Beruflich Dokumente

Kultur Dokumente

Globalization and Income Inequality IPR

Hochgeladen von

sk11983Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Globalization and Income Inequality IPR

Hochgeladen von

sk11983Copyright:

Verfügbare Formate

Journal of Policy Modeling 30 (2008) 725735

Available online at www.sciencedirect.com

Globalization and income inequality: Implications for

intellectual property rights

Samuel Adams

Ghana Institute of Management and Public Administration, P.O. Box AH 50, Achimota, Accra, Ghana

Received 15 June 2007; received in revised form 17 September 2007; accepted 20 October 2007

Available online 15 January 2008

Abstract

This paper examines the impact of globalization on income inequality for a cross-section of 62 developing

countries over a period of 17 years (19852001). The results of the study indicate that globalization explains

only 15% of the variance in income inequality. More specically, the results show that (1) strengthening

intellectual property rights and openness are positively correlated with income inequality; (2) foreign direct

investment is negative and signicantly correlated with income inequality but this is not robust to different

model specications; (3) the institutional infrastructure is negatively correlated with income inequality. The

studys ndings and the reviewof the literature suggest that globalization has both costs and benets and that

the opportunity for economic gains can be best realized within an environment that supports and promotes

sound and credible government institutions, education and technological development.

2008 Society for Policy Modeling. Published by Elsevier Inc. All rights reserved.

JEL classication: FO2; I30; K19

Keywords: Globalization; Income inequality; Intellectual property rights; Developing countries

1. Introduction

The past two decades can be described as the era of globalization. Although there is no consen-

sus on the denition of globalization, a common term that is synonymously with globalization is

integration, in terms of people, capital, ideas, technology, and services (Houck, 2005). Empirically,

globalization translates into greater mobility of the factors of production (capital and labor) and

greater world integration through increased trade, foreign direct investment (FDI), and enforce-

ment of intellectual property rights [IPR] (Milanovic, 2005; Wade, 2001). Though many studies

Tel.: +233 285173307/209450202.

E-mail address: sadamss2000@yahoo.com.

0161-8938/$ see front matter 2008 Society for Policy Modeling. Published by Elsevier Inc. All rights reserved.

doi:10.1016/j.jpolmod.2007.10.005

726 S. Adams / Journal of Policy Modeling 30 (2008) 725735

have been done to examine the effects of trade and FDI on both economic growth and income

inequality, not much has been on the effect of IPR. In the era of globalization, almost everyone is

a user and a potential creator of intellectual property and therefore its protection, which is called

intellectual property rights, should be of signicance to policymakers.

The purpose of this paper is to examine the impact of globalization especially the harmoniza-

tion of intellectual property rights (IPR) on income inequality. This is important because in the

past decade the protection of IPR has moved from an arcane area of legal analysis to the forefront

of global economic policymaking (Maskus, 2000a). This in no small measure has been motivated

by the successful completion of the World Trade Organizations (WTO) Agreement on Trade-

Related Aspects of Intellectual Property Rights (TRIPs) in 1994. The TRIPS agreement set strong

minimumstandards in each of the areas commonly associated with IPRs, including patents, copy-

rights, trademarks, and trade secrets (Maskus, 2000b). To the knowledge of the authors, this is the

rst paper to empirically examine the impact of IPRon income inequality in developing countries.

Further, we also control for regional groups to identify any differential effects of globalization

(with a particular reference to IPR) in developing countries.

The rest of the paper is organized as follows: Section 2 offers a brief review of the literature

on globalization and income inequality. Section 3 describes the data and methodology used and

Section 4 presents and analyzes the results. Section 5 presents the implications, directions for

future research, and offers concluding remarks.

2. Literature review

Many explanations have been given as to how global integration should affect the distribution

of income. For example, the neoclassical growth theory and the neoliberal paradigm, which

dominated public policy on issues of national development in the 1990s, suggest that integration in

to the world economy through trade and FDI should lead to reduction in the distribution of income

across nations (Heshmati, 2005; Wade, 2001). Thus, in the spirit of lawof even development or the

modernization perspective, countries are more likely to gain from integration into international

markets relative to less integration. The modernization perspective suggests that continued growth

expandthe middle class andincreases employment andthe savings rates amongthe poor, leadingto

reductioninincome inequality(Beer, 1999). The implicationis that developingeconomies wishing

to catch up with the standards of living of the developed countries should open up their markets

by lowering tariffs, removing trade restrictions, granting privileges to FDI and enforcing IPR. As

noted by Maskus (2000a) effective IPR regime has an effect not only on the incentive for new

knowledge creation and its dissemination, but even more important, the market structure, prices,

and distributional equity. Also, the CIPR (2002) report noted that in the poorest regions of the

world, strengthening IPRcould help to stimulate invention and newtechnologies, thereby leading

to an increase in agricultural or industrial production in less developed countries that could have

positive effect on the distribution of income. A World Intellectual Property Organization [WIPO]

(2003) report noted that intangible assets such as knowledge, creativity and inventiveness are

rapidly replacing traditional and tangible assets such as land labour and capital as the driving

forces of economic development.

