Beruflich Dokumente

Kultur Dokumente

Chapter-1: " A Study On Investment in Mutual Fund"

Hochgeladen von

Wilfred DsouzaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter-1: " A Study On Investment in Mutual Fund"

Hochgeladen von

Wilfred DsouzaCopyright:

Verfügbare Formate

1 | P a g e

A study on

investment in mutual

fund

Chapter-1

INTRODUCTION

2 | P a g e

A mutual fund is a kind of investment that uses money from many investors to

invest in stocks, bonds or other types of investment. A fund manager or

"portfolio manager" decides how to invest the money, and for this he is paid a

fee, which comes from the money in the fund.

In fact, too many people, investing means buying mutual funds. After all, its

common knowledge that investing in mutual funds is (at least should be)

better than simply letting your cash waste away in a savings account, but, for

most people, that's where the understanding of funds ends. It doesn't help

that mutual fund salespeople speak a strange language that is interspersed

with jargon that many investors don't understand.

There are a lot of investment avenues available today in the financial market

for an investor with an investable surplus. They can invest in Bank Deposits,

Corporate Debentures, and Bonds where there is low risk but low return. They

may invest in Stock of companies where the risk is high and the returns are

also proportionately high. The recent trends in the Stock Market have shown

that an average retail investor always lost with periodic bearish tends.

People began opting for portfolio managers with expertise in stock markets

who would invest on their behalf. Thus wealth management services provided

by many institutions. However they proved too costly for a small investor.

These investors have found a good shelter with the mutual funds.

Mutual funds are usually "open ended", meaning that new investors can join

into the fund at any time. When this happens, new units, which are like shares,

are given to the new investors.

3 | P a g e

There are thousands of different kinds of mutual funds, specializing in investing

in different countries, different types of businesses, and different investment

styles. There are even some funds that only invest in other funds.

History of mutual funds

The mutual fund industry in India started in 1963 with the formation of Unit

Trust of India, at the initiative of the Government of India and Reserve Bank

the. The history of mutual funds in India can be broadly divided into four

distinct phases.

First Phase 1964-87: Unit Trust of India (UTI) was established on 1963 by an

Act of Parliament. It was set up by the Reserve Bank of India and functioned

under the Regulatory and administrative control of the Reserve Bank of India.

In 1978 UTI was de-linked from the RBI and the Industrial Development Bank

of India (IDBI) took over the regulatory and administrative control in place of

RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of

1988 UTI had Rs.6,700 crores of assets under management.

Second Phase 1987-1993 (Entry of Public Sector Funds): 1987 marked the

entry of non- UTI, public sector mutual funds set up by public sector banks and

Life Insurance Corporation of India (LIC) and General Insurance Corporation of

India (GIC). SBI Mutual Fund was the first non- UTI Mutual Fund established in

June 1987 followed by Can bank Mutual Fund (Dec 87), Punjab National Bank

Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun

90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund in

June 1989 while GIC had set up its mutual fund in December 1990.

At the end of 1993, the mutual fund industry had assets under management of

4 | P a g e

Rs.47,004 crores.

Third Phase 1993-2003 (Entry of Private Sector Funds): With the entry of

private sector funds in 1993, a new era started in the Indian mutual fund

industry, giving the Indian investors a wider choice of fund families. Also, 1993

was the year in which the first Mutual Fund Regulations came into being,

under which all mutual funds, except UTI were to be registered and governed.

The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the

first private sector mutual fund registered in July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more

comprehensive and revised Mutual Fund Regulations in 1996. The industry

now functions under the SEBI (Mutual Fund) Regulations 1996.

The number of mutual fund houses went on increasing, with many foreign

mutual funds setting up funds in India and also the industry has witnessed

several mergers and acquisitions. As at the end of January 2003, there were 33

mutual funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India

with Rs.44,541 crores of assets under management was way ahead of other

mutual funds.

Fourth Phase since February 2003: In February 2003, following the repeal of

the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities.

One is the Specified Undertaking of the Unit Trust of India with assets under

management of Rs.29,835 crores as at the end of January 2003, representing

broadly, the assets of US 64 scheme, assured return and certain other

schemes. The Specified Undertaking of Unit Trust of India, functioning under

an administrator and under the rules framed by Government of India and does

not come under the purview of the Mutual Fund Regulations.

The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It

5 | P a g e

is registered with SEBI and functions under the Mutual Fund Regulations. With

the bifurcation of the erstwhile UTI which had in March 2000 more than

Rs.76,000 crores of assets under management and with the setting up of a UTI

Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with

recent mergers taking place among different private sector funds, the mutual

fund industry has entered its current phase of consolidation and growth. As at

the end of September, 2004, there were 29 funds, which manage assets of

Rs.153108 crores under 421 schemes.

