Beruflich Dokumente

Kultur Dokumente

Devashish Final

Hochgeladen von

Hiral ShahCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Devashish Final

Hochgeladen von

Hiral ShahCopyright:

Verfügbare Formate

A SUMMER PROJECT REPORT

ON

A STUDY OF TECHNICAL ANALYSIS FOR THE INVESTMENT

DECISION IN CAPITAL MARKET UNDER TAKEN AT

DEVASHIS SECURITY PVT LTD ,BARDOLI.

BY

MS SONAL PARMAR

108120592011

BATCH: 201011

UNDER THE !UIDANCE OF

MS MUNE"A KA!"1 #I$%&'$()*

A++%. P',-&++,' TMES, MANDVI

SUBMITTED TO

!UJARAT TECHNOLO!ICAL UNIVERSITY, AHMEDABAD

FOR THE PARTIAL FULFILMENT 0F RE.UIREMENT OF THE

A/ARD FOR THE DE!REE OF

MASTER OF BUSINESS ADMINISTRATION

THROU!H

Page 1

THE MANDVI EDUCATION SOCIETY INSTITUTE OF

BUSINESS MANA!EMENT AND COMPUTER STUDIES,

MANDVI

C,))&0& C,1&: 812 BATCH CODE: 9

TABLE OF CONTENT

Page 2

SR NO. PARTICULARS PAGE NO.

1) PART-1 General Information

Chapter - 1 Compan

information ! Pro"#$t

profile

1%-2&

2) PART-2 Primar St#"

Chapter - 2 A'o#t the topi$

2.1 Intro"#$tion

2.2 A((#mption

2.) O'*e$ti+e

2., Important Of The St#"

2&-))

)) Chapter-) Re(ear$h

-etho"olo. ).1 Pro'lem

Statement ).2

O'*e$ti+e

).) Re(ear$h /e(i.n

)., Sample Si0e

),-,1

,) Chapter-, /ata anal(i( !

Interpretation

,2-1,

2) Chapter-2 3in"in. 12-14

4) Con$l#(ion 1&-11

&) 5i'lio.raph

PART -1 GENERAL IN3OR-ATION

1.1 International Stock Market

Major Markets International Investing Values Trend

Page )

The global major stock market value trend this month, after having risen five

consecutive months, as to decline a bit! The "organ #tanle$ Ca%ital &nde'

("#C&) dro%%ed *+ in local terms and ,!-+ in .# dollar terms! Over the

month, fourteen global major stock markets advanced and four fell!

Major Markets International Investing Values Appreciation

The global major stock market ith the highest a%%reciation as in the

Netherlands (u% -!/+)! France (u% ,!0+) and Belgium (u% ,!,+) folloed this

lead! Over the last *, months the to% global major stock markets have been

Austria rising 1,!*! + ith Nora$ u% 2*!3+ and Belgium u% -1!*+!

Major Markets International Investing Values Lowest Appreciation

The orst %erforming global major stock market for the month as 4ong 5ong

(6-!/+), the .!#! as don ,!0+ and 7a%an don 6*!2+! The loest rising

global major stock market for the last $ear is #it8erland (u% 9!*+), .!#! (u%

9!2+) and :erman$ (u% /!+)!

The si' to% value global major stock markets are Belgium, ;enmark, France,

:erman$, &tal$, Netherlands and Nora$ at e<ual eights! The seven major

markets international investing values that have a lo rating and are

recommended as sell candidates are Austria, Canada, 4ong 5ong, 7a%an,

#inga%ore, #it8erland and the .!#!

International Investment Update for August

#%otting Trends e'%ert "ichael 5e%%ler continuall$ researches ever$ major

global stock market and com%ares their value based on current book to %rice,

cash flo to %rice, earnings to %rice, average dividend $ield, return on e<uit$

and cash flo return! 4e com%ares these to each global major stock market

histor$ and from this develo%s his global major stock market value strateg$!

4ere is his most recent revie!

International Investment ecent !evelopments " #utlook

&nternational investment e<uit$ markets e'%erienced their highest monthl$

gain since ;ecember ,==-! For the month, the "organ #tanle$ Ca%ital

&nternational ("#C&) >orld Total ?eturn &nde' advanced -!/ + in local

currencies, -!0 + in .# dollars and -!, + in euros!

All eighteen international investment markets covered advanced both in the

month and $ear to date! :erman$ (@1!1 +), #inga%ore (@1 +) and 4ong 5ong

Page ,

(@0!/ +) gained most (in local currenc$)! The Netherlands (@*!9 +), 7a%an

(@,!, +) and Australia (@,!9 +) had the loest monthl$ gain! Aear to date

Nora$ (@,/!, +), Austria (@,0!, +) and ;enmark (@,2 +) gained most of

an$ international investment market, hile the .nited #tates (@- +), 7a%an

(@2 +) and 4ong 5ong (@3!0 +) came in last!

1.$ %ational Market

&articulars %S' (S' M)*

Founded *33, */90 ,==-

4ead<uarters "umbai "umbai "umbai

5e$ %eo%le ?avi Narain

(";)

"adhu 5anan

("; and CEO)

Lamon ?utten

("; and CEO)

No! of listings *00, 0=/0 6

N#E is the 3th largest stock e'change in the orld b$ market

ca%itali8ation and largest in &ndia b$ dail$ turnover!

%S'+ The National #tock E'change (N#E) is &ndiaBs leading stock e'change

covering around 2== cities and tons all over &ndia! N#E introduced for the

first time in &ndia, full$ automated screen based trading! &t %rovides a modern,

full$ com%uteri8ed trading s$stem designed to offer investors across the

length and breadth of the countr$ a safe and eas$ a$ to invest or li<uidate

investments in securities! #%onsored b$ the industrial develo%ment bank of

&ndia, the N#E has been co6s%onsored b$ other develo%mentC %ublic finance

institutions, L&C, :&C, banks and other financial institutions such as #B&

Ca%ital "arket, #tockholding cor%oration, &nfrastructure leasing and finance

and so on!

&ndia has had a histor$ of stock e'changes limited in their o%erating

jurisdiction to the cities in hich the$ ere set u%!N#E started e<uit$ trading

on November -, *332 and ithin a short s%an of * $ear became the largest

e'change in &ndia in terms of volumes transacted! Trading volumes in the

e<uit$ segment have gron ra%idl$ ith average dail$ turnover increasing

Page 2

from ?s!9 crores in November *332 to ?s!1939 crores in Februar$ ,==* ith

an average of 3!1 lakh trades on a dail$ basis! ;uring the $ear ,===6,==*,

N#E re%orted a turnover of ?s!*-, -3,0*= crores in the e<uities segment

accounting for 20+ of the total market!

