Beruflich Dokumente

Kultur Dokumente

Working Capital Management: Navana Furniture Limited

Hochgeladen von

balal_hossain_1Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Working Capital Management: Navana Furniture Limited

Hochgeladen von

balal_hossain_1Copyright:

Verfügbare Formate

Working Capital Management

OF

Navana Furniture Limited

COURSE NAME : WORKING CAPITAL MANAGEMENT

COURSE CODE : F-405

SUBMITTED TO

M. Shahjahan Mina

Professor

Department of Finance

University of Dhaka

SUBMITTED BY:

Group Members

SL NO NAME CLASS ROLL

01. A.S.M Kamran 16- 040

02. Sharmin Akter 16- 048

03. Tamanna Tanvir Haque 16- 088

04. Alusli akter 16- 162

05. Belal Hossain 16- 264

Working capital Management

2

Letter of Transmittal:

July 13, 2013

M. Shahjahan Mina

Professor

Department of Finance

University of Dhaka

Sir,

We submit here with the report of the group assignment on Working Capital Management of

Navana Furniture Limited selected through the unanimous opinions of the group members

fixing the date of submission on 13/07/2013.

We think the topic that we have selected is really an important & interesting fact for the

finance students with the textual studies acquiring practical orientation of how the

manufacturing company is dealing with the issues related to working capital management to

run the company for maintaining profitability.

We thank you for giving us the opportunity to work on this topic.

Sincerely yours

Sharmin Akter

On behalf of all the members of our group.

Working capital Management

3

Acknowledgement:

We would like to pay our gratitude to all of the related books, authors, and related web site

that helped us a lot for the completion of this report before, during and after the working

period. At first we would like to acknowledge the Almighty, who helped us every time gave

us moral support and strength every moment.

We are especially grateful to our honourable course teacher M. Shahjahan Mina for giving us

valuable suggestions and guidelines so that we can prepare this report successfully. Without

his support it was almost impossible for us to complete this report.

Then we would like to thank the people who have provide us the valuable information about

Navana Furniture Limited to work on working capital management issues.

Working capital Management

4

Executive Summary:

The report on Working Capital Management is a very good experience for us. Every

manufacturing company faces the problem of Working Capital Management in their day-to-

day processes. An organization can reduce cost and the increase profits only if it is able to

manage its Working Capital efficiently. At the same time, the company can provide customer

satisfaction and hence can improve their overall productivity and profitability.

This report is a sincere effort to study and analyze the Working Capital Management

of Navana Furniture Limited. We have focused on the crucial managerial decisions about

making a financial overview of the company by conducting a Working Capital analysis of

NFL.

The report is a bridge between the institute and the organization. This made me employ my

theoretical knowledge about the myriad and fascinating facets of finance. Moreover, in the

process I could contribute substantially to the organizations growth. The experience that I

gathered over the past two months has certainly provided the orientation, which I believe will

help me in shouldering any responsibility in future.

Working capital Management

5

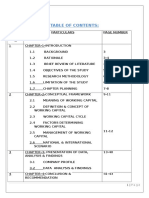

Table of Contents:

SL NO. TOPIC NAME PAGE

NO.

01.

10

02.

10

03.

11

04.

14

06.

17

07.

18

08.

21

09.

22

10.

24

11.

26

12.

30

11.

34

Working capital Management

6

01.I ntroduction To The Report :

1.1 Origin of the report:

The report has been prepared as a practical requirement for the Working Capital

Management course. M. Shahjahan Mina, our honourable course instructor, assigned the

students of BBA 16

th

batch to do a report on working capital management of a manufacturing

company (Bangladesh perspective).

1.2 Background of the Report:

Manufacturing companies play a very important role to improve the economic condition of a

country. In the following report we have tried to explore the managerial issues related to the

working capital and some certain activities according to those issues of a manufacturing

company named Navana Furniture Limited. We have also shown some mathematical

illustration of their working capital performance.

1.3 Objective of the study:

Our main objective of the study is to fulfil the requirement of our course on Working Capital

Management. Other objectives behind conducting this study are as follows:

To learn about how a manufacturing company manages its working capital and what are

the principles and procedures it follows in this case.