Parties to a Mutual fund

There are 4 principal parties to a mutual fund in addition to other parties

rendering specialised services. The parties are listed below:

A. Sponsor

B. Trustee

C. Asset Management Company

D. Custodian

E. Others Functionaries

6 | P a g e

Sponsor Trustee AMC Custodian Others

A. Sponsor:

Sponsor of mutual fund is like the promoter of a joint stock

company. He brings the mutual fund into existence. Every mutual fund

bears the name of the sponsor. UTI sponsored the UTI Mutual fund;

HDFC Mutual Fund sponsored HDFC Mutual fund. Canara Bank

sponsored Canara Mutual fund and list goes on...

Activities of the Sponsor:

Promotion: He promotes a mutual fund. He establishes it under Indian

Trust Act and gets it registered with SEBI.

Appointment: The sponsor appoints the Trustees, Custodians and the

Asset Management Company with the approval of SEBI. He should

comply wit h the guidelines of SEBI governing such appointments. The

sponsor also appoints other parties like Brokers, Registrar and Transfer

Agents, Depository Participants, bankers, auditors, selling agents and

distributors.

Track Record: The sponsor must have a track record of operating in the

financial markets at least in the last 5 years.

Parties of mutual fund

7 | P a g e

Profit Making: Out of the 5 year track record mentioned above, the

sponsor must have made profit at least in 3 years.

Capital Contribution: The Sponsor should contribute to a minimum of

40%of capital of the Asset Management Company. The income of the

sponsors the return it gets on such capital contribution.

B. Trustees:

The Sponsor appoints a Board of Trustee. Alternatively, a company

registered under the Companies Act can be appointed as the Trustee Company

or Board of Trustees should act according to the provisions of the Indian Trust

Act, 1882. The trustees should protect the interest of the investors. The AMC

and all other functionaries like Brokers, Selling Agents and Custodian etc.., are

accountable to the Trustees. The Trustees get these powers through a Trust

Deed executed by the sponsor in favour of the Trustees as per SEBI Regulation.

In addition the Deed id registered under Indian Trust Act.

The Trustees supervise the activities of the AMC. They also ensure all the

regulation and law are complied with in the operations. The AMC has to obtain

the concurrence of the trustees for floating any scheme to raise funds. They

can also seek any information pertaining to the operation. In the extreme case,

the Trustees can dismiss the AMC.

C. Asset Management Company (AMC):

The operational management of a Mutual fund is in the hands of the

AMC. It is also known as Fund Manager. It designs various schemes of the

Mutual fund, analyse corporate performance and securities, and buys and sells

securities.

8 | P a g e

Features of an Asset Management Company:

An AMC is registered as a private limited company.

Every AMC must be registered with SEBI.

The capital of the AMC is provided by the sponsor, its associates or its

joint venture partners.

Every AMC must have a minimum net worth of Rs. 10 crore at all times.

An AMC can not act as AMC of more than one mutual fund.

AMC also cannot undertake any business other than asset management

of a mutual fund.

The AMC signs an investment management agreement with the

Trustees. The provisions of the agreement should be n accordance with

SEBI Regulation.

The AMC charges a fee for the investment management. It is calculated

at a fixed percentage of the funds managed by it. It distributes this, after

meeting its expenses and staff cost, as dividend to the sponsors, its

associates or joint venture partners.

All the investments sale and purchase of securities are done by the AMC.

D. Custodian:

Custodians are responsible for maintaining the securities bought. They

perform the back-office function of acting on the corporate action. Where the

securities are held in the demat form, they ensure that the securities bought

are transferred to the demat a/c. When the shares are sold, delivery

instruction is issued by the custodian. Custodians also receive dividend or

interest on the mutual funds investment. Custodians also do what is necessary

9 | P a g e

regarding any corporate action like bonus issues, right offer and offer for sale,

buy-back and such other things on the advice of AMC.

A. Other Functionaries:

The following functionaries are appointed for specialised functions:

Registrar and transfer agents:

When the units are sold by mutual funds to the public. The Registrar and

Transfer Agents open the Register of Unit Holders. Throughout the life of the

Fund, purchase and sale of units by the Fund are entered in the Register

continuously.

Brokers:

Brokers are appointed for purchase and sale of securities by the AMC as apart

of investment. Brokers are members of any recognised stock exchange holding

SEBI registration.

Selling Agents and Distributors:

These are agents appointed to popularise the units of the mutual fund among

the investors. They are marketing agents or salesmen for the units of mutual

funds.

Depository Participants:

AMC purchases corporate and other securities which may have to be held in

the demat form. For this purpose the trustee open a demat account with a

Depository Participant(DP) .DP is any bank or financial service company

opening and operating demat accounts on behalf of clients either with

10 | P a g e

National Securities Depository Ltd (NSDL) or Central Depository Service Ltd.

(CDSL).

Bankers:

Bank accounts are opened to carry on the cash transactions of the mutual

fund. They maintain current accounts and other accounts of the mutual fund.

