Beruflich Dokumente

Kultur Dokumente

Customs and Foreign Exchange Operation

Hochgeladen von

Furkan FidanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Customs and Foreign Exchange Operation

Hochgeladen von

Furkan FidanCopyright:

Verfügbare Formate

CUSTOMS AND FOREIGN

EXCHANGE OPERATIONS

Submitted to: Assoc.Prof.Glzar KURT

Furkan FDAN

Faculty of Business

International Business and Trade

2009434020

zmir, 2014

CUSTOMS AND FOREIGN EXCHANGE OPERATIONS

Q.1. Explain one of the trade transactions (export, import, customs, logistics operations, etc.)

of your company in detail (remember the cases, companies, products, countries that you work

in your company).

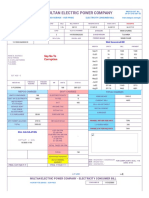

I am working at MSN Yldrm Custom Consultancy Limited Company. Our company serves

as consultant in foreign trade actions such import, export and logistics. MSN Yldrm Custom

Consultancy is working as official intermediary rather than exporter and importer. I will

explain one of export transaction between Turkish granite producer and exporter Company

and Italian importers in which our company served as consultancy. MSN Yldrm Custom

Consultancy did not give the names of these companies due to their ethic principles and I will

mention about them as just Turkish granite producer and exporter and Italian importer. I asked

deputy custom consultant of our company to explain all process of this export transaction

from beginning to end. Firstly, Italian importer contacted with Turkish producer to import

granite from Turkey. Italian importer asked price of 1000m

2

granite with Free on Board

(FOB) and Cost Insurance & Freight (CIF) incoterms. After that Turkish Company sought to

prices of insurance and freight to respond the requirements of CIF. These kind of companies

which are doing foreign trade generally have insurer and freighter that the company works

with them usually. And then, the Italian importer took the prices, they decided to CIF

incoterm. In the second step, Turkish Exporter invoiced the bill with approval of Turkish

Finance Office to start the export transaction and present it to customs. Also, FOB price of

goods needs to be written in invoice. Besides that total number of containers/packages, net

and gross weight of containers, payment methods such as cash against goods, cash against

documents, letters of credit, cash equivalent etc., which bank the payment will be done, and

name of producer need to be written in invoice without value added tax. In addition to this,

Turkish exporter prepared commercial invoice in English language with all information which

is written in the Turkish Invoice. And then, packing list was prepared to explain distribution

of goods such how many pack includes how much weights by Turkish exporter. After that

also transaction shipping order was prepared by Turkish exporter. Turkish exporter paid all

expense of customs and contact with transporter and paid all transportation expense from

loading point to port of destination. And then Turkish exporter informed that the approximate

arrival time to Italian importer. In that point, as MSN Yldrm Consultancy Company, our

business begun. Turkish exporter informed our company that the invoice with approval of

Turkish Finance Office, commercial invoice in English, packing list either in English or in

Turkish, shipping order which includes name of importer company, the address of destination

point, total weight that is loaded to truck, total number of packages/containers and type of

delivery and loading time of goods to truck. The goods loaded to truck on Friday. Custom

Consultancy prepared all necessary certificate and created customs declaration draft according

to invoice which includes some details of importer, payment method, shipping order, route

etc. And then, Custom Consultancy Company prepared ATR certificate which is circulation

of goods certificate according to free trade agreement between European Union and Turkey

and country of origin certificate due to this proposal is ordered by importer. After creation of

customs declaration draft, this declaration was presented to Chamber of Commerce with

invoice with approval with Turkish Finance Office to take approval of Chamber of

Commerce. After this step, ATR circulation of goods certificate needs to be endorsed by

Customs office by presenting ex number in certified declaration. Henceforward, Custom

Consultancy declared shifts to customs office due to transactions will continue after working

hours and it paid expenses. Invoice in Turkish, packing list and power of attorney which is

given by Turkish exporter, were added to declaration. After endorsement of ATR circulation

certificate of goods, declaration was presented to customs registration service. Customs

registration service checked all documents which was presented by custom consultancy

company, and it started to acceptance transaction of declaration. Hereupon, line condition of

declaration was identified that includes control of documents or physical control. Our

declaration was decided to do physical control and then customs officer asked customs

consultant to come customs for controlling. Containers were opened and controlled

physically and compared with packing list by red line customs controller officer. Goods were

controlled and approved. Declaration was signed and allowed to move to Italy by red line

controller officer. Thereafter, the declaration was presented to administration of customs and

it was received by shipping agent, and then shipping agent started to do departure

transactions. In conclusion, our customs consultancy company delivered ATR circulation

certificate of goods, commercial invoice that was sent by exporter, packing list, country of

origin certificate to shipping agency. Finally, shipping agency deliver these documents to

truck driver who will present to customs which are on the route and goods are ready to export.

