Beruflich Dokumente

Kultur Dokumente

Accountancy

Hochgeladen von

Nag28rajCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accountancy

Hochgeladen von

Nag28rajCopyright:

Verfügbare Formate

IIBS INDEPENDENT PU COLLEGE

PREPARATORY EXAMINATION II PU ACCOUNTANCY SECTION-A I ANSWER ANY EIGHT 1.what is single entry system? 2. What is current capital method? 3. What is Revalution account? 4. what is gain ratio? 5. what is calls in arrears? 6. what is share premium? 7. What is debenture? 8. Give the meaning of Depreciation. 9. what is realization account? 10. What is proposed dividend? 8X2=16 MARKS:100

SECTION-B

II ANSWER ANY THREE. 6X3=18

11. A and B are equal partners As drawings during the year 2010 had been as follows: Rs. 1000 on 31st Jan Rs. 2000 on 1st June Rs. 2000 on 30th August Rs.3200 on 1st December

Calculate interest on drawings 12% p.a. under product method. 12. X and Y are partners 3:2 they admit Z. future profits and losses are to be shared 8:7:5 find out Sacrifice ratio. 13. The Bajaj company limited forfeited 600 shares of Rs. 100 each for non-payment of first call money Rs.25 per share and final call Rs.15 per share as fully paid up. Reissued at Rs. 80 per share. Give journal entries. 14. Write any 6 difference between Shares and Debentures. 15. X,Y and Z are partners ratio 3:2:1. Capital balance on 1-1-2005 Rs.20000, Rs. 20000 and Rs. 10000. His executors are entitled for X died on 31st march 2005.

His capital balance Interest on capital at 6% p.a Share of reserve fund Rs. 24000 Share of goodwill. The firm value Rs. 36000 His last year profit 18000.

SECTION-C

III ANSWER ANY FOUR. 4X14=56

16. Mr. Ravi keeps his books under single entry system. He gives you following informations. PARTICULARS 1-1-2005 31-12-2005 Cash 1000 2000 B/R 4000 8000 Debtors 6000 9500 Stock 7000 8500 Furniture 4000 4000 Machinery 10,000 10,000 Creditors 8000 5000 B/P 1500 500 During the year Ravi has withdrawn Rs. 3500/- and brought Rs 800/- as additional capital. Depreciate furniture at 5% and machinery 10% There are outstanding salary 200/- and prepaid rent Rs. 400. Prepare Statement of Affairs and statement of P/l and Revised Statement of Affairs.

17. Ram and Sham are partners sharing P/L in the ratio 5:3 their balance-sheet on 31-3-2011 Liabilities Bank overdraft Loan Creditors Reserve Fund Capital A/cs Ram 50,000 Sham 30,000 Amount 20000 79000 40000 16000 Assets Cash Stock Debtors B/R Building Plant & Machinery Computers Amount 15000 35000 45000 10000 60000 40000 30000 2,35,000

80,000 2,35,000 They admit Bhim for 1/5th share in future profits on following terms:

Bhim should bring Rs.40000 as capital He should pay Rs. 24000 towrds Goodwill and amount retained in business. Depreciate computers and machinery at 15% each Appreciate building by Rs.25000 RDD 10% on Debtors. Outstanding printing bill Rs 2000. Prepare Revalution account, Partners Capital A/c and Balance Sheet of new firm.

18. M1, M2 and M3 are partners ratio 3:2:1 Balance Sheet as on 31-12-2007

Liabilities Creditors B/P Ks Loan Reserve Fund Capital Accounts: M1 90,000 M2 60,000 M3 30,000

Amount 60,000 18,000 40,000 36,000

1,80,000

Assets Bank B/R Stock Debtors Car Investment Furniture Machinery P/L A/c

a. b. c. d. e. f.

3,34,000 Assets realized as follows: Stock-44000, Debtors-90000, Machinery-56000, B/R-20000 Furniture is taken over by M1 at Rs. 30000 Investment is took over by M2 at Rs. 40000 Car is took over by M3 at Rs.14600 Creditors & B/P were paid off at 10% discount Dissolution expenses Rs. 8000 Prepare Realisation A/c , Capital A/c and Bank A/c.

