Beruflich Dokumente

Kultur Dokumente

Ge Shipping Mar 14 Presentation

Hochgeladen von

diffsoft0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten34 SeitenGe Shipping Mar 14 Presentation

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenGe Shipping Mar 14 Presentation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten34 SeitenGe Shipping Mar 14 Presentation

Hochgeladen von

diffsoftGe Shipping Mar 14 Presentation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 34

11

The Great Eastern Shipping Co. Ltd.

Business & Financial Review

March 2014

22

Forward Looking Statements

Except for historical information, the statements made in this presentation

constitute forward looking statements. These include statements regarding the

intent, belief or current expectations of GE Shipping and its management

regarding the Companys operations, strategic directions, prospects and future

results which in turn involve certain risks and uncertainties.

Certain factors may cause actual results to differ materially from those contained

in the forward looking statements; including changes in freight rates; global

economic and business conditions; effects of competition and technological

developments; changes in laws and regulations; difficulties in achieving cost

savings; currency, fuel price and interest rate fluctuations etc.

The Company assumes no responsibility with regard to publicly amending,

modifying or revising the statements based on any subsequent developments,

information or events that may occur.

33

Corporate Profile

Through subsidiary

Greatship (India) Limited

Shipping Business

Offshore Business

Dry bulk

Crude Tankers Product Tankers

- Logistics

The Great Eastern Shipping Co. Ltd.

Incorporated in 1948

Wet bulk

- Drilling

44

Company at a glance

Indias largest private sector Shipping Company

Diverse asset base with global operations

Completed 65 years of operations

29 years of uninterrupted dividend track record

Shareholding Pattern as on December 31, 2013

Promoters

30%

Public

23%

FIIs

25%

Govt/FI

16%

Bodies

Corporate

6%

55

Shipping business-owned fleet

30 ships aggregating 2.42 Mn dwt, avg.age 10.0 years

22 Tankers avg.age 10.52 years

- 8 Crude carriers (4 Suezmax, 4 Aframax) avg.age 11.2 years

- 13 Product tankers (4 LR1, 8 MR, 1 GP) avg.age 8.5 years

- 1 LPG Carrier (1 VLGC) avg. age 24.0 years

8 Dry bulk carriers avg.age 8.5 years

- 1 Capesize - avg.age 18.0 years

- 3 Kamsarmax - avg.age 3.0 years

- 4 Supramax- avg.age 7.3 years

Shipping business- CAPEX plan

6

Newbuilding:

- 1 Medium Range (MR) Product Tanker with STX Group - expected delivery Q4FY16

- 2 Kamsarmax Dry Bulk Carriers with Tsuneishi Shipbuilding - expected delivery H1FY16

- 3 Kamsarmax Dry Bulk Carriers with Jiangsu New Yangzi Shipbuilding Co. Ltd, China -

expected delivery Q2 & Q3 CY2016.

Secondhand

- 1 Very Large Gas Carrier (1994 built)- expected delivery H1FY15

Total committed CAPEX: ~ USD 205 mn

Asset Price Movement (5 yr old)- Tankers

7

Timeline- Jan 2001 till Jan 2014

Amt in US$ mn

Source: Clarkson

0

20

40

60

80

100

120

140

160

180

VLCC Suezmax MR

Asset Price Movement (5 yr old) Dry Bulk

8

Timeline- Jan 2001 till Jan 2014

Amt in US$ mn

Source: Clarkson

-

20

40

60

80

100

120

140

160

Capesize Panamax Supramax

Asset Price Movement

9

(Amt in $mn) High Low Current

Tankers

VLCC 165

(2008)

49

(1994)

68

Suezmax 105

(2008)

32

(1993)

47

MR 46

(2007)

20

(1999)

29

Dry Bulk

Capesize 155

(2008)

25

(1999)

46

Panamax 92

(2007)

14

(1999)

27

Supramax 75

(2007)

13

(1998)

26

Source: Clarkson

20 year High /Low: (5 year old assets)

BDTI & BCTI Movement (Jan 2001 to Feb 2014)

10

- Sluggish demand & steady fleet growth keeping the TCYs low

- Seasonal uptick in BDTI led by Winter demand and Chinese SPR program

Source: Baltic Exchange

0

500

1000

1500

2000

2500

3000

3500

BDTI BCTI

11

Global Oil Demand Scenario

Source: Clarkson/IEA

Global Oil demand growth Region wise demand growth

Muted growth from developed economies.

