Beruflich Dokumente

Kultur Dokumente

Curriculum NISM IIA RTACorp

Hochgeladen von

srinuindian007Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Curriculum NISM IIA RTACorp

Hochgeladen von

srinuindian007Copyright:

Verfügbare Formate

NISM-Series-II-A: Registrars to an Issue and Share Transfer Agents - Corporate

Certification Examination

Curriculum

I. Introduction to Securities

A. Categorization of securities into equity, debt and hybrid

B. Characteristics of securities

II. Characteristics of Equities

A. Rights of common shareholders

B. Par value, Face value and share premium

C. Dividend calculation and distribution

D. Authorized capital

E. Issued capital

F. Outstanding shares

G. Paid-up shares

H. Placement of preferred shares and features

I. Share buy-back

J. Rights issue

III. Characteristics of Other Securities

A. Warrants

B. Types of convertible bonds

C. Types of depository receipts

D. Fully convertible currency bonds (FCCBs)

IV. Characteristics of Debt Instruments

A. Payment terms

B. Face value

C. Coupon

D. Term to maturity

E. Market value

F. Current yield

G. Yield to maturity

H. Corporate debt securities

I. Government securities

J. Methods of corporate debt retirement

K. Types of fixed and floating rate instruments and relevant benchmarks

L. Standards and significance of credit rating of debt instruments

M. Types of money market instruments and features

N. Government debt securities and features

O. Company fixed deposits and features

V. Basics of Mutual Funds

A. Structure and objective of a mutual fund

B. Units of a fund, face value and ongoing value.

C. Benefits of mutual funds to investors

D. Characteristics of open and closed end funds

E. Assets Under Management (AUM)

F. Net Asset Value (NAV)

G. Unit Capital

H. Types of mutual fund products and classification by investment category

I. Returns as dividends and capital gains

VI. SEBIs Role and Relevant Regulations

A. Securities market regulatory environment

B. SEBIs and role

C. SEBIs powers

D. Investor Protection

E. SEBI (Registrars to an Issue and Share Transfer Agents) Regulations, 1993

F. SEBI (Intermediaries) Regulations, 2008

G. SEBI (Depositories and Participants) Regulations, 1996

VII. Public Offer of Securities -Features

A. Types of public issue and private placements

B. Types and process of Initial Public Offer

C. Buyback process through tenders, stock exchanges and reverse book building

VIII. Private Placement of Shares

A. Qualified Institutional Placement

B. Rights Issues

IX. Public Offer of Securities -Processes

A. Concepts in Public Issue of Shares

B. Underwriting

C. Green Shoe Option

D. Sequence in IPO Process

E. Features of Fixed Price Offering

F. Features of Book Built Offering

X. Roles and Responsibilities in a Public Issue

A. Role of the Registrar and Transfer Agent (R&T) in dematerialization and rematerialization of securities

B. Role of the R&T agent in reconciliation of daily balances

C. Role of the R&T agent in transfer of ownership of physical securities

D. Role of the R&T agent in issue of duplicate certificates

E. Role of the R&T agent in stop transfer for certificates reported Lost/ Stolen

F. Role of the R&T agent in issue of new certificates in corporate reorganizations

XI. Depository Services

A. Registration as a Depository and its role

B. Registration as a DP

C. Role of DP in transfer, transmission and transposition

D. Delivery Instruction Slip (DIS)

E. Ownership of dematerialised securities

F. Rights of Beneficial Owners

XII. Process related to Depositories

A. Process for pledging and hypothecation

B. Dispatch of periodic statements of accounts

C. Role of R&T and DP in providing information to issuers

D. Role of DP in downloading beneficiary positions to R&T agents

E. Role of R&T and DP in reflecting corporate actions

F. Process of trading and settlement of market and off-market trades

G. Process of reconciliation of records between the Depository and R&T agent

XIII. Investor Servicing Processes

A. Processes related to recording changes of address, bank & Power of Attorney

B. Processes related to dividend / interest payments

C. Processes related to transfer of ownership of securities

D. Processes related to issue of duplicate certificates

E. Processes related to lost securities and Stop Transfer instructions

F. Processes related to transmissions and deletions

G. Processes related to handling shareholder inquiries and complaints

XIV. Role of stock exchanges and other participants in the secondary market

A. Role of the secondary market

B. Role of the stock exchanges

C. Role of various participants in the stock markets

D. Advantages of listing

E. Salient features of the listing agreement

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Project Report On SEBIDokument26 SeitenProject Report On SEBIRahul Pillai56% (36)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Corporate Finance II - Alibaba's IPO DilemmaDokument27 SeitenCorporate Finance II - Alibaba's IPO DilemmaGiancarlo Corradini100% (1)