Amount 30,000 24,000 40,000 80,000 20,000 30,000 26,000 60,000 24,000 3,34,000

19. On 1-1-2005 a firm acquired lease costing Rs. 50,000/- for a term of 4 years. It is purposed to depreciate lease by annuity method charging 5% interest with reference to annuity tables to write off Rupee 1 at 5% over a period of 4 years. The amount charged is 0.282012. show lease account and interest Account. 20. The Bajaj company Ltd gives you its trial balance as on 31-12-2011 Sl. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Name of Accounts Share Capital(2500x10) Reserve Fund Salary Furniture Building 10% Debentures Opening stock Purchases and Sales Returns Goodwill Investments Calls in arrears Cash at Bank P/L A/c Vehicles Printing Freight Audit Fees Interim divened B/R & B/P Debtors & Creditors Debit Credit 2,50,000 1,25,000

10,000 30,000 2,10,000 50,000 40,000 1,30,000 5000 60,000 40,000 10000 25000 30000 6000 7000 8000 20000 20000 90000 2,10,000 10000

20000

10000 100000

22

Wages

34000 7,75,000

7,75,000

Adjustments: Stock on 31-12-2001 Rs 55000 Depreciate furniture and Building 5% each Provide RDD at 5% on Debtors Transfer Rs. 10000 to Reserve fund 10% debenture interest outstanding for 1 year Prepare Trading and P/L account, P/L Appropriation, Balance Sheet. SECTION-D IV ANSWER ANY TWO OF THE FOLLOWING 2X5=10

21. Prepare capital accounts of two partners under fluctuating capital system with 5 imaginary figures. 22. How do you treat the following in absence of partnership deed? a. b. c. d. e. Interest on capital Interest on drawings Interest on loan Distribution of Profit & loss Salary or Commission to partners

23. Prepare opening statement of affaires with imaginary figures. ************************************

IIBS INDEPENDENT PU COLLEGE

PREPARATORY EXAMINATION IPU ACCOUNTANCY SECTION-A I ANSWER ANY SEVEN QUESTIONS 1. What is book-keeping? 2. What is personal account? 3. Who is solvent person? 4. What do you mean by Drawings? 5. Write any two features of Journal 6. What is contra entry? 7. What do you mean by bad debts? 8. Give the meaning of Gross profit. 9. What do you mean by Two-column cash book? 10. What is Voucher? SECTION-B II ANSWER ANY FOUR QUESTIONS 11. Briefly explain any five accounting concepts. 12. Classify the following into Personal, Real and Nominal A/c a. Cash A/c f. Advertisement A/c b. Rent A/c g. Furniture A/c c. Canara Bank A/c h. Chandan Hospital A/c d. Salary A/c i. Machinery A/c e. Commission A/c j. Maheshs A/c 13. Prepare the personal A/c of Mr. Sagar. 2013 March 5 Debit balance in Sagars A/c 2013 March 10 Sold goods to Sagar 2013 March 15 Bought goods from him 2013 March 20 Sagar returned goods 2013 March 25 Sagar purchased goods from us 2013 March 30 Received from Sagar in full settlement Rs. 33000 4200 5500 200 2800 4500 5X4=20 2x7=14 MARKS:100

14. Prepare purchase book for the month of March 2013 in the books of Vidya Stationery March 01 Purchased 50 text books from Nuthan Publishers at 100 per copy. March 07 Bought Pens from Quick Suppliers Rs 4000 March 15 Credit Purchases from Veer Rs. 1000 worth March 16 Cash Purchases from Varun Traders Rs.2000 March 26 Purchase 10 dozen note books from Great Publishers Rs. 4500

