Beruflich Dokumente

Kultur Dokumente

Banking Law

Hochgeladen von

Manini JaiswalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banking Law

Hochgeladen von

Manini JaiswalCopyright:

Verfügbare Formate

BANKING LAW

Semesters: Sem. VIII Course Teacher: Dr. Ajay Kumar

Objectives of the Course Banks and the banking system evolved into a vital socio-economical institution in the modern age. This has been largely influenced by the socio-political and economic changes that have been witnessed at large. As a developing State India has been influenced by these developments leading to the evolutionary effect on banking structure, policies, patterns and practice. A study of these developments reveals the development from banking as a generic entity to specialized one. One could quote commercial banks, cooperative banks, development banks as a paradigm. The evolutionary process still continues with the global phenomenon of liberalization. This has witnessed the entry of foreign banking companies in the Indian market leading to a deviation in the banking policy. Moreover new means such as e-banking and ecommerce has made it essential that the Indian legal system adopt new modus operandi to cope with the modern scenario. In a backdrop of the above scene the course is designed to enlighten the students with - the conceptual and legal parameters including the judicial interpretation of banking law. - new and emerging dimensions in banking system including e-commerce and e-banking. - an abridged comparative analysis of a few banking systems in the World specifically Swiss banking, US banking and EU banking Contents Module 1: Introduction i. ii. iii. iv. Nature and development of banking History of banking Functions of banks Formation of Banks 1

v. vi.

Different Kinds of Banks Regulation of Banks

Module 2: Social control i. ii. iii. iv. v. Nationalization Development private ownership, nationalization and disinvestment Protection of depositors Priority lending Promotion of underprivileged classes Module 3: The relationship between Banks and their Customer i. ii. iii. Customer defined Legal character of Banker- Customer relationship Rights and obligations of Banks

Right to set-up, Bankers lien, Confidentiality iv. Various Accounts Current, Joint, Deposit, Trust v. Special cases

Lunatics, Minors, Agents, Administrators and Executors, Partnership firms, Companies Module 3: Law and the Banking Companies in India (Banking Regulation Act, 1949) i. ii. iii. iv. v. vi. Regulation by Government and the respective agencies On Management On Account and Audit On Money Lending Lending/ Credit policy Control by Ombudsman Principles of good banking Securities for advances Debt recovery tribunal

Module 4: Lending by Banks i. ii. iii.

Module 6: Control Banking Theory and the Reserve Bank of India (RBI) i. Evolution of RBI 2

Characteristics/ functions/ Economic/social objectives ii. Why it is the bankers bank? Central Bank, Functions, Regulation of money/s and monetary mechanism Domestic and foreign currency, Credit control, Exchange control, Fixation of bank rate policy formulation iii. Control over

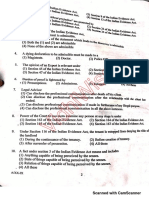

Financial companies, Non-financial companies Module 7: The Legal scenario i. ii. The Reserve Bank of India Act, 1934 The Negotiable Instruments Act, 1882

Negotiable Instruments, Promissory Notes, Cheques, Endorsement, What is sec 138 and sec 152 of the act? Meaning and kinds, Transfer and negotiations, Holder and holder in due course, Penalties the criminal and civil aspect iii. Information Technology Act, 2000 in regards to e-commerce and e-banking

Module 8: A comparative analysis of International Banking with Indian banking Swiss banking, US banking, EU banking Module 9: The future of Indian banking

ESSENTIAL READING AND REFERENCE SOURCING Basu, A. Review of Current Banking Theory and Practice (1998) Mac millan M. Hapgood (ed.), Pagets Law of Banking (1989) Butterworths, London R. Goode, Commercial Law, (1995) Penguin, London Ross Cranston, Principles of Banking Law (1997) Oxford. L.C. Goyle, The Law of Banking and Bankers (1995) Eastern M.L. Tannan, Tannans Banking Law and Practice in India (1997) India Law House, New Delhi,2 volumes K.C. Shekhar, Banking Theory and Practice (1998) UBS Publisher Distributors Ltd. New Delhi. M. Dassesse, S. Isaacs and G. Pen, E.C. Banking Law, (1994) Lloyds of London Press, London V. Conti and Hamaui (eds.), Financial Markets Liberalization and the Role of Banks, Cambridge University Press, Cambridge, (1993) 3