Contrary to the idea of convergence, anti-globalization advocates have long claimed that global

integration is a cause of divergence rather than convergence of incomes between the worlds

economies. They suggest that the traditional causes of income inequality (e.g., land concentration,

unequal access to education, and urbanrural gap) are unlikely to explain the rise the increase

in income inequality in the past two decades. Such an increase, they argue is more likely to be

S. Adams / Journal of Policy Modeling 30 (2008) 725735 727

related to the adoption of unfettered trade liberalization of domestic and international markets and

the shifts towards skill-intensive technologies all over the world (Giovanni, 1999). The idea of

divergence is consistent with the endogenous growth theory, which predicts divergence in income

between nations because of the increasing returns to knowledge and technological innovation,

which are more abundant in the developed countries.

Similarly, the dependency approach predicts that divergence is more likely from integration

because of the differential in benets from economic integration for developed and developing

countries. Thus, national income inequality is in large part determined by growth potentials of pro-

ductivities in the large global structure. For instance, Bornschier and Chase-Dunn (1985) claimed

that foreign investment creates an industrial structure in which monopoly is predominant, leading

to what they describe as underutilization of productive forces in the overall economy As a result,

countries that are wholly dependent on foreign investment will experience stagnation, unemploy-

ment, and increasing inequality. There are many studies like that of Bornschier and Chase-Dunn

(1985), which indicate that FDI is the primary means through which the modern capitalist world

system creates and maintains intra and international socioeconomic inequities (Beer, 1999).

Giventhe conictingtheoretical views, manyempirical studies have beenconductedtoexamine

the impact of the globalization on income inequality for both developed and developing countries

with a few focusing specically on developing countries. Like the theoretical studies, however,

the empirical studies have given inconsistent results. For example, while Milanovic (2002, 2005)

and Barro (2000) nd globalization to be proinequality, Ravallion (2001) and Dollar and Kraay

(2002) nd the effect of trade openness on income inequality to be insignicant. Milanovic (2005)

studied 77 countries between 1988 and 1998 and found that globalization (trade share in GDP) had

a negative effect on the distribution of income. However, the author reported that globalizations

effect was more severe for countries with GDP per capita income of less than $8000. Conversely,

Dollar and Kraay used an unbalanced data of 92 countries over a period of 40 years (19601999)

and found that that their openness measure was not signicantly related to the income share of

the lowest quintile.

Like the openness measure, results of studies on the FDIincome inequality relationship have

been ambiguous. While Dixon and Boswell (1996a, 1996b) and Beer (1999) reported a positive

correlation between FDI and income inequality, Sylwester (2005) reported otherwise. However,

Tsai (1995) suggested that the typical positive nding between FDI and income inequality might

be due to most of the studies not controlling for regional differences. To assess Tsais (1995)

assertion that the positive correlation between FDI and income inequality may have emerged

spuriously, Alderson and Nielsen (1999) used a large data set of 88 countries from 1967 to 1994.

They found that controlling for the different geographical regions did not change the signicant

positive effect of foreign capital penetration on income inequality. On the other hand, Sylwester

(2005) in a study of 29 less developed countries from 1970 to 1989 reported that there is no

evidence that FDI is associated with income inequality. Instead, the evidence though weak, points

to a negative association between FDI and income inequality.

With respect to IPR, though there have been a lot of theoretical and empirical studies on

the impact of IPR on economic growth (Falvey, Foster, & Greenaway, 2006; Park & Ginarte,

1997; Thompson & Rushing, 1996, 1999), almost all the studies on the IPRincome inequality

relationship are theoretical in nature. Consequently, this study contributes to the literature on

globalization by examining empirically the effect of strengthening of IPR on income inequality

in developing countries. Nevertheless, the consensus of the studies so far indicate that the scope,

depth, and enforcement of IPR are likely to differ across countries according to their economic

and political institutions, and ability to engage in and disseminate the fruits of research and

728 S. Adams / Journal of Policy Modeling 30 (2008) 725735

development (R&D) (La Croix & Konan, 2006). In light of these ndings, CIPR (2002) assert

that developing countries are less likely to benet from the harmonization of IPR, as the R&D

needed to promote innovation is absent.

The reviewof the empirical literature indicates that the impact of the globalization variables on

income inequality is inuenced by data heterogeneity, observed and unobserved country-specic

effects, and endogeneity issues. Accordingly, we control for these factors in our analysis of the

impact of globalization on income inequality for a panel data set of 62 developing countries over

the period 19852001. The data and empirical methodology used are described below.

3. Methodology and data

The empirical analysis is based on a panel data set consisting of four separate periods of 5-year

intervals between 1985 and 2001. In this study we employ a form of panel regression where we

regress the dependent variable at a time T against the independent variables at a previous period

time (T-1, T-2, or T-3) depending on the availability of Gini data. The independent variables are

taken for 1985, 1990, 1995, and 2000 and the dependent variable is taken for 1987, 1993, 1996, and

2001. The use of lagged values helps to reduce any problems of reverse causality or endogeneity

related to income inequality and the globalization variables. We use the 5-year intervals because

the IPRs data is available for these periods. The equation we estimated is specied as follows:

Gini

it

=

0

+

1

FDI

it

+

2

OPEN

it

+

3

POP

it

+

4

GOV

it

+

5

INST

it

+

6

SEC

t

+

7

IPR

it

+

8

LGCAP

it

+

9

LGCAPSQ

it

+

i

+

it

where Gini (a measure of income inequality) is the variable to be explained for a country i at a time

t; foreign direct investment (FDI), integration in to the world economy (OPEN), and intellectual

property rights (IPR) are the globalization variables; POP represents population and GOV is

government consumption; INST is a proxy for a countrys overall institutional or governance

infrastructure; SEC represents human capital; LGDCAP controls for the level of development

and LGCAPSQis the square of LGCAP;

i

s are the coefcients to be estimated;

i

represents the

country-specic effect which is assumed to be time invariant, and

it

is the classical disturbance

error term.

