Beruflich Dokumente

Kultur Dokumente

NHBF Magzine

Hochgeladen von

rahulchauhan7869Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NHBF Magzine

Hochgeladen von

rahulchauhan7869Copyright:

Verfügbare Formate

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

1

NEWS UPDATES

TABLE OF CONTENTS:

20 highway projects may go for re-bid if govt approves report

My way on the highway

Half-built flyover spells trouble for motorists

Tiruchi-Karaikudi bypass project on fast track

Flyover, underpass at Hero Honda Chowk gets NHAI, govt nod

How to gain from the fall in inflation

NCDs rise in popularity as a debt instrument

Critical need to improve infrastructure sector to boost growth

India-Japan summit: Infra clearly a growing story

Japan to provide Rs 1,267 cr loan for road project in Bihar

Afghan builders interested to form JVs with Indian firms: Ficci

Ashoka Buildcon selected bidder for KSHIP WAP-2 project

Project monitoring group clears hurdles in 84 mega projects

Work on Rs 800-crore terminal at Cochin Airport to begin tomorrow

Panel on coal linkages to meet on February 19

Abu Dhabi's TAQA to acquire two hydropower assets from Jaypee Group for Rs 12,000-13,000

crore

*Contact for advertisement in this daily e-newsletter:

Cell: 9871160490, Tel:011-25081247, e-mail- murali_nhbf@yahoo.co.in or nhbf.road@gmail.com

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

2

www.strataindia.com

Innovative Geotechnical Solutions

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

3

BUSINESS STANDARD

20 highway projects may go for re-bid if govt approves report

Manu Balachandran | New Delhi :As many as 20 road projects worth Rs 20,000 crore, awarded

between 2011 and 2013, could be scrapped and might be re-bid if the Cabinet approves the

recommendations made by a panel led by the Prime Minister's Economic Advisory Council

chairman, C Rangarajan, on rescheduling of premiums. The projects haven't taken off because of

unfavourable economic conditions and lack of funding. Developers were seeking lenient

premium-rescheduling norms.

According to experts, the projects have seen an escalation of 30 per cent on account of costlier

land and raw materials. Earlier, National Highways Authority of India (NHAI) ChairmanR P

Singh had also written to the roads ministry about the rising costs. According to the letter,

projects witnessed a 26 per cent rise in costs in the past two years and private developers were

seeking the rescheduling to factor in the rising costs of construction, on the back of an economic

slowdown. "In all likelihood, the developers would walk out of the projects. If they go for re-

bids, that will essentially mean we will not see aggressive bidding or may have to seek the

government to fund the projects," said a senior NHAI official.

ROADBLOCK

Highway projects worth Rs 20,000 crore havent taken off because of

unfavourable economic conditions and lack of funding

Projects have seen an escalation of 30 per cent on account of costlier land and

raw materials

Private developers were seeking lenient rescheduling norms to factor in the

rising costs of construction on the back of an economic slowdown

If projects go for re-bids, they would not see aggressive bidding or might have

to seek the government to fund the projects

According to the Rangarajan committee report given to the government last week, projects facing

economic stress are allowed to avail relief under a revenue shortfall loan clause given in the

model concession agreement. The amount of shortfall between the toll revenue collected by the

highway developer and expenses incurred, including operation and maintenance costs and debt

servicing and premium payments, will be extended as a loan to companies which have been

seeking a rescheduling of premium.

Premium is the amount road developers have to pay the government for build-operate-transfer

projects on the assumption that the returns from the project would be quite high. The amount is

decided at the time of bidding on the basis of projected future traffic flow.

Contd.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

4

Advertisement

www.techfebindia.com

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

5

According to an industry source, NHAI has already worked out deals with 10 road developers

and the projects could be re-bid soon. "Some have been terminated and in some cases, the road

developers have backed out. There are 10 such projects and we are likely to see another five or

10 being added to that list. This could include the GMR projects worth Rs 5,500 crore."

In an interview to Business Standard last week, Planning Commission member, B K Chaturvedi

had said the road projects should be scrapped and re-bid because work had not started on any of

the projects. "We need to draw a line somewhere and in some of these projects not a brick has

been laid out... My view is we scrap them and go for re-bids. I think the committee has proposed

a reasonable package and all they are saying is, build up the roads and service the debt,"

Chaturvedi had said.

Industry experts believe scrapping some projects would bring some stability in the road sector.

"There has been aggressive bidding in the past. Now when the projects go for re-bid, we will see

a moderate, cautious bidding. In the long-run, the committee's recommendations will be good for

the road developers," said the CEO of a leading infrastructure company.

The roads ministry has been looking at ways to improve investments into the sector. It recently

notified a revamped exit policy to allow companies to exit road projects. "The recommendations

will help developers who are involved in the two-lane to four-lane construction. There are so

many riders in the report and one of them is on the loan. India Infrastructure Finance Company

currently lends at 11.35 per cent and the committee recommendations also work out to the same.

Then there is the penalty. In that sense, it will become difficult for highway developers," said M

Murali, director-general, National Highway Builders Federation.

THE TIMES OF INDIA

My way on the highway

Dipak Kumar Dash,New Delhi:The new roads are smooth-sailing , but recovering investments is

going to be a long journey for private developers as commuters across India, backed by political

parties, refuse to pay toll

Just days before Maharashtra Nav Nirman Sena (MNS) leader Raj Thackeray reportedly incited

party members to vandalize toll booths across highways in Maharashtra , residents from Rohtak,

Haryana, were organizing a more peaceful protest of their own. United as the Toll Bachao

Sangharsh Samiti, they negotiated to lower toll tax on the Rohtak-Panipat highway.

The timing of both incidents is no coincidence with elections around the corner, there is a

likelyhood of similar protests nationwide. Political outfits like the Shiv Sena-BJP combine and

Aam Aadmi Party have already put forth their intent to make roads across Maharashtra and

Haryana tollfree , if they come to power. And while the National Highways Authority of India

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

6

(NHAI) have resolved the problem at the Delhi border toll plaza on Gurgaon Expressway

reportedly, it may become toll-free soon NHAI officials say it will be tougher to find solutions

on other stretches where similar demands have been raised.

Central and state governments maintain that private investment is essential to meet India's

growing demand for better roads. Private investment has increased significantly from Rs

9.323 crore during 2002-2007 to around Rs 60,000 crore during 2007-2012 . Developers recover

money by collecting toll in their contract period, a uniform rate based on type of vehicle and

grade of road set by government.

But questions are being raised about whether commuter concerns are being ignored. All India

Confederation of Goods Vehicle Owners' Associations president Chittranjan Dass says, "Road

development should be oriented towards need of road users' and not for pampering the

concessionaires."

According to highway ministry officials, commuters are against paying toll for different reasons.

"Some believe the government already collects taxes and cess for road development. Others

accuse developers of failing to provide facilities managing traffic congestion , the upkeep of

roads," says an NHAI official. A senior official adds that most complaints are related to bad

roads even after developers collect toll or on stretches where toll is collected while construction

is underway, like the Gurgaon-Jaipur highway. "Developers must provide the best services . For

example, if the Gurgaon Expressway operator had managed to improve traffic flow at the border

there would not have been objection to toll," says highways secretary Vijay Chhibber.

