Beruflich Dokumente

Kultur Dokumente

Confidential 2 BM/TEST 1/FIN542/620: © Hak Cipta Universiti Teknologi MARA

Hochgeladen von

JaneahmadzackOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Confidential 2 BM/TEST 1/FIN542/620: © Hak Cipta Universiti Teknologi MARA

Hochgeladen von

JaneahmadzackCopyright:

Verfügbare Formate

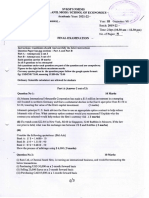

CONFIDENTIAL 2 BM/TEST 1/FIN542/620

Name: ___________________________________________

Matric No.:_________________________________

QUESTION 1

a) You are a foreign exchange dealer at S Bank in Malaysia and one of your customers

ould like to o!tain the ringgit Malaysia "#M) $rices against the Singa$ore dollar "S%). &f

these 'uotations are a(aila!le: #M).*+*,-.,-/S% and S%0.12++-2,-/S%3 determine the

ringgit $er Singa$ore dollar "#M-S%) cross rate 'uotation.

&s there any ar!itrage o$$ortunity if the BBank is trading the /S dollar and S% at the rate

of S%0.124+-+,-/S%5 &f you ha(e /S%1 million to ar!itrage3 ho much $rofit ould you

make5

"1, marks)

!) Mr. Mc 6onalds !uys fi(e futures contract of Siss francs at an o$ening $rice of /S%

,.*+,, on 7cto!er 0130,,8. "9ontract si:e: S;10+3,,,). <e ould close out the contract

to days later. =he closing $rices of the futures contract on 7cto!er 013 00 and 0) are

/S% ,.**4,3 /S% ,.*.8, and /S% ,.*+1+3 res$ecti(ely. <o much is Mr. Mc 6onalds

$rofit or loss on his marked>to>market on the futures contract5

"1, marks)

QUESTION 2

a) ?B9 Sdn Bhd has to !uy and sell currencies at different time $eriods. =he Bank has

$ro(ided the folloing 'uotes on foreign currencies.

S$ot 1>month forard )>month forard

#M ).+2.0-24-/S% ),-4, *0-+*

#M+.)14+-*+-@ *4-20 00-18

i) <o many $ound sterling ould you recei(e if you ha(e #M2,,3,,, today5

"0 marks)

ii) <o many /S dollars can you $urchase for deli(ery in one month ith #M03+,,3,,,5

") marks)

iii) <o many ringgit ould you recei(e if you sell @.+3,,, for deli(ery in three months5

") marks)

i() Ahat is the !id>offer $rice of /S dollar $er @ today5

"0 marks)

Hak Cipta Universiti Teknologi MARA CONFIENTIA!

CONFIDENTIAL 3 BM/TEST 1/FIN542/620

QUESTION "

a) Su$$ose in Bangkok3 the s$ot 'uote for @,.)+0,-4+-/S% and B,.02*+-8,-/S%.

i) Ahat is the s$ot 'uote for B-@ in Bangkok5

"0 marks)

ii) &f the /S% as 'uoted at @,.))0+-2+ in ;rance3 hat ould you do to $rofit from this

situation5

"0 marks)

iii) 9om$ute the $ercentage !id>ask s$read on !oth currencies in Bangkok.

"0 marks)

!) You called your dealer and ask for 'uotation on S%-#M s$ot3 1>month and )> month. =he

dealer res$onded ith the folloing:

#M0.0+*2-2+-S% )2-+0 .+-+,

Ahat are the forard outright rates in terms of S% $er #M5

"4 marks)

c) ?n ?merican com$any im$orted goods orth #M+,,3,,, fears that ringgit ill

a$$reciate in the coming months. <e ould like to hedge the risk through o$tions.

7$tions are a(aila!le at to different strike rates from to !anks. Bank ? is offering

/S%,.0.-#M and Bank B is /S%,.0*-#M. =he $remium in !oth cases is /S%,.,,0-#M.

&f he $redicts that the s$ot rate on the maturity ill go u$ to /S%,.0*+-#M3 hich o$tion

should !e chosen5 9alculate his $rofit if his $rediction is correct.

"1, marks)

QUESTION #

a) Ci(en the ex$ected annual inflation rates in Malaysia and /D are 4E and *E

res$ecti(ely and the current !id-ask s$ot rates are #M+.1111-.. -F3 calculate the 1>

year !id-ask s$ot rates according to Gurchasing Goer Garity conce$t.

"0 marks)

!) =he ex$ected annual interest rates in Malaysia and /D are 4E and *E res$ecti(ely

and the one ay current s$ot rate is #M+.1111 - F and the #M ill strengthened !y

0.+E against the British F in 1>yearHs time3 ould Malaysian in(estors in(est at home

or in /D according to &nternational ;isher Iffect $arity condition5 Sho your

calculation.