We estimate a system of four equations using the seemingly unrelated regressions (SUR)

method. The SUR estimation allows for different error variances in each equation and for correla-

tion of these errors across equations (Makki &Somwaru, 2004). To eliminate any country-specic

effects or unobserved heterogeneity we rst-differenced the data. To further eliminate or reduce

heteroscedasticity problems we used SUR with cross-section weights.

The Gini index is measured as the Gini coefcient multiplied by 100. The Gini coefcient

is a ratio with values between 0 and 1, with 0 representing perfect income equality and 1 being

perfect inequality. Thus, higher values of the index indicate increasing inequality and lower values

explain otherwise. The income inequality data is obtained from Chen, Datt, and Ravallion (2004)

POVCALsoftware, which is maintained on the World Banks website. LGCAPSQis an additional

variable that is included in the income inequality regressions as the level of development and

income inequality is hypothesized to exhibit a curvilinear relationship (Ahluwalia, 1976; Kuznets,

1955; Lee, 2006; Sylwester, 2005; Tsai, 1995); Income inequality is therefore expected to increase

initially but over time, continual growth will lead to a reduction in income inequality. We therefore

expect LGCAP and LGCAPSQ to be positively and negatively correlated with income inequality,

respectively.

S. Adams / Journal of Policy Modeling 30 (2008) 725735 729

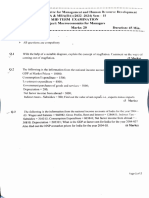

Table 1

Descriptive statistics

INEQ IPR FDI OPEN

Mean 45.85 2.27 1.97 61.96

Maximum 66.70 4.04 16.17 231

Minimum 28.41 0.00 5.21 0.929

S.D. 9.24 0.80 2.58 36.13

The globalization literature suggests that openness promotes growth; however, it also increases

income disparities between countries. Consequently we expect the openness measure (trade share

in GDP) to exert a positive effect on economic growth and a negative effect on the distribution

of income. From the perspective of the globalization advocates, FDI may play a signicant role

in generating positive spillover effects in terms of new technologies and management skills that

contribute to growth (Sylwester, 2005). However, the modernization and dependency theories,

suggest that FDI may have negative effect on the distribution of income and consequently we

expect FDI to be positively correlated with income inequality. IPR is expected to have positive

effect consumer welfare and overall social progress especially in highly innovative countries with

active R&D. However, R&Dis nearly absent in most developing countries and therefore we expect

IPR to have a negative effect on the distribution of income.

The data on SEC and FDI come from the World Development Indicators CD-ROM (2006),

and are measured as the gross secondary school enrollment and net FDI inows share in GDP,

respectively. The strength of intellectual property rights protection (IPR) is measured by the

GinartePark index of patent rights, which is based on ve categories of patent laws: (1) extent of

coverage; (2) membership in international patent agreements; (3) provisions for loss of protection;

(4) enforcement mechanism; and (5) duration of protection. Each of these categories (per country,

per time period) is scored a value ranging from0 to 1, and the outweighed sumof these ve values

constitutes the overall value of the patent rights index. The index therefore ranges from 0 to 5,

with higher numbers indicating stronger protection.

Data on OPEN (trade share in GDP) and the level of development (GDP per capita) were

obtained from the Global Development Network Growth Database (2007) and data on the gov-

ernment consumption and gross xed investment were obtained from the World Development

Indicators CD-ROM (2006). The institutional variable is a composite measure of the investment

climate, which is obtained from the Political Risk Services Country Risk Guide (2006). It is

made up of three measures: political, nancial, and economic risk and it includes factors like

law and order, government stability, bureaucratic quality and corruption. It is rated on a scale of

zero to 100, with zero meaning highest risk and 100 referring to the lowest risk. We expect a

negative effect of INST on income inequality as good governance would ensure that rent seek-

ing by privileged groups is avoided or at the least reduced and also ensures that government

bureaucracies concentrate on enhancing the opportunities and possibilities of the poor (Lopez,

2003). The descriptive statistics is presented in Table 1 and the list of countries is presented in the

Appendix A.

4. Results and discussion

The regression results are reported in Table 2. Column 1 shows that the globalization variables

explain about 15% of the variance in income inequality. The results show that strengthening IPRs

7

3

0

S

.

