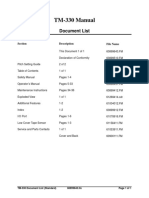

Beruflich Dokumente

Kultur Dokumente

Eekly Conomic Pdate: Doug Potash Presents

Hochgeladen von

Doug Potash0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten2 SeitenMay 12, 2014

Originaltitel

Weekly Economic Update

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenMay 12, 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten2 SeitenEekly Conomic Pdate: Doug Potash Presents

Hochgeladen von

Doug PotashMay 12, 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Doug Potash Presents:

WEEKLY ECONOMIC UPDATE

WEEKLY QUOTE

Every great mistake

has a halfway

moment, a split

second when it can

be recalled and

perhaps remedied.

- Pearl S. Buck

WEEKLY TIP

Sometimes a radio

commercial or cable

TV ad will pitch a

vaguely described

investment that you

must know about

offering impressive

returns with virtually

no risk. These claims

are red flags.

WEEKLY RIDDLE

James has two kids.

If the eldest is a girl,

what are the chances

that the youngest is

also a girl?

Last weeks riddle:

It has dozens of fine

teeth, but you can hold

it in your hand and it

will never bite you.

What is it?

Last weeks answer:

A comb.

May 12, 2014

ISM: SERVICE SECTOR VERY HEALTHY

At 55.2, the Institute for Supply Managements April non-manufacturing PMI

climbed 2.1 points above the March reading. The nations service sector expanded

for a 51st straight month, and the survey saw big monthly leaps in its new orders

index (up 4.8 points to 58.2) and its business activity index (which rose 7.5 points to

60.9).

1

THE S&P EARNINGS SCORECARD (SO FAR)

As last week ended on Wall Street, 451 members of the S&P 500 had announced

results in the Q1 earnings season. According to Bloombergs tally, 76% of those firms

exceeded profit projections and 53% beat revenue forecasts. Analysts surveyed by

Bloomberg estimate that earnings for S&P constituents improved 5.5% in Q1 while

sales rose 3.0%.

2

GAS AT $3.66 A GALLON, OIL JUST UNDER $100

The Memorial Day weekend arrives May 24-26; will prices fall slightly by then? The

national average for regular unleaded on May 9 was $0.11 higher than a year ago,

according to AAAs Daily Fuel Gauge Report. NYMEX crude rose 0.2% across five

days to settle at $99.99 as the week ended; gold pulled back 1.2% last week, finishing

at $1,287.60 on the COMEX Friday.

3,4

A RECORD CLOSE FOR THE DOW

A small Friday advance left the index at 16,583.34 at Fridays closing bell. While the

blue chips rose 0.43% for the week, the S&P 500 retreated 0.14% and the Nasdaq

declined 1.26%. The S&P settled at 1,878.48 Friday, the Nasdaq at 4,071.87.

5

THIS WEEK: Monday, Wall Street will react to the weekend independence vote

held by pro-Russian separatists in eastern Ukraine, who have vowed to form their

own republic; no major news is scheduled stateside. April retail sales numbers are

out Tuesday along with Q1 results from Hertz Global; additionally, investors will

consider Chinas April industrial output and retail sales. Wednesday marks the

release of Aprils PPI plus earnings from Cisco, Jack in the Box, Macys,

Abercrombie & Fitch, RE/MAX, SodaStream and Valero. Thursday, Federal Reserve

chair Janet Yellen speaks on small businesses and the economy in the nations

capital; Aprils CPI and industrial production report arrive, the latest initial claims

figures are released and Wal-Mart, Kohls, Nordstrom and J.C. Penney announce

quarterly results. Friday sees the release of the University of Michigans initial May

consumer sentiment index and data on April building permits and housing starts.

% CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG

DJIA +0.04 +9.95 +18.68 +6.60

NASDAQ -2.51 +19.44 +26.83 +11.48

S&P 500 +1.63 +15.48 +20.43 +7.28

REAL YIELD 5/9 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO

10 YR TIPS 0.44% -0.50% 1.77% 2.25%

Sources: USATODAY.com, bigcharts.com, treasury.gov - 5/9/14

6,7,8,9

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly.

These returns do not include dividends.

Please feel free to forward this article to family, friends or colleagues.

If you would like us to add them to our distribution list, please reply with their address.

We will contact them first and request their permission to add them to our list.

Doug Potash, CRPC

Vice President & Wealth Advisor

Legacy Financial Group, LLC

888 Bestgate Road, Suite 205

Annapolis, MD 21401

410-897-9401

Fax- 443-292-5119

Cell- 443-994-1897

www.legacyfinancialgroup.com

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC

Advisory services offered through Cambridge Investment Research Advisors, Inc. A Registered Investment Advisor

Legacy Financial is an independent firm and is not affiliated with Cambridge Investment Research

Doug Potash Disclosure

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their

affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past

performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services.