Non OECD countries making up for the lost demand

2.3%

3.6%

1.6%

1.3%

1.6%

-0.6%

-1.2%

2.9%

1.0%

1.1%

1.0%

1.2%

-2%

-1%

0%

1%

2%

3%

4%

03 04 05 06 07 08 09 10 11 12 13 14

mn.bpd 2011 2012

2013

(E)

2014

(E)

% chg

(CY14 over

CY13)

N.America 24.1 23.8 23.8 23.8 -

OECD Europe 14.3 13.8 13.5 13.4 (0.7)%

OECD Pacific

(Japan & Korea) 8.1 8.5 8.4 8.3 (1.2)%

Asia

(Non - OECD) 20.3 21 21.6 22.4 3.7%

Other

Non OECD 22.1 22.7 23.5 24 2.1%

Total 88.9 89.9 90.8 91.9 1.2%

Oil Trade Changing patterns...

12

Resulting in long haul trade routes

Oil supply dynamics changing

US Shale revolution

Iran Uncertainty on Sanctions

North Sea Decreasing Supply

Venezuela Diversifying Customer base

West Africa More takers

Angola , Algeria production inching up

Nigeria increasingly unstable

of Refined Products

Oil demand sourcing matrix changing

China & India in forefront

Latin America Increase in imports

of Refined Products

Other Market Developments

Increasing demand from India & China

Political Risk - MENA, Venezuela

13

Products TradeContinues to grow steadily

Global refinery crude distillation capacity set to rise by 9.5 mb/d from 2013 to 2018, Asia accounting

for about 60% and M.E about 22%.

Total world refining capacity will reach 106.7 mb/d by the end of 2018, of which 60% will be in non-

OECD countries.

US refining sector to benefit, due to increasing exports of distillates to Latin America and Europe.

Products trade Evolving Trade Patterns

14

BDI Movement (Jan 2001 to Feb 2014)

15

0

2000

4000

6000

8000

10000

12000

14000

Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14

BDI hovering at low levels on back of relentless fleet growth

despite steady improvement in the cargo movement

Source: Baltic Exchange

2008 market

crash, BDI

dropped by 94%

China announces

$586 bn stimulus

Cargo growth

but record NB

deliveries

16

Seaborne Bulk Trade growing steadily

Source: Clarkson

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Iron Ore Coal Grains Minor Bulk

Contribution to seaborne trade growth by commodity

Global dry bulk seaborne trade

reached 4.3 bn tons in 2013

Seaborne trade to grow at CAGR 5%

between 2012 & 2014

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

(E)

Minor Bulk Grains Coal Iron Ore

Mn.tons

Dry Bulk Trade Evolving Trade Patterns

17

China imports to continue

-Iron ore & Coal imports running at a

steady pace

- Coastal trade to firm up due to inland

transport restrictions

India catching up

-To be leading coal importer in the

world

- Developing ports to specifically suit

the trade

- UMPPs to create greater coal demand

once commissioned

- Apart from Indonesia & S.Africa, China going far away to Colombia to source coal

- Larger parcel size moved from Brazil to China (Chinamaxes)

Long routes & bigger parcels

Chinas dependency on imported iron ore

18

CHINA: Iron ore import dependency has increased from

37% in 2001 to 70% in 2012 and growing.

Main Import Drivers

Domestic Iron ore (Fe) content < 25% and declining.

Expensive domestic Cost of prodn. due to:

- Labor & energy cost Inflation has been 15% YoY

- Deep Underground iron ore mines: High strip ratio

- Energy & water intensive beneficiation process.

- Steel plants located in coastal areas; high transport cost.

