Beruflich Dokumente

Kultur Dokumente

1990 Euromoney Swaps Survey

Hochgeladen von

thcm20110 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

138 Ansichten18 SeitenEuromoney swaps survey article

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenEuromoney swaps survey article

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

138 Ansichten18 Seiten1990 Euromoney Swaps Survey

Hochgeladen von

thcm2011Euromoney swaps survey article

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 18

SWAPS

Bankers Trust operates a network of swaps cenEes in New

York, [-ondon, Tokyo, Hong Kong and Toronto and has

been a substantial market player since the beginnrng of this

funding revolution.

The frrst unit was established in New York by Allen

Wheat and Tim Lindberg in l9B2' and was the acom

Fom which the bank's capital markets oak would ultimately

grow. Indeed, most BT swaps e.\perts today are also

skilled capital markets generalists whose careers have

evolved out of this partcular discipline. Wheat's recent

appoinhnent as head of capital markets illustrates the point'

In 1983, Wheat and Lindberg migated to London to

extend the swaps empire and, later, to develop other

aspects of the capitai markets group. Consequendy,

Wheat's New York leadership slot was assumed by

Jon

Berg, who is a BT managing director and deputy head of

capital markets.

The next link to.be forged was in Tokyo, where BT set

up its swaps shop in l9B2 under the aegis of Brady

Dougan, a vice president in the capital markets group.

BenWeston and Tim Lindbetg at Banhers

Trust uith ( centre) Bernt Ljunggten ftom SEK

This was followed in 1984 by Hong Kong, which is

headed by BT associate Trevor Price. Earlier this year,

vice president Brian Walsh

-

one of a four-man team of

defectors to BT Fom Canada's Wood Gnrndy merchant

bank- founded the New York bank's Toronto swaps unit.

While Wheat may now be de

facto

head of capital

markets and, ipso

facto,

of swaps, most BT gmgraphical '

operations are highly decentalized and have become

quintessential capital marker entities wtth pronounced

swaps skills. According to Berg in New York, BT today

54 Special sponsored supplement

offers the full gamut of swaps services and

-

based on

Federal Reserve Bank statistics

-

ranl's number three in

the dollar interest rate league after Citibank and Salomon

Brothers with deals in l9B5 worth $24 billion rising to

more than $30 billion in the current year. And, while no

reliable figures are available for currency swaps, BT claims

to be a leading player, ranking, overall, among the top five

swaps operations worldwide.

The pro6le of BT's strengths and related atkibutes

highlights a sound trading balance bet'ween interest rate and

curency swaps with particular eminence in two to

three-year interest rate swaps, swaps combined with

options and US dollars as well as yen and Swiss franc

swaps. It also claims the distinction of being the frst market

maker in interest rate swaps in Tokyo'

In the market-making context, BT takes sizeable

positions, although typically not longer than two weeks. In

recent months, business has been 507o sourced in the US,

25Vo n Europe, and 25Vo in Tokyo. It is also heavily

linked to new issues and investment swaps'

Berg uiso points to BTs innovative qualities and cites

last year's yen option bond issues for l.ongterm Credit

Bank of

Japan

and British Peuoleum. A more recent

example, he adds, was the swap-driven bond issue for

Swedish Export Credit, whic} was described in the

l,ondon financiai media as the lowest cost-swap ever

adueved from a Eurobond. "Our capital markets group

has virtually grown up around swaps," explained Berg,

"which has resulted in many of our capital markets products

having swaps feahres."

L"ookins to the future, Berg foresees a world of

ever-bigger swaps. Outstanding issues still to be resolved,

however, are those of documentation and credit risk.

"At

some point," he said, "the markei may experience a major

default which could negatively impact business and volume.

Nbtrvitirstanding, my prognosis for the future is onwards

and upwards with the real value-added coming from new

arbitrages. What is innovative today will become generic

tomorrow."

This is the $25 billion-plus swaps operation that

pales any comparison. Citibank is reputed to be the

creator and the nurturer of the swap, a market which

kicked off in the early 1980s. Since then, the world's

largest bank has also become the world's largest swap

business. All this activity, however, poses a major and

THE

BIG PLAYERS

IN

THE

SWAPS

GAME

Although the swaps revolution took off only a!-the s:tart of this decade,

the maj-or banks *"".

quick to take up the challenge, md business is

booming

SWAPS

';Lrh;3

problem for the bank's swaps department

-

6+*

itself fully staffed. Citibank's swaps employees

fvc

migrated

en masse from their training ground to

Chemical

Bank'

But such

problems do not daunt Yves de Balmann,

who heads the interest rate and currency risk unit for the

bank in Nerv York. An I l-year veteran of Citibank, de

Balmann

started out his career as a scientist after

receiving

a MSc from Stanford, but soon ended up in

6nance.

He held positions for Citibank in the Middle

East, London, and, most recently, his native France

before returning to New York in 1984. Swaps were

nothing new to de Balmann, though, who headed the

bank's leasing business in France.

"You

learn by osmosis

and by doing," he explained.

Furthermore, there is always the strength of the

Citibank business itself. "Part of our strength is our

distribution network and our relationship managers,"

said de Balmann. We cover more corporate names than

anyone."

Citibank, unlike some of its competitors, keeps all of

its staff involved in swaps business on its huge trading

floor on Wall Street. The New York desk currently

numbers 20 professionals, all of whom have been trained

within the bank.

There are about 50 professionals globally who deal

exclusively with swaps.

Twelve of them are in London headed by Mark

Blundell. The office, which is separated from the

dealing room by a glass wall, has been particularly busy.

In one week alone this year, it arranged 35 swap deals.

Recently, it became the 6rst house to launch sterling caps

and collars.

Blundell has split his team into three parts.

Marketing of US dollar and sterling caps and collars

employs two people, a further four are taken up

arranging "old

fashioned" counterparty matching:

litibank make a speciality of non-reserve currencies in

this 6eld, such as Ecu, Dutch guilders, Saudi riyals and

Belgian francs. The third group, of frve, is occupied

The team at the mighty Citibank. The banh b

c r edite d. uith pio neerhg sut aps

with the warehouse positioning books in sterling,

Deutschemarks, Swiss francs and US dollars. The Far

East team also positions Australian do[ars. To satisfu

in-house restrictions, virtually all positions are hedged.

"We

can handle any size of transaction," said

Blundell.

"From only $ I million to practically no upper

limit." Uke many in his 6eld, Blundell is excited by

technicalities.

"The more complicated a transaction, the

better we like it," he said.

All this new activity, however, is not straining the

current staff, said de Balmann. "We

don't have a large

need to increase our size substantially," he said, although

he anticipates a fairly large amount of turnover. But,

then again, the promise of such career advancement

makes swaps a hot area for the swarm of bright young

professionals at Citibank. "'We see the best resum6s

around," he said. "This business tends to attract very

smart people."

Staffmembers say the competitive atmosphere, which

Citibank is renowned for in financial circles, does not

mean they cannot be team players. "We have a lot of

fun," asserted Citibank vice president, Alan Schealy,

one of the desk's three traders. "There's a clear idea of

your responsibility here and we work productive hours."

Additionally, Citibank's large capital base of $ l6

billion more than adequately allows the bank to book

swaps, a record that shifts so frequently that a thick

computer print-out list is updated constantly and handed

out every morning.

"This is a risk-oriented environment.

'lVe

can structure complex transactions, the esoteric

swaps that are the vogue right now," noted de Balmann.

"To

us, there's no deal that can't be done."

