Beruflich Dokumente

Kultur Dokumente

FT Europe

Hochgeladen von

sonia87Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FT Europe

Hochgeladen von

sonia87Copyright:

Verfügbare Formate

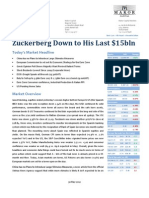

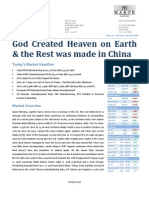

EUROPE Wednesday July 25 2012

Jul 24 prev %chg

S&P 500 1329.25 1350.52 1.57

Nasdaq Comp 2855.15 2890.15 1.21

Dow Jones Ind 12522.94 12721.46 1.56

FTSEurorst 300 1018.61 1024.27 0.55

Euro Stoxx 50 2151.54 2179.31 1.27

FTSE 100 5499.23 5533.87 0.63

FTSE All Share UK 2857.63 2873.37 0.55

CAC 40 3074.68 3101.53 0.87

Xetra Dax 6390.41 6419.33 0.45

Nikkei 8488.09 8508.32 0.24

Hang Seng 18903.2 19053.47 0.79

FTSE All World $ (u) 200.99

COMMODITIES

Jul 24 prev chg

Oil WTI $ Sep 88.50 88.14 0.36

Oil Brent $ Sep 103.42 103.26 0.16

Gold $ 1,577.40 1,584.75 7.35

price yield chg

US Gov 10 yr 103.16 1.40 0.03

UK Gov 10 yr 122.74 1.46 0.02

Ger Gov 10 yr 104.78 1.24 0.06

Jpn Gov 10 yr 100.56 0.74 0.01

US Gov 30 yr 111.16 2.47 0.04

Ger Gov 2 yr 100.12 0.06 0.01

Jul 24 prev chg

Fed Funds E 0.14 0.13 0.01

US 3mBills 0.10 0.10 0.01

Euro Libor 3m 0.31 0.32 0.01

UK 3m 0.76 0.76

Prices are latest for edition

Jul 24 prev

$ per 1.208 1.212

$ per 1.553 1.551

per 0.778 0.781

per $ 78.2 78.4

per 121.4 121.6

$ index 82.4 82.4

SFr per 1.201 1.201

Jul 24 prev

per $ 0.827 0.825

per $ 0.644 0.645

per 1.285 1.280

per 94.53 95.00

index 84.5 84.3

index 85.51 85.76

SFr per 1.543 1.537

STOCK MARKETS CURRENCIES INTEREST RATES

Google agrees outline deal with

EU to avoid long antitrust battle

By Alex Barker

in Brussels

Google has agreed the outlines

of a settlement with Europes

top competition authority, in a

deal that would spare the US

search giant from formal anti-

trust charges for allegedly abus-

ing its dominance.

In a big test for how Google

handles the mounting regula-

tory scrutiny it is facing world-

wide, the company offered to

make significant changes to its

business to avoid a lengthy EU

legal battle and the threat of

multibillion-dollar fines.

While the deal must still be

finalised, the talks have cleared

an important hurdle that could

save Google from the sort of

decade-long fight in Brussels

that dogged the likes of Micro-

soft and Intel.

The details of the concessions

are still unclear, but they

address four specific concerns

laid out publicly in an earlier

warning by the EU to Google.

The breakthrough came after

Google said it would in principle

extend the remedies it had

offered to make for PC-based

search to cover mobile search

services too. Joaqun Almunia,

the EUs competition commis-

sioner, made this a key demand

in the final days of talks, reflect-

ing the growing popularity of

smartphones.

Mr Almunia concluded that

Googles proposed concessions

were a sound basis for moving

to advanced talks on a pre-

charge settlement, people

involved in the talks said.

A two-year Brussels investiga-

tion had identified concerns

with the way Google favours its

own products in search results

and demotes potential competi-

tors, copies content from

rivals without permission, shuts

out competition with its adver-

tising agreements with other

websites and restricts advertis-

ers from moving online ad cam-

paigns to rival search engines.

The Google proposal covers all

of these areas. It is likely that

Brussels will keep open a sepa-

rate investigation into the

alleged dominance of Googles

Android mobile phone and tab-

let operating system.

The 20-strong group of compa-

nies that complained about

Google including Microsoft,

Expedia and TripAdvisor have

pushed Brussels to take tough

action against the internet

group and will probably make

their concerns clear if the reme-

dies are seen as cosmetic.

Google said it continued to

work co-operatively with the

commission. Mr Almunias

office declined to comment.

Google is still under investiga-

tion in the US, Korea and India.

Austria 3.50 Malta 3.30

Bahrain Din1.5 Mauritius MRu90

Belgium 3.50 Morocco Dh40

Bulgaria Lev7.50 Netherlands 3.50

Croatia Kn29 Nigeria Naira715

Cyprus 3.30 Norway NKr30

Czech Rep Kc120 Oman OR1.50

Denmark DKr30 Pakistan Rupee 130

Egypt E19 Poland Zl 16

Estonia 4.00 Portugal 3.50

Finland 3.80 Qatar QR15

France 3.50 Romania Ron17

Germany 3.50 Russia 5.00

Gibraltar 2.30 Saudi Arabia Rls15

Greece 3.50 Serbia NewD420

Hungary Ft880 Slovak Rep 3.50

India Rup85 Slovenia 3.50

Italy 3.50 South Africa R28

Jordan JD3.25 Spain 3.50

Kazakhstan US$5.20 Sweden SKr34

Kenya Kshs300 Switzerland SFr5.70

Kuwait KWD1.50 Syria US$4.74

Latvia Lats3.90 Tunisia Din6.50

Lebanon LBP7000 Turkey TL7.25

Lithuania Litas15 UAE Dh15.00

Luxembourg 3.50 Ukraine 5.00

Macedonia Den220

Cover Price

9 7 7 0 1 7 4 7 3 6 1 3 5

3 0

In print and online

Tel: +44 20 7775 6000

Fax: +44 20 7873 3428

email: fte.subs@ft.com

www.ft.com/subscribetoday

Subscribe now

THE FINANCIAL TIMES

LIMITED 2012 No: 37,988

Printed in London, Liverpool, Dublin,

Frankfurt, Brussels, Stockholm, Milan,

Madrid, New York, Chicago, San Francisco,

Dallas, Orlando, Washington DC,

Johannesburg, Tokyo, Hong Kong,

Singapore, Seoul, Abu Dhabi, Sydney

Small EU banks warn

on fallout from rules

Small European banks are

warning that EU rules aimed

at staving off crises at bigger

banks could wreak havoc on

their capital costs. Page 11

Spain fears rise

Spains economy minister

flew to Berlin for talks about

the eurozone crisis with his

German counterpart, as the

former Spanish central bank

governor warned of a

collapse in confidence.

