Beruflich Dokumente

Kultur Dokumente

Financial Terms

Hochgeladen von

optimistic07Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Terms

Hochgeladen von

optimistic07Copyright:

Verfügbare Formate

Definition of 'Plutocracy'

A government controlled exclusively by the wealthy either directly or indirectly. A plutocracy allows, either openly or by circumstance, only the wealthy to rule. This can then result in policies exclusively designed to assist the wealthy, which is reflected in its name (comes from the Greek words "ploutos" or wealthy, and "kratos" - power, ruling)

Investopedia explains 'Plutocracy'

A plutocracy doesn't have to be a purposeful, overt format for government. Instead, it can be created through the allowance of access to certain programs and educational resources only to the wealthy and making it so that the wealthy hold more sway. The concern of inadvertently creating a plutocracy is that the regulatory focus will be narrow and concentrated on the goals of the wealthy, creating even more income and asset-based inequality.

Definition of 'Plutocracy'

A government controlled exclusively by the wealthy either directly or indirectly. A plutocracy allows, either openly or by circumstance, only the wealthy to rule. This can then result in policies exclusively designed to assist the wealthy, which is reflected in its name (comes from the Greek words "ploutos" or wealthy, and "kratos" - power, ruling).

Investopedia explains 'Plutocracy'

A plutocracy doesn't have to be a purposeful, overt format for government. Instead, it can be created through the allowance of access to certain programs and educational resources only to the wealthy and making it so that the wealthy hold more sway. The concern of inadvertently

creating a plutocracy is that the regulatory focus will be narrow and concentrated on the goals of the wealthy, creating even more income and asset-based inequality.

Read more: http://www.investopedia.com/terms/p/plutocracy.asp#ixzz2JLO2aAed

Cult Brand

A product or service that has an energetic and loyal customer base. A cult brand, unlike others, has customers who can be described as near-fanatical, true believers in the brand and may feel a sense of ownership or vested interest in the brand's popularity and success. Cult brands have achieved a unique connection with customers, and are able to create a consumer culture that people want to be a part of. Examples of modern cult brands include the Mini Cooper, HarleyDavidson, Vespa, Zappos and Apple.

Investopedia Says: A brand, by definition, is a distinguishing logo, mark, sentence, symbol or word that identifies a particular product. Companies use various strategies to improve brand recognition and build brand equity. Very recognizable brands include Nike, Coca-Cola and Microsoft.

Cult brands are different from fads. A fad is a short-lived "craze" where a particular product suddenly gains a lot of attention among a large population, marked by a temporary and excessive enthusiasm and then just as quickly fizzles out of style. Where fads are unsustainable and last only a short period of time, cult brands typically begin small and gradually build a steady following

Definition of 'Risk Parity'

A portfolio allocation strategy based on targeting risk levels across the various components of an investment portfolio. The risk parity approach to asset allocation allows investors to target specific levels of risk and to divide that risk equally across the entire investment portfolio in

order to achieve optimal portfolio diversification for each individual investor. Risk parity strategies are in contrast to traditional allocation methods that are based on holding a certain percentage of investment classes, such as 60% stocks and 40% bonds, within one's investment portfolio.

Investopedia explains 'Risk Parity'

The risk parity approach to portfolio asset allocation focuses on the amount of risk in each component rather than the specific dollar amounts invested in each component. In other words, risk parity focuses not on the allocation of capital (like traditional allocation models), but on the allocation of risk. Risk parity considers four different components: equities, credit, interest rates and commodities, and attempts to spread risk evenly across the asset classes. The goal of risk parity investing is to earn the same level of return with less volatility and risk, or to realize better returns with an equal amount of risk and volatility (versus traditional asset allocation strategies).

A traditional 60/40 portfolio can attribute 80 to 90% of its risk allocation to equities. As a result, the portfolio's returns will be dependent upon the returns of the equity markets. Proponents of the risk parity strategy state that while the 60/40 approach performs well during bull markets and periods of economic growth, it tends to fail during bear markets and economic slumps. The risk parity approach attempts to balance the portfolio to perform well under a variety of economic and market conditions.

Several risk parity-specific products, including mutual funds, are available, and investors can also build their own risk parity portfolios through careful research or by working with a qualified financial professional. The first risk parity fund, the All Weather hedge fund, was introduced by Bridgewater Associates in 1996.

Read more: http://www.investopedia.com/terms/r/risk-parity.asp#ixzz2JLRSzjlu

Definition of 'Robin Hood Effect'

A phenomenon where the less well-off gain at the expense of the better-off. The Robin Hood effect gets its name from the folkloric outlaw Robin Hood, who, according to legend, stole from the rich to give to the poor. A reverse Robin Hood effect occurs when the better-off gain at the expense of the less well-off.