CPM leader Sitaram Yechury, has questioned why people are made to pay a fee when there are

no public conveniences for commuters along highway corridors.

SP Gupta of People's Voice, which had filed a case against toll on Gurgaon Expressway in

Supreme Court, says that in several locations, the NHAI and state public works departments have

closed service roads to ensure everyone pays toll. "The state must ensure people get a free road.

Those opting for a signal free road can pay for better facility," he says. Often protestors are local

commuters and farmers, who pay toll even for using a small stretch of the highway . This was

what fuelled protests by Bhartiya Kisan Union in Western UP in 2012, who were objecting to

farmers carrying fodder in tractors having to pay toll.

Organizations highlighting commuter woes say the simmering discontent is erupting in violent

protests across the country. "Positioning the plazas at city entry/ exit points results in long

queues. Also, several plazas are perceived to be overcharging and not providing committed

services ," says SP Singh of Indian Foundation of Transport Research and Training, a think tank

on transport issues.

Dass, however, believes protests and vandalizing toll plazas are not the solution. Protests against

toll have already derailed road development projects in Kerala and West Bengal. Now there are

fears whether violent protests in Maharashtra and UP will also drive investors away. As M

Murali, director-general of National Highway Builders Federation (NHBF), points out,

developers will claim damages from the government. "There are clauses in every contract

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

7

agreement for such compensation and the contracting party from government side has to make

that payment. This will be followed in Maharashtra . Soon we are also going to approach NHAI

and the road transport ministry on cases of similar protests on NH stretches," he says.

THE TIMES OF INDIA

Half-built flyover spells trouble for motorists

Debabrata Mohapatra,BHUBANESWAR: Safety measures are allegedly amiss at an under-

construction flyover near Vani Vihar, which witnessed two accidents this month. A biker had a

bad fall on Saturday night after he took the incomplete flyover by mistake. A similar mishap had

taken place on January 16.

Police and NHAI officials expressed ignorance about the latest mishap. "It is the responsibility of

the NHAI and the infrastructure company to adopt precautions at the under-construction

overbridges. We will ask them to install barricades and signages at the construction sites," DCP

(traffic) S Shyni told TOI. She is scheduled to convene a meeting with the officials of NHAI and

the infrastructure company on Monday.

While traffic police are trying to locate the accident victim, construction workers said he

survived after falling on a heap of sand. On January 16, businessman Srinivas Barik too took the

flyover in front of Satsang Vihar and tumbled over at Vani Vihar up to which it has been

completed. "There was no stop board or warning while I was coming from Rasulgarh. Besides,

there are no lights to guide motorists. Luckily, I escaped with minor injuries," Barik said.

Inspector-in-charge of Saheed Nagar police station confirmed the January 16 accident.

Commuters accused traffic police of being lenient to the company, constructing flyovers on NH-

5. "The company should be taken to task for not ensuring safety measures at the construction

sites. It is difficult to cross the stretch due to poor illumination," said Bijay Mishra, a Nayapalli

resident.

The NHAI and construction company authorities rubbished the allegations. "We have taken

adequate safety measures and put up signages," said an NHAI officer.

THE HINDU

Tiruchi-Karaikudi bypass project on fast track

S. GANESAN: TRICHY: The by-pass road, linking the Tiruchi-Thanjavur and Tiruchi-

Pudukottai highways, coming up near Tiruchi.

It would help BHEL and surrounding ancillary units

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

8

Work on the development of 107-km Tiruchi-Karaikudi highway, including the laying of a

bypass between Asoor on the Tiruchi-Thanjavur Highway and Mathur on the Tiruchi-Pudukottai

highway, is expected to be completed in six months as the Madras High Court had recently given

the go-ahead for the project.

The Madras High Court, in a recent order, upheld the petitions of the National Highways

Authority of India (NHAI) quashing the Public Works Departments orders stopping work on the

project on grounds that the alignment of the road impacts water bodies. The stop-work notices

initially stalled the Rs. 374-crore project. However, the NHAI had obtained an interim injunction

early last year to continue with the project, which involves laying of new bypass in Tiruchi,

Keeranur, Pudukottai, Thirumayam, and Karaikudi. The High Court has directed the NHAI to

preserve the water bodies and carry out dredging or restoration, if required.

The PWDs stop-work had mainly impeded the laying of the bypass from Asoor to Mathur.

Although the NHAI went ahead with the project after obtaining an interim injunction, work on a

couple of stretches along the bypass had remained suspended after farmers objected to laying the

road across irrigation tanks near K. Sathanur.

According to sources in the NHAI, a major portion of the 26-km bypass has been completed.

Already, about 15 km of the bypass had been laid and the work on the remaining portion will be

completed soon. An overpass has to be built at Kumaramangalam. On the Tiruchi-Karaikudi

section, work on nearly 75 km has been completed out of about 84 km. Being executed on the

build-operate-transfer basis, the project would be completed in the next six months, the sources

said.

Once completed, the bypass forming part of a semi ring road around the city would help quick

and hassle-free transportation of material from the power sector major BHEL and ancillary units

located around Thuvakudi.

THE TIMES OF INDIA

Flyover, underpass at Hero Honda Chowk gets NHAI, govt nod

Dipak Kumar Dash, NEW DELHI: The expressway's second big traffic hurdle has fallen in as

many weeks.

The Haryana government and the National Highways Authority of India on Friday approved a

three-level crossing at Hero Honda Chowk, paving the way for the corridor's other big bottleneck

to be resolved after bankers last week agreed to remove the toll plaza at Sirhaul.

The three-level crossing, which will see a flyover being constructed over the existing road and an

underpass below the intersecting road, got in-principle approval from both sides and will be built

with an approximate investment of Rs 150 crore.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

9

After proposing and junking several plans to solve the perpetual logjam at this crossing in the

past six-seven years, the highways ministry recently decided to build a flyover on the existing

highway for smooth flow of traffic. "We have gone a step ahead to find a complete solution to

the traffic problem. Once the three-level crossing is constructed, traffic can move seamlessly in

all directions," said NHAI chief general manager Dr B S Singla.

The project includes an eight-lane flyover on the main Delhi-Jaipur Road (NH-8) for traffic

coming from both Delhi and Jaipur. Cars moving across the expressway, between Subhash

Chowk and Old Gurgaon, can take the four-lane divided underpass. Traffic taking a right turn at

the crossing will use the existing road.

Both the highways ministry and the Haryana government have agreed to implement the project

with complete government funding. The final project cost is yet to be worked out. While the

NHAI will foot 75% of the bill, the remaining 25% will come from Haryana. The state

government will also provide the required land for construction.

It was also decided on Friday that Haryana government will clear all encroachments so that work

can start without any hassle. The meeting was attended by top officials from NHAI, Haryana

Urban Development Authority, Public Works Department and authorities from Gurgaon besides

the city police commissioner.

"Once the estimate is worked out we will get the approval from highways ministry and tendering

will start," said a source.

In October, highways minister Oscar Fernandes had said that the flyover will be operational in

the next 18-20 months.

