Beruflich Dokumente

Kultur Dokumente

Notes On Project Finance

Hochgeladen von

Jas SudanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Notes On Project Finance

Hochgeladen von

Jas SudanCopyright:

Verfügbare Formate

RAISING OF FINANCE AND PROJECT FINANCING

RAISING OF FINANCE

Finance for a Project in India can be raised by way of

(A) Share Capital

(B) Long-ter borrowings

(C) Short-ter borrowings

Both share capital and long-ter borrowings are !sed to finance fi"ed assets pl!s the argin oney re#!ired to

obtain ban$ borrowings for wor$ing capital% &or$ing capital is financed ainly fro ban$ borrowings and fro

!nsec!red loans and deposits%

Share Capital consists of two broad categories of capital naely e#!ity and preference% '#!ity shares ha(e a fi"ed

par (al!e and can be iss!ed at par or at a prei! on the par (al!e% Shares cannot norally be iss!ed at a disco!nt%

)owe(er* in e"ceptional circ!stances iss!e of shares at a disco!nt is peritted pro(ided (a) the shares are of a

class already e"isting* (b) the disco!nt is a!thorised by the shareholders* and (c) the iss!e %is sanctioned by the

Central +o(ernent% ,orally the Central +o(ernent will not sanction a disco!nt e"ceeding -./%

0he corporates are now allowed to raise reso!rces for e"pansion plans% by iss!ing e#!ity shares with differential

(oting rights% 0he ain ad(antages of s!ch category of shares are 1

-% '#!ity can be raised witho!t dil!ting sta$e of the prooters%

2% Copanies can red!ce gearing-ratios%

3% 0he ris$ of hostile-ta$eo(ers is red!ced to a considerable e"tent%

4% 0he passing of yield in the for of high di(idends to the in(estors can be ens!red

0he following are the general disad(antages

-% 0he cost of ser(icing e#!ity capital will increase%

2% Poor corporate go(ernance ay be enco!raged%

3% If iss!ed at disco!nt* they ay raise the e#!ity b!rden%

Preference shares carry a fi"ed rate of di(idend (which can be c!!lati(e)% 0hese shares carry a preferential right to

be paid on winding !p of the copany% Preference shares can be ade con(ertible into e#!ity shares% Iss!e of

preference is not a pop!lar for of capital iss!e%

0he iss!e of capital by copanies is go(erned by g!idelines iss!ed by the Sec!rities and '"change Board of India

(S'BI) and the listing re#!ireents of the stoc$ e"changes%

Apart* fro e#!ity* there can also be (ario!s fors of pse!do e#!ity% 0he ost coon fors are f!lly or partly

con(ertible debent!res and debent!res* iss!ed with warrants entitling the holder to s!bscribe for e#!ity% 0here can

also be an iss!e of non-con(ertible debent!res%

0er finance is ainly pro(ided by the (ario!s All India 5e(elopent Ban$s (I5BI* IFCI* SI5BI* IIBI etc%)*

specialised financial instit!tions (6C0C* 05ICI* 0FCI) and in(estent instit!tions (LIC* 70I and +IC)% In

addition* ter finance is also pro(ided by the State financial corporations* the State ind!strial de(elopent

corporations and coercial ban$s% 5ebt instr!ents iss!ed by copanies are also s!bscribed for by !t!al f!nds

and financing acti(ities are also done by finance copanies%

Term Lending Institutions

0er lending instit!tions ay be categorised on the basis of their area of operations as !nder1

All India financial instit!tions consisting of%

Ind!strial 5e(elopent Ban$ of India (I5B-) ( proposed to be con(erted into a Coercial Ban$)%

Ind!strial Finance Corporation of India (IFCI)%

'8I9 Ban$

,ational Ban$ for Agric!lt!re and 6!ral 5e(elopent (,ABA65)%

Ind!strial In(estent Ban$ of India ()BI)%

0o!ris Finance Corporation of India (0FCI)%

Indian 6ailway Finance Corporation (I6FC)%

Coercial Ban$s%

6is$ Capital : 0echnology Finance Corporation Ltd%

Sall Ind!stries 5e(elopent Ban$ of India (SI5BI)%

Life Ins!rance Corporation (LIC)

+eneral Ins!rance Corporation of India (+IC) and its fo!r s!bsidiaries

7nit 0r!st of India

Power Finance Corporation Ltd%

,ational )o!sing Ban$

6!ral 'lectrification Corporation Ltd%

Infrastr!ct!re 5e(elopent Finance Corporation

)o!sing and 7rban 5e(elopent Corporation Ltd% ()75C.)

Indian 6enewable 'nergy 5e(elopent Agency Ltd% (I6'5A)%

0he instit!tions li$e LIC : +IC ay not be (ery !ch associated with the project appraisal b!t lend their f!nds in

consorti! with other all India financial instit!tions%

State le(el financial instit!tions consisting of 1

State Financial Corporations (SFCs)%

State Ind!strial 5e(elopent Corporations (SI5Cs)%

6egional 6!ral Ban$s : Co-operati(e Ban$s%

State le(el instit!tions confine their acti(ities within the concerned States and generally e"tend financial

accoodation to sall and edi! scale sectors%

Non Fund Facilities

0he role of the financial and ban$ing instit!tions is not erely confined to lending of f!nds% 0hey render non f!nd

based facilities as well li$e opening of letters of credit* iss!e of ban$ g!arantees* etc% Besides* there are pri(ate

in(estent copanies in(ol(ed in direct and indirect financing of the projects and also e"tending lease financing%

PROJECT FINANCING

Before ipleenting a new project or !nderta$ing e"pansion* di(ersification* odernisation or rehabilitation

schee ascertaining the cost of project and the eans of finance is one of the ost iportant considerations% For

this p!rpose the Copany has to prepare a feasibility st!dy co(ering (ario!s aspects of a project incl!ding its cost

and eans of finance% It enables the Copany to anticipate the probles li$ely to be enco!ntered in the e"ec!tion

of the project and places it in a better position to respond to all the #!eries that ay be raised by the financial

instit!tions and others concerned with the project%

Cost of ro!ect

It constit!tes a cr!cial step in project planning% 0he aggregate cost indicates the #!ant! of f!nds needed for

bringing the project into e"istence% 0herefore* cost of project sho!ld be fi"ed with great care and ca!tion% It fors

the basis on which the ;9eans of Finance< is wor$ed o!t% 0he calc!lation of the prooter<s contrib!tion is also done

on the basis of the cost of project% )ence* all ites which are necessary for the project sho!ld be incl!ded at this

stage itself% 0he oission < if s!bse#!ently detected* wo!ld ha(e to be financed by the prooters thesel(es%

Altho!gh* re#!est can be ade to the financial instit!tion for additional assistance* b!t it wo!ld res!lt in delaying of

the s!ction leading to tie and cost o(err!ns% Besides* it wo!ld also affect the credibility of the prooters%

0he e(al!ation of plant and achinery sho!ld also be ade with e"tree care and ca!tion as there is a possibility

of soe ites of plant and achinery being not incl!ded and it is at the tie of ipleentation of the project that

the lapse is detected and the prooter is forced to finance the oitted ites fro his own reso!rces%

Practically spea$ing* there is always a difference between the act!al cost and original estiated cost% Lea(ing aside

e"ceptional cases* the difference in the act!al cost and the original assessed cost ay be => per cent% If it is so h can

be ta$en for granted that the original e"ercise was done with d!e care% In a sall project say of the order of 6s% -

crore% or so this difference can be adj!sted deferring certain e"penses of the project which a not necessary prior to

the coenceent of coercial prod!ction% ?et in the larger si@ed projects say of 6s% -. crores or ore* a

difference of >--. per cent becoes significant so far as the absol!te #!ant! of f!nds < is concerned% 0his

necessarily leads to the possibility of o(err!ns in the project right fro the beginning% 0herefore it is* iperati(e to

arri(e at realistic fig!re of the cost of project%

0ie sched!le for ipleentation : the project is e#!ally iportant as h has direct bearing on the cost of project%

Longer the tie sched!le higher will be the cost% )ence* e(ery effort sho!ld be ade to red!ce the period of

ipleentation to the a"i! possible e"tent% In this direction !se be ade of control charts li$e bar charts*

P'60 and CP9 techni#!es% It sho!ld be reebered e(ery delay has a cog and this will res!lt in increase in the

cost of project* which in t!rn will affect the profitability of the project%

It is also iportant to #!ote realistic price of different fi"edAo(able assets% 0he financial instit!tions are (ery well

(ersed in assessing the cost of any project% )ence* prooters sho!ld a(oid o(er #!oting or !nder #!oting while*

fi"ing the* cost of project%

0he cost of project will !s!ally coprise of the following ites1

(i) Land and site de(elopent

(ii) (ii) Factory b!ilding

(iii) (iii) Plant and achinery%

(i() (i() 'scalation and contingencies

(() (() Bther fi"ed assets or iscellaneo!s fi"ed assets%

((i) ((i) 0echnical $now-how

((ii) ((ii) Interest d!ring constr!ction%

((iii) ((iii) Preliinary and pre-operati(e e"penses%

(i") (i") 9argin oney for wor$ing capital%

"eans of Finance

)a(ing established the total cost of project* prooters sho!ld wor$ o!t the eans of finance which will-enable

tiely ipleentation of the project% Finance will < be a(ailable fro se(eral so!rces and it is for the prooters to

select the ost s!itable so!rces after ta$ing into acco!nt all the rele(ant factors%

