Beruflich Dokumente

Kultur Dokumente

60 New Hire Package Rev.11.11.11

Hochgeladen von

Fortyniners49ersCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

60 New Hire Package Rev.11.11.11

Hochgeladen von

Fortyniners49ersCopyright:

Verfügbare Formate

REV 7.

2011

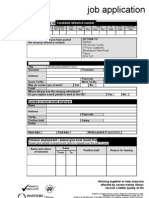

APPLICATION FOR EMPLOYMENT

INTERCRUISES SHORESIDE & PORT SERVICES is an equal opportunity employer and does not discriminate on the basis of race,

religion, color, national origin, age, sex, gender, disability, genetic information, or any other characteristic protected by law.

Referral Source: Walk-in Employee Relative Website Other: ___________________________

PERSONAL INFORMATION

Please print clearly

Last Name: First Name: Email:

Current Street Address: City: State: Zip:

Home Telephone Number: Cell Phone Number:

Other name which you have been previously employed under:

Are you at least 18 years of age?

If hired, are you able to provide documents to establish your eligibility to work in the United States? Yes No

Have you since the age of 18 been convicted of a Felony? Yes No If yes, please explain:

Have you ever been asked to resign from a position? Yes No If yes, please explain.

EMPLOYMENT DESIRED

Position: Date Available: Can you travel if the work requires it?

Yes No

Have you previously been employed by Intercruises: Yes No If yes, please indicate dates and location:

Would you be willing to work at any Intercruises location? Yes No

Type of work desired: Full Time Part time Seasonal Summer only

Are you willing and able to work: Overtime Holidays Weekends Evenings Nights

Hours

Available

Monday Tuesday Wednesday Thursday Friday Saturday Sunday

From:

To:

SPECIAL SKILLS TRAINING

List any special skills/trainings that are related to the position for which you are applying:

List additional languages spoken aside from English:

Computer skills:

REV 7.2011

EDUCATION

Name and Address Number

of years

Major/Subject Course Graduated? Degree/Certificate

College or University

High School

Vocational School

Other

EMPLOYMENT HISTORY

Start with most recent

Company Name: Start Dates: End Date:

Address: City:

State: Zip: Telephone Number: Position:

Reason for Leaving: Start Wage: End: Supervisor:

Summary of Responsibilities: May we contact for Reference

Yes No Notify me prior

Company Name: Start Dates: End Date:

Address: City:

State: Zip: Telephone Number: Position:

Reason for Leaving: Start Wage: End: Supervisor:

Summary of Responsibilities: May we contact for Reference:

Yes No Notify me prior

Company Name: Start Dates: End Date:

Address: City:

State: Zip: Telephone Number: Position:

Reason for Leaving: Start Wage: End: Supervisor:

Summary of Responsibilities: May we contact for Reference:

Yes No Notify me prior

CERTIFICATION AND AUTHORIZATION

I understand that this application is not intended to be a contract of employment and that any employment is strictly on at-will

basis, meaning that I or Intercruises may terminate my employment at any time, for any reasons consistent with applicable state or

federal laws. I authorize Intercruises Shoreside & Port Services to conduct a thorough background investigation of my work and

personal history, and verify all data provided on this application and during interviews. I hereby release the company and its

representatives from any liability that might result from such an investigation. I authorize individuals, schools, and companies

named to provide any requested information and release them from all liability for providing the requested information.

Intercruises Shoreside & Port Services is a drug free work place and in the event of employment I understand that I will be subject to

random drug testing and positive results may result in termination. In the event of employment, I understand that false or

misleading information provided on this application or interview may result in termination.

Applicants Signature: ______________________________________ Date: _____________________________

REV 7.2011

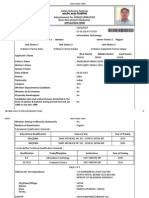

NEW HIRE OR REHIRE

ADDITIONAL INFORMATION

[To be filled out by Employee]

EMPLOYEE INFORMATON

EMPLOYEE NAME:

(Please Print)

ADDRESS:

(Including apartment number)

CITY: STATE: ZIP:

HOME TELEPHONE NUMBER: CELULAR NUMBER: OTHER TELEPHONE NUMBER:

EMAIL ADDRESS: (Please Print) GENDER:

MALE FEMALE

EMERGENCY CONACT INFORMATION

PRIMARY CONTACT NAME:

RELATIONSHIP:

TELEPHONE NUMBER:

SECONDARY TELEPHONE NUMBER:

SECONDARY CONTACT NAME:

RELATIONSHIP:

TELEPHONE NUMBER:

SECONDARY TELEPHONE NUMBER:

EMPLOYEES SIGNATURE: ____________________________ DATE: _________________________

OFFICE USE ONLY

Indicate multiple locations if applicable

HIRE DATE: PART TIME SEASONAL

FULL TIME PERMANENT

EMP ID NUMBER:

PORT LOCATION: POSITION: CRUISE LINE: RATE:

PORT LOCATION:

POSITION: CRUISE LINE: RATE:

PORT LOCATION:

POSITION: CRUISE LINE RATE:

Rev 4.2010

EQUAL EMPLOYMENT OPPORTUNITY (EEO)

SELF-IDENTIFICATON FORM

Instructions: Employees are treated during employment without regard to race, color, religion, sex, national origin, age,

marital status or veteran status, medical condition or handicap, or any other legally protected status.

Employers are subject to certain governmental recordkeeping and reporting requirements for the administration of civil

rights laws and regulations. In order to comply with these laws, the employer invites employees to voluntarily self-

identify their race or ethnicity. Submission of this information is voluntary and refusal to provide it will not subject you

to any adverse treatment. The information obtained will be kept confidential and may only be used in accordance with

the provisions of applicable laws, executive orders, and regulations, including those that require the information to be

summarized and reported to the federal government for civil rights enforcement. When reported, data will not identify

any specific individual.

PLEASE PRINT

This form will be kept in a confidential file separate from your employment file.

Name (Last, First, MI): ____________________________________________________________

Street Address: ____________________________________________________________

City, State, Zip Code: ____________________________________________________________

Position: ________________________

Gender Identification (check one)

____ Female ____ Male

Race/Ethnic Identification (check one):

____ Hispanic or Latino - A person of Cuban, Mexican, Puerto Rican, South or Central American, or other Spanish

culture or origin regardless of race.

If you did not check Hispanic or Latino above, please select one of the following race/ethnic identifications.

____ White (Not Hispanic or Latino) - A person having origins in any of the original peoples of Europe, the Middle

East, or North Africa.

____ Black or African American (Not Hispanic or Latino) - A person having origins in any of the black racial

groups of Africa.

____ Native Hawaiian or Other Pacific Islander (Not Hispanic or Latino) - A person having origins in any of the

peoples of Hawaii, Guam, Samoa, or other Pacific Islands.

____ Asian (Not Hispanic or Latino) - A person having origins in any of the original peoples of the Far East,

Southeast Asia, or the Indian Subcontinent, including, for example, Cambodia, China, India, J apan, Korea, Malaysia,

Pakistan, the Philippine Islands, Thailand, and Vietnam.

____ American Indian or Alaska Native (Not Hispanic or Latino) - A person having origins in any of the original

peoples of North and South America (including Central America), and who maintain tribal affiliation or community

attachment.

____ Two or More Races (Not Hispanic or Latino) - All persons who identify with more than one of the above five

races.

_____ Decline self-identification

_________________________________________________ __________________

Applicants Signature Date

Form W-4 (2011)

Purpose. Complete Form W-4 so that your

employer can withhold the correct federal

income tax from your pay. Consider completing a

new Form W-4 each year and when your

personal or financial situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign

the form to validate it. Your exemption for 2011

expires February 16, 2012. See Pub. 505, Tax

Withholding and Estimated Tax.

Note. If another person can claim you as a

dependent on his or her tax return, you cannot

claim exemption from withholding if your income

exceeds $950 and includes more than $300 of

unearned income (for example, interest and

dividends).

Basic instructions. If you are not exempt,

complete the Personal Allowances Worksheet

below. The worksheets on page 2 further adjust

your withholding allowances based on itemized

deductions, certain credits, adjustments to

income, or two-earners/multiple jobs situations.

Complete all worksheets that apply. However,

you may claim fewer (or zero) allowances. For

regular wages, withholding must be based on

allowances you claimed and may not be a flat

amount or percentage of wages.

Head of household. Generally, you may claim

head of household filing status on your tax return

only if you are unmarried and pay more than

50% of the costs of keeping up a home for

yourself and your dependent(s) or other

qualifying individuals. See Pub. 501, Exemptions,

Standard Deduction, and Filing Information, for

information.

Tax credits. You can take projected tax credits

into account in figuring your allowable number of

withholding allowances. Credits for child or

dependent care expenses and the child tax

credit may be claimed using the Personal

Allowances Worksheet below. See Pub. 919,

How Do I Adjust My Tax Withholding, for

information on converting your other credits into

withholding allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends,

consider making estimated tax payments using

Form 1040-ES, Estimated Tax for Individuals.