A

d

a

m

s

/

J

o

u

r

n

a

l

o

f

P

o

l

i

c

y

M

o

d

e

l

i

n

g

3

0

(

2

0

0

8

)

7

2

5

7

3

5

Table 2

Regression coefcients for the impact of globalization on income inequality

1 2 3 4 5 6

OPEN 0.005

**

(0.002) 0.017

***

(0.004) 0.009

***

(0.004) 0.011

**

(0.005) 0.005 (0.006) 0.010

*

(0.005)

IPR 1.137

***

(0.255) 1.177

***

(0.327) 1.155

***

(0.363) 1.227

***

(0.379) 1.155

***

(0.363) 2.045

***

(0.399)

FDI 0.009 (0.021) 0.115

**

(0.047) 0.051 (0.067) 0.054 (0.071) 0.051 (0.067) 0.059

*

(0.047)

LGCAP 0.804 (1.302) 4.632

***

(1.180) 5.156

***

(1.392) 2.717

**

(1.112) 1.713 (0.927)

GOV 0.047

**

(0.021) 0.019 (0.046) 0.002 (0.042) 0.017 (0.043) 0.049

*

(0.027)

INST 0. 040

**

(0. 017) 0. 043

***

(0. 014) 0. 039

***

(0. 014) 0. 038

***

(0. 012) 0. 036

*

(0. 017)

POP 0.000

**

(0.000) 0.000

***

(0.000) 0.000

***

(0.000) 0.000

***

(0.000) 0.000

**

(0.000)

SEC 0.012 (0.021) 0.013 (0.022) 0.000 (0.020)

LGCAPSQ 25.315 (22.197)

ASIA 1.274

***

(0.409)

LA 0.920 (0.734)

SSA 0.557 (0.601)

IPR*AS 0.006 (0.004)

IPR*LA 0.505 (0.709)

IPR*SSA 2.568 (0.622)

Constant 0.120

***

(0.028) 0.229

*

(0.120) 0.314

***

(0.084) 0.350

***

(0.081) 0.416 (0.622) 0.129 (0.091)

N 175 155 136 136 136 155

R

2

adjusted 0.15 .18 0.47 0.60 .49 .28

Note. t-statistics in parentheses.

*

Signicant at the 10% level.

**

Signicant at the 5% level.

***

Signicant at the 1% level.

S. Adams / Journal of Policy Modeling 30 (2008) 725735 731

has a signicant positive effect on income inequality in almost all the model specications. This

nding is consistent with the assertion that not only do developing countries not benet from

strengthening the IPR system, but that they may be worse off with the benet accruing to more

developed or innovating countries. Furthermore, it is possible that some corporations will focus

their resources on defending their original innovations rather than developing new products and

therefore limiting their output below socially desirable levels leading to negative consequences

on consumer welfare (Shapiro & Hassett, 2005). Controlling for regional differences does not

change the coefcient on the IPR variable (Column 4). Further, the cross product of the IPR and

regional dummies show that none of the interaction terms is signicantly correlated with income

inequality (Column 6), which indicates that strengthening IPR does not exert different effects in

developing countries. OPEN is also positive and signicantly correlated with income inequality,

suggesting that increased integration into the world economy negatively affects the distribution

of income in developing countries.

FDI, however, is negative and in a fewcases even signicantly related to income inequality. The

implication is that increased ow of FDI may have a positive effect on the distribution of income

in developing countries. It is important to note, however, that many studies have suggested that

FDI has been more productive in Asia than in other regions of the world (Agosin & Mayer, 2000;

Fry, 1993), which suggests that FDIs effect may be sensitive to regional differences. As noted in

Column 5, when the regional groups are controlled for, the FDI variable is no longer signicant

supporting the assertion of Tsai (1995) that FDIs effect on income inequality is sensitive to the

type of countries included in the study.

The LGCAP and its power term (LGCAPSQ) have the correct signs but the LGCAPSQ is not

signicant and therefore we do not nd support for a curvilinear relationship between the level of

development and income inequality for the sample of countries over the study period (Column 4).

With respect to the other explanatory or control variables, the institutional, population, govern-

ment consumption, and human capital variables are negatively correlated with income inequality,

while the level of development is positively correlated with income inequality. The effect of the

institutional variable is one of the most robust ndings to different model specications, which

suggests that the country conditions in particular, may be more important in inuencing the dis-

tribution of income than any domestic or international policy per se. Though the human capital

variable is never signicantly related to income inequality, it is important to note, however, that

when it is included in the regression, the explanatory power of the model improves signicantly

as seen in the increase of the adjusted coefcient of determination from less than 0.20 (Columns

1 and 2) to a high gure of 0.60 (Columns 5). This result might mean that though human capital is

an important element in reducing income inequality; most of the countries of the studys sample

have not reached the minimum threshold of skill needed to positively affect the distribution of

income.

5. Policy implications and concluding remarks

The impact of globalization on income inequality has been generally examined in the literature

with only a fewfocusing specically on developing countries. Further, many of these studies have

focused on two main channels of globalization, including trade and FDI. This paper contributes

to the literature by examining a third and important component of the globalization processthe

protection of intellectual property rights.

The results of the study show that trade liberalization and strengthening of IPR have a negative

effect on the distribution of income, while FDIs effect on income inequality is sensitive to the type

732 S. Adams / Journal of Policy Modeling 30 (2008) 725735

Table 3

IPR and Gini values in the 1990s

Region IPR Gini

SSA 2.66 46.9

LA 2.36 49.3

AS 2.11 35

Source: Authors calculation based on Ginarte and Park (1997) and Deninger and Squire (1996).

of countries included in the studys sample. Even more important, the study nds that the overall

country conditions in terms of the institutional infrastructure and skill level are key determinants

of income inequality. These results have policy implications.