THE TIMES OF INDIA

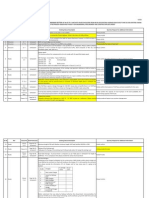

How to gain from the fall in inflation

Narendra Nathan | New Delhi:At long last, there is some -respite on the inflation fronttheretail

inflation based on the consumer price index (CPI) returned to single digits in December 2013,

hitting 9.87% from 11.24% a month earlier. The wholesale inflation also came down to 6.16% in

December (see Falling inflation). More importantly, the fall in both these numbers was well

above the market expectations.

The big question now is: which way is inflation headed from now onwards? Says Indranil Sen

Gupta, India economist, Bank of America Merrill Lynch: "Inflation is expected to fall for a few

more months." The recent fall in wholesale and retail inflation is primarily due to the easing of

vegetable prices. Since the latter is continuing to drop, so should inflation.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

10

However, don't rush to celebrate yet because the fall may be a short-term phenomenon. The

current dip in vegetable prices is due to the winter and may climb back at the onset of summer.

The low base effect of April/May last year, when the wholesale inflation was below the 5%

mark, is another reason inflation may rise. The wholesale debt market has already started

celebrating the fall in inflation. For instance, the yield of the 10-year government of India papers

has fallen to 8.64%, a two-and-a-half month low (see 10-year yield). "We see the 10-year yield

coming down further to 8% in the next three to six months," says Gupta.

Here's a look at some investment products that can help you benefit.

Long-term income and gilt funds

Since the price of debt papers and yield are inversely correlated, the recent yield fall has resulted

in a rally of corporate debt/gilt papers. This is clearly visible in the NAVs of long-dated income

and gilt funds. Most of them had given a 2-3% absolute return in the past month (see Top 5

tables). Since the yield is expected to fall further, shifting assets from short-term debt and liquid

funds to long-term debt funds is a good strategy. If inflation rate, as well as interest rates, drop in

the coming months as expected, investors in these long-term income and gilt funds stand to enjoy

further gains.

However, financial planners advise not to go overboard with this strategy. To begin with, this is a

high-risk, high-return strategy. Each of the one-month best performers have given paltry or even

negative absolute returns in the past year when the interest rate rose.

If you choose to take this route, shift only a part of your portfolio. "Long duration funds should

only form a small part of your portfolio," cautions Raghvendra Nath, managing director,

Ladderup Wealth Management. This is because inflation is not the sole factor that decides

interest rates. So, any untoward incident at a global level, say, a re-emergence of the debt crisis in

Europe, can unsettle the applecart once again. Secondly, you need to stagger your investments.

"The best strategy to invest in long duration funds at present is to do it in a phased manner till

end-March," says Anil Rego, CEO, Right Horizons. Given that March is typically a month of

tight liquidity due to the advance tax outflow and other year-end considerations, the yield may

firm up once again during that period. Lastly, don't get carried away by short-term return

possibilities and stick with the long-term view while investing in such high-risk products.

"Though you can book profit if the interest rates fall significantly in the middle, the original

investment horizon should be at least two years," adds Rego.

Tax-free bonds

The high-interest tax-free bond issues from government-sponsored entities are the best option at

the moment. Since an 8.75% post-tax interest works out to 12.66% pre-tax interest for investors

in the 30.9% bracket, this is a no-brainer. "This is also the best option for retired people since

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

11

they can lock in at high tax-free rates for a very long time," says Rego. This explains why the Rs

2,100 crore NHB tax-free bond offering, which provided retail investors 9.01% on its 20-year

paper, got oversubscribed on the first day itself. Though the rates have come down since then,

both the issues that are currently available in the marketIRFC and NHAI-offer good returns

for 10-year and 15-year papers (neither player offers 20-year -papers). Though these are long-

term investments, there is no lock-in period and are listed in the market. This means that it will

also generate a short-term trading opportunity if the expected fall in interest rate continues. In

fact, many of the recent issues are already quoting at a premium.

Should you pick the IRFC or NHAI? If you are a retail investor and want to put in only a small

amount, go for NHAI because it is -offering better coupon rates. If you are a high net worth

individual (HNI) and want to invest, say, Rs 20 lakh, invest equally in both offerings rather than

going for NHAI alone because the rate on offer for HNIs is less by 25 basis points.

Bank FDs and fixed maturity plans

Fixed deposits are offering decent returns at present, but there is no reason to rush and park your

funds here. The credit-to-deposit ratio is high for banks and they may try to corner more deposits

by keeping the rates high. Taxation is another problem with FDs, especially for HNIs.

It is better to go for the tax-efficient fixed maturity plans (FMP) from mutual funds. The yield on

one-year FMPs is around 9%, which is good to lock in at. However, FMPs are closed-ended

products and only investors with holding power should get in.

Equity

This asset class also benefits from falling -interest rates. Firstly, it helps companies report a better

profit since their interest burden reduces. The sale of several rate-sensitive sectors also picks up.

Several stocks, such as banking, real estate, auto and capital goods, are picking up momentum

after the drastic fall in inflation numbers. However, the Indian economy is going through a slow

growth phase and, hence, getting into equity market only to benefit from the falling inflation and

interest rates may be risky.

Financial Chronicle

NCDs rise in popularity as a debt instrument

By Ravi Ranjan Prasad/, Mumbai:

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

12

Last year witnessed the maximum number of debt issuances, mostly via NCD issues, with 32

offers mopping up Rs 34,392 cr

Amount rose through debt offers like non-convertible debentures (NCDs) and tax-free bonds in

the primary market have been on the rise since 2009 as companies are finding it increasingly

difficult to raise funds through the initial public offering (IPO) route. Last year witnessed the

maximum number of debt issuances; 32 debt issuances mopped up Rs 34,392.50 crore, mostly

through public issue of NCDs, according to data analysis and research agency Primedatabase.

Popularity of NCDs as a debt instrument is particularly rising. Issuers of NCDs as well as the

regulators, Reserve Bank of India (RBI) and Securities and Exchange Board of India (Sebi), are

accordingly introducing new features to make NCDs a safe and investor-friendly product.

When one buys an NCD, one lends money to the issuer, the company that issues the bond. In

exchange, the company promises to return the money, also known as principal, on a specified

maturity date. Until that date, the company usually pays a stated rate of interest, generally semi-

annually, also known as coupon rate.

Experts say the rising popularity of debt offerings over equity offerings is due to investors

moving their savings to safer asset classes. NCDs provide attractive rate of returns to investors.

Observing frequent private placement of NCDs, RBI in a July 2013 circular has put some

restrictions. Such issuances can now be organised only after a six month gap and can be issued to

a maximum of 49 institutional investors. NBFCs have lately been raising resources from the

retail public on a large scale, through private placement, especially by issue of debentures,

Reserve Bank of India (RBI) said.

Companies issue bonds to raise money for a variety of purposes, such as building a new plant,

purchasing equipment, or expanding business.

These bonds do not have an ownership interest in the issuing company, unlike the companys

equity stock.

Companies also offer NCDs on private placement basis to select institutional investors at fixed

coupon rate, which sets the benchmark for the coupon rate to be offered to the subscribers in a

NCD public issue later.

