Beruflich Dokumente

Kultur Dokumente

Chap 017

Hochgeladen von

Zoebair0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

335 Ansichten6 SeitenCopyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

335 Ansichten6 SeitenChap 017

Hochgeladen von

ZoebairCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

Problem 17-12 Problem 17-20

Spreadsheet Templates by Block, Hirt and Danielsen

Copyright 2009 McGraw-Hill/Irwin and ANSR Source India Pvt Ltd. (www.ansrsourceindia.com)

Spreadsheet Templates

Foundations of Financial Management

MAIN MENU - CHAPTER 17

Common and Preferred Stock Financing

Problem 17-20

Spreadsheet Templates by Block, Hirt and Danielsen

Copyright 2009 McGraw-Hill/Irwin and ANSR Source India Pvt Ltd. (www.ansrsourceindia.com)

Spreadsheet Templates

Foundations of Financial Management

MAIN MENU - CHAPTER 17

Common and Preferred Stock Financing

Problem 17-12

Objective: Different classes of voting stock

Student Name:

Course Name:

Student ID:

Course Number:

Rust Pipe Co. was established in 1994. Four years later the company went public. At that time, Robert Rust, the

original owner, decided to establish two classes of stock. The first represents Class A founders stock and is entitled

to 10 votes per share. The normally traded common stock, designated as Class B, is entitled to one vote per share.

In late 2010, Mr. Stone, an investor, was considering purchasing shares in Rust Pipe Co. While he knew the

existence of founders shares were not often present in other companies, he decided to buy the shares anyway

because of a new technology Rust Pipe had developed to improve the flow of liquids through pipes.

Of the 1,200,000 total shares currently outstanding, the original founders family owns 51,325 shares. What is the

percentage of the founders family votes to Class B votes?

Foundations of Financial Management

Block, Hirt and Danielsen - Fourteenth Edition

Copyright 2011 McGraw-Hill/ Irwin Spreadsheet Template by Block, Hirt and Danielsen Problem: 17-12

Problem 17-12

Instructions

Enter formulas to calculate the requirements of this problem.

Information

Founder's family shares 51,325

Votes per share 10

Shares outstanding 1,200,000

Founder's family votes FORMULA

Class B votes FORMULA

Percentage of founder's votes to Class B votes FORMULA

Solution

Copyright 2011 McGraw-Hill/ Irwin Spreadsheet Template by Block, Hirt and Danielsen Problem: 17-12

Problem 17-20

Objective: Preferred stock dividends in arrears

Student Name:

Course Name:

Student ID:

Course Number:

Robbins Petroleum Company is four years in arrears on cumulative preferred stock dividends. There are 850,000

preferred shares outstanding, and the annual dividend is $6.50 per share. The vice-president of finance sees no real

hope of paying the dividends in arrears. She is devising a plan to compensate the preferred stockholders for 90

percent of the dividends in arrears.

a. How much should the compensation be?

b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market

environment in which the going rate of interest is 14 percent for similar bonds. The bonds will have a 15-year

maturity. Using the bond valuation table in Chapter 16 (Table 163 on page 500), indicate the market value of a

$1,000 par value bond.

c. Based on market value, how many bonds must be issued to provide the compensation determined in part a?

(Round to the nearest whole number.)

Foundations of Financial Management

Block, Hirt and Danielsen - Fourteenth Edition

Copyright 2011 McGraw-Hill/ Irwin Spreadsheet Template by Block, Hirt and Danielsen Problem: 17-20

Problem 17-20

Instructions

Enter formulas and functions to calculate the requirements of this problem.

Information

Dividend per share $6.50

Shares outstanding 850,000

Years in arrears 4

Compensation percentage 90%

a. How much should the compensation be? FORMULA

b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market

environment in which the going rate of interest is 14 percent for similar bonds. The bonds will have a 15-year

maturity. Using the bond valuation table in Chapter 16 (Table 163 on page 500), indicate the market value of a

$1,000 par value bond.

Bond value FORMULA

c. Based on market value, how many bonds must be issued to provide the compensation determined in part a?

