IPCAs US revenues will remain flat at ~US$10mn, expect traction to pick up by FY15E as Indore SEZ commercializes. On the overall export front we expect Alembic to continue its growth trajectory with 47% YoY growth. Ciplas growth would look healthy at 36% (YoY) but partly driven by Medpro acquisition. On the domestic front IPM registered single digit growth of 8.5/4.5% in Jan/Feb, but with the price hike window available in April, we expect the growth rates to inch higher in FY15. From our coverage universe (for the domestic formulations segment) we expect midteens growth to continue for IPCA, Indoco, Lupin, Sun, Alembic and Torrent. However Cipla (due to seasonality)/ Cadila (due to Boheringer contract expiry) will report growth of 10/5%(YoY). We believe DRL will continue to struggle for growth with a mere 5% growth in this quarter. Biocon is expected to post 18%(YoY) growth in this segment. Expect margins to expand YoY but QoQ we expect certain blips mainly led by currency. Specifically, margins are expected to dip for Biocon QoQ due to higher R&D outgo. Higher other expenses and dip in gross margins will keep the margins sequentially lower for Cipla and DRL. We continue to remain positive on the overall sector due to strong pipeline for US markets, resilient domestic formulations market and plans to foray into difficult but lucrative markets like Japan and LATAM. Top pick - Lupin and Alembic Pharma.

14

4QFY14E RESULTS PREVIEW

4QFY14E : Pharma universe

COMPANY Alembic Pharma Aurobindo Biocon Cadila Hc Cipla Dr Reddy's Labs Indoco IPCA Labs Lupin Sun Pharma Torrent Pharma CMP (Rs) 270 543 428 991 397 2,550 136 819 954 615 568 TP (Rs) 392 663 390 1,064 426 2,840 110 920 1,120 685 574 RECO* BUY BUY SELL BUY NEU BUY NEU BUY BUY BUY BUY NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 4.7 4.8 3.8 21.4 7.1 18.8 24.1 36.0 1.8 8.7 30.4 41.4 9.9 21.4 7.0 18.6 25.5 35.3 1.9 8.2 29.8 42.9 9.9 15.5 6.3 15.7 19.1 33.4 1.6 6.6 25.4 30.7 8.0 EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 1.0 1.0 0.7 6.2 1.5 3.6 4.2 9.0 0.3 2.2 7.7 18.0 2.2 6.4 1.8 3.4 4.7 9.8 0.3 2.2 8.0 20.0 2.4 2.4 1.1 3.1 4.1 7.2 0.3 1.4 6.6 12.8 2.0 EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 22.0 21.0 17.3 28.8 20.3 18.8 17.3 25.0 15.6 25.2 25.2 43.3 21.5 30.1 25.3 18.1 18.1 27.6 16.5 26.1 26.6 46.4 23.2 15.3 17.9 18.8 20.8 21.5 16.0 21.2 25.5 41.3 22.6 APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.8 0.7 0.4 3.9 0.9 2.2 2.2 5.5 0.1 1.4 4.9 12.9 1.4 4.2 1.1 2.2 2.5 5.8 0.2 1.4 4.8 15.3 1.7 1.2 0.6 4.5 2.7 5.7 0.1 0.9 4.1 10.1 1.3 4Q FY14E 4.1 13.3 4.3 10.5 2.7 32.1 1.5 11.3 10.9 6.2 8.2 Adj. EPS 3Q 4Q FY14 FY13 3.5 2.3 14.3 5.6 10.5 3.2 33.9 1.8 11.3 10.7 7.4 10.3 4.2 3.1 13.5 3.3 33.6 1.6 6.9 9.2 4.9 7.6

