Beruflich Dokumente

Kultur Dokumente

Investor Presentation Q2FY13

Hochgeladen von

Anugraha JainCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investor Presentation Q2FY13

Hochgeladen von

Anugraha JainCopyright:

Verfügbare Formate

Copyright 2012 Tata Communications Ltd. All rights reserved.

1

Q2 FY2013 Earnings Update

November 6

th

, 2012

Our vision for

The New World of

Communications

1

Copyright 2012 Tata Communications Ltd. All rights reserved.

SAFE HARBOR STATEMENT

Some of the statements herein constitute forward-looking statements that do not directly or

exclusively relate to historical facts. These forward-looking statements reflect our intentions,

plans, expectations, assumptions and beliefs about future events and are subject to risks,

uncertainties and other factors, many of which are outside our control. Important factors that

could cause actual results to differ materially from the expectations expressed or implied in the

forward-looking statements include known and unknown risks. Because actual results could differ

materially from our intentions, plans, expectations, assumptions and beliefs about the future, you

are urged to view all forward-looking statements contained herein with caution. Tata

Communications does not undertake any obligation to update or revise forward looking

statements, whether as a result of new information, future events or otherwise.

2

Copyright 2011 Tata Communications Ltd. All rights reserved.

Highlights: Q2 FY2013

3

Consolidated financial highlights

Consolidated Q2 revenues of Rs 42,710 million, up 26.6% y-o-y and 4.0% q-o-q

Client acceleration continues at a healthy pace

Gained significant MNC business in Q2, up 17% y-o-y in constant currency with marquee wins

Made in roads in new generation businesses

Healthy pipeline build up GDS sales funnel up 86% y-o-y

Managed services maintain traction growing at 26% y-o-y during Q2

Q2 Consolidated Operating EBITDA margins lower by 390 bps y-o-y and 270 bps q-o-q to 10.3%

due to

Impact due to regulatory changes (WPC Wimax charges and increase in license fee rate)

One time actuarial loss on Canada pension fund

Unfavorable settlements in Global Voice Services as compared to positive settlements previous quarter

Increased sales spending and investments for future growth

Copyright 2011 Tata Communications Ltd. All rights reserved.

Highlights: Q2 FY2013

4

Consolidated financial highlights

Due to these, Q2 FY13 financial performance understates operational performance and health of

business

H1 FY13 over H1 FY12 is a better reflection of steady state operational performance of the

business

26% growth in consolidated revenues and 21% growth in operating EBITDA

Operating EBITDA margins of 11.6% in H1 FY13 compared to 12.1% in H1 FY12

Normalizing for changes in external environment (revision in fee from regulators etc.) and one-offs (Canada Pension impact

etc.) business is performing at a better level

Copyright 2011 Tata Communications Ltd. All rights reserved.

Highlights: Q2 FY2013

5

Segment highlights

Voice (GVS)

ILD volumes continue to grow faster than industry average, Q2 volume up 16% y-o-y.

Overall, Net Revenue per Minute (NRPM) have declined sequentially, largely impacted by one-offs

Data (GDS)

25% revenue growth y-o-y, up 5% sequentially

Continue to see good demand traction with strong pipeline build-up

Continued investments for future growth (sales, marketing, network expansion, product development) have

impacted profitability

Start-up (primarily Neotel)

6% sequential revenue growth and double digit EBITDA margins

Investments in accelerating growth continues

Copyright 2011 Tata Communications Ltd. All rights reserved.

Particulars Q2 FY

2012

Q1 FY

2013

Q2 FY

2013

Revenue from operations

33,736 41,074 42,710

Operating EBITDA

4,780 5,328 4,393

Operating EBITDA %

14.2% 13.0% 10.3%

Operating EBIT

440 38 (914)

Operating EBIT %

1.3% 0.1% -2.1%

PBT

(2,098) (893) (2,708)

PBT (% of total income)

-6.2% -2.1% -6.3%

PAT

(1,652) (1,429) (2,742)

PAT (% of total income)

-4.9% -3.4% -6.4%

Revenue From Operations

Operating EBITDA (% of Gross Revenue)

Profit Before Tax (PBT)

4.0% Q-o-Q

33,736

41,074

42,710

Q2 FY12 Q1 FY13 Q2 FY13

4,780

5,328

4,393

14.2%

13.0%

10.3%

Q2 FY12 Q1 FY13 Q2 FY13

26.6% Y-o-Y

(2,098)

(893)

(2,708)

-6.2%

-2.1%

-6.3%

Q2 FY12 Q1 FY13 Q2 FY13

17.5% Q-o-Q

Consolidated Financial Performance Q2 FY2013

6

INR Mn

8.1% Y-o-Y

Copyright 2011 Tata Communications Ltd. All rights reserved.

