Beruflich Dokumente

Kultur Dokumente

Final Cmrs

Hochgeladen von

P M PeterCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final Cmrs

Hochgeladen von

P M PeterCopyright:

Verfügbare Formate

Introduction

The term unorganized labor has been defined as those workers who have not been able to organize

themselves to pursuit of their common interests due to certain constraints like casual nature of

employment, ignorance and illiteracy, small and scattered size of establishments, etc.

Ministry of Labor has categorized the unorganized labor force under four groups in terms of

occupation, nature of employment, especially distressed categories and service categories. In terms

of occupation, it included small and marginal farmers, landless agricultural laborers, share croppers,

fishermen and those engaged in animal husbandry, beedi rolling, labeling and packing, building and

construction workers, leather workers, weavers, artisans, salt workers, workers in brick kilns and

stone quarries, workers in saw mills, oil mills etc.,. In terms of nature of employment, they are

attached agricultural laborers, bonded laborers, migrant workers, contract and casual laborers. Toddy

tappers, scavengers, carriers of head loads, drivers of animal driven vehicles, loaders and un loaders,

belong to the especially distressed category while midwives, domestic workers, fishermen and

women, barbers, vegetable and fruit vendors, newspaper vendors etc. come under the service

category. In addition to the above categories, there exists a large section of unorganized labor force

such as cobblers, hamals, handicraft artisans, handloom weavers, lady tailors, physically

handicapped self-employed persons, rickshaw pullers/ auto drivers, sericulture workers, carpenters,

leather and tannery workers, power loom workers and urban poor.

Social Security for the Unorganized Workers: The Needs

The foregoing discussion about the growing unorganized labor force, their characteristics and the

social security initiatives of the Centre, State and NGOs indicated that the needs are much more

than the supports provided and the efforts must be targeted and vast enough to cover the growing

unorganized workers. In this context, it is worthwhile to list out the major security needs of the

unorganized workers. They are:

Food Security:

Food security is considered as an important component of social security. The rural workers and

weaker sections of the community are badly affected during times of drought, flood and famine, and

due to similar natural calamities. The DPAP largely confines itself in the provision of employment

through rural works program. What is required is to provide security for food in times of difficulty

and during normal times. The Public Distribution System (PDS) implemented in Indian States stand

as a model attempt in this direction. It is through the PDS that the government endeavors to protect

the real purchasing power of the poorer sections by providing them an uninterrupted supply of food

grains at prices far below market prices. It is to be noted that the PDS was introduced only to the

urban areas initially, but since 1970s rural areas are also covered

Nutritional Security:

It is not just food, but the nutrition is very important. The weaker sections of the community and

the unorganized workers are not conscious about the nutrient intake. Particularly, the children and

women, pregnant women and aged do not receive adequate nutrient requirements. Lack of nutrient

lead to poor growth, poor health and sickness, poor performance and shorter life. There are certain

initiatives by the states, local bodies and NGOs to create awareness on health and nutrition and to

ensure adequate nutrient intake for the targeted groups, particularly to children and women.

Health Security:

Health security can be described as ensuring low exposure to risk and providing access to health care

services along with the ability to pay for medical care and medicine. Such health security should be

made available to all citizens. Several studies that examined rural health conditions and health care

needs highlight that the inadequate and poor rural health infrastructure, growing health care needs

and health care expenses.

Establishing hospitals with required infrastructure in all the villages is a question of feasibility,

viability and availability of inputs and resources. However, it is a matter of concern to consider the

needs of the 70 per cent of the people living in villages. The poor do not treat for common illness

and sometimes to major diseases that are unidentified by them, causing higher level of untreated

morbidity. Similarly, the cost and burden of treatments are ever increasing and leading to difficulty

for the poor and weaker sections of the community.

