Beruflich Dokumente

Kultur Dokumente

2014 State of Manufacturing - Pollster's Powerpoint

Hochgeladen von

FluenceMediaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2014 State of Manufacturing - Pollster's Powerpoint

Hochgeladen von

FluenceMediaCopyright:

Verfügbare Formate

Helping Manufacturing Enterprises Grow Profitably

Presents

On behalf of Enterprise Minnesota, Public Opinion

Strategies is pleased to present the key findings from the

sixth annual survey of manufacturing executives in

Minnesota.

The survey was conducted February 28-March 13, 2014,

among 400 manufacturing executives; it has a margin of

error of +4.9%. Respondent titles included owners, CEOs,

CFOs, COOs, presidents, vice presidents, and managing

officers.

Rob Autry is a Partner of Public Opinion Strategies, a

national political and public affairs survey research firm

based in Alexandria, VA.

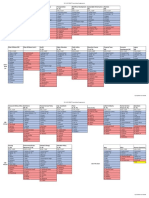

79%

78%

83%

82% 82%

84%

21% 21%

16%

17% 17%

15%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Confident Not Confident

From a financial perspective, how do you feel right now about the future for your company?

Slide 4

Financial confidence is at its highest level

since we started this study.

8%

26%

40%

32%

34%

37%

34%

53%

49%

55%

46%

54%

56%

19%

9%

10%

15%

7%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Economic Expansion Flat Economy Recession

Thinking about the upcoming year, in 2014, do you anticipate economic expansion,

a flat economy, or a recession?

Slide 5

Manufacturing executives are more economically

hopeful than in previous years; recessionary

concerns are at their lowest.

30%

33%

41%

40%

39%

41%

55%

54%

47% 47%

49%

51%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Right Direction Wrong Track

Generally speaking, in regard to being a competitive business location, would you say that things in

Minnesota are going in the right direction, or have they pretty seriously gotten on the wrong track?

Those who say the states business climate is on the

wrong track is at its highest level since 2010.

Slide 6

23%

17%

19%

44%

36%

24%

51%

39%

32%

47%

31%

27%

41%

32%

28%

45%

35%

27%

Gross Revenues Profitability Capital Expenditures

2008 2010 2011 2012 2013 2014

Percent Expecting Increases Per Year

Slide 7

We also see a slight uptick in expected gross

revenues and profitability for 2014,

but not with capital expenditures.

We asked manufacturing executives to rate how concerned

they were about a series of factors affecting companies

like theirs. In total, we had them rate 7 different factors.

Now, I would like to read you a list of

factors that some companies are

concerned about. For each one, please

rate how concerned your firm is about

that particular factor using a scale

from 1 to 10, where one means that

your firm is NOT AT ALL CONCERNED

about it and where ten means your firm

is VERY CONCERNED about it.

1

2

3

4

5

80

90

100

110

6

7

8

9

10

Slide 9

59%

55%

34%

31%

18%

16%

11%

Concerns Ranked By % Concern (8-10)

Slide 10

The costs of health care coverage

Government policies and regulations

The ability to attract and

retain qualified workers

Economic and global uncertainty

Costs of employee salaries and

benefits, not including health insurance

Increased competition from

foreign sources

Managing supply chain relationships

Health care costs and government policies and

regulations top the list of concerns.

48%

31%

31%

29%

21%

What would you say are the one or two biggest challenges your firm is facing that

might negatively impact future growth? (Ranked By % Combined Choice)

Slide 11

Unfavorable business climate,

such as taxes, regulations,

and policy uncertainties

Rising health care and

insurance costs

Weak economy and lower

sales for your products

Rising costs of energy and

materials for your products

Attracting and retaining a

qualified workforce

The business climate and government policies

are seen as the biggest obstacle to growth.