Source : Company, HDFC sec Inst Research * Last published

15

4QFY14E RESULTS PREVIEW

Ports : Volume strength to sustain

Although overall bulk and cargo traffic continues to see muted single digit YoY growth, both companies in our coverage universe, Adani Ports & SEZ and Gujarat Pipavav Port (GPPV) are expected to show continued high double digit volume growth. For Adani Ports, cargo volume growth at Mundra has been strong with over 100MT of cargo handled in FY14 . Consolidated profits will also be dependent on growth and profitability at other ports (Dahej and Hazira) . Key monitorables for Adani Port are utilisation of surplus cash reserves towards Dhamra Port acquisition and corporate guarantees for Abbot Point going off the companys books. Post recent run up in stock price, we revise our rating to NEUTRAL from BUY earlier. For GPPV, we expect YoY uptick in volumes coupled with operating margin expansion on account of positive operating leverage. We see multiple levers for profit growth for GPPV in CY14-15E led by 1) tariff revision in Aug-13 along with 70% USD denominated revenues, 2) two new services introduced in Jun-13 in place of Maersk lines, 3) new Gulf service expected to add 50,000-60,000 TEUs, and 4) commencement of liquid cargo handling operations in Mar-14. With GPPV having recently received the environmental clearance for port expansion, the key monitorable will be the final cost and expected construction timeline for port expansion.

COMPANY Adani Ports & SEZ Gujarat Pipavav Port*

CMP (Rs) 193 88

TP (Rs) 176 74

RECO NEU NEU

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 11.2 10.8 10.4 1.4 1.5 1.2

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 7.0 6.7 6.3 0.7 0.8 0.6

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 62.1 62.0 60.9 51.0 57.5 47.8

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 4.2 4.5 3.6 0.5 0.6 0.4

4Q FY14E 2.0 1.1

Adj. EPS 3Q 4Q FY14 FY13 2.2 1.8 1.3 0.7

Source : Company, HDFC sec Inst Research, * Standalone

16

4QFY14E RESULTS PREVIEW

Power : Stabilisation underway, remain selective

Power sector remains burdened by slow progress of reforms. While there has been some progress on the tariff revision pleas of Tata Power and Adani Power, final resolution is far from over. CERCs final 2014-19 tariff regulations have also acted as a sentiment dampener for the sector. We remain selective and prefer stocks with strong balance sheets and unutilised capacity. We expect NTPC to be the key beneficiary of increasing PLFs as demand revives and have upgraded the stock to BUY. We expect Jaiprakash Power to report a loss of Rs 2.08bn as the impact of a seasonally weak quarter is amplified by high debt burden and under recovery of costs at Bina. PGCIL should report decent growth driven by commissioning of assets during the past one year. For NTPC, we expect robust earnings growth, driven primarily by improved coal availability. JSW Energy is expected to report weak earnings due to cost under recovery as Raj West plant was shut for 2 months. Reliance Power will report steady earnings driven by Rosa power plant. Progress on under construction plants will be the key monitorable. Tata Powers earning will continue to be impacted by lower coal prices and losses at Mundra. Management commentary on the progress on tariff revision for Mundra UMPP will be keenly watched. CESC should report strong standalone earnings, as fuel coats variation in FY14 will be recovered in 4Q. Movement in store level EBITDA for Spencers and progress on capacity tie up for Chandrapur will be the key monitorables.

COMPANY CESC Jaiprakash Power JSW Energy NTPC Power Grid Corp Reliance Power Tata Power Co

CMP (Rs) 518 16 65 124 108 75 87

TP (Rs) 586 26 62 139 112 84 90

RECO BUY BUY NEU BUY BUY BUY NEU

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 15.5 11.9 14.9 4.7 21.8 192.1 37.8 13.2 90.6 4.9 21.2 187.8 36.8 13.7 84.7 3.7 22.6 164.6 33.7 12.5 88.7

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 4.6 2.9 4.6 2.0 7.7 46.3 32.1 4.6 20.7 2.8 8.0 46.6 31.1 5.0 18.3 1.6 8.0 47.9 28.3 4.6 18.0

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 29.3 24.7 30.6 43.7 35.2 24.1 85.0 34.6 22.9 56.1 37.8 24.8 84.3 36.4 21.6 44.4 35.2 29.1 83.9 37.1 20.3

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.38 1.07 2.56 (2.08) 3.32 27.32 11.52 2.41 2.50 (1.53) 2.22 30.86 10.43 2.55 1.30 (1.22) 3.31 23.47 9.46 2.54 1.40