Page 2; Editorial Comment,

Page 6; Martin Feldstein, Page 7;

Markets, Page 20;

www.ft.com/euro

Damascus squeezed

The conflict in Damascus has

tightened an already severe

economic squeeze on Syrias

capital, sending business

plummeting during the holy

month of Ramadan. Page 3;

www.ft.com/syria

Germany feels strain

Germanys private sector

shrank in July at the fastest

rate in more than three

years, supporting suggestions

that the eurozone was in

recession. Page 2

Online tax resisted

A move to make all online

retailers levy sales tax

continues to face resistance

from some lawmakers in the

US Congress even as it is

backed by Amazon. Page 4

UPS cuts outlook

Bellwether package-delivery

group UPS missed analysts

quarterly results estimates

and cut its 2012 profit

forecast, citing fears among

its customers that the US

economy is slowing. Page 11

D Bank misses goals

Deutsche Bank has revealed

a steep fall in quarterly

profits, missing market

expectations with its first

results reported under co-

chief executives Anshu Jain

and Jrgen Fitschen. Page 11

Taliban defections

Thirteen Afghan police

officers have defected to the

Taliban after poisoning seven

comrades, officials in Farah

province said. Page 4

China growth hopes

The manufacturing sector in

China is clawing its way

back towards growth, says a

survey that suggests policies

to support the economy are

starting to work. Page 2

Liberals fight back

A pro-Republican group of

fund managers is backing

efforts to legalise same-sex

marriage in four states that

will vote on the issue, as the

partys socially liberal donors

try to regain ground. Page 4;

David Frum, Page 7

4G auction nears

The airwaves needed for next

generation 4G mobile

broadband are set to be sold

in a multibillion-pound UK

auction at the end of the

year after long delays.

www.ft.com/uk; Lex, Page 10

Train deal expected

The largest and most

ambitious train procurement

programme undertaken in

the UK is expected to be

signed off this week after a

delay of more than three

years. www.ft.com/uk

Fingers crossed

London will have to rely on

luck to avoid serious transport

problems during the Olympics,

according to the man

overseeing the capitals

preparations for the

International Olympic

Committee. Gilbert Felli said

London was one of the most

difficult cities in the world to

hold the games, given its

narrow streets. We all cross

our fingers, Mr Felli said.

Report, Page 3

By Ben Fenton in London

Two former newspaper editors

in Rupert Murdochs media

empire were charged with

involvement in phone hacking

yesterday after prosecutors

decided there was enough evi-

dence to implicate them and six

others in a scandal that has

rocked the UK establishment.

The eight people charged with

a total of 19 offences include

Rebekah Brooks, former chief

executive of News International,

and Andy Coulson, a former edi-

tor of the News of the World

who also served as director of

communications for David Cam-

eron, UK prime minister.

It was the most significant

stage yet in a criminal investi-

gation that has been running for

18 months.

News Corp has so far paid out

at least $257m in legal fees and

settlements over the hacking

scandal, which led to the clo-

sure of the News of the World

and the resignation of Mrs

Brooks and other senior execu-

tives.

Prosecutors alleged that News

of the World journalists targeted

up to 600 people, including Milly

Dowler, a British teenager who

was murdered in 2002, Holly-

wood stars Brad Pitt and Ange-

lina Jolie, and Lord Prescott,

the former UK deputy prime

minister.

Mrs Brooks, Mr Coulson and

five other News of the World

executives were accused of con-

spiracy to hack phones under

the Regulation of Investigatory

Powers Act.

Stuart Kuttner, the News of

the Worlds former managing

editor, and former news editors

Ian Edmondson, Greg Miskiw,

Neville Thurlbeck and James

Weatherup, were also charged.

All seven also face a general

charge of conspiracy to hack

phones between October 2000

and August 2006 while Glenn

Mulcaire, a private detective

who worked for the News of the

World, was charged with con-

spiracy to hack the phones of

four individuals.

The defendants are all due to

appear before magistrates in

London on August 16. All deny

the charges.

Mrs Brooks, who is also a

close friend of the prime minis-

ter, was defiant. I am not

guilty of these charges, she

said in a statement. I did not

authorise, nor was I aware of,

phone hacking under my editor-

ship. I am distressed and angry

that [prosecutors] have reached

this decision when they knew

all the facts and were in a posi-

tion to stop the case at this

stage.

Mr Coulson said he was disap-

pointed by the decision to prose-

cute and would fight the allega-

tions in court.

The charges come 18 months

after Scotland Yard set up Oper-

ation Weeting to investigate

phone hacking involving the

News of the World. In announc-

ing the charges, Alison Levitt

QC, the principal leading

adviser to the Crown Prosecu-

tion Service, said she had

decided there was a realistic

prospect of conviction and it

was in the public interest to pro-

ceed.

www.ft.com/phonehacking

Hacking

charges for

Murdoch

lieutenants

UK prosecutors cite 19 charges in total

World Markets

World Business Newspaper

News Briefing

The camera maker that

didnt hear filmwas dead

Business Life, Page 8

Time for a radical Fed

Bernanke is too cautious. Sebastian Mallaby, Page 7

Rosneft

out to buy

stake in

TNK-BP

By Courtney Weaver and

Charles Clover in Moscow

State oil company Rosneft yes-

terday declared an interest in

acquiring oil major BPs 50 per

cent stake in TNK-BP, its

Russian joint venture, in a move

that pits the Kremlin against

some of the countrys most

powerful oligarchs.

Analysts estimate that BPs

stake is worth between $25bn

and $30bn. Rosneft has long

been understood to be interested

in it, but any move to acquire it

sets up a potential clash

between the state oil company

headed by Igor Sechin, an ally

of president Vladimir Putin, and

the AAR consortium of oli-

garchs, BPs current partners in

TNK-BP, who want to buy the

stake themselves.

Mr Sechin said Rosneft

considered TNK-BP an attrac-

tive commercial proposition.

AAR expressed formal

interest in BPs stake last week

and, given its aggressive record,

the group is unlikely to surren-

der without a legal battle.

AAR declined to comment on

Rosnefts announcement.

Valery Nesterov, an energy

analyst at Troika Dialog in Mos-

cow, said Rosnefts announce-

ment upped the stakes for the

AAR investors, forcing them to

potentially shell out more

money for BPs stake or risk

having Rosneft as a co-investor,

an undesirable scenario given

the two groups fraught history.

AAR butted heads with

Mr Sechin last year after it suc-

cessfully blocked a landmark

exploration deal that BP had

struck with Rosneft. For the

AAR shareholders its probably

the worst possible outcome to

be 50-50 partners with Rosneft,

Mr Nesterov said.

Rosneft could try to first buy

out BP and then AAR to obtain

control of TNK-BP, analysts

said. Rosneft would then gain

control of 40 per cent of Russias

oil production, according to

Renaissance Capital, the bank.

Lex, Page 10

Mayors march Protest by Italian officials

Mayors from Italys regions, wearing their tricolour sashes, protest in Rome yesterday against

the governments spending cuts Sicilian accord, Page 2 Bloomberg

2

FINANCIAL TIMES WEDNESDAY JULY 25 2012

FINANCIAL TIMES

Number One Southwark Bridge, London SE1 9HL

SUBSCRIPTIONS AND CUSTOMER

SERVICE:

Tel: +1 44 207 775 6000

fte.subs@ft.com

www.ft.com/subscribetoday

LETTERS TO THE EDITOR:

Fax: +44 20 7873 5938

letters.editor@ft.com

ADVERTISING:

Tel: +44 20 7873 3794

emeaads@ft.com

EXECUTIVE APPOINTMENTS:

Tel: +971 4299 754

www.exec-appointments.com

Published by: The Financial Times Limited, Number One Southwark Bridge, London SE1 9HL, United

Kingdom. Tel: +44 20 7873 3000; Fax: +44 20 7407 5700. Editor: Lionel Barber.