Otherwise, you may owe additional tax. If you

have pension or annuity income, see Pub. 919 to

find out if you should adjust your withholding on

Form W-4 or W-4P.

Two earners or multiple jobs. If you have a

working spouse or more than one job, figure the

total number of allowances you are entitled to

claim on all jobs using worksheets from only one

Form W-4. Your withholding usually will be most

accurate when all allowances are claimed on the

Form W-4 for the highest paying job and zero

allowances are claimed on the others. See Pub.

919 for details.

Nonresident alien. If you are a nonresident alien,

see Notice 1392, Supplemental Form W-4

Instructions for Nonresident Aliens, before

completing this form.

Check your withholding. After your Form W-4

takes effect, use Pub. 919 to see how the

amount you are having withheld compares to

your projected total tax for 2011. See Pub. 919,

especially if your earnings exceed $130,000

(Single) or $180,000 (Married).

Personal Allowances Worksheet (Keep for your records.)

A Enter 1 for yourself if no one else can claim you as a dependent . . . . . . . . . . . . . . . . . . A

B Enter 1 if:

{

You are single and have only one job; or

You are married, have only one job, and your spouse does not work; or . . .

Your wages from a second job or your spouses wages (or the total of both) are $1,500 or less.

}

B

C Enter 1 for your spouse. But, you may choose to enter -0- if you are married and have either a working spouse or more

than one job. (Entering -0- may help you avoid having too little tax withheld.) . . . . . . . . . . . . . .

C

D Enter number of dependents (other than your spouse or yourself) you will claim on your tax return . . . . . . . . D

E Enter 1 if you will file as head of household on your tax return (see conditions under Head of household above) . . E

F Enter 1 if you have at least $1,900 of child or dependent care expenses for which you plan to claim a credit . . . F

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

G Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

If your total income will be less than $61,000 ($90,000 if married), enter 2 for each eligible child; then less 1 if you have three or more eligible children.

If your total income will be between $61,000 and $84,000 ($90,000 and $119,000 if married), enter 1 for each eligible

child plus 1 additional if you have six or more eligible children . . . . . . . . . . . . . . . . . .

G

H Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.)

H

For accuracy,

complete all

worksheets

that apply.

{

If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

If you have more than one job or are married and you and your spouse both work and the combined earnings from all jobs exceed

$40,000 ($10,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to avoid having too little tax withheld.

If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Cut here and give Form W-4 to your employer. Keep the top part for your records.

Form W-4

Department of the Treasury

Internal Revenue Service

Employee's Withholding Allowance Certificate

Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

OMB No. 1545-0074

2011

1 Type or print your first name and middle initial. Last name

Home address (number and street or rural route)

City or town, state, and ZIP code

2 Your social security number

3 Single Married Married, but withhold at higher Single rate.

Note. If married, but legally separated, or spouse is a nonresident alien, check the Single box.

4 If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card.

5 Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2) 5

6 Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . . 6

$

7 I claim exemption from withholding for 2011, and I certify that I meet both of the following conditions for exemption.

Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and

This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write Exempt here . . . . . . . . . . . . . . .

7

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employees signature

(This form is not valid unless you sign it.)

Date

8 Employers name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.) 9 Office code (optional) 10 Employer identification number (EIN)

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 10220Q Form W-4 (2011)

Department of Homeland Securify

U.S. Citizenship and Immigration Services

OMB No. 1615-0047; Expires 08/31/12

Form I-9, Employment

Eligibility Ve rifi cafion

Read instructions carefully before completing this form. The insfructions must be available during completion of this form,

ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work-authorized individuals. Employers CAII{NOT

specify which document(s) they will accept from an employee. The refusal to hire an individual because thC documents have a

future expiration date may also constitute illegal discrimination.

City

Section 1. Employee Information and Yerification (fo be completed

Print Name: Last

Address (Street Name and Number)

I am aware that federal law provides for

imprisonment and/or fines for false statements or

use of false documents in connection with the

completion of this form.

Middle Initial Maidqr Name

Apt. # Dale of BifiJr (month/day/yur)

Zip Code Social Secuitv #

I attmt under penalty of perjury, that I am (check one of the following) :

f,

A citizen of the United States

[-l

Anoncitizennational ofthe United States (sre instruetions)

fl

Ahxfirlpmanmtresident(Alien #)

!

ao ,U* authorized to work (Alien # or Admission #)

until

(emi

if amlicrble -

Employee's Signature

Dale (month/day/year)

Preparerand/orTranslatorCertification (Tobecunplaedandsignedfsectionlispreparedbyapersonotherthantheemployee)Iattest,under

penalty of perjury, that I have sssisted in the completion of this

form

and that to the best of my knowledge the information is true aad correct.