Q.2. What are the personal requirements/capabilities needed to be successful in your company

(analyze the duties and responsibilities of the workers in the company and write a report about

the capabilities)?

Firstly, to work for customs consultancy company, the people have to be graduated from

some specific departments in collage such as business administration, economy, public

administration, labor economics and industrial relations, or foreign trade, export-import,

customs administration according to customs office. After this, they start to work in customs

consultancy company as trainee during a year. Hereafter, they need to pass exam of custom

consultancy which is made by the undersecretariat of customs. After passing this exam,

workers responsibility increases due to they are responsible for all transactions they made.

Firstly, they have to be really carefully while they are examining or analyzing the documents.

Whether they are not carefully enough, it might be ended even in jail or their certificate might

be taken back from them. In addition to this, they have to use computer very efficiently and

usefully as it is required most of works. They have to obey and respect ethic rules. They need

to have ability to speak at least one foreign language. Besides that, they have to use Turkish

efficiently due to most of times they need to write some letters, mails, and petition or make

phone conversation. That means they need to have some communication abilities with other

people. They need to be honest towards the people and be patient. Finally, to work for custom

consultancy company requires lots of ability as it is mentioned about before, and workers

need to apply their experience to the work.

Das könnte Ihnen auch gefallen

- Incoterms: Rules for international tradeDokument11 SeitenIncoterms: Rules for international tradeVõ Trung NguyênNoch keine Bewertungen

- Documents Used in Foreign Trade TransactionsDokument7 SeitenDocuments Used in Foreign Trade TransactionskshobanaNoch keine Bewertungen

- Internship Activity LogggggggggggDokument7 SeitenInternship Activity LogggggggggggIrene Quỳnh AnhNoch keine Bewertungen

- Documents Required For Import DocumentationDokument11 SeitenDocuments Required For Import DocumentationJohn HonnaiNoch keine Bewertungen

- Documents Used in Foreign Trade TransactionsDokument5 SeitenDocuments Used in Foreign Trade TransactionsANILN1988Noch keine Bewertungen

- CUSTOMS AND EXCISE DUTY MANAGEMENT Notes 2022Dokument89 SeitenCUSTOMS AND EXCISE DUTY MANAGEMENT Notes 2022Amanya GibsonNoch keine Bewertungen

- International Trade AssgmentDokument6 SeitenInternational Trade AssgmentMuhammad AazanNoch keine Bewertungen

- Import Export DocumentsDokument32 SeitenImport Export DocumentsPriya Shah100% (1)

- Kindly Remember These Terms You Have To Give A Test by Monday Start of The Shift. Glossary of TermsDokument5 SeitenKindly Remember These Terms You Have To Give A Test by Monday Start of The Shift. Glossary of Termsyousha younusNoch keine Bewertungen

- Import-Export Documents GuideDokument16 SeitenImport-Export Documents GuidekshobanaNoch keine Bewertungen

- Bài thuyết trìnhDokument9 SeitenBài thuyết trìnhHuyền TràNoch keine Bewertungen

- Export DocumentationDokument10 SeitenExport DocumentationCharu ModiNoch keine Bewertungen

- ADL 85 Export, Import Procedures & Documentation V2Dokument23 SeitenADL 85 Export, Import Procedures & Documentation V2ajay_aju212000Noch keine Bewertungen

- Custom Clerarance: Area of Operations and AuthorityDokument4 SeitenCustom Clerarance: Area of Operations and AuthorityRajeev VyasNoch keine Bewertungen

- Exim DocumentationDokument25 SeitenExim DocumentationKARCHISANJANANoch keine Bewertungen