The N#E re%resented an attem%t to overcome the fragmentation of regional

markets b$ %roviding a screen6based s$stem, hich transcends geogra%hical

barriers! 4aving o%erationalised both the debt and e<uit$ markets, the N#E is

%lanning for a derivative market, hich ill %rovide futures and o%tions in

e<uit$! &ts main objectives has been to set u% com%rehensive facilities for the

entire range of securities under a single umbrella, namel$,

To set u% a nationide trading facilit$ for e<uities, debt instruments and

h$bridsD

To ensure e<ual access to investors across the countr$ through an

a%%ro%riate communication netorkD

To %rovide a fair, efficient and trans%arent securities market to investors

using the electronic trading s$stemD

To ensure shorter settlement c$cles and book entr$ settlement

s$stemsD and

To meet the current international standards %revalent in the securities

&ndustr$Cmarkets!

COMPANY INFORMATION & PRODUCT PROFILE

COMPANY PROFILE:

#hri!5rishnakant ;esai is the chairman E shri!Ashish ;esai is the managing

director of the ;evashish #ecurities Fvt! Ltd!, as ell as ;evashish

Commodities Fvt! Ltd! ;uring 7une *331, the$ have started it as ;evashish

&nvestment, a famil$ firm ith %artners of 5rishankant ;esai and his son

Page 4

Ashish ;esai! #enior Fartner 5rishnakant ;esai had long e'%erience as

Accountant in Bardoli #ugar Factor$ and in #ardar Baga$at! ;evashish

&nvestment ith a gallo% start as Financial Advisors due to overhelming

su%%ort from surrounding residents of Bardoli areas as converted into

;evashish #ecurities Fvt! Ltd! ithin fe $ears!

#ince */3-, in their famil$ the$ had agenc$ of government of &ndia! Father of

Ashishbhai as an em%lo$ee of GBardoli sugar factor$H holding a ke$ %osition

of an accountant earned goodill of hundred of farmer member of the sugar

factor$! >ith this background, the$ launched in 7une *331D a %artnershi% firm

called G;evashish &nvestmentH Those ere the da$ hen there ere no official

share brokers in Bardoli! &nterested customer had to go to #urat for their share

dealing! Tele%hone facilit$ as %oor, on6line trading and E6mail facilitates

came in to the %icture $ear later!

;evashish #ecurities Fvt! Ltd is a recogni8ed sub6broker of #EB&, their

netork Fartner being "essrs! 5isan ?atilal Chokse$, Bomba$ based #hare

Brokers! :raduall$ the$ started other de%artments I "utual Fund I &nsurance

Com%an$ ;e%osits etc!

Their office accommodation hen the$ have started their Business Activities

as of *0= #<! Ft! of their on! No it is one of the established com%anies in

these areas having 20== #<! Ft! office s%ace!

The$ have full modern on6line e<ui%ments and infrastructure! The$ have also

established their ebsite! #o that their clients can track their %ortfolio, can

also kno market related da$6 to6da$ nes and informationJs!

:roth of the commercial activit$ of ;#FL E ;CFL demanded e'tension of

areas of de%artments! 4ence o%ening of branches at Navsari in 7anuar$ ,==0

E at K$ara in ma$ ,==1!

&n the %ervious $ear in 7une the$ successfull$ com%leted eleven $ear of their

e'istence! Fresentl$ strength of their man%oer on their %a$roll is -, in the

main office at Bardoli, *, in Navsari branch *- K$ara branch!

&n 7anuar$ ,==- ;#FL becomes the sub broker of messes G5ishan ?atilal

Chokse$ share E securit$ Fvt! Ltd!H, "umbai! ;#FL is also a%%roved as sub

broker firm of #EB&! ;#FL manage ;E"AT as section as sub6de%artment of

Page &

messes G5 ? Chokse$H! Their ;F6C;# registration number is *,=*=9==!

Their clients run their ;F Account ith ;evashish in their office onl$!

;CFL is a direct no of G"ult$ Commodit$ e'changeH, "umbai! Their member

registration no! being ,3920! As registration a%%roved the broker of "CL, and

due to all on6line e6business machiner$ E e<ui%ment installed in their all of

three offices! Their clients do their commodit$ dealing from ;evashish office!

&n their head office at Bardoli E branch in Navsari and K$ara the$ have main

three de%artments I e<uit$ dealing, commodit$ dealing, saving investment vi8,

mutual funds, insurance schemes E com%an$ de%osit.

DEPARTMENTATION OF DEVASHISH

Departmentation:

The departmentation of the company is based on function performed by

different departments i.e. Finance, personnel, Marketing, system and operation, etc.

Each of this basic function is classified in subsidiary unit. Here each department

wise the responsibility of a particular work is assigned to an expert.

List o Departments:

1. ersonnel department

!. Finance department

". #ystem and operation department

$. Marketing department

%. &esearch 'epartment

(. roduct and ser)ice management department

!"#&'S#%%'L !'&ATM'%T+

Fersonnel management is also knon as human resource management! 4?"

is concern ith the %eo%le dimensions in the organi8ation! Fersonnel

de%artment includes recruitment6selection, training E develo%ment,

%erformance a%%raisal, ages E salar$, labor relation activities, transfer6

%romotion

GFersonnel management can be defining as the %rocess of accom%lished

organi8ational objective b$ ac<uiring, retaining, terminating, develo%ment, and

%ro%erl$ using the human resource in an organi8ation!

Page 1

Mr. ,etul &atel is the head of 4uman ?esource ;e%artment at ;evashish

#ecurities!

La-our elation Activities+

&n ;evashish #ecurities Fvt! Ltd! ?elation among em%lo$ees and

management is health$ and there is no union s$stem! For maintaining good

and health$ relations em%lo$ees can contact management directl$ via mail or

em%lo$ees can discuss their %roblems to their e'ecutives and then the

%roblem flos in hierarchal order to the to% management!

&a.roll S.stem

Fa$roll s$stem is the fundamental s$stem of all the organi8ation! Ever$

organi8ation should have fundamentall$ strong %a$roll s$stem! &f the

fundamental structure of organi8ation is strong than ever$ %erson satisf$ ith

the job and after all ever$one is %rimaril$ concerned ith the mone$!

&n ;evashish #ecurities %a$roll s$stem is fundamentall$ strong! The$ calculate

salaries on the basis of attendance record! One casual leave %er month is

alloed to each em%lo$ee and there are no fi'ed rules for #ick Leave but the$

allo sick leaves as %er the medical certificate! The salar$ is being %aid after

deducting Frovided Fund, Frofessional Ta' and %enalties if an$! Com%an$

uses electronic %unch card machine to kee% record of attendance!

Com%an$ gives different t$%es of alloances of em%lo$ee hich are added in

salar$ and ages likeM

;earness alloances

4ome rental alloances

Trans%ort alloances

Canteen alloances

"edical alloances

Education alloances

Leave travel alloances

.niform alloances

"obile alloances

Page 6

Fetrol alloancees

ecruitment

?ecruitment is the %rocess of searching for %ros%ective em%lo$ee and

stimulating and encouraging them to a%%l$ for jobs in an organi8ation!