Preparr's/Translator's Si gnature kint Name

Address (Street Name and Number, City, State, Zip Code) Date (month/day/year)

Section 2. Employer Review and

yerification

(fo be completed arul signed by employer. Examine one documentJiom List A

exarnine one doament

from

List B and one

from

List C, as listed on the reverse of this

fitm,

and record the title, number, and

expiration date, if any, af the document(s).)

List A List B ANI) List C

Document title:

Issuing authority:

Docummt #:

Exp r attor D ate ( if any

).

Document #:

Exptr aluo n D ate ( if a ny

)

:

CERTIFICATION: I attest under penalty of perjury, that I have examined the document(s) presented by the above-named employee, that

the above-listed document(s) appear to be genuine and to relate to the employee named, that the employee began employment on

(month/&ry/year) and that to the best of my knowledge the employee is authorized to work in the United States, (State

Signature ofEmployer or Au

Business or

tion

A. New Name (if applicable) B. Date of Rehire (month/day/year) ({applicable)

Docummt Title: Drcummt#: Exptt rtion D ate ( if an y

)

:

I atteS, undei penalty of perjury, that to the best ofmy knowledge, this employee is authorized to work in the United States, and ifthe employee presented

document(s), the document(s) I have examined appear to be genuine and to relate to the individual.

OR

rlilt

,r.r':li

/./r'1;,

atz

/,72,

llrjt

:;..,,.

Z'

'1,.;

?1../1

'L,,t?,/

'1./.Jili.

t:1,

'/;1,/t,

emploSrment agencies may omit the date lhe employee began amplolment

)

C. Ifemployee's previous grant ofwork authorization has expired, provide the information below for the document that establishss cunent employment authorization.

Fom I-9 (Rev. 08/07109) Y Page 4

LISTS OF ACCEPTABLE DOCTJMENTS

All documents must be unexpired

LIST A LIST B LIST C

Documents that Establish Both Docuilents that Establish I)ocuments that Establish

Identity and Employment Identity Employment Authorization

Authorization OR ANI)

l. U.S. Passport or U.S. Passport Card Drive/s license or ID card issued by

a State or outlying possession ofthe

United States provided it contains a

photograph or information such as

name, date of birth, gender, heigh!

eye color, and address

1. Social Security Account Number

card other than one that specifies

on the face that the issuance of the

2. Permanent Resident Card or Alien

Regishation Receipt Card (Form

I-ssl)

card does not authorize

employment in the United States

2. Cefiifrcation of Birth Abroad

issued by the Department of State

(Form FS-545) Foreign passport that contains a

temporary I-55 I stamp or temporary

I-551 printed notation on a machine-

readable immigrant visa

ID card issued by federal, state or

local government agencies or

entities, provided it contains a

photograph or information such as

name, date of birth, gender, heighq

eye color, and address

3. Certification of Report of Birth

issued by the Department of State

(Form DS-1350)

4. Employment Authorization Document

that contains a photograph (Form

r-766)

3. School ID card with a photograph

4. Voter's registration card

Original or certified copy of birth

certihcate issued by a State,

@&ty, municipal authority, or

territory of the United States

bearing an official seal

5. In the case of a nonimmigrant alien

authorized to work for a specific

employer incident to status, a foreign

passport with Form I-94 or Form

I-94A bearing the same name as the

passport and containing an

endorsement of the alien's

nonimmigrant status, as long as the

period ofendorsement has not yet

expired and the proposed

employment is not in conflict with

any restrictions or limitations

idenlified on the form

5. U.S. Military card or draft record

6. Military dependenfs ID card

7. U.S. Coast Guard Merchant Mariner

Card

5. Native American tribal document

8. Native American tribal document

6, U.S. Citizr;n ID Card (Form I-197)

9. Drivels license issued by a Canadian

government authority

For persons under age 18 who

are unable to present a

document listed above:

7. Identification Card for Use of

Resident Citizen in the United

States (Form I-179)

Passport from the Federated States of

Mironesia (FSM) or the Republic of

the Marshall Islands (RMI) with

Form I-94 or Form I-94A indicating

nonimmigrant admission under the

Compact of Free Association

Between the United States and the

FSM orRMI

10. School recordorreportcard

8. Employment authorization

document issued by the

Deparbnent of Homeland Security

11. Clinic, doctor, or hospital record

12. Day-care or nursery school record

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274)

Form I-9 (Rev. 08/07/09) Y Page 5

Rev 10.2011

Direct Deposit Agreement

Authorization Agreement

Intercrui ses Shoreside & Port Servi ces in an effort to protect the environment manages a paperless payroll and provides

various options for Direct Deposit of wages earned. All employees are eligible to participate in direct deposit and can deposit

to multiple accounts.