Particulars H1 FY

2012

H1 FY

2013

Revenue from operations

66,307 83,784

Operating EBITDA

8,044 9,721

Operating EBITDA %

12.1% 11.6%

Operating EBIT

(501) (876)

Operating EBIT %

-0.8% -1.0%

PBT

(4,678) (3,601)

PBT (% of total income)

-7.0% -4.2%

PAT

(3,807) (4,171)

PAT (% of total income)

-5.7% -4.9%

Revenue From Operations

Operating EBITDA (% of Gross Revenue)

Profit Before Tax (PBT)

66,307

83,784

H1 FY12 H1 FY13

8,044

9,721

12.1% 11.6%

H1 FY12 H1 FY13

26.4% Y-o-Y

(4,678)

(3,601)

-7.0%

-4.2%

H1 FY12 H1 FY13

Consolidated Financial Performance H1 FY2013

7

INR Mn

20.9% Y-o-Y

Copyright 2011 Tata Communications Ltd. All rights reserved.

CORE STARTUP CONSOLIDATED

Q2 FY

2012

Q1 FY

2013*

Q2 FY

2013

Q2 FY

2012

Q1 FY

2013

Q2 FY

2013

Q2 FY

2012

Q1 FY

2013*

Q2 FY

2013

Gross Revenues 29,079 36,464 37,840 4,657 4,610 4,870 33,736 41,074 42,710

Y-o-Y Growth

Q-o-Q Growth

EBITDA 4,687 4,734 3,878 93 594 516 4,780 5,328 4,393

Y-o-Y Growth

Q-o-Q Growth

EBIT 1,073 241 (823) (633) (204) (91) 440 38 (914)

PBT 473 262 (1,637) (2,571) (1,154) (1,072) (2,098) (893) (2,708)

PAT after Minority

Interest

185 (273) (1,828) (1,837) (1,155) (915) (1,652) (1,429) (2,742)

INR Mn

Financial Performance by Segment Q2 FY 2013

* Q1 FY13: PBT includes an amount of Rs. 1105 million being reversal of a provision made in earlier year (Rs 272 million) and

an interest of Rs. 833 million calculated on Penalty consequent to a favorable order from TDSAT.

Rs/$ Exchange rate: Q2 FY12 at 45.74; Q1 FY13 at 53.98; Q2 FY13 at 55.21 ZAR/$: Q2 FY12 7.12 at; Q1 FY13 at 8.12; Q2

FY13 at 8.26 8

30.1%

3.8%

4.6%

5.6%

26.6%

4.0%

-17.3%

-18.1%

454.8%

-13.1%

-8.1%

-17.5%

Copyright 2011 Tata Communications Ltd. All rights reserved.

CORE STARTUP CONSOLIDATED

H1 FY

2012

H1 FY

2013

H1 FY

2012

H1 FY

2013

H1 FY

2012

H1 FY

2013

Gross Revenues 57,842 74,305 8,465 9,479 66,307 83,784

Y-o-Y Growth

EBITDA 8,537 8,612 (493) 1,109 8,044 9,721

Y-o-Y Growth

EBIT 1,391 (582) (1,891) (294) (501) (876)

PBT 422 (1,375) (5,100) (2,226) (4,678) (3,601)

PAT after Minority Interest (79) (2,100) (3,728) (2,071) (3,807) (4,171)

INR Mn

Financial Performance by Segment H1 FY 2013

9

28.5%

12.0%

26.4%

0.9%

NM

20.9%

Rs/$ Exchange rate: Q2 FY12 at 45.74; Q1 FY13 at 53.98; Q2 FY13 at 55.21 ZAR/$: Q2 FY12 7.12 at; Q1 FY13 at 8.12; Q2

FY13 at 8.26

Copyright 2011 Tata Communications Ltd. All rights reserved.