J.Dermine (ed.), European Banking in the 1990s (1993) Blackwell, Oxford. C. Goodhart, The Central Bank and the Financial System (1995); Macmillan, London S. Chapman, The Rise of Merchant Banking (1984) Allen Unwin, London K. Subrahmanyan, Banking Reforms ain India (1997) Tata Maigraw Hill, New Delhi. Subodh Markandeya and Chitra Markandeye, Law Relating to Foreign Trade in India: Being a Commentary on the Foreign Trade, (Development and Regulation) Act 1992, Universal Law Publishing Co. Pvt. Ltd. Delhi. R.S. Narayana, The Recovery of Debts due to Banks and Financial Institutions Act, 1993 (51 of 1993), Asia Law House, Hyderabad. M.A. Mir, The Law Relating to Bank Guarantee in India (1992), Metropolitan Book, New Delhi. Anthony Pierce, Demand Guarantees in International Trade (1993) Sweet & Maxwell, Ross Cranston (ed.) European Banking Law: The Banker-Customer Relationship (1999) LLp, London Mitra, The Law Relating to Bankers Letters of Credit and Allied Laws (1998) University Book Agency, Allahabad. R.K. Talwar, Report of Working Group on Customer Service in Banks Janakiraman Committee Report on Securities Operation of Banks and Financial Institution (1993) Narasimham Committee report on the Financial System (1991) Second Report (1999)

Note: This syllabus is subject to changes. Appropriate cases and acts will be discussed during the lectures. If necessary additional information on reading and reference sourcing will be provided as the course proceeds.

PROJECT TOPIC Law of Banking and Finance SEMESTER - VIII

ROLL NO. 401 402 403 404 405 406 408 409 410 411 412 416 417 418 419 420 421 422 423 425 426 428 NAME OF THE PROJECT Consumer Protection in Banks Emergence of Bank as a service sector : a critique National Housing Bank NPA Management R.C.Cooper v/s Union of India A Critical Study Banking Ombudsman RBI and its Role as Central Bank Promotional Role of RBI Critical study of Bankers Books and Evidence Act EXIM Bank and its role in International Trade Analysis of Bank - Customer Relationship: As Agency Relationship Analysis of Bank Customer Relationship: As Trusteeship Relationship Analysis of Bank Customer Relationship: As Debtor and Creditor Remedies to Bank for Recovery of Loan Right of set-off Foreign Currency Management E-Banking Government Control over the Management of Bank Functioning of RBI Role and Functions of Banking Institutions in India in the Development of Indian Economy Governmental control over lending of Bank Role of Banking Institution in India 5

429 430 431 433 434 435 437 438 439 440 442 443 444 445 448 449 450 452 454 455 456 457 458 459 460 462 465 466 467

Role and Function of Reserve Bank of India Bankers Lien Assets Back Securities Securities for Bank advancement: A critique Merger of Banking Companies Reconstruction of Banks Banking Services and Consumer Protection Co-operative Bank Bankers duty of confidentiality Kishan Credit Card Scheme: A critical analysis The Banking regulation Act 1949: A review Winding up of Banks Voluntary Amalgamation of Banks Dishonour of Cheque Bankers Draft Functions of Commercial Bank Comparative Analysis of International Banking Practices with Indian Indian Banks Rural Banks in India Letter of Credit and Bank Guarantee Cash reserve and statutory liquidity Ratios in Bank Social Banking IBA Code and Banking Practices NABARD Swiss-Banking System: A comparative Study Debt Recovery Tribunal Emergence of Industrial Bank: A critical analysis Merger and Amalgamation of Banking Institutions Liberalization of Banking system Merger of Banking Institutions

468

Lead Bank Scheme

469 Foley v/s Hill Critical Analysis 470 Legal position of Directors in Bank 471 472 475 Transformation of a financial institution to a universal bank- The ICICI Story Bankers Right Foreign Banks in India Legal positions of Directors of Banks 479 Regulatory affairs for Private Banks 480 Reserve Bank of India mandatory and credit policy 481 Bank Audit 4373 Government Control over Lending of Banks 4376

Dr. AJAY KUMAR

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Form No.4: (See Regulation-15 (1) (B) )Dokument1 SeiteForm No.4: (See Regulation-15 (1) (B) )Manini JaiswalNoch keine Bewertungen

- Form No.4: (See Regulation-15 (1) (B) )Dokument1 SeiteForm No.4: (See Regulation-15 (1) (B) )Manini JaiswalNoch keine Bewertungen

- SKS InterestDokument1 SeiteSKS InterestManini JaiswalNoch keine Bewertungen

- Form No 15Dokument1 SeiteForm No 15Manini JaiswalNoch keine Bewertungen

- DRT Form 3Dokument2 SeitenDRT Form 3Manini JaiswalNoch keine Bewertungen

- Admissions Notification Application 2018 19 PDFDokument5 SeitenAdmissions Notification Application 2018 19 PDFManini JaiswalNoch keine Bewertungen

- Banking Ombusman - (Consume Affairs)Dokument8 SeitenBanking Ombusman - (Consume Affairs)Manini JaiswalNoch keine Bewertungen

- AffidavitDokument1 SeiteAffidavitManini JaiswalNoch keine Bewertungen

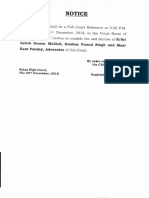

- In The High Court of Judicature at Patna (Civil Writ Jurisdiction) C.W.J.C. NO OF 2019Dokument7 SeitenIn The High Court of Judicature at Patna (Civil Writ Jurisdiction) C.W.J.C. NO OF 2019Manini JaiswalNoch keine Bewertungen