To enroll in direct deposit, please review and fill out the information requested below.

I hereby authorize Intercruises Shoresi de & Port Servi ces to initiate automatic deposits to my account at the

financial institution named below. I also authorize Intercrui ses Shoresi de & Port Services to make withdrawals

from this account in the event that a credit entry is made in error.

I agree not to hold Intercrui ses Shoresi de & Port Servi ces responsible for any delay or loss of funds due to

incorrect or incomplete information supplied by me or by my financial institution or due to an error on the part of my

financial institution in depositing funds to my account.

This agreement will remain in effect until Intercrui ses Shoresi de & Port Servi ces receives a written notice of cancellation

from me or my financial institution, or until I submit a new direct deposit form to the Payroll Department.

Employee Information

Please Print Clearly

First Name: _________________________ Middle Initial: ____ Last Name: _____________________________

Social Security #: __________________________

I wish to: Initiate Deposit Change Information Paycard

Primary Account Information

Name of Financial Institution:

Routing Number:

Percentage: _______________

Amount: _______________

Account Number:

Checking

Savings

Secondary Account Information

Name of Financial Institution:

Routing Number:

Percentage: _______________

Amount: _______________

Account Number:

Checking

Savings

Signature

Employee Signature: Date:

Attaching a voided check or deposit slip will assist in processing but is not necessary

Das könnte Ihnen auch gefallen

- App 1Dokument2 SeitenApp 1api-245306076Noch keine Bewertungen

- Employee EngagementDokument25 SeitenEmployee EngagementPratik Khimani100% (4)

- Application Form: Develop With Richmond FellowshipDokument8 SeitenApplication Form: Develop With Richmond FellowshipAngela.MullinsNoch keine Bewertungen

- Job Application Form Template 2Dokument8 SeitenJob Application Form Template 2marklola12Noch keine Bewertungen

- Aldrees e FormDokument9 SeitenAldrees e FormAtif Hussain KhattiNoch keine Bewertungen

- Sign Up ApplicationDokument5 SeitenSign Up Applicationapi-197845478Noch keine Bewertungen

- Application FormDokument6 SeitenApplication FormNadia MaisaraNoch keine Bewertungen

- New Application FormDokument7 SeitenNew Application FormMohammed NadeemNoch keine Bewertungen

- Singapore Employment Contract SampleDokument5 SeitenSingapore Employment Contract SampleMichelle LouiseNoch keine Bewertungen

- The Boeing 7E7 - Write UpDokument6 SeitenThe Boeing 7E7 - Write UpVern CabreraNoch keine Bewertungen

- Application For EmploymentDokument2 SeitenApplication For EmploymentAnonymous FPMfCo8FGNoch keine Bewertungen

- Application Form Toys "R" Us Is An Equal Opportunities EmployerDokument4 SeitenApplication Form Toys "R" Us Is An Equal Opportunities EmployerMaydelle LorenzoNoch keine Bewertungen

- Reg 2-Primary Care Claim Form-31 Oct 2008Dokument2 SeitenReg 2-Primary Care Claim Form-31 Oct 2008Pradeep KhubchandaniNoch keine Bewertungen

- SEPO Application FormDokument3 SeitenSEPO Application FormMuhammad MuzammilNoch keine Bewertungen

- Candidate Application Form V2 23 June 2015 Neo EltariDokument4 SeitenCandidate Application Form V2 23 June 2015 Neo Eltarianita nahakNoch keine Bewertungen

- AppForm - Layout M. CityDokument10 SeitenAppForm - Layout M. CityRahmaatul HusnaNoch keine Bewertungen

- New Staff Details Original Copy2Dokument3 SeitenNew Staff Details Original Copy2Annie LamNoch keine Bewertungen

- Balady Job ApplicationDokument2 SeitenBalady Job ApplicationBalady BaladyNoch keine Bewertungen

- CCC - Application Form PDFDokument4 SeitenCCC - Application Form PDFLudovico NoccoNoch keine Bewertungen

- 4 Page Support App Form With EO Jun11 1Dokument7 Seiten4 Page Support App Form With EO Jun11 1parginaNoch keine Bewertungen

