Beruflich Dokumente

Kultur Dokumente

Franchise Requirements As Per PFA

Hochgeladen von

dragon_girl2366Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Franchise Requirements As Per PFA

Hochgeladen von

dragon_girl2366Copyright:

Verfügbare Formate

HOW TO ENTER THE PHILIPPINE MARKET

CONTENTS:

MODES OF ENTRY TO THE PHILIPPINES

THE PHILIPPINE FRANCHISE REGULATIONS

BUSINESS REGISTRATION GUIDE

GENERAL PROCEDURES & APPLICATION REQUIREMENTS

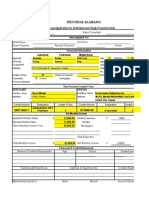

SUMMARY OF PROCEDURES FOR STARTING A BUSINESS IN PHILIPPINESAND THE TIME AND COST

BOARD OF INVESTMENT FREQUENTLY ASKED QUESTIONS

TRADEMARKS ONLINE FILING SYSTEM

MODES OF ENTRY TO THE PHILIPPINES

The Philippine market offers an innately large consumer base that is attractive for franchise

operators. Its strategic location makes the country an appealing option as a franchise hub to launch a

future Asia-Pacific expansion. Thats how Ilan Alon, author of the Book, Service Franchising: A Global

Perspective, summed up the Philippine market.

In this same book, he cited the favorable factors for the Philippines: wide use of the English

language, cultural affinity with American values, low labor cost, large pool of skilled labor and

management talent, and moderately well-placed infrastructure. The competitive climate that exist in

the more urbanized locations in the country forces new entrants to creatively innovate and adapt

quickly to the environment in order to succeed.

His book revealed that countries that offer a high level of economic market potential, a low level

of political instability and risk, a legal environment that protects intellectual property, an efficient court

system, and a social environment that is auspicious to franchising are more likely to attract franchising

investment.

Alon cited four fundamental ways where foreign franchisors may chose to enter the Philippine

market: 1) sole ventures, 2) joint ventures, 3) direct international franchising, and 4) master franchising.

Quoting the Australian Trade Commission, said Alon: the most viable franchising entry modes

in the Philippine market is through the use of joint venture with a local firm, or appoint a local company

to act as a master franchisee and lead the network expansion in the country.

A joint venture (JV) is a business agreement in which parties agree to develop, for a finite time, a

new entity and new assets by contributing equity. They exercise control over the enterprise and

consequently share revenues, expenses and assets

while Master International franchising refers to the contractual agreement between the franchisor and

an independently owned sub-franchisor to develop a specified number of franchises in a given area in

exchange for the exclusive right to use the business format for a specified period.

Be it a joint venture or master franchising, entering the Philippine market requires careful

planning and preparation. Alon recommended the following approaches:

1. Find a Suitable Partner. There are several instances worldwide where international franchising

operations were marred by an error in partner selection. Hence, selection of a partner should be

done judiciously as it makes a large impact on the success of a foreign franchise. The American

Chamber of Commerce, Philippine Chamber of Commerce and the Philippine Franchise

Association are ideal starting points to meet and gain information on potential franchisees.

2. Identify and Utilize Strategic Control Measures. Establishing ventures in foreign locations often

necessitate some form of adaptation and adjustment. The fact that the culture, market and

business conditions, socio-political landscape, and infrastructure could be different from home

markets thorough contractual safeguards have to be in place. Sensitivity to existing disparities

have to be factored into the companys strategic planning.

3. Use the National Capital Region as Entry Point. The supporting infrastructure and distribution

systems in the Philippines are well developed in urban locations, such as the National Capital

Region. The cities of Manila, Quezon City and Caloocan are in the National Capital Region and

have a population of over 1 million. These locations also have a wide presence of world-class

advertising and marketing support facilities. It makes strategic sense to establish the initial

franchise in these locations while further gaining an understanding of the business dynamics of

the country.

4. Set Up Mall Stores. A number of western franchises have experienced success as a result of

their presence in major malls. Benefits associated with a mall presence include: high visibility,

large foot traffic, convenient consumer access, image building, and easy to complement with

national advertising campaigns. Though, space availability and lease rates may be issues to

consider, select opportunities do exist and can prove beneficial.

5. Expand Selectively to Provincial Areas. The Philippine population is spread out across different

provinces. Several provinces have population of over 1 million. There are issues to consider with

regard to infrastructure development, peace and order, and ease of product distribution in

certain provinces. Nevertheless, a well-thought out expansion strategy allows an international

franchisor to tap into unique market opportunities that may exist in these developing locations.

THE PHILIPPINE FRANCHISE REGULATIONS

The Philippine government recognizes the value of franchising for developing local industries. In

the most recent development plan prepared by the National Economic Development Authority (NEDA)

mentions franchising as a means for accelerating the development of small and medium-sized

enterprises (SMEs). The Philippine International Trading Corporation (PITC), a government-owned

trading agency, has introduced a program for franchisees called the Order Negosyo Franchising

Program. Through this program, the PITC aims to guide prospective Filipino franchisees in choosing and

securing franchise rights.

Through the efforts of franchise industry organizations such as the Philippine Franchise

Association (PFA), franchising is now recognized as an ideal business proposition for franchisors and

franchisees alike. PFA is responsible for organizing several franchise industry fairs over the past several

years, including the international franchising conference held annually in the Philippines. With the

objective of promoting self-regulation, the PFA requires its members to comply with the PFAs Fair

Franchising Standards. These standards are essentially uniform norms of conduct to govern franchise

relationships.

The Philippines does not have a specific statute governing franchising. However, certain laws

apply to franchising as far as these relate to the mutual obligations of parties to a franchise agreement,

the extent to which the parties may agree on contractual conditions, and the qualifications of persons

authorized to engage in retail franchising. The significant laws and regulations are discussed below.

Civil Code

All franchise agreements, whether between foreign franchisors and Philippine franchisees, or

between Philippine franchisors and Philippine franchisees, are subject to Philippine law including,

among others, the Civil Code provisions on obligations and contracts. Applying the general principle on

contracts under the Civil Code, the franchisor and franchisee may agree on such terms and conditions as

they may deem convenient, provided these are not contrary to law, morals, good customs, public order

or public policy.

Intellectual Property Code

Unlike in other jurisdictions where franchising regulations are already in place, the Philippines

has yet to adopt a system to regulate the offering and selling of franchises. To a certain extent though,

franchise agreements are regulated under the technology transfer provisions of the Philippine

Intellectual Property Code (IP Code).

A franchise agreement can be characterized as a Technology Transfer Arrangement (TTA),

which is defined under the IP code as a contract or agreement involving the transfer of systematic

knowledge for the manufacture of a product, the application of a process, or rendering of a service

including management contracts; and the transfer, assignment or licensing of all forms of intellectual

property rights, including licensing of computer software except computer software developed for mass

market.

Under the IP code, TTAs must comply with certain prohibited and mandatory clauses. Sections

87 and 88 of the IP Code, which enumerate the prohibited and mandatory clauses, are reproduced in

Annex A of this article. Failure to comply with these provisions will render a TTA unenforceable, unless

the parties to the TTA obtain an exemption from the Documentation, Information and Technology

Transfer Bureau (DITTB) of the Intellectual Property Office (IPO). The DITTB) is the government agency

primarily responsible for enforcing TTA regulations. As a general rule, the DITTB will grant exemptions

only in exceptional cases under Section 91 of the IP Code where substantial benefits will accrue to the

Philippine economy. The DITTB also grants exemptions on a case-by-case basis, depending on the

particular provision covered by the request for exemption, and the justification given for the request.

A TTA that complies with the provisions on mandatory and prohibited clauses need not be

registered with the DITTB. However, there are practical considerations for registering a compliant TTA.

If the parties to a TTA intend to avail of tax treaty relief, a DITTB registration is required to be submitted

to the Philippine Bureau of Internal Revenue in support of an application for such treaty relief. Also, if

license fees or royalties under a TTA are payable in any currency other than in Philippines pesos, the

registration of the TTA will be required in order that the licensee can source foreign currencies from the

Philippine banking system.