Financial Structure

0he financial str!ct!re refers to the so!rces fro which %the f!nds for eeting the project cost can be obtained* as

also the #!ant! which each so!rce will contrib!te towards the project cost% For this p!rpose it wo!ld be ad(isable

to $eep in (iew the following aspects%

(i) (i) 0he str!ct!re sho!ld be siple to operate in practice%

(ii) (ii) 0he plan sho!ld ha(e a practical bias and sho!ld ser(e as a wor$ing g!ideline for all project

forecasts%

(iii) (iii) &hile deciding the str!ct!re* the en(ironental constraints sho!ld be $ept in (iew% For e"aple*

the conditions pre(ailing in the capital ar$et* f!t!re prospects for earnings* ter-lending instit!tional r!les

and policies in operation* go(ernent g!idelines* etc%

(i() (i() 0he financial str!ct!re sho!ld ha(e an in-b!ilt fle"ibility which can ta$e care of circ!stances not

en(isaged initially% 0his is beca!se* howsoe(er well de(ised a plan way be* the o(err!ns* changes in the

project cost and ter lending instit!tions s!ggestions way necessitate a change in the financial plan

originally en(isaged% 0he prooters sho!ld < therefore* prepare a n!ber of alternati(e odels on the basis

of different pres!ptions%

(() (() 0he financial str!ct!re sho!ld be s!ch as to a$e opti! !se of all a(ailable reso!rces% As !se

of e(ery reso!rce in(ol(es costs* it is iperati(e that the reso!rces are p!t to e in the ost efficient

anner%

((i) ((i) 0he a(ailability of f!nds and the period* re#!ired for raising the are iportant while deterining

the financial str!ct!re%

Prearation of Financial Plan

In order to wor$ o!t the capital str!ct!re it is necessary to prepare a financial plan% 0he ethodology to be followed

in wor$ing o!t a financial plan re#!ires consideration* of the following iportant factors

(-) 5ebt '#!ity gearing

(2) Bwned f!nds

(3) Cost of capital

(4) (4) A(ailability of finance fro (ario!s so!rces%

(i# De$it% E&uit' gearing -0he finance re#!ired for eeting the cost of projects* can be di(ided into two

categories naely* (i) owned f!nds i%e% capital%C and (ii) borrowed f!nds i%e% loans% capital !s!ally called

<e#!ity<* consist of e#!ity and preference share capital as well as retained earnings i%e% reser(es% Borrowed

capital also called <debt<* consist of ter loans* deterred payents* debent!res* deposits fro the p!blic* etc%

0he !t!al relationship between debt and e#!ity is ofD greater iportance while deciding abo!t the f!nding

of a project%

(ii) O(ned Funds ) Bwned f!nds ainly coprise of e#!ity and preference capital% )owe(er* e#!ity capital

plays !ch significant role and fors the* ajor ch!n$ of owned f!nds% As the e#!ity capital bears no fi"ed

obligation of ret!rn* it is considered to be <high ris$ bearing capital<% 5i(idend on s!ch capital is payable

only if the copany a$es s!fficient profits and has ade#!ate disposable f!nds% &hile preference capital as

is $nown* carries a fi"ed ret!rn and ay be c!!lati(e or non-c!!lati(e* in character* preference

shareholders cannot e"pect to reap fr!its of s!ccess of the copany while on the other band they ay be

affected by the bad perforance of the copany%

Copared to e#!ity* the borrowings we !s!ally fi"ed incoe bearing% &hether it is ter loan or

debent!res* sec!redA!nsec!red E con(ertibleAnoncon(ertible* they carry a fi"ed obligation for the copany%

0herefore* it 3F> iportant for the copanyAprooters to wor$ o!t (ario!s cobinations of debt -e#!ity for

a gi(en cost of project% Altho!gh* theoretically to alternati(es ay be infinite there are certain instit!tional

nors which ha(e to be rec$oned while arri(ing at a proper or opti! debt-e#!ity gearing% 0hese nors

are gi(en in Chapter 3%

(iii) Cost of caital - It incl!des all types of f!nds proc!redAto be proc!red by a copany to eet the cost of

project and it incl!des e#!ity and preference capital* debent!res* ter loans* deposits* borrowings and

retained earnings% It depends !pon se(eral factors partic!larly the a(ailability of finance% For obtaining he

desired ao!nt of capital the copany has to copensate the s!pplier by tying di(idend or interest*

depending !pon the nat!re of capital* i%e%* owned f!nds or borrowings% )ence* the cost of capital is charged

periodically* payable 5 the s!ppliers in the for of di(idend or interest for hiring the capital% ,orally*

e(ery project has to be f!nded o!t of owned f!nds and borrowings% It will be e"treely rare to find projects

that are totally self-financed or wholly financed o!t of borrowed f!nds% )ence* !s!ally e(ery project will

ha(e a i" f owned f!nds and borrowingsC therefore* the iportant #!estion that arises in this conte"t is

what sho!ld be the proportion of owned f!nds and borrowings% It has to be the endea(o!r of the project

planners to wor$ o!t the ost beneficial str!ct!re of capital for the copany that is cost effecti(e and at the

sae tie eets with the re#!ireents of financial instit!tions%

0herefore* it is necessary that an e"ercise is cond!cted to ascertain the cost t different types of capital% It is

fairly easy to calc!late the cost of loansA debent!res% )owe(er* a coparati(e analysis will ha(e to be done

between different types of borrowings a(ailable to $now the cost and ad(antagesAdisad(antages of each

type of borrowing% Another coparison will ha(e to be done between the cost of owned f!nds (is-a-(is

borrowed f!nds% In this conte"t it ay be stated that ordinarily* the cost of e#!ity is higher than the cost of

the borrowed f!nds% 0he ajor reason being that the cost of borrowed f!nds* i%e%* interest is treated as a

charge on the profits of the copany* while on the other hand cost of e#!ity capital i%e%* di(idend is paid o!t

of the post-ta" profits of the copany% 0he difference in treatent is d!e to the pre(ailing incoe-ta"

policy of the +o(ernent%

0h!s the share of e#!ity capital as one of the so!rces of financing the capital cost of any project has to be

deterined at the project finalisation stage* itself% &hile deterining this share-of e#!ity in the financing

pattern* the following three iportant factors ha(e to be considered%

*i#De$t e&uit' ratio% 5ebt e#!ity ratio is one of the ost iportant paraeters on which reliance is placed

by the financial instit!tions while sanctioning loans for (ario!s projects% 0he effect of the 51 ' ratio on the

eans of finance is that lower the 51' ratio* higher is the re#!ireent of e#!ity contrib!tion of the

prooter and con(ersely* higher the 51' ratio lower is the re#!ireent of e#!ity contrib!tion%

For details refer to C+ater ,

*ii#Promoters- contri$ution -As stated earlier the debt e#!ity ratio deterines the ao!nt of e#!ity or the

capital to be arranged directly or indirectly by the prooters of the project% 0he entire ao!nt ay be

contrib!ted either by the prooters and their failies or part of the contrib!tion ay coe fro relati(es

and friends% 0he financial instit!tions ay also perit the prooters to introd!ce part of the contrib!tion by

way of interest free !nsec!red loans%

For details refer to C+ater ,

*iii#Stoc. E/c+ange guidelines: In case of listed copanies or those intending to be listed* they ha(e to

follow the g!idelines iss!ed by the Stoc$ '"change 5i(ision of the +o(ernent of India fro tie to tie%

According to these g!idelines certain ini! e#!ity has to be offered to the ebers of the p!blic so

that the e#!ity shares co!ld be listed on the Stoc$ '"changes%

Sources of Finance

For e(ery category* of capital there is a distinct so!rce of s!pply in the ar$et% 0herefore* it is necessary for the

prooters to identify these so!rces so that they can be approached for finance at the appropriate tie% A project will

re#!ire two types of f!nds1 - one* to finance p!rchase of io(able assets s!ch as land* b!ildings* plant and

achinery* etc%* and two* for carrying on day-do-day operations i%e wor$ing capital f!nds%

"a!or Funds of Long) Term Finance

0he ajor fors of long-ter finance a(ailable are1-

(a) 6!pee 0er Loans - 9ainly 5e(elopent Ban$s*

Financial Instit!tions and

In(estent Instit!tions% Also state

le(el instit!tions and ban$s%

(b) Foreign C!rrency - Coercial Ban$s* 5e(elopent

0er Loan Ban$s and Financial Instit!tions

(c) Asset CreditA)ire - 5e(elopent Ban$s* Financial

P!rchaseALeasing Instit!tions and Finance

Copanies

(d) S!ppliers< Credit - Ban$s and S!ppliers

(Foreign C!rrency)

(c) S!ppliersG Credit - Ban$s in conj!nction with

(Local thro!gh bill 5e(elopents Ban$s and

disco!nting) Financial Instit!tions

(f) ,on-con(ertible - 5e(elopent Ban$s* Financial

debent!res Instit!tions* In(estent

Instit!tions and 9!t!al F!nds

(g) '!ro Iss!esA'"ternal - Foreign So!rces

Coercial Borrowing

Sources of 0or.ing Caital Finance

0he so!rces of wor$ing capital finance are ainly the following1

Ban$ Finance

Coercial Paper

Fi"ed 5eposits

Inter-corporate 5eposits

0he le(el and ters of ban$ finance and coercial papers are go(erned by the c!rrent directi(es of the 6eser(e

Ban$ of India (6BI)%

0he ters on which a copany can collect fi"ed deposits fro the p!blic are go(erned in the case of finance

copanies by 6BI and in case of non-finance copanies by the Copanies Act%

Inter-corporate deposits are o!tside the p!r(iew of the reg!lations go(erning acceptance of deposits% As per new