Global Voice Services

(GVS)

Global Data Services

(GDS)

Q2 FY

2012

Q1 FY

2013

Q2 FY

2013

Q2 FY

2012

Q1 FY

2013

Q2 FY

2013

Gross Revenues 15,758 20,485 21,138 13,321 15,980 16,703

Y-o-Y Growth

Q-o-Q Growth

Net Revenue 2,760 3,704 3,309 10,706 12,547 12,866

Y-o-Y Growth

Q-o-Q Growth

EBITDA 1,221 1,950 1,289 3,466 2,784 2,588

EBITDA % 7.7% 9.5% 6.1% 26.0% 17.4% 15.5%

Core Business by Business Unit Q2 FY 2013

10

34.1%

3.2%

25.4%

4.5%

19.9%

-10.7%

20.2%

2.5%

Management estimates based on internal MIS and cost allocation assumptions

INR Mn

Copyright 2011 Tata Communications Ltd. All rights reserved.

Global Voice Services

(GVS)

Global Data Services

(GDS)

H1 FY 2012 H1 FY 2013 H1 FY 2012 H1 FY 2013

Gross Revenues 31,881 41,622 25,961 32,682

Y-o-Y Growth

Net Revenue 5,427 7,012 21,003 25,413

Y-o-Y Growth

EBITDA 2,186 3,239 6,351 5,373

EBITDA % 6.9% 7.8% 24.5% 16.4%

Core Business by Business Unit H1 FY 2013

11

30.6% 25.9%

29.2% 21.0%

Management estimates based on internal MIS and cost allocation assumptions

INR Mn

Copyright 2011 Tata Communications Ltd. All rights reserved.

Debt Profile

Debt Profile

Core

As on

Jun 30, 2012

As on

Sep 30, 2012

Foreign Currency Loans 1,372 1,386

Rupee Loans

233 245

Avg. Cost of Loans* 5.07% 4.99%

Total Gross Debt 1,605 1,631

Cash & Cash Equivalent 84 57

Net Debt 1,521 1,574

USD Mn

Rs/$ Exchange rate: as on 30

th

Jun, 2012 55.89, as on 30

th

Sep, 2012 52.74

* Average cost of Loans during the quarter

12

Copyright 2012 Tata Communications Ltd. All rights reserved. 13

Thank You

13

Copyright 2011 Tata Communications Ltd. All rights reserved.

28,763

29,079

31,648

35,091

36,464

37,840

12,967

13,466

15,190

16,202

16,251

16,174

Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13

Gross Revenue Net Revenue

Core Business Gross and Net Revenues

Rs/$ Exchange rate: 1Q12 at 44.73, 2Q12 at 45.74; 3Q12 at 50.84; 4Q12 at 50.34; 1Q13 at 53.98; 2Q13 at 55.21

14

INR Mn

Copyright 2011 Tata Communications Ltd. All rights reserved.

3,866

4,687

4,852

4,600

4,734

3,878

334

1,073

843

254 241

(823)

(44)

473 506

157

262

(1,637)

Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13

EBITDA EBIT PBT

Core Business EBITDA, EBIT and PBT

15

INR Mn

Rs/$ Exchange rate: 1Q12 at 44.73, 2Q12 at 45.74; 3Q12 at 50.84; 4Q12 at 50.34; 1Q13 at 53.98; 2Q13 at 55.21

Copyright 2011 Tata Communications Ltd. All rights reserved.

Quarterly trends : Neotel

578

724

699

685 690

723

(91)

14

26

39

73

75

Q1FY11 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13

Gross Revenues EBITDA

Neotel EBITDA positive from Q2 FY12 onwards

$/Zar Exchange rate: 1Q12 at 6.79, 2Q12 at 7.12; 3Q12 at 8.10; 4Q12 at 7.77; 1Q13 at 8.12; 2Q13 at 8.26

ZAR Mn

16

Copyright 2011 Tata Communications Ltd. All rights reserved.

33%

34%

13%

9%

6%

4%

31%

26%

18%

10%

9%

5%

1%

Data Center Svcs

Mobility

Banking Svcs

Enterprise Voice

Transformation Svcs

Collaboration Svcs

Other

40%

27%

30%

2%

1%

38%

32%

27%

2%

1%

Traditional N/w

VPN Svcs

Internet Transit

Media Svcs

Other

GDS | YoY Gross Revenue Product Mix

Network Services Managed Services

Network Service Portfolio

Traditional Network Services: IPL, NPL, IRUs

VPN Services : DGE and VPN

Media Services: Vconnect, Broadcast, CDN, Mosaic

Internet Transit IP-T, ILL

Other: Inmarsat, GNS others

Managed Services Portfolio:

Data Center Services: Colo, Hosting, Cloud (MSO)

Collaboration Services: Telepresence,

Transformation Services: TCTS

Banking Services: TCBIL

Other: MSS

H1 FY13

H1 FY12

H1 FY13

H1 FY12

17

Copyright 2011 Tata Communications Ltd. All rights reserved.