(Round to the nearest whole number.) FORMULA

Solution

Copyright 2011 McGraw-Hill/ Irwin Spreadsheet Template by Block, Hirt and Danielsen Problem: 17-20

Das könnte Ihnen auch gefallen

- F551 A01Dokument11 SeitenF551 A01Osman AnwarNoch keine Bewertungen

- Sample ExamDokument17 SeitenSample ExamJasonSpringNoch keine Bewertungen

- Chap 011Dokument44 SeitenChap 011Jessica Cola50% (2)

- Chapter 11 Solutions ManualDokument49 SeitenChapter 11 Solutions ManualHasham Naveed60% (10)

- Ross 7 e CH 01Dokument24 SeitenRoss 7 e CH 01seshagsNoch keine Bewertungen

- Excel Chapter 15 StudentDokument8 SeitenExcel Chapter 15 StudentsagarsbhNoch keine Bewertungen

- General Mathematics: Stocks and BondsDokument21 SeitenGeneral Mathematics: Stocks and BondsJhayziel OrpianoNoch keine Bewertungen

- Chapter 11Dokument48 SeitenChapter 11Sarah MoonNoch keine Bewertungen

- Fundamentals of Investing Smart 12th Edition Test BankDokument13 SeitenFundamentals of Investing Smart 12th Edition Test Bankbonesetcedilla.bupe100% (39)

- Financial 9: Updates For 2011 Edition Last Updated March 8, 2011Dokument3 SeitenFinancial 9: Updates For 2011 Edition Last Updated March 8, 2011livebird78Noch keine Bewertungen

- Chapter 1Dokument24 SeitenChapter 1mobinil10% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Finance Chapter 17Dokument30 SeitenFinance Chapter 17courtdubs75% (4)

- Test Bank For Financial Statement Analysis and Valuation 5th Edition by Easton Mcanally Sommers ZhangDokument30 SeitenTest Bank For Financial Statement Analysis and Valuation 5th Edition by Easton Mcanally Sommers Zhangagnesgrainneo30100% (1)

- Strategic Management 3rd Edition Rothaermel Test Bank DownloadDokument120 SeitenStrategic Management 3rd Edition Rothaermel Test Bank DownloadFrancine Lalinde100% (23)

- Chap 04Dokument4 SeitenChap 04Rohit SharmaNoch keine Bewertungen

- Financial Management Principles and Applications 11th Edition Titman Test BankDokument32 SeitenFinancial Management Principles and Applications 11th Edition Titman Test Bankodiledominicmyfmf100% (26)

- Financial Management Principles and Applications 11Th Edition Titman Test Bank Full Chapter PDFDokument48 SeitenFinancial Management Principles and Applications 11Th Edition Titman Test Bank Full Chapter PDFMichelleJenkinsmtqi100% (9)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistVon EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistBewertung: 4 von 5 Sternen4/5 (32)

- Chap 012Dokument84 SeitenChap 012Noushin Khan0% (2)

- Continental CarrierDokument10 SeitenContinental CarrierYetunde James100% (1)

- Look Before You Leverage!Dokument2 SeitenLook Before You Leverage!cws0829444367% (3)

- Test Bank For Fundamentals of Advanced Accounting 7th Edition by HoyleDokument61 SeitenTest Bank For Fundamentals of Advanced Accounting 7th Edition by Hoylezacharyjacobsgsoictjazw100% (27)

- B-4 HomeworkDokument5 SeitenB-4 HomeworkDaniel GabrielNoch keine Bewertungen

- Question and Answer - 50Dokument31 SeitenQuestion and Answer - 50acc-expertNoch keine Bewertungen

- Fin401 - Summary - Final Crash Course - Winter 2016Dokument2 SeitenFin401 - Summary - Final Crash Course - Winter 2016Ana BelloNoch keine Bewertungen

- Financial and Managerial Accounting 8th Edition Wild Test BankDokument38 SeitenFinancial and Managerial Accounting 8th Edition Wild Test Bankmiguelstone5tt0f100% (15)

- Financial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFDokument67 SeitenFinancial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFClaudiaAdamsfowp100% (9)

- Chapter 11Dokument34 SeitenChapter 11Kad Saad100% (3)

- Financial Analysis Spreadsheet Templates: Main Menu - Chapter 3Dokument3 SeitenFinancial Analysis Spreadsheet Templates: Main Menu - Chapter 3SALOMON QUITONoch keine Bewertungen

- Corporate Value Creation: An Operations Framework for Nonfinancial ManagersVon EverandCorporate Value Creation: An Operations Framework for Nonfinancial ManagersBewertung: 4 von 5 Sternen4/5 (4)

- Project (Take-Home) Fall - 2021 Department of Business AdministrationDokument5 SeitenProject (Take-Home) Fall - 2021 Department of Business AdministrationAftab AliNoch keine Bewertungen