First, it is important to note that though Latin American and African countries, for example,

are known to have more open economies and higher IPR protection compared to Asian countries,

the level of income inequality is lowest in Asia (Table 3).

Further, Asian countries have been more proactive in making use of TRIPS exibilities

(UNCTAD, 2007). India, for example, has taken WTO exibilities concerning IPR rules to refuse

patents on existing medicines. Indeed, India recently won a case against Novartis, that led a law-

suit against India challenging the constitutionality of Section 3(d) of the provision of Indian Patent

Lawthat states that patent monopolies will be awarded for only truly innovative medicines rather

than minor changes of existing medicines (Odell, 2007).

Similarly, Thailand has established a program to help it provide cheap medicines to people

with AIDS by issuing compulsory licenses on several patented medicines to ensure that they

are available at more affordable prices than they would otherwise be (Action for Global Health,

2007). The WIPO (2003) report indicated that Singapore and Korea have also adopted a proactive

approach to patent policy such that it promoted patent licensing, joint ventures, and strategic

alliances to encourage local inventions as well as foreign direct investment. Indeed, The WTOs

Doha Declaration in 2001 accepts governments rights to use compulsory licensing as a means

to facilitate access to cheaper medicines through import or local production (Commission on

Intellectual Property Rights, 2006).

Second, though IPR protection has been recognized as part of the infrastructure supporting

investments in R&Dleading to innovation and subsequent economic development (Kanwar, 2006;

World Bank, 2005, and World Intellectual Property Organization (WIPO), 2003), it is also known

that strengthening IPR has costs (Horii & Iwaisako, 2007; Maskus, 2000a). Even more critical

is the argument that the current global IPR system favors the holders of intellectual property,

which invariably happens to be the developed countries over the users of intellectual property

that are mostly the LDCs. This is not surprising as the number of global patents originating in

the 50 countries identied by the UN as LDCs has dropped from an average of 66 per year in the

early 1990s to just 10 per year between 2000 and 2004 (UNCTAD, 2007). Incidentally, the US

net surplus of royalties and fees increased from $14 billion in 1991 to $22 billion in 2001, while

developing countries suffered a decit of nearly $7.5 billion in 1999 alone. The discussion above

is consistent with the assertion of Helpman (1993) that if anyone benets from patent protection,

it is certainly not the South.

Third, the effectiveness of the IPRs systemis dependent onhowit impacts oninnovation, market

structure, and technology transfer (Naghavi, 2005), and hence the need to enhance the skill level

or absorptive capacity of domestic rms in improving their productivity. This requires investment

in information and communications technology, and education and job training to enhance the

S. Adams / Journal of Policy Modeling 30 (2008) 725735 733

entrepreneurial capability of both individuals and rms in the production of goods and services

to partake fully in the benets that globalization brings. Bernanke (2007), for example, has noted

that the greatest cause of inequality in the era of globalization can be attributed to the very high

returns to education and consequently, policies that maximize opportunities for education and

job training will help to reduce income inequality. Obviously, workers with more education and

training will be better able to adapt to the fast paced changing demands in the workplace in the

21st century.

Finally, globalization is not completely responsible for income inequality within and across

countries. As shown in Column 1, the studys results show that the three-globalization variables

explain only 15%of the variance in income inequality. This nding is consistent with the assertion

of Stewart and Berry (2000) that though globalization might negatively affect the distribution of

income, other country conditions, including labor laws, strength of unions and a variety of gov-

ernment safety net provisions might modify or accentuate the impact of globalization on income

inequality. Rather, the evidence suggests that countries that have grown rapidly and improved

their standard of living have not only opened up their economies for trade and FDI but have also

maintained macroeconomic stability (Rodrik, 1999).

The challenge for developing countries is how to reform their IPRs regime to maximize their

gains, while limiting the potentially adverse effects of improved protection and to facilitate access

of local entrepreneurs to the IPR system as has been done in India, Thailand, and South Korea. It

has also been argued the developed and those developing countries that have achieved substantial

growth rates have all ne tuned their IPRs system to match their development needs, rather

than blindly implementing a wholesale IPRs policy (CIPR, 2002; Dolfsma, 2006; Kumar, 2002;

Maskus, 2000a). These studies suggest that there has generally been an association with weak

rather than strong forms of patent protection in the formative period of economic development

and the IPRs regimes strengthened as countries became signicant producers of innovations and

new technology as seen in Korea and India.

In discussing the ndings and implications of the study, it is worth mentioning the limitations

of the study. First, the time period is not long enough to make conclusive statements about the

effect of globalization on income inequality. Data constraints made that impossible. Second, the

changing macroeconomic and political events in the various developing countries suggest that we

might not be able to capture all the factors that might inuence income inequality. The limitations

and the inconsistency of the other studies reviewed suggest that many more country-specic

studies are needed to validate the more global studies. Further, as more consistent data on income

inequality becomes available for many developing countries, it will be possible to evaluate the

long-run effects of globalization on the distribution of income

We conclude by asserting that globalization is neither inherently good nor bad for developing

countries, as current debates seem to suggest. Instead, globalization has both costs and benets.