There are many receipts and payments every day made by the mutual fund

through the bank accounts.

Legal Advisors:

Lawyers or advocates are employed to comply with the legal formalities. Any

dispute or litigation arising may also be looked after by the legal advisors.

Auditors:

Like the auditor of any other firm, he inspects the books of accounts

maintained and the transactions carried on. He also audits the accounts and

gives his report every year.

Types of Mutual fund Schemes:

Mutual fund Schemes are divided on the basis of structure or on the basis of

investment objective.

A. Classification on the Basis of Structure: On the basis this schemes are

divided into three types.

1) Open-Ended Schemes:

These are schemes not having any fixed maturity. Initially the units are sold

by way of an offer document at the face value. An entry load may be charged

11 | P a g e

at a fixed percentage (management fee) on the face valve. After the issue

closes, the mutual fund buys and sells the units continuously based on the

Net Asset Valve. Selling Agents and Distributors are used for the sale of units

to investors. E.g. US-1964 of UTI, SBI-Magnum Equity Fund, UTI-Master

Plus91.

2) Close-Ended Schemes:

These schemes have a fixed maturity. After the initial offer of the units, the

Mutual fund does not buy or sell the units. Only on the date of Maturity the

Mutual fund buys the units back from the unit-holders. Before that, these

units are listed on stock exchanges. The investors can buy sell the units on the

stock exchange using the services of the brokers. E.g. UTI-Master Equity Plan-

91, LIC-Mutual fund-Dhanavarsha.

3) Interval Schemes:

Under these schemes the units are listed on the stock exchanges. In addition

the mutual fund also sells and repurchases the units at the Net Asset Value

Based price. E.g.UTI-Mastershare..

B. Classification on the Basis of investment Objective:

There is an umpteen number of schemes classified on the basis of the

investment objective. There are plenty of classes of investors with

varied investment objectives. Different schemes have been designed to

suit the requirement of every investor. Most important schemes are

listed below.

12 | P a g e

1) Growth Schemes:

The Fund under the scheme is predominantly invested in equity shares of

companies. The main aim is to tap capital gains in the medium to long-term.

Fluctuations in share prices may affect the growth or value of the fund.

2) Income Schemes:

The fund is invested in income yielding securities like Bonds, debentures,

Government Securities, Commercial Paper and other money market

instruments. If allowed, they can also lend in the call-money market.

3) Balanced Schemes (Growth and Income Funds):

These funds invest partially in equity shares and the remaining money in

equity shares and the remaining money in debt related securities. By doing

this, they derive income in the form of interest and capital gains and dividend

on the equity. It balances the risk and return far better than either growth

funds or income funds. E.g. Prudential ICICI Balanced Fund and PNB-Balanced

Growth Fund.

4) Equity Linked Savings Schemes (ELSS):

This Scheme was brought into existence in 1922 by a notification of Ministry

of Finance Investors in this Scheme are eligible for tax benefits. From the

financial year 2005-06 an amount invested in ELSS is eligible to be included in

Sec 80C deduction up to Rs.100000 .There is a lock in period of 3 years. It is

eligible for exemption from capital gains tax. The fund raised in the scheme is

invested in equity shares essentially. E.g. Birla Equity Plan, Sundaram Tax Saver

and HDFC Long Term Advantage Fund.

13 | P a g e

5) Index Funds:

These funds are invested in the shares included in a share index Amount is

allocated among the stocks in such a percentage which each stock claims in the

index by way of weight age. The returns are related to the movement in the

index. Indian Index Funds Prefer S&P CNX Nifty Index.

6) Gilt Funds:

These funds aim to invest in totally risk-free securities. Risk management is

total and return is secondary. Therefore the funds are invested in Government

Bonds and Treasury bills issued by the Central Government. If permitted the

funds may also be invested in call money market through lending .E.g. UTI-G-

Sec Fund...

7) Money Market Scheme:

Funds raised under the scheme aim at liquidity of investment. To achieve the

liquidity, investment is made mainly in Treasury Bills, Commercial Paper,

Certificate of Deposit and Call-Monet. E.g. Lng-Vysya Liquid Fund.

8) Theme Funds:

Also known as Focus or Sectoral Funds, these are invested in equity of the

companies failing into a single industry. The industry selected is a high growth

one like software industry, pharmaceutical industry, FMCG industry etc. These

funds have a high risk-return profile.

9) Fund of Funds:

It is a fund that is invested not in the securities of companies, but in the units

of the same mutual fund or in the units of other mutual funds. Mutual fund

14 | P a g e

stands for diversification of investment. Fund of Funds carries this

diversification further.

10) Contra Fund:

There are companies whose share prices are far below their real worth. The

stock market has not realised the true worth of other these companies. Contra

Fund is invested in the equity shares of such companies. E.g. HDFC Core

&Satellite Fund...