- Cost of CapitalDokument53 SeitenCost of CapitalJaodat Mand KhanNoch keine Bewertungen

- Scarb Eesbm6e TB 05Dokument21 SeitenScarb Eesbm6e TB 05Nour AbdallahNoch keine Bewertungen

- GB101 S07 Practice Exam For Students - Posted April 3rdDokument23 SeitenGB101 S07 Practice Exam For Students - Posted April 3rdmahendra_dandage10100% (1)

- Topic 3.8 Quiz and Discussion Section 9 Consolidated and Separate Section 19 Business CombinationsDokument17 SeitenTopic 3.8 Quiz and Discussion Section 9 Consolidated and Separate Section 19 Business CombinationsDavid OparindeNoch keine Bewertungen

- ME1000 Home Exam 2010 Exam RealDokument11 SeitenME1000 Home Exam 2010 Exam RealUsman WaliNoch keine Bewertungen

- American Home Questions - UPDATEDDokument2 SeitenAmerican Home Questions - UPDATEDDaniil Ovchinnikov50% (2)

- AssessmentDokument24 SeitenAssessmentt_hargonNoch keine Bewertungen

- Cima F3 DumpsDokument6 SeitenCima F3 DumpsOlivia Merchant67% (3)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1Dokument30 SeitenFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1toddvaldezamzxfwnrtq100% (28)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1Dokument60 SeitenFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1audra100% (41)

- Eastboro Case SolutionDokument22 SeitenEastboro Case Solutionuddindjm100% (2)

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDokument30 SeitenFinancial Statement Analysis and Valuation 4th Edition Easton Test BankTroyKnappdpci100% (15)

- Test Bank For Fundamentals of Investing 14th Edition Scott B Smart Chad J Zutter Isbn 10 0135179300 Isbn 13 9780135179307Dokument34 SeitenTest Bank For Fundamentals of Investing 14th Edition Scott B Smart Chad J Zutter Isbn 10 0135179300 Isbn 13 9780135179307chrisrasmussenezsinofwdr100% (27)

- Chapter 11 - Sources of CapitalDokument21 SeitenChapter 11 - Sources of CapitalArman100% (1)

- Discussion Questions: AnswerDokument5 SeitenDiscussion Questions: AnswerMegachan MegamanNoch keine Bewertungen

- Macroeconomics 6th Edition Hubbard Test BankDokument70 SeitenMacroeconomics 6th Edition Hubbard Test Bankgrainnematthew7cr3xy100% (27)

- Macroeconomics 6th Edition Hubbard Test Bank Full Chapter PDFDokument68 SeitenMacroeconomics 6th Edition Hubbard Test Bank Full Chapter PDFhanhcharmainee29v100% (12)

- Tutorial Questions Spring 2014Dokument13 SeitenTutorial Questions Spring 2014lalaran123Noch keine Bewertungen

- Eastboro Case SolutionDokument23 SeitenEastboro Case Solutionvasuca2007Noch keine Bewertungen

- Series 65 101Dokument52 SeitenSeries 65 101Cameron Killeen100% (3)

- Test Bank For Financial Statement Analysis Valuation 4th Edition by Easton Mcanally Sommers ZhangDokument30 SeitenTest Bank For Financial Statement Analysis Valuation 4th Edition by Easton Mcanally Sommers ZhangJames Martino100% (36)

- FinalDokument5 SeitenFinalmehdiNoch keine Bewertungen

- Full Download Test Bank For Financial Statement Analysis and Valuation 5th Edition by Easton Mcanally Sommers Zhang PDF Full ChapterDokument23 SeitenFull Download Test Bank For Financial Statement Analysis and Valuation 5th Edition by Easton Mcanally Sommers Zhang PDF Full Chaptervespersrealizeravzo100% (12)

- Question and Answer - 52Dokument31 SeitenQuestion and Answer - 52acc-expertNoch keine Bewertungen

- MAN 321 Corporate Finance Final Examination: Fall 2001Dokument8 SeitenMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNoch keine Bewertungen

- Armstrong-83. Cap. Structure 0-324-53116-8 - 0001-1Dokument8 SeitenArmstrong-83. Cap. Structure 0-324-53116-8 - 0001-1Tien Pham HongNoch keine Bewertungen

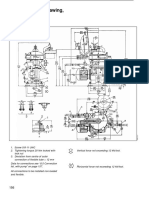

- 90 Series (ET1590) InstructionsDokument24 Seiten90 Series (ET1590) InstructionsZoebairNoch keine Bewertungen