Since the first tax-free bond issue in 2010-11 by National Highway Authority of India (NHAI),

there has been substantial fund raising through tax-free bonds by government-owned companies

over the past three years.

Such tax-free bond issuances are also in the nature of secured, redeemable, NCDs, with tax-free

interest payment being the additional feature.

Corporate bonds are debt securities that are generally considered as long-term investment option.

The maturity period of these securities ranges from one to 20 years. These bonds are mostly

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

13

listed with major stock exchanges, such as the Bombay Stock Exchange (BSE) and National

Stock EXhange (NSE).

As per the provisions of companies act, appointment of debenture trustee to manage the servicing

of debentures and redemption liabilities is mandatory. However, issue of debentures/bonds with

maturity of 18 months or less is exempt from the requirement of appointment of trustee.

In case of debenture/ bonds with maturity beyond 18 months, a trustee or an agent is appointed to

take care of the interest of debenture/bond holders.

The exit options before the maturity period for NCDs and other type of bonds still remain rather

narrow due to the lack of depth in the bond market.

Corporate bonds tend to rise in value when interest rates fall, and they fall in value when interest

rates rise. Usually, the longer the maturity, the greater is the degree of price volatility, which

leads to price arbitrage opportunity, provided there is enough liquidity in the exchange market.

Also when interest rates rise, new issues come to market with higher yields than older securities,

making those older ones worthless. Hence, their prices go down.

When interest rates decline, new bond issues come to market with lower yields than older

securities, making those older, higher-yielding ones worth more. Hence, their prices go up. As a

result, if one sells a bond before maturity, it may be worth more or less than it was paid for.

By holding a bond until maturity, one may be less concerned about these price fluctuations

(which are known as interest-rate risk, or market risk), because one will receive the par, or face,

value of the bond at maturity.

Bonds and interest rates share an inverse relationship with each other, that is, bonds are worth

less when interest rates rise and vice versa.

Premature redemption of bonds on stock exchanges is still in its early year with volumes rising

slowly but steadily. Thus, exit options before maturity still remain limited.

Online order matching system for corporate bond trading was introduced on the recommendation

of RH Patil Committee that was formed to look into the factors inhibiting the development of an

active debt market.

Now stock exchange volumes of traded bonds are on a rise. On the National Stock Exchange

(NSE), corporate bonds traded daily on an average in January this year was Rs 1,076 crore as

against Rs 722 crore in January 2010.

The lower liquidity here is also being addressed by some bond issuers who have started their own

NCD buyback programme.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

14

The L&T Finance NCD issue was launched in September 2009 and the buyback option was

launched in May 2012, an L&T Finance spokesperson said.

L&T Finance has announced an NCD buyback programme for dated NCDs maturing in

September 2014 with coupon rates of 9.51 per cent and 9.62 per cent, maturing in September

2017 with a coupon rate of 9.95 per cent and maturing in September 2019 with a coupon rate of

10.24 per cent. The L&T Finance buyback programme is open for a limited period and the NCDs

have a buyback price. The buyback programme provides to investors an exit opportunity over

and above the available exchange trading platform. But there is a limit up to which investors can

tender.

Investors can tender up to 100 debentures in a quarter, that is, debentures worth Rs 1 lakh face

value.

In the buyback programme, the company accepts overall 5 lakh debentures per quarter from all

debenture holders.

The buyback price for each month is made available on L&T Finance website.

The pricing in the buyback is different from traded prices on exchanges.

L&T Finance fixes pricing in the buyback scheme on a methodical calculation, whereby,

benchmark G-sec yields and benchmark spreads as per the PDAI-FIMMDA curve are

considered.

The traded prices on the stock exchanges do not follow any particular yield pattern and are quite

erratic, mainly on account of the low volumes of trading. Hence, the pricing in the buyback could

be higher than, or lower than, or equal to the traded prices on the exchanges, L&T Finance said.

Experts say because there is no active market for non-convertible debentures in the capital

market segment of the stock exchanges, the liquidity and market prices of NCDs may fail to

develop and may accordingly be adversely affected.

L&T Finance says it will pay investors participating in the buyback programme the accrued

interest for the period from the previous interest payment date up to one day before the settlement

date, which is also is the date of dispatch of the money. So the investor doesnt lose even one day

interest till the last day of redemption.

Deccan Herald

Critical need to improve infrastructure sector to boost growth

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

15

Sharada Prahladrao:Globally, adequate and efficient infrastructure is critical for industrial growth

and economic prosperity. Developed economies, such as the US and countries in Europe are now

grappling with how to repair/replace worn-out infrastructure with limited funding.

Governments the world over are focusing on the public/private partnership model to finance and

build infrastructure initiatives. Institutional investors are looking at this sector in terms of future

returns and inflation-hedging potential.

In developing countries, strategically planned and executed investments in the infrastructure

sector can help improve logistics and connectivity, equalise opportunities and provide the

wherewithal to compete in a global marketplace. But economic and political conditions have a

strong bearing on effective infrastructure investments. In an increasingly connected world, India's

infrastructure sector is impacted by downswings in other countries as it reins in international

funding.

India's economic growth is bogged down by multiple issues, but the infrastructure logjam is

perhaps the key constraint. Recent debates and conferences highlight that the infrastructure

sector, which encompasses the gamut from transport, buildings, water and wastewater, energy etc

is getting choked due to absence of integrated planning and logistical bottlenecks.

Rapid urbanisation for employment and better standard of living puts tremendous strain on the

infrastructure. These challenges include: providing basic facilities such as potable water, power,

etc; building mass transport systems; overhauling existing infrastructure; and perhaps most

important - timely completion of projects. According to estimates, by 2030 about 40 per cent

(600 million) of the country's population will be in urban areas. Evidently, infrastructure delivery

in India is hugely affected by fuel supply to the power sector.

Panelists at the National Infrastructure Summit 2013 concurred that while alternative sources of

energy are being considered and recommended, coal would remain the mainstay of India's energy

source. In this sector, environmental clearances were the common grouse but infrastructural

constraints and logistical bottlenecks emerged as the primary challenge in developing

incremental capacity. The total output of coal in 2012-13 is 557 million tonne and coal imports

135 mt.

In the 11th Five-Year Plan (2007- 2012), capacity was ramped up to 56,000 mw, of which 76 per

cent was thermal capacity. Since then capacity addition on an annual basis was more than during

previous Five-Year Plan tenures. Coal transportation is another challenge as the evacuation

logistics are inadequate. With the right logistics, production in each coal block can reach 100 mt

incremental capacity within three years. Substantiating this point is the fact that 300 mt of

additional supply potential is stuck due to the lack of three rail corridors in Jharkhand, Odisha,

and Chhattisgarh.

Improving connectivity

India is about sheer volumes - both in terms of population and aspirational demands. Every year,

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

16

14 million vehicles get added. Although India has one of the world's densest road networks - 1.42

km per sq.km of land compared to 0.66 km for the US and 0.43 km for China - the number of

multi-lane highways is rather low. The decade-old underground metro system in New Delhi is

also approaching overcapacity. For smooth transition of goods and services it is vital to have

efficient road and rail networks.