- Export Procedure & Documentation: VIVA College S.Y.B.M.S Roll No. 61to70Dokument27 SeitenExport Procedure & Documentation: VIVA College S.Y.B.M.S Roll No. 61to70Nitin ChauhanNoch keine Bewertungen

- Mining in EthiopiaDokument11 SeitenMining in EthiopiaTsinatNoch keine Bewertungen

- Assignment ON Internation Marketing. Import DocumentationDokument4 SeitenAssignment ON Internation Marketing. Import DocumentationNeelakshi PujariNoch keine Bewertungen

- Import Procedures IN IndiaDokument13 SeitenImport Procedures IN IndiaAston Rahul PintoNoch keine Bewertungen

- Export-Import Documentation and Risk Management in Export-Import BusinessDokument32 SeitenExport-Import Documentation and Risk Management in Export-Import BusinessSaptarshi Roy100% (1)

- Export Import Procedures and Documentation Dec 2022Dokument10 SeitenExport Import Procedures and Documentation Dec 2022Rajni KumariNoch keine Bewertungen

- Ibo-4 Unit-3 Export Import Documents OverviewDokument35 SeitenIbo-4 Unit-3 Export Import Documents OverviewSudhir Kochhar Fema Author100% (1)

- Export Process in PakistanDokument14 SeitenExport Process in Pakistanazeemtahir56625% (4)

- Export ProcedureDokument8 SeitenExport ProcedureTonmoyNoch keine Bewertungen

- Export Documents GuideDokument23 SeitenExport Documents GuidePragati MehndirattaNoch keine Bewertungen

- Export-Import Documentation and Risk Management in Export-Import BusinessDokument32 SeitenExport-Import Documentation and Risk Management in Export-Import BusinessPraveena KumariNoch keine Bewertungen

- FreightDokument3 SeitenFreightSharon AmondiNoch keine Bewertungen

- Current Situation of The Process of Importing Goods by Sea at Vinaline LogisticsDokument11 SeitenCurrent Situation of The Process of Importing Goods by Sea at Vinaline LogisticsIrene Quỳnh AnhNoch keine Bewertungen

- In Order For The CompanyDokument11 SeitenIn Order For The CompanyNguyễn Thị Yến PhượngNoch keine Bewertungen

- UnitDokument11 SeitenUnitRohanNoch keine Bewertungen

- 24.customs Clearance - Meaning, Scope and DocumentationDokument1 Seite24.customs Clearance - Meaning, Scope and DocumentationWah KhaingNoch keine Bewertungen

- Export Documentation in IndiaDokument23 SeitenExport Documentation in IndiaRamalingam ChandrasekharanNoch keine Bewertungen

- Aligned Documentation System (ADS)Dokument25 SeitenAligned Documentation System (ADS)Ansari Amir67% (3)

- ChetnaDokument20 SeitenChetnaChetna VermaNoch keine Bewertungen

- Export Documentation GuideDokument10 SeitenExport Documentation GuideNick NikhilNoch keine Bewertungen

- Import Bill DetailsDokument13 SeitenImport Bill Detailssohan h m sohan h mNoch keine Bewertungen

- Export ProceduresDokument8 SeitenExport ProceduresJindalNoch keine Bewertungen

- Export Notes For LearningDokument16 SeitenExport Notes For LearningSyed Waqas AhmedNoch keine Bewertungen

- Export-Import Documentation in India: A GuideDokument23 SeitenExport-Import Documentation in India: A GuideMageswariNoch keine Bewertungen

- International Trade GuideDokument2 SeitenInternational Trade Guideaka619ASHNoch keine Bewertungen

- Import Procedure: Prof. C. K. SreedharanDokument68 SeitenImport Procedure: Prof. C. K. Sreedharanamiit_pandey3503Noch keine Bewertungen

- Learning Activity 15 Evidence 8Dokument17 SeitenLearning Activity 15 Evidence 8jorgeNoch keine Bewertungen

- Export-Import DocumentationDokument31 SeitenExport-Import DocumentationpakhtunNoch keine Bewertungen

- Import Documentation Requirement For Customs ClearanceDokument3 SeitenImport Documentation Requirement For Customs ClearanceanuboraNoch keine Bewertungen