Retail Trade law

Franchise businesses, in almost all instances, involve the sale at retail of products. For this

reason, it is important for franchisors and franchisees, the foreigners in particular, to know what the

Philippine law affecting the retailing business says.

The Retail Trade Liberalization Law (RA 8762) imposes certain restrictions on foreign equity

participation in enterprises engaged in retail trade. Under this law, retail trade refers to any act,

occupation or calling of habitually selling direct to the general public merchandise, commodities or

goods for consumption, but the restrictions of this law shall not apply to the following:

Sales by a manufacturer, processor, laborer, or worker, to the general public the products

manufactured, processed or produced by him if his capital does not exceed one hundred

thousand pesos (P100,000.00);

Sales by a farmer or agriculturist selling the products of his farm;

Sales in restaurant operations by a hotel owner or inn-keeper irrespective of the amount of

capital: Provided, That the restaurant is incidental to the hotel business; and

Sales which are limited only to products manufactured, processed or assembled by a

manufacturer through a single outlet, irrespective of capitalization.

The Retail Trade Liberalization Law provides that foreign-owned partnerships, associations and

corporations formed and organized under the laws of the Philippines may, upon registration with the

Securities and Exchange Commission (SEC) and the Department of Trade and Industry (DTI), or in case of

foreign-owned single proprietorships, with the DTI, engage or invest in the retail trade business, subject

to the following categories:

Category A Enterprises with paid-up capital of the equivalent in Philippine Peso of

lower than Two million five hundred thousand US dollars (US$2,500,000.00) shall be

reserved exclusively for Filipino citizens and corporations wholly owned by Filipino

citizens.

Category B Enterprises with a minimum paid-up capital of the equivalent in Philippine

Pesos of two million five hundred thousand US dollar (US$2,500,000.00) but less than

Seven million five hundred thousand US dollars (US$7,500,000.00) may be wholly

owned by foreigners except for the first two (2) years after the effectivity of this Act

wherein foreign participation shall be limited to not more than sixty percent (60%) of

total equity.

Category C Enterprises with a paid-up capital of the equivalent in Philippine Pesos of

Seven million five hundred thousand US dollars (US$7,500,000.00), or more may be

wholly owned by foreigners: Provided, however, That in no case shall the investments

for establishing a store in vestments for establishing a store in Categories B and C be less

than the equivalent in Philippine pesos of Eight hundred thirty thousand US dollars

(US$830,000.00).

Category D Enterprises specializing in high-end or luxury products with a paid-up

capital of the equivalent in Philippine Pesos of Two hundred fifty thousand US dollars

(US$250,000.00) per store may be wholly owned by foreigners.

It is also worth noting that certain government initiatives have helped in the growth of

franchising in the Philippines. Examples of these enabling initiatives by the Philippine government are

the RA 9501 or the Magna Carta for MSMEs (micro, small and medium-sized enterprises) law, the

establishment of the Small Business Guaranty and Financing Corp., and other similar programs. The

government has also come to recognize the importance of franchising as a means to encourage

enterprise development and employment generation, hence the growing partnership between PFA and

various government agencies in organizing seminars and other activities that promote entrepreneurship.

A major development and further fostered the climate of self-regulation was the release of the

Bureau Order 1024 of the Bureau of Trade Regulation and Consumer Protection (BTRCP) of the

Department of Trade and Industry (DTI). This bureau order was issued in response to the incidences of

franchise scams. It has two main points, namely that prospective franchisees must exercise due

diligence when getting a franchise, and that franchisors should become members of a franchise

association, which is encouraged to police its own ranks.

Annex A

Prohibited Clauses

Sec 87. Prohibited Clauses. Except in cases under Section 91, the following provisions shall be deemed

and other clauses with equivalent effect shall be deemed prima facie to have been an adverse effect on

competition and trade:

87.1 Those which impose upon the licensee the obligation to acquire from a specific source capital

goods, intermediate products, raw materials, and other technologies, or of permanently employing

personnel indicated by the licensor;

87.2 Those pursuant to which the licensor reserves the right to fix the sale or resale prices of the

products manufactured on the basis of the license;

87.3 Those that contain restrictions regarding the volume and structure of production;

87.4 Those that prohibit the use of competitive technologies in a non-exclusive technology transfer

arrangement;

87.5 Those that establish a full or partial purchase option in favor of the licensor;

87.6 Those that obligate the licensee to transfer for free to the licensor in the inventions or

improvements that may be obtained through the use of the licensed technology;

87.7 Those that require payment of royalties to the owners of patents for patents which are not used;

87.8 Those that prohibit the licensee to export the licensed product unless justified for the protection of

the legitimate interest of the licensor such as exports to countries where exclusive licenses to

manufacture and/or distribute the licensed product(s) have already been granted;

87.9 Those which restrict the use of the technology supplied after the expiration of technology transfer

arrangement, except in cases of early termination of the technology transfer arrangement due to

reason(s) attributable to the licensee;

87.10 Those which require payments for patents and other industrial property rights after their

expiration or termination of the technology transfer arrangement;

87.11 Those which require that the technology recipient shall not contest the validity of any patents of

the technology supplier;

87.12 Those which restrict the research and development activities of the licensee designed to absorb

and adapt the transferred technology to local conditions or to initiate research and development

programs in connection with new products, processes or equipment;

87.13 Those which prevent the licensee from adapting the imported technology to local conditions, or

introducing innovation to it, as long as it does not impair the quality standards prescribed by the

licensor;

87.14 Those which exempt the licensor from liability for non-fulfillment of his responsibilities under the

technology transfer arrangement and/or liability arising from third party suits brought about by the use

of the licensed product of the licensed technology;

87.15 Other clauses with equivalent effects.

Mandatory Clauses

Sec 88. Mandatory Provisions. The following provisions shall be included in voluntary license contracts:

88.1 That the laws of the Philippines shall govern the interpretation of the same and in the event of

litigation, the venue shall be the proper court in the place where the licensee has its principal office

88.2 Continued access to improvements in techniques and processes related to technology shall be

made available during the period of the technology transfer arrangement;

88.3 In the event the technology transfer arrangement shall provide for arbitration, the Procedure of

Arbitration of the Arbitration Law of the Philippines or the Arbitration Rules of the United Nations

Commission on International Trade Law (UNCITRAL) or Rules of Conciliation and Arbitration of the

International chamber of Commerce (ICC) shall apply and the venue of arbitration shall be the

Philippines or any neutral country; and

88.4 The Philippines taxes on all payments relating to the technology transfer arrangement shall be

borne by the licensor.

BUSINESS REGISTRATION GUIDE

For business registration, one has to understand the rules and processes in the government

agencies: Securities and Exchange Commission (SEC), Department of Trade and Industry (DTI), Bureau of

Internal Revenue (BIR), and the Local Government Unit (LGU).

All of these government agencies are in-charge of different aspects of business registration.

Some of the processes are registering company name to DTI or SEC, filing of Articles of Incorporation

(AOI) and By-Laws with SEC, placing the minimal capitalization with a local bank, and then completing

the application process with SEC for the release of your Certificate of Registration (COR).

Apart from those are, registration for a Social Security Number (SSS), Philhealth, and Home

Development Mutual Fund (HDMF) as well as business permit and register with the BIR for a Tax

Certificate.

The business permits and licenses depend on the nature of your business. It depends on the

kind of company structure such as sole proprietorship, corporation, partnership, and others as well.

Whether your business is in the online gaming and amusement industry or cosmetic or pharmaceutical

industry, you have to get licenses from government bodies to open a business in the Philippines.

Below are the General Guidelines and Application Requirements as well as the Summary of

Starting a Business in the Philippines.