2010 2011 2012 2013 2014

The costs of health care coverage 68% 71% 68% 67% 59%

Government policies and regulations 57% 61% 56% 58% 55%

The ability to attract and retain

qualified workers

19% 14% 31% 30% 34%

Economic and global uncertainty

n/a n/a n/a n/a

31%

Costs of employee salaries and

benefits, not including health

insurance

16% 15% 13% 19% 18%

Increased competition from foreign

sources

27% 20% 21% 17% 16%

Managing supply chain relationships

n/a n/a

15% 10% 11%

Slide 13

Concerns Among Manufacturing Executives (% Concern 8-10)

We have seen a consistent rise in concern about

finding and keeping qualified workers.

We asked manufacturing executives to rate how important a

series of factors were in helping them to attract and recruit

new employees to their firm.

Changing the focus somewhat to

attracting and recruiting new employees

to your firm...I am going to read a series

of factors and, after I read each one,

please tell me how important that

particular factor is to your firm in

attracting workers, using a one to ten

scale where one means that factor is

NOT IMPORTANT AT ALL and where ten

means that factor is VERY IMPORTANT.

1

2

3

4

5

80

90

100

110

6

7

8

9

10

Slide 14

55%

40%

45%

58%

60%

67%

43%

55%

50%

39%

36%

32%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Difficult Not Difficult

How difficult is it to attract qualified candidates for your firms vacancies?

Slide 15

Two-thirds now say it is difficult to attract new

workers, the highest margin in six years.

54%

61%

55%

75%

43%

37%

43%

25%

December 2008 March 2014 December 2008 March 2014

Difficult Not Difficult

How difficult is it to attract qualified candidates for your firms vacancies?

Slide 16

Difficulty in filling vacancies has noticeably

soared with non-Metro area manufacturers.

Metro Firms Non-Metro Firms

20%

19%

49%

6%

22%

21%

47%

6%

2013 Data 2014 Data

When looking to hire new employees, where is your need greatest?

Slide 17

Entry-level employees

Employees with

technical training

Employees with technical

training and experience

Employees with four-year

college degrees

Nearly half of all manufacturers say theyre looking

for employees with training and experience.

27%

22%

23%

16% 16%

14%

56%

60%

62%

January 2012 March 2013 March 2014

Grow Shrink About The Same

Looking back on the last 12 months, did your companys workforce grow,

shrink, or stay about the same?

Slide 18

Sixty-two percent of firms say their workforce

has stayed about the same in the past year.

29%

25%

30%

2%

5%

2%

68%

69%

67%

January 2012 March 2013 March 2014

Grow Shrink About The Same

In the next 12 months, does your company expect to grow or shrink the size

of its workforce, or will it stay about the same?

Slide 19

And, two-thirds expect their workforces to stay

about the same for the next year, too.

2013 2014

Metro Firms 25% 30%

Non-Metro Firms 26% 30%

Less than $1 million in revenue 20% 21%

$1-5 million in revenue 31% 33%

Over $5 million in revenue 33% 41%

50 or fewer employees 23% 27%

Over 50 employees 39% 42%

Been in operation 1-15 years 25% 27%

Been in operation over 15 years 25% 31%

Slide 20

Percent Expect Their Firm To Grow In Next 12 Months

We are starting to see some interesting differences

on workforce growth by firm type.

66%

48%

41%

43% 43%

54%

6%

13%

14%

9%

10%

5%

27%

38%

44%

46%

44%

39%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Increased Decreased Stayed About the Same

On average, over the last two years, have your firms wages increased,

decreased, or stayed about the same?

Slide 22

A majority of executives report increasing wages

for the first time since the recession.

41%

45%

53%

54%

48%

62%

7%

4%

2% 2%

4%

2%

51%

49%

44%

43%

46%

35%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Increase Decrease Stay About the Same

Do you expect the average wages to increase or decrease over

the next two years, or will they stay about the same?

Slide 23

The highest percentage since 2008 expect wages

to rise over the next two years.