If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be

construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither

a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as

such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a price-

weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all

over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard

& Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not

possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange

(the NYSE) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx, and the Pacific Exchange). NYSE Group is a

leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX)

is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with

trading conducted through two divisions the NYMEX Division, home to the energy, platinum, and palladium markets, and the

COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency

fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the

market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past

performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when

originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are

unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other

professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 - ism.ws/ISMReport/NonMfgROB.cfm [5/5/14]

2 - bloomberg.com/news/2014-05-09/u-s-stock-futures-retreat-as-investors-assess-earnings.html [5/9/14]

3 - fuelgaugereport.aaa.com [5/9/14]

4 - proactiveinvestors.com/companies/news/54023/gold-loses-12-on-week-oil-settles-at-9999-54023.html [5/9/14]

5 - thestreet.com/story/12702814/1/market-hustle-stocks-lower-amid-deal-news-markets-eye-ukraine-vote.html [5/9/14]

6 - usatoday.com/money/markets/overview/ [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F9%2F13&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F9%2F13&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F9%2F13&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F8%2F09&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F8%2F09&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F8%2F09&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F10%2F04&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F10%2F04&x=0&y=0 [5/9/14]

7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F10%2F04&x=0&y=0 [5/9/14]

8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [5/9/14]

9 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [5/9/14]

Das könnte Ihnen auch gefallen

- The Weekly Market Update For The Week of April 13, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of April 13, 2015.mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of February 9, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of February 9, 2015.mike1473Noch keine Bewertungen

- Eekly Conomic Pdate: PresentsDokument2 SeitenEekly Conomic Pdate: Presentsmike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of March 9, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of March 9, 2015.mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of May 18, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of May 18, 2015.mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of December 15, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of December 15, 2014.GianaNoch keine Bewertungen

- The Weekly Market Update For The Week of June 1, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of June 1, 2015.mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of November 10, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of November 10, 2014.mike1473Noch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of April 6, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of April 6, 2015.mike1473Noch keine Bewertungen

- Weekly Market Update For The Week of October 7Dokument3 SeitenWeekly Market Update For The Week of October 7mike1473Noch keine Bewertungen

- The Weekly Ecomonic Update For The Week of April 20, 2015.Dokument2 SeitenThe Weekly Ecomonic Update For The Week of April 20, 2015.mike1473Noch keine Bewertungen

- Weekly Market Update July 22Dokument3 SeitenWeekly Market Update July 22mike1473Noch keine Bewertungen

- Weekly Market Update Aug 12Dokument3 SeitenWeekly Market Update Aug 12mike1473Noch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of February 2, 2015Dokument2 SeitenThe Weekly Market Update For The Week of February 2, 2015mike1473Noch keine Bewertungen

- Eekly Conomic Pdate: Charles D. Vercellone, CHFC PresentsDokument3 SeitenEekly Conomic Pdate: Charles D. Vercellone, CHFC PresentscdvwsgNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument2 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- April 15 Weekly Economic UpdateDokument2 SeitenApril 15 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of November 3, 2014Dokument2 SeitenThe Weekly Market Update For The Week of November 3, 2014mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of November 17, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of November 17, 2014.mike1473Noch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- June 10 Update - Correct VersionDokument2 SeitenJune 10 Update - Correct Versionmike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of December 8, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of December 8, 2014.mike1473Noch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument2 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of August 18th.Dokument2 SeitenThe Weekly Market Update For The Week of August 18th.mike1473Noch keine Bewertungen

- FB 101512Dokument2 SeitenFB 101512mike1473Noch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of March 2, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of March 2, 2015.mike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of January 26, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of January 26, 2015.mike1473Noch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- 9-18-2012 Weekly Economic UpdateDokument2 Seiten9-18-2012 Weekly Economic UpdatespectrumfinancialNoch keine Bewertungen

- Eekly Conomic Pdate: Economy Grows 2.8% in Q4Dokument2 SeitenEekly Conomic Pdate: Economy Grows 2.8% in Q4api-118535366Noch keine Bewertungen

- The Weekly Market Update For The Week of October 13, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of October 13, 2014.mike1473Noch keine Bewertungen

- Weekly Market Update For The Week of September 30thDokument3 SeitenWeekly Market Update For The Week of September 30thmike1473Noch keine Bewertungen

- The Weekly Market Update For The Week of December 1, 2014.Dokument2 SeitenThe Weekly Market Update For The Week of December 1, 2014.mike1473Noch keine Bewertungen

- Weekly Market Update June 17thDokument2 SeitenWeekly Market Update June 17thmike1473Noch keine Bewertungen