15. Record the following transactions in an analytical petty cash book under imprest system and balance it. 2013 Jan 1 Received a cheque 500 2013 Jan 6 Paid cartage 50 Jan 8 Paid for postage 75 Jan 10 paid travelling charges 60 12 purchase stationary 40 15 paid wages 50 20 paid for news paper bill 50 24 refreshment 25 30 paid to Santosh 50 16. Prepare a trial balance as on 31/3/2013 Sl.no Name of accounts Amount 1. Capital 24000 2. Opening Stock 8500 3. Furniture 2600 4. Purchases 8950 5. Sales 22500 6. Purchase returns 1900 7. Sales returns 350 8. Discount received 970 9. Carriage inward 300 10. Cash 25570 SECTION-C III ANSWER ANY FOUR QUESTIONS 14X4=56 17. Journalise the following transactions: 2012 Jan 1, Anand started business with cash Rs.1,00,000 2, open a bank A/c Rs.30000 4, Purchase goods from Adarsh Rs.20000 6, Sold goods to Rahul Rs.15000 10, Bought goods from Suresh on Credit Rs. 15000 13, Sold goods to Suman on credit Rs. 20000 16, received cheque from Suman Rs. 19500 20, cheque given to Ajay on account Rs. 10,000 22, Rent paid by Cheque RS.2000 23, deposit into bank Rs.16000 jan 25, withdraw money from bank Rs.10000 26, received commission Rs. 2000 28, withdraw money for personal use Rs. 5000 29, paid salaries Rs.4000 18. Journalise the following transactions & post them in Ledger accounts & balance it Mar 1 Commenced business with cash Rs. 80,000 & Furniture 20,000. 3 Deposit into state bank Rs.10,000 & Canara Bank Rs. 20,000 5 Purchase goods Rs.3000 & Stationery Rs. 2000 7 Sold goods Rs.2000 & Machinery Rs.5000 9 Withdrew money for personal use Rs.7000 15 Received commission Rs. 500 & Discount Rs. 1000 20 Paid salary Rs. 2000 & Rent Rs.3000

19. Enter the following transactions in THREE column cash book M ay 1 Balance of cash in hand Rs.60,000 & at bank Rs.30,000 2 Sold goods for cash Rs. 2,500 4 Paid cash into bank Rs. 2000 6 Received a cheque from Mahesh Rs.5000 & discount Rs. 100 8 Karthik directly paid into our account Rs.5000 10 Drew from bank for office use Rs. 3000 12 Paid Naresh half in cash & half by cheque Rs.4000 14 Paid Satya by cheque Rs. 2000 in full settlement of his account Rs. 2150 16 Drew a cheque for personal use Rs.1000 20 Cash received from sale of building Rs. 20000 22 Paid for insurance by cheque Rs. 6000 27 Paid to Ganesh & earned discount @ 2% Rs. 5000 29 Paid salary staff by cheque Rs. 8000 30 Paid rent by cheque Rs. 6000 20. Mr Hari keeps his books under single entry system: Particulars Furniture Machinery Building Stock Debtors Bills Receivable Creditors Bills Payable Bank loan 1/1/2010 15,000 50,000 1,00,000 25,000 20,000 5,000 15,000 10,000 12,000 31/12/2010 15,000 50,000 1,00,000 25,000 26,000 10,000 25,000 8,000 10,000

During the year he withdrew for personal use Rs.15,000 and invested further capital Rs.18,000 Write off bad debts Rs.1000 Prepaid salary Rs. 6000 Appreciate building by 20% Allow interest on opening capital @ 5% p.a.

Prepare statement of affairs, statement of P/L & revised statement 21. From the following trial balance of Shri Ram prepare trading account, Profit & loss account & Balance sheet Sl.No 1. 2. 3. 4. 5. 6. 7. Name of account Capital Drawings Opening stock B/R & B/P Purchase & Sales Returns Debtors & Creditors Debit -------40,000 1,00,000 20,000 4,14,000 10,000 64800 Credit 2,00,000 --------------24,000 6,50,000 14,000 48000

8. Salaries 9. Wages 10. Machinery 11. Furniture 12. Rent &Tax 13. Insurance 14. Printing charges 15. Cash 16. Bank

44000 38400 120,000 20,000 14000 5200 6000 800 38,800 9,36000

--------------------------------------------------------9,36000

Adjustments Closing Stock valued at 72,000 Depreciation on Machinery @5% & Furniture 2000 Outstanding Expnses: Wages-1600 & Rent-400 Insurance Prepaid -600 Bad debts -500 & RDD 5% on Debtors Prepare Trading A/C, Profit/Loss A/C & Balance-Sheet. SECTION-D IV Answer any Two 22. Write the accounting Equation & Findout the missing figures. Assets Liabilities Capital ? 1,70,000 3,00,000 5,20,000 4,00,000 ? 3,80,000 ? 5000 1,00,000 20,000 ? ? 30,000 20,000 23. Draft a specimen of debit note. 24. Prepare accounting cycle. 2x5=10