DELIVER A

NEW WORLD OF COMMUNICATIONS

TO ADVANCE THE REACH AND

LEADERSHIP OF OUR CUSTOMERS

Our Vision

18

Copyright 2011 Tata Communications Ltd. All rights reserved.

NEW WORLD OF

COMMUNICATIONS

Our New World of Communications strategy

19

Copyright 2011 Tata Communications Ltd. All rights reserved.

Voice

Neotel Data

Mature; Stable

Scale business

Market Leader

Mature; Growth

Solutions & brand

Challenger

Emerging Mkt

Investments

New Challenger

CORE

STARTUP*

* Startup includes consolidation of United Telecom Limited (UTL) Nepal, in addition to Neotel, South Africa

Business structure

20

Copyright 2011 Tata Communications Ltd. All rights reserved.

Tata Communications in numbers

45

Billion Minutes

of International

Voice Traffic

13

Terabits

of International

Bandwidth Lit Capacity

42

Data Centers

with more than 10,000

racks and one million

square feet

3,200

Petabits

every month on

our Internet backbone

Million Voice Transactions

handled every day

21

Copyright 2012 Tata Communications Ltd. All rights reserved.

22

Ownership of one of the most advanced, seamless

global transmission networks

For a more interactive and detailed overview of our global network footprint, please visit

http://www.tatacommunications.com/map2/Network.html

Global network footprint

Copyright 2012 Tata Communications Ltd. All rights reserved.

Headcount split by geography and function

India

80%

North America

11%

Europe

5%

Asia Pacific

4%

MENA

0%

Sales, Marketing

and Account

Management

20%

Product

Management

8%

Engineering and

Operations

59%

Corporate

Shared

Services

13%

By Geography By Function

* In addition to this, the company has 961 employees in its South Africa Operations (Neotel)

6,952 Employees in Core business as on September 30, 2012*

23

Copyright 2012 Tata Communications Ltd. All rights reserved.

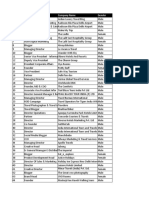

Global management team

Vinod Kumar

MD and Group CEO

(Singapore)

Michel Guyot

President GVS

(Canada)

Laurie Bowen

President, Enterprise Business

(UK)

Allan Chan

President, Global Carrier

Solution

(USA)

Sanjay Baweja

CFO

(India)

Sunil Joshi

MD & CEO of Neotel

(South Africa)

John Hayduk

President, Product Management

and Service Development

(USA)

Madhusudhan MR

Chief Network Officer

(India)

Srinivasa Addepalli

Chief Strategy Officer

(India)

Aadesh Goyal

Global Head, Human Resources

(India)

Sunil Rawal

Global Head Business

Excellence, CQO

(India)

John Freeman

General Counsel

(Singapore)

(Country) represents

where each

executive is located.

Rangu Salgame

CEO Growth Ventures

(India)

24

Copyright 2012 Tata Communications Ltd. All rights reserved.

Shareholding pattern

Tata Group

50%

Government of

India

26%

ADR

6%

Institutions

14%

Non-institutions

4%

As on September 30, 2012

1. Tata group includes Panatone Finvest Ltd (31.10%), Tata Sons (14.22%), and Tata Power Ltd. (4.71%)

2. Institutions include Mutual funds (1.29%), Financial institutions (5.91%), Insurance companies (4.81%) and Foreign

Institutional Investors (2.46%)

3. Non-institutions include individuals (2.79%), Bodies corporate (0.70%) and others (0.10%)

1

2

3

25

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- President CEO COO CIO in United States Resume Mark JohnsonDokument3 SeitenPresident CEO COO CIO in United States Resume Mark JohnsonMark Johnson 1Noch keine Bewertungen

- Essay Questions of Strategic ManagementDokument12 SeitenEssay Questions of Strategic ManagementMaqsood Ali Jamali75% (4)