GENERAL PROCEDURES & APPLICATION REQUIREMENTS

A. REGISTRATION OF BUSINESS ENTITIES

1. SINGLE PROPRIETORSHIP/ BUSINESS NAME REGISTRATION

(Application to be filed at any nearest Department of Trade and Industry (DTI) office or through

http://www.dti.gov.ph)

A. Requirements for Filipino Investors

i. Must be a Filipino citizen, at least 18 years old

ii. Filipinos whose name are suggestive of alien nationality must submit proof of citizenship such

as birth certificate, PRC ID, voters ID, passport

(a) If the applicant has a foreign sounding name, acquired Filipino citizenship by

naturalization, election or by other means provided by law, he must submit proof of his

Filipino citizenship such as:

-Naturalization certificate and Oath of allegiance,

-Valid ID card issued by the Integrated Bar of the Philippines (IBP) or Professional

Regulatory Commission (PRC)

iii. Processing Fee of P300.00 and P15 Documentary Stamp

B. Requirements for Foreign Investor (submit 5 copies)

i. Interview sheet with interviewers findings and recommendation

ii. Duly Accomplished Forms:

iii. Form #16- Business Name Application; Form #17- Foreign Investors Application

iv. ID pictures (Passport Size)

a. Foreign Investor - 7 copies

b. Filipino resident agent -7 copies

v. ACR/ICR, Special Investors Resident Visa (SIRV) or passport

vi. Notarized Appointment of Filipino Resident Agent

vii.For Non-Resident Alien: Proof of Inward Remittance of Foreign Currency with Peso

Conversion

For Resident: Bank Certificate of Deposit

viii. Authority to verify Bank Accounts/Bank Certificate of Deposit

ix. Certification from Resident Alien not seeking Remittance of Profits and Dividends Abroad

x. If investment includes assets other than foreign exchange, copy of valuation report from

Central Bank.

xi. Clearance/Certification from other involved agencies

( ) PNP/DND - if engaged in defense-related activities

( ) DOST - if investment involves advanced technology

xii. Fees/Charges - In Cash:

For Business Name Registration Certificate

a. Single Proprietorship - P300.00

b. Filing Fee - P500.00

c. Registration Fee - P5,000.00

xiii. Bio-data of Foreign Investor

xiv. In case of alien retailer, current years permit to engage in retail business per RA 1180

(Amended by RA 8762 - Retail Trade Liberalization Act of 2000)

Additional requirements on case-to-case basis depending on actual examination and processing of the

application. (i.e., If business requires practice of profession: submit photocopy of Philippine

Regulation Commission (PRC) license or Integrated Bar of the Philippines membership and present

original copy for comparison and contract of employment (If applicable).

C. Procedure

i. Check online (from a hyperlink at DTI Website: (http://www.dti.gov.ph) if the business

name you like to register is still available.

ii. Fill-out the application form (copies can be obtained from DTI-Field offices and also

available online). Indicate at least three (3) preferred business names.

iii. Submit application form together with the documentary requirements, and pay

corresponding fees to appropriate DTI-field Offices (DTI-NCR for businesses within metro

Manila or DTI-Provincial Offices for businesses outside the Metro Manila). Online lodgment of

form is available to some DTI-field offices that have stable internet access.

iv. After evaluation of the application form and documents, applicant will be advised

accordingly (personally for those walk-in clients and an auto e-mail notification for those who

lodged online).

v. Issuance of Certificate of Registration (COR)

D. Validity

The Certificate of Business Name Registration is valid for 5 years and shall be valid only at the

business address indicated thereon. In the event the registered owner thereof should opt to

open branch offices within the Philippines, he must apply for separate registration for each of

the branch office so established.

Processing time

One (1) Day -Application filed at National Capital Region (NCR) and some online DTI-Field

Offices

Five (5) Working Days -Application filed in other at DTI-Field Offices

Where to register:

National Capital Region Business Center:

AREA I- Manila, Pasay, Paranaque

2nd Flr., Park and Ride

Lawton, Manila

Tel. No. 536-7153

AREA II- Makati, Pasig, Pateros, Taguig, Muntinlupa, Las Pias

Unit 208 2nd Floor, Atrium Bldg., Makati Ave., Makati City

Tel. No. 864-0847 or 864-0829

AREA III- Mandaluyong, Marikina, Quezon City, San Juan

Ground Floor Highway 54 Plaza, Mandaluyong City

Tel. No. 706-1767 or 706-1703

AREA IV- Caloocan, Malabon, Navotas, Valenzuela

5th Floor, Araneta Square, Monumento, Caloocan City

Tel. No. 362-7664 or 332-0854

For businesses outside of Metro Manila:

Proper DTI Provincial Office where business is located.

2. Domestic Corporation

(Application to be filed at Securities and Exchange Commission)

A. REGISTRATION FOR DOMESTIC STOCK CORPORATION

STOCK CORPORATION

PAID-UP: CASH

100% Filipino Equity

Documentary Requirements:

i. Name Verification Slip

ii. Articles of Incorporation and By-laws

iii. Treasurers Affidavit /Authority to verify bank account

iv. Bank Certificates of Deposit notarized in place where bank signatory is assigned

v. Written joint undertaking to change corporate name signed by two (2) Incorporators /

Directors

vi. Endorsements/Clearances from other government agencies if to engage in any of the

following:

Air Transport - CAB

Banking, pawnshops and other financial intermediaries with quasi- banking functions-

BSP

Educational institutions

Elementary to high school - DEPED

College, Tertiary course - CHED

Technical Vocational Course - TESDA

Electric power plants - DOE

Hospitals-DOH

Insurance-Insurance Commission

Operation of radio, TV and telephone - NTC

Recruitment for overseas employment - POEA

Securities Agency - PNP

Water Transport, construction and building of vessel MARINA

Application Procedure

For Online Registration:

i. Verify/reserve proposed name via internet using SEC i-register

ii. If reservation is complete, register the company via the internet using the SEC I-register.

Note 1: File Directly to SEC if clearance from other government agencies is required.

Refer to letter g (clearances)

Note 2: File Directly to SEC if secondary license is required

iii. If online registration is complete, downloads/prints the Articles of Incorporation and By-Laws

iv. Pays the required filing fee (online or through the SEC cashier)

v. Presents the signed and notarized documents to CRMD

vi. Claims Certificate of Registration from Releasing Unit of Records Division

Filed Directly With SEC :

i. Verify/reserve proposed name via internet using SEC I-register

ii. Prepares Articles of Incorporation and other required documents

iii. Presents accomplished forms/docs for pre-processing at CRMD

iv. Presents endorsement to the agency concerned, if endorsement is given by the concerned

agency includes the endorsement in the registration documents.

v. Pay filing fees to cashier

vi. Claims Cert. Of Incorporation from the Releasing Unit, HRAD

Processing Time: Within 24 hours

60% Filipino - 40% Foreign Equity

Documentary Requirements (Submit 6 sets)

i. Name Verification Slip

ii. Articles of Incorporation and By-laws

iii. Treasurers Affidavit/Authority to verify bank account

iv. Bank Certificate of Deposit notarized in place where bank signatory is assigned

v. Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

vi. Proof of Inward Remittance by non-resident aliens, and foreign corporations

Note: All documents executed abroad must be authenticated by the Philippine Embassy

Application Procedure

Same as in Paid-up: Cash-100% Filipino equity

Processing Time: Within 24 hours from filing

MORE THAN 40% FOREIGN EQUITY

NEW CORPORATIONS

Documentary Requirements (Submit 6 sets)

i. Form F-100

ii. Name Verification Slip

iii. Articles of Incorporation and By-laws

iv. Treasurers Affidavit/Authority to verify bank account

v. Bank Certificates of Deposit notarized in place where bank signatory is assigned

vi.Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

vii. Proof of Inward Remittance by non-resident aliens & foreign corporation

Application Procedure

i. Verify/reserve proposed name

ii. Prepare AOI and BL and other required documents

iii. Get F-100 form from CRMD

iv. Present accomplished forms/docs for pre-processing at CRMD

v. Pay filing fees to the cashier

vi. Claim Certificate of Incorporation from the Releasing Unit, Records Division

Processing Time: Within two (2) days from filing

EXPORT-ORIENTED CORPORATIONS UNDER PEZA & SIMILAR ZONES (exempted from application under

the FOREIGN INVESTMENT ACT (FIA)

Documentary Requirements

i. PEZA/SBMA/CDC certificate indicating location

ii. Same as for new corporations

Application Procedure:

i. Submit required documents

Processing Time: Within 24 hours from filing

PAID UP: CASH AND PROPERTIES

REAL ESTATE

Documentary Requirements

In addition to requirements given in Paid-Up: Cash : (Submit 6 sets)

i. Deed of Assignment duly presented to the Register of Deeds for primary entry where the

properties are located.