11) Others:

There are many other funds like Emerging Opportunities Fund, Emerging

Technology Fund, and Inverse Index Fund etc...

12) Systematic Investment Plan:

This is a mode of investment where by the investor invests a fixed amount

every month in a particular scheme. It is similar to a recurring bank deposit. As

a concept, it is revolutionary. When the Net Asset Value is less, the investor

will receive more number of units (as in a declining market). When the market

booming, he gets less number of units. But, the value of total investment until

that date goes up high because of higher Net Asset Value.

On the basis of on the basis of

Structure Investment Objective

Types of mutual funds

15 | P a g e

Importance of Mutual Fund:

Small investors face a lot of problems in the share market, limited resources,

lack of professional advice, lack of information etc. Mutual funds have come as

a much needed help to these investors. It is a special type of institutional

device or an investment vehicle through which the investors pool their savings

which are to be invested under the guidance of a team of experts in wide

variety of portfolios of Corporate securities in such a way, so as to minimise

risk, while ensuring safety and steady return on investment. It forms an

important part of the capital market, providing the benefits of a diversified

portfolio and expert fund management to a large number, particularly small

investors. Now a day, mutual fund is gaining its popularity due to the following

reasons:

l. With the emphasis on increase in domestic savings and improvement in

deployment of investment through markets, the need and scope for mutual

fund operation has increased tremendously. The basic purpose of reforms in

the financial sector was to enhance the generation of domestic resources by

reducing the dependence on outside funds. This calls for a market based

institution which can tap the vast potential of domestic savings and chanalise

them for profitable investments. Mutual funds are not only best suited for the

purpose but also capable of meeting this challenge.

2. An ordinary investor who applies for share in a public issue of any company

is not assured of any firm allotment. But mutual funds who subscribe to the

capital issue made by companies get firm allotment of shares. Mutual fund

latter sell these shares in the same market and to the Promoters of the

company at a much higher price. Hence, mutual fund creates the investors

confidence.

16 | P a g e

3. The phyche of the typical Indian investor has been summed up by Mr.S.A.

Dave, Chairman of UTI, in three words; Yield, Liquidity and Security. The

mutual funds, being set up in the public sector, have given the impression of

being as safe a conduit for investment as bank deposits. Besides, the assured

returns promised by them have investors had great appeal for the typical

Indian investor.

4. As mutual funds are managed by professionals, they are considered to have

a better knowledge of market behaviours. Besides, they bring a certain

competence to their job. They also maximise gains by proper election and

timing of investment.

5. Another important thing is that the dividends and capital gains are

reinvested automatically in mutual funds and hence are not fritted away.The

automatic reinvestment feature of a mutual fund is a form of forced saving and

can make a big difference in the long run.

6. The mutual fund operation provides a reasonable protection to investors.

Besides, presently all Schemes of mutual funds provide tax relief under Section

80 L of the Income Tax Act and in addition, some schemes provide tax relief

under Section 88 of the Income Tax Act lead to the growth of importance of

mutual fund in the minds of the investors.

7. As mutual funds creates awareness among urban and rural middle class

people about the benefits of investment in capital market, through profitable

and safe avenues, mutual fund could be able to make up a large amount of the

surplus funds available with these people.

8. The mutual fund attracts foreign capital flow in the country and secures

profitable investment avenues abroad for domestic savings through the

opening of off shore funds in various foreign investors. Lastly another notable

thing is that mutual funds are controlled and regulated by S E B I and hence are

17 | P a g e

considered safe. Due to all these benefits the importance of mutual fund has

been increasing.

Disadvantages of mutual funds: Mutual funds have disadvantages as well,

which include:

Fees

Less control over timing of recognition of gains

Less predictable income

No opportunity to customize

Need for the study:

The main purpose of doing this project was to know about mutual fund and its

functioning. This helps to know in details about mutual fund investors in

mutual fund. It also helps in understanding different schemes of mutual funds.

Because the study depends upon prominent funds in India and their schemes

like equity, income, balance as well as the returns associated with those

schemes

Objectives:

My objectives of study are:

To check the popularity and growth of mutual fund.

To examine whether mutual funds are really having a better prospect in

MANGALORE.

18 | P a g e

To know the needs and wants of clients.

To do the detail study of mutual funds.

To study the financial awareness of the investors regarding mutual fund.

To know the investor approach towards the various mutual fund

company.

Scope of study:

The study is restricted to analyze the investment pattern of investors in

mutual fund in an around Mangalore.

Materials and methodology of the study:

The data in the study is through collection from primary data and secondary

data method.

Data sources:

Research is totally based on primary data. Secondary data can be used only for

the reference. Research has been done by primary data collection, and primary

data has been collected by interacting with various investors.

Sample size:

The sample size was restricted to only 50 investors, which comprised of mainly

peoples from different regions of Mangalore due to time constraints.

Sampling Area:

The area of the research was MANGALORE, India.

