Beruflich Dokumente

Kultur Dokumente

Porter's Five Forces Model

Hochgeladen von

Nguyễn DungCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Porter's Five Forces Model

Hochgeladen von

Nguyễn DungCopyright:

Verfügbare Formate

P ORT E R S F I V E F ORCE S M ODE L OF I N DU S T RY

COM P E T I T I V E A DV A N T A GE

Professor and strategy consultant Gary Hamel once wrote in a Fortune cover story that the dirty little secret

of the strategy industry is that it doesnt have any theory of strategy creation.

[79]

While there is no silver

bullet for strategy creation, strategic frameworks help managers describe the competitive environment a

firm is facing. Frameworks can also be used as brainstorming tools to generate new ideas for responding to

industry competition. If you have a model for thinking about competition, its easier to understand whats

happening and to think creatively about possible solutions.

One of the most popular frameworks for examining a firms competitive environment is Porters Five

Forces, also known as the Industry and Competitive Analysis. As Porter puts it, analyzing [these] forces

illuminates an industrys fundamental attractiveness, exposes the underlying drivers of average industry

profitability, and provides insight into how profitability will evolve in the future. The five forces this

framework considers are (1) the intensity of rivalry among existing competitors, (2) the threat of new

entrants, (3) the threat of substitute goods or services, (4) the bargaining power of buyers, and (5) the

bargaining power of suppliers.

The Five Forces of Industry Competitive Analysis

New technologies can create jarring shocks in an industry. Consider how the rise of the Internet has

impacted the five forces for music retailers. Traditional music retailers like Tower and Virgin found that

customers were seeking music online. These firms scrambled to invest in the new channel out of what is

perceived to be a necessity. Their intensity of rivalry increases because they not only compete based on the

geography of where brick-and-mortar stores are physically located, they now compete online as well.

Investments online are expensive and uncertain, prompting some firms to partner with new entrants such as

Amazon. Free from brick-and-mortar stores, Amazon, the dominant new entrant has a highly scalable cost

structure. And in many ways the online buying experience is superior to what customers saw in stores.

Customers can hear samples of almost all tracks, selection is seemingly limitless (the long tail

phenomenonsee this concept illuminated in Chapter 3, Netflix: David Becomes Goliath), and data is

leveraged using collaborative filtering software to make product recommendations and assist in music

discovery.

[80]

Tough competition, but it gets worse because CD sales arent the only way to consume music.

The process of buying a plastic disc now faces substitutes as digital music files become available on

commercial music sites. Who needs the physical atoms of a CD filled with ones and zeros when you can

buy the bits one song at a time? Or dont buy anything and subscribe to a limitless library instead.

From a sound quality perspective, the substitute good of digital tracks purchased online is almost always

inferior to their CD counterparts. To transfer songs quickly and hold more songs on a digital music player,

tracks are encoded in a smaller file size than what youd get on a CD, and this smaller file contains lower

playback fidelity. But the additional tech-based market shock brought on by digital music players

(particularly the iPod) has changed listening habits. The convenience of carrying thousands of songs trumps

what most consider just a slight quality degradation. iTunes is now responsible for selling more music than

any other firm, online or off. Most alarming to the industry is the other widely adopted substitute for CD

purchasestheft. Music is available free, but illegally. And while exact figures on real losses from online

piracy are in dispute, the music industry has seen album sales drop by 45 percent in less than a decade.

[81]

All this choice gives consumers (buyers) bargaining power. They demand cheaper prices and greater

convenience. The bargaining power of suppliersthe music labels and artistsalso increases. At the start

of the Internet revolution, retailers could pressure labels to limit sales through competing channels. Now,

with many of the major music retail chains in bankruptcy, labels have a freer hand to experiment, while

bands large and small have new ways to reach fans, sometimes in ways that entirely bypass the traditional

music labels.

While it can be useful to look at changes in one industry as a model for potential change in another, its

important to realize that the changes that impact one industry do not necessarily impact other industries in

the same way. For example, it is often suggested that the Internet increases bargaining power of buyers and

lowers the bargaining power of suppliers. This suggestion is true for some industries like auto sales and

jewelry where the products are commodities and the price transparency of the Internet counteracts a

previous information asymmetry where customers often didnt know enough information about a product to

bargain effectively. But its not true across the board.