To learn about what are limitations a manufacturing company has in managing working

capital activities.

To gather practical knowledge about those.

Working capital Management

7

1.4 Source of information:

The report is prepared using both primary and secondary information.

The primary information is collected mainly from our course related book written by I.M.

Panda and from the employees of that manufacturing company.

The secondary information used in the report has been extracted mainly from online source.

We have also explored the related website.

1.5 Limitations:

Firstly, we have not enough experience to make a qualified business report.

Secondly, we have not got enough time, which hampered the related processes to some

extent. The time was not enough to prepare a formal and long business report.

Thirdly, financial bindings were another drawback in preparing the report.

Fourthly, there were some technological problems.

We think the report could be organized more extensively if there was sufficient time and

proper response of the reference groups to cover all particulars regarding report format,

structure, investigation etc.

Working capital Management

8

Working Capital Management

Navana Furniture Limited.....

Working capital Management

9

Concepts of working capital:

Working capital (abbreviated WC ) is a financial metric which represents operating liquidity

available to a business, organization or other entity considered a part of operating capital.

There are two concepts of working capital management gross and net.

Gross working capital refers b to the firms investment in current assets. Current assets are

the assets which can be converted into cash within an accounting and include cash, short-term

securities, debtors, bills receivables and stock. The consideration of the level of investment in

current assets should avoid two danger points. Excessive investment in current assets should

be avoided because it impairs the firms profitability, as idle investment earns nothing. On the

other hand, inadequate amount of working capital can threaten solvency of the firm because

its inability to meet its current obligations.

Net working capital refers to the difference between current assets and current liabilities.

Current liabilities are those claims of outsiders which are expected to mature for payment

within an accounting year and include creditors, bills payables, and outstanding expenses.

Net working capital is a qualitative concept. It indicates the liquidity position of the firm and

suggests the extent to which working capital needs may be financed by permanent sources of

funds.

Operating and cash conversion cycle:

Operating cycle is the time duration required to convert sales, after the conversion of

resources into inventories, into cash. The operating cycle of a manufacturing company

involves three phases:

Acquisition of resources such as raw material, labour, power and fuel etc.

Manufacture of the product which includes conversion of raw material into work-in-

process into finished goods.

Sale of the product either for cash or on credit. Credits sales create account receivable

for collection.

Working capital Management

10

The length of the gross operating cycle of a manufacturing firm is the sum of:

1. Inventory conversion period (ICP).

2. Debtors conversion period (DCP)

Inventory conversion period (ICP):

The inventory conversion period is the sum of raw material conversion period (RMCP) work-

in-process conversion period (WIPCP) finished goods conversion period (FGCP).

ICP = RMCP + WIPCP + FGCP

Raw material conversion period (RMCP): The raw material conversion period (RMCP) is

the average time period taken to convert material into work in process. It depends on; a) raw

material consumption and (b) raw material inventory. The following formula is used in

calculation of RMCP.

RMCP = ( 360 days/RMC )* RMI

Work-in-process conversion period (WIPCP): The work-in-process conversion period

(WIPCP) is the average time period taken to convert work in process into finished goods. The

following formula is used in calculation of WIPCP.

WIPCP = ( 360 days/COP ) * WIPI

Finished goods conversion period (FGCP): The finished goods conversion period (FGCP)

is the average time period taken to sell the finished goods. The following formula is used in

calculation of FGCP.

FGCP = ( 360 days/COGS) * FGI

Debtor conversion period (DCP):

The debtor conversion period (DCP) ) is the average time period taken to convert debtors into

cash. DCP represents the average collection period. It is calculated as follows:

DCP (collection period) = ( 360 days / cost of sales or credit sales)*Debtors

Working capital Management

11

Net operating cycle:

Net operating cycle (NOC) is the difference between gross operating cycle and payables

deferred period (PDP).

NOC = GOC PDP

BASIC ELEMENTS OF CREDIT POLICY :

The term credit policy is used to refer to the combination of three decision variables. These

variables are discussed below :-

CREDIT STANDARD :

Credit standards are criteria to decide the types of customers to whom goods

could be sold on credit. If a firm has more slow-paying customers , its

investment in accounts receivable will increase. The firm will also be exposed to

higher risk of default.