19 | P a g e

Social relevance:

Mutual fund is a good way of investing especially for middle class people as it

involves less risk. This study on mutual fund investment will helps to know the

financial situation of the investors. It gives the clear picture of the mutual fund

investment, with the help of this those people, who want to invest in mutual

fund in future, they gets ideas and plans.

Chapter Scheme:

The project report begins with the introduction to the various areas the

project is concerned with. It also gives brief description of the entire project

work by providing information on research objectives, need for the study,

research methodology, limitations of the study, social relevance of the study

and chapter wise division of the project work.

The second chapter provides the report on review of literature i.e.

importance of mutual fund. This was done by referring books, newspaper

articles, journals, various information on the study and analysis of mutual fund.

The third chapter deals with the profile of the company. This tells

about companies performance and also all details of the company .companies

history, economic situation etc

The fourth chapter comprehensive concept and techniques which

shows the analysis of data through tabulation, computation and graphical

representation of data collected from survey.

The fifth chapter with the findings, suggestion and conclusion part

which very much important after analysis is made.

20 | P a g e

Limitations of the study:

The time period provided for the study is limited..

The research is confined to a certain parts of Mangalore and does not

Necessarily shows a pattern applicable to all of Country.

Research has been done only in Mangalore.

Possibility of Error in analysis of data due to small sample size.

Respondents error.

Limited resources.

The time constraint is one of the major problems.

The study is limited to the different schemes available under the mutual

funds selected.

The study is limited to selected mutual fund schemes.

The lack of information sources for the analysis part.

Bibliography:

For the references different books, journals, and newspapers have been used

and different websites have been used.

Investment analysis and Portfolio management by Rustage

Investment analysis and Portfolio management by Prasanna Chandra

Security analysis and Portfolio management by Punidavathi pandiyan

21 | P a g e

Investment management by V.K. Bhaalla

How to invest in mutual fund and earn high rates of return safely by

Alan Northcut

www.google.com

www.wikipedia.com

www.hdfc.com

Das könnte Ihnen auch gefallen

- A Project Report On Mutual Fund As An Investment Avenue at NJ India InvestDokument16 SeitenA Project Report On Mutual Fund As An Investment Avenue at NJ India InvestYogesh AroraNoch keine Bewertungen

- A Summer Project Report ON: Mutual Fund As An Investment Avenue ATDokument93 SeitenA Summer Project Report ON: Mutual Fund As An Investment Avenue ATRanjeet SinghNoch keine Bewertungen

- A Summer Project Report ON: Mutual Fund As An Investment Avenue atDokument66 SeitenA Summer Project Report ON: Mutual Fund As An Investment Avenue atRanjeet Singh100% (1)

- Mutual FundDokument60 SeitenMutual FundAnand ChavanNoch keine Bewertungen

- Project On Mutual Funds As An Investment AvenueDokument18 SeitenProject On Mutual Funds As An Investment AvenueRishi vardhiniNoch keine Bewertungen

- Introduction To Mutual FundsDokument31 SeitenIntroduction To Mutual FundsHARSHA SHENOYNoch keine Bewertungen

- RIMT Mutual FundDokument63 SeitenRIMT Mutual Fundguri_toorNoch keine Bewertungen

- Investors Perception Towards Mutual FundsDokument60 SeitenInvestors Perception Towards Mutual FundsBe Yourself50% (2)

- Industry Profile Mutual FundsDokument13 SeitenIndustry Profile Mutual FundsPrince Satish Reddy100% (1)

- Comparative Study of Mutual Funds in India Black BookDokument79 SeitenComparative Study of Mutual Funds in India Black BookNasruddin Chaudhary78% (9)

- Customer Perception Towards Mutual FundsDokument52 SeitenCustomer Perception Towards Mutual FundsRk BainsNoch keine Bewertungen

- Leela Project 2018Dokument58 SeitenLeela Project 2018Anonymous LbM7i3UaOjNoch keine Bewertungen

- An Interim ReportDokument13 SeitenAn Interim ReportKalpsYadavNoch keine Bewertungen

- Third Party Product and Wealth ManagementDokument54 SeitenThird Party Product and Wealth ManagementKonark Jain100% (1)

- Mutual Fund in India UTIDokument70 SeitenMutual Fund in India UTIkartik ChauhanNoch keine Bewertungen

- Mutual Fund AssignmentDokument51 SeitenMutual Fund AssignmentKuljeet Singh83% (6)

- Mutual Funds1Dokument206 SeitenMutual Funds1Anjy ChokraNoch keine Bewertungen

- Relience Mutual FundDokument92 SeitenRelience Mutual FundAnil MakvanaNoch keine Bewertungen

- Revised Mutul Fund ProjectDokument37 SeitenRevised Mutul Fund Projectlucky137Noch keine Bewertungen

- IL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Dokument56 SeitenIL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Vijetha EdduNoch keine Bewertungen