- Application Form v1Dokument10 SeitenApplication Form v1smashjmNoch keine Bewertungen

- Application FormDokument2 SeitenApplication Formapi-247126655100% (1)

- Teaching Application FormDokument6 SeitenTeaching Application FormEthan YatesNoch keine Bewertungen

- Brigham & Ehrhardt: Financial Management: Theory and Practice 14eDokument46 SeitenBrigham & Ehrhardt: Financial Management: Theory and Practice 14eAmirah AliNoch keine Bewertungen

- Employment Services Division: Personal DetailsDokument4 SeitenEmployment Services Division: Personal DetailsAndy AsanteNoch keine Bewertungen

- Job Application Form Teachers 1Dokument3 SeitenJob Application Form Teachers 1Ruja RanaNoch keine Bewertungen

- NBR Tin Certificate 164138662022Dokument1 SeiteNBR Tin Certificate 164138662022Md. Jasim UddinNoch keine Bewertungen

- Family Planning Application Form August 2017Dokument3 SeitenFamily Planning Application Form August 2017Pradeep MinhasNoch keine Bewertungen

- MTW Standard Application FormDokument8 SeitenMTW Standard Application FormRicas13Noch keine Bewertungen

- Application For Addition of Notation As An Enrolled Nurse or Nurse Practitioner ANMV 04Dokument3 SeitenApplication For Addition of Notation As An Enrolled Nurse or Nurse Practitioner ANMV 04mariusz.stachura8537Noch keine Bewertungen

- MNL - Applicant Information Pack Home Affairs - LE3 Visa Processing Officer Jan 2018Dokument6 SeitenMNL - Applicant Information Pack Home Affairs - LE3 Visa Processing Officer Jan 2018Christine Aev OlasaNoch keine Bewertungen

- Grameen Bank - A Case StudyDokument9 SeitenGrameen Bank - A Case Studyajeyasimha100% (4)

- Mahdlo Application FormDokument4 SeitenMahdlo Application FormRebecca BaronNoch keine Bewertungen

- Project Report On Cash Management of State Bank of SikkimDokument39 SeitenProject Report On Cash Management of State Bank of Sikkimdeivaram50% (10)

- Fcaapp EngwalesDokument7 SeitenFcaapp Engwalesthe_bigapethNoch keine Bewertungen

- Standard Application Format Aa India Jobs Aug 2012Dokument5 SeitenStandard Application Format Aa India Jobs Aug 2012Thangaraj MswNoch keine Bewertungen

- Application Form - Support - Updated 1.5.15Dokument14 SeitenApplication Form - Support - Updated 1.5.15acybnsoNoch keine Bewertungen

- Global Partnership For Competence Development & Cooperation GPCDC 2013-15Dokument7 SeitenGlobal Partnership For Competence Development & Cooperation GPCDC 2013-15azhar_maju2009Noch keine Bewertungen

- Real Estate TaxationDokument88 SeitenReal Estate TaxationMichelleOgatis89% (9)

- Khalid Cement Complex Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormDokument10 SeitenKhalid Cement Complex Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormMahira MalikNoch keine Bewertungen

- Application For Employment: in ConfidenceDokument6 SeitenApplication For Employment: in ConfidenceGlenn Bede A.BenabloNoch keine Bewertungen

- The British Deputy High Commission Is An Equal Opportunity EmployerDokument4 SeitenThe British Deputy High Commission Is An Equal Opportunity Employermalikshafiq_1Noch keine Bewertungen

- Unit - 4: Amalgamation and ReconstructionDokument54 SeitenUnit - 4: Amalgamation and ReconstructionAzad AboobackerNoch keine Bewertungen

- Emmaus UK Application FormDokument8 SeitenEmmaus UK Application FormThatRecruit.comNoch keine Bewertungen

- Application FormDokument4 SeitenApplication Formfor_anca6392Noch keine Bewertungen

- FINANCIAL FORECASTING AND PLANNING SynopsisDokument17 SeitenFINANCIAL FORECASTING AND PLANNING Synopsismudigonda snehaNoch keine Bewertungen

- Application For Boundary Oak School Employment: ConfidentialDokument6 SeitenApplication For Boundary Oak School Employment: ConfidentiallivrosNoch keine Bewertungen

- CAJEGAS CHLOE WorksheetDokument8 SeitenCAJEGAS CHLOE WorksheetChloe Cataluna100% (1)