CREDIT TERMS :

Credit terms specify duration of credit and terms of payment by customers.

Investment in accounts receivable will be high if customers are allowed

extended time period for making payments.

COLLECTION EFFORTS :

Collection efforts determine the actual collection period. The lower the

collection period, the lower the investment in accounts receivable and vice

versa.

THE REASONS FOR GRANTING CREDIT :

Companies in practice feel the necessity of granting credit for several reasons :

COMPETION :

Generally the higher the degree of competition, the more the credit granted by a

firm.

COMPANYS BARGAINING POWER:

If a company has a higher bargaining power vis--vis its buyers, it may grant no

or less credit. The company will have a strong bargaining power if it has a strong

product, monopoly power, brand image, large size or strong financial position.

BUYERS REQUIREMENTS :

In a number of business sectors buyers or dealers are not able to operate

without extended credit. This is particularly so in the case of industrial products.

Working capital Management

12

BUYERS STATUS :

Large buyers demand easy credit terms because of bulk purchases and higher

bargaining power. Some companies follow a policy of not giving much credit to

small retailers since it is quite difficult to collect dues from them.

RELATIONSHIP WITH DEALERS :

Companies sometimes extend credit to dealers to build long-term relationships

with them or to reward them for their loyalty.

MARKETING TOOL :

Credit is used as a marketing tool, particularly when a new product is launched

or when a company wants to push its weak product.

INDUSTRY PRACTICE :

Small companies have been found guided by industry practice and norm more

than the large companies. Sometimes companies continue giving credit because

of past practice rather than industry practice.

TRANSIT DELAYS :

This is a forced reason for extended credit in the case of a number of companies.

Most companies have evolved systems to minimize the impact of such delays.

Some of them take the help of banks to control cash flows in such situation.

FACETS OF CASH MANAGEMENT :

Cash management is concerned with the managing of :

1. Cash flows into and out of the firm.

2. Cash flows within the firm.

3. Cash balances held by the firm at a point of time by financing deficit or investing

surplus cash.

It can be represented by a cash management cycle as shown in the following figure. Sales

generate cash which has to be disbursed out. The surplus cash has to be invested while

deficit has to be borrowed. Cash management seeks to accomplish this cycle at a minimum

cost. At the same time it also seeks to achieve liquidity and control. Cash management

assumes more importance than other current assets because cash is the most significant

and the least productive assets that a firm holds. It is significant because it is used to pay the

firms obligations. However cash is unproductive. Unlike fixed assets or inventories, it does

Working capital Management

13

not produce goods for sale. Therefore, the aim of cash management is to maintain adequate

control over cash position to keep the firm sufficiently liquid and to use excess cash in some

profitable way.

Figure : Cash management cycle.

MOTIVES FOR HOLDING CASH :

The firms need to hold cash may be attributed to the following three motives :

The transaction motive

The precautionary motive

The speculative motive

TRANSACTION MOTIVE :

The transaction motive requires a firm to hold cash to conduct its business in the ordinary

course. The firm needs cash primarily to make payments for purchase, wages and salaries,

other operating expenses, taxes, dividends etc. The need to hold cash would not arise if

Information

and control

Business

operation

Cash

collection

Cash

payments

Deficit

Surplus

Borrow

Invest

Working capital Management

14

there were perfect synchronisation between cash receipts and cash payments, i.e., enough

cash is received when the payment has to be made. But cash receipts and payments are not

perfectly synchronized. The transactions motive mainly refers to holding cash to meet

anticipated payments whose timing is not perfectly matched with cash receipts.

PRECAUSIONARY MOTIVE :

The precautionary motive is the need to hold cash to meet contingencies in the future. It

provides a cushion or buffer to withstand some unexpected emergency. The precautionary

amount of cash depends upon the predictability of cash flows. If cash flows can be predicted

with accuracy, less cash will be maintained for an emergency. The amount of precautionary

cash is also influenced by the firms ability to borrow at short notice when the need arises.

Precautionary balance should be held more in marketable securities and relatively less in

cash.