- Type of ThreadDokument13 SeitenType of ThreadVils ArabadzhievaNoch keine Bewertungen

- International Standard: Hydraulic Turbines, Storage Pumps and Pump-Turbines - Model Acceptance TestsDokument9 SeitenInternational Standard: Hydraulic Turbines, Storage Pumps and Pump-Turbines - Model Acceptance TestsZoebairNoch keine Bewertungen

- Appendix B - 20100903 - 145453Dokument25 SeitenAppendix B - 20100903 - 145453AkoKhalediNoch keine Bewertungen

- Structures and Mechanisms ClassificationsDokument1 SeiteStructures and Mechanisms ClassificationsminakirolosNoch keine Bewertungen

- 1 12 (End)Dokument17 Seiten1 12 (End)ZoebairNoch keine Bewertungen

- TurbinesDokument19 SeitenTurbinesSamarakoon BandaNoch keine Bewertungen

- Spring-Supported Thrust BearingsDokument4 SeitenSpring-Supported Thrust BearingsZoebairNoch keine Bewertungen

- 1 Technical Data Sheets TurbineDokument7 Seiten1 Technical Data Sheets TurbineZoebairNoch keine Bewertungen

- ENZX TechDokument30 SeitenENZX TechZoebairNoch keine Bewertungen

- Ratle Enm Reply Tecnical Prebid Points 080212Dokument42 SeitenRatle Enm Reply Tecnical Prebid Points 080212ZoebairNoch keine Bewertungen

- Quality Conference TTL KUDokument6 SeitenQuality Conference TTL KUZoebairNoch keine Bewertungen

- CA6NMDokument2 SeitenCA6NMjoene3Noch keine Bewertungen

- Installation and Operating Procedures: Manual Grease InterceptorsDokument8 SeitenInstallation and Operating Procedures: Manual Grease InterceptorsZoebairNoch keine Bewertungen

- Indigenous ManufacturersDokument6 SeitenIndigenous ManufacturersZoebairNoch keine Bewertungen

- PJPR0 V 200 Ucturing 0 Data 0 SheetDokument3 SeitenPJPR0 V 200 Ucturing 0 Data 0 SheetZoebairNoch keine Bewertungen

- 8.4 Basic Size Drawing, With Pump: Alfa Laval Ref. 557913 Rev. 0Dokument1 Seite8.4 Basic Size Drawing, With Pump: Alfa Laval Ref. 557913 Rev. 0ZoebairNoch keine Bewertungen

- Calculate The Number of Extinguishers Needed in A BuildingDokument3 SeitenCalculate The Number of Extinguishers Needed in A BuildingZoebairNoch keine Bewertungen

- Datasheet TurbineDokument2 SeitenDatasheet TurbineZoebairNoch keine Bewertungen

- Solutions EngDokument6 SeitenSolutions EngZoebairNoch keine Bewertungen

- Scada SystemDokument1 SeiteScada SystemZoebairNoch keine Bewertungen

- 1 - Layout of H-FrancisDokument1 Seite1 - Layout of H-FrancisZoebairNoch keine Bewertungen

- Load AcceptanceDokument2 SeitenLoad AcceptanceZoebairNoch keine Bewertungen

- Construction Specification 71-Water Control Gates: Instructions For UseDokument2 SeitenConstruction Specification 71-Water Control Gates: Instructions For UseZoebairNoch keine Bewertungen

- 3DS Net OrthoGen For Intergraph CADWorx Plant ProfessionalDokument2 Seiten3DS Net OrthoGen For Intergraph CADWorx Plant ProfessionalThanadkitBunkaewNoch keine Bewertungen

- PJPR0 V 200 Ucturing 0 Data 0 SheetDokument3 SeitenPJPR0 V 200 Ucturing 0 Data 0 SheetZoebairNoch keine Bewertungen

- Hy 25 ValvesDokument3 SeitenHy 25 ValvesZoebairNoch keine Bewertungen

- Hy 25 ValvesDokument3 SeitenHy 25 ValvesZoebairNoch keine Bewertungen

- 3 Tables Friction Loss AquacultureDokument10 Seiten3 Tables Friction Loss AquacultureZoebairNoch keine Bewertungen

- CEE 331: Fluid Mechanics, Homework Set 2, SolutionsDokument7 SeitenCEE 331: Fluid Mechanics, Homework Set 2, SolutionsZoebairNoch keine Bewertungen