- Important Information On Travel To Australia : Student (Subclass 500)Dokument5 SeitenImportant Information On Travel To Australia : Student (Subclass 500)Domantė StrigockytėNoch keine Bewertungen

- Used Cars For Sale Offer FormDokument3 SeitenUsed Cars For Sale Offer FormRaymond GabrielNoch keine Bewertungen

- Ireland QuestionnaireDokument4 SeitenIreland QuestionnaireSujay BiswasNoch keine Bewertungen

- Indian Ordnance FactoryDokument4 SeitenIndian Ordnance FactoryNilesh SinghNoch keine Bewertungen

- CNRL Job Application Form..Dokument4 SeitenCNRL Job Application Form..Shakeel AhmedNoch keine Bewertungen

- 38 Form 6 Starboard ApplicationDokument3 Seiten38 Form 6 Starboard ApplicationFortyniners49ersNoch keine Bewertungen

- NSW Photo Card ApplicationDokument3 SeitenNSW Photo Card Applicationkai.the.loner208Noch keine Bewertungen

- Auntie Anne S ApplicationDokument2 SeitenAuntie Anne S ApplicationKaitlynn GenevieveNoch keine Bewertungen

- Employee Self Verification FormDokument6 SeitenEmployee Self Verification Formdharsan321Noch keine Bewertungen

- Crown Hotel Job Application & Interview Form PDFDokument2 SeitenCrown Hotel Job Application & Interview Form PDFVishwanathNoch keine Bewertungen

- Tcs Employment Application FormDokument6 SeitenTcs Employment Application Formmantusahu472Noch keine Bewertungen

- Ward Security Application Form Nov 2011Dokument14 SeitenWard Security Application Form Nov 2011Wajid Iqbal100% (1)

- Crs2005856003 - Checklist Cover LetterDokument11 SeitenCrs2005856003 - Checklist Cover LetterChristian Montoya CanoNoch keine Bewertungen

- Job Application LetterDokument1 SeiteJob Application LetterAhmad KhoerurizalNoch keine Bewertungen

- Pacific MMI Claim Form PDFDokument3 SeitenPacific MMI Claim Form PDFKaitaMahn100% (1)

- ICA - Update Change of Residential Address in IC (For Singapore Citizens - Permanent Residents Residing Overseas)Dokument2 SeitenICA - Update Change of Residential Address in IC (For Singapore Citizens - Permanent Residents Residing Overseas)Michael JordanNoch keine Bewertungen

- Application For Employment (Executive Appointment)Dokument5 SeitenApplication For Employment (Executive Appointment)jammushaNoch keine Bewertungen

- SeaVenture ApplicationDokument4 SeitenSeaVenture ApplicationTomas PirirNoch keine Bewertungen

- Goodwill Employment ApplicationDokument4 SeitenGoodwill Employment ApplicationAnonymous YjoaBucK4Noch keine Bewertungen

- Background Check Application Form2Dokument7 SeitenBackground Check Application Form2Vivek BelaNoch keine Bewertungen

- 73-Unit 11 AssignmentDokument3 Seiten73-Unit 11 AssignmentFortyniners49ersNoch keine Bewertungen

- Portfolio: The Port of Los AngelesDokument6 SeitenPortfolio: The Port of Los AngelesFortyniners49ersNoch keine Bewertungen

- 71-YIR 2011 FinalDokument10 Seiten71-YIR 2011 FinalFortyniners49ersNoch keine Bewertungen

- 66-Sample Resume - Youth CounselorDokument2 Seiten66-Sample Resume - Youth CounselorFortyniners49ersNoch keine Bewertungen

- Job Offers: Complaints and Inquiries About Deceptive Job Ads Include: Postal JobsDokument3 SeitenJob Offers: Complaints and Inquiries About Deceptive Job Ads Include: Postal JobsFortyniners49ersNoch keine Bewertungen

- 38 Form 6 Starboard ApplicationDokument3 Seiten38 Form 6 Starboard ApplicationFortyniners49ersNoch keine Bewertungen

- Leisure Industry Graduate Pack WWW - Leisurejobs.co - UkDokument21 SeitenLeisure Industry Graduate Pack WWW - Leisurejobs.co - UkFortyniners49ersNoch keine Bewertungen

- Cruising For A Bruising: Why Washington Needs Laws To Protect Its Waters From Cruise Ship DumpingDokument28 SeitenCruising For A Bruising: Why Washington Needs Laws To Protect Its Waters From Cruise Ship DumpingFortyniners49ersNoch keine Bewertungen