Investopedia explains 'Robin Hood Effect'

The term "Robin Hood effect" is most commonly used in discussions of income inequality and educational inequality. For example, a government that collects higher taxes from the rich and lower or no taxes from the poor, and then uses that tax revenue to provide services for the poor, creates a Robin Hood effect.

Frame Dependence

The human tendency to view a scenario differently depending on how it is presented. Frame dependence is based on emotion, not logic, and can explain why people sometimes make irrational choices. For example, when presented with a scenario in which a sweater is being offered at its full price of $50 and a scenario in which the same sweater is regularly priced at $75 but on sale for $50, many consumers would perceive the latter as a better value even though in both situations they are being asked to pay the same price for the same sweater. Thus a real-life application of frame dependence is the use of strategic pricing by retail stores to influence consumers' purchasing behavior.

Investopedia Says: Frame dependence is one component of psychologist Daniel Kahneman's Nobel Prize-winning prospect theory, a major contribution to behavioral economics. Along with co-researcher Amos Tversky, Kahneman showed several cognitive biases that cause people to make irrational decisions, including the anchoring effect, loss aversion, mental accounting, the planning fallacy and the illusion of control.

Das könnte Ihnen auch gefallen

- Impact of Human Capital Investment On BankDokument31 SeitenImpact of Human Capital Investment On Bankoptimistic07Noch keine Bewertungen

- First Shift: Islamic University, Kushtia C' Unit First Waiting List Admission Test 2013 2014Dokument4 SeitenFirst Shift: Islamic University, Kushtia C' Unit First Waiting List Admission Test 2013 2014optimistic07Noch keine Bewertungen

- Awwui C 'I WJWLZ Cixÿvi DJVDJ XVKV Wefvm: Gvwbkmä RJVTDokument4 SeitenAwwui C 'I WJWLZ Cixÿvi DJVDJ XVKV Wefvm: Gvwbkmä RJVToptimistic07Noch keine Bewertungen

- United International University (UIU) : Submitted By: Md. Abidur Rahman: 024091018 Subject Code: EEE-312 Sec-ADokument4 SeitenUnited International University (UIU) : Submitted By: Md. Abidur Rahman: 024091018 Subject Code: EEE-312 Sec-Aoptimistic07Noch keine Bewertungen

- Wifi File TransferDokument1 SeiteWifi File Transferoptimistic07Noch keine Bewertungen

- First Shift: Islamic University, Kushtia C' Unit Merit List Admission Test 2013 2014Dokument3 SeitenFirst Shift: Islamic University, Kushtia C' Unit Merit List Admission Test 2013 2014optimistic07Noch keine Bewertungen

- Globalization Impact On BDDokument21 SeitenGlobalization Impact On BDoptimistic07Noch keine Bewertungen

- Security Issues For Cloud ComputingDokument13 SeitenSecurity Issues For Cloud Computingbrian1mugadzaNoch keine Bewertungen

- Globalization Impact On BDDokument21 SeitenGlobalization Impact On BDoptimistic07Noch keine Bewertungen

- 2.0.1.2 Stormy Traffic InstructionsDokument2 Seiten2.0.1.2 Stormy Traffic Instructionsoptimistic07Noch keine Bewertungen

- Data Security and Privacy Protection Issues in Cloud ComputingDokument5 SeitenData Security and Privacy Protection Issues in Cloud Computingoptimistic07Noch keine Bewertungen

- Cloud Computing For Academic EnvironmentDokument5 SeitenCloud Computing For Academic Environmentoptimistic07Noch keine Bewertungen

- SME Policy 2005Dokument10 SeitenSME Policy 2005optimistic07Noch keine Bewertungen

- Cloud Computing - Unabridged GuideDokument6 SeitenCloud Computing - Unabridged GuidealmtsfhNoch keine Bewertungen

- How Debt Limits A Country's OptionDokument5 SeitenHow Debt Limits A Country's Optionoptimistic07Noch keine Bewertungen

- Reports On Audited Financial Statements PDFDokument28 SeitenReports On Audited Financial Statements PDFoptimistic070% (1)

- Facing Bold Faced QuestionsDokument6 SeitenFacing Bold Faced Questionsoptimistic07Noch keine Bewertungen

- How ATMs WorkDokument10 SeitenHow ATMs Workoptimistic07Noch keine Bewertungen

- Do Tax Cuts Stimulate The EconomyDokument4 SeitenDo Tax Cuts Stimulate The Economyoptimistic07Noch keine Bewertungen

- Index CalculationDokument13 SeitenIndex Calculationoptimistic07100% (1)

- The Impact of Combining The US GAAP & IFRSDokument7 SeitenThe Impact of Combining The US GAAP & IFRSoptimistic07Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Evolution of Management TheoriesDokument5 SeitenEvolution of Management Theoriesoptimistic07100% (1)

- Product DiffrentiationDokument26 SeitenProduct Diffrentiationoptimistic07100% (1)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Orientation Reports-SanofiDokument20 SeitenOrientation Reports-Sanofioptimistic07Noch keine Bewertungen