There are basicall$ to sources of recruiting em%lo$eesM

* ) &nternal

, ) E'ternal

Com%an$ is using both sources to recruit em%lo$ees!

As a %art of internal recruitment com%an$ encourages relatives of the e'isting

em%lo$ees to a%%l$ for the job and the$ also use %romotion and transfer to fill

the vacanc$!

Com%an$ recruits an em%lo$ee e'ternall$ through folloing a$

The$ give advertisement in the nes%a%er

Through em%lo$ment e'change

Through Cam%us recruitment

Selection

#election is the %rocess of obtaining and using information about job

a%%licants in order to determine ho should be hired for long6 or short6 term

%ositions!

For selecting an em%lo$ee, com%an$ give first advertisement in various

nes%a%ers! After that a%%lication form a candidate has to fill u%! Then the$

take %ersonal intervie! The candidate is a%%roved on the basis of %ersonal

intervie, <ualification and ork e'%erience! Once the em%lo$ee is hired

heCshe must continue the job for ne't to $ears! &f an em%lo$ee ants to

resign heCshe has to give notice before one month of resignation so that

com%an$ can recruit ne em%lo$ee and in %eriod of one month the ne

recruited em%lo$ee can take training from that em%lo$ee!

&erformance Appraisal

&n ;evashish #ecurities %erformance a%%raisal is done on overall %erformance

or out%ut not on individual %erformance or out%ut! Though the com%an$ gives

a%%raisal certificate and monetar$ alloances to the deserved candidates!

Page 1%

?ecentl$ com%an$ has broken all the record of intrada$ transaction as ell as

deliver$ transaction! #o the com%an$ has arranged a function for all the

em%lo$ees and to motivate them the$ have given some amount to all the

em%lo$ees!

Training and !evelopment

>ith the change in technolog$ the training %rogrammed is organi8ed to give

technological knoledge to the orker for lots of advantages! #o ith the

%h$sical ork orker can adjust ith ne technological environment or ne

machineries! #ome training for the betterment of orker is also done like

safet$ training, first aid training!

Training is not onl$ for loer level %erson but it is also for higher level %erson!

For higher level %erson some seminar is conducted or some training %rogram

organi8ed and some %ractical ork given to them for more knoledge!

There are mainl$ to t$%es of training given to the em%lo$eeM

On the job training

Off the job training

;evashish #ecurities %rovide both t$%e of training! .nder on job training

em%lo$ees learn from their mistakes and from their seniors! All the em%lo$ees

of com%an$ are highl$ co6o%erative!

&n Off the job training com%an$ arrange seminars, lectures, grou% discussion,

%ersonalit$ develo%ment etc! For the training regarding ne anal$sis softare develo%ment etc! For the training regarding ne anal$sis softare

com%an$ encourages the em%lo$ees for im%arting training from "umbai b$ com%an$ encourages the em%lo$ees for im%arting training from "umbai b$

%a$ing the entire amount of that %articular course! %a$ing the entire amount of that %articular course!

Basicall$, the aim of training E develo%ment is to develo% some s%ecific skills

and knoledge, to im%rove em%lo$ee motivation and to im%rove %roductivit$

that achieves the organi8ational goal!

/elfare Activitie s

*!Clean ;rinking >ater Facilit$

The Com%an$ %rovides clean drinking ater facilit$ to their staff members!

The ater cooler facilit$ is %rovided for cold and clean ater!

Page 11

,!>ash room facilit$

>ash room is available for the em%lo$ees! The &6cards of each em%lo$ee

carr$ an electronic chi% through hich the$ can get entr$ in ash rooms and

rest rooms! The %ur%ose of this facilit$ is to maintain cleanliness!

-!Tour ArrangementM

Com%an$ arranges * or , da$ %icnic for its em%lo$ees!

Food and snacks

Advance %a$ment

Birthda$ celebration

&ndoor games on ever$ #aturda$

Cricket tournament

$0.1I%A%)' !'&ATM'%T

Finance is regarded as the life blood of a business organi8ation! The stud$ of

finance management relates to the %rocess of %rocuring financial resources E

its judicious utili8ation ith a vie ma'imi8ing the oner ealth! Efficient

management of ever$ business enter%rise is largel$ de%ends on the efficient

management of its finance!

All the activit$ of financial management %ertaining to the rising of funds using

of the funds and management of the earning are collectivel$ knon as

financial function!

GFinancial management means managerial function like %lanning, controlling,

%ertaining to ac<uisition and using of fund needed in the businessH

Sources of 1unds

&n ;evashish #ecurities both internal and e'ternal source is available to raise

the fund! The sources of funds of ;evashish #ecurities are as follos

Frofit generated b$ ;evashish #ecurities Fvt Ltd!

Frofit of ;evashish Commodities Fvt Ltd!

Page 12

Frofit of ;evashish Advisor$ services Fvt! Ltd!

Loan

Cash Credit

elations2ip wit2 ot2er !epartments

Marketing !epartment

The finance de%artment maintain all the reneal account related to the

marketing i!e! the claims of distribution the record of %a$ment of investors!

Finance is also linked ith marketing de%artment because finance is needed

for ever$ ste% of marketing! &n finance ca%ital budgeting involves %lanning the

availabilit$, controlling of long term investment funds for %romoting %roducts

through advertisement, selling and giving free sam%les, the finance is first

as%ects to be taken care! At the time of deciding cash discount on different

customer and different <uantit$, both finance and marketing manager sitting

together!

&ersonnel !epartment

The maintenance charges of rest room are %aid b$ the financial de%artment!

Finance is %rovided b$ finance de%artment to fulfill facilities %rovided to

em%lo$ees! "an$ other alloances and an$ other miscellaneous e'%enditure

incurred b$ the em%lo$ee are %aid b$ the financial de%artment! #alar$ is being

%aid b$ the finance de%artment!

S.stem and #perations !epartment

The account and finance de%artment arranged the fund for the %rocurement of

ne e<ui%ments like com%uters, %rinters, soft ares etc! The$ also monitor

and maintain budget of the e'%ense b$ #$stem and O%erations ;e%artment!

Page 1)

Accounting &olicies

There should not be naked debit in an$ investors account! That is an investor

having debit ithout having an$ securities in hisCher account is not alloed!

Credits are alloed to the investors for to da$s!

;e%reciation

Assets valuation

#alaries are %aid on monthl$ basis and if an$ em%lo$ee has taken advance

than that amount ill be deducted in installation and not on lum% sum basis

30 S4ST'M A%! #&'ATI#%S !'&ATM'%T

A s$stem is an organi8ed, %ur%oseful structure regarded as a hole and

consisting of interrelated and interde%endent elements (com%onents, entities,

factors, members, %arts etc!)! These elements continuall$ influence one

another (directl$ or indirectl$) to maintain their activit$ and the e'istence of the

s$stem, in order to achieve the goal of the s$stem!