2008 2010 2011 2012 2013 2014

Affordable Health Care 39% 39% 45% 50% 54% 51%

Salary and Wage Expectations 43% 38% 29% 22% 25% 32%

Competitive Benefits Package 35% 32% 31% 22% 27% 25%

Flexible Work Schedules 32% 30% 20% 14% 12% 13%

The Need to Accommodate

Part-Time Workers

n/a n/a n/a n/a n/a 7%

Top Recruitment Factors Ranked By Importance (8-10)

Slide 24

And, we have also seen a significant rise in

salary and wage expectations since 2012.

16%

19%

18%

17%

18%

25%

13%

10%

8% 8%

12%

7%

69%

67%

71%

72%

68%

67%

December

2008

January

2010

January

2011

January

2012

March

2013

March

2014

Will Invest More Will Invest Less Will Stay the Same

Generally speaking, would you say that as a percentage of payroll your company will

invest MORE in employee development or LESS next year compared to 2013,

or will it stay about the same?

Slide 25

And, now a quarter of firms predict investing more

in employee development in the coming year.

Yes No

Metro Firms 34% 65%

Non-Metro Firms 27% 71%

Less than $1 million in revenue 8% 90%

$1-5 million in revenue 36% 63%

Over $5 million in revenue 55% 44%

50 or fewer employees 24% 76%

Over 50 employees 62% 34%

Been in operation 1-15 years 23% 76%

Been in operation over 15 years 33% 66%

Slide 26

Does your company have an employee development and retention program

for your less-experienced employees?

Larger firms are more likely to have employee

development and retention programs.

Yes No

Metro Firms 27% 72%

Non-Metro Firms 32% 68%

Less than $1 million in revenue 11% 89%

$1-5 million in revenue 26% 74%

Over $5 million in revenue 57% 41%

50 or fewer employees 20% 79%

Over 50 employees 66% 33%

Been in operation 1-15 years 18% 82%

Been in operation over 15 years 32% 68%

Slide 27

Does your firm have a recruiting relationship with one or more vocational,

technical, or community colleges or universities?

Non-Metro firms and firms that expect to grow are

forming relationships with educational institutions.

How much of your product did you ship internationally in the last year?

2008 2010 2011 2012 2013 2014

None 58% 58% 56% 52% 56% 51%

10% or Less 31% 29% 28% 29% 29% 23%

11% - 25% 5% 7% 8% 9% 8% 14%

26% - 50% 4% 4% 6% 7% 4% 4%

51% or More 1% 1% 2% 2% 2% 5%

Slide 29

We see a bump up in the percentage of firms that

ship more than 11% of their product aboard.

11% or More 10% 12% 16% 18% 14%

23%

24%

66%

"Home Sourcing"

Yes No

Slide 30

Have you gained new business because of home sourcing

(or re-shoring) by your OEM customers?

About one fourth of firms have gained new

business due to home sourcing.

Yes

Metro Area Firms 23%

Non-Metro Firms 26%

Less than $1 million revenue 12%

$1-5 million in revenue 35%

Over $5 million revenue 34%

50 or fewer employees 23%

Over 50 employees 32%

Been in operation 1-15 years 19%

Been in operation over 15 yrs 26%

Slide 31

Shorter lead times and costs are the main reasons

why supply chain relationships have changed.

AMONG THOSE WHO GAINED NEW BUSINESS: And, what would you say is

the main reason why your supply chain relationships changed?

31%

26%

18%

12%

11%

Shorter lead times

Total costs vs. only

product costs

Closer relationships/regional

suppliers

Better inventory management

Dont know/Not sure

87%

56%

44%

81%

33%

27%

Confident In Firm's

Financial Future

Expect Increase In Gross

Revenues

Expect Increase In

Profitability

Have Formal Planning Process Do NOT

Slide 32

Firms with formal planning processes are more

likely to expect increases in gross revenues and

profitability for the coming year.

87%

60%

46%

82%

31%

26%

Confident In Firm's

Financial Future

Expect Increase In Gross

Revenues

Expect Increase In

Profitability

Have Formal Marketing Process Do NOT

Slide 33

And, we find the same differences exist between

firms that have formal marketing processes

and those that dont.