- What Is The Difference Between A Liner & Tramp Services ?: Whoisaliner?Dokument9 SeitenWhat Is The Difference Between A Liner & Tramp Services ?: Whoisaliner?Vijay ChanderNoch keine Bewertungen

- Import / Export Policy & Procedures: Zewdu LDokument17 SeitenImport / Export Policy & Procedures: Zewdu LZewdu Lake TNoch keine Bewertungen

- INTRODUCTION To 5chapterDokument51 SeitenINTRODUCTION To 5chapterkk kkNoch keine Bewertungen

- Import & Export Documentations in International Trade - PPTX - Week - 3Dokument37 SeitenImport & Export Documentations in International Trade - PPTX - Week - 3Kennedy HarrisNoch keine Bewertungen

- Export Procedure and DocumentationDokument22 SeitenExport Procedure and DocumentationnandiniNoch keine Bewertungen

- Import Documents and Procedure: Submitted byDokument46 SeitenImport Documents and Procedure: Submitted byprateek gandhiNoch keine Bewertungen

- Department of Marketing Management Assignment On Import and ExportDokument13 SeitenDepartment of Marketing Management Assignment On Import and ExportTekletsadik TeketelNoch keine Bewertungen

- International Trade Law Assignment - 1Dokument4 SeitenInternational Trade Law Assignment - 1Rajvi ChatwaniNoch keine Bewertungen

- Pon Sanger ExportsDokument11 SeitenPon Sanger ExportsTaruna BhadanaNoch keine Bewertungen

- Bangladesh Exporter GuidelinesDokument9 SeitenBangladesh Exporter Guidelinesfind4mohsinNoch keine Bewertungen

- Submitted To Suhal Ahmed: Module Name: Shipping and Banking Module Code: AMM-4323 Assignment OnDokument8 SeitenSubmitted To Suhal Ahmed: Module Name: Shipping and Banking Module Code: AMM-4323 Assignment OnMeghna LgNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- How To Buy A House For 1 Euro in Italy?: Practical bookVon EverandHow To Buy A House For 1 Euro in Italy?: Practical bookNoch keine Bewertungen

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.Von EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.Noch keine Bewertungen

- Import Business: A Guide on Starting Up Your Own Import BusinessVon EverandImport Business: A Guide on Starting Up Your Own Import BusinessBewertung: 4 von 5 Sternen4/5 (1)

- Market DescriptionDokument24 SeitenMarket DescriptionFurkan FidanNoch keine Bewertungen

- The Marketing Strategy of Ford MotorDokument100 SeitenThe Marketing Strategy of Ford MotorAbhishek Jha92% (13)

- Global Tobacco IndustryDokument2 SeitenGlobal Tobacco IndustryFurkan FidanNoch keine Bewertungen

- Financial Markets Institutions Interest Rates CH05Dokument4 SeitenFinancial Markets Institutions Interest Rates CH05Furkan FidanNoch keine Bewertungen

- Chap1 IntroDokument38 SeitenChap1 IntroFurkan FidanNoch keine Bewertungen

- Ders Pro Gibs 08012013Dokument5 SeitenDers Pro Gibs 08012013Furkan FidanNoch keine Bewertungen

- Martin Engegren Samsung Electronics Annual Report 2012Dokument60 SeitenMartin Engegren Samsung Electronics Annual Report 2012martin_engegrenNoch keine Bewertungen

- Salvatore Ch01Dokument37 SeitenSalvatore Ch01Furkan FidanNoch keine Bewertungen

- IMF Stand by Arrangement With GreeceDokument4 SeitenIMF Stand by Arrangement With GreeceFurkan FidanNoch keine Bewertungen

- CH 21Dokument34 SeitenCH 21Furkan FidanNoch keine Bewertungen

- CASE STUDY - Smart Stores Reinvent The Retail SpaceDokument1 SeiteCASE STUDY - Smart Stores Reinvent The Retail Spacetranthihien29604Noch keine Bewertungen

- 2020 List of All Ships Dismantled All Over The WorldDokument5 Seiten2020 List of All Ships Dismantled All Over The WorldThiago Castro RodriguesNoch keine Bewertungen

- Import Toner Shipment from Dominican Republic to CubaDokument8 SeitenImport Toner Shipment from Dominican Republic to Cubafrancisco madrazo PedroNoch keine Bewertungen