- VakalatnamaDokument1 SeiteVakalatnamaManini Jaiswal100% (2)

- Abir Infra vs. Teesta ValleyDokument98 SeitenAbir Infra vs. Teesta ValleyManini JaiswalNoch keine Bewertungen

- Djs Pre Exam 2019Dokument30 SeitenDjs Pre Exam 2019Manini JaiswalNoch keine Bewertungen

- Form Rti First For AppealDokument1 SeiteForm Rti First For AppealManini JaiswalNoch keine Bewertungen

- NoticeDokument1 SeiteNoticeManini JaiswalNoch keine Bewertungen

- Display PDFDokument42 SeitenDisplay PDFManini JaiswalNoch keine Bewertungen

- In The High Court of Judicature at Patna: Civil Writ Jurisdiction Case No.15712 of 2015Dokument1 SeiteIn The High Court of Judicature at Patna: Civil Writ Jurisdiction Case No.15712 of 2015Manini JaiswalNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tutorial Chapter 3Dokument3 SeitenTutorial Chapter 3ASMA HANANI BINTI ANUARNoch keine Bewertungen

- 92611902-KrugmanMacro SM Ch19 PDFDokument6 Seiten92611902-KrugmanMacro SM Ch19 PDFAlejandro Fernandez RodriguezNoch keine Bewertungen

- GO2Bank Template 2Dokument5 SeitenGO2Bank Template 2Roger kelly71% (14)

- Crans Montana Presentation PDFDokument49 SeitenCrans Montana Presentation PDFJohn OxNoch keine Bewertungen

- State Bank of India Project FinancingDokument87 SeitenState Bank of India Project Financingrangudasar83% (12)

- State Bank of India - Fema Form - For Stucked PaymentDokument2 SeitenState Bank of India - Fema Form - For Stucked PaymentRishabh Thakur100% (2)

- Bonifacio Es PDFDokument1 SeiteBonifacio Es PDFGil ArriolaNoch keine Bewertungen

- Notification No.54/2021 - Customs (N.T.) : Schedule-IDokument3 SeitenNotification No.54/2021 - Customs (N.T.) : Schedule-Ianil nayakanahattiNoch keine Bewertungen

- Jean Set Off & RecoupmentDokument2 SeitenJean Set Off & RecoupmentKonan Snowden98% (98)

- MoneyGram Payment System1Dokument1 SeiteMoneyGram Payment System1Agatha Dominique BacaniNoch keine Bewertungen

- Merger and AcquisitionDokument17 SeitenMerger and AcquisitionSonalNoch keine Bewertungen

- Tata CustomersDokument140 SeitenTata Customersjai4747Noch keine Bewertungen

- IA Q2 BondsDokument4 SeitenIA Q2 BondsJennifer RasonabeNoch keine Bewertungen

- Lines of Credit: Key TakeawaysDokument2 SeitenLines of Credit: Key TakeawaysKurt Del RosarioNoch keine Bewertungen

- Bank Recon and Petty CashDokument44 SeitenBank Recon and Petty CashJulienne UntalascoNoch keine Bewertungen

- CH 14Dokument71 SeitenCH 14Febriana Nurul HidayahNoch keine Bewertungen

- OM Hospital NEFTDokument1 SeiteOM Hospital NEFTMahendra DahiyaNoch keine Bewertungen

- Raju Chinthapatla: Oracle Applications 11i Order To Cash (O2C) Implementation StepsDokument12 SeitenRaju Chinthapatla: Oracle Applications 11i Order To Cash (O2C) Implementation Stepssuj pNoch keine Bewertungen

- Drozynski Maciej FinalDokument2 SeitenDrozynski Maciej FinalITNoch keine Bewertungen

- School Level Form 1.2Dokument29 SeitenSchool Level Form 1.2Chel GualbertoNoch keine Bewertungen

- Daily Walk in Jan 2021Dokument177 SeitenDaily Walk in Jan 2021fahad hassanNoch keine Bewertungen

- MSB ATM GuidanceDokument3 SeitenMSB ATM GuidanceJay CaplanNoch keine Bewertungen

- User Guide: Click "Internet Banking" Icon OnDokument22 SeitenUser Guide: Click "Internet Banking" Icon Onadaqq judi onlineNoch keine Bewertungen

- UntitledDokument2 SeitenUntitledAna marie PaetNoch keine Bewertungen

- Challan PrintDokument2 SeitenChallan PrintshraddhaNoch keine Bewertungen

- Youtube Crypto InfluencersDokument2 SeitenYoutube Crypto InfluencersDragomir DanielNoch keine Bewertungen

- A) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDokument10 SeitenA) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDR LuotanNoch keine Bewertungen

- FWFWD 47464Dokument5 SeitenFWFWD 47464Rmillionsque FinserveNoch keine Bewertungen

- AccountStatement01-03-2023 To 31-05-2023Dokument28 SeitenAccountStatement01-03-2023 To 31-05-2023anilpawar9594Noch keine Bewertungen

- EssayDokument2 SeitenEssayDevil faNoch keine Bewertungen