However, the opportunity for economic gains can be best realized within an environment that

supports skilled resources, sound and credible government institutions, and technological devel-

opment. Without these fundamentals, the pursuit of economic gains through trade liberalization,

establishing incentives to attract FDI, and strengthening of IPR will not be achieved for develop-

ing countries. Clearly, the literature reviewed and the ndings of this study call for IPR regimes

norms to be ne-tuned to establish a balance between intellectual property protection and eco-

nomic development of developing countries. Globalization, even though may be biased against

developing countries, has created a situation in which countries with the appropriate policies

might be able to succeed in bringing about economic development as is the case for most of the

Asian economies.

734 S. Adams / Journal of Policy Modeling 30 (2008) 725735

Appendix A

List of countries in study sample

Algeria Ecuador Malaysia Senegal

Argentina Egypt Mali Sierra Leone

Bangladesh El Salvador Mauritania South Africa

Bolivia Ethiopia Mexico Sri Lanka

Botswana Ghana Morocco Swaziland

Brazil Guatemala Mozambique Tanzania

Burkina Faso Guyana Nepal Thailand

Burundi Honduras Nicaragua Tunisia

Cameroon India Niger Uganda

Central African Rep Indonesia Nigeria Uruguay

Chile Iran Pakistan Venezuela

China Jamaica Panama Vietnam

Colombia Jordan Paraguay Zambia

Costa Rica Kenya Peru Zimbabwe

Cote dIvoire Madgascar Philippines

Dom Rep Malawi Rwanda

References

Action for Global Health (2007). Health: EU opposes cheap anti-AIDS drugs in Thailand. http://www.

globalhealthnetwork.eu/news/ (accessed 08/29/07).

Agosin, M., & Mayer, R. (2000). Foreign direct investment: Does it crowd in domestic investment? (United Nations

Conference on Trade and Development Working Paper No. 146). Geneva, Switzerland.

Ahluwalia, M. S. (1976). Inequality, poverty, and development. Journal of Development Economics, 3, 307342.

Alderson, S. A., & Nielsen, F. (1999). Income inequality, development, and dependence. American Sociological Review,

64, 617628.

Barro, R. (2000). Inequality and growth in a panel of countries. Journal of Economic Growth, 5, 532.

Beer, L. (1999). Income inequality and transnational corporate penetration. Journal of World Systems Research, 5, 125.

Bernanke, B. (2007). Inequality and globalization. Speech delivered before the Greater Omaha Chamber of Commerce.

February 6, 2007. CQ Transcripts Wire.

Bornschier, V., & Chase-Dunn, C. (1985). Transnational corporations and development. New York: Praeger.

Chen, S., Datt, G., & Ravallion, M. (2004). A program for Calculating Poverty Measures from Grouped Data.

http://iresearch.worldbank.org/PovcalNet/Introduction.html (accessed on 04/1/07).

Commission on Intellectual Property Rights (2002). Integrating intellectual property rights and development policy.

London.

Commission on Intellectual Property Rights (2006). Intellectual property right, innovation and pubic health.

www.who.int/intellectualproperty (accessed on 08/23/07).

Deninger, K., & Squire, L. (1996). A new data set measuring income inequality. World Bank Economic Review, 10(3),

565591.

Dixon, W. J., &Boswell, T. (1996a). Dependency, articulation, and denominator effect: Another look at the foreign capital

penetration. American Journal of Sociology, 102, 543562.

Dixon, W. J., & Boswell, T. (1996b). Differential productivity, negative externalities, and foreign capital dependency:

Reply to Firebaugh. American Journal of Sociology, 102, 576584.

Dolfsma, W. (2006). IPRs, technological development, and economic development. Journal of Economic Issues, 40(2),

333342.

Dollar, D., & Kraay, A. (2002). Growth is good for the Poor. Journal of Economic Growth, 7, 195225.

Falvey, R., Foster, N., & Greenaway, D. (2006). Intellectual property rights and economic growth. Review of Development

Economics, 10, 700719.

Fry, M.J. (1993). Foreign direct investment in a macroeconomic framework: Finance, efciency, incentives, and distortions

(Policy Research Working Papers No. 1141). Washington, DC. World Bank.

Ginarte, J. C., & Park, W. (1997). Determinants of patent rights: A cross-national study. Research Policy, 26, 283301.

S. Adams / Journal of Policy Modeling 30 (2008) 725735 735

Giovanni, A.C. (1999). Liberalization, globalization, and income distribution (UNU-WIDER Working Paper No. 157).

Helsinki.

Global Development Network Growth Database. http://www.nyu.edu/fas/institute/dri/database.html. Accessed on 4 Jan.

2007.

Helpman, E. (1993). Innovation, imitation, and intellectual property rights. Econometrica, 61(6), 12471280.

Heshmati, A. (2005). The relationship between inequality, poverty, and globalization (WIDER Research Paper No.

2005/37). Finland.

Horii, R., & Iwaisako, T. (2007). Economic growth with imperfect protection of intellectual property rights. Journal of

Economics, 90, 4585.

Houck, M. (2005). Globalization and inequality. Maryland: St. Marys Project.

Kanwar, S. (2006). Innovation and intellectual property rights (Center for Development Economics Working Paper No.

142). India: Delhi School of Economics.

Kumar, N. (2002). Intellectual property rights, technology transfer, and economic development: Experiences of Asian

countries. Commission on intellectual property rights background paper 1b. London: Commission on intellectual

property rights.