Smaller firms will face closure, disproportionate import

competition effect & tax regime in the wake of low prices.

World Fleet Growth

19

(mn dwt) 2002 2007 2013 % change

(2013 over 2002)

Dry 295 393 721 144%

Crude 222 280 364 63%

Product 74 106 138 86%

Fleet growth 2002-2013

Source: Clarkson

0

100

200

300

400

500

600

700

800

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Dry Bulk Crude Product

Mn.dwt

20 20

Fleet continues to grow

World Fleet

addition*

Fleet

(as on 1

st

Feb14)

CY2014 CY2015 CY2016+

(in mn dwt)

Crude tankers 364 5% 3% 4%

Product tankers 139 6% 4% 4%

Dry bulk carriers 728 9% 6% 4%

*includes only new building from yards

Source: Clarkson

but high slippages may happen

21 21

Scrapping too little to cheer

Source: Clarkson

Fleet as on

1

st

Feb14 Scrapping CY2010 CY2011 CY2012 CY2013

(in mn dwt)

364 Crude 2% 2% 3% 2.5%

139 Product 4% 2% 2% 2%

728 Bulk 1% 4% 5% 3%

* As of 1

st

Feb14

Require acceleration in

scrapping to minimize the

demand supply mismatch

Scrapping as % of world fleet (year wise)

Global Shipbuilding Shrinkage in Capacity

22

Capacity to contract due to combination of:

yard closures

return to pre-boom business models such as ship repairs

use of shipbuilding berths and workforces for non-shipbuilding activity

reduction in berth productivity

Global Shipbuilding Shrinkage in Capacity

23

Yard Output (mn.gt)

Yard output to decline from a peak of 49 mn gt in 2010 to 32 mn gt in 2013

. A decline of 35%

0

10

20

30

40

50

60

2002 2006 2008 2010 2011 2012 2013

2013 (e) yard capacity still higher than the pre boom capacity of 2006

Source: Industry/ research reports

Greatship (India) Limited

(a 100% subsidiary)

24

Business & Financial Review

March 2014

25 25

Current Owned Fleet

3 Jack Up Rigs (350ft)

4 Platform Supply Vessels (PSV)

9 Anchor Handling Tug cum Supply Vessels (AHTSV)

2 Multipurpose Platform Supply and Support Vessels (MPSSV)

6 Platform / ROV Support Vessels (ROVSV)

Offshore business- Fleet Profile

The Greatship Group

On Order: 1 Jackup Rig (350 ft) expected delivery in CY2015

26

Greatships Modern & Technologically Advanced Fleet

- Higher utilization rates

- Minimum down time

- Higher utilization rates

- Minimum down time

Revenue

Efficiencies

Revenue

Efficiencies

- Lower Operating costs

- Reduced maintenance capex

& opex

- Lower Operating costs

- Reduced maintenance capex

& opex

Cost

Efficiencies

Cost

Efficiencies

Young Fleet Young Fleet

Young fleet with an average age of approx. 4 years

by FY 2013

Demand shifting to modern vessels, especially as

safety becomes a major concern for oil companies

Technologically Advanced Technologically Advanced

Specialized/technologically advanced vessels

equipped with DP I/DP II (Dynamic Positioning)

and FiFi I (Fire Fighting) technologies

Equipped to operate in challenging environments

Efficient and versatile vessels

27

Offshore Service Value Chain

Exploration Exploration Development Development Production Production

Vessels Vessels

Description Description

Length of

Typical Cycle

Length of

Typical Cycle

- 3 to 5 years - 3 to 5 years - 2 to 4 years - 2 to 4 years - 5 to 55 years - 5 to 55 years

- Collection of survey data

- Analysis & interpretation

- Identification of oil & gas

reserves

- Collection of survey data

- Analysis & interpretation

- Identification of oil & gas

reserves

- Construction & installation of

production platforms,

pipelines & equipment

- Preparation for production

- Construction & installation of

production platforms,

pipelines & equipment

- Preparation for production

- Management of oil & gas

production

- Operations & Maintenance

- Retrofit work

- Management of oil & gas

production

- Operations & Maintenance

- Retrofit work

-AHTV, AHTSV, MPSSV, Tugs

- PSV/ Supply, Crewboats

- ROV Support Vessels

- Seismic survey & support

hydrographic survey (for

pipeline routes)

