Beruflich Dokumente

Kultur Dokumente

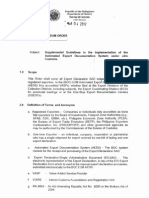

Bir Form 0605

Hochgeladen von

John Louise Tan100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

727 Ansichten2 SeitenThis document is a payment form from the Bureau of Internal Revenue of the Philippines. It contains instructions for taxpayers to use when making various tax payments, including income tax installments, deficiency taxes, penalties, and registration fees. The form requests background information about the taxpayer and tax details. It is to be filed in triplicate with an Authorized Agent Bank or Revenue office when tax payments are due.

Originalbeschreibung:

BIR FORM 0605

Originaltitel

BIR FORM 0605

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document is a payment form from the Bureau of Internal Revenue of the Philippines. It contains instructions for taxpayers to use when making various tax payments, including income tax installments, deficiency taxes, penalties, and registration fees. The form requests background information about the taxpayer and tax details. It is to be filed in triplicate with an Authorized Agent Bank or Revenue office when tax payments are due.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

727 Ansichten2 SeitenBir Form 0605

Hochgeladen von

John Louise TanThis document is a payment form from the Bureau of Internal Revenue of the Philippines. It contains instructions for taxpayers to use when making various tax payments, including income tax installments, deficiency taxes, penalties, and registration fees. The form requests background information about the taxpayer and tax details. It is to be filed in triplicate with an Authorized Agent Bank or Revenue office when tax payments are due.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

(To be filled up the BIR)

DLN: PSIC: PSOC:

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1

For the Calendar Fiscal

3

Quarter

4 Due Date ( MM / DD / YYYY) 5

No. of Sheets

6 A T C

2

Year Ended Attached

( MM / YYYY ) 1st 2nd 3rd 4th

7 Return Period ( MM / DD / YYYY )

8 Tax Type Code

BCS No./Item No. (To be filled up by the BIR)

7 8

Part I B a c k g r o u n d I n f o r m a t i o n

9 Taxpayer Identification No. 10 RDO Code 11 Taxpayer Classification 12 Line of Business/Occupation

I N

13 Taxpayer's 13 14 Telephone Number

Name

(Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individuals)

15 Registered 16 Zip Code

Address

17 Manner of Payment 18 Type of Payment

Voluntary Payment Per Audit/Delinquent Account Installment

Self-Assessment

Penalties

Preliminary/Final Assessment/Deficiency Tax No. of Installment

Tax Deposit/Advance Payment Accounts Receivable/Delinquent Account Partial

Income Tax Second Installment Payment

(Individual) Full

Others (Specify) Payment

Part II C o m p u t a t i o n o f T a x

19 Basic Tax / Deposit / Advance Payment

19

20 Add: Penalties Surcharge Interest Compromise

20A 20B 20C 20D

21 Total Amount Payable (Sum of Items 19 & 20D)

21

For Voluntary Payment For Payment of Deficiency Taxes Stamp of Receiving

From Audit/Investigation/ Office

and Date of Receipt

I declare, under the penalties of perjury, that this document has been

APPROVED BY:

made in good faith, verified by me, and to the best of my knowledge and

belief, is true and correct, pursuant to the provisions of the National

Internal Revenue Code, as amended, and the regulations issued under

authority thereof.

22B

22A

Signature over Printed Name of Taxpayer/Authorized Representative Title/Position of Signatory

Part III D e t a i l s of P a y m e n t

Particulars Drawee Bank/Agency Number MM DD YYYY Amount

23 Cash/Bank 23

Debit Memo

24A 24B 17C 24C 24D

24 Check

25 Tax Debit 25A 25B 25C

Memo

26A 26B 19C 26C 26D

26 Others

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

Taxpayer Classification: I - Individual N - Non-Individual

BIR Form 0605 (ENCS) - PAGE 2

ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT

Deliquent Accounts

Signature over Printed Name of

Head of Office

BIR Form No.