50%

48%

37%

48%

52%

62%

Formal Planning

Process

Formal Marketing

Process

Formal Quality

Management System

Yes No

Slide 34

Half of firms have marketing and planning

processes in place, and two thirds do not have

ISO or a similar quality standard.

Does your firm have a formal

planning process?

Does your company have a

formal quality management

system, such as ISO?

Does your firm have a formal

marketing process?

I. Health care remains the most important issue facing

manufacturers for the fifth year in a row.

II. We are seeing a rise in concern about finding, recruiting and

retaining qualified and experienced workers.

III. And, concern is soaring with firms that are located outside of

the metro area.

IV. While confidence in the financial future is at its highest level

yet and recessionary fears are at their lowest, a majority still

believe the states business climate is on the wrong track.

V. Firms that have strategic planning processes in place are

noticeably more optimistic about their future growth and

prosperity.

Helping Manufacturing Enterprises Grow Profitably

The 2014 State of Manufacturing Poll was sponsored by:

Full results can be viewed at

www.enterpriseminnesota.org

Das könnte Ihnen auch gefallen

- Raise Your Team's Employee Engagement Score: A Manager's GuideVon EverandRaise Your Team's Employee Engagement Score: A Manager's GuideNoch keine Bewertungen

- A Vision For GrowthDokument30 SeitenA Vision For Growth.Adi.Noch keine Bewertungen

- 2013 SalaryreportDokument21 Seiten2013 SalaryreportgabrielocioNoch keine Bewertungen

- Recruiting Trends Global Linkedin 2015Dokument37 SeitenRecruiting Trends Global Linkedin 2015Thejeswar ReddyNoch keine Bewertungen

- Shruti 1 PDFDokument30 SeitenShruti 1 PDFshrutiNoch keine Bewertungen

- 2014 Compensation Best Practices ReportDokument33 Seiten2014 Compensation Best Practices ReportjasmineparekhNoch keine Bewertungen

- Industry Employment: Section FourDokument9 SeitenIndustry Employment: Section FourVikas VermaNoch keine Bewertungen

- 2015 PayScale CompensationBestPracticesReportDokument26 Seiten2015 PayScale CompensationBestPracticesReportVVNAGESWARNoch keine Bewertungen

- 2011 Talent Shortage SurveyDokument30 Seiten2011 Talent Shortage SurveyDirtMcGurtNoch keine Bewertungen

- State of The CIO 2013Dokument9 SeitenState of The CIO 2013IDG_WorldNoch keine Bewertungen

- 2016 Global CEO OutlookDokument46 Seiten2016 Global CEO OutlookYe PhoneNoch keine Bewertungen

- Algorithmia 2020 State of Enterprise MLDokument29 SeitenAlgorithmia 2020 State of Enterprise MLsubbu banerjeeNoch keine Bewertungen

- 2011 Salary SurveyDokument35 Seiten2011 Salary SurveyAnkit GuptaNoch keine Bewertungen

- Yodle Small Business SurveyDokument8 SeitenYodle Small Business Surveyapi-236190294Noch keine Bewertungen

- Global PayrollDokument22 SeitenGlobal PayrollclaokerNoch keine Bewertungen

- Sales Comp TrendsDokument11 SeitenSales Comp TrendsPriyanka KommarajuNoch keine Bewertungen

- Survey: Simstaff 2013 Salary & CompensationDokument19 SeitenSurvey: Simstaff 2013 Salary & CompensationAshok KumarNoch keine Bewertungen

- HaysSalaryGuide 2011 AU Bank It ResDokument56 SeitenHaysSalaryGuide 2011 AU Bank It Resangel_c18Noch keine Bewertungen

- The 2011 Hays Salary Guide: Sharing Our ExpertiseDokument58 SeitenThe 2011 Hays Salary Guide: Sharing Our ExpertiseTristan YeNoch keine Bewertungen