Printed by: (Belgium) BEA Printing sprl, 16 Rue de Bosquet, Nivelles 1400; (Germany) Dogan Media

Group, Hurriyet AS Branch Germany, An der Brucke 20-22, 64546 Morfelden - Walldorf; (Italy) Poligrafica

Europa, S.r.l, Villasanta (MB), Via Enrico Mattei 2, Ecocity - Building No.8. Milan; (South Africa) Caxton

Printers a division of CTP Limited, 16 Wright Street, Industria, Johannesburg; (Spain) Fabripress, C/ Zeus

12, Polgono Industrial Meco-R2, 28880 Meco, Madrid. (Sweden) Bold Printing Group/ Boras Tidning

Tryckeri AB, Odegardsgatan 2, S-504 94, Boras. (Abu Dhabi) United Printing & Publishing Company LLC,

Muroor Road, PO Box 39955, Abu Dhabi

France: Publishing Director, Adrian Clarke, 40 Rue La Boetie, 75008 Paris, Tel. +33 (0)1 5376 8250; Fax:

+33 (01) 5376 8253; Commission Paritaire N 0909 C 85347; ISSN 1148-2753. Germany: Responsible

Editor, Lionel Barber. Responsible for advertising content, Adrian Clarke. Italy: Owner, The Financial Times

Limited; Rappresentante e Direttore Responsabile in Italia: I.M.D.Srl-Marco Provasi - Via Guido da Velate 11-

20162 Milano Aut.Trib. Milano n. 296 del 08/05/08 - Poste Italiane SpA-Sped. in Abb.Post.DL. 353/2003

(conv. L. 27/02/2004-n.46) art. 1 comma 1, DCB Milano. Spain: Legal Deposit Number (Deposito Legal)

M-32596-1995; Publishing Director, Lionel Barber; Publishing Company, The Financial Times Limited,

registered office as above. Local Representative office; Castellana, 66, 28046, Madrid. ISSN 1135-8262.

Sweden: Responsible Publisher, Bradley Johnson; Telephone +46 414 20320. UAE: Publisher, Adrian

Clarke, Tel: +33 (0)1 5376 8250; origin of publication, twofour54, Free Zone, Abu Dhabi.

Copyright The Financial Times 2012. Reproduction of the contents of this newspaper in any manner is

not permitted without the publishers prior consent. Financial Times and FT are registered trade marks

of The Financial Times Limited.

The Financial Times adheres to the self-regulation regime overseen by the UKs Press Complaints

Commission. The PCC takes complaints about the editorial content of publications under the Editors Code

of Practice (www.pcc.org.uk). The FTs own code of practice is on www.ft.com/codeofpractice.

Reprints are available of any FT article with your company logo or contact details inserted if required

(minimum order 100 copies). Phone +44 20 7873 4871. For one-off copyright licences for reproduction

of FT articles phone +44 20 7873 4816. For both services, email syndication@ft.com

WORLD NEWS

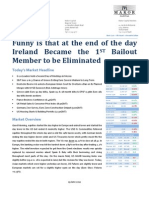

Without leaping to

premature judgments, it

seems unlikely just now

that the official response

to the eurozone crisis will

be held up as a model for

future governments to

follow.

The International

Monetary Funds role got

a blast of disdain last

week with the publication

of a resignation letter

from 20-year fund veteran

Peter Doyle, obtained by

CNN, accusing the

organisation of failing to

warn about the crisis

because of persistent pro-

European bias and

analytical risk aversion.

Not only did the IMF

fail to sound the alarm in

advance, but the renewed

turmoil in Spain and the

rising probability of a

full-blown bailout lend

urgency to the accusation

that the funds financial

involvement in the

rescues for Greece,

Ireland and Portugal have

hampered its ability to

speak frankly in public

about the eurozone since.

It would not be the first

time that the IMF has

suppressed disquiet about

countries whose rescue

programmes are

manifestly failing, the

most notorious example

being the funds

disastrous lending to

Argentina in the years

before that countrys 2001

sovereign debt default.

The IMFs reluctance to

be blamed for

precipitating a crisis

encourages it to keep the

money flowing even at

the cost of longer-term

damage to its legitimacy.

On top of that are the

conflicted interests among

IMF shareholder countries

that are political allies or

financial creditors of the

borrower government.

Following the 2001

Argentine default, for

example, a group of

shareholder governments

led by Spain, Italy and

France bounced the IMFs

management into

restarting lending to

Argentina, to the private

fury of some fund staff.

In theory there is a

clear organisational

differentiation between

IMF staff and

management including

the managing director,

currently Christine

Lagarde on one side,

and the funds executive

board of its shareholder

countries on the other. In

practice, a culture of

consensus often seeps

across the divide. Most

board votes are

unanimous, and

management will not

propose a course of action

without knowing in

advance that the board

will support it. Thus the

analysis of the entire

institution can be pushed

towards playing it safe.

In the case of the

eurozone, the potential for

institutional over-

optimism is even higher,

and not just because the

IMF board is dominated

by Europeans. The fund

is a junior financing

partner in the eurozone

rescues, and pulling the

plug would incur the

wrath of its fellow

troika members the

EU and the European

Central Bank as well as

the borrower country.

True, the IMF did begin

last year to throw its

weight around more in

the Greek rescue,

insisting on more realistic

growth forecasts and

pushing for more EU

rescue money and/or a

deeper writedown for

private creditors. But

overall it is hard to

dissent from Mr Doyles

conclusion that the

second global reserve

currency is on the brink,

and that the fund for the

past two years has been

playing catch-up and

reactive roles in the last-

ditch efforts to save it.

Spain is a good

opportunity for the IMF

to find a new calling in

Europes crisis, one

involving handing out

fewer financial sweeteners

to governments and more

unpalatable truths about

banks. Given that the

eurozone as a whole has

no external financing

constraint and does not

need foreign currency, it

was always debatable

whether it needed the

funds money at all. Like

Ireland, Spain principally

has a banking problem,

not a sovereign debt

problem, and needs

money directly to

recapitalise its banks, for

which IMF resources

cannot be used.

One of the IMFs

moderate recent successes

in speaking up involved

its warning last autumn

that Europes banks would

need a lot more capital.

At present, the

eurozone needs outside

money much less than it

needs an organisation

with technical

competence and an ability

to point out unpleasant

realities. If Spain asks for

a full-blown international

bailout, the IMF should

be very wary of joining a

rescue in which its

private misgivings have

to be suppressed for the

sake of public unity.

IMF must use

voice to deliver

harsh truths on

eurozone woes

Spain is a good

opportunity for

the IMF to find a

new calling in

Europe

GLOBAL INSIGHT

Alan Beattie

in Washington

By Miles Johnson in Madrid,

Quentin Peel in Berlin and

Peter Spiegel in Brussels

Luis de Guindos, Spains

economy minister, flew to

Berlin yesterday for talks

with Wolfgang Schuble,

his German counterpart, on

the eurozone crisis, as the

former governor of the

Spanish central bank

warned of a collapse in

confidence in the markets.

Officials in both Berlin

and Madrid cautioned that

the talks were to provide a

general exchange of

views on the current situa-

tion, rather than agree any

new initiatives to tackle the

crisis. They insisted that

the meeting had been

planned since before the

sharp sell-off of Spanish

debt at the end of last week.

Yet the talks took place

against a background of ris-

ing tension in the eurozone

markets, with Spain paying

its second highest interest

rate on short-term debt

since the euro was

launched, and Italy facing

its highest yield gap against

German benchmark bonds

over 530 basis points since

Mario Monti became prime

minister last November.

At the same time German

bunds sank, with yields

pushing up from near

record lows on Monday,

after Moodys, the rating

agency cut the outlook on

Germanys triple A credit

status to negative.

In Greece, troika offi-

cials from the International

Monetary Fund, the Euro-

pean Commission and the

European Central Bank

arrived in Athens to inspect

how far the Greek govern-

ment has fallen behind on

targets agreed as part of its

rescue programme. Worries

in Germany about a big

new financing gap emerg-

ing in Athens prompted

leading figures in all three

parties in the coalition gov-

ernment headed by Angela

Merkel, chancellor, to reject

any suggestion of a third

rescue programme winning

approval in Germanys par-

liament later in the year.