") marks)

c) &f the ex$ected annual interest rates in Malaysia and /D are 4E and *E res$ecti(ely

and the current one ay s$ot rate is #M+.,,,, - F and the #M ill eakened !y 0.+E

against the British F in 1>yearHs time.

i) Sho if there is an o$$ortunity for co(ered interest ar!itrage according to &nterest

#ate Garity condition.

Hak Cipta Universiti Teknologi MARA CONFIENTIA!

CONFIDENTIAL 4 BM/TEST 1/FIN542/620

"0.+ marks)

ii) Aould an ar!itrageur in(est and !orro5

"0.+marks)

iii) 6etermine the $rofit or loss if the ar!itrageur has #M+ million or F1 million.

"1, marks)

EN OF QUESTION $A$ER

Hak Cipta Universiti Teknologi MARA CONFIENTIA!

Das könnte Ihnen auch gefallen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Business Plan For Clothing ShopDokument14 SeitenBusiness Plan For Clothing ShopNamaku Ima100% (1)

- Assignment 3Dokument5 SeitenAssignment 3aklank_218105Noch keine Bewertungen

- Stamp Duty On Various DocumentsDokument6 SeitenStamp Duty On Various Documentsbidyuttezu100% (1)

- Bank of Maharashtra - General AwarnessdocDokument7 SeitenBank of Maharashtra - General Awarnessdocshraddha_ghag3760Noch keine Bewertungen

- SL - No Topic Concepts Covered Case-Study Icmr Case No Text Book Chapter NoDokument2 SeitenSL - No Topic Concepts Covered Case-Study Icmr Case No Text Book Chapter NoVinit ShahNoch keine Bewertungen

- Answer All: TEST 2 FIN 542 International Financial Management 2012Dokument5 SeitenAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- Chapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1Dokument16 SeitenChapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1samuel_dwumfourNoch keine Bewertungen

- Assignment QP MBA International Financial Management MF0015 Summer2013Dokument2 SeitenAssignment QP MBA International Financial Management MF0015 Summer2013Arvind KNoch keine Bewertungen

- International Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80Dokument3 SeitenInternational Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80SANAULLAH SULTANPURNoch keine Bewertungen

- ForexDokument62 SeitenForexVamshiKrishnaNoch keine Bewertungen

- "Future of Bata Shoe Company (Bangladesh) LTD in Present Competitive Market".Dokument33 Seiten"Future of Bata Shoe Company (Bangladesh) LTD in Present Competitive Market".Noyeem MahbubNoch keine Bewertungen

- Kenya Methodist University: Faculty of Business & Management StudiesDokument17 SeitenKenya Methodist University: Faculty of Business & Management StudiesAlice WairimuNoch keine Bewertungen

- Chapter 20 Interest Rate Risk: 1. ObjectivesDokument14 SeitenChapter 20 Interest Rate Risk: 1. Objectivessamuel_dwumfourNoch keine Bewertungen

- Solutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsDokument6 SeitenSolutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsBiloni KadakiaNoch keine Bewertungen

- BA 4722 Marketing Strategy SyllabusDokument6 SeitenBA 4722 Marketing Strategy SyllabusSri GunawanNoch keine Bewertungen

- GET Moldova PP 03 2012 enDokument20 SeitenGET Moldova PP 03 2012 enInna VirtosuNoch keine Bewertungen

- WUS RP SampleDokument37 SeitenWUS RP SamplejuzforkulainetNoch keine Bewertungen

- IAIP Student Research: Housing Developmen T Finance CorporationDokument24 SeitenIAIP Student Research: Housing Developmen T Finance Corporationreba_sNoch keine Bewertungen

- Chapter - 1: About Bata BangladeshDokument23 SeitenChapter - 1: About Bata BangladeshRasel SarderNoch keine Bewertungen

- SM Chapter 06Dokument42 SeitenSM Chapter 06mfawzi010Noch keine Bewertungen

- IPM Quize4 (A) Solution Spring 2013Dokument2 SeitenIPM Quize4 (A) Solution Spring 2013Euromina TheveninNoch keine Bewertungen

- Gilbreath Resume Drake UpdateDokument3 SeitenGilbreath Resume Drake UpdategilbrjlNoch keine Bewertungen

- Amity AssignmentDokument16 SeitenAmity AssignmentAnkita SrivastavNoch keine Bewertungen

- National Minorities Development & Finance Corporaiton: NMDFCDokument9 SeitenNational Minorities Development & Finance Corporaiton: NMDFCMunish KharbNoch keine Bewertungen

- International Finance 2021-22Dokument3 SeitenInternational Finance 2021-22NAITIK SHAHNoch keine Bewertungen