O%erations traditionall$ refer to the %roduction of goods andCor services

se%aratel$, although the distinction beteen these to main t$%es of

o%erations is increasingl$ difficult to make as manufacturers tend to merge

%roduct and service offerings! "ore generall$, o%erations management aims

to increase the content of value6added activities in an$ given %rocess!

Fundamentall$, these value6adding creative activities should be aligned ith

market o%%ortunit$ (through marketing) for o%timal enter%rise %erformance!

;evashish #ecurities is not a manufacturing organi8ation! #o, here #$stem

and O%eration refers to maintain the e<ui%ments used b$ the com%an$ and to

construct a service la$out in such a a$ that at ever$ stage value is added

ith minimum efforts and the %rocess carr$ out ithout an$ obstacles!

Mr. Ma.ur &anc2al is the head of s$stem ;e%artment at ;evashish

#ecurities!

Page 1,

50 MA,'TI%6 !'&ATM'%T

"arketing is the s$stem of business activities! &t is designed to %lan, %rice,

%romote and distribute an$ goods E services! "arketing activities are taken

%lace here goods and services are offered for sell!

"arketing is a set of human activities directed, facilitating and consummating

e'change, it is e'change of goods and the trans%ortation is to satisf$ that

human needs and ants! 4uman efforts, finance and management constitute

the %rimar$ sources in marketing!

Mr. S2ailes2 (2avsar is the head of "arketing ;e%artment at the ;evashish

#ecurities!

Marketing Mi7

As ;evashish #ecurities is a service organi8ation the marketing mi' of

;evashish securities consist of 9%s!

*! Froduct

,! Frice

-! Flace

2! Fromotion

0! Feo%le

1! Frocess

9! Fh$sical evidence

&roduct

;evashish #ecurities offers folloing services to its customers

;emat account

Commodit$ trading

Fan card

"utual Fund

Lum% sum %lan

#&F( #$stematic &nvestment %lan)

Page 12

&rice

!emat accountM Charge for o%ening a demat account in ;evashish securities

is ?s!0==! For the %ur%ose of %romotion there are no maintenance charges for

*

st

$ear! After com%letion of * $ear it takes ?s! -0= as maintenance charges

%er $ear! The brokerage of ;evashish #ecurities is =!=9 on intrada$

transaction and =!10 on deliver$ transaction!

)ommodit. AccountM Charge for o%ening a commodit$ trading account is

?s!-0=! Traders of gold and silver can also get the %h$sical commodit$ hen

the$ ant to ithdra and the gold the$ can is 33!30+ %ure ith a mark of

?B&!

Mutual 1undM ;evashish #ecurities offers to t$%es of mutual fund schemes!

&n lum% sum investment minimum amount to be invested is ?s!0=== and in

s$stematic investment %lans minimum amount debited %er month is ?s!0==!

&lace

The head office of ;evashish #ecurities is situated at Bardoli! &t has number of

branches and franchisees!

BranchesM NAK#A?&, KAA?A, #.?AT, "A4.KA

FranchiseMFAL#ANA,5A"?E7,.NA&,#ON:A;4,#.?AT,B4A?.C4,

AN5LE#4>A?,NAN;.?BA?,;E4?A;.N,C4AN;&:A;4,&N;O?E,

C44AF?A,"."BA&, NA#&5, 7O;4F.?!

&romotion

;evashish securities uses various communication %latforms for %romoting its

%roduct and services like advertising, sales %romotion, %ublic relations etc!

The com%an$ gives advertisement in nes%a%ers and billboards! As a %art of

sales %romotion it gives discount for ne investors and to maintain Fublic

?elations Com%an$ organi8es a function ever$ $ear and invite all the %otential

investors!

&eople

There are more than 2= em%lo$ees orking at ;evashish #ecurities including

Technicians, "arket e'%erts, "anagement e'%ertise, rece%tionist and %eon!

All the em%lo$ees are e'%erts in their %articular field!

&rocess

Page 14

;evashish #ecurities takes minimum time in delivering its services! A

rece%tionist on front desk guides the customers and handles their <ueries! At

market time investors can trade through calls or through their login &;!

&2.sical 'vidence

>here is the service being deliveredN Fh$sical Evidence is the element of the

service mi' hich allos the consumer again to make judgments on the

organi8ation!

At ;evashish #ecurities em%lo$ees are bus$ and sincere regarding their

duties! &t maintains smooth flo of %roviding services! Almost = times in

delivering services! #itting arrangement is there for the investors ho ant to

trade! There are , conference room available for interaction beteen

em%lo$ees and management and em%lo$ees and customers!

80 'S'A)9 !'&ATM'%T

A de%artment in a brokerage or institutional investor ith the task of evaluating

securities to determine hich to recommend to brokers, clients, and other

interested %arties! The research de%artment develo%s investment strategies

de%ending on the current and %rojected future conditions of markets! &t ma$

use technical anal$sis, fundamental anal$sis, or an$ other techni<ue in

%erforming its duties! Through the research results research anal$st hel%s

%ortfolio advisor or investment advisor to trade on behalf of the customers!

A$OUT TOPIC:

%.10 I%T#!U)TI#%

T')9%I)AL A%A4SIS is research of market d$namics that is done mainl$

ith the hel% of charts ith the %ur%ose of forecasting future %rice

develo%ment! Technical anal$sis com%rises several a%%roaches to stud$ of

%rice movement hich are interconnected in the frameork of one

harmonious theor$! This t$%e of anal$sis studied the %rice movement on the

market b$ the means of anal$sis on the basis of three market factorsM %rice,

volumes, and in case of stud$ of future contractsJ market, of an o%en interest

(number of o%en %osition)! Of these three factors the %rimar$ one for technical

anal$sis is the %rices, hile the alterations in other factor are studies mainl$ in

Page 1&

order to confirm the correctness of the identified %rice trend! This technical

theor$, just like an$ theor$, has its core %ostulates!

!'1I%ITI#%+

GA method of evaluating securities b$ anal$8ing statics generated b$

market activit$, such as %ast %rices and volume!H

Technical Anal$sis do not attem%t to measure a securit$Js intrinsic value

, but instead use charts and other tools to identif$ %attern that can

suggest future activit$! A technical anal$st believes that share %rices are

determined b$ the demand and su%%l$ forces in the market!

&'at is Te('ni(a) Ana)*sis+

&t is a %rocess of identif$ing trend reversals at an earlier stage to formulate the

bu$ing and selling strateg$! >ith the several indicators the$ anal$se the

relationshi% beteen %rice6volume and su%%l$6demand for the overall market

and the individual stock! Kolume is favorable on the u%sing i!e the number of

shares traded is greater than before and on the donside the number of

shares traded!

$.$0 ASSUM&TI#%S+

*! The market value of the scri% is determined b$ the interaction of su%%l$

and demand!

,! The market discounts ever$thing! The %rice of the securit$ <uoted

re%resents the ho%s, fears and inside information received b$ the

market %la$ers! &nside information regarding the issuing of bonus

shares and right issues ma$ su%%ort the %rice!