- April 8 Weekly Economic UpdateDokument3 SeitenApril 8 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Weekly Market Update For The Week of October 28Dokument3 SeitenWeekly Market Update For The Week of October 28mike1473Noch keine Bewertungen

- Dec 172012Dokument2 SeitenDec 172012mike1473Noch keine Bewertungen

- Eekly Conomic Pdate: Unemployment Down To 8.1%Dokument2 SeitenEekly Conomic Pdate: Unemployment Down To 8.1%api-118535366Noch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- The Weekly Market Update For The Week of February 16, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of February 16, 2015.mike1473Noch keine Bewertungen

- Weekly Market Update For The Week of October 14Dokument3 SeitenWeekly Market Update For The Week of October 14mike1473Noch keine Bewertungen

- The Weekly Economic Update For The Week of February 23, 2015.Dokument2 SeitenThe Weekly Economic Update For The Week of February 23, 2015.mike1473Noch keine Bewertungen

- April 29 Weekly Economic UpdateDokument2 SeitenApril 29 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- Dec3 Market UpdateDokument2 SeitenDec3 Market Updatemike1473Noch keine Bewertungen

- Eekly Conomic Pdate: Unemployment Falls To 8.2%Dokument2 SeitenEekly Conomic Pdate: Unemployment Falls To 8.2%api-118535366Noch keine Bewertungen

- April 22nd Weeky Economic UpdateDokument3 SeitenApril 22nd Weeky Economic UpdateDoug PotashNoch keine Bewertungen

- April 1 Weekly Economic UpdateDokument2 SeitenApril 1 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- Weekly Market Update 711Dokument3 SeitenWeekly Market Update 711mike1473Noch keine Bewertungen

- Weekly Market Update For The Week of October 21Dokument2 SeitenWeekly Market Update For The Week of October 21mike1473Noch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument2 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Weekly Market Update For The Week of Aug 20thDokument3 SeitenWeekly Market Update For The Week of Aug 20thmike1473Noch keine Bewertungen

- Investing in Junk Bonds: Inside the High Yield Debt MarketVon EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketBewertung: 3 von 5 Sternen3/5 (1)

- Classic Investing Mistakes: How Many Can You Prevent Yourself From Making?Dokument3 SeitenClassic Investing Mistakes: How Many Can You Prevent Yourself From Making?Doug PotashNoch keine Bewertungen

- June 23 Weekly Economic UpdateDokument3 SeitenJune 23 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- What Beneficiaries Have To KnowDokument4 SeitenWhat Beneficiaries Have To KnowDoug PotashNoch keine Bewertungen

- Tax Scams and SchemesDokument3 SeitenTax Scams and SchemesDoug PotashNoch keine Bewertungen

- Retirement in SightDokument2 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- Women, Longevity Risk & Retirement SavingDokument3 SeitenWomen, Longevity Risk & Retirement SavingDoug PotashNoch keine Bewertungen

- Coping With College LoansDokument3 SeitenCoping With College LoansDoug PotashNoch keine Bewertungen

- Weekly Eocnomic UpdateDokument2 SeitenWeekly Eocnomic UpdateDoug PotashNoch keine Bewertungen

- The Economy Heads For NormalDokument3 SeitenThe Economy Heads For NormalDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument3 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- There Are 5 Big "Unknowns" in RetirementDokument1 SeiteThere Are 5 Big "Unknowns" in RetirementDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Retirement in SightDokument2 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- Sometimes You Can Take Penalty-Free Early Withdrawals From Retirement Accounts.Dokument3 SeitenSometimes You Can Take Penalty-Free Early Withdrawals From Retirement Accounts.Doug PotashNoch keine Bewertungen

- Guarding Against Identity TheftDokument3 SeitenGuarding Against Identity TheftDoug PotashNoch keine Bewertungen

- Quarterly Economic UpdateDokument6 SeitenQuarterly Economic UpdateDoug PotashNoch keine Bewertungen

- Throwing Out The 4% RuleDokument2 SeitenThrowing Out The 4% RuleDoug PotashNoch keine Bewertungen

- Quarterly Economic UpdateDokument6 SeitenQuarterly Economic UpdateDoug PotashNoch keine Bewertungen

- The Retirement We Imagine, The Retirement We LiveDokument3 SeitenThe Retirement We Imagine, The Retirement We LiveDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument3 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument3 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Deadlines For Funding IRAsDokument2 SeitenDeadlines For Funding IRAsDoug PotashNoch keine Bewertungen

- Asset Location & Timing To Reduce Taxes in RetirementDokument3 SeitenAsset Location & Timing To Reduce Taxes in RetirementDoug PotashNoch keine Bewertungen

- China, Ukraine and The MarketsDokument3 SeitenChina, Ukraine and The MarketsDoug PotashNoch keine Bewertungen