- ATTEMP ALL QUESTIONS: Circle Only The Correct AnswerDokument8 SeitenATTEMP ALL QUESTIONS: Circle Only The Correct AnswerPrince Tettey NyagorteyNoch keine Bewertungen

- Finance (MBA)Dokument106 SeitenFinance (MBA)Deepika KrishnaNoch keine Bewertungen

- Mutual Fund ProjectDokument77 SeitenMutual Fund ProjectamoghvkiniNoch keine Bewertungen

- Assignment 5 2020Dokument5 SeitenAssignment 5 2020林昀妤Noch keine Bewertungen

- FM11 CH 16 Mini-Case Cap Structure DecDokument11 SeitenFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNoch keine Bewertungen

- Kenya Methodist University: Faculty of Business & Management StudiesDokument15 SeitenKenya Methodist University: Faculty of Business & Management StudiesAlice WairimuNoch keine Bewertungen

- Contratos BursatilesDokument104 SeitenContratos BursatilesSaulo MogollónNoch keine Bewertungen

- Concept and Pakistan's Experience: PreludeDokument3 SeitenConcept and Pakistan's Experience: PreludeAyesha AhmadNoch keine Bewertungen

- Study of HDFC Mutual FundDokument75 SeitenStudy of HDFC Mutual FundJaiHanumankiNoch keine Bewertungen

- Module 06 Tute Ans Macro Concepts - 2014s1Dokument2 SeitenModule 06 Tute Ans Macro Concepts - 2014s1visha183240Noch keine Bewertungen

- Forex MGMT SFMDokument98 SeitenForex MGMT SFMsudhir.kochhar3530Noch keine Bewertungen

- 474 07 Exchange Rate DeterminationDokument15 Seiten474 07 Exchange Rate Determinationjordi92500Noch keine Bewertungen

- Derivatives ProjectDokument23 SeitenDerivatives ProjectChirag RankjaNoch keine Bewertungen

- Scan 0009Dokument7 SeitenScan 0009Patrice ScottNoch keine Bewertungen

- IB0018 - Export-Import Finance - Fall 2014Dokument3 SeitenIB0018 - Export-Import Finance - Fall 2014AdityaNoch keine Bewertungen

- Canbnk Final ReportDokument63 SeitenCanbnk Final ReportRaman DulaiNoch keine Bewertungen

- T3 ReviewDokument9 SeitenT3 Reviewbkamelas86Noch keine Bewertungen

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDokument55 SeitenMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienNoch keine Bewertungen

- Security Analysis and Portfolio ManagementDokument11 SeitenSecurity Analysis and Portfolio ManagementAhasan HabibNoch keine Bewertungen

- Services Quality Analysis in SBI and Axis Bank (Awadesh)Dokument58 SeitenServices Quality Analysis in SBI and Axis Bank (Awadesh)jaganath121Noch keine Bewertungen

- FRM Part - I Test PaperDokument11 SeitenFRM Part - I Test PaperKaran Chopra100% (3)

- Homework 1 - Due 10/3/2012: MBA 570xDokument4 SeitenHomework 1 - Due 10/3/2012: MBA 570xNicholas Reyner TjoegitoNoch keine Bewertungen

- A Profile of Union Bank With Special Reference To Various Loan Schem's in Chikmagalur CityDokument4 SeitenA Profile of Union Bank With Special Reference To Various Loan Schem's in Chikmagalur CitySudhakar P M StriverNoch keine Bewertungen

- Bio 1210 Nota Companie Tradeville 18349400Dokument3 SeitenBio 1210 Nota Companie Tradeville 18349400Oana-Maria RadoiNoch keine Bewertungen

- Financial AwarenessDokument31 SeitenFinancial AwarenessAshok KumarNoch keine Bewertungen

- ControlsDokument33 SeitenControlsmaneeshkNoch keine Bewertungen

- Should India Issue Sovereign BondsDokument7 SeitenShould India Issue Sovereign BondsMonu SharmaNoch keine Bewertungen

- Strategy PaperDokument87 SeitenStrategy PaperSandeep Kumar MauryaNoch keine Bewertungen

- Role of World Bank in Global TradeDokument38 SeitenRole of World Bank in Global TradeAbhayG91100% (3)

- International Financial MarketsDokument10 SeitenInternational Financial MarketsFurqan AhmedNoch keine Bewertungen

- NBG Format-20.11.13Dokument6 SeitenNBG Format-20.11.13Srinivas MaheshwariNoch keine Bewertungen

- Summary of Charles B. Carlson's The Little Book of Big DividendsVon EverandSummary of Charles B. Carlson's The Little Book of Big DividendsBewertung: 4 von 5 Sternen4/5 (1)