For Morgan Guaranty's small group of swaps

professionals, a team approach is without question the

only viable one. At the bank, becoming a swaps

specialist is not a lifetime career commitment, but one

more rotation through a department in the bank. "This

bank does not identify its business with superstar

individuals," explained Mark Brickell, who

just

recently

took over the management of the five-member New

York team. As a result, he will not be putting any

personal stamp on the bank's swaps effort.

"lt's

not a

question of change: we'll continue to be good at this

business. I'd say there are some small corrections in the

course, but no change in the direction," he remarked.

This new assignment does not mean a seat on the

trading floor.either, since swaps are considered more a

function of corporate 6nance. As a result, the swaps

group, complete with their blinking sets of computers,

are nestled in one corner of an open room of desks.

"W'e're not

just

reacting to the market's activities, but

working with capital markets people and the corporate

finance professionals who deal directly with our clients,"

said Brickell.

Swaps are nothing new to Brickell, a Harvard

MBA whose past assignment was working for the

bank's treasury group, where swaps are used to create

fixed-rate funding for the bank. To prepare for this next

step, Brickell overlapped for a few weeks with his

predecessor, Peter Bernard, who has moved ur to

trading options within the bank. All the same, the

33-year-old Brickell says he has done a lot of reading up

on swaps.

"This job

takes a sense of discipline and

Special sponsored supplement 55

SWAPS

analyzing down to the last detail," he pointed out.

Aside from Brickell, there are four other swaps

professionals in New York, four in Tokyo and six in

London, none of whom have been recruited from

outside. But their training in swaps is as intense as

possible since the bank is a market leader, with

$2 I

billion in interest rate swaps outstanding, with a risk of

$1.2 billion, at year end I985. And those numbers do

not include currency swaps where the bank handles

nearly 20 curiencies and specializer in exotics, such as

swapping the hrst Yankee bond in New Zealand dollars

issue by Sallie NIae this year. Furthermore, the New

York team has its hands full simply keeping pace with

the demands of Morgan Guaranty's global customer

base, as well as the growing presence of Morganl

Guaranty Ltd, its London merchant banking arm, as a

Eurobond underwriter.

Morgan Guaranty's teann, their reputation is

based on their strengthin zero coupon sl.;r,aps

in all curtencies

Recently, there has been a trend for many houses to

do more business in London than in New York) At

Morgan Cuaranty, this is reflected by staff numbers.-

The London office, run by Conrad Volstad, outmans

New York with a crew of seven. There are a further

three people in place in Tokyo where Nick Rohatyn is

chief. The London office sees much room for expansion,

particularly in the areas of currency swaps and complex

deals.

"Business

is so varied we like to think we can do

anything," commented Volstad.

"lt's

a great area to work in the bank because it's so

busy all the time," said one young professional on the

desk.

Morgan Guaranty has been in the relatively young

swaps market for a long time, acting as an agent for,

currency swaps in the late 1970s, and taking on an

interest rate swap dollar book in 1982. But, not until

early l9B4 was a group of swap specialists formed to

handle the growing volume. Highly innovative, Morgan

Cuaranty made its reputation in the swaps market based

on its dominance of zero coupon swaps in all currencies.

Business is booming for First Boston's swaps team,

mostly as a result of the Credit SwissiFirst Boston

dominance of the new issues market. So much so that

swap volume should rise to $25 billion plus this year,

58 Special sponsored supplement

said Carol Einiger, a First Boston m.anaging

directot

;f*ne,*othe

firm,s short_term finun.ing

."pit.l

However, bigger is not always better.

This fast pace

of growth does not come without-some

cost,

unj

fo.

CSFB's New York office-, it has followed

a period

of

retrenchment. "For a brief period of time last year.

we

were less active in the market." said Einiger. "'We

toor

a

step back and looked at our business. Whar

sacrificed wasn't dollars, but market presence.

During that time, the firm evaluated the mechanrcs

oi

how things worked for its swaps team, from the physrcal

placement of its swaps professionals

in its bustling

trading room to its computer software system

and

various hedging techniques. The most visible change

to

any onlooker is the separation of swaps traders

and

marketers in the trading room, who sit diagonallv

opposite each other, while the currency s*ups t.am ,iis

amidst CSFB representatives and the foreign exchange

desk. The rest, however, is proprietary information,

but

the result, said Einiger, is "part of what gives us an edge

in the market.

'We're

comfortable with the financial

sophistication of our people, our software and ou.

hedging techniques."

Fbst Boston's grouting team, one of the most

innooatil.te in the marhet

The number of employees of the swaps desk has been

expanding as well, with new recruits coming from such

firms as Marine Midland, Citibank, Manufacturers

Hanover and Bankers Trust. Now, there are nine

professionals in New York as well as seven on the

marketing side.

.There

are also other employees who

deal exclusively in swaps for the 6rm around the world:

one professional in London, three in Tokyo, one in

Sydney, and three in Zurich. However, if support staff

are included the global team numbers around 40.

With these sweeping numbers of employees,

impersonal relations can result; But, everyone is

required to put in some time in the competitive New

York office. Part of their expertise, however, is the

result of First Boston's ability to attract some of the best

talent in the business at some of the highest salaries

around. This bevy of technical wizards has launched the

6rm's reputation as one of the most innovative. But, as

one trader explained: "There

are no books to teach you

how to do swaps. It's seat of the pants learning."

Einiger, 36, is the first female managing director at

First Boston. Right out of college, Einiger started out at

Goldman Sachs and after deciding frnance was in her

blood, went on to attend Columbia Business School.

i-U*n graduation, she

joined

First Boston

-

initially in

li. invatrnent

banking

-

before moving to the capital

.l markets

group, which has seen its business explode.

SWAPS

"We're forced to be opportunistic so we've become

the biggest agent in the business," said Walthur. One

way to beat the competition is by shaving some basis

points off the arrangement. Another is simply being

there at the right time, particularly since the swap desk is

integrated with instruments which play off each other

-

currency swaps, interest rate caps and synthetic

securities.

Of course, a lot of the unit's business springs right out

of Goldman itself, which is submerged in new issues,

particularly "heaven and heil" bonds.

International issues and time clock differences

recently forced one young trader to stay at Goldman all

night to tie up the counterparty for the swap transaction,

part of a recent Australian dollar issue by Ford Motor

Company, underwritten by Goldman.

Walthur, at 37, is a sage of this relatively young

business. A West Cerman by birth, he graduated from

Harvard Business School and conducted his first swaps

deals for First Boston Corp. Coldman lured him away

when Sears, Roebuck and Co., one of Goldman's

biggest clients, started doing its swap business at the

rival frrm. Walthur brought some of his old team with

him and has built the rest of his group largely from the

outsids including Citibank and First Chicago,

integrating them into Goldman's team player

atmosphere. Growth will continue, said Walthur,

noting the increasing standardization of swaps. "W'e've

come a long way from the days of sitting in corporate

finance without screens."

The Goldman SacAs surap s dealers, utho are

noted for their d.edication

Not that screens full of quotes are always necessary to

piece together a swap. One devoted young trader, who

recently suffered a back injury; came into work all the

same, lay down on the foor of a conference room and

started ringing up parties on the telephone.

"lt's an

intense place," said one competitor.

Morgan Stanley's swap team has gone through a bit of

an evolution in the last year. For one thing, it has

loosened up

(not something Morgan Stanley is known

for), and boosted the bottom line in the process. "We're

defrnitely more risk oriented," explained Bidyut Sen,

who came to Morgan Stanley from Citibank a year ago.

The Morgan Stanley method, in the past, was to

Special sponsored supplement 59

].

--rti; "g"ri."

early on recognized the growing

Upon

graduation, she

joined

First Boston

-

initially in

investment

banking

-

before moving to the capital

markets

group, which has seen its business explode.