Payment Form

0605

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

July 1999 (ENCS)

X

1 2 2 0 1 3

X

X

PHP 1,000 00

PHP 1,000 00

JAN LEON TIO TAN

2 5 8 5 5 5 0 8 5 0 0 0 015 X SACKS PRINTING0

DADAP, LUNA, ISABELA PHILIPPINES 3 3 0 4

JAN LEON T. TAN

II 011 Pure Compensation Income Tobacco Products XP120 Avturbo Jet Fuel

II 012 Pure Business Income XT010 & XT020 Smoking and Chewing Tobacco XP130 & XP131 Kerosene

II 013 Mixed (Compensation and Business) XT030 Cigars XP170 Asphalts

MC 180 Vat/Non-Vat Registration Fee XT040 Cigarettes Packed By Hand XP150 & XP160 LPG Gas

MC 190 Travel Tax XT050-XT130 Cigarettes Packed By Machine XP010, XP020 & Basetocks, Lubes and

MC 090 Tin Card Fees Tobacco Inspection Fees XP190 Greases

MC010 & MC020 Tax Amnesty XT080 Cigars XP040 Waxes and Petrolatum

MC 040 Income from Forfeited Properties XT090 Cigarettes XP030 Processed Gas

MC 050 Proceeds from Sale of Rent Estate XT100 & XT110 Leaf Tobacco & Other Manufactured Tobacco Miscellaneous Products/Articles

MC 060 Energy Tax on Electric Power Consumption XT120 Monitoring Fees XG020-XG090 Automobiles

MC 031 Deficiency Tax Petroleum Products XG100-XG120 Non Essential Goods

MC 030 Delinquent Accounts/Accounts Receivable XP070 Premium (Leaded) Gasoline Mineral Products

FP 010 - FP 930 Fines and Penalties XP060 Premium (Unleaded) Gasoline XM010 Coal & Coke

MC 200 Others XP080 Regular Gasoline XM020 Non Metallic & Quarry Resources

Excise Tax on Goods XP090 & XP100 Naptha & Other Similar Products XM030 Gold and Chromite

Alcohol Products XP110 Aviation Gasoline XM040 Copper & Other Metallic Minerals

XA010-XA040 Distilled Spirits XP140 Diesel Gas XM050 Indigenous Petroleum

XA061-XA090 Wines XP180 Bunker Fuel Oil XM051 Others

XA051-XA053 Fermented Liquor

T A X T Y P E

Code Description Code Description Code Description

RF REGISTRATION FEE CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-COMPENSATION

TR TRAVEL TAX-PTA ES ESTATE TAX WE WITHHOLDING TAX-EXPANDED

ET ENERGY TAX DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

QP QUALIFYING FEES-PAGCOR VT VALUE-ADDED TAX WG WITHHOLDING TAX - VAT AND OTHER

MC MISCELLANEOUS TAX PT PERCENTAGE TAX PERCENTAGE TAXES

XV EXCISE-AD VALOREM ST PERCENTAGE TAX - STOCKS WO WITHHOLDING TAX-OTHERS (ONE-TIME TRAN-

XS EXCISE-SPECIFIC SO PERCENTAGE TAX - STOCKS (IPO) SACTION NOT SUBJECT TO CAPITAL

XF TOBACCO INSPECTION AND SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

MONITORING FEES DS DOCUMENTARY STAMP TAX WR WITHHOLDING TAX - FRINGE BENEFITS

IT INCOME TAX WB WITHHOLDING TAX-BANKS AND OTHER WW WITHHOLDING TAX - PERCENTAGE TAX

CG CAPITAL GAINS TAX - Real Property FINANCIAL INSTITUTIONS ON WINNING AND PRIZES

BIR Form No. 0605 - Payment Form

Guidelines and Instructions

Who Shall Use

Every taxpayer shall use this form, in triplicate, to

pay taxes and fees which do not require the use of a tax

return such as second installment payment for income

tax, deficiency tax, delinquency tax, registration fees,

penalties, advance payments, deposits, installment

payments, etc.

When and Where to File and Pay

This form shall be accomplished:

1. Everytime a tax payment or penalty is due

or an advance payment is to be made;

2. Upon receipt of a

demand letter/assessment notice and/or

collection letter from the BIR; and

3. Upon payment of annual registration fee for

new business and for renewals on or before

January 31 of every year.

This form shall be filed and the tax shall be paid

with any Authorized Agent Bank (AAB) under the

jurisdiction of the Revenue District Office where the

taxpayer is required to register/conducting

business/producing articles subject to excise tax/having

taxable transactions. In places where there are no

AABs, this form shall be filed and the tax shall be paid

directly with the Revenue Collection Officer or duly

Authorized City Or Municipal Treasurer of the

Revenue District Office where the taxpayer is required

to register/conducting business/producing articles

subject to excise tax/having taxable transactions, who

shall issue Revenue Official Receipt (BIR Form No.

2524) therefor.