- Financial ManagementDokument8 SeitenFinancial Managementoptimistic070% (1)

- Financial ManagementDokument8 SeitenFinancial Managementoptimistic070% (1)

- Financial ManagementDokument8 SeitenFinancial Managementoptimistic070% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Why Are There No Ugly Icons in Cyberspace?Dokument14 SeitenWhy Are There No Ugly Icons in Cyberspace?小葵Noch keine Bewertungen

- Individual Reflection Paper HD 426Dokument6 SeitenIndividual Reflection Paper HD 426api-377835420Noch keine Bewertungen

- WHS Intro To Philosophy 2008 Dan TurtonDokument111 SeitenWHS Intro To Philosophy 2008 Dan TurtonDn AngelNoch keine Bewertungen

- Disorder in The American CourtsDokument3 SeitenDisorder in The American Courtsdagniv100% (1)

- Collaborative Couple Therapy: Page Pr/gurman3.htm&dir Pp/fac&cart - IdDokument39 SeitenCollaborative Couple Therapy: Page Pr/gurman3.htm&dir Pp/fac&cart - IdCarlos InfanteNoch keine Bewertungen

- Scared YouthDokument2 SeitenScared Youthnarcis2009Noch keine Bewertungen

- The Most Important Elements in Japanese CultureDokument13 SeitenThe Most Important Elements in Japanese CultureKevin Bucknall100% (3)

- Art Direction Mood BoardDokument13 SeitenArt Direction Mood BoardBE-K.Noch keine Bewertungen

- Psychology and ScienceDokument4 SeitenPsychology and ScienceSrirangam Bhavana 16PJW019100% (1)

- 1984 Shimp Consumer Ethnocentrism The Concept and A Preliminary Empirical TestDokument7 Seiten1984 Shimp Consumer Ethnocentrism The Concept and A Preliminary Empirical Testhchmelo100% (2)

- Rene Girard - I Saw Satan Fall Like LightningDokument5 SeitenRene Girard - I Saw Satan Fall Like LightningWill CrumNoch keine Bewertungen

- Sample SOPDokument2 SeitenSample SOPRajeev KumarNoch keine Bewertungen

- Marriage AstrologyDokument21 SeitenMarriage AstrologyCheri HoNoch keine Bewertungen

- Creative Adaptation DLPDokument14 SeitenCreative Adaptation DLPArgie Ray Ansino Butalid100% (3)

- Performance Management Summer ProjectDokument31 SeitenPerformance Management Summer Projectsaad124100% (1)

- 7 Principles of Healing Architecture by Erik A.Dokument16 Seiten7 Principles of Healing Architecture by Erik A.Rodrick Tracy100% (5)

- Process Mapping: Robert DamelioDokument74 SeitenProcess Mapping: Robert Dameliojose luisNoch keine Bewertungen

- Chapter 5Dokument20 SeitenChapter 5Loreth Aurea OjastroNoch keine Bewertungen

- Econometrics SyllabusDokument12 SeitenEconometrics SyllabusHo Thanh QuyenNoch keine Bewertungen

- Is There A Scientific Formula For HotnessDokument9 SeitenIs There A Scientific Formula For HotnessAmrita AnanthakrishnanNoch keine Bewertungen

- Motivations of Fuzzy LogicDokument3 SeitenMotivations of Fuzzy Logicaleena_bcNoch keine Bewertungen

- Cross Cultural ManagementDokument2 SeitenCross Cultural ManagementMohammad SoniNoch keine Bewertungen

- The Student Engagement GuideDokument9 SeitenThe Student Engagement GuideAmanda L ShoreNoch keine Bewertungen

- Moral Mazes - Bureaucracy and Managerial WorkDokument17 SeitenMoral Mazes - Bureaucracy and Managerial WorkLidia GeorgianaNoch keine Bewertungen

- Positive Self-Talk Part 2Dokument2 SeitenPositive Self-Talk Part 2api-396767767Noch keine Bewertungen

- The Presence of Buddhist Thought in Kalām LiteratureDokument31 SeitenThe Presence of Buddhist Thought in Kalām LiteratureVitaliiShchepanskyiNoch keine Bewertungen

- Chapter 1,2,3Dokument321 SeitenChapter 1,2,3Aniket Mhapnkar100% (1)

- Year 10 Lesson 4 I Like You Better On Social Media Lesson PlanDokument3 SeitenYear 10 Lesson 4 I Like You Better On Social Media Lesson Plansiphokeith ncubeNoch keine Bewertungen

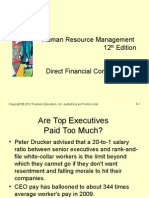

- Direct Financial CompensationDokument36 SeitenDirect Financial CompensationKatPalaganas0% (1)

- Neurophone CompleteDokument9 SeitenNeurophone CompleteSimon Benjamin100% (3)