- Commercial goods invoice for Maria Laura JimenezDokument2 SeitenCommercial goods invoice for Maria Laura JimenezLorena Velásquez71% (7)

- Chapter 15 The Money Supply ProcessDokument35 SeitenChapter 15 The Money Supply ProcessDUYEN LE HUYNH MYNoch keine Bewertungen

- Global PricingDokument24 SeitenGlobal PricingPrianca Heidy PrayogoNoch keine Bewertungen

- Mepco BillDokument2 SeitenMepco BillRao M. YasirNoch keine Bewertungen

- Lesson 2 - The Globalization of World EconomicsDokument10 SeitenLesson 2 - The Globalization of World EconomicsAdam TolentinoNoch keine Bewertungen

- 79 231 1 PBDokument10 Seiten79 231 1 PBDickyYogaswaraNoch keine Bewertungen

- 64749bos51938 Fnew p8Dokument19 Seiten64749bos51938 Fnew p8Salman ghaswalaNoch keine Bewertungen

- Chapter 3 National Income Test BankDokument45 SeitenChapter 3 National Income Test BankmchlbahaaNoch keine Bewertungen

- VTU Internal Test 2 International Marketing Management QuestionsDokument25 SeitenVTU Internal Test 2 International Marketing Management Questionsprasadkulkarnigit53% (19)

- International 1 Chap 2Dokument37 SeitenInternational 1 Chap 2sai krishnaNoch keine Bewertungen

- A Study On Muslim Economic Thinking 17th Century IeDokument90 SeitenA Study On Muslim Economic Thinking 17th Century IeM Ridwan UmarNoch keine Bewertungen

- QuotationDokument4 SeitenQuotationم.فرج العماميNoch keine Bewertungen

- Niharika Co. Op. Housing Society LTD: REGN No: N.B.O.M/CIDCO/H.S.G./ (T.C.) /8013/JTR/Year 2019-2020Dokument28 SeitenNiharika Co. Op. Housing Society LTD: REGN No: N.B.O.M/CIDCO/H.S.G./ (T.C.) /8013/JTR/Year 2019-2020Tejesh DakhinkarNoch keine Bewertungen

- Place (Distribution) StrategyDokument8 SeitenPlace (Distribution) StrategyLhorenz DianneNoch keine Bewertungen

- Rural RetailDokument4 SeitenRural RetailPradeep BhatnagarNoch keine Bewertungen

- CheatSheet Midterm v2Dokument10 SeitenCheatSheet Midterm v2besteNoch keine Bewertungen

- Characteristics of GENERAL CARGO TERMINALDokument2 SeitenCharacteristics of GENERAL CARGO TERMINALCarlos Adolfo Salah FernandezNoch keine Bewertungen

- Chap. 18Dokument149 SeitenChap. 18Nguyễn Lê ThủyNoch keine Bewertungen

- PALOMARIA-MODULE 4 - Consumer MathDokument16 SeitenPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANoch keine Bewertungen

- Chapter 3 Accounting Process and Books of AccountsDokument54 SeitenChapter 3 Accounting Process and Books of AccountsJust TihaNoch keine Bewertungen

- Money, Banking and Finance (ACFN-341)Dokument120 SeitenMoney, Banking and Finance (ACFN-341)Addis InfoNoch keine Bewertungen

- Quality InfrastructureDokument138 SeitenQuality InfrastructureAbou Bakr AbdullahNoch keine Bewertungen

- 5.05 Analyzing Statements of Cash Flows IIDokument5 Seiten5.05 Analyzing Statements of Cash Flows IIClaptrapjackNoch keine Bewertungen

- MEPCO GST No. Electricity BillDokument2 SeitenMEPCO GST No. Electricity BillAsad faridNoch keine Bewertungen

- Distribution Channel and Logistics in International MarketingDokument9 SeitenDistribution Channel and Logistics in International MarketingrajirithuNoch keine Bewertungen

- Moodle 1 Be T2C2Dokument4 SeitenMoodle 1 Be T2C2Vy NguyễnNoch keine Bewertungen

- Assignment 2 Walmart and Targets Inventory ManagementDokument8 SeitenAssignment 2 Walmart and Targets Inventory Managementvrenda.parhamNoch keine Bewertungen