In Madrid, the govern-

ment faced a furious

onslaught from Miguel

ngel Fernndez Ordez,

former central bank gover-

nor, in the Spanish parlia-

ment. In the first half of

the year we have witnessed

a collapse in confidence in

Spain, he said. Now we

are not only worse than

Italy, but worse than Ire-

land, a country that has

been rescued.

Mr de Guindos was due to

have dinner with Mr Schu-

ble in Berlin before flying

on to Paris for talks with

Pierre Moscovici, French

finance minister, today. He

was expected to spell out

more details of Spains

65bn austerity programme,

and how it will implement

the 100bn bank rescue.

But in Brussels, Spanish

officials further muddied

the waters by releasing a

statement that was sup-

posed to have been agreed

with France and Italy, call-

ing for quicker implementa-

tion of short-term rescue

measures agreed at last

months European summit.

Additional reporting by

Guy Dinmore in Rome

Editorial Comment, Page 6

Comment, Page 7

Berlin hosts talks on Spain crisis

De Guindos reveals

austerity plan details

Borrowing costs

also rise for Italy

By James Wilson

in Frankfurt

Germanys private sector

shrank in July at the fastest

rate in more than three

years, according to a survey

that underscored the spread

of the eurozone crisis to the

blocs strongest economies

and cemented the likelihood

that the region has slipped

into recession.

A eurozone index of pur-

chasing managers showed

activity across the regions

private sector contracting

for a sixth successive

month. Markit, compiler of

the survey, said its prelimi-

nary data suggested the eu-

rozone downturn showed

no sign of letting up at the

start of the third quarter.

The downturn in activity

in Germany, the largest

economy in the eurozone,

was sharper than expected,

after the Bundesbank, the

German central bank, said

on Monday that the country

was likely to have grown

moderately in the second

quarter.

Howard Archer, of IHS

Global Insight, said Ger-

many was being increas-

ingly dragged down by the

problems elsewhere in the

eurozone and slowing glo-

bal economic activity.

Germanys relative eco-

nomic vigour helped the

eurozone avoid a fall in

gross domestic product in

the first quarter of the year.

Official data for the second

quarter are due next

month. The surveys rein-

force suspicion that the

eurozone is headed for fur-

ther clear GDP contraction

in the third quarter after a

highly probable drop in the

second quarter, Mr Archer

said. He said the data sug-

gested the European Cen-

tral Bank might again have

to cut interest rates.

This month the ECB

made a quarter-point cut in

its main policy rate, bring-

ing the rate to a historic

low of 0.75 per cent.

Evelyn Herrmann, Euro-

pean economist at BNP

Paribas, said: The German

economy as a whole turns

out to be much less resil-

ient to the contraction and

stress elsewhere in the

eurozone than survey indi-

cators had suggested over

the past year.

French output also fell,

although activity in the

services sector rose margin-

ally for the first time since

March. Chris Williamson,

chief economist at Markit,

said this was likely to be

due to a post-election set-

tling down of business and

could prove temporary.

Data in the eurozone

index are consistent with

GDP falling at a quarterly

rate of around 0.6 per cent,

which is similar to the rate

of decline we expect to see

for the second quarter, Mr

Williamson said.

The composite eurozone

purchasing managers index

across manufacturing and

services was unchanged

at 46.4, according to prelimi-

nary estimates, where a

reading below 50 signals a

contraction. Germanys

composite PMI fell from 48.1

to 47.3, with manufacturing

even weaker at 43.3, mark-

edly worse than analysts

had expected.

German private sector data signal regional recession

Index of purchasing

managers gloomy

Manufacturing survey raises hopes on China growth

Chinas manufacturing

sector is clawing its way

back towards growth in July,

according to a survey that

suggests policies to support

the economy are starting to

work, writes Simon

Rabinovitch in Beijing.

HSBC said its purchasing

managers index for July

was on track to rise from

48.2 last month to 49.5,

which would mark a five-

month high. But, in

remaining below the 50

threshold, the flash PMI

figure the earliest piece of

monthly economic data for

China indicates that

factory activity is still

contracting at a mild pace.

Earlier easing measures

are starting to work, said

Qu Hongbin, head of Asian

research at HSBC. That

said, the below-50 July

reading implied demand still

remaining weak and

employment under

increasing pressure. This

calls for more efforts to

support growth and jobs.

The Chinese economy

grew 7.6 per cent in the

first half of the year, its

slowest since early 2009 at

the peak of the global

financial crisis. The

government has tried to

arrest the slowdown by

spending more and easing

monetary policy. Many

analysts believe these

measures will help the

economy towards a recovery

in the second half.

Yet investors remain

sceptical about how strong

the recovery will be. The

countrys benchmark stock

index, the Shanghai

Composite Index, has been

on a three-month slide,

bringing it close to its

lowest level in three years.

Although shifting its policy

footing to a pro-growth

stance, the government has

been reluctant to deploy a

large-scale stimulus as it did

in late 2008. The critical

factor in restraining its

response has been relative

stability in the labour

market.

But while showing

improvement on most

fronts, the HSBC PMI

pointed to a deterioration in

the jobs market, with its

employment sub-index

declining. A rise in

unemployment would put

pressure on the government

to do more to shore up

growth.

This weeks relentless rise

in the amount Spain must

pay to borrow money in the

markets has once again

raised questions about

whether Madrid will

quickly need a full-scale

bailout from its EU part-

ners.

But senior officials say no

such plan is in the offing

and several key European

decision makers have

already left for the summer

holiday, with no immediate

plans to return.

The reason for such inac-

tion is both practical and

political, according to offi-

cials involved. On the politi-

cal front, finance ministers

agreed last week to a

100bn bank bailout plan

that will not be fully imple-

mented until September,

when individual banks are

identified for rescue and,

potentially, liquidation.

Many officials believe it

would be wrong to redraft

the rescue plan before it

has had a chance to work.

If you give Spain a full

bailout, the markets know

they can force policy mak-

ers to do it in Italy, said

one person briefed on the

deliberations.

Practically, there are

even more troubling hur-

dles to an immediate res-

cue. The most obvious is a

lack of available funds.

Eurozone leaders planned

that a new 500bn rescue

fund would be in place this

month, but difficulties in

Germany where the con-

stitutional court will not

decide until September

whether the new fund is

legal has delayed its

implementation.

As a result, any potential

rescue would have to be

mounted by the eurozones

current 440bn fund, the

European Financial Stabil-

ity Facility, which is get-

ting close to depletion. Add

the planned 100bn for

Spanish banks to existing

Greek, Irish and Portuguese

bailouts and the fund has

only about 150bn left

hardly enough to meet

Madrids borrowing needs

over the next three years,

which most analysts esti-

mate at more than twice

that.

Short of a full-scale bail-

out, leaders have limited

options. The most obvious

would be to use the EFSF to

buy Spanish sovereign

bonds, a limited influx of

cash that analysts believe

would calm markets.

Although Angela Merkel,

the German chancellor, and

Italian premier Mario Monti

have disagreed over the

conditions that would be

attached to such bond

assistance, there are signs

Madrid may be heading in

that direction.

To qualify, Spain must

have a strategy in place to

bring its debt and deficit

levels back to EU limits a

plan Mariano Rajoy, Span-

ish prime minister,

unveiled two weeks ago.

Given the cap on EFSF

funds available, its effec-

tiveness could be limited,

since markets would know

such purchases could not be

sustained indefinitely.

But Mujtaba Rahman, an

analyst at Eurasia Group, a

risk consultancy, said EFSF

bond buying could free the

European Central Bank up

to restart its own dormant

bond purchase programme,

giving the eurozone the

big bazooka it has long

sought. If market stress

continues, Merkel and

Monti will pressure Rajoy

to request the EFSF [bond

programme] help to calm

things down. Such a move

could also provide cover for

ECB bond-buying if its

losses are guaranteed.