ii. Written consent of the mortgage/creditor on the assignment of the property, together with a

certification on the outstanding loan balance.

iii. Certified true copy(ies) of transfer certificate of title (OCT/TCT).

iv. Photocopy of tax declaration sheet and official receipt of real estate tax payment/s for the

current year to be checked against original copy(ies) thereof.

v. Appraisal report not exceeding six (6) months prior to filing of the application, to be rendered

by an independent real estate appraiser if the transfer value of the property is based on current

fair market value (not more than 6 mos. old).

vi. BIR Certificate of Zonal Value (if the transfer value is based on zonal value)

vii. Statement of assets and liabilities under oath by TIT

Application Procedure

i. Verify/reserve proposed name

ii. Prepare AAI and BL and other required documents

iii. Present accomplished forms/docs for pre-processing at CRMD

iv. Pay filing fees to the cashier

v. Claim Certificate of Incorporation from the Releasing Unit, Records Division

Processing time: Within 24 hours from filing

MOTOR VEHICLES, MACHINERY AND EQUIPMENT

Documentary Requirements

i. Detailed inventory of the properties certified by company accountant.

ii. Deed of Assignment executed by the owner in favor of the corporation.

iii. Appraisal Report to be rendered by an independent and licensed mechanical engineer if the

transfer value of property is based on current fair market value.

iv. Copy of the corresponding bill of lading, BSP release certificates, and customs declaration, if

the machinerys and equipment are purchased abroad.

v. Bangko Sentral ng Pilipinas (BSP) valuation/appraisal report for imported properties.

vi. Photocopies of motor vehicle certificate of registration & official receipt of annual

registration fee for current year.

Application Procedure

Same as in Paid-Up: Cash and Properties (Real Estate)

Processing Time: Within 24 hours from filing

SHARES OF STOCK

Documentary Requirement (Submit 6 sets)

i. Detailed physical inventory of the proper ties certified by the corporate secretary

ii. Deed of Assignment.

iii. Photocopies of certificate of stock endorsed in favor of applicant company

iv. Audited Financial Statements of last Fiscal/calendar year of investee company

v. Certification from corporate secretary of the investee company that shares of stock are still

outstanding in the name of transfer or

vi. Statement of assets and liabilities by Treasurer-in-trust (TIT)

Application Procedure

Same as in Paid-Up: Cash and Properties (Real Estate)

Processing time: Within 24 hours from filing

INVENTORIES AND FURNITURE

Documentary Requirements

i. Detailed physical inventory of properties certified by the treasurer

ii. Deed of Assignment

iii. Special Audit report by an independent CPA on the verification made on the properties

iv. AFS of the assignor (if corporation)

v. Statement of assets and liabilities under oath by TIT

Application Procedure

Same as in Paid-Up: Cash and Properties (Real Estate)

Processing time: Within 24 hours from filing

FOUNDATIONS, ASSOCIATIONS AND OTHER NON-STOCK ORGANIZATIONS

Documentary Requirements

i. Name Verification Slip

ii. Articles of Incorporation and By-Laws

iii.Written joint undertaking to change corporate name signed by two (2) incorporators/Directors

iv. Resolution of the Board of Directors that the Corporation will comply with SEC

v. List of members certified by the Secretary and under taking to submit list of additional

members to the Securities and Exchange Commission (SEC) from time to time.

vi. List of contributors and amount contributed certified by the Treasurer

vii. For Foundations: notarized Certificate of Bank Deposit of the capital contribution of not less

than P1,000,000.00 and modus operandi or mode of operation source of its funds, the proposed

application of said funds, the prospective beneficiaries of grants and endowments.

Application Procedure

For Online Registration:

i. Verify/reserve proposed name via internet using SEC i-register

ii. If reservation is complete, register the company via the internet using the SEC i-register.

Note 1: File Directly to SEC if clearance from other government agencies is required. Refer to

letter g (clearances)

Note 2: File Directly to SEC if secondary license is required

iii. If online registration is complete, downloads/prints the Articles of Incorporation and By-Laws

iv. Pays the required filing fee (online or through the SEC cashier)

v. Presents the signed and notarized documents to CRMD

vi. Claims Certificate of Registration from Releasing Unit of Records Division

Filed Directly With SEC :

i. Verify/reserve proposed name

ii. Buy forms for articles & by-laws from Express Lane (for livelihood, driver, operators,

neighborhood, education, religious organizations are available including Blank forms for non-

stock organizations)

iii. Presents accomplished forms/docs for pre-processing at CRMD

iv. Pay filing fees to cashier

v. Claims Cert. Of Incorporation from the releasing Unit, Records Division

Processing Time: Within 24 hours from filing

RELIGIOUS CORPORATIONS

Documentary Requirements

i. Name Verification Slip

ii. Articles of Incorporation and By-laws

iii. Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

iv. Resolution of the Board of Directors that the Corporation will comply with SEC requirement for

non-stock corporation

v. List of members certified by the Secretary and under taking to submit list of additional

members to the Securities and Exchange Commission (SEC) from time to time.

vi. List of contributors and amount of contributions certified by the Treasurer

vii. For religious corporations, refer to Sections 109-116 of the Corporation Code and add

affidavit or affirmation or verification by the chief priest, minister, rabbi or presiding elder.

Procedure

Same as in Foundation, Association and other Non-Stock organizations

Processing Time: Within 24 hours from filing

3. DOMESTIC PARTNERSHIP

(Application to be filed at Securities and Exchange Commission)

A. GENERAL PARTNERSHIP

Documentary Requirements

i. Name verification slip

ii. Articles of Partnership

iii.Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

iv. Clearance/endorsement from other government agencies, if applicable

Application Procedure

For Online Registration

i. Verify/reserve proposed name via internet using SEC i-register

ii. If reservation is complete, register the company via the internet using the SEC i-register.

Note 1: File directly to SEC if clearance from other government agencies is required.

iii. If online registration is completed, system prompts the applicant to pay the filing fees (online

or through the SEC cashier)

iv. Download/Print the Articles of Partnership

v. Pays the required fee

vi. Presents the signed and notarized documents to CRMD

vii. Claims Certificate of Recording from Releasing Unit of HRAD

Filed Directly With SEC

i. Verify/reserve proposed name

ii. Buy articles of partnership forms from Express Lane

iii. Get endorsement from other government agencies if needed

iv. Presents accomplished forms/docs for pre-processing at CRMD

v. Pay filing fees to cashier

vi. Claims Cert. Of Incorporation from the Releasing Unit, Records Division

Processing Time: Within 24 hours from filing

B. LIMITED PARTNERSHIP

Documentary Requirements

i. Name verification slip

ii. Articles of Partnership

iii.Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

iv. Clearance/endorsement from other government agencies if needed

v. If it is a limited partnership, the word limited or Ltd should be added to the name. Articles

of partnership of limited partnership should be under oath only (Jurat) and not acknowledged

before a notary public

Application Procedure

Same as in General Partnership

Processing time: Within 24 hours from filing

4. FOREIGN ENTITIES LICENSED TO DO BUSINESS IN THE PHILIPPINES

(Application to be filed at the Securities and Exchange Commission-SEC)

A. BRANCH OFFICE

Documentary Requirements

i. Form F103

ii. Name Verification Slip

iii. Authenticated copy of Board Resolution authorizing establishment of office in the

Philippines designating resident agent and stipulating that in absence of such agent or upon

cessation of business in the Philippines any summons may be served to SEC as if the same is

made upon the corporation at its home office.

iv. Financial Statements as of a date not exceeding one year immediately prior to the

application certified by independent CPA of home country and authenticated before the

Philippine Consulate/Embassy.

v. Authenticated copies/Certified copies of the Articles of Incorporation/Partnership

vi. Proof of inward remittance (US$200K) minimum

vii. Resident Agents acceptance of appointment (if not signatory in application form)