- Annapolis Film Festival ProgramDokument45 SeitenAnnapolis Film Festival ProgramDoug PotashNoch keine Bewertungen

- China, Ukraine and The MarketsDokument3 SeitenChina, Ukraine and The MarketsDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Retirement in SightDokument2 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- Leg Wri FInal ExamDokument15 SeitenLeg Wri FInal ExamGillian CalpitoNoch keine Bewertungen

- Royalty-Free License AgreementDokument4 SeitenRoyalty-Free License AgreementListia TriasNoch keine Bewertungen

- UKIERI Result Announcement-1Dokument2 SeitenUKIERI Result Announcement-1kozhiiiNoch keine Bewertungen

- PS300-TM-330 Owners Manual PDFDokument55 SeitenPS300-TM-330 Owners Manual PDFLester LouisNoch keine Bewertungen

- WELDING EQUIPMENT CALIBRATION STATUSDokument4 SeitenWELDING EQUIPMENT CALIBRATION STATUSAMIT SHAHNoch keine Bewertungen

- Haul Cables and Care For InfrastructureDokument11 SeitenHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNoch keine Bewertungen

- BAM PPT 2011-09 Investor Day PDFDokument171 SeitenBAM PPT 2011-09 Investor Day PDFRocco HuangNoch keine Bewertungen

- Fujitsu Spoljni Multi Inverter Aoyg45lbt8 Za 8 Unutrasnjih Jedinica KatalogDokument4 SeitenFujitsu Spoljni Multi Inverter Aoyg45lbt8 Za 8 Unutrasnjih Jedinica KatalogSasa021gNoch keine Bewertungen

- Eritrea and Ethiopia Beyond The Impasse PDFDokument12 SeitenEritrea and Ethiopia Beyond The Impasse PDFThe Ethiopian AffairNoch keine Bewertungen

- Dell 1000W UPS Spec SheetDokument1 SeiteDell 1000W UPS Spec SheetbobNoch keine Bewertungen

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDokument1 SeiteQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNoch keine Bewertungen

- ASCE - Art Competition RulesDokument3 SeitenASCE - Art Competition Rulesswarup babalsureNoch keine Bewertungen

- 2JA5K2 FullDokument22 Seiten2JA5K2 FullLina LacorazzaNoch keine Bewertungen

- Denial and AR Basic Manual v2Dokument31 SeitenDenial and AR Basic Manual v2Calvin PatrickNoch keine Bewertungen

- 3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsDokument9 Seiten3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsRingle JobNoch keine Bewertungen

- Pig PDFDokument74 SeitenPig PDFNasron NasirNoch keine Bewertungen

- 3) Stages of Group Development - To StudsDokument15 Seiten3) Stages of Group Development - To StudsDhannesh SweetAngelNoch keine Bewertungen

- 9780702072987-Book ChapterDokument2 Seiten9780702072987-Book ChaptervisiniNoch keine Bewertungen

- Broker Name Address SegmentDokument8 SeitenBroker Name Address Segmentsoniya_dps2006Noch keine Bewertungen

- Computers As Components 2nd Edi - Wayne WolfDokument815 SeitenComputers As Components 2nd Edi - Wayne WolfShubham RajNoch keine Bewertungen

- Advance Bio-Photon Analyzer ABPA A2 Home PageDokument5 SeitenAdvance Bio-Photon Analyzer ABPA A2 Home PageStellaEstel100% (1)

- Planning For Network Deployment in Oracle Solaris 11.4: Part No: E60987Dokument30 SeitenPlanning For Network Deployment in Oracle Solaris 11.4: Part No: E60987errr33Noch keine Bewertungen

- Case Analysis - Compania de Telefonos de ChileDokument4 SeitenCase Analysis - Compania de Telefonos de ChileSubrata BasakNoch keine Bewertungen

- C79 Service Kit and Parts List GuideDokument32 SeitenC79 Service Kit and Parts List Guiderobert100% (2)

- Philippine Architecture, Film Industry EvolutionDokument4 SeitenPhilippine Architecture, Film Industry EvolutionCharly Mint Atamosa IsraelNoch keine Bewertungen

- ABBBADokument151 SeitenABBBAJeremy MaraveNoch keine Bewertungen

- Continuation in Auditing OverviewDokument21 SeitenContinuation in Auditing OverviewJayNoch keine Bewertungen

- 3DS MAX SYLLABUSDokument8 Seiten3DS MAX SYLLABUSKannan RajaNoch keine Bewertungen

- Lec - Ray Theory TransmissionDokument27 SeitenLec - Ray Theory TransmissionmathewNoch keine Bewertungen

- Lorilie Muring ResumeDokument1 SeiteLorilie Muring ResumeEzekiel Jake Del MundoNoch keine Bewertungen