Short of such ECB action,

leaders may be forced to

revisit last months summit,

where markets were briefly

heartened by an agreement

to eventually move aid to

Spanish banks off Madrids

national debt books. But

the timeline for such a

move was called into doubt.

Last month, senior offi-

cials considered short-

circuiting the process by

getting the Spanish govern-

ment to pass legislation

handing over its bank

supervision to the ECB.

German officials signalled

their readiness to allow the

EFSF to inject funds

directly into Spanish banks

under the scenario, since it

would allow them to imme-

diately have more control

over the financial institu-

tions. But officials said the

plan was rejected by Mario

Draghi, ECB president, who

said the central bank was

not yet prepared to take

over such responsibilities.

Officials have not yet

indicated the plan is back

on the table. But with a tur-

bulent summer on the hori-

zon, it could quickly move

back into the debate.

Policy makers

patient despite

Spanish pain

News analysis

Officials see political

and practical

reasons for inaction

as talk grows of a

full-scale bailout,

writes Peter Spiegel

The Spanish flag on display outside the European parliament in Brussels. Madrid is to get 100bn for a bank bailout AFP

HSBC PMI data point to a

decline in the jobs market

ECB resists Madrids plea for help

Spains insistence that the

European Central Bank can

stop the dangerous spike in

its borrowing costs is

unlikely for now to

bring a policy response from

the central bank, where the

line has long been that it

should not be expected to

bail out troubled

governments, write James

Wilson, Robin Wigglesworth

and Claire Jones.

As the guardian of the

euro, though, the ECB may

ultimately have to blink if

market pressure mounts to

the point of endangering the

single currency area.

Safeguarding the euro is

part of our mandate, said

Mario Draghi, the ECB

president, in an interview

with Le Monde at the

weekend, even as he

rejected the idea that the

bank could resolve nations

financial problems.

Madrid would like the ECB

to resume its large-scale

buying up of government

bonds on secondary

markets, a tool to drive

down the yields on the

bonds and hence Spains

borrowing costs.

But bond-buying the

so-called securities market

programme that began in

2010 is now a last resort

for the ECB, which has

spent more than 210bn on

such purchases without

arresting the crisis. The

programme has been frozen

since early this year and the

central banks view is that

any bond-buying could and

should be done by the

bailout funds that eurozone

leaders called into being to

support troubled countries.

Ken Wattret, chief

eurozone market economist

at BNP Paribas, said: Not

so long ago, with yields at

these kind of levels I would

have assumed that the ECB

would have reactivated the

SMP. But you now have an

alternative. The use of the

EFSF [an EU rescue fund] is

more plausible now.

What else could the ECB

offer? More than 1tn in

long-term loans to the

banking sector helped ease

a credit crunch in the

eurozone six months ago.

However, Erik Nielsen, chief

economist at UniCredit, said

the ECB was unlikely to see

more long-term loans to

banks as the answer to the

recent spike in sovereign

borrowing costs.

My feeling is that first

they will be putting

enormous pressure on Spain

to accept a full bailout with

IMF and EU resources that

will take them out of the

markets, Mr Nielsen said.

210bn

Sum spent buying bonds

without arresting the crisis

Sicilian accord

Italy has imposed a

binding recovery plan on

Sicily in a move to pre-

empt the threat of a string

of defaults by over-

spending local authorities,

writes Guy Dinmore in

Rome. The deal, negotiated

yesterday between Mario

Monti, prime minister, and

Raffaele Lombardo, Sicilys

governor, effectively

imposes bailout conditions

on the island just as the

European Commission and

its international partners

have done with Greece.

In full, www.ft.com/europe

FINANCIAL TIMES WEDNESDAY JULY 25 2012

3

WORLD NEWS

The conflict across Damascus has

tightened an already severe economic

squeeze on the Syrian capital, shaking

a key supply route, trapping workers

at home and sending business plum-

meting during the Muslim holy month

of Ramadan.

Fuel queues have snaked through

the city this week and shops have

been shuttered, as violence disrupted

traffic and supplies on the main road

linking the capital to the other key

cities of Homs, Hama and Aleppo.

After a week of the heaviest clashes

seen in Damascus and Aleppo, the

biggest city and a crucial commercial

centre, Syrians in the capital are

braced for the fighting to tighten the

economic pressure already exerted by

international sanctions and plunging

output.

It is out of control, said one pro-

regime businessman, in a sign of the

heat being felt by a merchant class

long loyal to the regime. This is their

[rebel fighters] main target: to cause

chaos in the country.

Shelling by President Bashar al-As-

sads forces and battles with opposi-

tion gunmen have laid waste to some

areas of Damascus and had an impact

far beyond the conflict zones. While

some areas are reasonably busy,

streets are near-deserted in some dis-

tricts and much quieter than normal

in others especially at night, when

the city centre is pocked with check-

points manned by the army and gov-

ernment militiamen.

Queues at gas stations have become

commonplace, testing the already

frayed nerves of Damascenes scared

about the way the conflict that has

engulfed the rest of the country for 16

months has finally arrived on their

doorstep.

Dozens of cars blocked two of the

three road lanes outside a station in

the sprawling Mezzeh district, where

only two of the eight pumps were

operating and one of the workers said

they were short of both petrol and

staff. Nearby, blue gas cylinders lined

the pavements edge and women in

black abayas shaded themselves with

bits of cardboard, as they awaited a

delivery of the canisters many Syrians

use for cooking. One young woman in

the petrol queue said she was angry at

the situation, as she had had to leave

her sick father at home to trawl round

four gas stations looking for fuel.

Another onlooker blamed Mr Assads

regime for the problems. They are

thieves who fill their pockets, he

said. He is going to fall.

The government this week blamed

the petrol shortage on an unspecified

logistical problem that it said would

be solved soon.

One reason for disruption to sup-

plies of fuel and other goods, residents

and analysts say, is the increasing

violence around the main road

leading to the cities to the north

and the countrys sliver of coast in

the north-west. Earlier this week, a

burnt-out tanker straddled the central

reservation of the highway on the

outskirts of Damascus, an apparent

casualty of attacks that residents of

the capital say are becoming increas-

ingly frequent in the area near the

citys rebellious north-eastern sub-

urbs.

On Monday, unidentified gunman

opened fire on a company workers

bus on that section of road, killing

two men and critically injuring sev-

eral others, according to executives of

the business, who asked for it not to

be identified.

David Butter, an economic analyst

and former head of Middle East

research at the Economist Intelli-

gence Unit, said there were reports

that the lack of state security on high-

ways had triggered the creation of a

small industry for black market

operators filling up canisters from

tankers along the side of the road.

While the critical Damascus-Beirut

highway remains open, people in

Aleppo say fighting in the surround-

ing countryside has severely dis-

rupted to roads north to Turkey,

south to Hama and west to the coast.

In the centre of Damascus, the

fighting has left many businesses

short-staffed, as employees whose

commute goes through or near con-

flict zones stay at home.

While the government bombard-

ment of rebel-held areas has driven

thousands from their homes, many

also sleep at friends or relatives

houses to avoid potentially risky

journeys at night. At the Dama

Rose hotel, one woman explained

the reason for her overnight stay

in two words: hot zone, the term

many Syrian use to describe conflict

areas.

The ripple effect of the clashes has

also killed commerce in many areas

that would expect to be extra lively

during Ramadan, when Muslims tradi-

tionally cook big feasts to break their

fast and lead vigorous nocturnal

social lives.