- 2014 US CEO Survey - Full 2. Chart PackDokument52 Seiten2014 US CEO Survey - Full 2. Chart PackArik RizerNoch keine Bewertungen

- Despite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentDokument12 SeitenDespite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentVikas VermaNoch keine Bewertungen

- Despite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentDokument6 SeitenDespite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentVikas VermaNoch keine Bewertungen

- Australia & New Zealand: Staffing Trends 2016Dokument28 SeitenAustralia & New Zealand: Staffing Trends 2016dinakarcNoch keine Bewertungen

- 25424-DN 2010 Salary SurveyDokument44 Seiten25424-DN 2010 Salary SurveypolumathesNoch keine Bewertungen

- Q1 2013 Economic Outlook Survey ResultsDokument4 SeitenQ1 2013 Economic Outlook Survey ResultsAnonymous Feglbx5Noch keine Bewertungen

- Edelman Trust Barometer: Global ResultsDokument32 SeitenEdelman Trust Barometer: Global ResultsALBERTO GUAJARDO MENESESNoch keine Bewertungen

- Industry Employment: On Average, Companies Rely Less On Expat Workers Than in 2012Dokument9 SeitenIndustry Employment: On Average, Companies Rely Less On Expat Workers Than in 2012Vikas VermaNoch keine Bewertungen

- Despite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentDokument6 SeitenDespite Bonuses Being The Highest Ranked Benefit Across All Company Types, Health Plans Realised The Highest Increase of Five Per CentVikas VermaNoch keine Bewertungen

- Graphics For Media - 20th CEO SurveyDokument4 SeitenGraphics For Media - 20th CEO SurveyBernewsAdminNoch keine Bewertungen

- Deloitte Compensation Trends 2013Dokument132 SeitenDeloitte Compensation Trends 2013chandrabaiNoch keine Bewertungen

- EY - A Vision For Growth - EN 2016Dokument64 SeitenEY - A Vision For Growth - EN 2016CatalinNoch keine Bewertungen

- EY - A Vision For Growth - September 2014Dokument32 SeitenEY - A Vision For Growth - September 2014Catalin AlbstNoch keine Bewertungen

- Randstad Sourceright 2015 Talent Trends ReportDokument37 SeitenRandstad Sourceright 2015 Talent Trends ReportTiago GomesNoch keine Bewertungen

- State of Analytics Report SalesforceDokument37 SeitenState of Analytics Report SalesforceScribdNoch keine Bewertungen

- Digital Transformation of PeopleDokument14 SeitenDigital Transformation of PeopleAlaksam100% (1)

- Hays Salary Guide 2015Dokument31 SeitenHays Salary Guide 2015rockx1590Noch keine Bewertungen

- 2022人才市场分析报告 2022 State of Staffing - 20220727194855Dokument59 Seiten2022人才市场分析报告 2022 State of Staffing - 20220727194855ryanNoch keine Bewertungen

- 2012 Staffing SurveyDokument60 Seiten2012 Staffing SurveyagtorresgmailNoch keine Bewertungen

- SustainabilityDokument6 SeitenSustainabilityNeha PareekNoch keine Bewertungen

- Selective Investment: Insights To InformDokument52 SeitenSelective Investment: Insights To Informits4krishna3776Noch keine Bewertungen

- EY Global Mobility SurveyDokument24 SeitenEY Global Mobility SurveyEuglena VerdeNoch keine Bewertungen

- CFO To Chief Future OfficerDokument24 SeitenCFO To Chief Future OfficerSuccessful ChicNoch keine Bewertungen

- 2011CRS SurveyReport 1streleaseDokument27 Seiten2011CRS SurveyReport 1streleasemaverickgmatNoch keine Bewertungen

- CFIBBusinessBarometerNationalAugustReport September2012Dokument4 SeitenCFIBBusinessBarometerNationalAugustReport September2012Tessa VanderhartNoch keine Bewertungen