4Q FY14E 19.0 (0.7) 2.0 3.3 2.2 0.9 1.1

Adj. EPS 3Q 4Q FY14 FY13 8.6 20.5 (0.5) 1.4 3.7 2.0 0.9 0.5 (0.4) 2.0 2.8 1.8 0.9 0.6

Source : Company, HDFC sec Inst Research

17

4QFY14E RESULTS PREVIEW

Real Estate : Bengaluru continues to outperform

Channel checks indicate that 4QFY14 volumes at a pan-India level across cities were muted in spite of the marginal price correction seen across certain pockets. The NCR market continues to remain under pressure, while the Mumbai market continues to see sales volumes only in select projects with overall weakness persisting in that market. However, the Bengaluru market continues to remain resilient with the Rs 5-15mn ticket size continuing to attract buyers . We expect DLF to report weak operational numbers owing to limited launches and weak Gurgaon market. We expect QoQ decline in revenues with margins remaining under pressure. However, higher other income from Aman sale may cushion the impact to an extent. Oberoi Realty is expected to report QoQ increase in revenues owing to higher sales in Exquisite. Key monitorables are launch plans for Worli and Mulund projects and clarity on recent Borivali land acquisition.

CMP (Rs) 179 221 245 180 373 TP (Rs) 206 279 279 176 424 RECO BUY BUY BUY NEU BUY NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 17.7 20.6 22.3 2.1 0.7 5.8 5.3 1.7 0.8 4.3 5.4 3.0 0.7 5.6 5.9

Phoenix Mills is expected to see steady QoQ revenues and PAT. Announcement for new operator for Palladium hotel is the key monitorable. Prestige Estates is expected to see QoQ rise in revenues and PAT with two large projects, Ferns Residency and Mayberry expected to hit revenue recognition in 4QFY14. Sobha Developers is expected to see YoY revenue decline on account of high base effect (Gurgaon project had reached revenue recognition in 4QFY13). However, 4 new launches across 3.5msf during the quarter have enabled Sobha to bounce back to a quarterly volume run-rate of over 0.9msf. Maintain our preference for Oberoi Realty (TP Rs 279/sh), Sobha Developers (TP Rs 424/sh).

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 30.3 29.7 32.6 54.3 67.0 28.0 28.2 52.7 65.7 30.6 27.4 58.5 66.3 23.6 27.7 APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.2 1.5 (0.0) 0.8 0.4 1.0 0.7 0.7 0.4 0.8 0.6 1.5 0.4 0.9 0.7 Adj. EPS 4Q 3Q 4Q FY14E FY14 FY13 1.2 0.8 NM 2.3 2.5 2.7 7.0 2.1 2.6 2.3 5.9 4.4 2.5 2.5 7.1

COMPANY DLF Oberoi Realty Phoenix Mills# Prestige Estates Projects# Sobha Developers

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 5.4 6.1 7.3 1.2 0.5 1.6 1.5 0.9 0.5 1.3 1.5 1.8 0.5 1.3 1.6

Source : Company, HDFC sec Inst Research, # Standalone

18

4QFY14E RESULTS PREVIEW

Retail : Visible weakness in discretionary spends

Jewellery demand has remained weak across retailers in 4QFY14, although there has been a marginal improvement owing to increased supply of gold through official channels. For Titan, supply side concerns have been adequately addressed by the company in terms of gold availability and mitigating gold inventory price risks. With Titan having recently received approval from the Reserve Bank of India (RBI) to hedge gold and currency futures on international exchanges, Titan will now be able to insulate itself against gold price fluctuations in the international market. Effective interest cost will now be ~3.5-4% from 1QFY15 onwards vs. 10% adjusting for hedging costs resulting in annual savings on interest costs of Rs 0.5-0.6bn. However, demand concerns persist on gold and watches consumption due to a mix of slowdown in discretionary spends and persistently high gold prices. Although 4QFY14 has seen improvement in studded jewellery consumption, it has been at the cost of discounts offered to boost revenues. We expect Titan to post marginal 2% YoY increase in revenues with higher studded share of 35-40% in jewellery revenues. In watches, we expect 5% YoY revenue growth owing to low base (1.5% YoY) and extensive promotions during the quarter. Balance sheet risks persist with Titan continuing with upfront payment for gold and carrying debt of Rs 10-12bn on its books. Further, due to prevailing premiums of 15-25% in Indian gold prices over international gold prices, Titan will be exposed to possible inventory losses in case of reduction in import duty on gold and fall in scarcity premiums. Titan continues to maintain a cash balance of ~Rs 8-10bn to hedge against discontinuance of the Golden Harvest Scheme. Maintain our SELL rating on Titan (TP Rs 221 on 20x FY16 EPS of Rs 11.1/share),