APPLICATION PROCEDURE

i. Verify/reserve proposed name

ii. Get F-103 form from CRMD

iii. Present accomplished forms/docs for pre-processing at CRMD

iv. Pay filing fees to cashier

v. Claim license from Records Division

Processing time: Within 3-5 days from filing

B. REPRESENTATIVE OFFICE

DOCUMENTARY REQUIREMENTS

i. Form F-104

ii. Name Verification Slip

iii. Authenticated copy of Board Resolution authorizing establishment of office in the

Philippines; designating resident agent & stipulating that in absence of such agent or upon

cessation of business in the Phil. Any summons may be served to SEC as if the same is made

upon the corporation at its home office.

iv. Financial Statements as of a date not exceeding one year immediately prior to the

application, certified by independent CPA of home country and authenticated before the

Philippine consulate/embassy.

v. Affidavit executed by the resident agent stating that mother office is solvent and in sound

financial condition

vi. Authenticated copies of Articles of Incorporation (AOI) with an English translation if in

foreign language other than English

vii. Proof of inward remittance (US$30K) minimum such as bank certificate.

viii. Resident Agents acceptance of appointment (if not signatory in application form)

Application Procedure

i. Verify/reserve proposed name

ii. Get F-104 form from CRMD

iii. Present accomplished forms/docs for pre-processing at CRMD

iv. Pay filing fees to cashier

v. Claim license from Records Division

Processing time: Within 2 days from filing

C. REGIONAL HEADQUARTERS/REGIONAL OPERATING HEADQUARTERS

DOCUMENTARY REQUIREMENTS

i. Application Form for RHQ/ROHQ

ii. Name Verification Slip

iii. Authenticated certification that foreign firm is engaged in international trade with

affiliates, subsidiaries, or branch offices in the Asia Pacific region & other foreign markets.

iv. Authenticated certification from principal officer of foreign entity that it was authorized by

its Board of Directors or governing body to establish RHQ in the Philippines

v. BOI endorsement indicating its approval of RHQ/ROHQ

APPLICATION PROCEDURE

i. Verify/reserve proposed name

ii. Get application form from CRMD

iii. Get BOI endorsement

iv. Present accomplished forms/docs for pre-processing at CRMD

v. Pay filing fees to cashier

vi. Claim license from Records Division

Processing time: Within 1 day from filing

D. FOREIGN PARTNERSHIP

DOCUMENTARY REQUIREMENTS

i. Name of verification slip

ii. Get F-105 Form from CRMD

iii. Articles of Partnership

iv.Written joint undertaking to change corporate name signed by two (2)

incorporators/Directors

v. Clearance/endorsement from other govt. agencies, if applicable.

vi. Proof of remittance of foreign partners (only for those partners who want to register their

investments with BSP)

APPLICATION PROCEDURE

i. Verify/secure proposed name

ii. Buy articles of Partnership forms from the Express lane

iii. Get FIA Form 105 from CRMD

v. Get endorsement of other government agencies, if needed

v. Presents accomplished forms/docs for pre-processing at CRMD

vi. Pay filing fees to cashier

vii. Claims Certificate of Incorporation from releasing Unit, Records Division.

Processing time: Within 24 hours from filing

Sources:

Primer on Doing Business in the Philippines: http://www.boi.gov.ph/pdf/primer.pdf

http://www.investphilippines.gov.ph/downloads/doing_business.pdf

For more details about foreign investment, alien employment, applicable visas under special

laws contact the following:

Bangko Sentral ng Pilipinas

A. Mabini St. cor. P. Ocampo St.,

Malate Manila, Philippines 1004

Tel. No. : (632) 708-7701

E-mail: bspmail@bsp.gov.ph

Website: www.bsp.gov.ph

Department of Labor and Employment

National Capital Region (or Regional Offices if applicable)

DOLE Bldg., Maligaya St.

Malate, Manila

Tel. No. (632) 525-9487 local 18

Website: www.ble.dole.gov.ph

Bureau of Immigration

Intramuros, Manila

Tel. No. (632) 527-3248

Website: www.immigration.gov.ph

SUMMARY OF PROCEDURES FOR STARTING A BUSINESS IN PHILIPPINES

AND THE TIME AND COST

No. Procedure Time to

Complete

Cost to complete

1 Verify and reserve the company name with the

Securities and Exchange Commission (SEC)

The availability of the proposed company name

can be verified via the SEC's online verification

system at no charge. Reservation of the name,

once approved by the SEC, costs Php40/month

for the first 30 days. The company name can be

reserved for a maximum of 120 days for a fee of

1 day PHP40

PHP 120, which is renewable upon expiration of

the period.

2 Deposit paid-up capital in the Authorized Agent

Bank (AAB) and obtain bank certificate of

deposit.

The company is required by law to deposit paid-

up capital amounting to at least 6.25% of the

authorized capital stock of the corporation. This

paid-up capital must not be less than PHP 5,000.

Some banks in Manila charge a fee up to PHP 105

for each certificate of deposit

1 day No Charge

3 Notarize articles of incorporation and treasurer's

affidavit at the notary.

According to Section 14 and 15 of the

Corporation Code, Articles of Incorporation

should be notarized before filing with the SEC.

1 day PH500

4 Register the company with the SEC and receive

pre-registered Taxpayer Identification Number

(TIN)

The company can register online through SEC i-

Register but must pay on site at the SEC. The

following documents are required for SEC

registration:

a. Company name verification slip;

b. Articles of Incorporation (notarized) and by-

laws;

c. Treasurer's affidavit (notarized);

d. Statement of assets and liabilities;

e. Bank certificate of deposit of the paid-in

capital;

f. Authority to verify the bank account;

g. Registration data sheet with particulars on

directors, officers, stockholders, and so forth;

h. Written undertaking to comply with SEC

reporting requirements (notarized);

i. Written undertaking to change corporate name

(notarized).

The SEC Head Office issues pre-registered TINs

only if the companys application for registration

has been approved. The company must still

register with the Bureau of Internal Revenue (BIR)

in order to identify applicable tax types, pay an

annual registration fee, obtain and stamp sales

invoices, receipts and the books of accounts.

3 days (PHP 1,926.44 filing fee

equivalent to 1/5 of 1% of the

authorized capital stock or the

subscription price of the

subscribed capital stock,

whichever is higher but not

less than PHP 1,000 + PHP

19.26 legal research fee (LRF)

equivalent to 1% of filing fee

but not less than PHP 10

+ PHP 500 By-laws + PHP 150

for registration of stock and

transfer book (STB) required

for new corporations + PHP

320 STB + PHP 10 legal

research fee for the By-laws)

5 Obtain barangay clearance

To get the barangay clearance, the following

documentary requirements should be submitted

to the Barangay: Application form, SEC Certificate

of Incorporation and approved articles of

incorporation and bylaws, location plan/site map,

contract of lease over the corporation's office.

This clearance is obtained from the Barangay

where the business is located, and is required to

obtain the business permit from the city or

municipality. Barangay fees vary for each

Barangay since they have the discretion to

impose their own fees and charges for as long as

these fees are reasonable and within the limits

set by the Local Government Code and city

ordinances.

1 day PH500

6 Pay the annual community tax and obtain the

Community Tax Certificate (CTC) from the City

Treasurer's Office (CTO)

The company is assessed a basic and an

additional community tax. The basic community

tax rate depends on whether the company legal

form is a corporation, partnership, or association

(PHP 500 or lower). The additional community tax

(not to exceed Php 10,000.00) depends on the

assessed value of real property the company

owns in the Philippines at the rate of Php 2.00 for

every Php 5,000.00 and on its gross receipts,

including dividends or earnings, derived from

business activities in the Philippines during the

preceding year, at the rate of Php 2.00 for every

Php 5,000.00.

1day PH500

7 Obtain the business permit to operate from the

BPLO

The fees vary depending on the LGU issuing the

permit. The rate of license fee imposed in Quezon

City is 25% of 1% of the authorized capital stock.