- Chase boats

-AHTV, AHTSV, MPSSV, Tugs

- PSV/ Supply, Crewboats

- ROV Support Vessels

- Seismic survey & support

hydrographic survey (for

pipeline routes)

- Chase boats

- AHTV, AHTSV, MPSSV, Tugs

- PSV/ Supply, Crewboats

- Derrick/ Crane Vessels

- Cable & pipe-lay vessels

- Heavy Lift Transport

- Offshore Dredgers

- Accommodation units

- AHTV, AHTSV, MPSSV, Tugs

- PSV/ Supply, Crewboats

- Derrick/ Crane Vessels

- Cable & pipe-lay vessels

- Heavy Lift Transport

- Offshore Dredgers

- Accommodation units

- AHTSV,

- PSV/ Supply

- MPSSV/ Production Support

Vessels

- Emergency Rescue &

Response Vessels

- Crewboats

- Accommodation units

- AHTSV,

- PSV/ Supply

- MPSSV/ Production Support

Vessels

- Emergency Rescue &

Response Vessels

- Crewboats

- Accommodation units

E&P Activities Steady Growth

28

Global E&P Spending

Source: DNB

- Global E&P spending to increase to ~$650bn in 2014

- Up 4% from 2013

- Global E&P spending to increase to ~$650bn in 2014

- Up 4% from 2013

- National Oil Companies remain the largest

contributor to the E&P spending

- Energy security: key concern for every

nation

- National Oil Companies remain the largest

contributor to the E&P spending

- Energy security: key concern for every

nation

2014 E&P spending breakup

E&P spending to remain at a healthy level on back of attractive oil

prices and increased momentum of activities.

29 29

(Nos) Jackup Rigs AHTSVs PSV/Supply

Current Fleet 523 2,917 2,212

Orderbook 116 177 423

% of O/B to current fleet 22% 6% 19%

Source: Clarkson, Rigzone

Global Fleet Supply -Offshore

As of end Jan14

~ Half of the world offshore vessel fleet is more than 22 years

Average age of existing jackup rig fleet is about 24 years

- With increased focus on safety and efficiency, utilization for modern assets expected to

remain healthy

- Current world fleet profile skewed towards older fleet. Hence, replacement demand

should remain strong

FINANCIAL HIGHLIGHTS

Q3 FY 2014

30

31 31

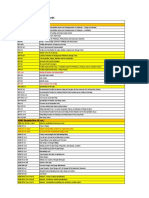

Q3FY 2014 Financial Highlights

Standalone Consolidated Key Figures

Q3FY'14 Q3FY'13 9MFY'14 (Amount in Rs. crs) Q3FY'14 Q3FY'13 9MFY'14

Income Statement

415.43 548.15 1388.65 Revenue (including other income) 792.99 881.55 2551.60

157.34 224.90 659.61 EBITDA (including other income) 360.62 441.51 1341.53

13.13 75.13 217.42 Net Profit 101.50 191.84 507.11

Balance Sheet

9742.29 9950.80 9742.29 Total Assets 15093.19 14407.43 15093.19

4886.98 5113.5 4886.98 Equity 6847.76 6417.59 6847.76

3544.83 3768.75 3544.83 Total Debt (Gross) 6688.23 6620.81 6688.23

413.55 507.46 413.55 Long Term Debt (Net of Cash) 2658.51 2481.52 2658.51

Cash Flow

148.39 160.81 402.75 From operating activities 450.48 188.36 1197.85

(38.70) 192.16 (134.39) From investing activities (245.04) 63.53 (389.16)

(141.84) (143.08) (704.67) From financing activities (308.53) 120.26 (1,224.15)

(32.15) 209.89 (436.31) Net cash inflow/(outflow) (103.09) 372.15 (415.46)