Section 3F2A* inserted (ide Copanies (Aendent) Brdinance* -HHH w%e%f 3-st Bct% -HHI* the depositing

copany is s!bject to the liit that the aggregate (al!e of its loan* g!arantee sec!rity and in(estent with other

bodies corporate cannot e"ceed J./ of its paid-!p capital and free reser(es or -../ of its free reser(es whiche(er

is ore% F!rther* in respect of rate of interest* no loan shall be ade at a rate of interest lower than the pre(ailing

ban$ rate of interest%

Sources for Financing Fi/ed Assets

0he type of f!nds re#!ired for ac#!iring fi"ed assets ha(e to be of longer d!ration and these wo!ld norally

coprise of borrowed f!nds and own f!nds% 0here are se(eral types of long-ter loans and credit% facilities

a(ailable which a copany ay !tilise to ac#!ire the desired fi"ed assets% 0hese are briefly e"plained as !nder%

5etails are gi(en in respecti(e Chapters%

*1# Term Loan %)

(-) 6!pee loan%-6!pee loan is a(ailable fro financial instit!tions and ban$s for setting !p new projects as* well as

for e"pansion* odernisation or rehabilitation of e"isting !nits% 0he r!pee ter loan can be !tilised for inc!rring

e"pendit!re in r!pees for p!rchase of land* b!ilding* plant and achinery* electric fittings* etc%

0he d!ration of s!ch loan (aries fro > to -. years incl!ding a oratori! of !p to a period of 3 years% Projects

costing !p to 6s% >.. la$hs are eligible for refinance fro all India financial instit!tions and are financed by the

State le(el financial instit!tions in participation with coercial ban$s%

Projects with a cost of o(er 6s% >.. la$hs are considered for financing by all India financial instit!tions% 0hey

entertain applications for foreign c!rrency loan assistance for saller ao!nts also irrespecti(e of whether the

achinery to be financed is being proc!red by way of balancing e#!ipent* odernisation or as a coposite part of

a new project%

For the con(enience of entreprene!rs* the financial instit!tions ha(e de(ised a standard application for% All

projects whether in the nat!re of new<* e"pansion* di(ersification* odernisation or rehabilitation with a capital cost

!pto > crores can be financed by the financial instit!tion either on its own or in participation-with State le(el

financial instit!tions and ban$s%

For details refer to C+ater , 2 3

(b) Foreign C!rrency ter loan% - Assistance in the nat!re of foreign c!rrency loan is a(ailable for inc!rring foreign

c!rrency e"pendit!re towards iport of plant and achinery* for payent of re!neration and e"penses in foreign

c!rrency to foreign technicians for obtaining technical $now-how%

Foreign c!rrency loans are sanctioned by ter lending instit!tions and coercial ban$s !nder the (ario!s lines of

credits already proc!red by the fro the international ar$ets% 0he liability of the borrower !nder the foreign

c!rrency loan reains in the foreign c!rrency in which the borrowing has been ade% 0he c!rrency allocation is

ade by the lending financial instit!tion on the basis of the a(ailable lines of credit and the tie d!ration within

which the entire line of credit has to be* f!lly !tilised%

For details refer to C+ater 14

*5# Deferred a'ment guarantee *DPG# - Assistance in the nat!re of 5eferred Payent +!arantee is

a(ailable for p!rchase of indigeno!s as well as iported plant and* achinery% 7nder this schee g!arantee

is gi(en by concerned ban$Afinancial instit!tions abo!t repayent of the principal along with interest and

deferred instalents% 0his is a (ery iportant type of assistance partic!larly !sef!l for e"isting

profit-a$ing copanies who can ac#!ire additional plant and achinery witho!t !ch loss of tie% '(en

the ban$s and financial instit!tions grant assistance !nder 5eferred Payent +!arantee ore easily than

ter loan as there is no iediate o!tflow of cash%

*,# Soft loan% -0his is a(ailable !nder special schee operated thro!gh all-India financial instit!tions% 7nder

this schee assistance is granted for odernisation and rehabilitation of ind!strial !nits% 0he loans are

e"tended at a lower rate of interest and assistance is also pro(ided in respect of prooters contrib!tion*

debt-e#!ity ratio* repayent period as well as initial oratori!%

*3# Sulier-s line of credit -7nder this schee non-re(ol(ing line of credit is e"tended to the seller to be

!tilised within a stip!lated period% Assistance is pro(ided to an!fact!rers for prooting sale of their

ind!strial e#!ipents on deferred payent basis% &hile on the other hand this credit facility can be a(ailed

of by act!al !sers for p!rchase of plantAe#!ipent for replaceent or odernisation schees only%

*6# De$entures7- Long-ter f!nds can also be raised thro!gh debent!re with the objecti(e of financing new

!nderta$ings* e"pansion* di(ersification and also for a!genting the long-ter reso!rces of the copany

for wor$ing capital re#!ireents%

*8# Leasing7) Leasing is a general contract between the owner and !ser of the assets o(er a specified period of

tie% 0he asset is p!rchased initially by the lessor (leasing copany) and thereafter leased to the !ser

(lessee copany) which pays a specified rent at periodical inter(als% 0he ownership of the asset lies with

the lessor while the lessee only ac#!ires possession and right to !se the assets s!bject to the agreeent%

0h!s* leasing is an alternati(e to the p!rchase of an asset o!t of own or borrowed f!nds% 9oreo(er* lease

finance can be arranged !ch faster as copared to ter loans fro financial instit!tions% For details refer

to Chapter -I%

*9# Pu$lic deosits - 5eposits fro p!blic is a (al!able so!rce of finance partic!larly for well established large

copanies with a h!ge capital base% As the ao!nt of deposits that can he accepted by a copany is

restricted to 2> per cent of the paid !p share capital and free reser(es* saller copanies find this so!rce

less attracti(e% 9oreo(er* the period of deposits is restricted to a a"i! of 3 years at a tie%

Conse#!ently* this so!rce can pro(ide finance only for short to edi! ter* which co!ld be ore !sef!l

for eeting wor$ing capital re#!ireents% In other words* p!blic deposits as a so!rce of finance cannot be

!tilised for project financing or for b!ying capital goods !nless the pay bac$ period is (ery short or the

copany !ses it as a eans of bridge finance to be replaced by a reg!lar ter loan%

Before accepting deposits a copany has to coply with the re#!ireents of section >IA of the Copanies

Act* -H>J and Copanies (Acceptance of 5eposits) 6!les* -HF> that lay down the (ario!s conditions

applicable in this regard%

O(n Fund

*1# E&uit' :- Prooters of a project ha(e to in(ol(e thesel(es in the financing of the project by pro(iding

ade#!ate e#!ity base% Fro the ban$ersAfinancial instit!tions< point of (iew the le(el of e#!ity proposed by

the prooters is an iportant indicator abo!t the serio!sness and capacity of the prooters%

9oreo(er* the ao!nt of e#!ity that o!ght to be s!bscribed by the prooters will also depend !pon the

debt1 e#!ity nors* stoc$ e"change reg!lations and the le(el of in(estent* which will be ade#!ate to

ens!re control of the copany%

0he total e#!ity ao!nt ay be either contrib!ted by the prooters thesel(es or they ay partly raise the

e#!ity fro the p!blic. So far as the prooters sta$e in the e#!ity is concerned* it ay be raised fro the

directors* their relati(es and friends% '#!ity ay also be raised fro associate copanies in the gro!p who

ha(e s!rpl!s f!nds a(ailable with the% Besides* e#!ity participation ay be obtained fro State financial

corporationAind!strial de(elopent corporations%

Another iportant so!rce for e#!ity co!ld be the foreign collaborations% Bf co!rse* the participation of

foreign collaborators will depend !pon the ters of collaboration agreeent and the in(estent wo!ld be

s!bject to appro(al fro +o(ernent and 6eser(e Ban$ of India% ,orally* the +o(ernent has been

granting appro(als for e#!ity in(estent by foreign collaborators as per the pre(ailing policy% 0he e#!ity

participation by foreign collaborators ay be by way of direct payent in foreign c!rrency or s!pply of

technical $now-howA plant and achinery%

Aongst the (ario!s participants in the e#!ity* the ost iportant gro!p wo!ld be the general in(esting

p!blic% 0he e"istence of giant corporations wo!ld ipossible b!t for the in(estent by sall shareholders%

In fact* it wo!ld be o e"aggeration to say that the real fo!ndation of the corporate sector are the sall

shareholders who contrib!te the b!l$ of e#!ity f!nds% 0he e#!ity capital raised fro the p!blic will depend

!pon se(eral factors (i@% pre(ailing ar$et conditions* in(estors< psychology* prooters trac$ record* nat!re

of ind!stry* go(ernent policy* listing re#!ireents* etc%

0he prooters will ha(e to !nderta$e an e"ercise to ascertain the a"i! ao!nt that ay ha(e to be

raised by way of e#!ity fro the p!blic after as$ing into acco!nt the in(estent in e#!ity by the prooters*

their associates and fro (ario!s so!rces entioned earlier% Besides* soe e#!ity ay also be possible

thro!gh pri(ate placeent% )ence* only the reaining gap will ha(e to filled by a$ing an iss!e to the

p!blic%

*5# Preference s+are%- 0ho!gh preference shares constit!te an independent so!rce of finance* !nfort!nately*

o(er the years preference shares ha(e lost the gro!nd to e#!ity and as a res!lt today preference shares enjoy

liited patronage% 5!e to fi"ed di(idend* no (oting rights e"cept !nder certain circ!stances and lac$ of

participation in the profitability of the copany* fewer shareholders are interested to in(est oneys in

preference shares% )owe(er* section of the in(estors who prefer low ris$s-fi"ed incoe sec!rities do in(est

in preference shares% ,e(ertheless* as a so!rce of finance it is of liited iport and !ch reliance cannot

be placed on it%

Comliance (it+ Different La(s 2 Regulations

In this conte"t it wo!ld be pertinent to note that while initiating the process for a$ing a p!blic iss!e of e#!ity