Housing Security:

Housing is one of the basic needs of every individual and family. The housing needs of the

unorganized workers and the poor are ever increasing in the context of the decay of joint family

system, migration and urbanization. In urban areas, though housing is a major issue, the organized

workers are supported by providing House Rent Allowances (HRA) or by providing houses through

Housing Boards and by providing accommodation in the Quarters. There are several financing

companies and commercial banks offering loans to organized workers to construct or purchase

houses. These facilities are normally not available and could not be enjoyed by the unorganized

workers. Moreover, the housing conditions of the rural poor are really poor and there is scope for

reconditioning, modification and reconstruction, in many. The rural housing program implemented

in Tamil Nadu namely Samathuvapuram and construction of houses under Slum Clearance Board

stand as examples for steps towards housing security.

Employment Security:

Unorganized workers are greatly affected by the seasonal nature of the employment opportunities.

The problem of under-employment and unemployment persist to a large extent among unorganized

sectors. There are several schemes such as Swarnajayanti Gram Swaeozgar Yojna (SGSY), Pradhan

Manntri Gran Sadak Yojana(PMGSY), Sampoorna Gramin Rozgar Yojana (SGRY), National Food

For Work Program(NFFWP), Indra Awass Yojna (JAY), Integrated Wastelands (IWDP), Drought

Prone Areas Program (DPAP) and Desert Development Program (DDP) initiated to generate

employment opportunities in rural India. Further, the Government has recently enacted the National

Rural Employment Guarantee Act to provide 100 days guaranteed employment to rural households.

Though these initiatives have contributed in reducing the rural unemployment problem, the problem

of employment insecurity needs to be addressed in a wider context and solved at.

Income Security:

Though income and number of days of employment are positively related, this relationship holds

good mainly for organized workers. As for as unorganized workers are concerned, their income is

highly influenced by nature of job, nature and type of products produced quantum of value addition,

market value, competition, etc. To protect from the crop loss, Crop Insurance Scheme is available.

But for various other self-employed enterprises and other jobs, there is no security available to

realize income for the efforts.

Life and Accident Security:

The death of a worker in a family is a great loss to the entire family and it adds burden too. The

death of a worker raises the question of survival of the family left behind due to the permanent loss

of income to the family. Similarly, an accident is a major problem for an informal worker since it

leads to loss of income and cost of treatment. If the accident leads to permanent or partial disability,

the financial loss will be severe and unimaginable. By covering the unorganized workers under the

Insurance schemes of individual, family and group could alone provide security for life and accident.

Old Age Security:

The workers of the unorganized sector face the problem of insecurity when they reach to the life

stage of aged when they could not work for themselves. The Question of dependency is a major

threat to the old age unorganized workers in the context of disappearing joint family system.

Old age pension scheme: Rs 200 per month

Insurance benefit: Health insurance benefits covering at least working member and children of

washer man family

BPL scheme- under BPL scheme poor can get ration at subsidized rate. Washer

man contacted enrolled under BPL scheme.

Income security since washer men totally dependent on irregular source of income. So

government should ensure their income security. Quantum of value addition according to the

effort put on the work is very less so government should give some other additional benefits

like education to their children in good schools at subsidized fee, ensure availability of coal

at subsidized rate, easy loan for expansion of their small work, making available other non

conventional sources of energy at cheaper rate.

They should be given dearness allowances which should be equal to their counterparts in

organized sectors because people in unorganized sectors face same problems due to inflation

Minimum wages - Minimum wage is the wage that is able to provide not only for bare

physical needs but also for preservation of efficiency of worker plus some measure of

education, health and other things. For washer men who come under the category of

unskilled it is Rs 174.

Fair Wage: - Fair wages is an adjustable step that moves up according to the capacity of the

industry to pay, and the prevailing rates of wages in the area of industry. We need to take into

consideration what others are getting in the same category in organized sectors. We can

compare wages provided to workers or laborers with same level of skill in organized sector

Government to start provident fund scheme even in unorganized sector people like washer

men etc they can be given these benefit on either on contributory basis or non-contributory

basis.