La Croix, S. J. L., & Konan, D. (2006). Have developing countries gained from the marriage between Trade Agreements

and Intellectual Property Rights? (University of Hawaii Manoa Economics Working Paper No. 06-5).

Lopez, H. (2003). Macroeconomics and Inequality. The World Bank Research Workshop on Macroeconomic Challenges

in low-income countries. Washington, DC: The World Bank.

Lee, J. (2006). Does globalization matter to income distribution in Asia? Journal of Policy Modeling, 28, 791796.

Kuznets, S. (1955). Economic Growth and Income Inequality. American Economic Review, 45, 128.

Makki, S., & Somwaru, A. (2004). Impact of foreign direct investment and trade on economic growth: Evidence from

developing countries. American Journal of Agricultural Economics, 86, 795801.

Maskus, Keith E. (2000). Intellectual property rights and economic development. Case Western Journal of International

Law, 32, 471506.

Maskus, Keith. E. (2000b). Intellectual property rights in the global economy. Washington, DC: Institute of International

Economics.

Milanovic, B. (2002). Can we discern the effect of income distribution? Evidence from household budget surveys (World

Bank Policy Research Working Paper 2876). Washington, DC: World Bank.

Milanovic, B. (2005). Can we discern the effect of income distribution? Evidence From household budget surveys. World

Bank Economic Review, 19, 2144.

Naghavi, A. (2005). Strategic Intellectual Property Rights Policy and NorthSouth Technology Transfer. NOTA DI

LAVORO 18.2005, Milano.

Odell, M.A. (2007). Awin for generic drugs: Indian court rules against drug maker Novartis. http://www.socialfunds.com.

M. Park, W. & Ginarte, J. C. (1997). Intellectual property rights and Economic Growth. Contemporary Economic Policy,

15, 5160.

Political Risk Services Country Risk Guide (2006). http://www.prsgroup.com/CountryData.aspx. Accessed on May 2007.

Ravallion, M. (2001). Inequality convergence. World Bank Policy Research Working Paper No. 2645. Washington, DC:

World Bank.

Rodrik, D. (1999). Where Did All the growth go? External shocks, social conict and growth collapses. Journal of

Economic Growth, 4, 385412.

Shapiro, R, & Hassett, K. (2005). The economic value of intellectual property. USA for Innovation. Washington, DC.

Stewart, F., & Berry, A. (2000). Globalization, liberalization, and inequality: Real causes. Challenge, 43, 4492.

Sylwester, K. (2005). Foreign direct investment, growth, and income inequality in less developed countries. International

Review of Applied Economics, 19, 289300.

Thompson, M., & Rushing, F. (1996). An empirical analysis of the impact of patent protection on economic growth.

Journal of Economic Development, 21(2), 6179.

Thompson, M., & Rushing, F. (1999). An empirical analysis of the impact of patent protection of economic growth: An

extension. Journal of Economic development, 24, 6776.

Tsai, P. L. (1995). Foreign direct investment and income inequality: Further evidence. World Development, 23, 469483.

United Nations Commission on Trade on Development [UNCTAD], (2007). The Least Developed Countries Report:

Knowledge, technological learning and innovation for development.

Wade, R. H. (2001). The rising inequality of world income distribution. Finance & Development, 38, pp. 3736

World Bank (2005). World Development Indicators, Washington, DC: World Bank.

World Bank (2006), World Development Indicators. Washington, DC: World Bank.

World Intellectual Property Organization [WIPO] (2003). Intellectual propertypower tool for economic growth. Geneva.

Das könnte Ihnen auch gefallen

- MahabhutasDokument203 SeitenMahabhutassk11983Noch keine Bewertungen

- Institutional Barriers in Tribal Hill Areas For Agricultural FinanceDokument5 SeitenInstitutional Barriers in Tribal Hill Areas For Agricultural Financesk11983Noch keine Bewertungen

- Abhyanga KSR 120321000729 Phpapp01Dokument10 SeitenAbhyanga KSR 120321000729 Phpapp01phereinike8883789Noch keine Bewertungen

- Ramayana SecretsDokument2 SeitenRamayana Secretssk11983Noch keine Bewertungen

- 20 Curses and Boons of Ramayan and Mahabharat That No One KnowsDokument3 Seiten20 Curses and Boons of Ramayan and Mahabharat That No One Knowssk11983Noch keine Bewertungen

- Hinduism-Reincarnation - Many Lives, Many MastersDokument3 SeitenHinduism-Reincarnation - Many Lives, Many Masterssk11983Noch keine Bewertungen

- 10 Love Stories From Mahabharat That No One KnowsDokument3 Seiten10 Love Stories From Mahabharat That No One Knowssk11983Noch keine Bewertungen

- Thewa Art IndiaDokument1 SeiteThewa Art Indiask11983Noch keine Bewertungen

- Digitize 200 Yr Old PapersDokument2 SeitenDigitize 200 Yr Old Paperssk11983Noch keine Bewertungen

- 7 Islands of BombayDokument14 Seiten7 Islands of Bombaysk11983Noch keine Bewertungen

- Quirky Facts About The 150-Year-Old Bombay High CourtDokument2 SeitenQuirky Facts About The 150-Year-Old Bombay High Courtsk11983Noch keine Bewertungen