First Boston early on recognized the growing

application

of swaps as a financing technique and moved

its swaps desk to the trading floor in 1983. The frrm has

also been on the cutting edge of developing a liquid

secondary market for traders of swaps by seeking

methods of making swaps more homogenous, by, for

example, requiring collateral from weaker credits like

thrifts.

"What

makes us different is that we're in the

forefront of the market. Not many 6rms are as far along

as we are in managing risk," Einiger noted.

Artur Walthur, Goldman Sach's co-head of capital

markets, begins his average workday by telephoning the

Tokyo of6ce from his car at about 6.30am to get a

reading on the market. He then calls London. But this is

just

the first round. When he arrives at Goldman's Wall

Street headquarters, he is on a conference call to both

cities at 8am. "That's

the time of day we all intersect."

he remarked with a grin. But, by 9pm the same day,

Walthur is still at work, making a'good morning'call to

Tokyo before he goes home for a quick nap.

Walthur's boundless energy is

just

one reason, albeit a

very important one, why Goldman was able to set a new

house record for swaps volume in April

-

about $2.4

billion in two weeks and a record $ I 2 billion for the first

third of 1986. With this intense pace, the name of the

game for Walthur and his I 7-member swaps unit is

hustle. Goldman, unlike some o[ its competitors, does

not put its own capital on the line by buying swaps

outright when counterparties cannot be found. So,

Walthur and his associates sweat it out like Hollywood

agents looking for the right press event in their

minute-by-minute searches for the appropriate

counterparties.

Paul Efron, at the six-strong London office,

explained the policy of not running a large book.

"You

have to ask if the capital is sufficient to

justifu

the risk,"

he said. "We think it's generally better to take positions

on the bond markets. I see the profitability of running a

large swaps book declining." However, Goldman Sachs

will take a short-term position to accommodate a

counterparty.

Efron moved in to lead the London offrce in

September from the New York team, before which he

worked for First Boston. Goldman Sachs has always

been a predominantly US house, and it was only last

year that currency swaps were introduced in a major

capacity. Already, currency swaps account for slightly

more business than do interest rate swaps.

This business mix is also represented in Tokyo, which

is staffed by a team of four.

"Yet, they differ in that they

tend to be more investment driven," noted Efron.

SWAPS

WHY S\ryAPS MAKE

SOME

CURRENCIES

POPULAR

Currency swaps have driven the Eurobond market.

In 1985 an estimatedTo%o of all issues \rere swapped. Why should

some currency sectors be more swap driven than others?

-

Up to 907o of yennew issues are swapped, according to

Japanese

banks, with an increasing number involving

three or more counterparties. Most borrowers need

dollars more than yen, and, like any low coupon

currency, the yen market offers attractive low-cost

funding opportunities to gain leverage in the yer/dollar

swap market.

"Like any new market, the yen sector suffers from

bouts of indigestion. It is less deep than traditional

European currencies," said

Jerry

Langley, treasurer of

McDonald Corporation. McDonald has regularly

tapped the yen sector, either to obtain working capital

for its chain of some 500 restaurants in

Japan

or for

lucrative swaps. In

January

I 985, it made its first foray

into the newly liberalized market with a straight Y25

billion bond, a portion of which was used for lending on

to the company's joint

venture. Another portion was

swapped into floating rate dollars at an all-in cost of

Libor minus 80-

Swaps triggered by yen obligations tend to be better

.

priced than European alternatives, explaining the

popularity of the sector among borrowers. "A

number

ofJapanese houses are pricing deals very competitively

.

to establish their market share," said Langley. "They

are willing to drive swap terms really fine."

Uberalization of

Japanese

financial markets in April

I 985 permitted the introduction of yen zero coupons,

FRNs, convertibles and dual currencies. "Dual

currencies in the yen sector are the single most important

development in the

Japanese

capital markets during

I 985," said Hiroshi Toda, executive director at

Nomura International. Nomura lead managed the first

ever yen dual currency in the shape of a Y I 5 billion

issue, redeemable in US dollars at $4000 per bond, for

Farm Credit Corporation of Canada, as well as around

20 of the subsequent deals.

The spate of dual currency issues, for names like

IBM, Credit National, Phibro Salomon, Honeywell

and Fannie Mae, were all swap driven, and resulted in

cheap dollars for the borrowers. IBM achieved

sub-commercial paper rates using the structure.

Swaps off yen dual currencies relied upon locating

investor appetite in order to drive borrowing costs

down. Investors were offered a higher than average

coupon

-

around 87o

-

rn return for accepting a foreign

exchange risk dependent on the dollar/yen rate on

maturity. For the borrower, the subsequent swap into

floating dollars only involved a spot foreign exchange

transaction of the principal and forward coupon swap,

since the principal repays in dollars.

Yen dual currency issues are a prime example of

"the

further opening up of the yen market, making it much

more sophisticated and easier to deal in", according to

Tam Robertson, Farm Credit treasurer. The issue

resulted in a final cost of funds of l0.02Vo after two

swaps into US, then Canadian dollars, or 28 basis

points under Canadian teasuries.

Euro-yen new issuance volume increased fivefold

during 1985, boosting the total market share of

yen-denominated international bonds to the equivalent

of $6,463 million, or 9Vo of thetotal Eurobond market.

In fact, the yen sector was the third largest in terms of

new issue activity during 1985. Much of the surge in

volume can be accounted for by swap driven issues.

"The

Euro-yen market is trying to follow the

Eurodollar," Toda concluded. "Borrowers

who

previously relied on the Eurodollar can now diversifu

their investor base and, through the swap market,

achieve any currency they want."

Since last October/November, *h.n ih" y.n',

meteoric rise began, the yen swap market has tended to

be all one way

-

borrowers anxious to tap investor

demand for yen-denominated securities with new issues,

and swap into dollars, while yen payers have been in

short supply. 'Japanese

companies have been keen to

sell yen forwartand buy dollars because of interest rate

differential between the currencies," said Shinsuka

Amiya of Yamaichi International. "With

the dollar at a

Special sponsored supplement 27

SWAPS

forward discount, they have been unwilling to accept

expensive yen debt in return for dollar debt."

Amiya argued that, given. the scarcity of natural

counterparties to yenldollar swaps,

Japanese

banks

have been hard at work creating synthetic

counterparties. This has been achieved through the

invention of dual currencies and heaven and hell issues,

which off-load the hedging of the final redemption

amount to the investors, making it possible for the

arranging banks to offer preferential swap rates to

borrowers willing to assume yen debt. Dollar equity

warrant issues for

Japanese

borrowers have also created

a pool of yen payers to supply the other side of the

equation.

"ln order to protect our market, it is necessary to keep

making innovations," Amiya summed up. "Only then

$/ill the yen market rival the Swiss franc or

Deutschemark in terms of volume.

'We

must seek new

schemes for swaps while the yen continues to be so

strong."

The Swiss franc capital market has always been

relatively free from regulation, a fact which early on

fostered a flourishing swap market. For sophisticated

international borrowers, accustomed to borrowing

Swiss francs, it was a natural progression to return to the

market to launch issues intended for swapping into

another currency. It was no coincidence that the first ever

crrrency swap between the World Bank and IBM

involved Swiss francs. "lt's a symptom rather than a

cause," was the opinion of one Swiss banker commenting

on the .*..6.y swap market developed out of

Switzerland.

Because retail investors

-

the mainstay of the Swiss

franc investor base

-

prefer debt from household names,

well-known US corporations have carved a lucrative

niche in the new issue related swap market. During

I 985, as the Swiss franc appreciated against the dollar

or interest rates fell, windows opened for North

American borrowers which were quickly seized upon.

Names like ITT, McDonnell Douglas, American

Fletcher, Textron and Goodyear Tyre and Rubber all

.

featured in the swap market.