- Financial Markets and InstitutionsDokument28 SeitenFinancial Markets and Institutionsmomindkhan100% (4)

- How To Use BDO Nomura Online Trading Platform PDFDokument20 SeitenHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNoch keine Bewertungen

- Study+guide 16-19Dokument39 SeitenStudy+guide 16-19bakerbjNoch keine Bewertungen

- SAPM Study MaterialsDokument74 SeitenSAPM Study MaterialsVivek Arnold100% (1)

- Investment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Dokument13 SeitenInvestment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Farwa SamreenNoch keine Bewertungen

- Admas University School of Postgraduate Studies MBA Financial Management AssignmentDokument17 SeitenAdmas University School of Postgraduate Studies MBA Financial Management AssignmentAbnet BeleteNoch keine Bewertungen

- Group 5 PPT-Amazon-1Dokument43 SeitenGroup 5 PPT-Amazon-1ruby panjiyarNoch keine Bewertungen

- Scrip, Bonus & Capitalisation Issues: A Scrip Issue Should Not Be Confused With A)Dokument12 SeitenScrip, Bonus & Capitalisation Issues: A Scrip Issue Should Not Be Confused With A)Dhananjay KumarNoch keine Bewertungen

- Facts and Figures 2014 December 2014Dokument53 SeitenFacts and Figures 2014 December 2014FranceBiotechNoch keine Bewertungen

- MS-11 (Cost of Capital, Leverage & Capital Structure)Dokument8 SeitenMS-11 (Cost of Capital, Leverage & Capital Structure)Kim BanuelosNoch keine Bewertungen

- Reliance Power Annual Report 2008 09Dokument92 SeitenReliance Power Annual Report 2008 09vidhi_153Noch keine Bewertungen

- Sector Report - Nutraceutical IndustryDokument28 SeitenSector Report - Nutraceutical IndustryvinyspNoch keine Bewertungen

- Digi PDFDokument2 SeitenDigi PDFdhannu yogaNoch keine Bewertungen

- Case Study On Fraudulent Financial Reporting Evidence From MalaysiaDokument17 SeitenCase Study On Fraudulent Financial Reporting Evidence From MalaysiaSamu BorgesNoch keine Bewertungen

- Chapter 3 Percentage Taxes - UpdatedDokument13 SeitenChapter 3 Percentage Taxes - UpdatedDudz Matienzo100% (1)

- Dangote Sugar Refinery PLC ProspectusDokument79 SeitenDangote Sugar Refinery PLC ProspectusBilly Lee100% (1)

- Fundamentals of Investing 12th Edition Smart Test BankDokument35 SeitenFundamentals of Investing 12th Edition Smart Test Bankaffluencevillanzn0qkr100% (23)

- Venture Capital Valuation ModelDokument4 SeitenVenture Capital Valuation ModelSivakumar KrishnamurthyNoch keine Bewertungen

- MFS Unit 2 Part 2Dokument18 SeitenMFS Unit 2 Part 2muntaquirNoch keine Bewertungen

- Issue Mechanism PDFDokument4 SeitenIssue Mechanism PDFNikshitha100% (1)

- Juno RSU PlanDokument2 SeitenJuno RSU PlanFredrick Kunkle100% (3)

- Snowflake Sec Form s1Dokument848 SeitenSnowflake Sec Form s1anoopiit2012Noch keine Bewertungen

- Equity Crowdfunding - The Complete Guide For Startups and Growing CompaniesDokument25 SeitenEquity Crowdfunding - The Complete Guide For Startups and Growing CompaniesNathan RoseNoch keine Bewertungen

- Thesis FinalDokument16 SeitenThesis FinalAlagon, Justine Lloyd H.Noch keine Bewertungen

- IPO PreparationDokument4 SeitenIPO Preparationdeshmukh_muzammil1917Noch keine Bewertungen

- Arch IdDokument264 SeitenArch Idsvnrao123Noch keine Bewertungen

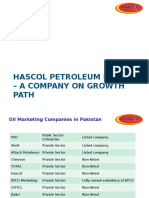

- Hascol Petroleum Limited - A Company On Growth PathDokument21 SeitenHascol Petroleum Limited - A Company On Growth PathMirzaNoch keine Bewertungen

- Masters Finance Thesis TopicsDokument8 SeitenMasters Finance Thesis Topicskerrylewiswashington100% (1)