The key challenges of the railway sector are: Inability to add to the existing railways network.

Since 1947 merely 10,464 km has been added whereas, China added 20,000 km in the last five

years. High freight rates are forcing commodities to shift to road transport. Share in freight

movement is only 30 per cent today (post-Independence it was 90 per cent). Reluctance to raise

passenger fares has resulted in operational losses. Losses in 2013-14 from passenger operations

amounted close to $4 billion.

The cost to build roads and transit systems to manage a huge population is significant, but it has

to be done in a comprehensive manner through long-term vision and planning. The Government

has allocated $1 trillion in the 12th Five-Year Plan (2012-2017) for infrastructure development -

focus will be on more private participation to build new roads. Statistics reveal that out of 564

infrastructure projects, over 40 per cent have been delayed.

According to the Department of Industrial Policy and Promotion (DIPP), the air transport

(including air freight) in India has attracted FDI worth $456.84 million from April 2000 to July

2013. In 2012-2013 total domestic passengers were above 65 million.

Although statistics show a marginal improvement, this sector is grounded by higher fuel prices;

the depreciating value of the rupee is also affecting airlines as 70-80 percent of costs (aircraft

leases, fuel) are dollar determined. High airport rates in Mumbai and Delhi have led economy

airlines such as Air Asia to withdraw flights from these airports. In the first quarter of 2013-14,

Indias 12 big ports, which account for about 58 per cent of the total cargo, shipped through the

countrys ports handled 137 mt of goods. Present port capacity stands at 750 mt and traffic

around 550 mt, which shows sub-optimal efficiency.

These are what need to be done to improve the port sector: connectivity with better road and

railway systems; expediting of environmental and security clearances; encourage investments;

improve efficiencies and reduce the turnaround (about 4.2 days) and pre-berthing detention time

(about 12 hours); mechanisation for faster cargo handling and reduction of labor costs; and

provide a level field for private operators with regularised tariffs.

Business Standard

India-Japan summit: Infra clearly a growing story

New Delhi: Much before Japanese premier Shinzo Abe's visit to India, Japanese investment into

India was on a steady rise, especially in the infrastructure sector. The growing India-Japan

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

17

economic cooperation, in fact, is increasingly been seen as a strategic alternative to Chinese

influence in the South Asian region.

Of the 51-paragraph joint statement issued on the first day of Abes three-day visit, some half a

dozen were devoted to cooperation in energy and infrastructure. These and defence cooperation

were the most important plank of bilateral talks.

"If one takes a close look at the statement, this one is much more explicit with several hints at the

China factor, compared to what it was in 2007 (when Abe earlier came to India). The very fact

that the statement emphasized on taking into consideration the strategic environment is proof

that the China factor loomed large on the visit, said Srikanth Kondapalli, chairperson, Centre for

East Asian Studies (School of International Studies) in Jawaharlal Nehru University.

On economic relations, though the highlight was expansion of bilateral currency swap

arrangement from $15 billion to $50 bn that came into effect from this month, Japanese official

development assistance (ODA) of a little over 200 billion was also negotiated. The two sides

agreed all instruments of funding of the Japan Bank for International Cooperation (JBIC) and the

Japan International Cooperation Agency (JICA), including the Special Term for Economic

Partnership, should be explored.

According to JICA, the Japanese cumulative commitment of ODA loans to India stood at 3,781

bn (Rs 229,100 crore) as of March 2013. JICA has signed around 230 ODA loan agreements with

India in various fields -- roads, metro projects, water supply and sanitation, environment

conservation, power and several other infrastructure sectors.

Kondapalli said in infrastructure development, while the Japanese have been making bold

announcements, actual work and progress on the ground has to be seen. While the intention is

there, India has to put its own house into order -- we have to tackle our environment laws, labour

laws, etc. We are very slow. Also, their assistance for developing the northeast region cannot be

delinked from the strategic moves they are taking. Abe came here just before the Diet (Japanese

legislature) session. This is enough proof for anyone to understand that Japan is serious about

India."

After the Delhi Metro rail, the Western Dedicated Freight Corridor is an important part of the

cooperation. The start of Phase-1 construction of the corridor in August 2013, which utilises

Japanese technologies, was reviewed during the talks. Nine projects financed by the DMIC trust

have already been approved.

Progress on the western corridor, however, has been slow to start with, compared to the World

Bank-funded eastern corridor. But JICA does not agree. We dont think Japanese-funded

projects are slower in implementation. Many of the projects being implemented with JICAs

assistance have also been completed ahead of the time schedule, said Shinya Ejima, JICA chief

in India. He cited the first phase of the Delhi Metro, covering 65 km, completed in 2005, two

years and nine months ahead of schedule. The second phase, too, was completed within the

estimated cost and well within the scheduled time, adding another 125 km, in 2011. This has

been viewed as a miraculous milestone achievement, he said.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

18

In the railway sector, another major achievement is the commencement of a joint feasibility study

and issuance of the inception report for a high speed railway system on the Mumbai-Ahmedabad

route. They agreed the joint study should be completed by July 2015.

In energy, government-controlled NTPC, the countrys largest power generator, signed an

agreement for two loans totalling $430 million (Rs 2,650 crore) for its Kudgi and Auraiya

projects. Besides, the Japanese are financing a scheme for two smart community projects, a

model project for a micro-grid system using large scale photo-voltaic power generation at

Neemrana and a seawate desalination project at Dahej.

India is the biggest receiver of Japanese ODA and Indian companies the second biggest receiver

of assistance from JBIC after Chinas. Overall Indo-Jap cooperation is heavily directed towards

long-term participation in infrastructure, much of which comes from the enormous demand.

Japanese investment is geared to tap this.

THE ECONOMIC TIMES

Japan to provide Rs 1,267 cr loan for road project in Bihar

NEW DELHI: Japan International Cooperation Agency will provide Rs 1,267 crore loan

for Bihar's National Highway Improvement Project.

Under the agreement signed between JICA and the Centre today, the loan is being

provided for upgradation of National Highway 82 connecting Gaya and Bihar sharif in

Bihar covering 92.93 km, a release said.

NDTV PROFIT

Afghan builders interested to form JVs with Indian firms: Ficci

New Delhi: Builders from Afghanistan have evinced interest in collaborating and forging

joint ventures with Indian companies for executing projects in the war-torn country in

housing, road construction, schools and hospitals.

The businessmen from Afghanistan "have also shown interest to source all kinds of

building materials and building equipments/machinery," industry body Ficci said in a

statement issued after its interaction with members of Afghanistan Builders Association

(ABA).

A 35-member Afghan delegation, led by ABA, is here on a visit.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

19

It said India is in the final stages of preparing a draft memorandum of understanding

under which India will help Afghanistan in developing roads. Highways and share its

knowledge in transportation technologies.

India has carried out several construction and infrastructure projects in Afghanistan,

including building of Afghanistan's Parliament.

ABA President Naeem Yassin said that the delegation's aim was to connect construction

firms of both the sides, facilitate joint venture opportunities in Afghanistan and explore

investment opportunities in construction sector.