Such borrowers

-

in response to investor appetite

-

were able to lower issue costs, then swap their debt for

sub-Libor funds with counterparties willing to assume

the Swiss franc liability. ITT's Sv',frl00 million issue

over l0 years in October, for example, was swapped

into 6red US dollars at 34 basis points over teasuries.

Tlie-best the company could have achieved in the

domestic market, at that time, was 60 to 80 over

Treasuries.

McDonnell Douglas's savings were equally large.

The final cost of funds, after swapping out of a Swfr I 00

million l0-year issue, was

just

44 basis points over

Treasuries, some 30 points less than a Eurodollar or US

debt market issue.

"'We like the Swiss market and they

like us," said Robert Owsley, treasurer and vice

30 Speciar sponsored rroo,.rnlJ,*t'ent

at McDonnell Douglas'

"The Swiss franc market is sometimes receptive to

some types of borrower who don't get the same relative

reception elsewhere," said Stephen Mahony, swaps

specialist at Swiss Bank Corporation International in

London.

In price terms, less than AAA credits 6nd Swiss

franc swaps favourable because yield differentials are

narrower in Switzerland than in the dollar market. A

US name is therefore able to contain cheap terms in the

Swiss market and exchange its debt for dollars at a

better rate than would be available to it in the dollar

sector, where lower ratings count more heavily.

Take for example the notional case of a BBB

company which is able to issue a l0-year Swiss franc

bond at an all-in cost of.5.5Vo. A swap into fixed-rate

dollars would result in a cost of around I 25 over

Tieasuries. In the Eurodollar or domestic market, the

same borrower would probably pay nearer Tieasuries

plus 140. The swap would save I5 basis points.

For an AAA rated borrower, however, the coupon

on.a Swiss franc fixed-rate debt issue might be nearer

43/+7o with an all-in cost of 5t/c%o. A currency swap

would result in cost of funds at around Treasuries plus

100, while a dollar issue would cost the same borrower

Treasuries plus 50, proving the relative value of the type

of swap to a lesser rate borrower.

Dawn Lomas of Shearson Lehman pointed out the

recent restrictibns imposed by the Swiss authorities,

which aim to curb what was seen as an alarming

tendency for the Swiss franc bond market to become a

'dumping' ground for lesser rated credits. Public debt

issues

-

or those longer than eight years

-

must be BBB

rated or better, according to the ruling. According to

Lomas, the Swiss market was at one time associated

with prestige borrowers, a psychological factor which is

no longer relevant since obtaining cheap cost of funds has

become the main priority.

Lomas predicted Swiss franc swaps will 'become

more competitive in future, as US investment banLs

slowly start to erode the domination of the big-th

Swiss banks

-

UBS, SBC and Cr6dit Suisse

-

in the

Swiss capital markets as a whole. "But it's going to take

a long time," she added.

Last October, a number of US and Canadian banks

made their presence felt in the Swiss market, winning

lead manager positions for big US name. like R

J

Reynolds, ITT and McDonnell Douglas. The trend

was continued in February with names such as Morgan

Griaranty and Royal Bank of Canada

.rn

in,ing

mandates for issues on behalf of Coastal Corporation,

Del,Webb and Humana. Other names to encroach on

the once hallowed ground include Chase Manhattan,

Citicorp, Banque Paribas and Coldman Sachs.

US banks, with their expertis'e in the swap market

and a worldwide network of swap counterparties, are

now in a strong position to establish themselves in the

Swiss market. Often, the all-in package, including

underwriting fee and swap, which they are able to quote

to borrowers, lures new issue business away from the big

three Swiss banks.

Swiss franc swaps have no basis interest rate over

which they are priced like Treasuries to the dollar

market, Schuldschein to Deutschemarks and gilts to

sterling. Shorter dated swaps, from two to four years,

i

tend to follow domestic interest rates, while the longer

end is priced off a hypothetical level of where new issues

would be brought.

The new issue related swap market in Swiss francs

6nds an abundance of counterparties in sovereigns and

supranationals, who need to mainthin a currency spread

in their debt portfolios, and may find a price advantage

in swapping into Swiss franc debt as opposed to a public

debt market offering of their own. Other entities seeking

to swap into Swiss francs are those wishing not to spoil

their reception for repeated financing through over-

borrowing.

Falling rates in Switzerland, in early 1986, enabled

swaps to be written off old debt, where borrowers

swapped out of relatively expensive foreign debt into

Swiss francs. The steady rise of the yen against the Swfr

also meant that

Japanese

borrowers, who have been

-favourites

in the Swiss market for a long time, provided

ready supply of Swiss payers.

Up to Bl?a of Ecu new issues are swapped,

according to Philippe Gautier, head of swaps at Chase

Manhattan. The high percentaSe is due mainly to the

fact that spreads between Treasuries and Eurodollars

are at their widest for two years, making swaps off

Eurodollars uncompetitive for all but the best names.

Instead, borrowers are turning to the Ecu market which

now offers some of the best opportunities for swaps into

cheap floating dollars.

On the large number of swap driven new issues,

Gautier remarked: "l think it's an advantage to the

market. Investors in the Ecu are getting access to a wider

variety of credits, such as borrowers from the US, the

-^

Pacific or Canada for example, which they would

,therwise

not have. From the investor's point of view,

the Ecu offers a strong currency with virtually the same

interest rate as the dollar."

The recent currency re-alignment within the

European Monetary System (EMS) has further

enhanced the Ecu swap market. Prior to the currency

adjustment potential, Ecu payers were deterred because

of uncertainty over the future exchange rate. "The

re-alignment cleared the air for swap counterparties,"

said Cautier, "which

has greatly enhanced possibilities."

Chase Manhattan has Iead managed a number of

swap driven Ecu issues over the last six months, for

names like Colgate-Palmolive, Modt Hennessy and Elf

Aquitaine. Although still very much a name market,

relying on the recognition of household entities among

retail investors. Gautier noted that recent issues for

EDC and Sweden have offered investors top-rated

credits in addition to well known names.

Because the Ecu swap market is name-conscious,

swap opportunities arise on a case-by-case basis,

depending on the names issuing and the demand for Ecu

paper. During

July

and August 1985, for instance,

there was a fantastic demand for Ecu paper from

good-quality US names like R

J

Reynolds, Chrysler

and Xerox which created swap windows for

SWAPS

corporations to win cheap dollars through a swap.

Walt Disney is a typical US company to have used

Ecu swaps as a cost-saving exercise. It tapped the Ecu

market twice in l9B5 to raise fixed yen rather than

dollars, achieving a competitive cost of funds compared

with a straight Euro-yen issue.

'Walt

Disney treasurer,

Don Tucker, claimed he likes the opportunities offered

in the Ecu market because

"the

Ecu is a well accepted

vehicle and there are always plenty of swaps available.

We always welcome more European investors."

The open and closed nature of the market is also due

to the counterparty-driven nature of the swaps, with

most banks preferring to match transactions rather than

warehouse positions. "The

market is still relatively

illiquid," commented one trader. "Not

many banks will

make an active Ecu market."

Counterparties to new issue Ecu swaps are typically

European companies which are unable to launch an issue

in the market directly because of insufficient credit

standing, or agencies and corporations with huge dollar

liabilities seeking to hedge their currency exposure.

Given the drop in the dollar, many borrowers are scared

of an upward correction, and want to lock into a

different currency at today's favourable rates.

"A good proportion of Ecu swaps takes place in the

quasi-secondary market," said Alec de Lezardiire of

Banque Paribas Capital Markets. "Around 75Vo to

80Vo of all Ecu swaps are companies managing existing

debt." The Ecu provides an ideal mechanism for

diversifuing risk, he argued, and, as the underlying Ecu

market gains depth and liquidity, more swaps will take

place

-

both into and out of the currency.