- 2012 Trust Barometer - Global Deck - 1-13ABTDokument25 Seiten2012 Trust Barometer - Global Deck - 1-13ABTJoshua PorterNoch keine Bewertungen

- Employee Attitudes: What Your Staff Are SayingDokument8 SeitenEmployee Attitudes: What Your Staff Are SayingAlisha KothariNoch keine Bewertungen

- Salary Guide 2016Dokument44 SeitenSalary Guide 2016sharfutaj100% (2)

- EY CompStudy Technology 2013Dokument8 SeitenEY CompStudy Technology 2013benpluggedNoch keine Bewertungen

- CLC Preparing Your Employment Value PropositionDokument36 SeitenCLC Preparing Your Employment Value PropositionGuru Chowdhary100% (1)

- PQNDT 2012 Salary SurveyDokument28 SeitenPQNDT 2012 Salary SurveycstirumuruganNoch keine Bewertungen

- Recruiting Metrics BenchmarkDokument22 SeitenRecruiting Metrics BenchmarkAlejandro Von HNoch keine Bewertungen

- SLFE2012 ChartsDokument3 SeitenSLFE2012 ChartsNationalLawJournalNoch keine Bewertungen

- Asia Pacific - Chemicals and Petroleum (Production Refining) - Cairn Energy India Pty LTD - FP6847 - CHRO - Feedback - Report 10-15-10 PDFDokument42 SeitenAsia Pacific - Chemicals and Petroleum (Production Refining) - Cairn Energy India Pty LTD - FP6847 - CHRO - Feedback - Report 10-15-10 PDFRishi SuriNoch keine Bewertungen

- CLC Quarterly Global Workforce Bench Marking Report Q1 2012Dokument32 SeitenCLC Quarterly Global Workforce Bench Marking Report Q1 2012Olga LegackaNoch keine Bewertungen

- Cole Taylor Bank Fall 2013Dokument2 SeitenCole Taylor Bank Fall 2013Reboot IllinoisNoch keine Bewertungen

- Edelman Trust BaromaterDokument32 SeitenEdelman Trust BaromaterAdryan KusumawardhanaNoch keine Bewertungen

- Accounting Disrupted: How Digitalization Is Changing FinanceVon EverandAccounting Disrupted: How Digitalization Is Changing FinanceNoch keine Bewertungen

- Talent Keepers: How Top Leaders Engage and Retain Their Best PerformersVon EverandTalent Keepers: How Top Leaders Engage and Retain Their Best PerformersNoch keine Bewertungen

- Integrated Talent Management Scorecards: Insights From World-Class Organizations on Demonstrating ValueVon EverandIntegrated Talent Management Scorecards: Insights From World-Class Organizations on Demonstrating ValueNoch keine Bewertungen

- Letter From Speaker Melissa Hortman To The MediaDokument1 SeiteLetter From Speaker Melissa Hortman To The MediaFluenceMediaNoch keine Bewertungen

- LETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzDokument7 SeitenLETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzFluenceMediaNoch keine Bewertungen

- LETTER: Blandin Request For Huber After Action FinalDokument2 SeitenLETTER: Blandin Request For Huber After Action FinalFluenceMedia100% (1)

- Vireo Fact Sheet - MinnesotaDokument4 SeitenVireo Fact Sheet - MinnesotaFluenceMediaNoch keine Bewertungen

- Humphrey Institute Study On Ranked Choice VotingDokument3 SeitenHumphrey Institute Study On Ranked Choice VotingFluenceMediaNoch keine Bewertungen

- 2023 Infrastructure Plan Fact SheetDokument2 Seiten2023 Infrastructure Plan Fact SheetFluenceMediaNoch keine Bewertungen

- Letter: October 11th - Opera Managment Letter To OrchestraDokument6 SeitenLetter: October 11th - Opera Managment Letter To OrchestraFluenceMediaNoch keine Bewertungen