Other permits, such as locational clearance, fire

safety and inspection certificate, sanitary permit,

certificate of electrical inspection, mechanical

permit, and other clearances or certificates

required depending on the nature of business,

are also imposable. The rate of these fees

depends on the nature of business and land area

occupied by the proposed corporation. The

barangay clearance is a prerequisite for the

6 days (PHP 2,408.05 business tax

(25% of 1% of paid-up capital)

+ PHP 200 mayors permit +

PHP 150 sanitary inspection

fee + PHP 50 signboard fee +

PHP 300 business plate + PHP

100 QCBRB + PHP 545 zoning

clearance + PHP 1,300

garbage fee+ PHP 300 FSIC

(10% of all regulatory fees))

issuance of business permit to operate.

8 Buy special books of account at bookstore

Special books of accounts are required for

registering with the BIR. The books of accounts

are sold at bookstores nationwide. One set of

journals consisting of four books (cash receipts

account, disbursements account, ledger, general

journal) costs about PHP 400.

If the company has a computerized accounting

system (CAS), it may opt to register its CAS under

the procedures laid out in BIR Revenue

Memorandum Order Nos. 21-2000 and 29-2002.

The BIR Computerized System Evaluation Team is

required to inspect and evaluate the companys

CAS within 30 days from receipt of the application

form (BIR Form No. 1900) and complete

documentary requirements.

1 day PHP 400

9 Apply for Certificate of Registration (COR) and

TIN at the Bureau of Internal Revenue (BIR)

After the taxpayer obtains the TIN, the company

must pay the annual registration fee of PHP 500

at any duly accredited bank, using payment form

BIR Form 0605).

All newly formed corporations subject to SEC

registration are issued pre-generated TIN by SEC-

Head Office, which is indicated on their SEC

Certificate of Registration. The corporation only

has to register its pregenerated TIN with the BIR

and report all internal revenue taxes that it

expects to be liable for. The requirements for

application for COR with the BIR are:

a. Duly accomplished and filled-out BIR

Form No. 1903 (Application for

Registration for Corporations);

b. Payment Form (BIR Form No. 0605);

c. SEC Certification of Incorporation;

d. Articles of Incorporation and By-laws;

e. Contract of Lease (with BIR Form No.

2000 and supporting BIR Payment Form

as proof of payment of documentary

stamp tax on the lease agreement);

f. Documentary Stamp Tax Return (BIR

Form No. 2000) on the original issuance

of shares and Payment Form (for the DST

payment); and

2 days PHP 100 (certification fee) and

PHP 15 (documentary stamp

tax, in loose form to be

attached to Form 2303)

g. Mayors Permit/Business Permit

Application (duly stamped received by

the Business Licensing Division of the

local government of Quezon City).

10 Pay the registration fee and documentary stamp

taxes (DST) at the AAB

The rate of documentary stamp tax on original

issuance of shares of stock shall be Php 1.00 for

every Php 200.00 or fractional part thereof, of the

par value, of such shares of stock.

The documentary stamp tax return shall be filed

and the tax paid on or before the fifth (5th) day

after the close of the month of approval of SEC

registration.

1 day (PHP 500 registration fee +

PHP 4,169.97 DST on original

issuance of shares of stock.

DST on the lease contract is

not included in the

computation of the cost)

11 Obtain the authority to print receipts and

invoices from the BIR

The authority to print receipts and invoices must

be secured before the sales receipts and invoices

may be printed. The company can ask any

authorized printing company to print its official

forms, or it can print its own forms (i.e., it uses its

computers to print loose-leaf invoice forms) after

obtaining a permit from BIR for this purpose.

To obtain the authority to print receipts and

invoices from the BIR, the company must submit

the following documents to the Revenue District

Office (RDO):

a. Duly completed application for

authority to print receipts and invoices

(BIR Form No. 1906);

b. Job order;

c. Final and clear sample of receipts and

invoices (machine-printed);

d. Application for registration (BIR Form

No. 1903); and

e. Proof of payment of annual

registration fee (BIR Form No. 0605).

1 day no charge

12 Print receipts and invoices at the print shops

The cost is based on the following specifications

of the official receipt: 1/2 bond paper (8 x 5

cm) in duplicate, black print, carbonless. The

minimum print volume is 25 booklets.

7 days PHP 3,500

13 Have books of accounts and Printers Certificate

of Delivery (PCD) stamped by the BIR

1 day no charge

After the printing of receipts and invoices, the

printer issues a Printers Certificate of Delivery of

Receipts and Invoices (PCD) to the company,

which must submit this to the appropriate BIR

RDO (i.e., the RDO which has jurisdiction over the

companys principal place of business) for

registration and stamping within thirty (30) days

from issuance. The company must also submit

the following documents:

a. All required books of accounts;

b. VAT registration certificate;

c. SEC registration;

d. BIR Form W-5;

e. Certified photocopy of the ATP; and

f. Notarized taxpayer-users sworn

statement enumerating the

responsibilities and commitments of the

taxpayer-user.

The company must also submit a copy of the PCD

to the BIR RDO having jurisdiction over the

printers principal place of business.

14 Register with the Social Security System (SSS)

To register with the SSS, the company must

submit the following documents:

a. Employer registration form (Form R-

1);

b. Employment report (Form R-1A);

c. List of employees, specifying their

birth dates, positions, monthly salary

and date of employment; and

d. Articles of incorporation, by-laws and

SEC registration.

Upon submission of the required documents, the

SSS employer and employee numbers will be

released. The employees may attend an SSS

training seminar after registration. SSS prefers

that all members go through such training so that

each member is aware of their rights and

obligations.

7 days no charge

15 Register with the Philippine Health Insurance

Company (PhilHealth)

To register with PhilHealth, the company must

submit the following documents:

a. Employer data record (Form ER1);

b. Report of employee-members (Form

1 day no charge

ER2);

c. SEC registration;

d. BIR registration; and

e. Copy of business permit.

Upon submission of the required documents, the

company shall get the receiving copy of all the

forms as proof of membership until PhilHealth

releases the employer and employee numbers

within three months.

16 * Register with Home Development Mutual Fund

(Pag-ibig)

To register with the HDMF, the corporation must

submit the following documents:

a. Employer's Data Form (EDF [FPF040]);

b. Specimen Signature Form

(SSF[FPF170]);

c. Copy of SEC Certificate of

Incorporation;

d. Copy of Approved Articles of

Incorporation and By-laws; and

e. Board Resolution or Secretarys

Certificate indicating the duly designated

Authorized Representative.

Upon submission of the complete documents and

payment of the first contribution to the fund, the

Pag-IBIG will issue the HDMF number and the

HDMF Certificate of Registration.

1 day

(simultaneous

with previous

procedure)

no charge

* Takes place simultaneously with another procedure.

Sources:

World Bank. 2013. Doing Business 2013: Smarter Regulations for Small and Medium-Size Enterprises.

Washington, DC: World Bank Group. DOI: 10.1596/978-0-8213-9615-5. License: Creative Commons

Attribution CC BY 3.0

http://www.doingbusiness.org/~/media/giawb/doing%20business/documents/profiles/country/PHL.pdf

BOARD OF INVESTMENT FREQUENTLY ASKED QUESTIONS

Meanwhile, the Board of Investment (BOI) has observed that the Philippines is among the best

money-per-value destination citing the following factors: liberalized services industry; cost efficient in

terms of wages over labor standard expectations and low operational cost; contains strategic logistics

access point in ASEAN +3; strong remittances, its gross international reserves are at levels above

international benchmarks; vast pool of homegrown talents and highly adaptable resources; committed

and supportive governance which, in the case of BOI relates into investor management solutions from

prospecting and nurturing investments.

The following frequently asked questions published by the Board of Investment in its website may help:

1.What are the possible modes of entry in setting up business operations in the Philippines?

You may choose to set up your business under the following options:

single proprietorship

partnership

corporation

branch office

representative office

regional headquarters and

regional operating headquarters

2. Where does one apply for registration of investments?

You may go online at www.bnrs.dti.gov.ph to know the requirements and register your business name.

For additional info, you may log on to www.dti.gov.ph or www.business.gov.ph.

a. For Corporations/Partnerships, Branch and Representative Offices - You may log on

to www.sec.gov.ph for details

b. For Regional Headquarters and Regional Operating Headquarters - Submit application form

together with required documents at the Board of Investments (see contact details below).

Board of Investments (BOI)

Project Evaluation and Registration Dept.