De Lezardiire estimated that the percentage of Ecu

issues subsequently swapped is nearer 757o for 1985,

and only 50Vo during the 6rst quarter of 1986. He

maintained that the trend is towards a decreasing

number of swapped new issues, as borrowers retain the

currency as a valid hedging medium against dollar debt.

"The

market is absorbing a huge volume of paper at the

moment, proving its liquidity. The differential berween

the real cost of borrowing in Ecu and the theoretical

yield, or borrowing in each of the separate component

currencies, has narrowed to around 50 basis points. It's

becoming more popular for non-swappers as well."

Ecu swaps are cyclical. "Every time the dollar

weakens, there's a food of European companies seeking

to lock in profits by swapping into Ecu or other

currencies," he maintained.. Italian and Spanish

companies are particularly active.

De Lezardidre predicts the next major development

for the Ecu swap market will be an increasing number of

banks prepared to warehouse swaps

-

something

Paribas is already doing. This will enhance volume in

the number of swaps off existing debt, enabling

companies to swap into Ecu when it suits them, rather

than when a new issue creates an Ecu receiver.

Swaps from Ecu new issues are facilitated by the fact

that credit differentials in the Ecu market are narrower

in the Ecu than in the Eurodollar market. This means a

single A credit, for example, is able to obtain frner terms

in Ecu than might be possible in Eurodollars, where its

lower credit rating wou[d count more. With the

relatively cheap Ecu debt, the company might then gain

leverage into cheaper dollars via a swap.

Special sponsored supplement 31

SWAPS

The development of the Euro-Australian bond

market has been given a tremendous boost by parallel

growth in the swap market. New issue volume in

Australian dollar denominated Eurobonds reached

nearly A$4.5 billion in 1985, compared with

just

4,$361 million in 1984

-

a twelvefold increase. The

number of issues also increased dramatically to 89 last

year from l0 in 1984.

The surge in new issue volume has been largely swap

driven, with up to 90Vo of new issues swapped, mainly

into floating rate dollars. The Euro-Australian dollar

market has become accustomed to a host of European

and US names, including prime corporations and

banks. Although they do not have any natural need for

the currency, they are unable to resist the opportunity to

raise cheap dollars. German borrowers have figured

prominently: names like BMW blazed a trail in August

l9B5 when it achieved Libor minus 50, while Deutsche

Bank and Commerzbank, more recently, are reported to

have.obtained floating dollars at

just

Libor minus 75.

"The

Australian dollar sector of the Euromarket

offered the best swap rates in the market to many

Cerman entities and US household names last year,"

said

John

Kerr, executive director at Orion Royal

Bank. "At the same time as the Deutsche Bank swap,

the yen, Ecu or Deutschemark could only off.er 25 to 40

basis points under Libor." Orion has established a

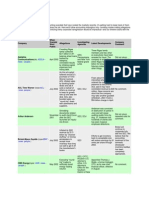

Comparison of costs of selected Euro-Australian

dollar bond issues with five year domestic

Commonwealth Bond yield

-

s-year domestic Commonwealth Bond

a lssues lead managed by ORB (book running position)

o Issues colead managed by ORB

a

AVCB

l{* t990

aut

r5'A* 1390

(r.

:-_ o

3

i

a

,

c

g

-'}R

15.5

Ili00LW08THs

13r,t* 1990 14 5

q

.L

E

@

14.O

BT AUSTRALI,A

13,lX 1992

a

BHiH','o'

SEC PAC AUST

14* 1988

l3i/r* 1988

At{z

l3r,t* 1992

a

13!i 1992

a cB.0P EUt X HAt{ot-ratc

al3rix

1992

crTtconP lAusT.)

. MOMAI' 6UAMI{TY AIJSI

t3"tx 1990

MY I{YP{)SAXX

13* 1990

a

o*ffi1t

I

COMM'ilwrAtIH &At{l( 0t Au'rf,rrt;1

.

I

I.AI'OE:iEAtIX RHgHIAIGPFI.AZ

r3x 1989

_ t2rt* 1990

EAYWNflNSMNX

' l2',t* 1gg5 'oEurSOtE

l2rlx 1992

aHflNz

12,iI 1990

SouEi Orio Foyal 8!nk Umhqd

1986-

34 Special sponsored supplement

SWAPS

strong market share in Iead managing Euro-Australian

dollar issues, bookrunning 39 of a total I I 9 issues

between 1983 and

January

1986, or nearly 3370.

Orion brought the first ever Euro-Australian dollar zero

coupon bond for the Commonwealth Bank of Australia,

which was also swapped.

Swap driven new issues in Australian dollars enjoyed

a freld day during the summer of 1985, and the market

once again sprang to life in the first quarter of I 986. A

flood of German bank borro*ers exploited the open

window to get cheap floating dollars, including

Badische Kommunale Landesbanke, DC Finance and

IKB Finance. Fiat and Pepsico quickly followed suit.

Pepsico achieved a 6nal cost of funds of around 80

basis points below Libor, or significantly below US

commercial paper rates, after swapping its A$75

million issue over three years

-

a very competitive rate

-

qompared with the company's outstanding debt

rrtfolio, according to an assistant treasurer at the

company. The cheaper floating rate dollars are being

used to replace Pepsico's existing commercial paper

borrowing.

Pepsico's

January

Australian dollar swap was only

its second venture into the market. "Our centralized

borrowing operation means our costs are averaged out,

making the whole debt portfolio more attractive," the

treasurer noted. However,

"it's

fringe market", he

added. "Opportunities

come and go. The other

detraction can be the small issue size you are limited to

-

A$75 million in only around $50 million."

The reason that so many non-Australian borrowers

are able to achieve such competitive dollar costs is

largely historic. The Australian domestic bond market

is underdeveloped, and Australian banks only lend on a

floating rate basis. The only way for many Australian

companies to obtain fixed Australian dollars, then, is

either to issue through a parent in the Euromarkets or

enter into a swap with a non-Australian counterparty.

--.

"Swaps

developed because Australian borrowers,

,ch as public sector entities, took out large US dollar

syndicated credits during the I 970s and early I 980s to

finance capital expenditure projects," explained Kerr.

"Typically, the borrowers only had income in

Australian dollars. So, when the currency collapsed in

early 1985, they suffered huge forex losses." Such

borrowers, with their need to pay Australian dollars

and receive US dollars, form the counterparties to the

swapped new issues abundant in the Euromarkets.

From an Australian borrower's point of view, only

the most highly rated company is able to tap the

Euromarket. The majority of borrowers end up paying

over the odds of l6Vo to 17Vo domestically. Australian

dollars obtained via a swap

-

at around 147o

-

obviously compare favourably. And most borrowers

want floating rate dollars.

"Ninety-frve per cent of the

swaps are cross currency interest rate swaps," added

Nicholas

Jordan

of Orion Royal Bank. "From floating

dollars to fixed Australian or vice versa."

When investor demand is present, prime non-

Australian names can achieve rates below those at which

the Australian government can borrow. This is due to

the popularity of household names among retail investors

-

the mainstay of the Eurobond investor base, and the

high coupons which Australian dollars carry relative to

the other currency sector in the Eurobond market.

Investors are drawn lrom Germany, Switzerland and

the Benelux countries, according to Orion, with interest

also emanating from

Japan.

Because investor appetite plays such an important

role in the success of a Euro-Austraiian dollar issue,

swap windows only open intermittently. Investor

demand can fluctuate according to anticipation of future

currency and interest rate moves in Australia, as well as

yield differentials at the time of issue between US and

Australian dollar bonds. Although Australian

government bonds offer higher yields, investors are

deterred because they are registered and subject to

witholding tax.