- Press Release December 22Dokument1 SeitePress Release December 22FluenceMediaNoch keine Bewertungen

- Focus On Ag (1-16-23)Dokument3 SeitenFocus On Ag (1-16-23)FluenceMediaNoch keine Bewertungen

- POLL: Key Findings MN Protect Our Charities Feb 2023Dokument4 SeitenPOLL: Key Findings MN Protect Our Charities Feb 2023FluenceMediaNoch keine Bewertungen

- Focus On Ag (1-30-23)Dokument3 SeitenFocus On Ag (1-30-23)FluenceMediaNoch keine Bewertungen

- Minnesotans Against Marijuana Legalization - ScorecardDokument2 SeitenMinnesotans Against Marijuana Legalization - ScorecardFluenceMediaNoch keine Bewertungen

- Focus On Ag (11-14-22)Dokument3 SeitenFocus On Ag (11-14-22)FluenceMediaNoch keine Bewertungen

- MSCA Leadership Press Release 2022Dokument1 SeiteMSCA Leadership Press Release 2022FluenceMediaNoch keine Bewertungen

- 2023 Minnesota Senate Committee AssignmentsDokument9 Seiten2023 Minnesota Senate Committee AssignmentsFluenceMediaNoch keine Bewertungen

- Sen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelDokument1 SeiteSen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelFluenceMediaNoch keine Bewertungen

- Wisconsin Take20221219Dokument6 SeitenWisconsin Take20221219FluenceMediaNoch keine Bewertungen

- For Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22Dokument5 SeitenFor Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22FluenceMediaNoch keine Bewertungen

- 2023-24 Minnesota House Committee MembershipDokument2 Seiten2023-24 Minnesota House Committee MembershipFluenceMediaNoch keine Bewertungen

- 2023-24 Minnesota House Committee MembershipDokument2 Seiten2023-24 Minnesota House Committee MembershipFluenceMediaNoch keine Bewertungen

- Twins Announce 2023 Spring Training Promo Dates and Ticket InfoDokument3 SeitenTwins Announce 2023 Spring Training Promo Dates and Ticket InfoFluenceMediaNoch keine Bewertungen

- Focus On Ag (12-12-22)Dokument3 SeitenFocus On Ag (12-12-22)FluenceMediaNoch keine Bewertungen

- Webster V DEED Complaint FINAL AcceptedDokument26 SeitenWebster V DEED Complaint FINAL AcceptedFluenceMediaNoch keine Bewertungen

- Focus On Ag (10-10-22)Dokument3 SeitenFocus On Ag (10-10-22)FluenceMediaNoch keine Bewertungen

- Focus On Ag (11-21-22)Dokument3 SeitenFocus On Ag (11-21-22)FluenceMediaNoch keine Bewertungen

- Media AdvisoryDokument1 SeiteMedia AdvisoryFluenceMediaNoch keine Bewertungen

- Focus On Ag (11-07-22)Dokument3 SeitenFocus On Ag (11-07-22)FluenceMediaNoch keine Bewertungen

- 2022-10-03 Madel Letter To NauenDokument15 Seiten2022-10-03 Madel Letter To NauenFluenceMediaNoch keine Bewertungen

- Focus On Ag (10-17-22)Dokument3 SeitenFocus On Ag (10-17-22)FluenceMediaNoch keine Bewertungen

- Focus On Ag (10-24-22)Dokument3 SeitenFocus On Ag (10-24-22)FluenceMediaNoch keine Bewertungen

- Bankura TP ListDokument16 SeitenBankura TP ListDeb D Creative StudioNoch keine Bewertungen

- Economics Perfectly Competitive MarketDokument25 SeitenEconomics Perfectly Competitive MarketEsha DivNoch keine Bewertungen

- Math2 q1 Week 6 Day1-5Dokument98 SeitenMath2 q1 Week 6 Day1-5zshaninajeorahNoch keine Bewertungen

