Beruflich Dokumente

Kultur Dokumente

Australian Managed Volatility Alpha: By, Cfa Head of Active Quantitative Equities, APAC

Hochgeladen von

api-127423253Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Australian Managed Volatility Alpha: By, Cfa Head of Active Quantitative Equities, APAC

Hochgeladen von

api-127423253Copyright:

Verfügbare Formate

ACTIVE EQUITY | STRATEGY HIGHLIGHTS

Australian Managed

Volatility Alpha

THE OTHER FORTY-FIVE PERCENT

The concentration of the Australian equity market is not a

sudden insight for most experienced investors, but it may

surprise some people to know how much contribution to risk

comes from banks and resources these days.

Firstly, lets touch on the banks. They are highly correlated,

so together they really represent one mega-bank: one exposure

amounts to about 30 percent of the S&P/ASX 300 Index. This

mega-bank is dependent on the Australian housing market and

unemployment remaining reasonable. If there are any doubts

about the local economy then you need to know that roughly

one third of the index is relying on it. How likely are the banks to

outperform the market for a third year in a row?

Next, lets think about the resources companies. Most of their

advancement and decline over the last 10 years has been

driven by expectations of Chinese demand for things we can dig

out of the ground. It is a fair expectation that the risk associated

with this segment will continue to be infuenced by surprises

to economic growth or policy response in China. Resources

contribute about a quarter of the risk of the S&P/ASX 300 index.

Where does that leave us? To summarise, approximately 30

percent of the Index could be impacted by a rollover in the

housing market and coupled with unemployment, 25 percent

from unexpected changes to Chinese growth and demand for

rocks. That leaves only around 45 percent of the Index exposed

to other thingsfor example, global developed market

growth, an ageing population and global regulatory changes for

healthcare reform, domestic staples, defensive segments and

technological advancement.

We think the banks and resources are likely to deliver below

market returns and/or higher risk to the market, so picking from

the other 45 percent is important for any Australian investment

portfolio in 2014. A diversifed and careful exposure to stocks

in these segmentssuch as healthcare and transport will

do better than concentrating the portfolio heavily in two narrow

themes, just as the market does. Our suggestion? Make sure

you build your portfolio with multiple sources of return, and a

greater contribution from the other 45 percent.

The SSgA Australian Managed Volatility Alpha Strategy (the

Strategy) prefers quality companies with growth potential,

strong cash fows, sustainable dividends at attractive valuations.

The benchmark index does not drive our portfolio construction.

MARCH 2014 MONTHLY UPDATE

by

Olivia Engel, CFA

Head of Active Quantitative

Equities, APAC

Figure 1: Contribution to Risk* S&P/ASX 300

Resources

25%

Others

44%

Banks

32%

Figure 2: Contribution to Risk* SSgA Australian Managed

Volatility Alpha Fund

*Contribution to total Industry Risk, Axioma Australian Medium Horizon Fundament Risk Model

Source: Axioma, Bloomberg, State Street Global Advisors, as of 31 December 2013

Resources

13%

Banks

4%

Others

83%

AUSTRALIAN MANAGED VOLATILITY ALPHA

2

The Strategy returned 0.07% (before fees) in March 2014.

The stock selection model showed good results within the

Consumer and Materials & Energy names. Companies that

were ranked well within our stock selection model such as G8

Education (+23.1%), DuluxGroup (+6.7%) and Kathmandu

(+20.5%) contributed positively. This was offset by the lower

representation in the major banks, which all performed strongly

during March. For the March quarter the Australian Managed

Volatility Alpha Strategy delivered a return of +2.5%, 0.5%

above the S&P/ASX 300 Index return of 2.0%.

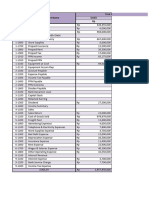

Figure 3: SSgA Australian Managed Volatility Alpha (AMVA) Strategy

March 2014 Performance (gross)

1 Month (%) 3 Months (%) CYTD (%)

1 Year

(% p.a.)

3 Years

(% p.a.)

Since Inception

(% p.a.)

3 Years

Risk (%)^

3 Years

Sharpe Ratio

SSgA Australian Managed

Volatility Alpha*

0.07 2.51 2.51 11.95 14.51 12.07 8.00 1.35

Benchmark 0.21 1.99 1.99 12.97 8.17 7.31 12.21 0.36

Value Added** -0.14 0.52 0.52 -1.02 6.34 4.77 -4.21 0.98

Inception date is September 2009. Benchmark: S&P/ASX 300 Accumulation Index, S&P/ASX 200 All Australian Accumulation Index prior to February 2013

^ Standard deviation of monthly returns. *Performance shown is for the SSgA Australian Managed Volatility Alpha Trust. **The value added returns may show rounding differences.