COMPANY Titan Company#

CMP (Rs) 263

TP (Rs) 221

RECO SELL

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 26.7 26.8 26.1

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 2.6 2.5 2.7

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 9.8 9.2 10.2

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 1.8 1.7 1.9

4Q FY14E 2.0

Adj. EPS 3Q 4Q FY14 FY13 1.9 2.1

Source : Company, HDFC sec Inst Research, # Standalone

19

4QFY14E RESULTS PREVIEW

Sugar : Still in the woods

Sugar production is likely to be ~23 mT in SS14 vs domestic demand of ~23.5 mT. Higher opening inventory (~8.5 mT) and adequate production will keep domestic prices muted. Sugar prices have declined by ~2% QoQ and are ~13% down YoY (current ex-mill price : MH ~30/kg and UP ~Rs 32/kg) vs cost of production of Rs 34-36/kg. Global raw sugar prices are hovering below 18 c/lb due to ~5% higher supply (~181 mT) than demand (~172 mT). Export incentive by govt (Rs 3.3/kg for 2 mT in Feb/Mar) and weather concerns have led to a sharp rally of ~20% in sugar prices from its bottom in Feb-14. Further clarity on monsoon will decide the fate of the sector. Bagasse and molasses availability will lead to higher profits from power and ethanol divisions. Lower sugar prices will lead to YoY decline in sugar divisions profitability. No decision has been taken related to the linking of cane price with sugar price. Govt has provided some incentives to the industry (interest free loans and waiver of some taxes). However, we feel that industrys outlook will remains grim till complete decontrol is established. We have upgraded Coromandel International to BUY and have increased its TP by 10% to Rs 264/sh. Correspondingly, we revise SOTP TP for EID Parry by 10% to Rs 167/sh. Exports incentive and recent rally in sugar prices bring hope. We increase TP for Balrampur Chini by 11% to Rs 50/sh (1.0x FY16E BV).

COMPANY Balrampur Chini EID Parry

CMP (Rs) 55 155

TP (Rs) 50 167

RECO NEU NEU

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 7.6 6.9 7.4 4.3 3.7 4.5

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.9 (0.1) 1.2 1.0 (0.1) 1.5

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 11.7 (1.2) 16.6 23.8 (2.7) 33.7

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 0.6 (0.5) 0.7 0.8 (0.1) 1.0

4Q FY14E 2.3 4.7

Adj. EPS 3Q 4Q FY14 FY13 (0.7) 2.9 (0.7) 5.9

Source : Company, HDFC sec Inst Research

20

4QFY14E RESULTS PREVIEW

Telecom : Modest volume growth, steady voice pricing

We expect Bharti and Idea to register a qoq volume growth of 2.9% and 4.1% respectively . However, yoy volume growth of ~4-5% would be the lowest for this industry due to three quarters of weak growth in voice volume post strong 4QFY13 and some degree of elasticity due to tariff hikes (voice RPM up yoy by 7-8%). During this quarter, we expect flattish qoq voice RPM for Bharti and Idea (+7-8% yoy). Idea has reversed some of the price hikes and has become aggressive in some of its smaller circles. At the industry level, even as discount reduction push continues, the pace of the same was slow in 4Q. Despite modest revenue growth, margins will remain soft owing to higher access, network operating and S&M costs. We remain constructive on telecom driven by increase in tariffs and industry consolidation. Impending launch by Reliance Jio and auctions towards the end of FY15 can act as headwinds for this sector. Bharti Airtel : We estimate consolidated revenues of Rs 226.5bn (+3.1% qoq, +15.6% yoy) and EBITDA of Rs 73.5bn (+3.7% qoq, +21.4% yoy, +30bps margin). We expect India revenues to grow by 2.7% qoq to Rs 148.6bn and Africa USD revenue growth of 1.5% qoq.