- Tourism Summit DataDokument12 SeitenTourism Summit DataPoonamNoch keine Bewertungen

- Research Methodology of Corporate GovernanceDokument20 SeitenResearch Methodology of Corporate GovernanceMichelle Mark50% (2)

- ICDC - List of ParticipantsDokument32 SeitenICDC - List of ParticipantsAbimbola Ige ChinemereNoch keine Bewertungen

- 2014 Catalyst Annual Report PDFDokument55 Seiten2014 Catalyst Annual Report PDFAltif AboodNoch keine Bewertungen

- 2016 Appointments (Jan-Oct) by AffairsCloud PDFDokument15 Seiten2016 Appointments (Jan-Oct) by AffairsCloud PDFRamGokul MNoch keine Bewertungen

- Ambuja CementDokument19 SeitenAmbuja CementDeesha DuttaNoch keine Bewertungen

- Epicentre Holdings LimitedDokument142 SeitenEpicentre Holdings LimitedEmily TanNoch keine Bewertungen

- Public Sector Accounting & FinanceDokument21 SeitenPublic Sector Accounting & Financeappiah ernestNoch keine Bewertungen

- Assignment 1Dokument6 SeitenAssignment 1Le Thi Linh ChiiNoch keine Bewertungen

- Research Test QuestionsDokument4 SeitenResearch Test QuestionsTom CruizeNoch keine Bewertungen

- Annual Report Fy 2018Dokument334 SeitenAnnual Report Fy 2018Praneeth ThotaNoch keine Bewertungen

- 2005-Sheehan-A Model For HRM Strategic Integration, Personnel ReviewDokument18 Seiten2005-Sheehan-A Model For HRM Strategic Integration, Personnel ReviewAbdul MannanNoch keine Bewertungen

- Centre For Charity Effectiveness: Course Overview April 2019Dokument14 SeitenCentre For Charity Effectiveness: Course Overview April 2019Christie JaimonNoch keine Bewertungen

- Enobakhare Corporate 2010Dokument78 SeitenEnobakhare Corporate 2010rayhan555Noch keine Bewertungen

- Economics For Managers GTU MBA Sem 1 Productivity Efficiency and EffectivenessDokument10 SeitenEconomics For Managers GTU MBA Sem 1 Productivity Efficiency and EffectivenessRushabh VoraNoch keine Bewertungen

- Marco Casiraghi Appointment As CEO of Power FluteDokument3 SeitenMarco Casiraghi Appointment As CEO of Power FluteAhveedrawnNoch keine Bewertungen

- Innotek Limited Annual Report 2019Dokument164 SeitenInnotek Limited Annual Report 2019WeR1 Consultants Pte LtdNoch keine Bewertungen

- Capital Link 19 InvestingGreeceDokument6 SeitenCapital Link 19 InvestingGreeceEconomy 365Noch keine Bewertungen

- Ceo AssignmentDokument17 SeitenCeo AssignmentANINDA NANDINoch keine Bewertungen

- LondonDokument20 SeitenLondonVojislavAntićNoch keine Bewertungen

- PEC Pakistan - Service Structure of EngineersDokument8 SeitenPEC Pakistan - Service Structure of EngineersMuhammad HarisNoch keine Bewertungen

- 2005 - Coombs - Stakeholder Management As A Predictor of CEO Compensation Main Effects andDokument14 Seiten2005 - Coombs - Stakeholder Management As A Predictor of CEO Compensation Main Effects andahmed sharkasNoch keine Bewertungen

- Alaina Macia ResumeDokument2 SeitenAlaina Macia Resumesarahwolfrum0% (1)

- Chief of Staff ResumeDokument4 SeitenChief of Staff Resumeafiwjsazh100% (2)

- Dick Smith Annual ReportDokument88 SeitenDick Smith Annual Reportacademicproffwritter0% (1)

- University of Minnesota Foundation CEO Position DescriptionDokument7 SeitenUniversity of Minnesota Foundation CEO Position DescriptionLars LeafbladNoch keine Bewertungen

- Lutheran Social Service of MN - Position Profile - CEODokument6 SeitenLutheran Social Service of MN - Position Profile - CEOLars LeafbladNoch keine Bewertungen

- RTA About Us Presentation 2014Dokument12 SeitenRTA About Us Presentation 2014RTAGreenwichNoch keine Bewertungen