******************

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- SS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFDokument13 SeitenSS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFEdmund YoongNoch keine Bewertungen

- Method Statement For Backfilling WorksDokument3 SeitenMethod Statement For Backfilling WorksCrazyBookWorm86% (7)

- HACCP Coconuts 2019Dokument83 SeitenHACCP Coconuts 2019Phạm Hồng Ngân100% (4)

- F5 - LTM TrainingDokument9 SeitenF5 - LTM TrainingAliNoch keine Bewertungen

- Circular For FfacultiesDokument3 SeitenCircular For FfacultiesNag28rajNoch keine Bewertungen

- Part Timers List UGDokument3 SeitenPart Timers List UGNag28rajNoch keine Bewertungen

- BBMP Letter For Permison To BannersDokument1 SeiteBBMP Letter For Permison To BannersNag28rajNoch keine Bewertungen

- Report of One Day Workshop ON "Ug Soft Skills Paper-Science & Society"Dokument2 SeitenReport of One Day Workshop ON "Ug Soft Skills Paper-Science & Society"Nag28rajNoch keine Bewertungen

- Criteria Key Aspects Affiliated Colleges 1. Curricular AspectsDokument2 SeitenCriteria Key Aspects Affiliated Colleges 1. Curricular AspectsNag28rajNoch keine Bewertungen

- Proposed List of Guest Lectures-MuthuDokument1 SeiteProposed List of Guest Lectures-MuthuNag28rajNoch keine Bewertungen

- Entrepre Nuer ShipDokument6 SeitenEntrepre Nuer ShipNag28rajNoch keine Bewertungen

- Department Profile: ParticularsDokument4 SeitenDepartment Profile: ParticularsNag28raj0% (1)

- Library InfoDokument8 SeitenLibrary InfoNag28rajNoch keine Bewertungen

- Naac Self Study Report: International Institute of Business StudiesDokument9 SeitenNaac Self Study Report: International Institute of Business StudiesNag28rajNoch keine Bewertungen

- Christ College Kerala SSR 2015Dokument380 SeitenChrist College Kerala SSR 2015Nag28rajNoch keine Bewertungen

- BU 096 Register UG 2015-16Dokument2 SeitenBU 096 Register UG 2015-16Nag28rajNoch keine Bewertungen

- GM: General Merit - Obc: Other Backward Caste - Min: Minorities - SC: Scheduled Caste - ST: Scheduled Tribe - For: Foreign PHC: Physical HandicappedDokument1 SeiteGM: General Merit - Obc: Other Backward Caste - Min: Minorities - SC: Scheduled Caste - ST: Scheduled Tribe - For: Foreign PHC: Physical HandicappedNag28rajNoch keine Bewertungen

- Value EducationDokument8 SeitenValue EducationNag28raj100% (2)

- Layout 1 For PhotosDokument2 SeitenLayout 1 For PhotosNag28rajNoch keine Bewertungen

- LIC Part Time Faculty ListDokument1 SeiteLIC Part Time Faculty ListNag28rajNoch keine Bewertungen

- Resolution For Establishment of New Technical InstitutionDokument2 SeitenResolution For Establishment of New Technical InstitutionNag28rajNoch keine Bewertungen

- Request For TonnerDokument1 SeiteRequest For TonnerNag28rajNoch keine Bewertungen

- Proforma For The Preliminary Project ReportDokument4 SeitenProforma For The Preliminary Project ReportNag28rajNoch keine Bewertungen

- Ii Puc - Ceba Students List SL No Register Number: I BatchDokument6 SeitenIi Puc - Ceba Students List SL No Register Number: I BatchNag28rajNoch keine Bewertungen