NET SALES (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 195.9 226.5 219.6 69.2 27.6 66.1 27.3 60.6 26.7

In India, wireless business minutes is expected to grow by 2.9% qoq to 262bn and 0.7% voice RPM increase leading to 3.7% wireless revenue growth. We estimate India business margin to improve by 10bps qoq to 36% and international margins to decline by 30bps qoq. Our APAT estimate of Rs 13.7 bn represents a 62% qoq increase due to lower tax outgo of Rs 12.4bn vs. Rs 16.5bn in 3QFY14. Previous quarter included exceptional tax of Rs 2.7bn and dividend distribution tax of Rs 1.3bn. Idea Cellular : We expect consolidated revenues of Rs 69.2 bn (+4.6% qoq, +14% yoy) and EBITDA of Rs 21.3 bn (+3.7% qoq, +22% yoy). We have build in a margin drop of 30 bps qoq, but +200 bps yoy to 30.8%. Our APAT for Idea is Rs 4.9 bn (+4.4 qoq, +25% yoy). Key assumptions (1) 4.1% qoq growth in voice volumes to 150.6 bn minutes, flat voice RPM (2) 13% qoq data revenue growth and (3) 35% effective tax rate. Bharti Infratel : We expect a tenancy-led modest 1.1% qoq growth in revenues to Rs 27.6 bn. We estimate EBITDA and earnings to decline marginally by 0.5/3% qoq to Rs 11.2 bn and Rs 4bn, respectively. This is attributable to lower energy spread.

Company specific expectations on key variables

COMPANY Bharti Airtel Idea Cellular Bharti Infratel

CMP (Rs) 320 144 196

TP (Rs) 375 131 224

RECO BUY NEU BUY

EBITDA (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 60.6 73.5 70.9 21.3 11.2 20.6 11.3 18.3 9.9

EBITDA Margin (%) 4Q 3Q 4Q FY14E FY14 FY13 32.5 32.3 30.9 30.8 40.6 31.1 41.3 30.1 37.1

APAT (Rs bn) 4Q 3Q 4Q FY14E FY14 FY13 7.1 13.7 7.6 4.9 4.0 4.7 4.1 3.9 2.9

4Q FY14E 5.3 7.4 12.7

Adj. EPS 3Q 4Q FY14 FY13 4.4 2.7 7.2 10.3 4.3 9.7

Source : Company, HDFC sec Inst Research

21

4QFY14E RESULTS PREVIEW

Rating Definitions BUY : Where the stock is expected to deliver more than 10% returns over the next 12 month period NEUTRAL : Where the stock is expected to deliver (-) 10% to 10% returns over the next 12 month period SELL : Where the stock is expected to deliver less than (-) 10% returns over the next 12 month period

Disclaimer: This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction. If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published for any purposes with out prior written approval of HDFC Securities Ltd . Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail and/or its attachments. HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organisations described in this report.

HDFC securities Institutional Equities Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai - 400 013 Board : +91-22-6171 7330 www.hdfcsec.com

22

Das könnte Ihnen auch gefallen

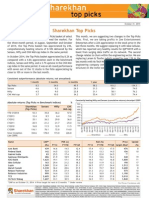

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDokument7 SeitenSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180Noch keine Bewertungen

- Stock Market Today Tips - Book Profit On The Stock CMCDokument21 SeitenStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNoch keine Bewertungen

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Dokument20 SeitenStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNoch keine Bewertungen

- TopPicks 020820141Dokument7 SeitenTopPicks 020820141Anonymous W7lVR9qs25Noch keine Bewertungen

- Zee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Dokument3 SeitenZee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Marutisinh RajNoch keine Bewertungen

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDokument7 SeitenSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNoch keine Bewertungen

- Qs - Bfsi - Q1fy16 PreviewDokument8 SeitenQs - Bfsi - Q1fy16 PreviewratithaneNoch keine Bewertungen

- IndiNivesh Best Sectors Stocks Post 2014Dokument49 SeitenIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNoch keine Bewertungen

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDokument24 SeitenStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNoch keine Bewertungen