-! The market ala$s moves in trend! E'ce%t for minor deviations, the

stock %rices move in trends! The %rice ma$ create definite %atterns too!

The trend ma$ be either increasing or decreasing! The trend continues

for sometimes and then it reverses!

2! The market technician assumes that %ast %rices %redict the future!

$.30#(:')TIV' M

To kno hich indicator can best suit to understand the %rice

movement!

To catch the %ro%er bu$ E sell signals to time the market su%%l$!

Page 11

To kno the carr$ out the %rice forecast!

To kno the finding the right com%an$ here invester can invest

in share is available to easil$!

$.50 IM&#TA%T #1 T9' STU!4+

The stud$ is useful for the finding the right com%an$ here

&nvester can invest in share is available to easil$!

The stud$ is useful to %in%oint o%timal entr$ and e'it in market!

The stud$ is useful to catch the %ro%er bu$ E sell signals to

time the market su%%l$!

To learn ho traders can avoid mistakes in their trading %attern

ith the use of technical Anal$sis!

$.80 LIT'ATU' 'V'VI'/+

This %a%er tests to of the sim%lest and most %o%ular trading rules66moving

average and trading range break66b$ utili8ing the ;o 7ones &nde' from */39

to *3/1! #tandard statistical anal$sis is e'tended through the use of bootstra%

techni<ues! Overall, their results %rovide strong su%%ort for the technical

strategies! The returns obtained from these strategies are not consistent ith

four %o%ular null modelsM the random alk, the A?(*), the :A?C46", and the

E'%onential :A?C4! Bu$ signals consistentl$ generate higher returns than

sell signals, and further, the returns folloing bu$ signals are less volatile than

returns folloing sell signals! "oreover, returns folloing sell signals are

negative, hich is not easil$ e'%lained b$ an$ of the currentl$ e'isting

e<uilibrium models! Co%$right *33, b$ American Finance Association!

&n a com%rehensive and influential stud$, Brock, Lakonishok, and LeBaron

OBrLL3,P, anal$8ed ,1 technical trading rules using 3= $ears of dail$ stock

%rices from the ;o 7ones &ndustrial Average u% to *3/9 and found that the$

all out%erformed the market!

B?OC5, >!, 7! LA5ONO5 and B! LEBA?ON, *33,! #im%le Technical

Trading ?ules and the #tochastic Fro%erties of #tock ?eturns!

The authors investigate the informational role of volume and its a%%licabilit$

for technical anal$sis! The$ develo% a ne e<uilibrium model in hich

Page 16

aggregate su%%l$ is fi'ed and traders receive signals ith differing <ualit$! The

authors sho that volume %rovides information on information <ualit$ that

cannot be deduced from the %rice statistic! The$ sho ho volume,

information %recision, and %rice movements relate, and demonstrate ho

se<uences of volume and %rices can be informative! The authors also sho

that traders ho use information contained in market statistics do better than

traders ho do not! Technical anal$sis, thus, arises as a natural com%onent of

the agentsB learning The authors investigate the informational role of volume

and its a%%licabilit$ for technical anal$sis! The$ develo% a ne e<uilibrium

model in hich aggregate su%%l$ is fi'ed and traders receive signals ith

differing <ualit$! The authors sho that volume %rovides information on

information <ualit$ that cannot be deduced from the %rice statistic! The$ sho

ho volume, information %recision, and %rice movements relate, and

demonstrate ho se<uences of volume and %rices can be informative! The

authors also sho that traders ho use information contained in market

statistics do better than traders ho do not! Technical anal$sis, thus, arises as

a natural com%onent of the agentsB learning %rocess! Co%$right *332 b$

American Finance Association!%rocess! Co%$right *332 b$ American Finance

Association!

B?OC5, >!, 7! LA5ONO5 and B! LEBA?ON, *33,! #im%le Technical

Trading ?ules and the #tochastic Fro%erties of #tock ?eturns!

The authors investigate the informational role of volume and its a%%licabilit$

for technical anal$sis! The$ develo% a ne e<uilibrium model in hich

aggregate su%%l$ is fi'ed and traders receive signals ith differing <ualit$! The

authors sho that volume %rovides information on information <ualit$ that

cannot be deduced from the %rice statistic! The$ sho ho volume,

information %recision, and %rice movements relate, and demonstrate ho

se<uences of volume and %rices can be informative! The authors also sho

that traders ho use information contained in market statistics do better than

traders ho do not! Technical anal$sis, thus, arises as a natural com%onent of

the agentsB learning %rocess! Co%$right *332 b$ American Finance

Association!

Page 2%

BL."E, L!, ;! EA#LEA and "! OB4A?A , *332! "arket #tatistics and

Technical Anal$sisM The ?ole of Kolume! The Journal of Finance. OCited b$

*3/P *9!,,

Economists have traditionall$ been ske%tical of the value of technical anal$sis,

the use of %ast %rice behavior to guide trading decisions in asset markets!

&nstead, the$ have relied on the logic of the efficient markets h$%othesis!

Christo%her 7! Neel$ briefl$ e'%lains the fundamentals of technical anal$sis

and the efficient markets h$%othesis as a%%lied to the foreign e'change

market, evaluates the %rofitabilit$ of sim%le trading rules, and revies recent

ideas that might justif$ e'tra%olative technical anal$sis!

QChristo%her 7! Neel$ briefl$ e'%lains the fundamentals of technical anal$sis

and the efficient markets h$%othesis as a%%lied to the foreign e'change

market, evaluates the %rofitabilit$ of sim%le trading rules, and revies recent

ideas that might justif$ e'tra%olative technical anal$sis!Q

NEELA, C!, *339! Technical Anal$sis in the Foreign E'change "arketM A

La$manBs :uide! Federal Reserve Bank of St. Louis Review.

This article reconciles an a%%arent contradiction found b$ recent research on

.!#! intervention in foreign e'change markets! LeBaron (*331) and #8akmar$

and "athur (*339) sho that e'tra%olative technical trading rules trade

against .!#! foreign e'change intervention and %roduce e'cess returns during

intervention %eriods! Leah$ (*330) shos that .!#! intervention itself is

%rofitable over long %eriods of time! &n other ords, technical trades make

e'cess returns hen the$ take %ositions contrar$ to .!#! intervention 6 .!#!

intervention itself is %rofitable, hoever! This article ill first %resent recent

research on these subjects! Then it ill discuss ho differing investment

hori8ons and var$ing returns and %osition si8es ma$ reconcile these facts!

This article reconciles an a%%arent contradiction found b$ recent research on

.!#! intervention in foreign e'change markets! LeBaron (*331) and #8akmar$

and "athur (*339) sho that e'tra%olative technical trading rules trade

against .!#! foreign e'change intervention and %roduce e'cess returns during

intervention %eriods! Leah$ (*330) shos that .!#! intervention itself is

%rofitable over long %eriods of time! &n other ords, technical trades make

e'cess returns hen the$ take %ositions contrar$ to .!#! intervention 6 .!#!