Australian dollar swap rates, which are priced off

Australian Commonwealth bonds, fluctuate wildly,

depending on counterparty availability and investor

demand, along with the quality of the issuers. "The

market swings enormously," said Kerr. "Rates have

gone from 40 basis points over Commonwealths to 25

below in six months."

Orion intermediate only rarely swaps, but more

commonly acts as an arranger, making the timing of a

deal critical. "We've

had a situation where an issue is

arranged at twelve o'clock, the swap offer confirmed to

one, then the issue launched at two," he

joked.

When the conditions are right for an issue, a lot of

pent-up borrowing with attached swaps emerges,

running the risk of swamping the market. Because of this

situation, the market can deteriorate rapidly once

investor demand is saturated. Some lead managers solve

this problem by warehousing paper from a new issue

after the swap, then feeding it out to investors as either

the currency or rates improve.

The Australian dollar market is an arbitrage market,

like any swap currencv sector, but the differentials

between Euro and domestic rates is particularly wide.

"Like

all arbitrages, it will diminish the more it is

exploited and with the maturity of the market," said

Jordan.

"Only when the Australian capital markets

become fully international will raies move closer

together."

Eurosterling swap activity has exploded in 1986,

with as much business in the first three months as in the

whole of 1985. The momentum may slacken, but the

rush of Eurosterling interest rate swaps this year has

established the market sufficiently for it to continue

expanding. Increased trading in sterling instruments

after the Big Bang in October will add a further boost.

Almost half the 33 Eurosterling bond issues this year

involved interest rate swaps and some may also have

involved currency swaps. Michael Baring, a director of

Baring Brothers, says there have been a lot of secondary

market swaps of sterling into dollar funds. Some bankers

see swaps as the driving force in the Eurosterling market

so far this year.

Swap opportunities appeared in February with a

revival of demand for Eurosterling bonds from

Special sponsored supplement 35

SWAPS

continental retail investors. They reckoned that sterling

had stabilized after the oil price plunge and were

attracted by UK interest rates, which were relatively

high bv world standards. So keen were they to buy

sterling paper that some Eurobond issues by top US

corporate names were trading well below gilts in the

secondary market. Gilts are less appealing to investors

because they are registered rather than bearer securities

and carry interest net of tax.

At the same time, UK corporate treasurers felt that it

was worth borrowing fixed-rate funds again, now that

interest rates had fallen

-to

around 107o. Companies

which were either too r*uil to tap the Eurobond market

-

themselves, or which wanted to borrow in tranches to

guard against missing the bottom in interest rates, were

happy to swap their floating rate bank loans for

fixed-rate money.

This paved the way for building societies and foreign

banks, which had a natural need for foating rate funds

to match their assets, to issue relatively cheap Gxed-rate

paper in the Eurosterling market. They then swapped

the proceeds to achieve sub-Libor funds. Three bani<.

swaps arranged by Samuel Montagu achieved rates

"better than I 5 basis points below Libor", said director

Bernard

Jolles.

Building societies are delighted to raise

money at these rates, but the difficulty of finding

counterparties obliges them to issue the bulk of their

Eurosterling debt at floating rates. Cary Lefevre,

assistant general manager of Nationwide Building

Society, says his society raised as much as it thought it

could swap and saved from

t/a?o

to

t/cVo

by doing so.

At least some of the foreign borrowers, such as the

Industrial Bank of

Japan

and Philips Finance, wanted

sterling funds to expand or refinance their UK

operations.

Building societies entered the Eurosterling market in

1985 after the Finance Act allowed them to pay interest

gross, like other Eurobond issuers. Facing 6erce

competition for deposits from banks, they responded by

issuing more than a third of the total Eurosterling bond

issues last year. The building societies' regulatory body

ruled in favour of interest rate swaps in March 1986

and, within days, four of them took advantageof this to

issue fixed-rate debt and swap it for floating. Building

societies face peak mortgage demand in the spring. A

bill expected to become law in

January

l9B7 will permit

them to make currency swaps as well. Nationwide's

Lefevre says he looks forward to issuing Eurodollar

bonds, to be swapped to sterling. He will also consider

other currencies.

The lead managers of the bond issues either 6nd the

counterparties themselves, take the swap onto their own

books, or arrange a swap with another bank, perhaps a

co-lead. The largest deal, a seven-year issue for t75

million by the Nationwide Building Society, was lead

managed and swapped by Credit Suisse First Boston

with a single counterparty, County Bank, but that is

now rare.

Originally, all swaps were matched exactly, but from

I 982 onwards banks have been prepared to match only

part ofa deal. They then hedge the rest to guard against

interest rate changes and warehouse it and hope to

parcel it out among a number of clients. The main

counterparties, receiving the fixed-rate funds, include

38 Special sponsored supplement

companies wanting to fix a specific debt or borrow in

stages, clearing and merchant banks trading swaps,

leasing companies hedging their portfolios, finance

companies and local authorities.

Nearly all the deals swapped this year were for sums

of f,50 million to t75 million and for maturities of five to

seven years

-

very much shorter and sma.ller end of the

Eurosterling market, which has

just

seen fixed-rate

issues for as much as f,l 50 million, floating rate for 1250

million and maturities stretching out to 2l years. The

lower maturity limit is set by Bank of England

regulations which do not permit Eurosterling deals for

less than five years.

Morgan Grenfeli is one of a handful of banks which

run a full-blown unmatched swap book in sterling. This

means it is prepared to make a market in swaps every

day and either way. Noting that the sterling swap

market had stayed still or even contracted while the

dollar swap market had expanded, lvlorgan Grer

spotted a niche. It decided early this year that it coutd

make a reasonable return if it expanded the scope of its

business in this way, taking odd dates and odd amounts.

In the

-

event the step to running an unmatched book

came

just

in time for the bank to beneht from the boom in

Eurosterling issues that began in February. But there

was so much swap trading that "it would have been

worthwhile even if we had not swapped a single new

issue", said Thomas, although it

"unquestionably

strengthened our hand" in winning issue mandates.

Sterling interest rate swaps are not new. UK locaj

authorities set in motion a thriving swap market in 1982

and 1983 by borrowing 6xed rate funds and swapping

them with banks into foating rate funds. This suited the

authorities because they were entitled to borrow

comparitively cheap fixed rate money from the official

Public Works Loan Board and 6xed rate funds were

more expensive than floating in the market at the time.

This arbitrage left them with sub-market floating rate

funds, which they could either use for their ow.

requirements or make a profit on, while the bar

achieved cheaper 6xed rate funds to match part of ther

loan portfolio. But the party ended in early l9B4

because the government saw this as an abuse of

privilege. As a result the swap market is thought to have

shrunk to 12 billion in i984 from f3 billion in 1983.

After this surprising beginning, tle market was

developed by banks who saw it as a means of getting

interest rate exposure, for example borrowing fixed on

tlie expectation of making a turn on rising interest rates.

Thomas of Morgan Grenfell thinks that, although the

market in short-dated Eurosterling bonds is notoriously

sporadic because it depends so much on currency

considerations, an active market in sterling swaps will

continue for three reasons. After the spurt of swaps this

year UK companies have conquered their shyness of the

idea and like the fexibility of swaps. The swap market

has acquired greater depth and solidity because a

number of banks, which were previously prepared to

operate only on a matched basis, now warehouse swaps.

The Big Bang will bring more players into the gilts

market and promote greater trading of all instruments

involving medium term sterling interest rates. This will

spill over into associated markets like glt futures and

options and also swaps, he says.