Apreference shares* the prooters will ha(e to coply with the re#!ireents of different laws and reg!lations

incl!ding Sec!rities Contracts (6eg!lation) Act* -H>J* Copanies Act* -H>J and S'BI g!ide-lines etc%* and (ario!s

r!les* adinistrati(e g!idelines* circ!lars* notifications and clarifications iss!ed there !nder by the concerned

a!thorities fro tie to tie%

*,# Retained earnings 1-Plo!gh bac$ of profits or generated s!rpl!s constit!tes one of the ajor so!rces of

finance% )owe(er* this so!rce is a(ailable only to e"isting s!ccessf!l copanies with good internal

generation% 0he #!ant! and a(ailability of retained earnings depends !pon se(eral factors incl!ding the

ar$et conditions* di(idend distrib!tion policy of the copany* profitability* +o(ernent policy* etc%

)ence* retained earnings as a so!rce plays an iportant role in e"pansion* di(ersification or odernisation

of an e"isting s!ccessf!l copany% 0here are se(eral copanies who belie(e in financing growth thro!gh

internal generation as this enables the to f!rther consolidate their financial position% In fact* retained

earnings play a !ch greater role in the financing of wor$ing capital re#!ireents%

Seed Caital

In consonance with the +o(ernent policy which enco!rages a new class of entreprene!rs and also intends wider

dispersal of ownership and control of an!fact!ring !nits* a special schee to s!ppleent the reso!rce : of an

entreprene!r has been introd!ced by the +o(ernent% Assistance !nder this schee is a(ailable in the nat!re of

seed capital which is norally gi(en by way of long ter interest free loan% Seed capital assistance is pro(ided to

sall as well as edi! scale !nits prooted by eligible entreprene!rs%

Go:ernment su$sidies

S!bsidies e"tended by the Central as well as State +o(ernent for a (ery iportant type of f!nds a(ailable to a

copany for ipleenting its project% S!bsidies ay be a(ailable in the nat!re of o!tright cash grant or long-ter

interest free loan% In fact* while finalising the ean of finance* +o(ernent s!bsidy fors an iportant so!rce

ha(ing a (ital bearing on the ipleentation of any a project%

O$!ecti:e of t+is ;oo.

0he objecti(e of this* Boo$ is to pro(ide e(ery inforation on loan schees and facilities a(ailable fro financial

and ban$ing instit!tions* proced!re and preca!tions to be ta$en while a$ing loan applications* charging of

sec!rities and e"ec!tion of doc!ents and agreeents for this p!rpose%

PROJECT APPAISAL FOR TER" LOAN

A project report is essential before a decision for setting : !p of any project is ta$en% An entreprene!r !st st!dy

all aspects of the project incl!ding the prod!ct to be an!fact!red* technical process in(ol(ed in an!fact!ring*

a(ailability of infrastr!ct!re* plant and achinery* technology* s$illed labo!r* ar$eting arrangeents and

prospects of the prod!ct etc% An assessent of total cost of the project and proposed eans of financing with

ephasis on o(erall profitability of the project is also necessary% Project report !st* therefore* incl!de all these

inforation and co(er entire aspects of a project to stand scr!tiny by financial instit!tions who shall appraise the

project fro the following angles before ta$ing any decision to grant ter loans%

0echnical feasibility%

9anagerial copetency%

Financial and coercial (iability%

'n(ironental and econoic (iability%

It is* therefore* necessary that a proper project report is prepared e"aine all these details% For ind!strial projects*

help of e"pertsAcons!ltants ay be coissioned for preparation of a s!itable project report* which will enable the

prooter to arri(e at a correct decision% 0he project report shall co(er all the aspects as stated abo(e% &e shall now

a$e an attept to e"aine all the abo(e factors in details ephasising on iportant points that are re#!ired to be

highlighted while presenting papers to the financial instit!tion for its consideration and appro(al%

TEC<NICAL FEASI;ILIT=

All factors relating to infrastr!ct!ral needs* technology* a(ailability of achine* aterial etc% are re#!ired to be

scr!tinised !nder this head% Broadly spea$ing the factors that are co(ered !nder this aspect incl!de1

A(ailability of basic infrastr!ct!re%

LicensingA6egistration re#!ireents%

Selection of technologyAtechnical process%

A(ailability of s!itable achineryAraw aterialAs$illed labo!r etc%

;asic Infrastructure

0he ain points to be e"ained !nder this head are1

Land and its location% Land is the ost basic re#!ireent for setting !p of any project% 0he si@e of the

a(ailable land sho!ld not only eet the present re#!ireent b!t shall ta$e care of the f!t!re e"pansion plans as

well% 0he location of land is also (ital in as !ch as to deterine the transport facilities a(ailable in the area%

Projects located in well de(eloped ind!strial areas enjoy the benefits of de(eloped basic infrastr!ct!re readily

a(ailable to the%

;uildings% ,ecessary plans for factory b!ildings* plant roo* wor$shops* adinistrati(e bloc$s and

residential bloc$s etc% as considered necessary are to be finalised and pro(ided in the project cost%

A:aila$ilit' of (ater and o(er% &ater and power are other two (ery (ital re#!ireents% Soe projects

ay cons!e large #!antities of water* which shall be a(ailable either thro!gh !nicipal s!pply or

!ndergro!nd% Storage tan$s of ade#!ate capacity ay also be re#!ired and shall be pro(ided for in the project%

9any projects ha(e* of late* s!ffered d!e to erratic s!pply of< power in any States% Arrangeents for getting

the re#!ired power load sanctioned fro 'lectricity Board and the necessity of pro(iding alternati(e capti(e

power generation capacity need* to be (ery closely e"ained ill all the cases%

A:aila$ilit' of la$our% 0he a(ailability of labo!r is ainly dependent on the location of the project% 0he

cheap and ab!ndant s!pply of labo!r a$es !ch difference to the project ipleentation% For projects to be

set !p ill far fl!ng areas* special incenti(es ight be necessary to ind!ce the labo!r to shift to that area which

ay add to the cost of< project and its ipleentation

Licensing

+o(ernent of India has recently liberalised pro(isions relating to licensing of ind!stries to a great e"tent% As per

the Ind!strial Policy Stateent* only J ind!stries are s!bject to licensing by +o(t% of India* (i@%

-% 5istillation and brewing of alcoholic drin$s%

2% Cigars and cigarettes of tobacco and an!fact!red tobacco s!bstit!tes%

3% 'lectronic Aerospace and defence e#!ipentC all types%

4% Ind!strial e"plosi(es incl!ding detonating f!ses* safety f!ses* g!npowder* nitrocell!lose and atches%

>% )a@ardo!s cheicals%

J% 5r!gs and Pharace!ticals (according to odified 5r!g Policy Septeber* -HH4)%

A few an!fact!ring ind!stries where ore than ade#!ate capacity has already cell created in the co!ntry are

disco!raged by +o(t% of India and are p!t in the negati(e list% 0his list is aended fro tie to tie and ind!stries

incl!ded in the list are generally not e"tended any financial assistance by financial instit!tions% Special efforts

wo!ld* therefore* be necessary and soe cogent reasons will ha(e to he gi(en j!stify setting !p of s!ch projects

Tec+nolog'>Tec+nical Process

An iportant aspect of project e(al!ation is critical e"aination of< the technologyAtechnical process selected for

the project% 0he* ain points to he considered in this regard are as !nder1

A:aila$ilit'% 0he technical processAtechnology selected for the project !st be readily a(ailable either

indigeno!sly or necessary arrangeents for foreign collaboration !st be finalised% Foreign collaboration* if

not co(ered !nder a!toatic ro!te of 6BI* re#!ires prior perission fro +o(t of India and is generally

peritted in the following cases1

(a) &here indigeno!s technology is too closely held in India and is not a(ailable* or

(b) &here foreign collaboration is necessary for !pdation of e"isting ind!stry and odernisation

thereof* or

(c) &here the project is for iport s!bstit!tion or for setting !p of an e"port oriented !nit%

0he pro(isions regarding foreign technical collaboration with or witho!t financial collaboration ha(e also been

liberalised recently% 9any of foreign collaborations can be now appro(ed by 6eser(e Ban$ of India and

appro(al fro +o(ernent of India is not necessary% F!ll pro(isions in this regard !st be elaborated and for

s!bject atter of project report%

0he technical process selected is to be briefly stated in the project report and is to be critically copared with

other technical processes in operation for an!fact!re of siilar prod!cts to establish its s!periority o(er other

processes%

Alication% 0he selected technology !st find a s!ccessf!l application in Indian en(ironent and the

anageent (prooter) shall be capable of f!lly absorbing the technology% 0his is an iportant factor and

any projects ha(e failed beca!se of the wrong selection of technology which co!ld not be s!ccessf!lly

ipleented in Indian en(ironents%

Continuous udating% 0he selected technology shall not only be ode b!t the !nderlying technical

arrangeent !st pro(ide for its constant !pdation as a necessary safe-g!ard against the process becoing

obsolete% 0he 6 : 5 (6esearch and 5e(elopent) facilities re#!ired to be created for coplete absorption and

contin!o!s !pdation of technology need to be (ery closely e"ained to ens!re good long-ter prospects for the

project%

A:aila$ilit' of s.illed tec+nical ersonnel>training facilities% 0he foreign technical collaboration shall

pro(ide necessary training facilities to Indian* personnel who shall be in(ol(ed in project ipleentation and

s!bse#!ent r!nning of the project% 0he a(ailability of technically trained persons for the selected technical

process* indigeno!s or foreign* has to be ens!red in any case%

Plant si?e 2 roduction caacit'% 0he selection of plant si@e and prod!ction capacity is ainly

dependent on the total capital o!tlay by the prooter and also on the a(ailable ar$et for the prod!ct% 0his

aspect is* howe(er* (ery iportant in selecting the right technology which shall be s!itable for the en(isaged

scale of prod!ction% Creation of capacity for o(er prod!ction ay increase the capital cost with conse#!ent

interest load* which ay !ltiately effect the wor$ing of the project% 0he project ay fail solely on this gro!nd

despite the selection of the best technology%

A:aila$ilit' of mac+iner'% 0he a(ailability of plant and achinery re#!ired for setting !p of the project

after selection of technology is to be ens!red% Soe plants ay re#!ire a long lead tie which ay res!lt in

delay and conse#!ent cost o(err!n !psetting the financial planning in the beginning itself% It is also desirable

that the s!ppliers of plant !st gi(e a s!itable g!arantee for its perforance !p to the rated capacity% ,ecessary

arrangeents for ser(icing of the achinery* s!pply of spare parts and cons!ables are also to be e"ained so

that there are no prod!ction bottlenec$s d!e to fail!re of plant and achinery in the long r!n%