In cases where network effects are strong or a sellers goods are highly differentiated, the Internet can

strengthen supplier bargaining power. The customer base of an antique dealer used to be limited by how

many likely purchasers lived within driving distance of a store. Now with eBay, the dealer can take a rare

good to a global audience and have a much larger customer base bid up the price. Switching costs also

weaken buyer bargaining power. Wells Fargo has found that customers who use online bill pay (where

switching costs are high) are 70 percent less likely to leave the bank than those who dont, suggesting that

these switching costs help cement customers to the company even when rivals offer more compelling rates

or services.

Tech plays a significant role in shaping and reshaping these five forces, but its not the only significant force

that can create an industry shock. Government deregulation or intervention, political shock, and social and

demographic changes can all play a role in altering the competitive landscape. Because we live in an age of

constant and relentless change, mangers need to continually visit strategic frameworks to consider any

market impacting shifts. Predicting the future is difficult, but ignoring change can be catastrophic.

Altering the Industry Structure

Altering the industry structure is the process of changing the industry to become more favorable to the company or

organization. The introduction of low-fare airline carriers, such as Southwest Airlines, has forever changed the airline

industry, making it difficult for traditional airline companies to make high profit margins. To fight back, airline

companies such as Delta are launching their own low-fare flights.38 Delta claims that its Song airline will be one of the

first all digital airlines. The approach will include a host of services on the flights, including entertainment, satellite

TV, and many similar services.

A company can also attempt to create barriers to new companies entering the industry. An established organization

that acquires expensive new technology to provide better products and services can discourage new companies from

getting into the marketplace.

Creating strategic alliances can also have this effect. A strategic alliance, also called a strategic partnership, is an

agreement between two or more companies that involves the joint production and distribution of goods and services.

Samsung Electronics and Echelon Corporation, for example, signed a strategic alliance agreement to develop and

market electronic devices that can be connected to each other and the Internet.39 The alliance is oriented to

the home networking market.

Creating New Products and Services

Creating new products and services is always an approach that can help a firm gain a competitive advantage, and it is

especially true of the computer industry and other high-tech businesses. If an organization does not introduce new

products and services every few months, the company can quickly stagnate, lose market share, and decline.

Companies that stay on top are constantly developing new products and services. A large U.S. credit-reporting

agency, for example, can use its information system to help it explore new products and services in different markets.

Delta Airlines created a new service by installing hundreds of self-service kiosks to reduce customer check-in times.

The new kiosks allow Delta customers to check in, get boarding passes, change seats, and sign up for standby flights

or upgrades. On average, the kiosks save flyers from 5 to 15 minutes for each check-in at an airport terminal.40

Improving Existing Product Lines and Services

Improving existing product lines and services is another approach to staying competitive. The improvements can be

either real or perceived. Manufacturers of household products are always advertising new and improved products. In

some cases, the improvements are more perceived than real refinements; usually, only minor changes are made to

the existing product.

Many food and beverage companies are introducing Healthy and Low-Carb product lines. Some companies are

now starting to put radio-frequency ID (RFID) tags on their products to identify them and track their location as they

move from one location to another.

41 Customers and managers can instantly locate products as they are shipped from suppliers, to the company, to

warehouses, and, finally, to customers. In another case, Metro, the third largest retail store in Europe, used portable

computers to show shoppers where products are located in the store and to display discounted prices and any

specials.42

Using Information Systems for Strategic Purposes

In simplest terms, competitive advantage is usually embodied in either a product or service that has the most added

value to consumers and that is unavailable from the competition or in an internal system that delivers benefits to a firm

not enjoyed by its competition.

Although it can be difficult to develop information systems to provide a competitive advantage, some organizations

have done so with success. A classic example is SABRE, a sophisticated computerized reservation system installed

by American Airlines and one of the first information systems recognized for providing competitive advantage. Travel

agents used this system for rapid access to flight information, offering travelers reservations, seat assignments,

and ticketing. The travel agents also achieved an efficiency benefit from the SABRE system. Because SABRE

displayed American Airline flights whenever possible, it also gave the airline a long-term, significant competitive

advantage. Today, SABRE is aggressively seeking a competitive advantage by investing heavily in e-commerce

technology and developing Internet travel sites. It invested more than $200 million in technology recently. Much of the

investment was in the companys Travelocity.com site (the second largest online travel agency) and GetThere.com.43

Increasingly, companies are using e-commerce as part of a strategy to achieve a competitive advantage. Table 1.5

lists several examples of how companies have attempted to gain a competitive advantage.