In Damascuss old city, a butcher

named Adnan lamented that hed had

only five customers by late afternoon

on the first day of Ramadan, com-

pared with the hundreds he would

expect during peacetime. Usually I

dont have time to serve all the peo-

ple, he said. So I can say people are

afraid.

A rumoured bread shortage over the

weekend led to big queues at bakeries,

a spending cap per customer and a

brief black market that led one

Damascene to pay 100 pounds for a

packet costing 15 at the counter. The

situation seemed back to normal yes-

terday but, with most Damascenes

expecting the fighting to continue, no

one is ruling out a repeat.

Conf lict tightens squeeze on Syrian economy

Damascus

Fighting has disrupted

traffic and supplies on the

main road linking the

capital to other key cities,

write Michael Peel and

Abigail Fielding-Smith

Main picture:

Syrian rebels hunt

for snipers in

Selehattin, near

Aleppo. Top right:

an image from

amateur video

showing a Syrian

tank on fire in

Aleppo. Right: an

image released by

SNN purports to

show damage

after shelling in

the al-Qadam

district of

Damascus AFP; AP

ONLINE

Latest news plus

comment and

analysis on the

Syria conflict

www.ft.com/

syria

Clinton sees rebel havens as vital footholds in ascent to power

Syrian rebels are making

territorial gains that will

eventually become havens

and provide a base for

further operations against

government forces, Hillary

Clinton, the US secretary of

state, has said, write FT

Reporters and Reuters.

We have to work closely

with the opposition, because

more and more territory is

being taken and it will

eventually result in a safe

haven inside Syria that will

then provide a base for

further actions by the

opposition, Mrs Clinton said

in Washington yesterday.

She said that despite

opposition gains, it was not

too late for President Bashar

al-Assad of Syria to begin

planning for political change.

We do believe that it is not

too late for the Assad

regime to commence with

planning for a transition, to

find a way that ends the

violence by beginning the

kind of serious discussions

that have not occurred to

date, she said.

It was also important for

Syrias armed opposition to

make clear that it was

fighting for all Syrians and

not to seek reprisals that

could lead to more violence,

Mrs Clinton said.

Fierce fighting continued

yesterday for a fourth day in

Syrias commercial capital

Aleppo, as international

condemnation mounted over

the regimes threat to use

chemical and biological

weapons. The state news

agency said government

forces fought with rebels in

the districts of Salaheddine

and Sukkari and inflicted

heavy losses.

The Britain-based Syria

Observatory reported heavy

fighting after midnight in

several districts, as well as

shelling by regime forces.

Some areas saw protests

calling for the governments

fall early in the morning.

Rebels announced at the

weekend that they intended

to liberate Aleppo, but

regime forces appeared to

have reasserted control over

Damascus after a week of

fighting.

Laurent Fabius, the French

foreign minister, echoed

western leaders anger at

the prospect that Syrias

government might use

chemical weapons. Any use

of chemical arms is

completely unacceptable . . .

These weapons are under

strict surveillance by the

international community, he

told France 2 television.

Mr Fabius also said the

Arab Leagues offer of a

safe exit would not save Mr

Assad from punishment.

Israels army chief warned

that direct intervention in

the conflict for example,

to destroy the stockpile of

chemical weapons could

drag Israel into a wider

conflict than planned.

Speaking to a parliamentary

committee, Lieutenant

General Benny Gantz

appeared keen to damp

speculation over a possible

Israeli air strike on Syrian

military sites to prevent

advanced weapons from

reaching militant groups.

By Roger Blitz and

Vanessa Kortekaas

London will have to rely on

luck to avoid serious trans-

port problems during the

Olympics, the man oversee-

ing the capitals prepara-

tions for the International

Olympic Committee has

warned.

As transport and security

shortcomings continue to

tax organisers in the run-up

to Fridays opening cere-

mony, Gilbert Felli, the

IOCs executive director,

said the UK capital was

one of the most difficult

cities in the world to host

an Olympics, because of its

narrow streets.

We all cross our fin-

gers, Mr Felli told the FT.

Its not going to be easy.

The organisers had done

what they had to do, add-

ing: Now we need to make

sure we have a bit of luck.

Games competition

begins today with a

womens football match in

Cardiff, against a backdrop

of last-minute security and

transport concerns.

David Cameron, prime

minister, yesterday ordered

the deployment of a further

1,200 troops to protect ven-

ues to add to the 17,000

already billeted the latest

acknowledgment of the fail-

ure of private security com-

pany G4S to deliver enough

guards. Paul Deighton,

chief executive of the Lon-

don organising committee

[Locog], said the decision to

call up the additional troops

was not a reflection of fur-

ther problems arising with

G4S, but rather an effort to

be prepared.

You cant be absolutely

certain about anything with

a temporary workforce, he

said, referring to the pool of

workers from which G4S

Olympic security personnel

is being recruited.

It was a big disappoint-

ment so close to the games

that G4S had failed to pro-

vide the 10,400 guards it

was contracted by Locog to

supply, he said. The com-

pany is now expected to

deliver 7,000 venue guards.

A big test of Londons

capacity to cope comes

today when the games

lanes, reserved for athletes,

officials, sponsors and the

media, come into force.

Londons creaking trans-

port system has already

come under strain this

week. Malfunctions on the

Tube and rail networks

caused delays on Monday

evening as 40,000 people

descended on the Olympic

stadium in Stratford for a

rehearsal for the opening

ceremony. These included a

track failure on the Central

line, one of the key Under-

ground lines serving the

Olympic Park.

Ministers sought to play

down the problems. Things

do go wrong, said Justine

Greening, transport secre-

tary, noting that other lines

serving the park had

worked normally.

Peter Hendy, Londons

transport commissioner,

said the system was able to

cope with parts of the net-

work being out of action.

Theres a huge amount of

redundancy in the system,

he said.

He and Boris Johnson,

London mayor, have con-

sistently warned London

commuters to avoid central

London during the games.

The mayor told the FT he

was absolutely confident

the transport network

would cope well.

But Mr Johnson added:

There may be times when

people will experience

delays, congestion. There

may be moments when

youd be well advised to go

and have a beer and wait

for the situation to ease off

a bit. Ms Greening urged

Olympic sponsors to use the

public transport network to

get to the games, instead of

chauffeur-driven cars.

Notebook, Page 6

Follow the games on:

www.ft.com/olympics

London needs a bit of luck to avoid

transport problems during Olympics

A big test of Londons capacity to cope comes today when

the games lanes come into force Reuters

4

FINANCIAL TIMES WEDNESDAY JULY 25 2012

WORLD NEWS

Republican challenger

Mitt Romney accused the

Obama administration yes-

terday of leaking informa-

tion for political gain

about the raid that killed

Osama bin Laden.

Describing the behav-

iour as contemptible, Mr

Romney used a foreign

policy address to claim

that the White House was

endangering national secu-

rity with selective leaks

and to call for a full inves-

tigation.

Mr Romneys speech to a

conference of Veterans of

Foreign Wars in Reno was

billed as the start of a

week when Mr Romney

would flesh out his foreign

policy ideas, including

during visits to the UK,

Israel and Poland.

Instead, Mr Romneys

main point of political

attack in his speech was

over the alleged leak of

information to the media

about incidents such as

the bin Laden killing and

the Stuxnet computer

virus that damaged Irans

nuclear programme.

The Romney campaign

leapt on comments on

Monday by Senator

Dianne Feinstein, the

Democrat who heads the

Senate intelligence com-

mittee. Asked about the

spate of recent leaks, she

said: I think the White

House has to understand

that some of this is com-

ing from their ranks.

The bin Laden raid has

become a particularly

important issue in the

election because it has

helped insulate the Obama

campaign against the tra-

ditional Republican charge

that Democrats are weak

on foreign policy and

defence issues.