SPECULATIVE MOTIVE :

The speculative motive relates to the holding of cash for investing in profit-making

opportunities as and when they arise. The opportunity to make profit may arise when the

security prices change. The firm will hold cash, when it is expected that interest rates will

rise and security prices will fall. The firms also speculate on materials prices. If it is expected

that materials prices will fall, the firm can postpone materials purchasing and make

purchases in future when price actually falls.

TYPES OF SHORT TERM INVESTMENT OPPORTUNITIES :

The following short term investment opportunities are available to companies to invest

their temporary cash surplus :

TREASURY BILLS :

Treasury bills are short-term government securities. The usual practice is to sell treasury

bills at a discount and redeem them at par on maturity. They can be bought and sold any

time; thus, they have liquidity. Also, they do not have the default risk.

Working capital Management

15

COMMERCIAL PAPERS :

Commercial papers are short-term, unsecured securities issued by highly creditworthy large

companies. They are issued with a maturity of three months to one year. It is marketable

securities and so liquidity is not a problem.

CERTIFICATES OF DEPOSITES :

Certificates of deposit are papers issued by banks acknowledging fixed deposits for a

specified period of time. CPs are negotiable instruments that make them marketable

securities.

BANK DEPOSITS :

A firm can deposit its temporary cash in a bank for a fixed period of time. The interest rate

depends on the maturity period. The default risk of the bank deposits is quite low.

INTER-CORPORATE DEPOSITS :

Inter-corporate lending/borrowing or deposits is a popular short-term investment

alternative for companies. Generally a cash surplus company will deposit (lend) its fund in a

sister or associate companies or with outside companies with high credit standing. The risk

of default is high, but returns are quite attractive.

MONEY MARKET MUTUAL FUNDS :

Money market mutual funds focus on short term marketable securities. They have a

minimum lock-in period of 30 days and after this period , an investor can withdraw the

money any time at a short notice . They offer attractive yields; yields are usually 2 percent

above than on bank deposits of same maturity.

QUESTION :

A companys current credit sale is tk 1 crore and has some unutilized capacity. Now

company is planning to increase the sales volume by extending the credit period from 45

days to 60 days with 2.5/20 net 60 terms of sales. It is expected that sales will increase by

20% but bad debt loss is expected to be 1% on all sales. Moreover, additional collection cost

would be tk 10,000 per month. Selling price and variable cost tk 100 and tk 70

respectively(per unit). It is expected that 50% of the accounts receivable will be collected

Working capital Management

16

within discount period. Opportunity cost of fund is 20% and corporate tax rate should be

25%. Should the company revise the credit policy?

Navana Furniture Limited

Statement of comprehensive income, 2012.

Particulars BD Taka BD Taka

Sales 426,319,150

Less: COGS

Raw material purchases 267,646,532

Add: opening stock 44,933,921

Less: closing stock 35,626,103

Raw material consumed 276,954,350

Add: opening WIP 63,010,670

Less: closing WIP 82,579,283

Less: factory over head 42,180,097

Cost of production 299,565,834

Add: opening FG 72,255,618

Less: closing FG 86,774,972

Cost of goods sold 285,046,480

Gross profit 141,272,670

Operating expenses 123,905,918

Net profit before tax 17,366,752

Income tax expenses 3,060,442

Net profit 14,306,310

Cost of sales ( COGS + Operating expenses) 408,952,398

Trade debtors 157,070,959

creditors 79,612,659

Working capital Management

17

Calculation of operating cycle of NFL:

No. Particulars 2012

A. Inventory conversion period: (1+2+3) 255.15 days

1. RMCP = ( 360 days/RMC )* RMI

= (360 days/276,954,350)* 35,626,103

46.31 days

2. WIPCP = ( 360 days/COP ) * WIPI

= (360 days/299,565,834)* 82,579,283

99.24 days

3. FGCP = ( 360 days/COGS) * FGI

= (360 days/285,046,480)* 86,774,972

109.60 days

B. DCP ( collection period) = ( 360 days/ cost of sales or credit

sales)*Debtors

= (360 days/408,952,398)* 157,070,959

138.27 days

C. Gross operating cycle (A+B) 393.42 days

D. Payable deferred period = (360 days/credit purchases)*creditors

= (360 days/267,646,532)* 79,612,659

107.08 days

E. Net operating cycle (C D) 286.34 days

Flow of working capital over the last 5 years:

Particulars 2008 2009 2010 2011 2012

Total Current Liabilities 109,876,935 108,419,846 212,358,117 362,936,070 491,451,302

Total Current assets 171,931,094 174,166,912 270,292,818 414,193,734 539,802,808

Net working capital 62,054,159 65,747,066 57,934,701 51,257,664 48,351,506

Working capital Management

18

-

100,000,000

200,000,000

300,000,000

400,000,000

500,000,000

600,000,000

2008 2009 2010 2011 2012

Years

Working capital trend

Total Current Liabilities

Total Current assets

Net working capital

Das könnte Ihnen auch gefallen

- Critical Reasoning HandoutDokument22 SeitenCritical Reasoning HandoutGovardhanRNoch keine Bewertungen

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Von EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Bewertung: 4.5 von 5 Sternen4.5/5 (3)

- Browning-Manufacturing BudgetingDokument19 SeitenBrowning-Manufacturing BudgetingMavis ThoughtsNoch keine Bewertungen

- Export Credit Agencies - The Unsung Giants of International Trade and FinanceDokument207 SeitenExport Credit Agencies - The Unsung Giants of International Trade and Financeace187Noch keine Bewertungen

- The Balanced Scorecard: Turn your data into a roadmap to successVon EverandThe Balanced Scorecard: Turn your data into a roadmap to successBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Managing RestructuringDokument140 SeitenManaging RestructuringCollinson GrantNoch keine Bewertungen

- The Performance Appraisal Tool Kit: Redesigning Your Performance Review Template to Drive Individual and Organizational ChangeVon EverandThe Performance Appraisal Tool Kit: Redesigning Your Performance Review Template to Drive Individual and Organizational ChangeNoch keine Bewertungen

- Working Capital ManagementDokument102 SeitenWorking Capital Managementvarun206383% (12)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementVon EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNoch keine Bewertungen

- Research Methodology On Credit Card HoldersDokument134 SeitenResearch Methodology On Credit Card Holdersaishwarya100% (4)

- Working Capital ManagementDokument75 SeitenWorking Capital ManagementShadab Khan100% (1)

- Accounting and Finance for Business Strategic PlanningVon EverandAccounting and Finance for Business Strategic PlanningNoch keine Bewertungen

- Working Capital Management (TATA STEEL)Dokument79 SeitenWorking Capital Management (TATA STEEL)Abhaydeep Kumar Jha60% (10)

- Chapter-1: 1. Industry Scenario 1.1 Macro ProspectiveDokument52 SeitenChapter-1: 1. Industry Scenario 1.1 Macro Prospectivemubeen902Noch keine Bewertungen

- 27 Ricardo B. Bangayan vs. Rizal Commercial Banking CorporationDokument2 Seiten27 Ricardo B. Bangayan vs. Rizal Commercial Banking CorporationArthur Archie TiuNoch keine Bewertungen

- Working Capital Management at Raymond Ltd.Dokument92 SeitenWorking Capital Management at Raymond Ltd.Bhagyesh R Shah67% (6)

- Roshni Project Report New As Per Secondary DataDokument100 SeitenRoshni Project Report New As Per Secondary DataAjay Poonia100% (3)

- Working Capital Management of AccDokument52 SeitenWorking Capital Management of AccSoham Khanna75% (4)

- Working Capital On WIPRO & ITCDokument50 SeitenWorking Capital On WIPRO & ITCMainak Bose75% (8)

- Accounting Education Project TopicsDokument57 SeitenAccounting Education Project TopicsProject ChampionzNoch keine Bewertungen

- Working Capital ManagementDokument45 SeitenWorking Capital ManagementRaghav100% (1)

- A Project Report On Iti Summer TrainingDokument31 SeitenA Project Report On Iti Summer TrainingDheeraj Sahu0% (1)