Page 21

intervention itself is %rofitable, hoever! This article ill first %resent recent

research on these subjects! Then it ill discuss ho differing investment

hori8ons and var$ing returns and %osition si8es ma$ reconcile these facts!

TECHNICAL INDICATOR:

*) MA)!;<Moving Average )onvergence=!ivergence0+

Introduction +

;evelo%ed b$ :erald A%%el, "oving Average ConvergenceC;ivergence

("AC;) is one of the sim%lest and most reliable indicators available!

"AC; uses moving averages, hich are lagging indicators, to include

some trend6folloing charistics!

These lagging indicators are turned into a momentum oscillator b$

subtracting the longer moving average from the shorter moving average!

The resulting %lot forms a line that oscillates above and belo 8ero, ithout

MA)!1ormula

The most %o%ular formula for the "AC; is the difference beteen a

securit$Bs ,16da$ and *,6da$ E'%onential "oving Averages(E"As)!

Out of the to moving averages that make u% "AC;, the *,6da$ E"A is

the faster and the ,16da$ E"A is the sloer! Closing %rices are used to

form the moving averages! .suall$, a 36da$ E"A of "AC; is %lotted along

side to act as a trigger line! A bullish crossover occurs hen "AC; moves

above its 36da$ E"A, and a bearish crossover occurs hen "AC; moves

belo its 36da$ E"A

)alculation

MA)!+ <1$; da. 'MA > $?; da. 'MA0

Signal Line+ @ > da. 'MA of 'MA 0

MA)! 9istrogram + MA)! > Signal Line

Trading Signal

B.AM >hen the lines are belo the 8ero line , if the "AC; Line

Crosses the average line from belo to above , itJs indicates

a bu$ing o%%ortunit$!

Page 22

#ELLM >hen the lines are above the 8ero line , crossing of the

"AC; lines from above to belo the average line signal

a selling o%%ortunit$!

$0 'LATIV' ST'%69T I%!'*+

7! >elles >ilder develo%ed the ?elative #trength &nde' (?#&) and introduced it

in the 7une *39/ article for Commodities maga8ine, hich is no Futures

maga8ine! >ilder %rovided further detail in his classic book, Ne Conce%ts in

Technical Trading #$stems, hich as also %ublished in *39/! This book

%rovides details on calculation, usage and signals for ?#& and man$ of

>ilderBs other indicators including Average True ?ange, Farabolic #A? and

A;L!

?#& is a momentum oscillator that measures the s%eed and change of %rice

movements! ?#& oscillates beteen 8ero and *==! Traditionall$, and according

to >ilder, ?#& is considered overbought hen above 9= and oversold hen

belo -=! #ignals can also be generated b$ looking for divergences, failure

sings and centerline crossovers! ?#& can also be used to identif$ the general

trend!

)alculation+

&#*+

&# + ,)erage -ain . ,)erage /oss

Trading signal M

B.A M>hen the ?#& has crossed the -= line from belo to above and

is rising , a bu$ing o%%ortunit$ is indicated!

#ELLM >hen it has crossed the 9= line from above to belo and is

falling , #ell signal is indicated!

3)ROC (Rate of Change):

The ?ate of Change (?OC) is a sim%le technical indicator that shos the

%ercentage difference beteen the current %rice and the %rice n %eriods ago!

The ?OC can be used as an$ momentum technical indicator b$ anal$8ing

%ositive and negative divergence, looking for high los and 8ero line

crossovers! The ?OC can be used to define overbought and oversold

Page 2)

markets! The higher ?OC is considered a more overbought securit$ and the

loer ?OC is a more oversold securit$! 4oever, in man$ cases, the

e'tremel$ overboughtCoversold ?OC ma$ indicate a continuation of the recent

trend!

The ?ate of Change (?OC) indicator measures the %ercentage change of the

current %rice as com%ared to the %rice a certain number of %eriods ago! The

?OC indicator can be used to confirm price moves or detect divergencesD it

can also be used as a guide for determining over-oug2t and oversold

conditions.

)alculation+

?OC A <)lose ; )lose % periods ago0 = )lose % periods ago B 1CC

Trading signal+

Rero line M &dentif$ bu$ing and selling o%%ortunit$!

B.AM .%side from belo to above the 8ero line that indicates a

Bu$ing o%%ortunit$!

#ELLM >hile donside crossing from above to belo the 8ero line

that indicates a selling o%%ortunit$!

?E#EA?C4 "ET4O;OLO:AM

3.10 &ro-lem statement+

G#tud$ of technical anal$sis tools for investment decision in ca%ital

market0

3.$0#-jective+

GTo kno the %ro%er bu$ E sell signals to invest for getting more return in

securit$ market!H

3.30 esearc2 !esign+

A research design is a frameork or blue for conducting the marketing

research %roject! &t s%ecifies the detail of the %rocedure necessar$ for

obtaining the information needed to structure and solve marketing

research %roblem!

A three t$%es of research designM

E'%lorator$ ?esearch

;escri%tive ?esearch

Page 2,

& selected descri%tive research design because the research to%ic based

on a %ast data!

The research design is descri%tive as it describes the result of technical

anal$sis tool to bu$ or sale the securit$! The stud$ is base on the secondar$

data collected from the National #tock E'! eb! The anal$sis is done using

"# e'cel! ?esearch em%lo$s three major indicators () for three com%anies

selected on the basis of market ca%itali8ation! (;ate)! ;ata collection duration

is from 7un ,==/ to 7.N ,=** for scri%ts! For data anal$sis the scri%tJs

o%ening, closing, high, lo %rices are considered!

3.50 !ata collection+

A to t$%es of data collectionM

*) Frimar$ data

,) #econdar$ data

&rimar. !ata+

Frimar$ data are freshl$ gathered data for s%ecific %ur%ose or for

s%ecific research %roject !H Frimar$ data are no one has collect the data

the first time search!

E'! Suestionaire, Focus grou% , &ntervie, #urve$ etc!

Secondar. !ata+

#econdar$ data are data that ere collected for another %ur%ose , and

alread$ e'ist some here!H

E'! &nternet, "aga8ine, ?esearch %a%er!

& #elected a secondar$ data because data collection through &nternet ,

maga8ine and research %a%er!

3.80Sample SiDe+

To% three Com%anies as %er market Ca%italisationM

?eliance

L E T

Tata #teel

A three &ndicator #uch asM

"AC;

?#&

?OC

Page 22

!ata collection !uration+7une ,==/6 to6 7une ,=**

3.?0 limitation of t2e stud.+

;ue to unavailabilit$ of the data as %er the re<uirement, the %rocess

becomes time consuming!

Page 24

T')9%I)AL I%!I)AT#

"AC;

These lagging indicators are turned into a momentum oscillator b$

subtracting the longer moving average from the shorter moving

average! The resulting %lot forms a line that oscillates above and belo

8ero, ithout an$ u%%er or loer limits!