The White House has

denied it was behind any

of the leaks.

Geoff Dyer, Washington

Romney calls for probe

into bin Laden death leaks

National security

Lee Myung-bak, the South

Korean president, has

apologised to the public

after his brother was

arrested in a graft inquiry.

The president delivered

the apology two weeks

after Lee Sang-deuk, his

76-year-old elder brother

and close political ally,

was arrested over allega-

tions which he denies

that he had accepted

$500,000 from two bank

chairmen seeking political

influence.

Mr Lee, who is entering

the final months of his

presidency, yesterday

expressed pride in

myself over his efforts to

crack down on political

corruption, but that said

recent events had caused

him embarrassment.

I started off with my

very own belief that I

would be involved in clean

politics, Mr Lee said.

However, my whole

world seemed to be col-

lapsing as disappointing

and regrettable incidents

occurred to people closest

to me. I can barely hold

my head up with embar-

rassment and sorrow.

South Korean prosecu-

tors are investigating

whether any of the money

allegedly received by his

brother had been used to

fund Mr Lees 2007 election

campaign.

A spokesman for the

president said he did not

want to respond to this

suggestion to avoid influ-

encing the investigation.

One person close to Mr

Lee said the apology was

intended to make clear

his sincerity to the

Korean people.

The person added that

the presidents statement

that the scandal was all

my fault should not be

seen as any kind of admis-

sion of guilt.

Simon Mundy, Seoul

Lee apologises for brother

over corruption scandal

South Korea

Ghanas president, John

Atta Mills, died in hospital

in Accra yesterday, aged

68.

Mr Mills had been suffer-

ing from throat cancer,

but his death was unex-

pected. The presidents

office said he died a few

hours after being taken ill.

It is with a heavy

heart . . . that we announce

the sudden and untimely

death of the president of

the Republic of Ghana,

his office said in a state-

ment.

Mr Mills, who had cele-

brated his 68th birthday

on Saturday, won a closely

fought election in late

2008, and was due to run

for a second term in

December. Rumours about

his health have circulated

in Ghana in recent

months.

Under his watch, Ghana

commenced oil production,

and the economy is grow-

ing strongly. The country

has seen two peaceful

changes of power in the

past 12 years, something

rare on the continent.

Mr Mills had medical

checks in the US last

month. A presidential aide

told Reuters that Mr Mills

had complained of pain on

Monday evening, and died

on Tuesday afternoon

after being taken to hospi-

tal.

An academic before

entering politics, Mr Mills

ran unsuccessfully for the

presidency in 2000 and

2004. Last year he was cho-

sen as the National Demo-

cratic Congresss candi-

date for the 2012 poll after

fending off a challenge

from Nana Konadu Agye-

mang-Rawlings, wife of

former military ruler and

president Jerry Rawlings,

who founded the party.

Xan Rice, Lagos

Ghana president dies just

hours after being taken ill

John Atta Mills

Mohamed Morsi, Egypts

Islamist president, has

asked Hisham Kandil, the

little-known irrigation

minister, to form a new

government.

His administration will

have to navigate serious

economic challenges after

months of instability and

protests.

The appointment of Mr

Kandil, who earned his

masters degree and doc-

torate from the University

of Carolina in the US and

who is unknown outside

his field of managing

water resources, puts an

end to weeks of conjecture

and leaks on the identity

of the new prime minister.

There had been specula-

tion that a high-profile

finance or economics spe-

cialist would be chosen to

head the government, to

help Egypt put its econ-

omy on a sounder footing

and boost the credibility of

the cabinet among

domestic and international

investors.

The benchmark EGX30

index of the Egyptian

stock exchange fell 1 per

cent after the announce-

ment. Egypt is hoping to

secure a $3.2bn loan from

the International Mone-

tary Fund once it has a

government in office that

can commit itself to a

programme of economic

reform.

Heba Saleh, Cairo

Egypts irrigation minister

named as next premier

Hisham Kandil

Hisham Kandil: serious

economic challenges

By Matthew Garrahan

in Los Angeles

A group of wealthy pro-

Republican hedge fund

managers is backing efforts

to legalise same-sex mar-

riage in four US states that

will vote on the issue in

November, as the partys

more socially liberal donors

try to regain ground ceded

to social conservatives.

The campaign to win

same-sex ballots in Maine,

Maryland, Minnesota and

Washington has received

financial support from Paul

Singer, the hedge fund bil-

lionaire who is one of the

partys biggest donors, and

Cliff Asness, the founder of

AQR Capital Management.

Dan Loeb, the activist

investor who recently

shook up the management

of Yahoo and Seth Klar-

man, the founder of

Baupost, the private equity

group, are also backing the

campaign. The four men

have donated money to

Freedom to Marry, a non-

profit group that aims to

legalise same-sex marriage,

and have also contributed

to American Unity, a super-

political action committee

started by Mr Singer which

will give financial support

to Republican congressional

candidates that back mar-

riage equality.

Ken Mehlman, the head

of public affairs at KKR, the

private equity group and

the former chairman of the

Republican National Com-

mittee is also backing the

same-sex marriage cam-

paign.

Supporting the right of

adults to marry the person

that they love is consistent

with Republican and con-

servative principles, Mr

Mehlman told the Financial

Times. With recent poll

data showing a surge in

support for same-sex mar-

riage, the Republican party

needed to stay relevant

with voters, he added. A

party that ignores reality

and demographic change is

a party that loses a lot of

elections and becomes less

relevant.

Republ i can- control l ed

state governments have

been more vocal in their

opposition to legalising

same-sex marriage than

those controlled by Demo-

crats. But there are signs

this is changing: last year,

the Republican-controlled

state legislature in New

York legalised same-sex

marriage. Mr Singer he

has a gay son Steven

Cohen, the billionaire hedge

fund manager, and Mr

Asness were among the

Republican donors that

backed the New York cam-

paign.

I dont think were going

to suddenly convince the

socially conservative wing

of the party to agree with

us, said Mr Asness. But

offering financial support to

candidates who are pro-

same-sex marriage will

give support and lend some

courage to those in the

party who are in the middle

on the issue.

Same-sex marriage is a

cross-party issue, added Mr

Loeb. We want to see free-

dom for everyone and as a

means to get there we want

to give Republican legisla-

tors the cover they need to

vote with their hearts as

opposed to some other

basis.

Mr Singer, a key fund-

raiser for George W. Bush

and, more recently, for Mitt

Romney, has given nearly

$10m to gay rights causes

and started American Unity

with a $1m donation.

Messrs Singer, Mehlman,

Asness and Klarman have

together donated more than

$1.5m to Freedom to Marry,

representing about 20 per

cent of the groups budget.

Legalising gay marriage

generated $259m in benefits

for New York City in the

past year, including hotel

stays, Michael Bloomberg,

mayor, said yesterday.

In the 12 months since

New Yorks legislature

passed the marriage equal-

ity act, the city has issued

8,200 licences for same-sex

marriage, more than 10 per

cent of the total, according

to a new survey by the

citys tourism agency.

Rich donors back gay marriage

Pro-Republicans

support ballots

Cash for campaigns

in four states

By Barney Jopson

in New York

A move to make all online

retailers levy sales tax con-

tinues to face resistance

from some lawmakers in the

US Congress even as it is

backed by Amazon, which

wants to avoid being singled

out by individual states that

are forcing it to collect.

Laws that let US internet

retailers avoid collecting

the tax from customers are

the most incendiary politi-

cal issue in the sector, the

source of rifts between

online and bricks-and-mor-

tar stores and between big

businesses and small rivals.