SWAPS

DEALINGWITHTHE

LATEST TECHNIQUES

The swap has developed a Iot since it emerged. Now when banks and

houses are setting up deals, increasing versatility and virtuosity are

being displayed

When SEK targeted an all-in dollar cost below a

conventional swapped Euro-yen issue, Nikko Securities

and.Coldman Sads krew they would have to come up

with a special skucture. The result was a two-pronged deal

involving, on one hand, a sraight Yl0. 14 billion issue

swapped into dollars and, on the other, a heaver and hell

FRN issue arranged by NiL*o for Flrst Interstate.

Together, the two legs provided SEK with floating dollars

at a cost said to be

just

Ubor minus 60.

In the 6rst stage of the deal, SEK raised Y I 0. I 4 billion

with a straight l0-year Euro-yen issue over l0 years

carrying a 65/aVo coupon. Niklo then covered the coupons

in the forward foreign exchange market and executed a par

forward with SEK on the principal to complete the swap

into dollars. SEK was left with a purely dollar liability.

The tick lay in Nikko not e:<ecuting forward cover for

the 6nal redernption amount

-

only the initial principal and

coupon payments. If the yen strengthaned before

redcnption date, SEK would only deliver $50 million (the

same exchange rate 6xed at the initial elclange of

principal), leaving Nil*o with a shortfall in the forex

market. Nikko then had to devise another scheme to cover

Nihho's Hiro Suzuhi: "The deal utas basically

irutester dioen"

8 Special sponsored supplement

its foreign exchange exposure at the issue's maturity.

It achieved this by launching simultaneously with the first

issue a $60 million FRN for Fust Interstate with a coupon

of Libor plus 25. The higher than normal yield on the bond

compensated the investor for writing an option on the

redernption amount in y*, calculated at the time of

redernption. The investor could both gain and lose on the

exchange rate, giving rise to the name heaven and hell

bond.

In this case, the strike price was set at Y 169/$. If, over

the lifetime of the FRN, the yen srengthened above the

sbike price, the investors would receive a redernption

amount of less than par. If, conversely, the yen weakened,

they would receive an e.xta dollar amount from Frst

Interstate, calculated on the basis of the bond formula $60

million X I * spot

-

169/spot. Nil,ko agreed ro make

good the final amount for First Interstate if positive, and

receive the balance if negative, thus hedsing its shortfall in

the forex market on the first part of the deal. NiL*o also

agreed to pay Fint Interstate erha dollar interest during

the bond's life to cover the higher coupon payments to the

investor.

'The

option elernent in the heaven and hell bond was the

pivot of the whole deal," argued Hiro Suzuki of Nikko's

new products swaps team. "lt meant we hedged the final

principal amount in yen at a better rate than in the forward

foreign exchange market." That, in turn, allowed Nikko to

offer better swap rates to SEK and Frst Interstate.

Moreover, the extra dollar interest paid to Frst Interstate

created an additional dollar liability to match Niklo's

receipts from the interest rate swap.

Suzuki said that the foreign exchange transactions,

hedging the initial principal and coupon flows, took place

mainly in Tokyo, the only place able to achieve the

necessary size and maturity for the deal. "Only

Japanese

Sanls would be able to offer the underlying forex in that size

in yen," he maintained, adding that the timing of the foreign

e{clange operation, as in all currency swaps, was critical.

In the final part of the deal, an interest rate swap with a

US insurance company was arranged, usrnd a

sophisticated discount skucture, swapping SEK's fixed-

rate dollar obfuation into floating rate dollan at a very

competitive rate.

SEK ageed that the heaven and hell FRN issue was

the key factor in achieving their substantially below Ubor

-

cost of firnds. The advantage gained by ihe

-6nal

redernption forward rate was used to hedge the principal

amount due on its initial yen issue: the option provided the

arbitrage to generate cost savings, they say.

According to Suzuki, the deal was one of the most

complicated that Nikl<o has ever accomplished. As

SWAPS

borrowers demand ever tighter terms, banks try to develop

more and more complicatd technical structures to provide

the necessary cost of firn&. For this reason, Suzuki

maintained, swap structures like this are likely to be

repeated.

A triple A rated borro*er like SEK would not have

been able to achieve comparable borrowing costs either

t}"o"eh a straight Euro-yen swapped into floating doliars

according to Suzuki, although he declined to be specific

about exact rates. Only by usrng two issues simultaneously

was it able to drive the costs low enough.

'The deal *ut [asically investor &iven," he summed

up. "As long as we can get hold of investors *ho will be

happy with these bonds, we can continue to produce

struchres which rely on them."

When the Mortgage Bank of Denmark wanted to

borrow Dutch guilders and Swiss francs at a competitive

rate, Citicorp Inveshnent Bank came up with a

multiJegged swap providing an all-in cost of funds at

nearly 50 basis points under market rates for a straight

guilder and Swiss bond issue. The secret lay in a series

of swaps drawing both on Citicorp's capacity to positio-

swaps as well as its network of counterpartie

_

facilitating the five-legged structure.

"Approaching the Euromarket directly for Swiss

francs and guilders would have been too expensive at the

time, but we were tempted by the rates we could obtain

through the swap," said Marian Ziirsen, head of the

banking office at Mortgage Bank of Denmark. She

estimated straight issues would have cost about 5.907o

a;r.d 7.557o respectively, while the swap costs were

5.45?o andT .121o-asaving of 45 and 43 basis poins.

With a favourable spread locked in, the funds were

destined to be on-lent to Mortgage Bank's customers,

consisting mainly of Danish municipal and stdte-run

entities,

I iLe other government agencies, the bank has

an ongoing need for cheap funds to add to its borrowing

portfolio and then lend to domestic bodies, and is

increasingly turning to the swap market to provide

competitive costs of funds. "The swap market has, in

many cases, enabled us to get better rates over the last

year than by going into the Euro or FRN market

ourselves," explained Ziirsen.

The key component of the deal from Citicorp's poi,

of view was lining up a bank counterparty wanting to

pay sterling and receive Dutch guilders

-

an unusual

combination of currencies. Citi was able to dovetail with

Mortgage Bank's guilder needs, therefore forming the

pivot of the exercise. Only when the sterling/guilder

swap was aligned.was the rest of the deal able to proceed

and a $85 million five-year Eurodollar issue for the

Mortgage Bank launched.

What made the initial swap more complar was the

fact that the Mortgage Bank wanted to swap $50

mil[on of its initial $85 million into Swiss francs and $35

million into guilders leaving Citi with a two currency

coupon flow. The Swiss franc stream was positioned in

Citi's warehouse and swapped into floating dollars,

while the guilder flow

-

a more difficult cashflow to deal

with

-

was swapped for floating sterling. The

sterling/dollar currency mismatch was then hedged in the

forward foreign exchange market, then the . dollar

fixed./floating mismatch solved with a straightforward

interest rate swap with the Citi dollar warehouse.

The guilder/sterling swap was the "stick that stirred

the pot", said Mark Blundell, head of swaps at

Citicorp. Without that tailor-made leg

-

done at a

favourable rate

-

the deal would not have worked. But

10 Special sponsored supplement

SWAPS

the structure also relied on Citi's ability to position swaps

on a number of books simultaneously. "'We were able to

position the Swiss franc/dollar and dollar interest rare

swap in our warehouse easily at the same time. Both

capabilities were needed."

Blundell explained that the seven currency swap

books Citicorp maintains are run on a blended basis,

marked to market every evening and valued at the net

present value of the swaps it is carrying. Swaps of the

kind used in the Mortgage Bank deal can therefore be

offset at the current market level'just like that".