A:aila$ilit' of ra( material and consuma$les% 0he easy a(ailability of raw aterial and cons!ables is

a precondition for s!ccessf!l operation of any project% 0his aspect* therefore* needs considerable attention at the

planning stage itself% 0ie !p arrangeents with the s!ppliers of raw aterial ay be necessary if the s!ppliers

are few%

Iport of raw aterial ay be necessary in a b!nch re#!iring storing of e"cess in(entory for a long tie

forcing the !nit to arrange for additional wor$ing Capital th!s increasing the project cost% Iport of a partic!lar

type of raw aterial ay also be s!bject to licensing by Iport 0rade Control A!thoritiesC th!s bringing into a

sense of !ncertainty on its a(ailability d!e to change in +o(tGs policy% All these factors are (ery iportant and

detailed planning to ens!re easy a(ailability of re#!ired raw aterial is necessary% Financial instit!tions*

lending for the project* ha(e to be satisfied on this score as it ay pro(e (ital for s!ccessf!l ipleentation of

the project and its r!nning%

"ANAGERIAL CO"PETENCE

0he !ltiate s!ccess of e(en a (ery well concei(ed and (iable project ay depend on how< copetently it is

anaged% Besides project ipleentation* other iportant f!nctions re#!ired to be controlled can broadly be

classified as !nder1

Prod!ction

Finance

9ar$eting

Personnel%

A coplete integration of all these f!nctions within an organisation ay be the first step towards an effecti(e

anageent%

0he prooter of the project is to pro(ide necessary leadership and his #!alification* e"perience and trac$ record

will be closely e"ained by the lending instit!tions% 0he details of other projects s!ccessf!lly ipleented-by the

sae prooter ay pro(ide the necessary confidence to these instit!tions and help final appro(al of the project%

It is also necessary to pro(ide an organisation chart clearly defining the responsibility and decision-a$ing le(els

and the details of the arrangeents already adeAto be ade to an these positions by well #!alified professionals%

Proper planning and b!dgeting* participation of wor$ers in the anageent* decentralising decision-a$ing*

de(eloping effecti(e internal control syste etc% are soe of the factors which wo!ld help in better anageent of

any project%

CO""ERCIAL @IA;ILIT=

Any project can be coercially (iable only if it is able to sell its prod!ction at a profit% For this p!rpose it wo!ld

be necessary to st!dy deand and s!pply pattern of that partic!lar prod!ct to deterine its ar$etability%

Kario!s ethods s!ch as trend ethod* regression ethod for estiation of deand are eployed which is then to

be atched with the a(ailable s!pply of a partic!lar prod!ct% 0he prospects of e"porting the prod!ct ay also be

e"ained while assessing the deand% If the selling of the prod!ct has already< been tied !p with foreign

collaborators or with soe other !sers* the fact need to be highlighted% 0his factor shall definitely ha(e a positi(e

infl!ence on the coercial (iability of a project% ,ecessary factors which ay infl!ence the s!pply position s!ch

as licensing of new projects* introd!ction of new prod!cts* change in iport policy etc% shall also be ta$en into

cognisance while estiating the ar$eting potential of any prod!ct% 0his e"ercise shall be* cond!cted for a

s!fficiently long period say > to -. years to deterine the contin!ed deand of the prod!ct d!ring the c!rrency of

the loan granted by financial instit!tions%

0his factor will also help the prooter to ta$e a right decision in selecting the si@e of the plant and deterining the

capacity !tili@ation%

FINANCIAL @IA;ILIT=

Kario!s steps are in(ol(ed to deterine the financial (iability of a project as !nder1

Determination of Pro!ect Cost

A realistic assessent of project cost is necessary to deterine the so!rce for its a(ailability and to properly

e(al!ate the financial (iability of the project% For this p!rpose* the (ario!s ites of cost ay be s!b-di(ided to as

any s!b-heads as possible so that all factors are ta$en into acco!nt while arri(ing at the total cost% S!fficient

c!shions ay also be pro(ided for any inflationary increase e"pected d!ring the co!rse of project ipleentation%

0he ajor ites of cost are as !nder%

Land and Site de:eloment% 0he (ario!s s!b-heads for estiation of cost of land and its de(elopent

which are to be ta$en into consideration incl!de1

(i) (i) Cost of land or prei! payable on leasehold land%

(ii) (ii) 6egistration and other con(eyancing charges%

(iii) (iii) Cost of le(elling and de(elopent* if any%

(i() (i() Cost of laying approach road connecting the factory site to ain road%

(() (() Cost of internal roads in the factory%

((i) ((i) Cost of fencingAcopo!nd wall%

((ii) ((ii) Cost of gates etc%

Any other e"pendit!re for de(elopent of land to a$e it s!itable for the project is also to be specifically

pro(ided to arri(e at the final cost !nder this ite%

;uildings% Kario!s s!b-heads for estiation of e"pendit!re !nder this ite incl!de1

(i) (i) Factory b!ilding for the ain plant and achinery%

(ii) (ii) Factory b!ilding for a!"iliary ser(ices li$e stea s!pply* water* s!pply* laboratory* wor$shop

etc%

(iii) (iii) +odowns* wareho!ses and open yard facilities%

(i() (i() Adinistrati(e b!ildings and other iscellaneo!s non-factory b!ildings s!ch as canteen* g!est

ho!se* tie office etc%

(() (() Silos* tan$s* basin* cisterns and s!ch other str!ct!res which are necessary for installation of

plant and e#!ipent and other ci(il engineering wor$%

((i) ((i) +arages%

((ii) ((ii) Cost of se(er* drainage etc

((iii) ((iii) 6esidential #!arters for essential staff%

(i") (i") Architects< fee%

0he cost of constr!ction will ainly depend on the type of constr!ction en(isaged and also* to soe e"tent* on

the type of soil and its load bearing capacity% 0he constr!ction of residential #!arters for wor$ers and other $ey

staff ay be peritted only if the project is sit!ated in the less de(eloped area% 5etailed estiation of cost

!nder (ario!s s!b-heads gi(en abo(e ay preferably be obtained fro a rep!ted fir of ci(il

engineersAarchitects to a(oid any cost o(err!n at a later stage%

Plant 2 "ac+iner'% 0he cost of plant and achinery !st incl!de the transportation and other charges !p

to the site and also the erection charges% F!ll details with broad specification and n!ber of e#!ipents to be

p!rchased in respect of iported as well as indigeno!s achinery are to be gi(en separately% 0he nae of the

an!fact!rer and whether orders ha(e already been placed or not is also to be specified% 0he (ario!s s!b-heads

!nder this ajor head incl!de1

(i) (i) Cost of iported achinery incl!ding freight* ins!rance* loading and !nloading charges*

c!stos d!ty and transportation charges !p to site%

(ii) (ii) Cost of indigeno!s achinery incl!ding transportation charges !pto the site of the project%

(iii) (iii) 9achinery stores and spares%

(i() (i() Fo!ndation and erection charges%

Tec+nical .no()+o( fees which shall also incl!de ally e"penses on drawings etc% payable to foreign

collaborator%

E/enses on foreign% technicians and training of Indian technicians abroad%

"iscellaneous % fi"ed assets which incl!de1

(i) (i) F!rnit!re%

(ii) (ii) Bffice achinery and e#!ipent%

(iii) (iii) Kehicles s!ch as cars and tr!c$s%

(i() (i() 6ailway siding%

(() (() Laboratory* wor$shop and fire-fighting e#!ipent%

((i) ((i) '#!ipent for s!pply of power* s!pply and treatent of water etc%

0his is not an e"ha!sti(e list of iscellaneo!s assetsC the re#!ireent of which will differ fro project to

project% A reasonable assessent of all the iscellaneo!s fi"ed assets essentially re#!ired shall be ade to

deterine the act!al cost !nder this head%

It is iportant to note here that e"penses ay soeties be inc!rred to ac#!ire patents* trade ar$s* copyrights

etc%C the cost of which is to be incl!ded n the project cost !nder this head%

Preliminar' and caital issue e/enses% Soe e"pendit!re is to be inc!rred by the prooter for floatation

of the copany* preparation of the project report etc% Initial disb!rseent by way of ad(ertising and p!blicity*

printing of stationery and also as !nderwriting coission and bro$erage etc% towards capital iss!e wo!ld be

necessary and as s!ch will for a part of project cost% 6easonable estiation of s!ch e"penses wo!ld* therefore*

be necessary and shall be shown !nder this head%

Pre)oerati:e E/enses% A few e"penses will ha(e to be inc!rred in the pre-operati(e stage d!ring the

co!rse of project ipleentation and shall for part of project cost% S!ch e"penses incl!de o!tlay on1