?EL&NCE CO"FANAM

B&: A??O> M#4O> T4E B.A&N: #&:NAL

#"ALL A??O>M #4O> T4E #ELL&N: #&:NAL

:ra%h*M

:ra%h ,M

:ra%h -M

Page 2&

:ra%h 2M

:ra%h 0M

:ra%h 1

Page 21

:ra%h 9

:ra%h/

Page 26

:ra%h 3

TATA #TEELM

*

Page )%

,

-

Page )1

2

0

Page )2

1

9

Page ))

/

3

LET

*

Page ),

,

-

Page )2

2

0

Page )4

1

9

/

Page )&

3

&NTE?F?&TAT&ON OF "AC;

S %#. )#M&A%4

%AM'

(U4

<Time !uration0

S'LL

<Time !uration0

10 'LIA%)' $8;Aug;to;CE;%ov;CF

$$;to;$3;:an;C@

$E;1e-;to1E;Mar;C@

CF;:un;to;31;:ul;C@

1@;to;$8;Aug;C@

$1;:ul;to;$$;Aug;CF

1C;%ov;$1;:an;C@

$E;:an;to;$?;1e-;C@

1F;Mar;to;C8;:un;C@

C3;to1F;Aug;C@

Page )1

$3;#ct;to;13;%ov;C@

18;to;3C;!ec;C@

$1;:an;to;5;Mar;C@

$C;Apr;to;1C;:an;1C

$C;:ul;to;C@;sep;1C

1$;%ov;to;13;!ec;1C

11;:an;to;1E;1e-;11

1F;Apr;to;31;Ma.;11

1?;to;3C;:un;11

$?;Aug;to;$$;#ct;C@

1?;%ov;to;15;!ec;C@

31;!ec;to;$C;:an;1C

C8;Mar;to;1@;Apr;1C

11;:an;to;1@;:ul;1C

13;Sep;to;11;%ov;1C

15;!ec;to;1C;:an;11

1F;1e-;to;18;Apr;11

C1;to;18;:un;11

Page )6

$0 TATA ST''L (U4

<Time !uration0

$1;:ul;to;CE;%ov;CF

$3;:an;to;C?;1e-;C@

$5;1e-;to;13;Mar;C@

1F;:un;to;$5;:ul;CF

1E;Aug;to;11;Sep;C@

$E;#ct;to;1F;%ov;C@

1C;to;$$;!ec;C@

$$;:an;to;$?;1e-;1C

$3;Apr;to;18;:un;1C

1F;Aug;to;C1;Sep;1C

13;#ct;to;1C;!ec;1C

11;:an;to;$3;Mar;11

3C;Apr;to;C?;:un;11

15;to;$3;:un;11

S'LL

<Time !uration0

1C;%ov;$$;:an;C@

C@;to;$C;1e-;C@

1?;Mar;to;1E;:un;C@

$E;:ul;to;1E;Aug;C@

15;Sep;to;$?;#ct;C@

1@;%ov;to;C@;!es;C@

$3;!ec;to;$1;:an;1C

C$;Mar;to;$$;Apr;1C

1?;:un;to;1E;Aug;1C

C$;Sep;to;1$;#ct;1C

13;!ec;to;1C;:an;11

$5;Mar;to;$@;;Apr;11

CE;to;13;:un;11

$5;to;3C;:un;11

Page ,%

30 L " T (U4<Time !uration0 S'LL<Time !uration0

$1;:ul;to;$C;Aug;CF

CE;%ov;to;$C;:an;C@

$?;1e-;to;13;Mar;C@

1F;:un;to;$8;Aug;C@

C@;#ct;to;CE;!ec;C@

13;:an;to;1@;1e-;1C

18;Apr;to;1F;Ma.;1C

$F;:ul;to;CF;Sep;1C

15;#ct;to;C$;%ov;1C

18;%ov;15;1e-;11

C3;Ma.;to;$F;Ma.;11

$1;Aug;to;C?;%ov;CF

$1;:an;to;C@;1e-;C@

1C;to;$8;1e-;C@

1?;Mar;to;1E;:un;C@

$8;Aug;to;CF;#ct;C@

CF;!ec;to;1$;:an;1C

$$;1e-;to;13;Mar;1C

1@;Ma.;to;$E;:ul;1C

C@;Sep;to;13;#ct;1C

18;1e-;to;C$;Ma.;11

$5;Ma.;to;3C:un;11

?#&

Page ,1

elative strengt2 inde7 <SI0 is a %rice6folloing oscillator that ranges

beteen = and *==! >hen ilder introduce the ?#&, he recommended using

a*26da$s ?#&! #ince then, the 36da$s and ,06da$s relative strength inde'

indicators have also gained %o%ularit$!

A %o%ular method of anal$8ing the ?#& is look for a divergence in hich the

securit$ is making a ne high, but the ?#& is failing to sur%ass its %revious

high! This divergence is an indication of an im%ending reversal! >hen the ?#&

then turns don and falls belo its most recent trough, it is said to have

com%leted a Gfailure singH! The failure sing is considered a confirmation of

the im%ending reversal!

?eliance

*

,

Page ,2

-

2

Page ,)

0

1

Page ,,

9

L E TM

*!

Page ,2

,

-

2

Page ,4

0

1

9

Page ,&

/

3

TATA #TEELM

*

Page ,1

,

-

2

Page ,6

0

1

9

Page 2%

/

&NTE?F?ETAT&ONM

?#& values above 9= are consider to denote overbought condition E values

belo -= are consider to denote oversold condition! >hen ?#& crossed the -=

line from belo to above E is rising, a bu$ing o%%ortunit$ is indicated! >hen

?#& crossed the 9= line from above to belo E is falling, a sell signal

is indicated!

#)

Page 21

The ?ate of Change (?OC) is a sim%le technical indicator that shos the

%ercentage difference beteen the current %rice and the %rice n %eriods ago!

The ?ate of Change (?OC) indicator measures the %ercentage change of the

current %rice as com%ared to the %rice a certain number of %eriods ago! The

?OC indicator can be used to confirm price moves or detect divergencesD it

can also be used as a guide for determining over-oug2t and oversold

conditions.

'LIA%)'+

*

,

-

Page 22

2

5

1

Page 2)

9

/

TATA #TEEL

*

Page 2,

,

-

2

Page 22

0

1

9

Page 24

/

L E TM

*

,

Page 2&

-

2

0

Page 21

1

9

/

Page 26

&NTE?F?ETAT&ONM

&n the ?OC chart the overbought 8one is above the 8ero line E the oversold

8one is belo the 8ero line! "an$ anal$st use the 8ero line for the identif$ing

bu$ing E selling o%%ortunit$, u%side crossing from (belo to above the 8ero

line) indicates a bu$ing o%%ortunit$, hile a donsi8e crossing from (above to

belo the 8ero line) indicates a selling o%%ortunit$!