- India Equity Analytics Today: Buy Stock of KPIT TechDokument24 SeitenIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNoch keine Bewertungen

- Idea Cellular: Wireless Traffic Momentum To SustainDokument10 SeitenIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNoch keine Bewertungen

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDokument7 SeitenSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNoch keine Bewertungen

- Two-Wheelers Update 27aug2014Dokument12 SeitenTwo-Wheelers Update 27aug2014Chandreyee MannaNoch keine Bewertungen

- Nestle IndiaDokument38 SeitenNestle Indiarranjan27Noch keine Bewertungen

- NCL Industries (NCLIND: Poised For GrowthDokument5 SeitenNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNoch keine Bewertungen

- ABG ShipyardDokument9 SeitenABG ShipyardTejas MankarNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryArun ShekharNoch keine Bewertungen

- Stock Research Report For Indian HotelDokument5 SeitenStock Research Report For Indian HotelSudipta Bose100% (1)

- Bartronics LTD (BARLTD) : Domestic Revenues Take A HitDokument4 SeitenBartronics LTD (BARLTD) : Domestic Revenues Take A HitvaluelettersNoch keine Bewertungen

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDokument25 SeitenInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNoch keine Bewertungen

- India Equity Analytics Today: Hold Rating On Prestige Estates StockDokument25 SeitenIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedNoch keine Bewertungen

- Stock Advisory For Today - Natural View On The Stock Dena Bank, Nestle India and Buy Vardhman TextilesDokument29 SeitenStock Advisory For Today - Natural View On The Stock Dena Bank, Nestle India and Buy Vardhman TextilesNarnolia Securities LimitedNoch keine Bewertungen

- Market Outlook 16th September 2011Dokument6 SeitenMarket Outlook 16th September 2011Angel BrokingNoch keine Bewertungen

- Stock Update Eros International Media: July 06, 2011Dokument8 SeitenStock Update Eros International Media: July 06, 2011narsi76Noch keine Bewertungen

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Dokument4 SeitenJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNoch keine Bewertungen

- Motilal REc ResearchDokument10 SeitenMotilal REc ResearchhdanandNoch keine Bewertungen

- JMV PreferredDokument25 SeitenJMV PreferredAnonymous W7lVR9qs25Noch keine Bewertungen

- IEA Report: 9th December, 2016Dokument26 SeitenIEA Report: 9th December, 2016narnoliaNoch keine Bewertungen

- Smart Gains 42 PDFDokument4 SeitenSmart Gains 42 PDF476Noch keine Bewertungen

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesDokument20 SeitenIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedNoch keine Bewertungen

- HDFC Bank (Hdfban) : Aligning With Market Conditions Slippages RiseDokument8 SeitenHDFC Bank (Hdfban) : Aligning With Market Conditions Slippages RiseShyam RathiNoch keine Bewertungen

- IT Sector Update 24-09-12Dokument20 SeitenIT Sector Update 24-09-12Pritam WarudkarNoch keine Bewertungen

- Kamat Hotels (KAMHOT) : Results InlineDokument4 SeitenKamat Hotels (KAMHOT) : Results InlinedidwaniasNoch keine Bewertungen

- As Slower Economic Growth Narnolia Securities Limited Recommended Buy Stock of Bank of IndiaDokument20 SeitenAs Slower Economic Growth Narnolia Securities Limited Recommended Buy Stock of Bank of IndiaNarnolia Securities LimitedNoch keine Bewertungen

- Market Outlook 27th April 2012Dokument7 SeitenMarket Outlook 27th April 2012Angel BrokingNoch keine Bewertungen

- Banking ResultReview 2QFY2013Dokument24 SeitenBanking ResultReview 2QFY2013Angel BrokingNoch keine Bewertungen

- India Equity Analytics: HCLTECH: "Retain Confidence"Dokument27 SeitenIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNoch keine Bewertungen

- Real Estate: 2QFY17E Results PreviewDokument8 SeitenReal Estate: 2QFY17E Results Previewarun_algoNoch keine Bewertungen

- La Opala RG - Initiating Coverage - Centrum 30062014Dokument21 SeitenLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNoch keine Bewertungen