Where the return is filed with an AAB, the

lower portion of the return must be properly

machine-validated and stamped by the Authorized

Agent Bank to serve as the receipt of payment. The

machine validation shall reflect the date of payment,

amount paid and transaction code, and the stamp

mark shall show the name of the bank, branch code,

tellers name and tellers initial. The AAB shall also

issue an official receipt or bank debit advice or credit

document, whichever is applicable, as additional

proof of payment.

One set of form shall be filled-up for each kind

of tax and for each taxable period.

Attachments

1. Duly approved Tax Debit Memo, if applicable;

2. Copy of letter or notice from the BIR for which

this payment form is accomplished and the tax

is paid whichever is applicable:

a. Pre-Assessment / Final Assessment

Notice/Letter of Demand

b. Post Reporting Notice

c. Collection Letter of Delinquent/

Accounts Receivable

d. Xerox copy of the return

(ITR)/Reminder Letter in case of

payment of second installment on

income tax.

Note: All background information must be

properly filled up.

The last 3 digits of the 12-digit TIN refers to the

branch code.

ENCS

Das könnte Ihnen auch gefallen

- 2307Dokument2 Seiten2307Nephy Bersales Taberara67% (3)

- Question 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofDokument3 SeitenQuestion 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofAlyssa Paula Altaya100% (2)

- Barangay Micro Business EnterpriseDokument16 SeitenBarangay Micro Business EnterpriseGerson CastroNoch keine Bewertungen

- CAT Accelerated Level 1Dokument4 SeitenCAT Accelerated Level 1aliciarigonan100% (1)

- Notes in StatisticsDokument36 SeitenNotes in StatisticsAlexanderOcbaAgoyloNoch keine Bewertungen

- Company Study - Ayala Land CorporationDokument7 SeitenCompany Study - Ayala Land CorporationRalph Adrian MielNoch keine Bewertungen

- A-Basic Share Capital Transactions2Dokument4 SeitenA-Basic Share Capital Transactions2Sophia Santos0% (1)

- Projected Income Statement of Ayala Land IncorporationDokument2 SeitenProjected Income Statement of Ayala Land IncorporationErika May RamirezNoch keine Bewertungen

- Gross Estate: Chapter 13-A: Gross Esate - Common RulesDokument3 SeitenGross Estate: Chapter 13-A: Gross Esate - Common RulesTitania ErzaNoch keine Bewertungen

- Citibank in Zaire CaseDokument19 SeitenCitibank in Zaire CaseMike Stephen TanNoch keine Bewertungen

- PLDT Ultera Request BillingDokument1 SeitePLDT Ultera Request Billingkim_santos_20Noch keine Bewertungen

- Atp Book Exercises inDokument6 SeitenAtp Book Exercises inKjoimyl CastilloNoch keine Bewertungen

- Definition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeDokument13 SeitenDefinition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeSKEETER BRITNEY COSTANoch keine Bewertungen

- Individuals Assign3Dokument7 SeitenIndividuals Assign3jdNoch keine Bewertungen

- Nfjpiancr 1920 Invitation Letter AcadconnorthDokument4 SeitenNfjpiancr 1920 Invitation Letter AcadconnorthjpiaNoch keine Bewertungen

- Maris CorporationDokument2 SeitenMaris CorporationmageNoch keine Bewertungen

- Reaction Paper - TaxationDokument1 SeiteReaction Paper - TaxationRodel Novesteras ClausNoch keine Bewertungen

- Bdo - Industryanalysis PaperDokument12 SeitenBdo - Industryanalysis PaperJohn Michael Dela CruzNoch keine Bewertungen

- Ge Elec 6 Flexible Obtl A4Dokument9 SeitenGe Elec 6 Flexible Obtl A4Alexandra De LimaNoch keine Bewertungen

- Im in International Business and Trade StudentsDokument84 SeitenIm in International Business and Trade Studentsdonttellmewhattodo.14Noch keine Bewertungen

- Credit and Background: Microfinance Flow ChartDokument21 SeitenCredit and Background: Microfinance Flow ChartJerry Sarabia JordanNoch keine Bewertungen

- Chapter 20Dokument25 SeitenChapter 20Aarti BalanNoch keine Bewertungen

- The Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio CityDokument14 SeitenThe Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio Cityjovelyn labordoNoch keine Bewertungen

- Economic Dev. Chapter 4Dokument66 SeitenEconomic Dev. Chapter 4oliiiiiveeeNoch keine Bewertungen

- Final Activity Income TaxationDokument6 SeitenFinal Activity Income TaxationPrincess MarianoNoch keine Bewertungen