The ?OC has to be used along ith %rice chart! The bu$ing E selling signal

indicated b$ the ?OC should also be confirmed b$ the %rice chart!

F&N;&N:#

Page 4%

The following are the findings from the analysis1

1. The indicator of

Page 41

CONCL.#&ON

Thus from the abo)e analysis it can be concluded that the substantial number of selected

stocks listed on 2#E does follow random walk. This implies that these stocks can be predicted

by using historical information. *n other words, technical analysis plays an important role in

de)ising profitable trading rules on the bases of historical information on share price.

The indicators of all three companies shows the different position of buying 3 selling. Each

indicator has its each

$i,)io-rap'*

(ooks+

1. unitha)athy andean, 4#ecurity ,nalysis and ortfolio Management0, )ikas

publishing House )t. /td. p.g.!5"6!7

Page 42

!. 'onald E.Fischer and &onald 8. 8ordan, 4#ecurity ,nalysis and ortfolio

Management0 9y, #ixth Edition :!;;(< p.g.%"56%%5.

". #.=e)in, otfolio Management, second Eddition,renice6Hall of *ndia ri)ate

/T'.,2ew delhi6!;;>p.g.1!!61"!

/e- Links 1or !ata used+

http1..www.nseindia.com.

Home ? E@uities ? Market *nformation ? Historical 'ata ? #ecurity6wise rice Aolume

'ata

#ources of literature usedM

1. http788999.in+e(torhome.$om8emh.htm

2. http788en.9i:ipe"ia.or.89i:i8Effi$ient;mar:et;hpothe(i(<A((#mption(

). http788en.1662 ' Ameri$an 3inan$e A((o$iation.

Page 4)

Page 4,

Page 42

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 06 PDFDokument1 Seite06 PDFHiral ShahNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Sharpe Index Model: Hari Prapan SharmaDokument11 SeitenThe Sharpe Index Model: Hari Prapan SharmaHiral ShahNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Ownership Structure and Dividend Policy: I J C R BDokument24 SeitenOwnership Structure and Dividend Policy: I J C R BHiral ShahNoch keine Bewertungen

- No. GTU/MBA /grade Card/2013/9734 Date: 15/11/2013 CircularDokument1 SeiteNo. GTU/MBA /grade Card/2013/9734 Date: 15/11/2013 CircularHiral ShahNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Circular:: Subject: Important Instructions For Centre Supervisors, Centre in Charge and University ObserversDokument1 SeiteCircular:: Subject: Important Instructions For Centre Supervisors, Centre in Charge and University ObserversHiral ShahNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Attendance SheetDokument3 SeitenAttendance SheetHiral ShahNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Custodial ServicesDokument24 SeitenCustodial ServicesHiral ShahNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Empirical Formula MgCl2Dokument3 SeitenEmpirical Formula MgCl2yihengcyh100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Prinsip TriageDokument24 SeitenPrinsip TriagePratama AfandyNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Chargezoom Achieves PCI-DSS ComplianceDokument2 SeitenChargezoom Achieves PCI-DSS CompliancePR.comNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Securities and Exchange Commission: Non-Holding of Annual MeetingDokument2 SeitenSecurities and Exchange Commission: Non-Holding of Annual MeetingBea AlonzoNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- PDF Document 2Dokument12 SeitenPDF Document 2Nhey VergaraNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Lesson Plan Earth and Life Science: Exogenic ProcessesDokument2 SeitenLesson Plan Earth and Life Science: Exogenic ProcessesNuevalyn Quijano FernandoNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Read Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallDokument1 SeiteRead Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallKJRNoch keine Bewertungen

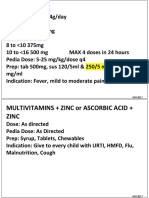

- Student Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415Dokument4 SeitenStudent Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415JohnNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Thursday 08 October 2020: MathematicsDokument32 SeitenThursday 08 October 2020: MathematicsAmjad AshaNoch keine Bewertungen

- Software Construction - MetaphorsDokument17 SeitenSoftware Construction - MetaphorsMahmoodAbdul-Rahman0% (1)

- WatsuDokument5 SeitenWatsuTIME-TREVELER100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- MU151 Group Assignment 6Dokument3 SeitenMU151 Group Assignment 6Jay CadienteNoch keine Bewertungen

- Calculation For Service Platform & Pump Shelter StructureDokument36 SeitenCalculation For Service Platform & Pump Shelter Structuretrian33100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- EP105Use of English ArantxaReynosoDokument6 SeitenEP105Use of English ArantxaReynosoArantxaSteffiNoch keine Bewertungen

- Fabre, Intro To Unfinished Quest of Richard WrightDokument9 SeitenFabre, Intro To Unfinished Quest of Richard Wrightfive4booksNoch keine Bewertungen

- Appendix H Sample of Coded Transcript PDFDokument21 SeitenAppendix H Sample of Coded Transcript PDFWahib LahnitiNoch keine Bewertungen

- Common RHU DrugsDokument56 SeitenCommon RHU DrugsAlna Shelah IbañezNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Sample Programs in CDokument37 SeitenSample Programs in CNoel JosephNoch keine Bewertungen

- Sosa Ernest - Causation PDFDokument259 SeitenSosa Ernest - Causation PDFtri korne penal100% (1)

- Baccarat StrategyDokument7 SeitenBaccarat StrategyRenz Mervin Rivera100% (3)

- Norman 2017Dokument7 SeitenNorman 2017Lee HaeunNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Chapter 5, 6Dokument4 SeitenChapter 5, 6anmar ahmedNoch keine Bewertungen

- Consolidated PCU Labor Law Review 1st Batch Atty Jeff SantosDokument36 SeitenConsolidated PCU Labor Law Review 1st Batch Atty Jeff SantosJannah Mae de OcampoNoch keine Bewertungen

- LabDokument11 SeitenLableonora KrasniqiNoch keine Bewertungen

- MarketingDokument5 SeitenMarketingRose MarieNoch keine Bewertungen

- Hydrozirconation - Final 0Dokument11 SeitenHydrozirconation - Final 0David Tritono Di BallastrossNoch keine Bewertungen

- Development Communication Theories MeansDokument13 SeitenDevelopment Communication Theories MeansKendra NodaloNoch keine Bewertungen

- Practical Interpretation and Application of Exoc Rine Panc Rea Tic Tes Ting in Small AnimalsDokument20 SeitenPractical Interpretation and Application of Exoc Rine Panc Rea Tic Tes Ting in Small Animalsl.fernandagonzalez97Noch keine Bewertungen

- What Enables Close Relationships?Dokument14 SeitenWhat Enables Close Relationships?Clexandrea Dela Luz CorpuzNoch keine Bewertungen

- Womack - Labor History, Industrial Work, Economics, Sociology and Strategic Position PDFDokument237 SeitenWomack - Labor History, Industrial Work, Economics, Sociology and Strategic Position PDFhmaravilloNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)