- Economic Effects of An AppreciationDokument11 SeitenEconomic Effects of An AppreciationIndeevari SenanayakeNoch keine Bewertungen

- A Handbook For The Viva Preparation For The Post of Assistant Director of Bangladesh BankDokument25 SeitenA Handbook For The Viva Preparation For The Post of Assistant Director of Bangladesh BankRakibul Islam Rakib100% (2)

- Coins and More - 14) Foreign Mints Which Have Minted Coins For India and Identification of Their Mint MarksDokument16 SeitenCoins and More - 14) Foreign Mints Which Have Minted Coins For India and Identification of Their Mint MarksSamir JhabakNoch keine Bewertungen

- International Entrepreneurship Starting Developing and Managing A Global Venture Null 3rd Edition Ebook PDFDokument62 SeitenInternational Entrepreneurship Starting Developing and Managing A Global Venture Null 3rd Edition Ebook PDFstanley.wilkes414100% (51)

- Memorandum of Law On Offer To Pay (July 5, 2013)Dokument15 SeitenMemorandum of Law On Offer To Pay (July 5, 2013)Keith Muhammad: Bey100% (7)

- Liebherr Tower Cranes Spec 40fcd9Dokument6 SeitenLiebherr Tower Cranes Spec 40fcd9Teresa Baquedano AraosNoch keine Bewertungen

- Kaupang Vol 2Dokument386 SeitenKaupang Vol 2adonisoinezpersonalNoch keine Bewertungen

- Falcon GC Full Brochure 2022 PDFDokument31 SeitenFalcon GC Full Brochure 2022 PDFuhasan1Noch keine Bewertungen

- Manual de Instruções - MD-4030Dokument13 SeitenManual de Instruções - MD-4030Johnny Barbosa Faustino78% (9)

- Forward Rates - July 26 2021Dokument2 SeitenForward Rates - July 26 2021Lisle Daverin BlythNoch keine Bewertungen

- Internship Report On Foreign Exchange and Foreign Trade Problems and ProspectsDokument107 SeitenInternship Report On Foreign Exchange and Foreign Trade Problems and ProspectsDurantoDxNoch keine Bewertungen

- RedemptionDokument27 SeitenRedemptionAkili74% (23)

- Crypto DorksDokument146 SeitenCrypto Dorksghhh huuNoch keine Bewertungen

- Group 7 - IFM ProjectDokument44 SeitenGroup 7 - IFM ProjectABHISEK BEHERANoch keine Bewertungen

- ACC 5116 - MODULE 3 - Lecture NotesDokument3 SeitenACC 5116 - MODULE 3 - Lecture NotesCarl Dhaniel Garcia SalenNoch keine Bewertungen

- Receipt ReportDokument34 SeitenReceipt ReportFiroz shaikNoch keine Bewertungen

- Annexure 3bank of IndiaDokument17 SeitenAnnexure 3bank of Indiayesh cyberNoch keine Bewertungen

- 06 Final Version of Angola Consolidated Template (JUNE-23) FKIA-FN-Form - 1Dokument46 Seiten06 Final Version of Angola Consolidated Template (JUNE-23) FKIA-FN-Form - 1Tainara CruzNoch keine Bewertungen

- Chapter 7Dokument26 SeitenChapter 7الزنبقة السوداءNoch keine Bewertungen

- International Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualDokument11 SeitenInternational Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualJenniferNelsonfnoz100% (38)

- Assignment 02:CHAPTER CENTRAL BANKDokument2 SeitenAssignment 02:CHAPTER CENTRAL BANKsadNoch keine Bewertungen

- Unit Money MattersDokument22 SeitenUnit Money MattersEmmaNoch keine Bewertungen

- 12 USC 95a PDFDokument25 Seiten12 USC 95a PDFfreetradezoneNoch keine Bewertungen

- Collectors Investments: South Africa Coin ListDokument5 SeitenCollectors Investments: South Africa Coin ListbelebelNoch keine Bewertungen

- The Encyclopedia of Roman Imperial CoinsDokument653 SeitenThe Encyclopedia of Roman Imperial CoinsDCLXVI93% (15)

- History of London Gold PoolDokument4 SeitenHistory of London Gold PoolGuy RazerNoch keine Bewertungen

- FCA - VX Trading Update Q3Dokument2 SeitenFCA - VX Trading Update Q3Kristi DuranNoch keine Bewertungen

- Dashboard 49Dokument330 SeitenDashboard 49Elder Angelo Ginú da SilvaNoch keine Bewertungen

- Gold StandardDokument13 SeitenGold Standardjyoti joonNoch keine Bewertungen

- Money and CreditDokument12 SeitenMoney and CreditthinkiitNoch keine Bewertungen