Maternity benefit: since in organized sector female workers are given maternity benefit due

their inability to work during pregnancy period or few weeks after child birth. On similar

pattern in unorganized sector these benefit should be given to protect labors of this sector

from unemployment effect.

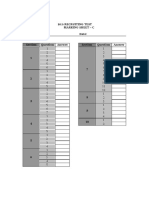

Washer Man 1

Family members-8

Daily income- 200-250

Ironing Rs 3/cloth

Ironing and washing- Rs 10

Coal consumption in ironing- Rs 100-200/per day

Vegetable consumed Rs 80-100/day

Coal cost Rs 100/day

Other cost Rs50/day

Total expenditure Rs250

Washer man 2

Family members-8

Daily income- 200-250

Ironing Rs 3/cloth

Ironing and washing- Rs 10

Coal consumption in ironing- Rs 100-200/per day

Vegetable consumed Rs 80-100/day

Other cost Rs50/day

Total expenditure Rs250

Washer man 3

Family members-4

Daily income- 300-400

Ironing Rs 5/cloth

Ironing and washing- Rs 10

Coal consumption in ironing- Rs 150-200/per day

Vegetable consumed Rs 80-100/day

Other cost Rs50/day

Total expenditure Rs 350

Washer man 4

Family members-4

Daily income- 300-350

Ironing Rs 3/cloth

Ironing and washing- Rs 5

Coal consumption in ironing- Rs 100-200/per day

Vegetable consumed Rs 80-100/day

Other cost Rs 60/day

Total expenditure Rs 300

Washer man 5

Family members-6

Daily income- 300-400

Ironing Rs 5/cloth

Ironing and washing- Rs 12

Coal consumption in ironing- Rs 100-150/per day

Vegetable consumed Rs 100/day

Other cost Rs 80/day

Total expenditure Rs 350-400

Washer man 6

Family members-5

Daily income- Rs 400-450

Ironing Rs 5/cloth

Ironing and washing- Rs 10

Coal consumption in ironing- Rs 200/per day

Vegetable consumed Rs 80-100/day

Other cost Rs 50/day

Total expenditure Rs 400

Minimum wages in Uttar Pradesh for unskilled worker employed in laundry or other

washing establishments- Rs 174.14

Wage Calculation:

Consolidated Wage Structure

Fixed Wage/ Day: Rs 100/ Day

Variable Wage/ Day: Re 1/cloth for Ironing and Rs 3/cloth for Ironing & Washing

Gross Wage = Fixed Wage + Variable Wage

Deduction:

5% of Gross Wage for Health Assistance

5% of Gross Wage for Welfare Fund

Weekly Leave: 1 Day Leave/Week (rotational excluding Saturday & Sunday as per preference)

Benefits to be given:

Monetary Benefits:

Maternity benefit (Expenses incurred during the period of Hospitalization in a Govt. hospital,

up to 2 children) only for Female Employee.

Health Assistance fund (5% of gross daily wage)

BPL Ration Card Enrollment (one time enrollment expense to be beared by the Employer )

Festival Bonus ( for any 2 festivals amounting to Rs 500 per festival )

Welfare fund (5% of gross daily wage) payable at time of retirement/leaving the company.

Non Monetary Benefits:

Education Assistance (Cost of Stationary)

Old age Assistance (assist him/her in enrolling for Govt. pension plan)

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- India Goldman Sachs ReportDokument22 SeitenIndia Goldman Sachs Reportvikingcruises0% (1)

- Work Participation of Tribal Women in India: A Development PerspectiveDokument4 SeitenWork Participation of Tribal Women in India: A Development PerspectiveInternational Organization of Scientific Research (IOSR)Noch keine Bewertungen

- Assessment Task 3 PDFDokument7 SeitenAssessment Task 3 PDFpurva0220% (5)