- Flattish Earnings Performance Broadly in Line: Result HighlightsDokument3 SeitenFlattish Earnings Performance Broadly in Line: Result HighlightssanjeevpandaNoch keine Bewertungen

- India Info Line ICICI DirectDokument6 SeitenIndia Info Line ICICI DirectSharad DhariwalNoch keine Bewertungen

- Sharekhan Top PicksDokument7 SeitenSharekhan Top PicksLaharii MerugumallaNoch keine Bewertungen

- May Bank Kim Eng PDFDokument19 SeitenMay Bank Kim Eng PDFFerry PurwantoroNoch keine Bewertungen

- Market Outlook 11th August 2011Dokument4 SeitenMarket Outlook 11th August 2011Angel BrokingNoch keine Bewertungen

- IDirect Banking SectorReport Mar2014Dokument16 SeitenIDirect Banking SectorReport Mar2014Tirthajit SinhaNoch keine Bewertungen

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Dokument23 SeitenIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNoch keine Bewertungen

- Weekly Wrap: Investment IdeaDokument4 SeitenWeekly Wrap: Investment IdeaAnonymous 0JhO3KdjNoch keine Bewertungen

- Deccan Cements (DECCEM: Value PlayDokument5 SeitenDeccan Cements (DECCEM: Value PlayDinesh ChoudharyNoch keine Bewertungen

- CMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)Dokument0 SeitenCMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)api-234474152Noch keine Bewertungen

- Market Outlook 3rd May 2012Dokument13 SeitenMarket Outlook 3rd May 2012Angel BrokingNoch keine Bewertungen

- Sharekhan Top Picks: October 26, 2012Dokument7 SeitenSharekhan Top Picks: October 26, 2012Soumik DasNoch keine Bewertungen

- Market Outlook 11th October 2011Dokument5 SeitenMarket Outlook 11th October 2011Angel BrokingNoch keine Bewertungen

- Yes Bank: CMP: Target Price: BuyDokument4 SeitenYes Bank: CMP: Target Price: BuyramanathanseshaNoch keine Bewertungen

- Dolat PreferredDokument45 SeitenDolat PreferredAnonymous W7lVR9qs25Noch keine Bewertungen

- Market Outlook 16th March 2012Dokument4 SeitenMarket Outlook 16th March 2012Angel BrokingNoch keine Bewertungen

- IDirect IDFC EventUpdate Apr2014Dokument8 SeitenIDirect IDFC EventUpdate Apr2014parry0843Noch keine Bewertungen

- Banking Sector UpdateDokument27 SeitenBanking Sector UpdateAngel BrokingNoch keine Bewertungen

- AngelBrokingResearch SetcoAutomotive 4QFY2015RUDokument10 SeitenAngelBrokingResearch SetcoAutomotive 4QFY2015RUvijay4victorNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsVon EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNoch keine Bewertungen

- Automobile Club Revenues World Summary: Market Values & Financials by CountryVon EverandAutomobile Club Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Mitutoyo India, Mitutoyo Japan, Mitutoyo Bangalore, Mitutoyo Branches in India, Mitutoyo Global Branches, Mitutoyo Mumbai, Mitutoyo Delhi, Mitutoyo M3 Center, MitutoyoIndiaDokument1 SeiteMitutoyo India, Mitutoyo Japan, Mitutoyo Bangalore, Mitutoyo Branches in India, Mitutoyo Global Branches, Mitutoyo Mumbai, Mitutoyo Delhi, Mitutoyo M3 Center, MitutoyoIndiaRajan KumarNoch keine Bewertungen

- André Gorz Autonomy and Equity in The Post-Industrial AgeDokument14 SeitenAndré Gorz Autonomy and Equity in The Post-Industrial Ageademirpolat5168Noch keine Bewertungen

- General AwarenessDokument137 SeitenGeneral AwarenessswamyNoch keine Bewertungen

- DebtDokument68 SeitenDebttalupurumNoch keine Bewertungen

- Money Matters VocabularyDokument16 SeitenMoney Matters VocabularySvetlana TselishchevaNoch keine Bewertungen

- Saln 2012 Form Chris 2018Dokument2 SeitenSaln 2012 Form Chris 2018Ronel FillomenaNoch keine Bewertungen