- LkhgyDokument2 SeitenLkhgyDynNoch keine Bewertungen

- Midterm Exam in Capital Market 1Dokument4 SeitenMidterm Exam in Capital Market 1Joel PangisbanNoch keine Bewertungen

- EXERCISE 7 (Indifference Curve Approach)Dokument1 SeiteEXERCISE 7 (Indifference Curve Approach)Irene Pacunayen100% (1)

- Financial Manamegent Prelim ModuleDokument52 SeitenFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- Donor's TaxDokument1 SeiteDonor's TaxJustineMaeMillanoNoch keine Bewertungen

- (A) To Investigate All Aspects of The Event (Including Safety and Security) and Accordingly (B)Dokument3 Seiten(A) To Investigate All Aspects of The Event (Including Safety and Security) and Accordingly (B)Berlyn Joyce S. HILISANNoch keine Bewertungen

- Annex B Livelihood Survey Questionnaire IndividualDokument3 SeitenAnnex B Livelihood Survey Questionnaire IndividualCarl100% (1)

- Five Interacting Components of Accounting Information SystemsDokument2 SeitenFive Interacting Components of Accounting Information SystemsFaye AlonzoNoch keine Bewertungen

- Financial Statements Unsolved PDFDokument4 SeitenFinancial Statements Unsolved PDFallijahNoch keine Bewertungen

- FS On Lending BusinessDokument3 SeitenFS On Lending BusinessMika FrancoNoch keine Bewertungen

- Credit Investigation or Background Investigation PDFDokument4 SeitenCredit Investigation or Background Investigation PDFjoan100% (3)

- Microeconomics Tutorial 2Dokument2 SeitenMicroeconomics Tutorial 2zillxsNoch keine Bewertungen

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDokument9 SeitenCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNoch keine Bewertungen

- Ch. 4: Financial Forecasting, Planning, and BudgetingDokument41 SeitenCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8Noch keine Bewertungen

- Documents in Credit TransactionsDokument6 SeitenDocuments in Credit Transactionsgeofrey gepitulanNoch keine Bewertungen

- OM3 CH 11 Forecasting and Demand PlanningDokument17 SeitenOM3 CH 11 Forecasting and Demand PlanningGeorge VilladolidNoch keine Bewertungen

- Backup QuestionnaireDokument4 SeitenBackup QuestionnaireJennelyn AbellaNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledJeremia DaNoch keine Bewertungen

- Chapter 7Dokument26 SeitenChapter 7Jenny Rose Castro FernandezNoch keine Bewertungen

- 3rd Tax Compliance of Freelance Workers in Lipa CityDokument146 Seiten3rd Tax Compliance of Freelance Workers in Lipa CityKrystel Mae JaenNoch keine Bewertungen

- Next-X Inc - FinalDokument9 SeitenNext-X Inc - FinalJam Xabryl AquinoNoch keine Bewertungen

- Dissolution and Winding UpDokument110 SeitenDissolution and Winding UpHahajaijaNoch keine Bewertungen

- TAX BAR Qs With AnswersDokument10 SeitenTAX BAR Qs With AnswersJanila BajuyoNoch keine Bewertungen

- RFBT Case Study - MidtermDokument1 SeiteRFBT Case Study - MidtermShenn Rose CarpenteroNoch keine Bewertungen

- Cover SheetDokument4 SeitenCover SheetJhoanna TriaNoch keine Bewertungen

- Audit QuestionsDokument2 SeitenAudit QuestionsJoseph Bayo Basan0% (1)

- Case Study Analysis Using MS Word and MS Excel: Laboratory ExerciseDokument3 SeitenCase Study Analysis Using MS Word and MS Excel: Laboratory ExerciseAbbegail CalinaoNoch keine Bewertungen

- LAW AMLA PresentationDokument28 SeitenLAW AMLA PresentationThilagavathy PalaniappanNoch keine Bewertungen

- Final Exam Taxation 101Dokument8 SeitenFinal Exam Taxation 101Live LoveNoch keine Bewertungen

- Can The Findings of Traits Approaches Be Used To Train Potential LeadersDokument1 SeiteCan The Findings of Traits Approaches Be Used To Train Potential LeadersVikram KumarNoch keine Bewertungen

- TaxationDokument9 SeitenTaxationGio PacayraNoch keine Bewertungen

- BIR Form 1701-Jan-2018-Encs.-FinalDokument6 SeitenBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Bir 0605Dokument11 SeitenBir 0605Sheelah Sawi0% (1)

- Econometrics Assignment.Dokument0 SeitenEconometrics Assignment.Naveen BharathiNoch keine Bewertungen