- Whitepaper - 10 Top Drivers To Launch A Mobile Wallet - SoftwaregroupDokument14 SeitenWhitepaper - 10 Top Drivers To Launch A Mobile Wallet - SoftwaregroupAba JifarNoch keine Bewertungen

- DocumentDokument8 SeitenDocumentMaaz ThakurNoch keine Bewertungen

- Project For MbaDokument66 SeitenProject For MbasagarNoch keine Bewertungen

- Project Report On Oswal Woolen MillsDokument43 SeitenProject Report On Oswal Woolen Millspabalapreet50% (2)

- Project On BudgetingDokument75 SeitenProject On BudgetingManeha SharmaNoch keine Bewertungen

- Working CapitalDokument88 SeitenWorking CapitalAarti TomarNoch keine Bewertungen

- Lovely Professional University Department of ManagementDokument75 SeitenLovely Professional University Department of ManagementdinnubhattNoch keine Bewertungen

- 200 Final ProjectDokument85 Seiten200 Final ProjectmujeebNoch keine Bewertungen

- A Project Report Submitted To Marwari Colleg1Dokument74 SeitenA Project Report Submitted To Marwari Colleg1Supriya Gautam0% (1)

- Workung CapitalDokument96 SeitenWorkung CapitalSanju ReddyNoch keine Bewertungen

- 1.1 Introduction To TopicDokument55 Seiten1.1 Introduction To Topickunal bankheleNoch keine Bewertungen

- Hons Project 09-02-16Dokument39 SeitenHons Project 09-02-16ayush mohta50% (2)

- Financial Analysis of Current Asset Composition of ITC, Trident & Samsung-ScribdDokument17 SeitenFinancial Analysis of Current Asset Composition of ITC, Trident & Samsung-ScribdRohan SinhaNoch keine Bewertungen

- Kavita Final YearDokument54 SeitenKavita Final YearVinayNoch keine Bewertungen

- Hindustan Biosynth Limited: A Project Report ONDokument60 SeitenHindustan Biosynth Limited: A Project Report ONArchita ParikhNoch keine Bewertungen

- The Impact of Working Capital ManagementDokument10 SeitenThe Impact of Working Capital ManagementAnil BambuleNoch keine Bewertungen

- Dipti Presentation SeminarDokument16 SeitenDipti Presentation Seminarpandadiptimayee99Noch keine Bewertungen

- WCM of PBLDokument24 SeitenWCM of PBLbalal_hossain_1Noch keine Bewertungen

- DattaDokument66 SeitenDattaJayasri MuraliNoch keine Bewertungen

- 02working Capital Management - Navdeep Bajwa, SMS, Pbi Uni.Dokument85 Seiten02working Capital Management - Navdeep Bajwa, SMS, Pbi Uni.Jitin BhutaniNoch keine Bewertungen

- Analysis of Working Capital Management: A Project Report OnDokument39 SeitenAnalysis of Working Capital Management: A Project Report OngitarghawaleNoch keine Bewertungen

- Oswal Woolen MillsDokument76 SeitenOswal Woolen MillsMohit kolliNoch keine Bewertungen

- Summer Training Finance Project On WORKING CAPITAL MANAGEMENTDokument82 SeitenSummer Training Finance Project On WORKING CAPITAL MANAGEMENTPravin chavda100% (2)

- A Project Report On: "A Study On Working Capital Management Done at State Bank of India (Bangalore)Dokument15 SeitenA Project Report On: "A Study On Working Capital Management Done at State Bank of India (Bangalore)Nirnaya AgarwalNoch keine Bewertungen

- Oswal Woolen MillsDokument76 SeitenOswal Woolen Millsharmeet2001Noch keine Bewertungen

- A Project Report On Iti Summer TrainingDokument31 SeitenA Project Report On Iti Summer TrainingSARTHAK SETHNoch keine Bewertungen

- Oswal Woolen MillsDokument76 SeitenOswal Woolen MillsRanbir SinghNoch keine Bewertungen

- Uno Minda RameezDokument139 SeitenUno Minda RameezRameez TkNoch keine Bewertungen