Historic performance is not necessarily indicative of future performance, which could differ substantially. The performance fgures contained herein are provided on a gross of fees basis and do not

refect the deduction of advisory or other fees which could reduce the return. The performance includes the reinvestment of dividends and other corporate earning is calculated in Australian dollars.

The index returns are unmanaged and do not refect the deduction of any fees or expenses. The index returns refect all items of income, gain and loss and the reinvestment of dividends and other

income. Performance returns for periods of less than one year are not annualised.

Source: S&P and State Street Global Advisors

Figure 4: Broad Diversifcation Across Sectors and Valuation Measures

Current Positioning as at 31 March 2014

Industry Examples of Portfolio Holdings

Consumers Coca-Cola, SKY Network, Tassal Group, Tatts Group, Village Roadshow, Wesfarmers, Woolworth

Utilities & Infrastructure AGL Energy, DUET Group, Spark Infrastructure, SP Ausnet, Sydney Airport, Transurban

Industrials Aurizon, Programmed Maintenance, Toll Holdings

Health Care Ramsay, Resmed, Sonic Healthcare

Financials ANZ, Challenger, IAG, NAB, SunCorp

A-REITs BWP Trust, CFS Retail, Federation Centres, GPT, Westfeld Retail

Materials and Energy Amcor, BC Iron, BHP Billiton, Dulux Group, Rio Tinto, Woodside Petroleum

Source: State Street Global Advisors, Factset

3 2014 State Street Corporation. All Rights Reserved. ID1126-AUSMKT-1108 0414 Exp. Date: 30/04/2015

ssga.com

State Street Global Advisors, Australia, Limited (ABN 42 003 914 225) (State Street Global Advisors Australia) is the holder of an Australian Financial Services Licence (AFSL Number 238276).

State Street Global Advisors Australias Responsible Entity, State Street Global Advisors, Australia Services Limited (ABN 16 108 671 441) (State Street Global Advisors, ASL) holds an Australian

Financial Services Licence (AFSL Number 274900) pursuant to Section 913B of the Corporations Act 2001. Registered offce: Level 17, 420 George Street, Sydney, NSW 2000, Australia Telephone:

+612 9240-7600 Facsimile: +612 9240-7611 Web: State Street Global Advisors.com.

References to the SSgA Australian Managed Volatility Alpha Trust (the Fund) in this document are references to the managed investment schemes domiciled in Australia, promoted by SSgA

Australia, in respect of which SSgA, ASL is the Responsible Entity.

The views expressed in this material are the views of the Australian Active Equity Team through the period ended 11 April 2014 and are subject to change based on market and other conditions.

The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not

guaranteed. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and

actual results or developments may differ materially from those projected. Past performance is not a guarantee of future results.

Risk associated with equity investing include stock values which may fuctuate in response to the activities of individual companies and general market and economic conditions. There are a number

of risks associated with futures investing including but not limited to counterparty credit risk, currency risk, derivatives risk, foreign issuer exposure risk, sector concentration risk, leveraging and

liquidity risks. Derivative investments may involve risks such as potential illiquidity of the markets and additional risk of loss of principal. Investing in foreign domiciled securities may involve risk of

capital loss from unfavourable fuctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Standard & Poors and S&P are registered trademarks of Standard & Poors Financial Services LLC (S&P) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow

Jones) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed by SSgA. The S&P/ASX 300 Index is a product of S&P Dow Jones Indices LLC, and has been licensed by

SSgA. SSgAs Australian Managed Volatility Alpha Strategy is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affliates, and none of S&P

Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affliates make any representation regarding the advisability of investing in such product(s).

The information in this document does not constitute an offer to any person to apply for interests in the Fund and must not be taken to be an offer. Past performance is not a reliable indicator of future

performance. Interest in the Fund is generally only available to persons in Australia and New Zealand who are eligible to hold interests in the Fund only. This document should be read in conjunction

with the latest Product Disclosure Statement which contains more information regarding the charges, expenses and risks involved when investing in the Funds.

An investment in the Fund does not represent a deposit with or liability of any company in the State Street group of companies. No company in the State Street group of companies, including SSgA,

ASL, State Street Bank and Trust Company (ABN 70 062 819 630) (AFSL Number 239679) and SSgA Australia guarantees the performance of any Funds or the repayment of capital or any particular

rate of return. The Funds are subject to investment risk including possible delays in repayment and loss of income and principal invested. Investors should obtain independent fnancial and other

professional advice before making investment decisions.