- Pliagiarism ReportDokument41 SeitenPliagiarism ReportShazpreet KaurNoch keine Bewertungen

- Mutual Funds and SEBI Regulations: R. M. KambleDokument5 SeitenMutual Funds and SEBI Regulations: R. M. KambleInternational Journal of computational Engineering research (IJCER)Noch keine Bewertungen

- Mutual FundsDokument60 SeitenMutual FundsParshva Doshi60% (5)

- Performance Evaluation of Elss Schemes of Mutual Funds-Project by ShivaniDokument53 SeitenPerformance Evaluation of Elss Schemes of Mutual Funds-Project by Shivanicutepie0671% (7)

- What Are Mutual Funds?Dokument19 SeitenWhat Are Mutual Funds?renukabsb6180Noch keine Bewertungen

- A Project Report On Mutual FundDokument42 SeitenA Project Report On Mutual Fundiam_ritehereNoch keine Bewertungen

- Creating Awareness of Mutual FundsDokument82 SeitenCreating Awareness of Mutual FundsNavyaRaoNoch keine Bewertungen

- XXXXX MFDokument24 SeitenXXXXX MFpratik0909Noch keine Bewertungen

- A Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionDokument17 SeitenA Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionPriyanka PandeyNoch keine Bewertungen

- Unit 4Dokument17 SeitenUnit 4rishavNoch keine Bewertungen

- Mutual FundsDokument30 SeitenMutual FundsPrince JoshiNoch keine Bewertungen

- Soaib FinalkDokument24 SeitenSoaib Finalkanunaykumar7847Noch keine Bewertungen

- FinalDokument110 SeitenFinalMadhur GuptaNoch keine Bewertungen

- Mutual Funds in India: Paper OnDokument17 SeitenMutual Funds in India: Paper OnjayakumaryNoch keine Bewertungen

- Assignment OF Workshop ON Regulatory Framework For Banks and Financial ServicesDokument25 SeitenAssignment OF Workshop ON Regulatory Framework For Banks and Financial ServicesRohit SinghNoch keine Bewertungen

- Literature ReviewDokument9 SeitenLiterature Reviewsrithirunav100% (1)

- A Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalDokument10 SeitenA Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalMonika MonaNoch keine Bewertungen

- Mutual Fund Operation Flow ChartDokument76 SeitenMutual Fund Operation Flow ChartjeevanNoch keine Bewertungen

- History of The Indian Mutual Fund Industry OriginDokument54 SeitenHistory of The Indian Mutual Fund Industry OriginPrashant AroraNoch keine Bewertungen

- Mutual FundsDokument65 SeitenMutual FundsSonalir RaghuvanshiNoch keine Bewertungen

- Analysis of Uti Mutual Fund With Reliance Mutual FundDokument64 SeitenAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayNoch keine Bewertungen

- Mutual Fund Operational Flow ChartDokument12 SeitenMutual Fund Operational Flow ChartNarasimhaPrasadNoch keine Bewertungen

- Mutual Funds FunctionsDokument75 SeitenMutual Funds FunctionsChristopher Paul50% (2)

- Structure of Mutual Funds in India: Asset Management CompanyDokument7 SeitenStructure of Mutual Funds in India: Asset Management CompanyPaavni SharmaNoch keine Bewertungen

- 1.1 Introduction To The StudyDokument62 Seiten1.1 Introduction To The Studymalli aiswaryaNoch keine Bewertungen

- Mutual Funds 1Dokument12 SeitenMutual Funds 1NarasimhaPrasadNoch keine Bewertungen

- Report Format For Capstone Project-I - 2Dokument128 SeitenReport Format For Capstone Project-I - 2Ritesh SiNghNoch keine Bewertungen

- Mutual Funds: Learning OutcomesDokument47 SeitenMutual Funds: Learning OutcomesPravesh PangeniNoch keine Bewertungen

- Introduction To Mutual FundsDokument16 SeitenIntroduction To Mutual FundsgurhanipawanNoch keine Bewertungen

- Mutual Funds InvestmentDokument60 SeitenMutual Funds Investmentselva kumarNoch keine Bewertungen

- Mutual Funds-: The Mutual Fund IndustryDokument20 SeitenMutual Funds-: The Mutual Fund Industrymangy4uNoch keine Bewertungen

- Theortical Background: Mutual Fund in IndiaDokument20 SeitenTheortical Background: Mutual Fund in IndiaHari JacinnaNoch keine Bewertungen

- Introduction of Mutual FundDokument17 SeitenIntroduction of Mutual FundParas Upreti100% (1)

- The Material Has Been Downloaded From And: WWW - Sebi.gov - inDokument15 SeitenThe Material Has Been Downloaded From And: WWW - Sebi.gov - inChintan PandyaNoch keine Bewertungen