The perceived tax loop-

hole gives online stores an

unfair advantage over

bricks-and-mortar rivals

which are losing shoppers to

Amazon and others and

denies states much-needed

revenue, according to law-

makers who want to close it.

But at a hearing yester-

day, the proponents of a bill

that would give all states

the right to levy online

sales tax were met with

challenges over whether it

would constitute a new tax,

would be feasible, and

would stifle the growth of

new start-ups.

Steve Womack, a Republi-

can Congressman sponsor-

ing a House bill, said small

bricks-and-mortar retailers

were crying out for help

as they saw customers use

their stores as showrooms

to test out goods then

bought them tax-free online

on their smartphones.

In short, this bill levels

the playing field in the

world of retail sales, he

said. It would not create a

new tax but would simply

update the imposition of an

existing tax to the internet

era, he stressed.

But Elton Gallegly, a

Republican member of the

judiciary committee, voiced

the concerns of some in his

party when he said: When

you have to pass a law to

tax somebody on a tax

theyre not paying, to me

thats a new tax.

Even the supporters of

twin bills in the House and

Senate, which both have

Republican and Democratic

sponsors, concede they are

unlikely to reach a vote

before Novembers US elec-

tion.

William Fox, a professor

at the University of Tennes-

see, has estimated that

state and local governments

this year could forgo more

than $11bn in potential tax

revenue from ecommerce.

Mr Womacks district in

north-west Arkansas is

home to Walmart, the

worlds biggest retailer by

sales, which has helped fund

vociferous lobbying against

online retailers along with

bricks-and-mortar peers

including Target, Best Buy,

Home Depot and Sears.

Amazon, the worlds big-

gest online retailer by sales,

has been increasingly sup-

portive of the federal bills as

states including California,

Texas and New Jersey force

Amazon to start collecting

sales tax while leaving its

online peers untroubled.

It has, however, turned

the state moves to its

advantage by deciding to

build distribution centres

which it previously resisted

because they would have

triggered the tax by giving

it a physical presence in

order to accelerate its deliv-

ery speeds.

Amazons online peers

remain opposed to the pro-

posed legislation. Patrick

Byrne, chief executive of

Overstock, an online

retailer, said: Tax is not

just a tithe to the gods. Its

a payment for services. And

a Walmart in Dubuque,

Iowa, puts greater strain on

services than we do by

mailing a box there.

The Amazon economy:

www.ft.com/amazon

Congress split over move to close online sales tax loophole

When Erskine Bowles, a

former White House chief of

staff, stepped up to the

podium of the National

Press Club last week, he

first sought to capture the

vintage wit of his missing

deficit-fighting partner.

Im going to quote my

hero, Al Simpson, he said,

referring to the former sen-

ator from Wyoming who,

with Mr Bowles, has been

on a two-man mission to get

Congress to compromise

and curb the US debt.

Mr Bowles cracked one of

Mr Simpsons favourite

jokes about it being so

cold even lawyers had their

hands in their pockets

eliciting laughter in the

small briefing room. Then

he turned serious.

In spite of record low bor-

rowing costs, the US was

facing the most predictable

economic crisis in history,

he said. Its debt was a can-

cer destroying the country

from within, and the US

political system needed to

act quickly. We had hoped

that common sense would

overrule politics and people

in this town would be hard

at work on this now. But it

looks like politics is going

to overrule common sense

and nothing is probably

going to happen until after

the election, Mr Bowles

said.

Mr Bowles is a Democrat

from North Carolina who

worked under Bill Clinton;

Mr Simpson who could

not attend last weeks event

is a Republican. Despite

many setbacks, their

double act of folksy humor,

stark warnings and budget-

ary knowhow in the service

of American fiscal rectitude

is alive and kicking.

Two years ago, they were

tapped by President Barack

Obama to lead an 18-

member bipartisan commis-

sion on the USs public

finances. They recom-

mended $4tn in deficit

reduction over 10 years,

proposing cuts in all areas

of the federal budget,

including the Pentagon and

popular government pen-

sion and healthcare

schemes.

They also suggested gen-

erating more revenue

through a plan to lower

income tax rates for all

Americans while ending

many tax breaks and deduc-

tions.

Every single person with

half a brain knows you

have to do something, and

everyone knows you have

to hit everybody, Mr Simp-

son said in an interview

yesterday. Their plan comes

with a lot of pain and

heartburn and BO [body

odour], he said.

In December 2010, their

report received 11 votes,

falling short of the 14-

member supermajority

required for an automatic

vote in Congress.

Yet far from throwing in

the towel, Mr Bowles, 66,

and Mr Simpson, 80, have

kept up the pressure. They

have continued to meet law-

makers and the White

House to cajole them into

an agreement. They claim

to have more than 40 sena-

tors on their side, though

support is less enthusiastic

in the House of Representa-

tives, where only 38 of 435

members voted for their

plan in March.

Mr Simpson accepts the

wonderful juxtaposition of

cowardice and greed in US

politics, but says their com-

mission broke through the

ice cap and, undeterred,

the pair has toured the

country in an effort to get

more grassroots support.

As the US faces a fiscal

cliff with $600bn in

spending cuts and tax

increases due to hit in 2013

they are redoubling their

efforts for a grand bar-

gain. Their new campaign

called Fix the Debt is

backed by top figures from

both parties, including Bob

Zoellick, former president

of the World Bank. One of

their goals is to use social

media to get 10m signatures

in favour of a big deal.

Judd Gregg, the former

Republican senator from

New Hampshire, is co-chair-

man of the effort and a fan

of Mr Bowles and Mr Simp-

son. They play off each

other so well, says Mr

Gregg. He says progress is

two steps forward and

three steps backwards but

the US usually does what is

right and when a big defi-

cit deal happens it will mir-

ror the Simpson-Bowles

plan. They sent out the

memo thats going to con-

trol the meeting, Mr Gregg

says.

But what to some is

charming straight talk, to

others on both the right

and the left can be offen-

sive, and the pair espe-

cially Mr Simpson has got

into trouble.

After Mr Simpson said

Grover Norquist, the anti-

tax conservative cam-

paigner, had captured the

minds of most Republi-

cans, Mr Norquist told Reu-

ters: Al Simpson is trying

to sell a tax increase to a

country thats overtaxed

and where the government

spends too much money.

Mr Simpson has also

clashed with senior groups.

He was forced to apologise

in 2010 after saying Social

Security was a milk cow

with 310m tits, and this

year a furore erupted after

he vented at protesters

from a California retirees

association, calling them

greedy geezers.

The pair is now pushing

for at least a framework of

a big debt deal in the lame

duck session of Congress

between the November elec-

tion and the end of the year

details to be filled in by

July 4 2013. And they

believe the American peo-

ple are way ahead of their

politicians in wanting defi-

cit compromise.

They understand that

the problem is real and the

solutions are painful. There

is no easy way out, Mr

Bowles said.

But if we do it, the

future of this country is

very, very bright.

Deficit-cutting duo step up mission to fix US debt

Politics

Simpson and

Bowles turn to the

grass roots to back

their plan for small

government, writes

James Politi

Double act

Erskine Bowles, left, and

Alan Simpson are seeking to

cajole fellow lawmakers into

backing their agenda AP

It looks like politics

is going to overrule

common sense and

nothing is probably

going to happen

until after the

election

Erskine Bowles

Every person with

half a brain knows

you have to do

something, and

everyone knows

you have to hit

everybody

Alan Simpson

People understand

the problem is real

and the solutions

are painful. There is

no easy way out

Erskine Bowles

White House move on fiscal cliff

The White House sought to

rally support behind its plan

to avert the fiscal cliff by

releasing a study showing

the average US family of