32 32

Q3FY 2014 Performance Highlights

Breakup of revenue days

Average TCY Details

Days (in %) Q3FY14 Q3FY13

Dry Bulk

Spot %

Time %

62%

38%

50%

50%

Tankers

Spot %

Time %

50%

50%

47%

53%

Total

Spot %

Time %

53%

47%

48%

52%

Mix of Spot & Time

Revenue Days

Q3FY14 Q3FY13

Owned Tonnage

2,598 3,144

Inchartered Tonnage

- 128

Total Revenue Days

2,598 3,232

Total Owned Tonnage (mn.dwt)

2.42 2.60

Average (TCY $ per day) Q3FY14 Q3FY13 % Chg

Crude Carriers

13,957 15,888 (12)%

Product Carriers (Incl. Gas)

16,036 16,111 0%

Dry Bulk

13,407 11,708 14.5%

Book Value & Net Asset Value (NAV) comparison

33

Consol. Book Value

(Rs. Per share)

Consol. NAV

(Rs. Per share)

December 2013 454 539

September 2013 444 532

June 2013 439 494

March 2013 416 433

Last 4 quarters

34 34

THANK YOU

visit us at www.greatship.com

Das könnte Ihnen auch gefallen

- Test Your PlayDokument166 SeitenTest Your PlaydiffsoftNoch keine Bewertungen

- Q1FY22 Earnings Call TranscriptsDokument20 SeitenQ1FY22 Earnings Call TranscriptsdiffsoftNoch keine Bewertungen

- Redington q2 Fy 22 TranscriptDokument17 SeitenRedington q2 Fy 22 TranscriptdiffsoftNoch keine Bewertungen

- Ge Shipping Feb 14 PresentationDokument34 SeitenGe Shipping Feb 14 PresentationdiffsoftNoch keine Bewertungen

- PWC Forensic Report On MCXDokument15 SeitenPWC Forensic Report On MCXdiffsoftNoch keine Bewertungen

- Auto Comp ReportDokument167 SeitenAuto Comp ReportnilekaniNoch keine Bewertungen

- Adampak AR 09Dokument74 SeitenAdampak AR 09diffsoftNoch keine Bewertungen

- Forbes 3Dokument3 SeitenForbes 3diffsoftNoch keine Bewertungen

- Adampak Prospectus (Clean)Dokument186 SeitenAdampak Prospectus (Clean)diffsoftNoch keine Bewertungen

- Santiago Golf Resort 01102007 FaqDokument8 SeitenSantiago Golf Resort 01102007 FaqdiffsoftNoch keine Bewertungen

- US Historical RoEDokument17 SeitenUS Historical RoEdiffsoft100% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Between Slack Wax and HOF Waxes - DittmerDokument20 SeitenBetween Slack Wax and HOF Waxes - DittmervasucristalNoch keine Bewertungen

- Engr. MariamDokument130 SeitenEngr. MariamMariam AsgharNoch keine Bewertungen

- Crude Oils Their Sampling Analysis and Evaluation Mnl68-Eb.618867-1Dokument82 SeitenCrude Oils Their Sampling Analysis and Evaluation Mnl68-Eb.618867-1Jawa Tkarang0% (1)

- Ejector Process Vacuum SystemsDokument13 SeitenEjector Process Vacuum SystemsLeon SanchezNoch keine Bewertungen

- Method Statement With Job Safety Analysis For Tank Hydro Testing (Rev 1) (22-07-2019)Dokument32 SeitenMethod Statement With Job Safety Analysis For Tank Hydro Testing (Rev 1) (22-07-2019)Pradip PaulNoch keine Bewertungen

- 8q1pQq PDFDokument100 Seiten8q1pQq PDFJonathan Riveros RojasNoch keine Bewertungen

- Carpenteria Corsi SRL BrochureDokument20 SeitenCarpenteria Corsi SRL BrochureubagweNoch keine Bewertungen