The information contained in this document is for information purposes only. SSgA Australia and SSgA, ASL, its employees, directors and offcers accept no liability for this information or any

consequences from its use. No person or entity should act on the basis of any information contained in this document without taking appropriate professional advice. Nothing contained in this

document constitutes an offer of, or an invitation to purchase or subscribe for interests in SSgA Australia Funds.

This material is of a general nature only and does not constitute personal advice. It does not constitute investment advice and it should not be relied on as such. It does not take into account any

investors particular investment objectives, strategies, tax status or investment horizon. We encourage you to consult your tax or fnancial advisor. There is no representation or warranty as to the

current accuracy of, nor liability for, decisions based on such information.

This communication is directed at institutional and wholesale clients only. The products and services to which this communication relates are only available to such persons and persons of any other

description (including retail clients) are not entitled to rely on this communication.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSgA Australias express written consent.

State Street Global Advisors is the investment management business

of State Street Corporation (NYSE: STT), one of the worlds leading

providers of fnancial services to institutional investors.

AUSTRALIAN MANAGED VOLATILITY ALPHA

Das könnte Ihnen auch gefallen

- ASX Announcement: 30 November 2012 Nib Completes Acquisition of TOWER Medical Insurance in New ZealandDokument1 SeiteASX Announcement: 30 November 2012 Nib Completes Acquisition of TOWER Medical Insurance in New Zealandapi-127423253Noch keine Bewertungen

- Investors Not Acting in Their Own Best InterestDokument3 SeitenInvestors Not Acting in Their Own Best Interestapi-127423253Noch keine Bewertungen

- Investor Confidence Index Falls in September by 3.5 Points To 101.4Dokument2 SeitenInvestor Confidence Index Falls in September by 3.5 Points To 101.4api-127423253Noch keine Bewertungen

- Investor Confidence Index Up Slightly in July From 93.3 To 94.0Dokument2 SeitenInvestor Confidence Index Up Slightly in July From 93.3 To 94.0api-127423253Noch keine Bewertungen

- Ssga Appoints Amanda Skelly Head of Australian SPDR Etf BusinessDokument3 SeitenSsga Appoints Amanda Skelly Head of Australian SPDR Etf Businessapi-127423253Noch keine Bewertungen

- State Street To Acquire Goldman Sachs Administration ServicesDokument4 SeitenState Street To Acquire Goldman Sachs Administration Servicesapi-127423253Noch keine Bewertungen

- News Release: Contact: Ric Shadforth (02) 8249 1110Dokument13 SeitenNews Release: Contact: Ric Shadforth (02) 8249 1110api-127423253Noch keine Bewertungen

- ASX Announcement: Hastings Diversified Utilities Fund (HDF)Dokument2 SeitenASX Announcement: Hastings Diversified Utilities Fund (HDF)api-127423253Noch keine Bewertungen

- Investor Confidence Index Rises 7.0 Points in June From 86.5 To 93.5Dokument2 SeitenInvestor Confidence Index Rises 7.0 Points in June From 86.5 To 93.5api-127423253Noch keine Bewertungen

- Ssga Australian Equity Market OutlookDokument2 SeitenSsga Australian Equity Market Outlookapi-127423253Noch keine Bewertungen

- State Street Awarded 2012 EOWA Employer of Choice For Women Citation For The 4th Consecutive YearDokument2 SeitenState Street Awarded 2012 EOWA Employer of Choice For Women Citation For The 4th Consecutive Yearapi-127423253Noch keine Bewertungen

- H3 Global Advisors Awarded Commodities Mandate by Local Government SuperDokument1 SeiteH3 Global Advisors Awarded Commodities Mandate by Local Government Superapi-127423253Noch keine Bewertungen

- Horizon Oil (HZN) Advises Half-Year Profit After Tax of Us$8.5 MillionDokument28 SeitenHorizon Oil (HZN) Advises Half-Year Profit After Tax of Us$8.5 Millionapi-127423253Noch keine Bewertungen

- Press Release: Contact: Ric Shadforth, State StreetDokument3 SeitenPress Release: Contact: Ric Shadforth, State Streetapi-127423253Noch keine Bewertungen

- ASX Announcement: Hastings Diversified Utilities Fund (HDF)Dokument4 SeitenASX Announcement: Hastings Diversified Utilities Fund (HDF)api-127423253Noch keine Bewertungen