Das könnte Ihnen auch gefallen

- IELTS Writing Band 9 Essays PDFDokument187 SeitenIELTS Writing Band 9 Essays PDFEranda90% (31)

- IELTS Writing Band 9 Essays PDFDokument187 SeitenIELTS Writing Band 9 Essays PDFEranda90% (31)

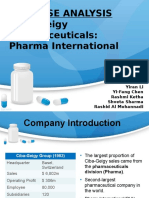

- Ceba-Geigy Pharmaceuticals - Pharma International AnalysisDokument20 SeitenCeba-Geigy Pharmaceuticals - Pharma International AnalysisRashmi KethaNoch keine Bewertungen

- GoMobile ADokument20 SeitenGoMobile AJohnNoch keine Bewertungen

- CHRO Lab PDFDokument10 SeitenCHRO Lab PDFChristian Cherry TeaNoch keine Bewertungen

- SalesDokument3 SeitenSalesEdgardo MartinezNoch keine Bewertungen

- Duracell Case FINALDokument5 SeitenDuracell Case FINALRob ZhangNoch keine Bewertungen

- Five Competitive Forces of e Comerce IndustryDokument5 SeitenFive Competitive Forces of e Comerce Industrypallav00191% (11)

- 【泰】純了鄭家純泰國寫真書 PDFDokument85 Seiten【泰】純了鄭家純泰國寫真書 PDFAaron C.Noch keine Bewertungen

- People, Service, and Profit At: Jyske BankDokument12 SeitenPeople, Service, and Profit At: Jyske BankArushiRajvanshiNoch keine Bewertungen

- Xerox and Fuji XeroxDokument37 SeitenXerox and Fuji XeroxRahul RanjanNoch keine Bewertungen

- Arvind Eye Care Case StudyDokument48 SeitenArvind Eye Care Case StudyNader NazihNoch keine Bewertungen

- Porter's Five Forces Analysis Is A Framework For The IndustryDokument4 SeitenPorter's Five Forces Analysis Is A Framework For The Industrylove_bkbNoch keine Bewertungen

- Bottom of Pyramid Business StrategyDokument36 SeitenBottom of Pyramid Business StrategyTyra Lim Ah KenNoch keine Bewertungen

- Marketing at The Bottom of The PyramidDokument10 SeitenMarketing at The Bottom of The PyramidAsim AyazNoch keine Bewertungen

- Buyer Supplier RelationshipsDokument9 SeitenBuyer Supplier Relationshipsrupesh_pNoch keine Bewertungen

- Lasserre Globalisation IndicesDokument10 SeitenLasserre Globalisation IndicesNavneet KumarNoch keine Bewertungen

- Service Marketing Question BankDokument9 SeitenService Marketing Question BankKarthika NathanNoch keine Bewertungen

- Cola Wars CaseDokument11 SeitenCola Wars CaseAneeshKKedlayaNoch keine Bewertungen

- Chapter-1 Buying Behaviour of Coustomers at Maruthi Suzuki CarsDokument82 SeitenChapter-1 Buying Behaviour of Coustomers at Maruthi Suzuki CarsPavi RaviNoch keine Bewertungen

- TVAHelp ComDokument51 SeitenTVAHelp ComSunil KesarwaniNoch keine Bewertungen

- MTI Project Presentation Ideo Product Development PDFDokument22 SeitenMTI Project Presentation Ideo Product Development PDFDamian DeoNoch keine Bewertungen

- BGS ModelsDokument24 SeitenBGS Modelsprasannamurthy100% (1)

- Porcini's Pronto - Great Italian Cuisine Without The WaitDokument1 SeitePorcini's Pronto - Great Italian Cuisine Without The WaitRupesh TiwariNoch keine Bewertungen

- Answers To Exercises and Review Questions: Part Three: Preliminary AnalysesDokument10 SeitenAnswers To Exercises and Review Questions: Part Three: Preliminary Analysesjhun bagainNoch keine Bewertungen