"The timing was absolutely critical," added

Frederick Leeuws of Citicorp, who was responsible for

tracing the guilder/sterling

counterparty. "lt was rather

like a

juggler

throwing up balls and catching them all at

the same time." The tlree currency swaps formed a

triangular structure, added Andre Shortell, who

handled the dollar issue, providing a practical solution to

ihe Mortgage Bank's needs.

"We were very impressed by Citicorp's ability to

carry out the swaps," commented Ziirsen. "l've seen

swaps with three or four parties before, but never five.

I'm amazed it can be done." The bank also appointed

Privat Bank as financial adviser on the deal.

The Mortgage Banh has repeated the same structure

to raise cheap Swiss francs and guilders, and also

variations on dollar swaps to obtain other European

currencies at better rates than a direct Euromarket

offering. It will continue to exploit possibilities to swap

what Ziirsen describes as a "significant proportion" of

its primary market borrowing.

"lt's

a fantastic new environment. We've

just

discovered something of great value." These are the

glowing terms used by Bernt Ljunggren in describing the

technique of applying forward swaps to outstanding,

callable debt. Swedish Export Credit Corporation

(SEC), one of the most sophisticated borrowers in the

Euromarket, showed off its discovery when it teamed a

forward swap with an existing swapped

$ I l2 million

143/+7o issue due I 990 and callable in I 988. It was then

able to launch a new frve-year

$200 million 83AVo issue

swapped into an astonishing Libor minus 200 plus.

"lt was a way of cashing in the value of the future call

in today's low interest rate environment," explained Ben

'Weston,

capital markets specialist at Bankers Trust.

Together with colleagues Tim Lindberg and

John

'Watson,

the Bankers' team devised a scheme to

capitalize on current lower inierest rates to effectively

lock in the value of a call on high-coupon debt.

The value of a future call option on a high-coupon,

fixed-rate bond issue is uncertain, Weston argues. If

SEK waits until l9BB to call the issue, inrerest rates may

have risen to erode

-

or even eliminate

-

the value of the

option compared with today's favourable rates.

SEK and Bankers Trust entered into a forward swap

agreement starting on the call date in 1988 and running

to maturity on the outstanding high coupon bond in

1990. Under the agreement, SEK would pay Bankers

an amount equal to the annual coupon payments on the

outstanding issue in return for Libor. Assuming SEK

calls the issue and refinances at Libor fat (a conservative

estimate for SEK), the cashflows remain unchanged.

The forward swap would simply have reversed the swap

on the original issue from years two to four.

Since the payments from SEK were at a much higher

rate than current swap market rates, Bankers Trust was

prepared to compensate SEK with an up-front payment

for receiving l4Vo aganst Ubor. The sum was close to

eight figures

-

the amount Bankers calculated to be the

net present value of the forward swap. The amount

could be calculated precisely with references to readily

available swap market rates, whereas if SEKhad opted

for a debt warrant issue

-

which would have achieved

the same objective of crystallizing the value of the call

feature

-

the pricing would have depended on investor

demand for a low geared instrument (namely,

a warrant

into a high-coupon bond).

Bernt Ljunggren of Sutedbh Export Credit:

happy in"a fantastic neut enoirorunenttt

The reason the swap written by SEK was so valuable

to Bankers was twofold. Firstly, interest rates had

declined considerably since SEK wrote its original

swap, leaving it with an above market income stream it

Special sponsored supplement 11

SWAPS

agreed to pass on to Bankers. Secondly, the yield curve

had flattened, reducing the cost of forward swaps,

making the SEK agreement all the more attractive.

So far, the cashflow picture was the same as that

created by issuing debt warrants, where the borrower

receives a premium in return for offering investors the

right to exercise into debt at a later date. If SEK had

chosen the warrant route, and interest rates fell, the

investors would exercise the warrants and SEK would

call its l+/c%o issue, maintaining the same stream of

payments. Using the warant structure, SEK would

then have invested the proceeds until needed to finance

the call of its original bond. Instead, the up-front savings

created tlrough the forward swap were spread over the

lifetime of the new bond issue which was then swapped

into deep sub-Libor funds. "We ended up with a

sum-certain lump of value which we distributed over the

new issue," said Weston.

SEK had ensured that the funding for the call was

adequately provided for at today's rates. In this

pre-refinancing, as Bankers calls it, SEK had double

financing for the 6rst two years, which at the time suited

its borrowing requirements. With a continuous demand

for funds from its own borrowers, it could easily

incorporate short term (two year) funds into its debt

portfolio.

"The great thing about the asset structure of SEK is

that we can change our balance sheet when we want,"

said Ljunggren. "One of the negative aspects about

options is that they can put pressure on the balance sheet

at the wrong time. But, in our case, the double financing

suited our needs."

The structure had involved three main components

-

a forward swap, a new issue and a second interest rate

swap of the 85/a7o issue, all against the backdrop of

existing debt at higher levels with a call feature.

Following on from two naked debt warrant issues for

DSM and Casunie, which also capitalized on today's

lower rates to reduce interest costs, the SEK Bankers

deal added the extra layer of a five-year

"front" bond to

pre-refinance the call.

"We built on to the existing technology of the

market," noted Lindberg. "lt was the natural follow-on

from debt warrants." W'eston echoes the sentiment.

"When we saw the naked debt warrant structure, we

asked ourselves 'is there another way to skin this cat?' It

was a purely mathematical decision which of the two

-

debt warrants or a forward swap

-

was the most

efficient."

Bankers argues that the forward swap structure and

particularly, the specific structure executed with SEK,

has advantages of flexibility over debt warrants,

enabling the borrower to benefit from a further

mirviment in interest rates. First, if rates continue to fall,

SEK's net new funding is floating-rate, allowing a

further reduction in interest costs over the life of the

structure. They also calculate that when the call is due, if

rates are higher than 14.47o, it would be cheaper for

SEK to leave the high-coupon issue in place and reverse

the forward swap. "'Warrant deals take a view of rates,"

Weston continued. "They suit borrowers who believe

rates have both bottomed out and will not rise to their

previous levels. Forward swaps with swapped pre-

refinancing give the borrower upside potential

14 Special sponsored supplement

whichever direction interest rates move."

Ljunggren's opinion is that the structure shows up the

value of a'call feature on a bond issue, and may

encourage SEK to build in calls into future Euromarket

offerings.

"l think, on the whole, calls tend to be

undervalued by the market. We will be looking at this

type of structure more and more. With the current

volatility of interest rates, options are coming into their

own."

When faced with three separate swap counterparties,

two would-be 6xed dollar payers and one 6xed Swiss.

'

takes quite a balancing act to coordinate all three ir.-

one mega-deal to satisfu everyone. This was the task

facing Nomura International in late March. In a

structure spanning both the London, New York and

Tokyo offrces, Nomura came up with a complex,

multi-party deal involving a labyrinthine stream of

principal and coupon flows, resulting in a better cost of

funds for the three enitities

-

Coca-Cola FHLB

(Federal Home Loans Bank) and NTN (Toy"

Bearing Company)

-

than each could have obtained by

going directly into the market.

Blaine Tomlhson of Nomura: "We stripped the

cashflo@s to get the exposure ute needed. . . "

"Our approach was to see the whole structure as a

series of cashflows rather than separate swapped bond

isspes," said Blaine Tomlinson, Noniura's head of

swaps in London.

"ln addition to the natural geographic

arbitrages between borrowers and investors taking each

borrower to the most receptive investor base there was

the currency option built into the heaven and hell issue,

which had substantial economic value to both issuers."

"We carry a list of borrowers with certain targets in

mind," added Antony Yates of Nomura.

"Coke

and

FHLB wanted fixed dollars, while NTN wanted 6xed

Swiss francs, and it happened they all wanted l0-year