- 337 Hotel Management & CateringDokument175 Seiten337 Hotel Management & CateringThusith WijayawardenaNoch keine Bewertungen

- Stok Masuk-2021-02-16 - 2021-02-16Dokument6 SeitenStok Masuk-2021-02-16 - 2021-02-16feni enjelinaaNoch keine Bewertungen

- Memorandum Circular Number 2011-004Dokument12 SeitenMemorandum Circular Number 2011-004Amber ThompsonNoch keine Bewertungen

- Purisima Vs Phil Tobacco Case Digest - LuigiDokument1 SeitePurisima Vs Phil Tobacco Case Digest - LuigiLuigi JaroNoch keine Bewertungen

- Naway - Jury Level.6 Teacher's.notes 5pDokument5 SeitenNaway - Jury Level.6 Teacher's.notes 5pPaula Andrea MoreiraNoch keine Bewertungen

- 261 SCRA 236 Commissioner of Internal Revenue Vs CA 1996Dokument31 Seiten261 SCRA 236 Commissioner of Internal Revenue Vs CA 1996Panda CatNoch keine Bewertungen

- Cigarettes Brands in India .Dokument53 SeitenCigarettes Brands in India .MerroDon ThomasNoch keine Bewertungen

- Vroom Postmedieval CeramicsDokument24 SeitenVroom Postmedieval Ceramicslatinist1Noch keine Bewertungen

- Sales and Distribution Channel of ITC Cigarettes 1Dokument18 SeitenSales and Distribution Channel of ITC Cigarettes 1RishabhKumarNoch keine Bewertungen

- 3.29 Zapp Ingles Listening AdvertisingDokument15 Seiten3.29 Zapp Ingles Listening Advertisinggiancarlo1396Noch keine Bewertungen

- Quitters Inc. TextDokument14 SeitenQuitters Inc. TextElvis StevenNoch keine Bewertungen

- English Essay UpsrDokument11 SeitenEnglish Essay UpsrShalini BhaskaranNoch keine Bewertungen

- OD4141 Medical - Recreational Marijuana Growing Industry ReportDokument31 SeitenOD4141 Medical - Recreational Marijuana Growing Industry ReportOozax OozaxNoch keine Bewertungen

- MIGHTY CORPORATION and LA CAMPANA FABRICA DE TABACODokument3 SeitenMIGHTY CORPORATION and LA CAMPANA FABRICA DE TABACOPhi SalvadorNoch keine Bewertungen

- Benson & HedgesDokument17 SeitenBenson & HedgesAash KhanNoch keine Bewertungen

- Reorder ParagraphsDokument45 SeitenReorder ParagraphsKhuram TabassomNoch keine Bewertungen

- Akij Food and Beverage LimitedDokument32 SeitenAkij Food and Beverage LimitedLayal Hasan67% (3)

- HotsDokument46 SeitenHotsTina Roy100% (1)

- Imperial Tobacco Company of India Limited (ITC) .: Presented byDokument23 SeitenImperial Tobacco Company of India Limited (ITC) .: Presented byanshikapoorNoch keine Bewertungen

- ITC PPT On Consumer BehaviorDokument13 SeitenITC PPT On Consumer BehaviorAamir KhanNoch keine Bewertungen

- 2016 VTN Issue 020Dokument32 Seiten2016 VTN Issue 020Bounna PhoumalavongNoch keine Bewertungen

- Trademark Cases: IPC Sections 161-170Dokument19 SeitenTrademark Cases: IPC Sections 161-170Jose Li ToNoch keine Bewertungen

- GhodawatGroup Presen 06oct06Dokument37 SeitenGhodawatGroup Presen 06oct06api-3823381100% (1)

- Eng - PPTDokument24 SeitenEng - PPTLore BallesterosNoch keine Bewertungen

- General Insurance Agent ManualDokument192 SeitenGeneral Insurance Agent ManualVinay SinghNoch keine Bewertungen

- Sin Tax in The PHDokument3 SeitenSin Tax in The PHMary Louise R. ConcepcionNoch keine Bewertungen

- HDPE KT10000 HD Ép Dow Mfi 8Dokument3 SeitenHDPE KT10000 HD Ép Dow Mfi 8Vishal RawlaniNoch keine Bewertungen

- Banquet Policy PDFDokument3 SeitenBanquet Policy PDFreceptionhallsNoch keine Bewertungen

- TaxDokument21 SeitenTaxDemi PardilloNoch keine Bewertungen