- Real-Time Optimization of A Gasoline Run-Down Header Blending OperationDokument18 SeitenReal-Time Optimization of A Gasoline Run-Down Header Blending Operationkirandevi1981Noch keine Bewertungen

- Syah Hafiz Bin Mohd Nor 15034 - SIT ReportDokument44 SeitenSyah Hafiz Bin Mohd Nor 15034 - SIT Reporthairie azam RazakNoch keine Bewertungen

- Chatper Hydrogen Generation Unit (Hgu) : IntrodctionDokument3 SeitenChatper Hydrogen Generation Unit (Hgu) : IntrodctionAnkit VermaNoch keine Bewertungen

- Entrepreneurs and BankersDokument6 SeitenEntrepreneurs and Bankersapi-326276148Noch keine Bewertungen

- Process Costing vs. Job CostingDokument11 SeitenProcess Costing vs. Job CostingRhea Royce CabuhatNoch keine Bewertungen

- Hydrocarbon Engineering Mayo 2014 Vol 19 05Dokument107 SeitenHydrocarbon Engineering Mayo 2014 Vol 19 05digecaNoch keine Bewertungen

- A Brief History of PetroleumDokument2 SeitenA Brief History of PetroleumManish Tukaram Deshpande100% (1)

- Assessment of Oil Refinery PerformanceDokument13 SeitenAssessment of Oil Refinery PerformanceAshikur RahmanNoch keine Bewertungen

- Inspirage Planning Solution For Downstream Oil & Gas: The ChallengeDokument3 SeitenInspirage Planning Solution For Downstream Oil & Gas: The Challengeguptagaurav1212Noch keine Bewertungen

- Api 619 Api 620 Api 630 Api 650 Api 660 Api 661 Api 670 Api 671 Api 673 Api 674 Api 675 Api 676 Api 677 Api 678Dokument1 SeiteApi 619 Api 620 Api 630 Api 650 Api 660 Api 661 Api 670 Api 671 Api 673 Api 674 Api 675 Api 676 Api 677 Api 678Jader David Rocha MoralesNoch keine Bewertungen

- Oil RefiningDokument11 SeitenOil RefiningMohammed ErwaihaNoch keine Bewertungen

- Industrial Chemistry II Module Chem451 Finasubmitted 1 1Dokument206 SeitenIndustrial Chemistry II Module Chem451 Finasubmitted 1 1tesfayeNoch keine Bewertungen

- 1 s2.0 S2772912522000100 MainDokument15 Seiten1 s2.0 S2772912522000100 MainSecretario SigmaNoch keine Bewertungen

- Prashant Final Project-OnGCDokument127 SeitenPrashant Final Project-OnGCvpceb22enNoch keine Bewertungen

- Manoj Kumar ProfileDokument5 SeitenManoj Kumar ProfileHameed Bin AhmadNoch keine Bewertungen

- Merger of RIL and RPLDokument11 SeitenMerger of RIL and RPLChirag708388% (8)

- Estimation of Pressure Drop in Pipe SystemsDokument29 SeitenEstimation of Pressure Drop in Pipe SystemsDino DinoNoch keine Bewertungen

- Identifier Company Name Country of HeadquartersDokument32 SeitenIdentifier Company Name Country of HeadquartersTABAH RIZKINoch keine Bewertungen

- List of International Standards: API Standards Block (25 Nos.)Dokument4 SeitenList of International Standards: API Standards Block (25 Nos.)Siva baalan100% (1)

- Aviation Turbine Fuels: Standard Specification ForDokument19 SeitenAviation Turbine Fuels: Standard Specification ForAhmad Mu'tasimNoch keine Bewertungen

- Crude Oil DistillationDokument64 SeitenCrude Oil DistillationGautam SharmaNoch keine Bewertungen

- Re-Refining of Used Lubricating OilsDokument30 SeitenRe-Refining of Used Lubricating OilsJaydeep TayadeNoch keine Bewertungen

- A Handbook of Petroleum, Asphalt and Natural GasDokument514 SeitenA Handbook of Petroleum, Asphalt and Natural GasJeyaraj Anand100% (1)