- IIT Alumni Update Newsletter - Aug 2009Dokument12 SeitenIIT Alumni Update Newsletter - Aug 2009sk11983Noch keine Bewertungen

- Pollution of Water Bodies - 1Dokument54 SeitenPollution of Water Bodies - 1sk11983Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Econ Prelims ReviewerDokument9 SeitenEcon Prelims ReviewerWillianne Mari SolomonNoch keine Bewertungen

- Bird y Slack (2002)Dokument48 SeitenBird y Slack (2002)paulamszNoch keine Bewertungen

- Energy and Mining Sector Board Paper No 20Dokument152 SeitenEnergy and Mining Sector Board Paper No 20Saravanaperumal RajuNoch keine Bewertungen

- View Report Comprehensive Development Plan Puducherry 2036 PDFDokument522 SeitenView Report Comprehensive Development Plan Puducherry 2036 PDFdiptilundiaNoch keine Bewertungen

- Kelley 1991Dokument11 SeitenKelley 1991Andrea Katherine Daza CubillosNoch keine Bewertungen

- The Global Economy: Organization, Governance, and DevelopmentDokument24 SeitenThe Global Economy: Organization, Governance, and DevelopmentKaye ValenciaNoch keine Bewertungen

- Econ 2200 Exam 3Dokument42 SeitenEcon 2200 Exam 3jeffbezosssNoch keine Bewertungen

- CFA Research Report - Team APUDokument30 SeitenCFA Research Report - Team APUAnonymous 6A1OAiGidZNoch keine Bewertungen

- Report On Investment Bank in BangladeshDokument31 SeitenReport On Investment Bank in BangladeshMd Rayhan Uddin100% (1)

- Illovo Sugar Africa: Illovo Sugar (Malawi) PLC Socio-Economic Impact Assessment Internal Management ReportDokument39 SeitenIllovo Sugar Africa: Illovo Sugar (Malawi) PLC Socio-Economic Impact Assessment Internal Management ReportWILSON MSAKUNoch keine Bewertungen

- Polytechnic University of The Philippines Sta. Mesa, Manila: Economic GrowthDokument15 SeitenPolytechnic University of The Philippines Sta. Mesa, Manila: Economic GrowthJohnnie HarrisNoch keine Bewertungen

- Nepal Economic Survey 2009-10Dokument357 SeitenNepal Economic Survey 2009-10Chandan Sapkota100% (1)

- Turkish Food & Beverage Industry Report: Republic of Turkey Prime MinistryDokument22 SeitenTurkish Food & Beverage Industry Report: Republic of Turkey Prime MinistryEleni Michailidou0% (1)

- Panchayat Finances and The Need For Devolutions From The State GovernmentDokument8 SeitenPanchayat Finances and The Need For Devolutions From The State GovernmentSujeet KumarNoch keine Bewertungen

- ECONOMYDokument55 SeitenECONOMYjasson babaNoch keine Bewertungen

- Political FactorsDokument4 SeitenPolitical FactorsThùyy DunggNoch keine Bewertungen

- GFAL Sample ComputationDokument14 SeitenGFAL Sample ComputationIsaac Daplas Rosario73% (11)

- Prioritization of Food Safety Issues 2019Dokument20 SeitenPrioritization of Food Safety Issues 2019Francis Mwangi ChegeNoch keine Bewertungen

- Costco in ChinaDokument10 SeitenCostco in ChinaMakauNoch keine Bewertungen

- Philippines: Million As of 1 JulyDokument11 SeitenPhilippines: Million As of 1 JulyAndreiNicolaiPachecoNoch keine Bewertungen

- Gujarat Setco Annual Report 2011Dokument104 SeitenGujarat Setco Annual Report 2011HitechSoft HitsoftNoch keine Bewertungen

- Burgundy Private Hurun India 500Dokument37 SeitenBurgundy Private Hurun India 500Bhurishrwa AbhishekNoch keine Bewertungen

- MacroDokument2 SeitenMacroyashasvi pandeyNoch keine Bewertungen

- FMS 2009 Question Paper and Ans KeyDokument32 SeitenFMS 2009 Question Paper and Ans KeyKumar GauravNoch keine Bewertungen

- Asean Tourism Investment Guide FinalDokument255 SeitenAsean Tourism Investment Guide Finalhusna012Noch keine Bewertungen

- Visitor Profiling NotesDokument5 SeitenVisitor Profiling NotesHaziqHambali100% (1)

- University of Cambridge International Examinations International General Certificate of Secondary Education Economics Paper 3 Multiple Choice May/June 2005 1 HourDokument12 SeitenUniversity of Cambridge International Examinations International General Certificate of Secondary Education Economics Paper 3 Multiple Choice May/June 2005 1 HourShadyNoch keine Bewertungen

- Aggregate Demand and Aggregate Supply: Slides by John F. HallDokument57 SeitenAggregate Demand and Aggregate Supply: Slides by John F. Hallajugalex@gmail,comNoch keine Bewertungen

- West Bengal Economic ReviewDokument42 SeitenWest Bengal Economic ReviewSantosh GarbhamNoch keine Bewertungen

- Philippine AnimationDokument7 SeitenPhilippine Animationtintinchan100% (2)