"ABA facilitates international investors and companies to work in Afghanistan in

construction field," it said quoting Yassin. The bilateral trade between the countries

stood at $632.18 million in 2012-13.

MONEYCONTROL

Ashoka Buildcon selected bidder for KSHIP WAP-2 project

Ashoka Buildcon Ltd has informed BSE that Company along with GVR Infra Projects

Limited, as a Consortium (51%:49%) had submitted its bid to The Chief Project Officer,

Karnataka State Highways Improvement Project ("KSHIP") engaged by Government of

Karnataka (Public works Department) for the Project viz. PROJECT NO. WAP - 2: -

Design, Build, Finance, Operate, Maintain and Transfer (DBFOMT) the Existing State

Highway (SH18) from Mudhol to Maharashtra Border (Approx length 107.937 Kms) in

the State of Karnataka on DBFOMT Annuity Basis" ("Project").The project is on Annuity

Basis with a Concession Period of 10 years and KSHIP cost of the Project is Rs. 317.60

Crores.The Chief Project Officer, Karnataka State Highways Improvement Project, has

declared the Consortium as a "Selected Bidder" for the aforesaid Project vide Letter of

Award dated February 01, 2014.Source

Project monitoring group clears hurdles in 84 mega projects

Entail investments worth 3.71 lakh crore in the past seven months

Kolkata:

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

20

The Project Monitoring Group (PMG), attached to the Cabinet Secretariat, could sort out

problems for some 84 mega projects totalling 3.71 lakh crore investments in the past

seven months since the inception of the group.

Anil Swaroop, Chairman of the PMG, told here that actually problems for more projects

about 137 have been resolved. But, we have received clear information about 84

projects. Other project implementation agencies, mostly private sector ones, have been

slow in filing updated inputs about progress of their projects, he added.

PMG identified some 419 stalled projects worth almost 20 lakh crore that had been

pending for years.

He said projects related to coal mining and evacuation formed the biggest chunk of the

stalled projects followed by ones that were stuck because of non-availability of forest or

environmental clearances. Some 70,000 MW worth coal related projects have been

cleared, the PMG Chairman added.

Swarup said that the Todi-Shibpur-Hazaribagh rail project work for coal evacuation

would start this month after decades of delay.

PMG has only been taking up projects worth 1,000 crore or more. He said that nine

States, including Andhra Pradesh, Maharashtra, Gujarat, Madhya Pradesh, Rajasthan

and Jharkhand, have decided to set up their own monitoring groups for projects worth

less than 1,000 crore.

West Bengal has also decided to set up such a group. The PMG Chairman on Friday

discussed the pipeline project linking Paradip, Haldia and Durgapur as also railway,

highway and power transmission projects. He said in West Bengal problems for the

mega infrastructure projects stemmed mainly from the issues related to land

acquisition.

THE ECONOMIC TIMES

Work on Rs 800-crore terminal at Cochin Airport to begin tomorrow

MUMBAI: Work on a new Rs 800-crore terminal at Cochin International Airport Ltd

would begin tomorrow in the biggest expansion since it started operations in 1999.

Kerala Chief Minister will lay the foundation stone for the world-class terminal tomorrow.

The development comes a day ahead of the work on the fourth international airport in

the state at Kannur kicking off on February 2.

"Chief Minister Oommen Chandy will lay the foundation stone for the new international

terminal tomorrow and the work construction will begin on the same day.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

21

"The new terminal is likely to be opened to the public in two-and-a-half years. We are

investing over Rs 800 crore for the terminal," Cochin International Airport Ltd (CIAL)

Managing Director V J Kurien told PTI from Cochin today.

The other projects, involving over Rs 200 crore investments, are the second phase of

the CIAL would include a golf course, a solar power unit, a duty-free warehousing

complex, a golf academy, an aviation safety training institute, and an integrated airport

management system, he said.

For the Cochin airport, this Rs 1,000-crore ambitious plan marks its biggest expansion

since it began operations in 1999 as the first greenfield airport in the public-private

partnership model.

The new terminal will have three-times more built-up area of 15 lakh sq ft with 15

aerobridges that can handle a peak hour capacity of up to 4,000 passengers or 10

million passengers annually, Kurien said.

Meanwhile, Defence Minister A K Antony will lay the foundation stone for Kerala's fourth

international airport at Kannur, a multi-party joint venture on Sunday. The first phase of

the project involves and investment of Rs 1,590 crore.

The government will hold 35 per cent in the airport, Airports Authority 26 per cent, oil

major BPCL will have 23 per cent and the rest will be held by private sector,

including Federal Bank and NRI businessman M A Yusuf Ali, would hold 5 per cent

stateke each and the remaining 5 per cent would be given to NRK groups.

The new international airport is expected to be ready in 2015. Kerala already has three

airports in Thiruvananthapuram, Kozhikode and Kochi a fifth one is planned to come up

at Aranmulla in Pathanamthitta district in central Kerala.

The new Kochi airport terminal will help the airport, set up way back in 1999 under a

PPP model with investments individual public, mostly from non-resident Keralites, to

keep pace with its increasing passenger traffic that is growing by 12-13 per cent, Kurien

added.

MONEYCONTROL

Panel on coal linkages to meet on February 19

An inter-ministerial panel will meet on February 19 to review the status of existing coal

supply arrangements to the power and other sectors.

"The meeting of the Standing Linkage Committee (Long-Term) for

power/sponge/cement to review the status of existing coal linkages/letters of assurance

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

22

and other related matters will be held on February 19," according to a Coal Ministry

memorandum.

Amid continuous delays, the Cabinet Committee on Investment had earlier said

timelines for signing fuel supply pacts for power projects of 78,000 MW capacity should

be met.

State-owned Coal India has signed 157 fuel supply agreements with power producers

for a capacity of 71,145 MW, missing two deadlines.

Coal Minister Sriprakash Jaiswal had said that the remaining supply agreements would

be signed once technical glitches are addressed.

Coal India will supply as much as 80 per cent of a power producer's requirements, of

which 65 per cent will be sourced locally and 15 per cent will be met through imports.

The mining company last month invited fresh applications for supply of coal from

overseas to meet its obligations to power producers under the fuel supply agreements. It

plans to import 5 million tonnes of coal.

Abu Dhabi's TAQA to acquire two hydropower assets from Jaypee Group for Rs 12,000-

13,000 crore

By Arijit Barman,

The deal signals growing appetite among foreign investors for infrastructure assets. TAQA is

forming a consortium of sponsors to conclude this transaction

MUMBAI: Abu Dhabi's flagship energy and utilities company TAQA (energy in Arabic) is set to

acquire two hydropower projects in Himachal Pradesh from Delhi-based Jaypee Group at an

enterprise valuation of Rs 12,000-13,000 crore ($1.9-2.07 billion) signaling growing appetite

among foreign investors for infrastructure assets. TAQA is forming a consortium of financial

sponsors to conclude this transaction, said multiple sources involved in the process.

After months of negotiations, last week, TAQA's top brass met their counterparts in Jaypee in

New Delhi to finalise plans to buy the 300 mw Baspa II and the 1000 mw Karcham Wangtoo

projects on the Sutlej river.