- Business Analysis ReportDokument23 SeitenBusiness Analysis ReportDulon DuttaNoch keine Bewertungen

- Training Project (Tulika Narayan)Dokument112 SeitenTraining Project (Tulika Narayan)Swarup SarkarNoch keine Bewertungen

- Shubh AmDokument57 SeitenShubh AmOm Emmi KkcNoch keine Bewertungen

- Working Capital Management in HCL InfosystemDokument49 SeitenWorking Capital Management in HCL InfosystemDipankar Hans50% (2)

- A Summer Internship A Summer Internship Project Report ON Capital Budgting Project ReportDokument90 SeitenA Summer Internship A Summer Internship Project Report ON Capital Budgting Project ReportFaisal ArifNoch keine Bewertungen

- Working Capital Management at Kirloskar Pneumatics Co. Ltd. by Neeraj SajwanDokument170 SeitenWorking Capital Management at Kirloskar Pneumatics Co. Ltd. by Neeraj SajwanNeeraj SajwanNoch keine Bewertungen

- Acoount ProjectDokument54 SeitenAcoount Projectvikassharma7068Noch keine Bewertungen

- Final MBA-suragDokument84 SeitenFinal MBA-suragSurag VsNoch keine Bewertungen

- Working Capital Management Thesis DownloadDokument7 SeitenWorking Capital Management Thesis Downloadcaseyhudsonwashington100% (1)

- A Project Submitted in The Partial Fulfillment of Requirement For The Award of Degree ofDokument38 SeitenA Project Submitted in The Partial Fulfillment of Requirement For The Award of Degree ofSUBODH DHONGADENoch keine Bewertungen

- Dissertation On Working Capital ManagementDokument5 SeitenDissertation On Working Capital ManagementBuyPapersOnlineHighPoint100% (1)

- A Study of Working Capital Management of Taj Mahal Palace With Oberoi HotelDokument37 SeitenA Study of Working Capital Management of Taj Mahal Palace With Oberoi HotelIrshad Khan50% (2)

- A Project Report On Ratio Analysis 2016Dokument40 SeitenA Project Report On Ratio Analysis 2016Catchy Digital AcademyNoch keine Bewertungen

- Working Capital ManagementDokument45 SeitenWorking Capital Managementbulu_bbsr03Noch keine Bewertungen

- Working Capital Project Introduction On Vijaya DairyDokument8 SeitenWorking Capital Project Introduction On Vijaya DairyAnnapurna VinjamuriNoch keine Bewertungen

- Earthquake Lab PDFDokument8 SeitenEarthquake Lab PDFbalal_hossain_1Noch keine Bewertungen

- Test 2 Formula SheetDokument7 SeitenTest 2 Formula Sheetbalal_hossain_1Noch keine Bewertungen

- McMullen - Giving Thanks With CheesecakeDokument3 SeitenMcMullen - Giving Thanks With Cheesecakebalal_hossain_1Noch keine Bewertungen

- Mock GMAT 4 SolDokument53 SeitenMock GMAT 4 SolSushobhan SanyalNoch keine Bewertungen

- Masud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRODokument4 SeitenMasud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRObalal_hossain_1Noch keine Bewertungen

- IKEA: Design and Pricing: CaseDokument3 SeitenIKEA: Design and Pricing: Casebalal_hossain_1Noch keine Bewertungen

- Preface: United Commercial Bank Limited M. Shahjahan Bhuiyan Head Office, Dhaka Managing DirectorDokument1 SeitePreface: United Commercial Bank Limited M. Shahjahan Bhuiyan Head Office, Dhaka Managing Directorbalal_hossain_1Noch keine Bewertungen

- List of UniversitiesDokument6 SeitenList of Universitiesbalal_hossain_1Noch keine Bewertungen

- M Faisal Riyad 2014Dokument3 SeitenM Faisal Riyad 2014balal_hossain_1Noch keine Bewertungen

- Raiyan's IeltsDokument3 SeitenRaiyan's Ieltsbalal_hossain_1Noch keine Bewertungen

- Executive SummaryDokument27 SeitenExecutive Summarybalal_hossain_1Noch keine Bewertungen