- The Upside of Clumsiness: Clumsy Solutions For Wicked ProblemsDokument18 SeitenThe Upside of Clumsiness: Clumsy Solutions For Wicked ProblemsArk SukhadiaNoch keine Bewertungen

- Module 3 - Group 2-XYZ CaseletDokument3 SeitenModule 3 - Group 2-XYZ CaseletconeshaNoch keine Bewertungen

- 07 - Strategy-Business - The Fortune at The Bottom of The Pyramid - Prahalad and Hart PDFDokument16 Seiten07 - Strategy-Business - The Fortune at The Bottom of The Pyramid - Prahalad and Hart PDFRESMITA DASNoch keine Bewertungen

- IMC Mountain Dew Case StudyDokument13 SeitenIMC Mountain Dew Case StudyGaligeNoch keine Bewertungen

- Implemented For The Impending Launch? Justify Your AnswerDokument2 SeitenImplemented For The Impending Launch? Justify Your AnswerShrinivas PuliNoch keine Bewertungen

- Factors Affecting Selection of Distribution ChannelDokument2 SeitenFactors Affecting Selection of Distribution ChannelDivya SinghNoch keine Bewertungen

- SWOT Tata StarbucksDokument1 SeiteSWOT Tata StarbucksAnik ChakrabortyNoch keine Bewertungen

- Supply Chain Management: Post Graduate Programme in ManagementDokument3 SeitenSupply Chain Management: Post Graduate Programme in Managementvijay kumarNoch keine Bewertungen

- Case4 Group17Dokument11 SeitenCase4 Group17Ankur2804Noch keine Bewertungen

- GDP Estimation and Its Relevance As A Measure of Growth of Indian EconomyDokument21 SeitenGDP Estimation and Its Relevance As A Measure of Growth of Indian EconomyAthik AhmedNoch keine Bewertungen

- Marketing Management: Assignment Case - Trouble Brews at StarbucksDokument6 SeitenMarketing Management: Assignment Case - Trouble Brews at StarbuckssubhorovrNoch keine Bewertungen

- Hmsi Case Study Which Focuses On HR ProblemsDokument2 SeitenHmsi Case Study Which Focuses On HR ProblemsDing LinNoch keine Bewertungen

- PPG-Self Directed Workforce Company OverviewDokument3 SeitenPPG-Self Directed Workforce Company OverviewKrishNoch keine Bewertungen

- IBM Startegic AllianceDokument11 SeitenIBM Startegic Alliancenonsenseatul0% (1)

- How Smart, Connected Products Are Transforming CompetitionDokument14 SeitenHow Smart, Connected Products Are Transforming CompetitionReshma MajumderNoch keine Bewertungen

- HR Drives Strategy at XYZ IncDokument2 SeitenHR Drives Strategy at XYZ IncAnkur JainNoch keine Bewertungen

- MonopolyDokument19 SeitenMonopolyDanijel BuhinNoch keine Bewertungen

- The Strategic Development of Procter and Gamble Into A GlobalDokument5 SeitenThe Strategic Development of Procter and Gamble Into A Globalkhurram36Noch keine Bewertungen

- SHRM Case Analysis 2Dokument4 SeitenSHRM Case Analysis 2SAntosh TamhaneNoch keine Bewertungen

- Pricing of ServicesDokument9 SeitenPricing of ServicesMaruko ChanNoch keine Bewertungen

- Assignment - MM - Vora & Co - PNDokument6 SeitenAssignment - MM - Vora & Co - PNPrashant NarulaNoch keine Bewertungen

- Tehelka in Crisis: 1. SummaryDokument3 SeitenTehelka in Crisis: 1. SummarykaranNoch keine Bewertungen

- MBA 540 Final - ExamDokument4 SeitenMBA 540 Final - ExamJoeNoch keine Bewertungen

- QDokument2 SeitenQUmair AwanNoch keine Bewertungen

- Amisha Gupta Case AnalysisDokument1 SeiteAmisha Gupta Case AnalysisSAURAV KUMAR GUPTANoch keine Bewertungen

- Sec A - Group 13 - Case 2Dokument17 SeitenSec A - Group 13 - Case 2Nishant YadavNoch keine Bewertungen