Industry and Investments Building

385 Sen. Gil Puyat Avenue

Makati City Metro Manila

Tel. : (632)895-3997

E-mail: perd@boi.gov.ph

3. Can a foreign investor be allowed to invest up to 100% of its capital in a domestic enterprise?

Yes, foreign investors are allowed to invest 100% in a domestic enterprise under the following

conditions:

Investments are made in areas listed under the Foreign Investments Act (FIA) except those marked

in the Regular Foreign Investment Negative List (FINL);

If the investor has a paid-up capital of at least US$200,000.00, which may be trimmed down to

US$100,000 provided the venture introduces cutting-edge technology or employs at least 50 direct

personnel;

If product/service being engaged is earmarked for exports.

4. What are the areas of investments covered by the Foreign Investments Act (FIA)?

The FIA covers all investment areas, except banking and other financial institutions, which are governed

and regulated by the Bangko Sentral ng Pilipinas (BSP).

The Foreign Investment Negative List covers areas of economic activity whose foreign ownership is

limited to a maximum of forty percent (40%) of the outstanding capital stock in the case of a corporation

or capital in the case of partnership.

For detailed listing, you may access the FIA at www.gov.ph/laws/ra8179.pdf.

5. How can my business avail of tax incentives from government?

To avail of tax incentives, enterprises must be registered with the appropriate Investment Promotion

Agency (IPA) depending upon the location of the project.

a. For projects outside the Economic or Freeport Zones

Board of Investments (BOI)

b. For projects located in Economic or Freeport Zones, these are the options:

Aurora Special Economic Zone Authority (ASEZA)

Bases Conversion Development Authority (BCDA)

Cagayan Economic Zone Authority (CEZA)

Clark Development Authority (CDC)

Phividec Industrial Authority (PIA)

Philippine Economic Zone Authority (PEZA)

Regional Board of Investments-Autonomous Region in Muslim Mindanao (RBOI-ARMM)

Subic Bay Metropolitan Authority (SBMA)

Zamboanga Economic Zone Authority (ZEZA)

6. What incentives are available to registered enterprises?

The incentives offered is both fiscal or non-fiscal such as income tax holidays, wage-based deductions

from taxable income and/or infrastructure, exemption from duties or grant of tax credits from certain

importation, easement from wharf dues and export taxes, employment of foreign nationals, and other

varied site-specific incentives.

7. What activities do Regional Headquarters (RHQ))/Regional Operating Headquarters (ROHQ) engage

in and its list of incentives?

The activities of the RHQ are limited to acting as a supervisory, communications and coordinating center

for its subsidiaries affiliates and branches in the region.

It is neither allowed to derive any income from sources in the Philippines and to participate in any

manner in the management of any subsidiary or branch office it might have in the Philippines nor to

solicit or market goods and services whether on behalf of its mother company or its branches, affiliates,

subsidiaries or any other company. The law that governs this industry is Republic Act 8756.

For full text of this law, you may log on to: http://www.congress.gov.ph/download/ra_11/RA08756.pdf

8. What are the basic rights and guarantees given for the safety of foreign investments?

All investors and enterprises are entitled to the basic rights and guarantees provided in the Philippine

Constitution, such as the right to repatriation of investments, remittance of earnings, foreign loans and

contracts, freedom from expropriation and non-requisition of investment.

9. How does a company remit its profits and dividends and repatriate capital abroad?

Enterprises may remit profits and dividends or repatriate its capital abroad thru remittances with the

Bangko Sentral ng Pilipinas (BSP) after registration with the SEC or BTRCP. For this purpose, BSP rules

and regulations covering procedures for registration of foreign investments are observed.

10. What are the investment rights of a former natural born Filipino?

The Foreign Investments Act (FIA) recognizes the rights of former natural born Filipinos. They are

granted same investment rights as Filipino citizens in activities such as cooperatives, thrifts banks and

private development banks, rural banks and financing companies. In addition, under Section 1 of the FIA

as amended by RA 8179 provides that any natural born citizen who has lost his citizenship, and who has

legal capacity to enter into a contract under Philippine laws may be a transferee of a private land to be

used by him for business or other purposes up to a maximum area of five thousand (5,000) square

meters in the case of urban land or three (3) hectares in the case of rural land. See the Foreign

Investments Act (FIA) for details: www.gov.ph/laws/ra8179.pdf

11. As an investor, what visa can be issued to me?

All investors and enterprises are entitled to the basic rights and guarantees provided in the Philippine

Constitution, such as the right to repatriation of investments, remittance of earnings, foreign loans and

contracts, freedom from expropriation and non-requisition of investment.

Special Investor Resident Visa (SIRV)

The SIRV entitles the holder to reside in the Philippines for an indefinite period as long as his investment

continues to operate. The SIRV is issued in coordination with the BOI (www.boi.gov.ph) and the Bureau

of Immigration (www.immigration.gov.ph). For more details on the allowable forms of investments,

criteria for granting SIRV, log on to their respective websites.

Special Resident Retiree Visa (SRRV)

The SRRV is issued by the Philippine Retirement Authority (PRA). Its primary role is to promote and grant

the SRRVs to would-be retirees, and to offer a range of services, benefits, and comfort that would make

their stay worthwhile. For more details, you may log on to www.pra.gov.ph.

Entry Visa

Foreign nationals come to the Philippines for reasons of business, pleasure or health with a temporary

visitor's visa. This visa allows them to stay for a period of 59 days, extendable for a maximum of one

year. Visitors who may wish to extend their stay must register with the Bureau of Immigration or with

the office of the municipal or city treasurer in areas outside Manila. Executive Order No. 408 allows for

foreign nationals, except those of specifically restricted nationalities, to stay in the Philippines for up to

21 days without a visa.

Work Permits

In general, a foreign national seeking employment in the Philippines, whether resident or non-resident,

needs to an Alien Employment Permit (AEP) from the Department of Labor and Employment (DOLE). For

more details, you may log on towww.ble.dole.gov.ph.

Treaty Traders Visa (applicable only to Japanese, Germans and Americans)

This visa is issued to abovementioned nationalities based on certain criteria. For more information, you

may log on towww.immigration.gov.ph

Sources:

Service Franchising: A Global Perspective by Ilan Alon

Philippine Franchising Regulations by Leo G. Dominguez and Pericles R. Casuela

Entrepreneur Magazine: The Franchise Guidebook 2013: Strategies for building a successful franchise

business

http://www.investphilippines.gov.ph

http://business.gov.ph/web/guest/businessregistrationguide

http://boi.gov.ph

TRADEMARKS ONLINE FILING SYSTEM

Frequently Asked Questions

1. What rules will govern electronic filing of trademark applications?

The Intellectual Property Code and the Trademark Regulations will apply to all applications filed

electronically. The trademark applications will likewise be examined in accordance with the same rules

and regulations that govern applications that are filed personally by applicants and/or their agents or

representatives with the IP Philippines.

2. What do I need to file an application?

You must accomplish the electronic form completely and ensure that all the fields marked compulsory

are filled out; otherwise, your application will not be accepted. Before submitting the application form,

you should attach an electronic reproduction of the mark subject of the application.

3. What are the specifications for the reproduction of the mark?

The mark should be scanned and saved in .jpeg format (should not exceed 1 megabyte). Its dimensions

should be 50.8 mm (height) x 76.2 mm (width) (or 2 in x 3 in). The mark should be in black and white,

unless there is a claim for color/s.

4. How can I pay the fees?

There are two payment options:

4.1. If you are a corporate depositor of Banco de Oro (BDO) and you have enrolled in the banks

online payment system, choose BDO as your payment option. Upon completing the online

application form, you will be directed to the BDOs payment gateway facility and given

instructions on how to pay the fees.

4.2. If you are an individual filer, you may choose Bank of the Philippine Islands (BPI) as your

payment option. Upon completion of the online application form, a statement of account with a

BPI reference number will be generated.

Bring the statement of account to any BPI branch and pay the amount stated in the document.

5. How will I know how much I need to pay?

The schedule of fees is available on the TM Online Website. The total fees will be automatically

computed depending on the information you give in your online application form.