- State Street Launches Swapex Initiative, Significantly Expanding End-To-End Derivatives SolutionDokument3 SeitenState Street Launches Swapex Initiative, Significantly Expanding End-To-End Derivatives Solutionapi-127423253Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Android Hacker-S HandbookDokument2 SeitenAndroid Hacker-S HandbookJack LeeNoch keine Bewertungen

- Prime Bank LimitedDokument29 SeitenPrime Bank LimitedShouravNoch keine Bewertungen

- Mutual Help in Rural GaliciaDokument19 SeitenMutual Help in Rural GaliciamasewalNoch keine Bewertungen

- The Coca Cola Company Financial Risk AssessmentDokument6 SeitenThe Coca Cola Company Financial Risk AssessmentAshmit RoyNoch keine Bewertungen

- 2016 Nomura Summer Internship ProgramDokument25 Seiten2016 Nomura Summer Internship ProgramTing-An KuoNoch keine Bewertungen

- PRe Departmental ReviwersDokument7 SeitenPRe Departmental ReviwersCañon, Lorenz GeneNoch keine Bewertungen

- Credit and Thrift Co-Operatives in NigeriaDokument6 SeitenCredit and Thrift Co-Operatives in NigeriaAbu FadilahNoch keine Bewertungen

- Subject Link 5 WB KeysDokument18 SeitenSubject Link 5 WB Keyssolsol0125Noch keine Bewertungen

- Violation of The Truth Lending Act, Sample ComplaintDokument12 SeitenViolation of The Truth Lending Act, Sample ComplaintShan KhingNoch keine Bewertungen

- Exercise 2 - AccountingDokument2 SeitenExercise 2 - AccountingAnna Jeramos25% (4)

- Siklus Akuntansi Pada PT Adi JayaDokument11 SeitenSiklus Akuntansi Pada PT Adi Jayafitrianura04Noch keine Bewertungen

- Macroeconomics 1B: Mthokozisi MliloDokument41 SeitenMacroeconomics 1B: Mthokozisi MliloJake DysonNoch keine Bewertungen

- Treasury Management AssignmentDokument11 SeitenTreasury Management AssignmentBulshaale Binu Bulshaale100% (1)

- LCC PDFDokument79 SeitenLCC PDFSyikin RadziNoch keine Bewertungen

- 153b First Grading ExamDokument7 Seiten153b First Grading ExamJungie Mablay WalacNoch keine Bewertungen

- "The Curse of Cash" by Ken RogoffDokument21 Seiten"The Curse of Cash" by Ken RogoffOnPointRadio100% (1)

- Wahyudi-Syaputra Assignment-2 Akl-IiDokument4 SeitenWahyudi-Syaputra Assignment-2 Akl-IiWahyudi SyaputraNoch keine Bewertungen

- Tata Motors Notes Forming Part of Financial StatementsDokument36 SeitenTata Motors Notes Forming Part of Financial StatementsSwarup RanjanNoch keine Bewertungen

- Fa Finc 2302 Approved (Sem 2 2020 - 2021)Dokument9 SeitenFa Finc 2302 Approved (Sem 2 2020 - 2021)Abdullah AlziadyNoch keine Bewertungen

- Maldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathDokument1 SeiteMaldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathMH DataNoch keine Bewertungen

- Newslletter Infrastructure Debentures May 2022 v2Dokument78 SeitenNewslletter Infrastructure Debentures May 2022 v2douglas silvaNoch keine Bewertungen

- Annexure KDokument2 SeitenAnnexure KMukesh SharmaNoch keine Bewertungen

- Carding 20K To Bitcoin For $100Dokument7 SeitenCarding 20K To Bitcoin For $100Kamerom CunninghamNoch keine Bewertungen

- Bruno - Gomes Statement 2021 07Dokument4 SeitenBruno - Gomes Statement 2021 07B gNoch keine Bewertungen

- Practice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementDokument12 SeitenPractice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementMay ChenNoch keine Bewertungen

- FM4 Ch21 - Immunization - TemplateDokument15 SeitenFM4 Ch21 - Immunization - TemplateAndrea DouglasNoch keine Bewertungen

- Financial Economics Study MaterialDokument13 SeitenFinancial Economics Study MaterialFrancis MtamboNoch keine Bewertungen

- BM - Simple and CompoundDokument50 SeitenBM - Simple and CompoundMarites Domingo - Paquibulan100% (1)

- The Foreign Exchange Matrix: A New Framework For Traders To Understand Currency MovementsDokument7 SeitenThe Foreign Exchange Matrix: A New Framework For Traders To Understand Currency MovementsAnthony FilpoNoch keine Bewertungen

- Minor Project BcomDokument1 SeiteMinor Project BcomYash DadheechNoch keine Bewertungen