- TspProfiles Census Hlaingbwe 2014 ENGDokument59 SeitenTspProfiles Census Hlaingbwe 2014 ENGKhin Wathan OoNoch keine Bewertungen

- The Magna Carta of WomenDokument15 SeitenThe Magna Carta of WomenXtine CampuPotNoch keine Bewertungen

- Work-Sharing and Job-SharingDokument4 SeitenWork-Sharing and Job-SharingAxelNoch keine Bewertungen

- FICCI Agri Report 09-03-2015Dokument60 SeitenFICCI Agri Report 09-03-2015adishNoch keine Bewertungen

- Benefits of Economic EmpowermentDokument4 SeitenBenefits of Economic EmpowermentSolidimpression GraphicsNoch keine Bewertungen

- Col Ella 2012Dokument130 SeitenCol Ella 2012Gina Carmen FășieNoch keine Bewertungen

- The India Employment ReportDokument116 SeitenThe India Employment ReportAyush PandeyNoch keine Bewertungen

- Class Structure of PakistanDokument34 SeitenClass Structure of PakistanMohammadAhmadNoch keine Bewertungen

- Designdenmark: The Danish GovernmentDokument20 SeitenDesigndenmark: The Danish Governmentandra_gavNoch keine Bewertungen

- Minimum Wages and Informal Labour in IndiaDokument29 SeitenMinimum Wages and Informal Labour in IndiaAiswarya MishraNoch keine Bewertungen

- Republic Act 9710 - BookletDokument131 SeitenRepublic Act 9710 - BookletpcwlibraryNoch keine Bewertungen

- Occupational Health and Safety PhilippinesDokument6 SeitenOccupational Health and Safety PhilippinesIan CutinNoch keine Bewertungen

- Vol 1 CLUP (2013-2022)Dokument188 SeitenVol 1 CLUP (2013-2022)Kristine PiaNoch keine Bewertungen

- Work Life Balance and Women ProfessionalsDokument8 SeitenWork Life Balance and Women Professionalspurple girlNoch keine Bewertungen

- Dạng Câu Mẫu Nâng Cao WT1Dokument38 SeitenDạng Câu Mẫu Nâng Cao WT1Jadon Hoang SanchoNoch keine Bewertungen

- Beechey - Some Notes On Female Wage Labour in Capitalist ProductionDokument22 SeitenBeechey - Some Notes On Female Wage Labour in Capitalist Productionmaurilio1985Noch keine Bewertungen

- Employment Law in Pakistan.Dokument13 SeitenEmployment Law in Pakistan.aes_dhaNoch keine Bewertungen

- Unorganised SectorDokument13 SeitenUnorganised Sector1994sameerNoch keine Bewertungen

- Between Helping Hand and Reality (MOM's TJS) by Yi enDokument23 SeitenBetween Helping Hand and Reality (MOM's TJS) by Yi encyeianNoch keine Bewertungen

- CA1 Social Developmental IssueDokument28 SeitenCA1 Social Developmental IssueMenduNoch keine Bewertungen

- Eur 21573 enDokument45 SeitenEur 21573 enbxlmichael8837Noch keine Bewertungen

- Gender Equality Is A MythDokument15 SeitenGender Equality Is A MythharoonNoch keine Bewertungen

- BCG Practice TestDokument26 SeitenBCG Practice TestDan CreţuNoch keine Bewertungen

- Sample Analysis PaperDokument30 SeitenSample Analysis PaperRichard BorjaNoch keine Bewertungen

- Bhattacharya 2014Dokument22 SeitenBhattacharya 2014Nitin VarmaNoch keine Bewertungen

- 2018 Gambia Labour Force SurveyDokument129 Seiten2018 Gambia Labour Force SurveyAbby HesterbergNoch keine Bewertungen

- 3-WEF FOJ Executive Summary JobsDokument12 Seiten3-WEF FOJ Executive Summary JobsBasura00Noch keine Bewertungen