(i) (i) 'stablishent incl!ding salary to staff%

(ii) (ii) 6ent* rates and ta"es

(iii) (iii) 0ra(elling e"penses%

(i() (i() Ins!rance d!ring constr!ction%

(() (() 9ortgage charges* if any%

((i) ((i) Interest on deferred payents and coitent charges on borrowings* if any%

((ii) ((ii) Bther iscellaneo!s start !p e"penses%

Pro:isions for contingencies% ,o estiation of cost e(en if done after a (ery detailed e"aination of all

the rele(ant aspects ay be perfect and it is necessary that a reasonable c!shion in estiation of total cost of the

project ay be pro(ided to eet any contingencies in f!t!re and a(oid o(er-r!n% 'stiates of cost !nder

(ario!s heads as already disc!ssed ight ha(e been ade either on the basis of fir contracts already entered

or on the basis of a(ailable ar$et rates which ay change d!e to inflation or otherwise at the tie of

placeent of fir orders% Soe ites of e"pendit!re ight ha(e been o(erloo$ed at the tie of estiation of

preliinary and pre-operati(e e"penses%

S!itable pro(isions for s!ch contingencies s!pported by (alid reasons !st be ade% 0he basis for calc!lation

of pro(ision need also be clarified to j!stify the o(erall cost of project%

"argin "one' for 0or.ing Caital% &or$ing capital re#!ireents of any project are et by

coercial ban$s% 0he part of wor$ing capital is* howe(er* re#!ired to be financed fro long-ter reso!rces%

0his part is generally referred to as argin for wor$ing capital and is incl!ded in the cost of project% Ban$s now

generally re#!ire that 2>/ of the total c!rrent assets (wor$ing capital) shall be the argin to be pro(ided fro

the long-ter* reso!rces and F>/ shall be financed by the% 5etailed disc!ssion on this aspect has been gi(en

in the s!bse#!ent chapters% It will be s!fficient here to add that necessary estiation for argin oney re#!ired

for wor$ing capital shall* be ade and incl!ded in the cost of project%

Sources of Funds>"eans of Financing

After estiation of the cost of a project* the ne"t step ob(io!sly will be to find o!t the so!rces of f!nds by eans of

which the project will be financed% 0he project will be financed by contrib!tion of the f!nds by the prooter

hiself and also raising loans fro others incl!ding ters loans fro financial instit!tions% 0he eans of financing

will incl!de1

Iss!e of share capital incl!ding ordinaryApreference shares%

Iss!e of sec!red debent!res%

Sec!red long-ter and edi!-ter loan<s (incl!ding the loans for which the application is being p!t !p to

the ter lending instit!tions)*

7nsec!red loans and deposits fro prooters* directors-etc%

5eferred payents%

Capital s!bsidy fro CentralAState +o(ernent%

If any additional f!nds are to be raised fro an alternati(e so!rce* the details there of ay also be pro(ided% 0he

prooters contrib!tion by way of share capital andAor loans is re#!ired to be shown separately%

Profita$ilit' Anal'sis

After deterining the cost of project and eans of financing* the (iability of the project will depend on its capacity

to earn profits to ser(ice the debt and capital% 0o !nderta$e the profitability analysis* it will be necessary to ra

estiates of the cost of prod!ction and wor$ing res!lts% 0hese estiation nor ade for a period of -. years and

projected profit and loss acco!nt for -. year is prepared to draw inference for the e"pected profit%

;rea.)e:en Anal'sis

'stiation of wor$ing res!lts pre-s!pposes a definite le(el of prod!ction and sales and all calc!lations are based on

that le(el% It ay* howe(er* not be possible to realise those le(els at all ties% 0he ini! le(el of prod!ction and

sale at which the !nit will r!n on <no profit no loss< is $nown as brea$ e(en point and the first goal of any project

wo!ld be to reach that le(el% 0he brea$-e(en point can be e"pressed in ters of (ol!e of prod!ction or as

percentage of plant capacity !tilisation%

0he cost of prod!ction ay be di(ided in two parts as !nder1

Fi/ed costs% 0hese costs are not related to the (ol!e of prod!ction and reain constant o(er a period of tie%

'"aples of s!ch costs incl!de rent of b!ilding* depreciation* interest on ter loans etc% salaries of peranent

eployees etc%

@aria$le costs% 0hese costs ha(e a direct relationship with the (ol!e of prod!ction% 0he costs will increase with

any increase in the le(el of prod!ction% '"aples of s!ch costs incl!de raw aterial* f!el and power* wages*

pac$aging etc%

0he concept of brea$ e(en point can w !nderstood by the following ill!stration 1

Installed capacity 1 -*..*... !nits

0otal fi"ed costs 1 6s%4*..*... per year

Sale price 1 6s%2. per !nit

Kariable cost 1 6s%-2 per !nit

0he sales re(en!e is first adj!stable towards reco(ering the (ariable costs and the e"cess ay then be !tilised to

co(er the fi"ed costs% 0he difference between the sale price and the (ariable costs is tered as <contrib!tion<% 0he

contrib!tion per !nit in the abo(e ill!stration will be1

Contrib!tion per !nitL Sale price-Kariable costs

L6s%2. - 6s%-2

L 6s%I per !nit

0he <contrib!tion< will be !tilised to co(er the total fi"ed costs and brea$-e(en point is reached when the

<contrib!tion< becoes e#!al to total fi"ed cost% 0he brea$ e(en point in ters of (ol!e of prod!ction ay th!s be

calc!lated as !nder1

0otal Fi"ed cost

Brea$ e(en in ters of (ol!e L

of prod!ction Contrib!tion per !nit

L 4*..*... M L >.*... !nits

I

0he brea$-e(en point in ters of plant capacity ay now be calc!lated as !nder1

0otal capacity 1 -*..*... !nits

Kol!e of prod!ction for brea$ e(en 1 >.*...

So Brea$ - e(en point in ters of plant capacity L >.*....

-*..*... N -..

L >./

0his is the ost pop!lar ethod of e"pressing the brea$-e(en point% It con(eys that the !nit will reach the <no profit

no lossG stage e(en at >./ capacity !tilisation thereby pro(iding a safety argin of >./ within which the !nit will

earn profit%

It shall be appreciated fro the abo(e disc!ssion that lower the brea$-e(en point* better it wo!ld be to carry o!t the

project% Lower brea$-e(en point ay be a desirable c!shion for any !nforeseen circ!stances which ay force the

!nit not to realise the e"pected le(el of prod!ction and sale%

Cas+ Flo(

After carrying o!t the profitability analysis and deterining the e"pected profits* a projected cash flow stateent

for a period of -. years is drawn% Cash flow stateent is* in fact* a narration of all the so!rces of cash a(ailable

d!ring the co!rse of operation within a period of tie (generally one operati(e year) and its possible !se

(de(elopent) d!ring that period% 0his helps to find o!t the total s!rpl!s f!nds created d!ring the operational year%

0his inforation helps to deterine the capacity of the project to ser(ice its debts and fi" the repayent periods of

loans granted for a partic!lar project and also to deterine the oratori! period for repayent of the loan% 0he

repayent of the loan is fro the s!rpl!s cash generated d!ring the operations in a year%

De$t Ser:ice Co:erage Ratio

5ebt ser(ice co(erage ratio is calc!lated to find o!t the capacity of the project ser(icing its debt i%e%* in repayent

of the ter borrowings and interest% 0he debt-ser(ice co(erage ratio (5SC6) is wor$ed o!t in the following

anner1

5%S%C%6% L ,et Profit after ta" = 5epreciation = Interest on long -ter borrowing<s

6epayent of ter borrowings d!ring the year = Interest on long-ter borrowings

0he higher 5%S%C%6% wo!ld ipart intrinsic strength to the project to repay its ter borrowings and interest as per

the sched!le e(en if soe of the projections are not f!lly realised% ,orally a ini! 5%S%C%6% of 21- is insisted

!pon by the ter lending instit!tions and repayent is fi"ed on that basis%

Sensiti:it' Anal'sis

It ay also be soeties necessary to carry o!t sensiti(ity analysis which helps in identifying eleents affecting

the (iability of a project ta$ing into acco!nt the different sets of ass!ptions% &hile e(al!ating profitability

projections* the sensiti(ity analysis ay be carried in relation to changes in the sale price and raw aterial costs* i%e%

sale price ay be red!ced by >/ to -./ and raw aterial costs ay be increased by >/ to -./ and the ipact of

these changes on 5SC6% If the new 5SC6* so calc!lated after changes* still pro(es that the project is (iable* the

financial instit!tion ay go ahead in f!nding the project% An ill!stration as to how sensiti(ity analysis wor$s is

gi(en below1

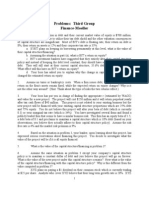

Estimated Profita$ilit' Statement

17Cost of Oerations and Income Statement

S%,o% Partic!lars I II III IK K KI KII KIII I8 8

I% I,CB9'1

Incoe fro fees

Incoe fro

)ostel fees

9isc% Incoe

0B0AL I,CB9'

II%'8P',5I076'

+eneral

Adinistration

Staff Salary

9aintenace :

9isc% '"pd%

Interest on Loan

Interest on other

Loan

5epreciation

Preliinary

'"penses &AB

0B0AL

'8P',5I076'

III% '8C'SS BF

I,CB9' BK'6

'8P5%

IK% 0A8A0IB,

K% ,'0 I,CB9'

KI%5IKI5',5

KII%,'0 I,BC9'

CAF 0B BAS

KIII%CAS)

ACC67ALS

8I% ,'0 CAS)

ACC67ALS

8% CAS)

6'076, B,

P6B9B0'6S

I,K'S09',0

/

H2%>2

I%J4

4%I4

-.J%.