- Barista Coffee Company Limited: - Group B2Dokument6 SeitenBarista Coffee Company Limited: - Group B201202Noch keine Bewertungen

- PLPDokument6 SeitenPLPgaurav vermaNoch keine Bewertungen

- Case Study GilletteDokument6 SeitenCase Study GilletteNomi SiekoNoch keine Bewertungen

- Why Do You Think Himont Chose To License Out Its Cutting Edge Technology and Thus Gave Away A Strong Proprietary Resource?Dokument4 SeitenWhy Do You Think Himont Chose To License Out Its Cutting Edge Technology and Thus Gave Away A Strong Proprietary Resource?ruchi singlaNoch keine Bewertungen

- Answer of Service and Retail MarketingDokument12 SeitenAnswer of Service and Retail MarketingMAMANoch keine Bewertungen

- 1-2. Red. Nature of TradlDokument6 Seiten1-2. Red. Nature of TradldewpraNoch keine Bewertungen

- Chapter 3 - ServicesDokument42 SeitenChapter 3 - ServicesZainabChandio67% (3)

- GHRM StaffingDokument14 SeitenGHRM StaffingrojabommalaNoch keine Bewertungen

- Strategic Management ProjectDokument9 SeitenStrategic Management Projectnaeem sarwarNoch keine Bewertungen

- Poter Five ForcesDokument6 SeitenPoter Five ForcesNadeem AnjumNoch keine Bewertungen

- Self Study Question : Table 3.1Dokument7 SeitenSelf Study Question : Table 3.1Jea Millar ConchadaNoch keine Bewertungen

- Common Frameworks For Evaluating The Business EnvironmentDokument10 SeitenCommon Frameworks For Evaluating The Business EnvironmentKristia AnagapNoch keine Bewertungen

- Macroeconomics I-2009Dokument205 SeitenMacroeconomics I-2009Nguyễn Dung100% (1)

- Human CapitalDokument22 SeitenHuman CapitalNguyễn DungNoch keine Bewertungen

- Macroeconomics Lecturer Notes PDFDokument96 SeitenMacroeconomics Lecturer Notes PDFNguyễn DungNoch keine Bewertungen

- Lecture13 - MacroDokument16 SeitenLecture13 - MacroNguyễn DungNoch keine Bewertungen

- Cau Hoi MarketingDokument22 SeitenCau Hoi MarketingNguyễn DungNoch keine Bewertungen

- Campus Map 15Dokument1 SeiteCampus Map 15Nguyễn DungNoch keine Bewertungen

- Ebanking 2Dokument9 SeitenEbanking 2Nguyễn DungNoch keine Bewertungen

- (P) BOE Implications of The Bank Merger WaveDokument13 Seiten(P) BOE Implications of The Bank Merger WaveNguyễn DungNoch keine Bewertungen

- Board StructureDokument17 SeitenBoard StructureNguyễn DungNoch keine Bewertungen

- Case14 AppleDokument9 SeitenCase14 AppleNguyễn DungNoch keine Bewertungen

- Kishore Behavioural Finance Application Property MarketDokument17 SeitenKishore Behavioural Finance Application Property MarketMayank GoelNoch keine Bewertungen

- Abreu-Brunnermeier - Bubbles and CrashesDokument32 SeitenAbreu-Brunnermeier - Bubbles and CrashesChi-Wa CWNoch keine Bewertungen

- Informal Conversational ExpressionsDokument13 SeitenInformal Conversational ExpressionsNguyễn DungNoch keine Bewertungen

- Fauji Fertilizer RatiosDokument86 SeitenFauji Fertilizer RatiosnickchikNoch keine Bewertungen

- Chuyªn §Ò Hi®rocacbon Kh«ng No Nguyễn Văn NamDokument4 SeitenChuyªn §Ò Hi®rocacbon Kh«ng No Nguyễn Văn NamNguyễn DungNoch keine Bewertungen

- Principles of Bank Management - 1Dokument60 SeitenPrinciples of Bank Management - 1Nguyễn Dung0% (1)

- Definition of The Federal Funds RateDokument7 SeitenDefinition of The Federal Funds RateNguyễn DungNoch keine Bewertungen