- Final 2020 Mid-Year Fiscal Policy Review - Ken Ofori-AttaDokument44 SeitenFinal 2020 Mid-Year Fiscal Policy Review - Ken Ofori-AttaKweku Zurek100% (1)

- Exploring Succession Planning in Small, Growing FirmsDokument18 SeitenExploring Succession Planning in Small, Growing FirmstalalarayaratamaraNoch keine Bewertungen

- Account Payable ManualDokument57 SeitenAccount Payable ManualfaizfaizNoch keine Bewertungen

- Cir vs. Solidbank CorporationDokument1 SeiteCir vs. Solidbank CorporationRaquel DoqueniaNoch keine Bewertungen

- 033129Dokument1 Seite033129vinsensius rasaNoch keine Bewertungen

- CHAPTER 18 Multiple Choice Answers With ExplanationDokument10 SeitenCHAPTER 18 Multiple Choice Answers With ExplanationClint-Daniel Abenoja75% (4)

- 1.statement of Financial Position (SFP)Dokument29 Seiten1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- What Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Dokument2 SeitenWhat Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Zahra Malik100% (5)

- Idh 8 R 5Dokument30 SeitenIdh 8 R 5Quint WongNoch keine Bewertungen

- Anna University Question PaperDokument5 SeitenAnna University Question PaperSukesh R100% (1)

- Spy Gap StudyDokument30 SeitenSpy Gap StudyMathias Dharmawirya100% (1)

- When KD Is Less Than Coupon Intrest RateDokument3 SeitenWhen KD Is Less Than Coupon Intrest RateAmit Kr GodaraNoch keine Bewertungen

- Population: Basic Statistics: We Are Continuing To GrowDokument4 SeitenPopulation: Basic Statistics: We Are Continuing To GrowarnabnitwNoch keine Bewertungen

- 04 Trenovski Tashevska 2015 1 PDFDokument21 Seiten04 Trenovski Tashevska 2015 1 PDFArmin ČehićNoch keine Bewertungen

- Randstad Salary Guide Engineering Web PDFDokument28 SeitenRandstad Salary Guide Engineering Web PDFMer HavatNoch keine Bewertungen

- PreviewPDF PDFDokument2 SeitenPreviewPDF PDFLing TanNoch keine Bewertungen

- 1st Barcelona Metropolitan Strategic PlanDokument42 Seiten1st Barcelona Metropolitan Strategic PlanTbilisicds GeorgiaNoch keine Bewertungen

- Amount of Net Taxable Income Rate Over But Not OverDokument1 SeiteAmount of Net Taxable Income Rate Over But Not OverDennah Faye SabellinaNoch keine Bewertungen

- Getting Moving: A Manifesto For Cycling in Greater ManchesterDokument10 SeitenGetting Moving: A Manifesto For Cycling in Greater ManchesterManchester Friends of the EarthNoch keine Bewertungen

- BRAC Bank Limited - Cards P@y Flex ProgramDokument3 SeitenBRAC Bank Limited - Cards P@y Flex Programaliva78100% (2)

- Cognos LearningDokument12 SeitenCognos LearningsygladiatorNoch keine Bewertungen

- SBI PO Prelims 2020 2021 Questions Memory Based Paper 05 Jan 2021Dokument23 SeitenSBI PO Prelims 2020 2021 Questions Memory Based Paper 05 Jan 2021Suvid100% (1)

- Business PlanDokument20 SeitenBusiness Planlucian89% (18)

- Health TourismDokument61 SeitenHealth TourismT. Chang100% (1)

- Records - POEA PDFDokument1 SeiteRecords - POEA PDFTimNoch keine Bewertungen

- Bhavnath TempleDokument7 SeitenBhavnath TempleManpreet Singh'100% (1)

- Universal Remote SUPERIOR AIRCO 1000 in 1 For AirCoDokument2 SeitenUniversal Remote SUPERIOR AIRCO 1000 in 1 For AirCoceteganNoch keine Bewertungen