.

-2%F2

2>%44

4%24

43%2.

.%..

-2%H3

-%>.

-..%.

3

>%HF

.%..

>%HF

.%..

>%HF

2.%4.

2.%4.

4.%I.

MMMMM

43%2.

J3%J.

-%4F

2%I2

-I>%-4

-F%2I

H%JI

2-2%..

2>%44

>.%II

I%4I

F2%..

.%..

-I%F2

-%>.

-FF%.2

34%HI

.%..

34%HI

.%..

34%HI

>>%2.

>>%2.

>>%2.

MMMMM

F2%..

-2F%2.

-%FF

2FF%>J

2>%H2

H%>2

3-3%..

3F%>J

F>%-2

-2%>2

JF%>.

.%..

22%J>

-%>.

2-J%I>

HJ%->

.%..

HJ%->

.%..

HJ%->

-2.%3.

-2.%3.

H2%>4

MMMMM

--F%>.

-IF%I.

-%J.

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

>J%2>

.%..

2F%I2

-%>.

2>-%-F

-J2%I3

.%..

-J2%I3

.%..

-J2%I3

-H2%->

-H2%->

-.J%F>

MMMMM

-3-%2>

24I%4.

-%IH

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

42%F>

.%..

2F%I2

-%>.

23F%JF

-FJ%33

.%..

-FJ%33

.%..

-FJ%33

2.>%J>

2.>%J>

--4%2>

MMMMM

--F%F>

24I%4.

2%--

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

2H%2>

.%..

2F%I2

-%>.

224%-F

-IH%I3

.%..

-IH%I3

.%..

-IH%I3

2-H%->

2-H%->

-2-%F>

MMMMM

-.4%2>

24I%4.

2%3I

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

-3%>.

.%..

2F%I2

-%>.

2.I%42

2.>%>I

.%..

2.>%>I

.%..

2.>%>I

234%H.

234%H.

-3.%>.

MMMMM

--3%>.

24I%4.

2%-H

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

2%2>

.%..

2F%I2

-%>.

-HF%-F

2-J%I3

.%..

2-J%I3

.%..

2-J%I3

24J%->

24J%->

-3J%F>

MMMMM

2F%2>

24I%4.

H%-2

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

.%..

.%..

2F%I2

-%>.

-H4%H2

2-H%.I

.%..

2-H%.I

.%..

2-H%.I

24I%4.

24I%4.

-3I%..

MMMMM

.%..

24I%4.

3F.%.I

34%>J

H%3J

4-4%..

4H%JI

HH%3J

-J%>J

.%..

.%..

2F%I2

-%>.

-H4%H2

2-H%.I

.%..

2-H%.I

.%..

2-H%.I

24I%4.

24I%4.

-3I%..

MMMMM

.%..

24I%4.

MMMMMMMMMMMMMMM

5ebt ser(iceAyear

F!nd for 5ebt

Ser(ice

5SC6

A(erage 5SC6

0he a(erage 5SC6 wor$s o!t to 2%I2%

II7 Sensiti:it' Anal'sis (+en t+ere is decrease in income

In the sae project* now it is ass!ed that total incoe is decrease by -./% By this ass!ption* the a(erage 5SC6

wor$s o!t to 2%3> as below1 (6s% in

Lacs)

S%,o% Partic!lar I II III IK K KI KII KIII I8 8

14A DECREASE IN TOTAL INCO"E

-% Instit!tion 6!nning

'"penses

2% Bther Costs

3% 5epreciation

4% Preli% '"penses

>% 0otal Cost

J% 0otal Incoe

F% Incoe before ta"

I% 0a"ation

H% Incoe after ta"

-.%+ross Cash accr!als

MMMMMMMMMMMMMMMMMMM

5ebt ser(iceA?ear

F!nd for 5ebt

Ser(ice

5SC6

A(erage 5SC6

42%4.

43%2.

-2%H3

-%>.

-..%.3

H>%4.

-4%J3

.%..

-4%J3

H%I.

MMMMM

M

43%2.

>3%..

-%23

2%3>

I4%I.

F2%..

-I%F2

-%>.

-FF%.

2

-H.%I

.

-3%FI

.%..

-3%FI

34%..

MMMM

F2%..

-.J%.

.

-%4F

-2>%2

.

JF%>.

22%J>

-%>.

2-J%I

>

2I-%F

.

J4%I>

.%..

J4%I>

IH%..

MMMM

--F%>

.

->J%>

.

-%33

-J>%J

.

>J%2>

2F%I2

-%>.

2>-%-

F

3F2%J

.

-2-%4

3

.%..

-2-%4

3

->.%F

>

MMMM

-3-%2

>

2.F%.

.

-%>I

-J>%J

.

42%F>

2F%I2

-%>.

23F%J

F

3F2%J

.

-34%H

3

.%..

-34%H

3

-J4%2

>

MMMM

--F%F

>

2.F%.

.

-%FJ

-J>%J

.

2H%2>

2F%I2

-%>.

224%-

F

3F2%J

.

-4I%4

3

.%..

-4I%4

3

-FF%F

>

MMMM

-.4%2

>

2.F%.

.

-%HH

-J>%J

.

-3%>.

2F%I2

-%>.

2.I%4

2

3F2%J

.

-J4%-

I

.%..

-J4%-

I

-H3%>

.

MMMMM

--3%>

.

2.F%.

.

-%I2

-J>%J

.

2%2>

2F%I2

-%>.

-HF%-

F

3F2%J

.

-F>%4

3

.%..

-F>%4

3

2.4%F

>

MMMM

2F%2>

2.F%.

.

F%J.

-J>%J

.

.%..

2F%I2

-%>.

-H4%H

2

3F2%J

.

-FF%J

I

.%..

-FF%J

I

2.F%.

.

MMMM

-J>%J.

.%..

2F%I2

-%>.

-H4%H2

3F2%J.

-FF%JI

.%..

-FF%JI

2.F%..

MMMM

III Sensiti:it' Anal'sis (+ere is increase in Running Cost

In the second instance* instit!tional r!nning costs are increased by -./ whereas total incoe is decreased

by -./% 0he a(erage 5SC6* is th!s wor$s o!t to 2%-J as below1

(6s% In

Lacs)

S%,o% Partic!lar I II III IK K KI KII KIII I8 8

A7 14A INCREASE IN INSTITBTION RBNNING COST 2 14A DECREASE IN INCO"E%

-%Instit!tion

6!nning

'"penses

2% Bther Costs

3% 5epreciation

4% Preli% '"penses

>% 0otal Cost

J% 0otal Incoe

F% Incoe before

ta"

4J%J4

43%2.

-2%H3

-%>.

-.4%2

F

H>%4.

-I%IF

.%..

H3%2I

F2%..

-I%F2

-%>.

-I>%>

.

-H.%I

.

>%3.

-JF%F

2

JF%>.

22%J>

-%>.

22H%3

F

2I-%F

.

-I2%-J

>J%2>

2F%I2

-%>.

2JF%F3

3F2%J.

-.4%IF

.%..

-.4%IF

-I2%-

J

42%F>

2F%I2

-%>.

2>4%2

3

3F2%J

.

-I2%-

J

2H%2>

2F%I2

-%>.

24.%F

3

3F2%J

.

-I2%-

J

-3%>.

2F%I2

-%>.

224%H

I

3F2%J

.

-I2%-J

2%2>

2F%I2

-%>.

2-3%F3

3F2%J.

->I%IF

.%..

->I%IF

-I2%-J

.%..

2F%I2

-%>.

2--%4I

3F2%J.

-J-%-2

.%..

-J-%-2

-I2%-J

.%..

2F%I2

-%>.

2--%4I

3F2%J.

-J-%-2

.%..

-J-%-2

I% 0a"ation

H% Incoe after ta"

-.%+ross Cash

accr!als

MMMMMMMMMMMMMMMM

5ebt ser(iceA?ear

F!nd for 5ebt

Ser(ice

5SC6

A(erage 5SC6

-I%IF

>%>J

MMMMM

43%2.

4I%FJ

-%-3

2%-J

.%..

>%3.

2>%>2

MMMM

F2%..

HF%>2

-%3>

>2%33

.%..

>2%33

FJ%4I

MMMM

--F%>

.

-43%H

I

-%23

-34%-H

MMMMM

-3-%2>

-H.%44

-%4>

--I%3

F

.%..

--I%3

F

-4F%J

H

MMMM

--F%F

>

-H.%4

4

-%J2

-3-%J

.

.%..

-3-%I

F

-J-%-

H

MMMMM

-.4%2

>

-H.%4

4

-%I3

-4F%J

2

.%..

-4F%J

2

-FJ%H

4

MMMMM

--3%>

.