- Introduction To Mutual FundsDokument17 SeitenIntroduction To Mutual FundsSaakshi SinghalNoch keine Bewertungen

- MF Sem 1Dokument33 SeitenMF Sem 1aditisurve11Noch keine Bewertungen

- Indian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaVon EverandIndian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingVon EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNoch keine Bewertungen

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersVon EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNoch keine Bewertungen

- Credit RiskDokument18 SeitenCredit RiskWilfred DsouzaNoch keine Bewertungen

- AptitudeDokument3 SeitenAptitudeWilfred DsouzaNoch keine Bewertungen

- A Project Report On A Study of Investors Perception Towards Investment in Equity Market - 1Dokument81 SeitenA Project Report On A Study of Investors Perception Towards Investment in Equity Market - 1Wilfred Dsouza63% (8)

- Bhula Dena LyricsDokument1 SeiteBhula Dena LyricsWilfred DsouzaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentWilfred DsouzaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentWilfred DsouzaNoch keine Bewertungen

- Tu Mere Agal Bagal Hai LyricsDokument2 SeitenTu Mere Agal Bagal Hai LyricsWilfred DsouzaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentWilfred DsouzaNoch keine Bewertungen

- Shwitha KarkeraDokument5 SeitenShwitha KarkeraWilfred DsouzaNoch keine Bewertungen

- Findings SuggestionsDokument4 SeitenFindings SuggestionsWilfred DsouzaNoch keine Bewertungen

- Final PrasadDokument3 SeitenFinal PrasadWilfred DsouzaNoch keine Bewertungen

- Presented by WilfyDokument6 SeitenPresented by WilfyWilfred DsouzaNoch keine Bewertungen

- Questionnaire On Mutual Fund:: Dear Sir/MadamDokument4 SeitenQuestionnaire On Mutual Fund:: Dear Sir/MadamWilfred DsouzaNoch keine Bewertungen

- Tauba Tumhare Yeh Ishare Lyrics From Chalte Chalte (2003)Dokument1 SeiteTauba Tumhare Yeh Ishare Lyrics From Chalte Chalte (2003)Wilfred DsouzaNoch keine Bewertungen

- AptitudeDokument3 SeitenAptitudeWilfred DsouzaNoch keine Bewertungen

- Supply Chain A2Dokument31 SeitenSupply Chain A2Wilfred DsouzaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument2 SeitenNew Microsoft Office Word DocumentWilfred DsouzaNoch keine Bewertungen

- StrategyDokument8 SeitenStrategyWilfred DsouzaNoch keine Bewertungen

- Admin TQMDokument28 SeitenAdmin TQMManuel Sanchez QuispeNoch keine Bewertungen

- Supply Chain A2Dokument31 SeitenSupply Chain A2Wilfred DsouzaNoch keine Bewertungen

- S. No First Name Surname Country Specialism Previous IPL Team(s) Reserve Price US'000Dokument4 SeitenS. No First Name Surname Country Specialism Previous IPL Team(s) Reserve Price US'000Wilfred DsouzaNoch keine Bewertungen

- FM Chapter 1Dokument3 SeitenFM Chapter 1Durga Prasad100% (6)

- Time Management 101Dokument17 SeitenTime Management 101Wilfred DsouzaNoch keine Bewertungen

- StrategyDokument8 SeitenStrategyWilfred DsouzaNoch keine Bewertungen

- Supply Chain Management (3rd Edition)Dokument33 SeitenSupply Chain Management (3rd Edition)Pranav VyasNoch keine Bewertungen

- SongDokument2 SeitenSongWilfred DsouzaNoch keine Bewertungen

- Humse Door Jaoge Kaise, Dil Se Hume Bhoolaoge Kaise, Hum Wo Khushboo Hai Jo Saanso Me Baste Hain, Khudkee Saanso Ko Rok Paaoge KaiseDokument1 SeiteHumse Door Jaoge Kaise, Dil Se Hume Bhoolaoge Kaise, Hum Wo Khushboo Hai Jo Saanso Me Baste Hain, Khudkee Saanso Ko Rok Paaoge KaiseWilfred DsouzaNoch keine Bewertungen

- Deewana Kar Raha Hai Lyrics: (Musalsal:continues)Dokument1 SeiteDeewana Kar Raha Hai Lyrics: (Musalsal:continues)Wilfred DsouzaNoch keine Bewertungen

- Strategic Control Guiding and Evaluating StrategiesDokument9 SeitenStrategic Control Guiding and Evaluating StrategiesWilfred DsouzaNoch keine Bewertungen

- Dolfin Rubbers - AR - 2021Dokument77 SeitenDolfin Rubbers - AR - 2021Ag gaNoch keine Bewertungen

- Teps - Annual Report Fy 2019-20 - Final 20.12.2020Dokument58 SeitenTeps - Annual Report Fy 2019-20 - Final 20.12.2020PrinoyDharNoch keine Bewertungen