- Company Profile PT BTR 2022 - 220611 - 085254 - 220707 - 113639Dokument20 SeitenCompany Profile PT BTR 2022 - 220611 - 085254 - 220707 - 11363902171513Noch keine Bewertungen

- Applied Economics Lesson 2 1Dokument23 SeitenApplied Economics Lesson 2 1Angeline PreclaroNoch keine Bewertungen

- The Multiplier Effect in SingaporeDokument6 SeitenThe Multiplier Effect in SingaporeMichael LohNoch keine Bewertungen

- Jarandeshwar Sugar 31120Dokument1 SeiteJarandeshwar Sugar 31120chief engineer CommercialNoch keine Bewertungen

- Assignment 3 - Financial Case StudyDokument1 SeiteAssignment 3 - Financial Case StudySenura SeneviratneNoch keine Bewertungen

- "I'm The Most Loyal Player Money Can Buy!" - Don Sutton, Pitcher, LA DodgersDokument9 Seiten"I'm The Most Loyal Player Money Can Buy!" - Don Sutton, Pitcher, LA DodgersJosh ONoch keine Bewertungen

- The Globe and Mail MCS-February 2004Dokument1 SeiteThe Globe and Mail MCS-February 2004ssiweb_adminNoch keine Bewertungen

- Davao Airport Project BriefDokument3 SeitenDavao Airport Project BriefDonnabelle AliwalasNoch keine Bewertungen

- Information Age JoshuaDokument4 SeitenInformation Age JoshuaClaren daleNoch keine Bewertungen

- Garden Reach Shipbuilders & Engineers LimitedDokument63 SeitenGarden Reach Shipbuilders & Engineers LimitedSRARNoch keine Bewertungen

- Integrated Guide PDFDokument71 SeitenIntegrated Guide PDFJha NizNoch keine Bewertungen

- 1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Dokument10 Seiten1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Alina-Elena AstalusNoch keine Bewertungen

- The Byzantine Empire Followed A Tradition of Caesaropapism in Which The Emperor Himself Was The Highest Religious Authority Thereby Legitimizing Rule Without The Need of Any Formal InstitutionDokument2 SeitenThe Byzantine Empire Followed A Tradition of Caesaropapism in Which The Emperor Himself Was The Highest Religious Authority Thereby Legitimizing Rule Without The Need of Any Formal Institutionarindam singhNoch keine Bewertungen

- The Guidebook For R and D ProcurementDokument41 SeitenThe Guidebook For R and D Procurementcharlsandroid01Noch keine Bewertungen

- Midterm Sample Questions Based On Chapter 2Dokument3 SeitenMidterm Sample Questions Based On Chapter 2Alejandro HerediaNoch keine Bewertungen

- Chapter 7: Financial Reporting and Changing Prices: International Accounting, 6/eDokument26 SeitenChapter 7: Financial Reporting and Changing Prices: International Accounting, 6/eapi-241660930Noch keine Bewertungen

- 002 PDFDokument59 Seiten002 PDFKristine Lapada TanNoch keine Bewertungen

- 1.transferable Lessons Re Examining The Institutional Prerequisites of East Asian Economic Policies PDFDokument22 Seiten1.transferable Lessons Re Examining The Institutional Prerequisites of East Asian Economic Policies PDFbigsushant7132Noch keine Bewertungen

- FAO Statistics Book PDFDokument307 SeitenFAO Statistics Book PDFknaumanNoch keine Bewertungen

- A Profile On Reader's DigestDokument11 SeitenA Profile On Reader's DigestAparna RameshNoch keine Bewertungen

- Environmental ImpactDokument2 SeitenEnvironmental ImpactAadhan AviniNoch keine Bewertungen

- DisinvestmentDokument2 SeitenDisinvestmentBhupendra Singh VermaNoch keine Bewertungen

- Springer - The Anarchist Roots of Geography Towards Spatial EmancipationDokument8 SeitenSpringer - The Anarchist Roots of Geography Towards Spatial EmancipationRobertNoch keine Bewertungen

- Incremental Concept From The Marginal ConceptDokument2 SeitenIncremental Concept From The Marginal Conceptsambalikadzilla6052Noch keine Bewertungen