- Human Capital1Dokument8 SeitenHuman Capital1Nguyễn DungNoch keine Bewertungen

- Human Capital1Dokument8 SeitenHuman Capital1Nguyễn DungNoch keine Bewertungen

- Iam Opc Security Wp1Dokument39 SeitenIam Opc Security Wp1Industrial Automation and MechatronicsNoch keine Bewertungen

- 2024.02.09 MPK Handbook Final Copy (8.5x11) For PrintingDokument100 Seiten2024.02.09 MPK Handbook Final Copy (8.5x11) For PrintingKuya MikolNoch keine Bewertungen

- Smart City Blueprint Consultancy Study - Full Report (EN) PDFDokument233 SeitenSmart City Blueprint Consultancy Study - Full Report (EN) PDFJonathan LiNoch keine Bewertungen

- 702P06257 Service Manual Supplement For Self Serve Kit v2Dokument94 Seiten702P06257 Service Manual Supplement For Self Serve Kit v2Data PrintNoch keine Bewertungen

- 1.GSM OverviewDokument46 Seiten1.GSM OverviewAmit ThakurNoch keine Bewertungen

- How To Free Port 80Dokument4 SeitenHow To Free Port 80ethelfajardoNoch keine Bewertungen

- Adobe Document Service CONFIG GUIDEDokument10 SeitenAdobe Document Service CONFIG GUIDESudarshan DavidRajamNoch keine Bewertungen

- Hema Resume 1Dokument5 SeitenHema Resume 1Intuites(Pavan Kumar Kanigiri)Noch keine Bewertungen

- Cumont, Franz (1922) - Afterlife in Roman PaganismDokument261 SeitenCumont, Franz (1922) - Afterlife in Roman Paganismdzimmer6Noch keine Bewertungen

- Domain Summary: What Is My IP: 178.138.34.145Dokument6 SeitenDomain Summary: What Is My IP: 178.138.34.145TMNoch keine Bewertungen

- PLC Training HandoutDokument69 SeitenPLC Training HandoutAgnimuthu100% (1)

- EMG ManualDokument2 SeitenEMG ManualOmar Manzano CaceresNoch keine Bewertungen

- GS36J04A10-01E - 020 (Exaquantum)Dokument10 SeitenGS36J04A10-01E - 020 (Exaquantum)Tran DinhNoch keine Bewertungen

- PT845 NotesDokument118 SeitenPT845 NotesRiyaz AhamedNoch keine Bewertungen

- Dork Diaries Activity PackDokument10 SeitenDork Diaries Activity PackSimonKidsUK93% (14)

- FLUENT ClusterDokument11 SeitenFLUENT Clustergat11Noch keine Bewertungen

- Vra Bp90 Oraclehrms III v2.1Dokument61 SeitenVra Bp90 Oraclehrms III v2.1ahosainyNoch keine Bewertungen

- I61132001G1-8 Hix5622Dokument2 SeitenI61132001G1-8 Hix5622Mariem Sameh Ben LimemNoch keine Bewertungen

- Tib Hawk Installation ConfigurationDokument225 SeitenTib Hawk Installation Configurationrams1984Noch keine Bewertungen

- AdobeGaramondProReadme PDFDokument2 SeitenAdobeGaramondProReadme PDFAjversonNoch keine Bewertungen

- 6.2.3.8 Packet Tracer - Router and Switch RedundancyDokument4 Seiten6.2.3.8 Packet Tracer - Router and Switch RedundancySantiago Aldana SusanaNoch keine Bewertungen

- Open Her Box by Vin DicarloDokument3 SeitenOpen Her Box by Vin DicarloWilliam Farias PortoNoch keine Bewertungen

- Valentin PopescuDokument7 SeitenValentin PopescuValentin PopescuNoch keine Bewertungen

- PSMC Designer Users GuideDokument42 SeitenPSMC Designer Users GuideelvinguitarNoch keine Bewertungen

- ASCII Art by ZenmasterDokument108 SeitenASCII Art by ZenmasterKaitlin ChanNoch keine Bewertungen

- Vscan+Product+Manual EnglishDokument221 SeitenVscan+Product+Manual Englishgigidurul1111Noch keine Bewertungen

- Synopsis - Doc ShareDokument10 SeitenSynopsis - Doc ShareRajneesh PrajapatiNoch keine Bewertungen