TAQA has roped in Canadian pension fund PSP Investments and home-grown infrastructure-

focused PE player IDFC Alternatives - part of infrastructure finance company IDFC - to form a

consortium.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

23

TAQA TO HOLD MAJORITY STAKE

The Abu Dhabi company will have operational control with a majority stake of at least 51%

while PSP will be a significant minority partner. IDFC is likely to have a 10% shareholding after

the deal is concluded. More financial investors may come in later.

The foreign direct investment could range from $875 million (assuming an enterprise valuation

of $1.9 billion) to $1.03 billion (at an enterprise valuation of $2.07 billion). The new investors

will inherit the project debt, which stands at close to Rs 7,000 crore.

The total project cost for the two power plants is about Rs 8,900 crore - including Rs 2,600 crore

of equity, which means TAQA and its partners are paying a substantial premium.

"Last Friday, both sides shook hands and agreed on the broad terms of this landmark deal.

Diligence and pricing discussions are already over. Some commercial conditions are yet to get

finalised, following which the final signatures will be appended and a formal announcement is

expected," said an official aware of the ongoing discussions. He spoke on the condition of

anonymity as the talks are still in private domain.

Since the latter half of last year, Jaypee's listed power arm Jaiprakash Power Ventures Limited -

India's largest private sector hydropower producer with 1.7 gw of operational capacity - has been

negotiating with TAQA to sell two of its three operating hydropower assets, often considered the

jewels in its portfolio.

ET was the first to report the discussions last year in its edition dated September 9, 2013.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

24

The deal is expected to be announced by March-end. But with most of the terms being agreed

upon, the matter is likely to be discussed when Jaiprakash Power's board meets on Monday to

announce the third quarter numbers. ET was unable to verify if the proposed deal is part of the

formal agenda.

A Jaypee Group spokesperson refused comment, saying the company did not respond to market

speculation. "What you are saying is speculation and I will not comment on it. I am out of town

and am not aware of any meeting that you are referring to," added Suren Jain, managing director

& CFO of Jaiprakash Power Ventures.

"We are listed on the Abu Dhabi Securities Exchange. Any updates regarding new acquisitions

would only be made through stock exchange notifications. Our policy is not to comment on

rumours," TAQA's Abu Dhabi-based global spokesperson told ET.

Mails sent to PSP Investments did not receive a response till the time of going to press. The

IDFC Alternatives spokesperson was also unavailable for comment.

Last year, Jaypee Group had sold its Gujarat cement plants to Aditya Birla Group's UltraTech

for Rs 3,800 crore as part of an exercise to pare debt. Jaypee runs a diversified portfolio of roads,

cement and power plants as well as construction, real estate and sports companies. The group

owns India's only Formula One (F1) racing track.

PSP Investments is one of Canada's largest pension fund managers with $76.1 billion of assets

under management as of March 2013. The firm invests on behalf of the pension plans of the

Canadian Armed Forces, Royal Canadian Mounted Police and the Reserve Force. The Jaypee

deal will be its first direct investment in India.

IDFC's PE division (under IDFC Alternatives) has recently raised $644 million from investors in

continental Europe and America to be deployed in Indian roads, port and power projects. It aims

to raise up to a billion dollars in what would be the largest PE fund-raising in the past five years

for investments in India's core sector. Incidentally, PSP is also a sponsor (limited partner) to

IDFC's new fund.

Founded in 2005, TAQA - with 2012 revenues of $7.6 billion - is 72.5% owned by the Abu

Dhabi government and its various agencies. TAQA is the listed international business arm of

Abu Dhabi Water & Electric Authority (ADWEA). ADWEA has five subsidiaries that generate,

clean, buy, transmit and distribute water and electricity throughout the emirate. TAQA operates

in 11 countries across four continents, including a small presence in India.

According to company officials, TAQA's interests lie in conventional and alternative power

generation, water desalination, oil & gas exploration and production, pipelines and gas storage.

As of end-2012, its global assets are valued at $33.4 billion while its current global power

generation capacity stands at 16,395 mw.

Consulting firm EY is advising the Jaypee Group.

February 3, 2014 NATIONAL HIGHWAYS BUILDERS FEDERATION

25

DELEVERAGING JP BALANCE SHEET

Analysts reckon both Baspa and Karcham Wangtoo are attractive assets. The former has been

operational since 2005-06 and has consistently generated close to 25% return on equity. It sells

100% of its output under a power purchase agreement (PPA) with Himachal Pradesh. In

Karcham Wangtoo, Jaiprakash Power Ventures is selling the entire output as a merchant power

producer.

The company had signed a PPA with Power Trading Corporation to sell 70% of the output on a

cost-plus basis. However, a dispute between the two on implementation of the PPA is being

adjudicated by the Central Electricity Regulatory Commission.

"At 1.25-1.5 times price-to-book, this is a great valuation keeping the net worth at around Rs

4,000 crore. Since commissioning, the projects have been accumulating profits of around Rs

1,400 crore. This will help bring down the (debt) stress," said an analyst at a foreign brokerage

who tracks the group and the power sector.

Jaypee, among the top 10 indebted corporate groups in India, had a gross debt of over Rs 63,000

crore ($10 billion) in FY13, as per a Credit Suisse estimate. Of that, Jaypee Power alone had

accumulated Rs 23,000 crore of debt, and by next fiscal this is estimated to reach close to Rs

28,000 crore as new capacities in Uttar Pradesh and Madhya Pradesh commence operations.

Flagship Jaiprakash Associates' shares have dropped 51% in the past one year. Jaiprakash Power

has also plummeted 63% during the same period. The scrip closed at Rs 13 on Friday.

After the disinvestment, the company plans to deploy part of the proceeds of around Rs 3,000

crore as equity for the Prayaraj and Nigrie projects in Uttar Pradesh and Madhya Pradesh,

respectively, said officials briefed on the matter. The group has said it would cut total liabilities

by 25% by selling assets in power, real estate and cement sectors. The sale, once consummated,

would help the conglomerate reach its target of paring debt by Rs 15,000 crore by June 2014. It

has already managed to bring down debt by Rs 6,300 crore by monetising cement plants and land

parcels.