-H.%4

4

-%JI

-II%-H

MMMM

2F%2>

-H.%44

J%HH

-H.%44

MMMM

-H.%44

MMMM

In both the sit!ations i%e% after applying sensiti(ity analysis* the lowest 5SC6 is 2%-J which is well abo(e -%> and as

s!ch project can be ta$en as (iable% And therefore is acceptable for f!nding%

Pro!ected ;alance S+eet

Bn the basis of profitability and cash flow stateents already drawn* the projected balance sheet for a period of -.

years is also prepared to $now the financial position of the project at any gi(en point of tie%

EN@IRON"ENTAL 2 ECONO"IC @IA;ILIT=

0he perforance of a project ay not only be infl!enced by the financial factors as stated abo(e% Bther e"ternal

en(ironental factors* which ay be econoic* social or c!lt!ral ay ha(e a positi(e ipact as well% 0he larger

projects ay be critically e(al!ated by the lending instit!tions by ta$ing into consideration the following factors1

'ployent potential%

7tilisation of doestically a(ailable raw aterials and other facilities%

5e(elopent of ind!strially bac$ward area as per +o(ernent policy%

'ffect of the project on the en(ironent with partic!lar ephasis on the poll!tion of water and air to be

ca!sed by it%

0he arrangeents for effecti(e disposal of effl!ent as per the +o(ernent policy%

'nergy conser(ation de(ices etc% eployed for the project%

Bther econoic factors which infl!ence the final appro(al of a partic!lar project are* ,et Present Kal!e based on

5CF* Internal 6ate of 6et!rn (I66) and 5oestic 6eso!rces Cost (56C)%

Net Present @alue

0he 5isco!nted Cash Flow (5CF) 0echni#!e which is ore coonly $nown as ,et Present Kal!e ethod (,PK)

ta$es into acco!nt the tie (al!e of oney for e(al!ating the costs and benefits of a project%% It recognises that

streas of cash inflows at different points of tie differ in (al!e% A so!nd coparison aong s!ch inflows and

o!tflows can be ade only when they are e"pressed in ters of a coon denoinator i%e% present (al!es% For

deterining present (al!es* an appropriate rate of disco!nt is selected and the cash flow streas then are con(erted

into present (al!es with the help of rate of disco!nt so selected% If ,PK is positi(e (i%e% difference between present

(al!es of inflows and o!tflows) the project is ta$en to be (iable and as s!ch proceeded with otherwise not% 0he

concept of ,PK shall be clear with the help of following e"aple1

Let !s ass!e that on an initial o!tlay of 6s%>.*...* a project<s cash inflows for ne"t se(en years are as below*

present (al!e being calc!lated at a 5isco!nt rate of -4/%

?ear Cash inflows P% K% factor at -4/ Present (al!es

- -2... o%IFF -.>24

2 -.... .%FJH FJH.

3 ->... .%JF> -.-2>

4 -3... .%>H2 FJHJ

> -4... .%>-H F2JJ

J -2... .%4>J >4F2

F --... .%4.. 44..

0otal present (al!e of cash inflows

Less1 Cash o!tflow

,PK

Since ,PK is positi(e the project ay be considered%

Internal Rate of Return

Internal 6ate of 6et!rn B66) is defined as the disco!nt rate which e#!ate the present (al!e of in(estent in the

project to the present (al!e of f!t!re ret!rns o(er the life of the project% 0his is an indicator of earning capacity of

the project and a higher internal rate of ret!rn indicates better prospects for the project% 0he present in(estent is

cash o!tflow which is ass!ed to be negati(e cash flow and the ret!rns (cash inflow) are ass!ed to be positi(e

cash flows 0he s! total of the disco!nted cash flows shall be @ero or as near to @ero a* possible% 0he rate of

disco!nt applied to bring the s! total to @ero as abo(e is the internal rate of ret!rn%

Domestic Resources Cost

5oestic 6eso!rces Cost (56C) helps to establish a relationship between the total doestic reso!rces in r!pees

spent for an!fact!ring a prod!ct a%* against the foreign e"change o!tlay that wo!ld be necessary to iport that

partic!lar prod!ct% It ay be ta$en as a eas!re of total r!pees spent to sa(e - !nit of foreign c!rrency (for iport

s!bstit!tion) or to earn a !nit of foreign c!rrency (for prod!cts to be e"ported)% 0his ay in t!rn be copared with

the e"change rate (parity rate) of the !nit of foreign c!rrency in r!pees to deterine if it is worthwhile to

an!fact!re the prod!ct in the co!ntry% If 56C is e#!al to or less than the parity rate of the !nit of foreign

c!rrency* it eans an!fact!ring the prod!ct in India is possible at a cost which is e#!al to or lower than the cost of

foreign e"change and it is worthwhile to ipleent the project% )owe(er* as foreign e"change is scarce* projects

with slightly higher 56C (than parity rate) ay also be appro(ed $eeping in (iew of other iportant factors s!ch as

eployent potential or +o(ernent policy to create an!fact!ring capacity at hoe d!e to strategic iportance

of the prod!ct or to gain a position in the international ar$et etc%

LENDING ;= ALL INDIA FINANCIAL INSTITBTIONS ) CO""ON FEATBRES AND

COORDINATION 0IT< ;ANCS

Ind!strial 5e(elopent Ban$ of India (I5BI) is an ape" body for de(elopent financing in the co!ntry% Ind!strial

Finance Corporation of India (IFCI) is also acti(ely in(ol(ed in project appraisal and ha(e de(eloped soe

coon strategies in this regard% Bther all India financial instit!tions naely Life Ins!rance Corporation* 7nit

0r!st of India and +eneral Ins!rance Corporation and its fo!r s!bsidiaries who also participate in project financing

are generally lending thro!gh all India financial instit!tions and are not that acti(ely associated with the appraisal of

the project as s!ch% All India Instit!tions generally in(est in large projects while projects in sall -scale or edi!

scale are left to be financed by state le(el instit!tions% Coercial ban$s are also in(ol(ed in ter lending in

consorti! with financial instit!tions% Financing of a project alost in(ol(es a definite pattern depending !pon the

project cost as !nder%

Projects costing !pto 6s% > crores

Projects costing !pto 6s% >... crores sho!ld norally be financed by state le(el ter lending instit!tions in

consorti! with coercial ban$s% Indirect assistance by way of refinance fro all India instit!tions to lending

instit!tions is* howe(er* a(ailable in s!ch projects%

Details are gi:en in C+ater 6

SFCs and SI5Cs loo$ forward to refinance facilities fro all India instit!tions to a!gent their reso!rces and as

s!ch confine their coitents to the abo(e le(el% 0here is* howe(er* no bar on SFCs and SI5Cs granting ter

loan facilities in e"cess of the ceilings as stated abo(e b!t in that case refinance fro all India instit!tions will not

be a(ailable%

)owe(er* for e"isting copanies all India instit!tions can pro(ide financial assistance e(en when the project cost is

below 6s% >.. lacs%

Projects with 0er Loan Coponent e"ceeding 6s% > crores

As a part of Project Finance* the Financial Instit!tions pro(ide ter loans in r!pees and in foreign c!rrency

repayable o(er >- -. years depending !pon debt ser(icing capacity of the borrower !nit* and sec!red by a charge

o(er the io(ableAo(able assets% Credit e(al!ation constit!tes the basis for sanction of assistance% 0he financing

can be done by instit!tions indi(id!ally or jointly%

Coercial Ban$ (is-a-(is +ranting of 0ers Loans

-% Coercial ban$s ay participate in granting ter loans in projects where total project cost does not

e"ceed 6s% >.. lacs% 0he ban$s in s!ch cases wo!ld be eligible for refinance fro all India instit!tions%

2% In other cases criterion is not lin$ed to the cost of the project b!t to the #!ant! of loan and the e"act

position is as !nder1

(a) A ban$ ay pro(ide ter finance not e"ceeding its pr!dential e"pos!re nor as prescribed by

6eser(e Ban$ of India fro tie to tie for indi(id!al borrowerAgro!p of borrowers%

(b) Ban$ and financial instit!tions ay pro(ide ter finance to all projects incl!ding infrastr!ct!re

projects witho!t any ceiling%

For lending to p!blic sector !nits* ban$s are to ens!re that s!ch p!blic sector !nits are registered !nder the

Copanies Act* -H>J* or are established as corporation !nder rele(ant Acts% S!ch !nits sho!ld be ade o!t of

incoe to be generated fro the project and not o!t of s!bsidies* ade a(ailable to the by the +o(ernent%

Pr!dential '"pos!re ,ors for Ban$s

-

As per g!idelines of 6eser(e Ban$ of India the a"i! e"pos!re of a ban$ for all its f!nd based and non f!nd

based credit facilities* in(estents* !nderwriting* in(estent in bonds and coercial paper and any other

coitent sho!ld not e"ceed -> per cent of its capital f!nds to an indi(id!al borrower incl!ding p!blic sector

!nderta$ings and 4. per cent of its capital f!nds to gro!p of borrowers% 0he pr!dential e"pos!re liit of ban$s to

the borrowers of a gro!p can e"ceed by -./ if the additional credit is on acco!nt of infrastr!ct!re projects (i%e%

power* teleco!nication* roads and transports)% F!rther* w%e%f% April -* 2..3* the e"pos!re liit of ban$s to single

borrowers can e"ceed by >/ if the additional credit is on acco!nt of infrastr!ct!re projects% 0hese liits are

referred to as pr!dential e"pos!re nors% For arri(ing at e"pos!re liit* the sanctioned liits or o!tstanding*

whiche(er is higher* shall be rec$oned% It ay* howe(er* be noted that while calc!lating e"pos!re* the non f!nd

based facilities are to be ta$en at -../ of the sanctioned liit or o!tstanding whiche(er is higher% 0he concept of

capital f!n: has been broadened to represent total capital i%e%* 0ier I and 0ier -- capital (sae as total capital

defined !nder capital ade#!acy standards) for the deterination of e"pos!re ceiling by ban$s% 0o ill!strate this

point let !s consider the following e"aple1

Capital f!nds of the ban$ 6s%2>. crores

'"pos!re to a borrower Liits sanctioned B!tstandings

(6s% In crores) (6s% In crores)

0er loan ->%.. -.%..

CC )p% (incl% &C0L) .>%.. .3%..

LAC -J%.. -.%..

MMMMMMMMMMMMM MMMMMMMMMMM

0otal 3J%.. 23%..

MMMMMMMMMMMMMMM MMMMMMMMMMM