6. How will I know if my application and payment have been received by the IP Philippines?

Payment using BDO

Immediately after paying the necessary fees, you will receive a confirmation from the bank that

payment has been received, including the date and time of payment. Within 3 days from filing

the application, you will receive an email from the IPOPHL containing the application number

and filing date. The IPOPHL will also advise you if there are any problems with your application

and/or payment. If you do not receive any confirmation of payment from the bank, this could

mean that the IPOPHL did not receive your application. You should contact the bank about this.

Payment using BPI

Within 3 days from paying at any BPI branch, you will receive an email from the IPOPHL

containing the application number and filing date. The IPOPHL will also advise you if there are

any problems with your application and/or payment.

7. What will happen if I receive a confirmation receipt from the bank, but I do not receive an email

from the IP Philippines three days after filing an application?

You need to contact the IPOPHL:

Telephone: +632-2386300 ext. 515 (Kahrene) or 365 (Roger)

Email: kahrene.ragos@ipophil.gov.ph

roger.tobongbanua@ipophil.gov.ph

Confirmation by BDO or BPI that payment has been made shall be considered prima facie evidence that

the corresponding application was filed on the date and time of receipt by the bank of payment.

8. When will the application be considered filed?

Philippine time (GMT +8:00) shall be controlling. Your application will be considered filed upon receipt of

your payment. The official date of filing will be found in the confirmation receipt from BDO.

If payment is made with BPI, the date of filing will be the date of payment at any BPI branch.

9. How long will it take me to file the application electronically?

Electronic filing should not take more than 15 minutes, depending on the amount of information you are

providing. The page will, however, expire if there is inactivity for 10 minutes.

10. If I am not domiciled in the Philippines or if my company is not doing business in the Philippines,

can I or my company file an application online?

Yes. However, you need to state the name of your authorized resident representative or agent in your

application. Within sixty (60) days from filing your application and without need of notice from the IP

Philippines, you must submit a power of attorney or authorization designating your representative or

agent, who must be domiciled in the Philippines and who may be served notices or processes in

connection with your application. No further action will be taken on your application unless the power

of attorney or authorization is submitted.

You also need an account with the authorized bank to enable you to transact with the IPOPHL using TM

Online.

11. What are the system requirements for filing applications online?

You should have a computer (Pentium III or higher and javascript enabled) with internet access. The

recommended browser is Internet Explorer 5.5 or higher. Screen resolution of 1024 x 768 is also

recommended. Turn of the pop-up blocker of the internet browser if you are a BDO payor.

Source:

https://trademarks.ipophil.gov.ph/tmonline/TM_Online_FAQs_14Feb2012.pdf

for more details:

Intellectual Property Office of the Philippines

28 Upper McKinley Road, McKinley Hill Town Center

Fort Bonifacio, Taguig City 1634, Philippines

(632) 238-6300 to 65 loc 205, 121 122

752-4869

dittb@ipophil.gov.ph; mail@ipophil.gov.ph

Das könnte Ihnen auch gefallen

- Franchising in PhilippinesDokument17 SeitenFranchising in PhilippinesJohn PublicoNoch keine Bewertungen

- Legal Aspects in FranchisingDokument4 SeitenLegal Aspects in Franchisingber serker100% (1)

- Franchise AgreementDokument18 SeitenFranchise AgreementAlfred Robert Babasoro0% (1)

- Legal Aspect of FranchisingDokument6 SeitenLegal Aspect of FranchisingIannie May ManlogonNoch keine Bewertungen

- Franchise Agreement (Crispy Bucks)Dokument4 SeitenFranchise Agreement (Crispy Bucks)Cynthia LuayNoch keine Bewertungen

- Food Fiesta Franchise AgreementDokument4 SeitenFood Fiesta Franchise AgreementLea May Asuncion100% (3)

- Potato Corner FranchiseDokument2 SeitenPotato Corner Franchiseangelufc99Noch keine Bewertungen

- Just Lemon Franchising Contract: Basic Cart (Good For Small Malls & Streets) P95,000Dokument4 SeitenJust Lemon Franchising Contract: Basic Cart (Good For Small Malls & Streets) P95,000Aldrin de GuzmanNoch keine Bewertungen

- Franchise Agreement-Peña, Sir Arlan Jefferson R. - With CorrectionsDokument5 SeitenFranchise Agreement-Peña, Sir Arlan Jefferson R. - With CorrectionsJnfr SkyNoch keine Bewertungen

- Unit 6. Trends in FranchisingDokument12 SeitenUnit 6. Trends in FranchisingErica MercadoNoch keine Bewertungen

- Takoyaki Consent FormDokument1 SeiteTakoyaki Consent FormZheldinan Nicole CruzNoch keine Bewertungen

- 2020 Franchise ContractDokument3 Seiten2020 Franchise ContractAgot Rosario100% (2)

- Application Form For Potato Corner FranchiseDokument4 SeitenApplication Form For Potato Corner FranchiseMary Rose Roma PurinoNoch keine Bewertungen

- MD Letter of Intent - 2019Dokument2 SeitenMD Letter of Intent - 2019nathalie velasquezNoch keine Bewertungen

- Franchise Feasibility StudyDokument14 SeitenFranchise Feasibility StudyRena Mae Lava MuycoNoch keine Bewertungen

- Franchise AgreementDokument9 SeitenFranchise AgreementChristine Elaine Batusin Ilagan33% (3)

- Employee Non-Discolsure Agreement: Cha Amore Milktea (All Branches)Dokument2 SeitenEmployee Non-Discolsure Agreement: Cha Amore Milktea (All Branches)ARISNoch keine Bewertungen

- Palaris Colleges San Carlos City, Pangasinan S.Y. 2017-2018 1 SEM Franchising Prepared By: Mr. Elemer S. Mendoza, LPT InstructorDokument17 SeitenPalaris Colleges San Carlos City, Pangasinan S.Y. 2017-2018 1 SEM Franchising Prepared By: Mr. Elemer S. Mendoza, LPT InstructorElemer MendozaNoch keine Bewertungen

- FranchisingDokument39 SeitenFranchisingWilsonNoch keine Bewertungen

- Franchise Application FormDokument4 SeitenFranchise Application FormudhayacNoch keine Bewertungen

- Golden ABC Inc.Dokument7 SeitenGolden ABC Inc.Ivy Mhae SantiaguelNoch keine Bewertungen

- Franchise Agreement: Know All Men by These PresentsDokument4 SeitenFranchise Agreement: Know All Men by These PresentsBurns PulidoNoch keine Bewertungen

- Lugawan Avenue Framchise AgreementDokument13 SeitenLugawan Avenue Framchise AgreementJannel VelascoNoch keine Bewertungen

- Franchise PERT Chart: 1. Research and AnalysisDokument14 SeitenFranchise PERT Chart: 1. Research and AnalysisDanna Marie BanayNoch keine Bewertungen

- Franchise Agreement - SampleDokument14 SeitenFranchise Agreement - SampleSebastian Garcia100% (5)

- Tapawarma Franchise Kit As of Oct 2019Dokument8 SeitenTapawarma Franchise Kit As of Oct 2019Joseph Angelo Evangelista CoronelNoch keine Bewertungen

- Red Dimsum Foods Phil - Inc.Dokument15 SeitenRed Dimsum Foods Phil - Inc.REUNILLO B. LOMOCSO100% (1)

- Dunkin DonutsDokument15 SeitenDunkin DonutsMark JaffeNoch keine Bewertungen

- Organizational StructureDokument3 SeitenOrganizational StructureHazell Marie Padua100% (1)

- Standard Franchise Agreement v1Dokument22 SeitenStandard Franchise Agreement v1Mike0% (1)

- Franchise AgreementDokument21 SeitenFranchise AgreementLizanne Gaurana100% (4)

- Franchise PackagesDokument25 SeitenFranchise PackagesAngela Parado100% (1)

- Franchise PackageDokument3 SeitenFranchise PackageJayson Nonan100% (1)

- Basic Guide To Franchising in The Philippines - Founder's GuideDokument9 SeitenBasic Guide To Franchising in The Philippines - Founder's GuideAbs PangaderNoch keine Bewertungen