- Chart of Accounts DumpDokument70 SeitenChart of Accounts DumpAbilash V BNoch keine Bewertungen

- Supply Chain Finance Financial Constraints and Corporate Performance - An Explorative Network Analysis and Future Research AgendaDokument20 SeitenSupply Chain Finance Financial Constraints and Corporate Performance - An Explorative Network Analysis and Future Research Agendayunzhang hNoch keine Bewertungen

- IndexDokument8 SeitenIndexsakthimadanNoch keine Bewertungen

- IFR Asia-16 May 2020 PDFDokument46 SeitenIFR Asia-16 May 2020 PDFCristian PascuNoch keine Bewertungen

- SMEs RevenueDokument20 SeitenSMEs RevenueVanityHughNoch keine Bewertungen

- Bond Prices and Yields: Mcgraw-Hill/IrwinDokument53 SeitenBond Prices and Yields: Mcgraw-Hill/IrwinAhmed AbdelsalamNoch keine Bewertungen

- AFM 3 4表格Dokument3 SeitenAFM 3 4表格mincole17Noch keine Bewertungen

- Period PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Dokument1 SeitePeriod PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Vhiena May EstrelladoNoch keine Bewertungen

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDokument50 SeitenBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONoch keine Bewertungen

- Eriodic Ransaction Eport: Hon. Nancy Pelosi MemberDokument2 SeitenEriodic Ransaction Eport: Hon. Nancy Pelosi MemberRajeshbhai vaghaniNoch keine Bewertungen

- Chapter 14 Marketing Planning Implementation and ControlDokument35 SeitenChapter 14 Marketing Planning Implementation and ControlJENOVIC KAYEMBE MUSELENoch keine Bewertungen

- 1-Alternative StrategiesDokument20 Seiten1-Alternative StrategiesNeelabhNoch keine Bewertungen

- Completed Chapter 5 Mini Case Working Papers Fa14Dokument12 SeitenCompleted Chapter 5 Mini Case Working Papers Fa14Gauri KarkhanisNoch keine Bewertungen

- Harvard Case Study - Flash Inc - AllDokument40 SeitenHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Murree Brewery: Beverage IndustryDokument12 SeitenMurree Brewery: Beverage Industrykinza bashirNoch keine Bewertungen

- Marksans Pharma LTD.: Date: 25"may, 2021Dokument3 SeitenMarksans Pharma LTD.: Date: 25"may, 2021Shrin RajputNoch keine Bewertungen

- CPALE CoverageDokument15 SeitenCPALE CoverageMajariya Sahar SabladNoch keine Bewertungen

- KCBC Ifb-Bond Calc - 16feb2022Dokument55 SeitenKCBC Ifb-Bond Calc - 16feb2022Edel AchiengNoch keine Bewertungen

- ILP ProspectusDokument130 SeitenILP ProspectusHamza SiddiquiNoch keine Bewertungen

- Forex For Beginners To Forex TradingDokument42 SeitenForex For Beginners To Forex TradingMake Money BossNoch keine Bewertungen

- ACCT5001 2022 S2 - Module 1 - Student Lecture SlidesDokument34 SeitenACCT5001 2022 S2 - Module 1 - Student Lecture Slideswuzhen102110Noch keine Bewertungen

- IFRS For SME 2015 Disclosure ChecklistDokument25 SeitenIFRS For SME 2015 Disclosure ChecklistUmar Naseer100% (1)

- Wijaya Karya: IndonesiaDokument7 SeitenWijaya Karya: IndonesiayolandaNoch keine Bewertungen

- Fundamentals of Accounting ReviewerDokument3 SeitenFundamentals of Accounting ReviewerRandy ParasNoch keine Bewertungen

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsDokument185 Seiten(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheNoch keine Bewertungen

- Auditing Problems With AnswersDokument12 SeitenAuditing Problems With Answersaerwinde79% (34)

- 1: Introduction To Financial MarketsDokument18 Seiten1: Introduction To Financial Marketsshiko tharwatNoch keine Bewertungen

- Manajemen KeuanganDokument2 SeitenManajemen KeuanganATHAYA ARIELLA GALVANINoch keine Bewertungen

- 91 3 STOIKOV Microstructure TalkDokument60 Seiten91 3 STOIKOV Microstructure Talkantonello_camilettiNoch keine Bewertungen

- CUACM 413 Tutorial QuestionsDokument31 SeitenCUACM 413 Tutorial Questionstmash3017Noch keine Bewertungen