- Slip PDFDokument1 SeiteSlip PDFPrachi BhosaleNoch keine Bewertungen

- 5pmf1612195pmf12db70afcfc6934ee7 Fpesig1612195p4zfgec76l55a4nDokument11 Seiten5pmf1612195pmf12db70afcfc6934ee7 Fpesig1612195p4zfgec76l55a4nkannan73drNoch keine Bewertungen

- Ipo Scams: Yes Bank Ltd. CaseDokument11 SeitenIpo Scams: Yes Bank Ltd. CaseshraynNoch keine Bewertungen

- GM BreweriesDokument74 SeitenGM BreweriesReTHINK INDIANoch keine Bewertungen

- Sanco Annual Report 2019Dokument187 SeitenSanco Annual Report 2019Sonu KumariNoch keine Bewertungen

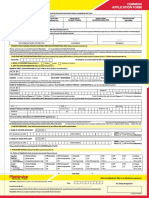

- Mutual Fund Restatementization Request FormDokument1 SeiteMutual Fund Restatementization Request FormRaj KumarNoch keine Bewertungen

- Padmakshi IntroductionDokument13 SeitenPadmakshi IntroductionRamana GNoch keine Bewertungen

- A Project Report On "Market Behavior Towards Investment of Equity"Dokument78 SeitenA Project Report On "Market Behavior Towards Investment of Equity"Dhaval TrivediNoch keine Bewertungen

- Notice of 103rd AGM of Britannia Industries LimitedDokument20 SeitenNotice of 103rd AGM of Britannia Industries LimitedSag SagNoch keine Bewertungen

- Adjudication Order in Respect of M/s Custom Capsules Private Limited in The Matter of M/s Niraj Cement Structurals LimitedDokument24 SeitenAdjudication Order in Respect of M/s Custom Capsules Private Limited in The Matter of M/s Niraj Cement Structurals LimitedShyam SunderNoch keine Bewertungen

- Investment ManagementDokument21 SeitenInvestment Managementshahid veettil67% (3)

- Mahindra MF Application FromDokument4 SeitenMahindra MF Application FromnanduvermaNoch keine Bewertungen

- Common Form For Non-Financial Transactions: Please Fi LL in The Information Below Legibly in English and in CAPITALSDokument3 SeitenCommon Form For Non-Financial Transactions: Please Fi LL in The Information Below Legibly in English and in CAPITALSRRKNoch keine Bewertungen

- Emergency Services To Customer by BankDokument53 SeitenEmergency Services To Customer by BankNinad PatilNoch keine Bewertungen

- Customer Survey Report On Demat Account: Submitted ToDokument15 SeitenCustomer Survey Report On Demat Account: Submitted ToSoumik ParuaNoch keine Bewertungen

- Student Declaration: Engineering and Technology, Greater Noida. I Hereby Declare That TheDokument98 SeitenStudent Declaration: Engineering and Technology, Greater Noida. I Hereby Declare That TheRaaj JainNoch keine Bewertungen

- CG Notes PDFDokument49 SeitenCG Notes PDFT S NarasimhanNoch keine Bewertungen

- Class 12 Businessstudy Notes Chapter 10 Studyguide360Dokument28 SeitenClass 12 Businessstudy Notes Chapter 10 Studyguide360sandipNoch keine Bewertungen

- Financial OrganiserDokument4 SeitenFinancial OrganiserAbhay MishraNoch keine Bewertungen

- RKSV Securities India Private Limited DP of Central Depository Services (I) LTDDokument1 SeiteRKSV Securities India Private Limited DP of Central Depository Services (I) LTDJABIRNoch keine Bewertungen

- VikaslifeDokument118 SeitenVikaslifePrathamesh KambleNoch keine Bewertungen

- Bombay Annual Report 2015-2016Dokument152 SeitenBombay Annual Report 2015-2016Sushobhan DasNoch keine Bewertungen

- NSDL-CDSL-DP - Common - POA - Ver - 20 1 - 13 11 2020Dokument2 SeitenNSDL-CDSL-DP - Common - POA - Ver - 20 1 - 13 11 2020kiranas1990Noch keine Bewertungen

- Lecture 2.1.2 Primary MarketDokument27 SeitenLecture 2.1.2 Primary MarketDeepansh SharmaNoch keine Bewertungen

- Background: Power of Attorney & InstructionsDokument5 SeitenBackground: Power of Attorney & InstructionsPrakash Chandra TripathyNoch keine Bewertungen

- SRS - Stock MasterDokument20 SeitenSRS - Stock MasterNaveen Krishnan55% (11)

- Demo - Nism 6 - Depository ModuleDokument7 SeitenDemo - Nism 6 - Depository ModuleNitin BNoch keine Bewertungen

- Ijsrp Feb 2012 45Dokument7 SeitenIjsrp Feb 2012 45Joanna HernandezNoch keine Bewertungen