- List of Sessions Top One PercentDokument1 SeiteList of Sessions Top One Percentbalal_hossain_1Noch keine Bewertungen

- Identification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan ProvinceDokument6 SeitenIdentification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan Provincebalal_hossain_1Noch keine Bewertungen

- WCM of PBLDokument24 SeitenWCM of PBLbalal_hossain_1Noch keine Bewertungen

- Pijush Roy CVDokument2 SeitenPijush Roy CVbalal_hossain_1Noch keine Bewertungen

- Bryan Pepin DonatDokument21 SeitenBryan Pepin Donatsabah8800Noch keine Bewertungen

- Full Download Ebook Ebook PDF Macroeconomics Global Edition 13th Edition PDFDokument41 SeitenFull Download Ebook Ebook PDF Macroeconomics Global Edition 13th Edition PDFcarol.martinez79498% (42)

- Financing Small Scale Industries Sbi Vis-À-Vis Other BanksDokument98 SeitenFinancing Small Scale Industries Sbi Vis-À-Vis Other BanksAnonymous V9E1ZJtwoENoch keine Bewertungen

- AUSCOIN Whitepaper Mark UpDokument15 SeitenAUSCOIN Whitepaper Mark UpAnonymous IjFCR0CNoch keine Bewertungen

- CBSE Class 10 Social Science Question Paper NSQF Set 3 2017Dokument20 SeitenCBSE Class 10 Social Science Question Paper NSQF Set 3 2017Jayaprakash PrakashNoch keine Bewertungen

- Performance Appraisal PDFDokument60 SeitenPerformance Appraisal PDFAbhìshek MalekarNoch keine Bewertungen

- Overseas Direct InvestmentDokument61 SeitenOverseas Direct InvestmentSutonu BasuNoch keine Bewertungen

- Corporate Finance 2 SyllabusDokument11 SeitenCorporate Finance 2 SyllabusMai NguyenNoch keine Bewertungen

- Retail Credit SchemesDokument18 SeitenRetail Credit SchemesAman MujeebNoch keine Bewertungen

- Balance SheetDokument8 SeitenBalance SheetNagaraju MamillaNoch keine Bewertungen

- Code of ConductDokument6 SeitenCode of ConductPrabu PappuNoch keine Bewertungen

- Memorandum of UnderstandingDokument2 SeitenMemorandum of Understandingnatasha catteryNoch keine Bewertungen

- Business Correspondent (BC) Model For Inclusive Growth: Performance Analysis of SKDRDPDokument8 SeitenBusiness Correspondent (BC) Model For Inclusive Growth: Performance Analysis of SKDRDPmdevi190499Noch keine Bewertungen

- VE EFB2 Tests ProgressTest03Dokument3 SeitenVE EFB2 Tests ProgressTest03DamMayXanhNoch keine Bewertungen

- Kushagra Amrit 1882053Dokument16 SeitenKushagra Amrit 1882053Kushagra AmritNoch keine Bewertungen

- Zeal Black Book Project NewDokument86 SeitenZeal Black Book Project NewAshwini PadwalNoch keine Bewertungen

- E BankingDokument72 SeitenE Bankingmuhammad_hasnai243850% (2)

- Managing A Successful Business Project Talent Management of TESCO Bank, UKDokument17 SeitenManaging A Successful Business Project Talent Management of TESCO Bank, UKDipayanNoch keine Bewertungen

- Corporate Governance Measures in BankingDokument2 SeitenCorporate Governance Measures in BankingvidhiNoch keine Bewertungen

- Release Notes PSM Funds Management EHP6 PSMDokument18 SeitenRelease Notes PSM Funds Management EHP6 PSMankish77Noch keine Bewertungen

- Namma Kalvi 12th Commerce Book Back 1 Mark Test Question Paper em 215254Dokument5 SeitenNamma Kalvi 12th Commerce Book Back 1 Mark Test Question Paper em 215254Aakaash C.K.100% (1)

- The Effects of Marketing Strategies On Sales Performance of Commercial Business in KenyaDokument93 SeitenThe Effects of Marketing Strategies On Sales Performance of Commercial Business in KenyaabdulazizNoch keine Bewertungen