- Welcome SpeechDokument4 SeitenWelcome SpeechNag28rajNoch keine Bewertungen

- University of Delhi: 4year Under Graduate Admission-2014 Advisory For Students With DisabilitiesDokument1 SeiteUniversity of Delhi: 4year Under Graduate Admission-2014 Advisory For Students With DisabilitiesNag28rajNoch keine Bewertungen

- HOVAL Dati Tecnici Caldaie IngleseDokument57 SeitenHOVAL Dati Tecnici Caldaie Ingleseosama alabsiNoch keine Bewertungen

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Dokument21 SeitenAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Donnie HavierNoch keine Bewertungen

- BS351: Financial Reporting: Learning ObjectivesDokument3 SeitenBS351: Financial Reporting: Learning ObjectivesMajeed Ullah KhanNoch keine Bewertungen

- Hw5 MaterialsDokument2 SeitenHw5 MaterialsmehdiNoch keine Bewertungen

- Válvula DireccionalDokument30 SeitenVálvula DireccionalDiego DuranNoch keine Bewertungen

- Call For Papers ICMIC-2016Dokument1 SeiteCall For Papers ICMIC-2016Zellagui EnergyNoch keine Bewertungen

- J 2022 SCC OnLine SC 864 Tushardubey Symlaweduin 20221015 214803 1 23Dokument23 SeitenJ 2022 SCC OnLine SC 864 Tushardubey Symlaweduin 20221015 214803 1 23Tushar DubeyNoch keine Bewertungen

- Response LTR 13 330 VielmettiDokument2 SeitenResponse LTR 13 330 VielmettiAnn Arbor Government DocumentsNoch keine Bewertungen

- Long Term Growth Fund Fact SheetDokument2 SeitenLong Term Growth Fund Fact SheetmaxamsterNoch keine Bewertungen

- Feed Water Heater ValvesDokument4 SeitenFeed Water Heater ValvesMukesh AggarwalNoch keine Bewertungen

- July2020 Month Transaction Summary PDFDokument4 SeitenJuly2020 Month Transaction Summary PDFJason GaskillNoch keine Bewertungen

- Governance of Cyber Security Research ProposalDokument1 SeiteGovernance of Cyber Security Research ProposalAleksandar MaričićNoch keine Bewertungen

- Roasted and Ground Coffee Manufacturing Industry Feasibility StudyDokument22 SeitenRoasted and Ground Coffee Manufacturing Industry Feasibility StudyGhirmaye AbebeNoch keine Bewertungen

- AMM Company ProfileDokument12 SeitenAMM Company ProfileValery PrihartonoNoch keine Bewertungen

- Slope Stability Analysis Using FlacDokument17 SeitenSlope Stability Analysis Using FlacSudarshan Barole100% (1)

- Transparency in Organizing: A Performative Approach: Oana Brindusa AlbuDokument272 SeitenTransparency in Organizing: A Performative Approach: Oana Brindusa AlbuPhương LêNoch keine Bewertungen

- Natures CandyDokument19 SeitenNatures CandyFanejegNoch keine Bewertungen

- Automatic Star Delta StarterDokument11 SeitenAutomatic Star Delta StarterAmg 360Noch keine Bewertungen

- A 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series PrinterDokument4 SeitenA 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series Printerahmed salemNoch keine Bewertungen

- Reliability EngineerDokument1 SeiteReliability EngineerBesuidenhout Engineering Solutions and ConsultingNoch keine Bewertungen

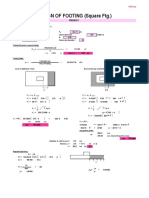

- Design of Footing (Square FTG.) : M Say, L 3.75Dokument2 SeitenDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNoch keine Bewertungen

- Usb - PoliDokument502 SeitenUsb - PoliNyl AnerNoch keine Bewertungen

- Addendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032Dokument22 SeitenAddendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032stretch317Noch keine Bewertungen

- Electrical Installation Assignment 2023Dokument2 SeitenElectrical Installation Assignment 2023Monday ChristopherNoch keine Bewertungen

- Manual de Parts ES16D6Dokument36 SeitenManual de Parts ES16D6Eduardo CortezNoch keine Bewertungen

- 1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersDokument12 Seiten1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersRichard LundNoch keine Bewertungen