*Contact for advertisement in this daily e-newsletter:

Cell: 9871160490, Tel:011-25081247, e-mail- murali_nhbf@yahoo.co.in or nhbf.road@gmail.com

Das könnte Ihnen auch gefallen

- GUIDE BUND Type C-8Dokument1 SeiteGUIDE BUND Type C-8rahulchauhan7869Noch keine Bewertungen

- GAD of 1210 M Span BridgeDokument5 SeitenGAD of 1210 M Span BridgeRahul ChauhanNoch keine Bewertungen

- Analysis of Rates (Nh-15 Barmer - Sanchor)Dokument118 SeitenAnalysis of Rates (Nh-15 Barmer - Sanchor)rahulchauhan7869Noch keine Bewertungen

- WC10 617Dokument24 SeitenWC10 617om_833654993Noch keine Bewertungen

- KRCL BridgesDokument1 SeiteKRCL Bridgesrahulchauhan7869Noch keine Bewertungen

- MISDokument99 SeitenMISdassreerenjiniNoch keine Bewertungen

- Aunta SimaariaDokument1 SeiteAunta Simaariarahulchauhan7869Noch keine Bewertungen

- Bid Document & SchedulesDokument229 SeitenBid Document & Schedulesrahulchauhan7869Noch keine Bewertungen

- Aide Memoire-Brahmaputra Bridge - EPCDokument3 SeitenAide Memoire-Brahmaputra Bridge - EPCrahulchauhan7869Noch keine Bewertungen

- RelianceDokument1 SeiteReliancerahulchauhan7869Noch keine Bewertungen

- FDokument58 SeitenFrahulchauhan7869Noch keine Bewertungen

- ID Card FormatDokument1 SeiteID Card Formatrahulchauhan7869Noch keine Bewertungen

- PGPM 31 - NICMAR AssignmentsDokument28 SeitenPGPM 31 - NICMAR AssignmentsVinod Vasan67% (6)

- Farzi NWDokument3 SeitenFarzi NWrahulchauhan7869Noch keine Bewertungen

- Project Risk Management in ConstructionDokument11 SeitenProject Risk Management in Constructionrahulchauhan7869Noch keine Bewertungen

- Nicmar Nicmar Institute of Construction Management and Research School of Distance EducationDokument13 SeitenNicmar Nicmar Institute of Construction Management and Research School of Distance Educationrahulchauhan7869Noch keine Bewertungen

- Ongoing Projects in DelhiDokument5 SeitenOngoing Projects in Delhirahulchauhan7869Noch keine Bewertungen

- Project Risk Management in ConstructionDokument11 SeitenProject Risk Management in Constructionrahulchauhan7869Noch keine Bewertungen

- Aligarh Moradabad Section of NH-93 Pre-Bid Queries-07 07 14Dokument14 SeitenAligarh Moradabad Section of NH-93 Pre-Bid Queries-07 07 14rahulchauhan7869Noch keine Bewertungen

- ID Card FormatDokument1 SeiteID Card Formatrahulchauhan7869Noch keine Bewertungen

- Engineer CertificatesDokument69 SeitenEngineer Certificatesrahulchauhan7869Noch keine Bewertungen

- Unnao 22feb2014Dokument69 SeitenUnnao 22feb2014rahulchauhan7869Noch keine Bewertungen

- April, 14Dokument7 SeitenApril, 14rahulchauhan7869Noch keine Bewertungen

- Precast Segments ConstructionDokument9 SeitenPrecast Segments Constructionrahulchauhan7869Noch keine Bewertungen

- 5 RFQ - Bikaner Phalodi - Final Mode24 02 2014Dokument68 Seiten5 RFQ - Bikaner Phalodi - Final Mode24 02 2014rahulchauhan7869Noch keine Bewertungen

- Local Expense Claim FormDokument2 SeitenLocal Expense Claim Formrahulchauhan7869Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Iif 8 Epcm Contracts Feb16 3Dokument22 SeitenIif 8 Epcm Contracts Feb16 3Jorge RammNoch keine Bewertungen

- Abl 2009 PDFDokument125 SeitenAbl 2009 PDFAli SyedNoch keine Bewertungen

- International Financial Reporting StandaDokument122 SeitenInternational Financial Reporting StandaZain AliNoch keine Bewertungen

- Pillar 3 Disclosures ConsolidatedDokument27 SeitenPillar 3 Disclosures ConsolidatedPuja BhallaNoch keine Bewertungen

- GK Capsule8Dokument9 SeitenGK Capsule8Kritika JainNoch keine Bewertungen

- 2 Taxation of International TransactionsDokument7 Seiten2 Taxation of International TransactionssumanmehtaNoch keine Bewertungen

- Bihar Startup Policy 2016Dokument35 SeitenBihar Startup Policy 2016Vikash KushwahaNoch keine Bewertungen

- Overnight Delivery Industry Competition AnalysisDokument9 SeitenOvernight Delivery Industry Competition AnalysisJohn WilliamsNoch keine Bewertungen

- Vallix QuestionnairesDokument14 SeitenVallix QuestionnairesKathleen LucasNoch keine Bewertungen

- Abilene Reflector ChronicleDokument8 SeitenAbilene Reflector ChronicleARCEditorNoch keine Bewertungen

- DLL Tle He 6 Q1 W1Dokument4 SeitenDLL Tle He 6 Q1 W1Analiza Dequinto Balagosa100% (4)

- Clarium Investment Commentary - The Wonderful Wizard of OzDokument15 SeitenClarium Investment Commentary - The Wonderful Wizard of Ozmarketfolly.com100% (40)

- Doubling, Nick Leeson's Trading StrategyDokument24 SeitenDoubling, Nick Leeson's Trading Strategyapi-3699016Noch keine Bewertungen

- "Equity Research On Cement Sector": Master of Business AdministrationDokument62 Seiten"Equity Research On Cement Sector": Master of Business AdministrationVishwas ChaturvediNoch keine Bewertungen

- Survey Questionnier For Startup BarriersDokument5 SeitenSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- ProjectReport Unilever WWKBDokument83 SeitenProjectReport Unilever WWKBEmiria Ferida ShafianandaNoch keine Bewertungen

- Developing A Strategic Business PlanDokument75 SeitenDeveloping A Strategic Business Planearl58100% (10)

- The Effect On Five Forces Model in Banking and Financial IndustryDokument21 SeitenThe Effect On Five Forces Model in Banking and Financial IndustryMay Myat ThuNoch keine Bewertungen

- Kriti Industries 2019 PDFDokument132 SeitenKriti Industries 2019 PDFPuneet367Noch keine Bewertungen

- TermProj assignMutFund 2019 SpringDokument1 SeiteTermProj assignMutFund 2019 Springjl123123Noch keine Bewertungen

- What is a Futures ContractDokument4 SeitenWhat is a Futures Contractareesakhtar100% (1)

- Micro Shots 2010Dokument158 SeitenMicro Shots 2010arif7000Noch keine Bewertungen

- List of Indian Companies with Reg. No. and NameDokument105 SeitenList of Indian Companies with Reg. No. and NameShikhar AgarwalNoch keine Bewertungen

- LLQP Financial Math2015sampleDokument10 SeitenLLQP Financial Math2015sampleYat ChiuNoch keine Bewertungen

- Other Long Term InvestmentsDokument1 SeiteOther Long Term InvestmentsShaira MaguddayaoNoch keine Bewertungen

- INF090I01569 - Franklin India Smaller Cos FundDokument1 SeiteINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNoch keine Bewertungen

- PI Final CombineDokument46 SeitenPI Final CombineMonique LimNoch keine Bewertungen

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Dokument9 SeitenAllama Iqbal Open University, Islamabad (Department of Business Administration)Muhammad AbdullahNoch keine Bewertungen

- Uk Pestle Analysis FinalDokument48 SeitenUk Pestle Analysis FinalGreeshmaNoch keine Bewertungen

- List of Bank in KarnatakaDokument43 SeitenList of Bank in KarnatakaGunjanNoch keine Bewertungen