- Cruiseport Gloucester,: Employment ApplicationDokument2 SeitenCruiseport Gloucester,: Employment ApplicationFortyniners49ersNoch keine Bewertungen

- The Cruise Industry: Contribution of Cruise Tourism To The Economies of Europe 2012 EditionDokument32 SeitenThe Cruise Industry: Contribution of Cruise Tourism To The Economies of Europe 2012 EditionFortyniners49ersNoch keine Bewertungen

- 35-EconStudy State Facts 2011Dokument18 Seiten35-EconStudy State Facts 2011Fortyniners49ersNoch keine Bewertungen

- 30-Crusie Ship in New London Eia 3.19.04Dokument24 Seiten30-Crusie Ship in New London Eia 3.19.04Fortyniners49ersNoch keine Bewertungen

- Cruising For A Bruising: Why Washington Needs Laws To Protect Its Waters From Cruise Ship DumpingDokument28 SeitenCruising For A Bruising: Why Washington Needs Laws To Protect Its Waters From Cruise Ship DumpingFortyniners49ersNoch keine Bewertungen

- 25 Cruise Scotland News BulletinDokument2 Seiten25 Cruise Scotland News BulletinFortyniners49ersNoch keine Bewertungen

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDokument4 SeitenMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakNoch keine Bewertungen

- Question 591541Dokument7 SeitenQuestion 591541sehajleen randhawaNoch keine Bewertungen

- Disposable SyringeDokument13 SeitenDisposable SyringemanojassamNoch keine Bewertungen

- SBI PO Application FormDokument4 SeitenSBI PO Application FormPranav SahilNoch keine Bewertungen

- General Comments: The Chartered Institute of Management AccountantsDokument25 SeitenGeneral Comments: The Chartered Institute of Management AccountantsSritijhaaNoch keine Bewertungen

- Midterm Test No2 - JIB60 1Dokument1 SeiteMidterm Test No2 - JIB60 1k60.2112520041Noch keine Bewertungen

- Search Results For "Certification" - Wikimedia Foundation Governance Wiki PDFDokument2 SeitenSearch Results For "Certification" - Wikimedia Foundation Governance Wiki PDFAdriza LagramadaNoch keine Bewertungen

- Macro Policy in A Global SettingDokument23 SeitenMacro Policy in A Global SettingVidya RamadhanNoch keine Bewertungen

- Advanced Accounting Full Notes 11022021 RLDokument335 SeitenAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- United States Court of Appeals, Fourth CircuitDokument4 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Verana Exhibit and SchedsDokument45 SeitenVerana Exhibit and SchedsPrincess Dianne MaitelNoch keine Bewertungen

- KSA Amiantit Annual ReportDokument56 SeitenKSA Amiantit Annual ReportShyam_Nair_9667Noch keine Bewertungen

- Final - Adv Accounting2 - July 19 - 2021Dokument3 SeitenFinal - Adv Accounting2 - July 19 - 2021Eleonora VinessaNoch keine Bewertungen

- Proof of Cash or Four Column Reconciliation: Kuya Joseph's BlogDokument9 SeitenProof of Cash or Four Column Reconciliation: Kuya Joseph's BlogYassi CurtisNoch keine Bewertungen

- Henry vs. Structured Investments Co.Dokument9 SeitenHenry vs. Structured Investments Co.pbsneedtoknowNoch keine Bewertungen

- Kepada Yth. /: Yudi Dwi SaputraDokument1 SeiteKepada Yth. /: Yudi Dwi SaputraRido PuteraNoch keine Bewertungen

- 4 - Notes Receivable Problems With Solutions: ListaDokument21 Seiten4 - Notes Receivable Problems With Solutions: Listabusiness docNoch keine Bewertungen

- Tutorial Topic 4Dokument4 SeitenTutorial Topic 4Aiyoo JessyNoch keine Bewertungen

- BusOrg - Chapter 2Dokument3 SeitenBusOrg - Chapter 2Zyra C.Noch keine Bewertungen

- RRJ EnterprisesDokument1 SeiteRRJ EnterprisesOFC accountNoch keine Bewertungen

- JIO 102 JUNE BILL - CompressedDokument1 SeiteJIO 102 JUNE BILL - CompressedRANDHIR SINGHNoch keine Bewertungen

- Senate Hearing, 109TH Congress - Unobligated Balances: Freeing Up Funds, Setting Priorities and Untying Agency HandsDokument63 SeitenSenate Hearing, 109TH Congress - Unobligated Balances: Freeing Up Funds, Setting Priorities and Untying Agency HandsScribd Government DocsNoch keine Bewertungen