Beruflich Dokumente

Kultur Dokumente

Career Essay

Hochgeladen von

api-2545304140 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten5 SeitenOriginaltitel

career essay

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten5 SeitenCareer Essay

Hochgeladen von

api-254530414Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

Career Essay

Before Chuck The Iceman Liddell became

a UFC (Ultimate Fighting Championship) Hall of

Famer and UFC World Champion, Liddell studied

accounting and graduated from California

Polytechnic State University with a Bachelors of

Arts in Business Accounting in 1995. Generally

speaking though, being a world class mixed martial

artist is not a prerequisite for becoming an accountant. Nor is it a prerequisite for a successful

mixed martial artist to obtain a degree in accounting. So if not knocking out opponents in the

UFC is what accountants spend their days doing, then what are the typical duties of an

accountant? From the Bureau of Labor Statistics, Accountants and auditors prepare and

examine financial records. They ensure that financial records are accurate and that taxes are paid

properly and on time. Accountants and auditors assess financial operations and work to help

ensure that organizations run efficiently (Accountants and Auditors: Occupational Outlook

Handbook: U.S. Bureau of Labor Statistics). This essay will explore the many different facets of

a career in the accounting field.

Working environments vary slightly between the different types of accountants; but on

average most work in a professional office environment (Accountants and Auditors:

Occupational Outlook Handbook: U.S. Bureau of Labor Statistics). The hours also vary; for

example an accountant that works primarily from their homes may work less hours. For the

most part though, accountants work a 40 hour week most of the year. Speaking to Certified

Public Accountants (CPA) that are in my family it is typical to see a large spike in working hours

during end of the budget

year and the three month

period between January

and April when federal

taxes are due. This

increase in hours usually

ranges from 60-80 hours a week, which includes working most weekends. One family member

who is a Tax compliance manager at a payroll processing firm see this increase every quarter due

to the fact that most business pay their taxes on a quarterly basis instead of yearly. 40, 60, 80

hour work weeks, with so many working hours, what exactly is it that keep accountants so busy?

Well for starters, accountants (Welcome to America's Career InfoNet, n.d.):

Prepare, examine, or analyze accounting records, financial statements, or other financial

reports to assess accuracy, completeness, and conformance to reporting and procedural

standards.

Report to management regarding the finances of establishment.

Establish tables of accounts and assign entries to proper accounts.

Develop, implement, modify, and document recordkeeping and accounting systems,

making use of current computer technology.

Compute taxes owed and prepare tax returns, ensuring compliance with payment,

reporting or other tax requirements.

Maintain or examine the records of government agencies.

Advise clients in areas such as compensation, employee health care benefits, the design

of accounting or data processing systems, or long-range tax or estate plans.

Develop, maintain, and analyze budgets, preparing periodic reports that compare

budgeted costs to actual costs.

Provide internal and external auditing services for businesses or individuals.

Analyze business operations, trends, costs, revenues, financial commitments, and

obligations, to project future revenues and expenses or to provide advice.

According to accountants and CPAs I have spoken too, this is just scraping the surface.

Higher Education is a must for the future accountant. According to the website

www.acinet.org (Welcome to America's Career InfoNet, n.d.), 57% of all accountants have a

Bachelors degree. While 20% have obtained

a Masters degree or better. The education

literally pays off. The median wage for an

accountant with a Bachelors degree in 2012

was $63,550 (ETA O*NET, Employment &

Training Administration (ETA) - U.S.

Department of Labor, n.d.). To become a

CPA though a student must have at a minimum of 150 semester hours. These hours are

necessary to even sit for the exam. What essentially adds up to an extra year of schooling pays

off as the median salary of a CPA is roughly $75,000 a year, with your more experienced CPAs

generating salaries in the six figure range (Accountants and Auditors: Occupational Outlook

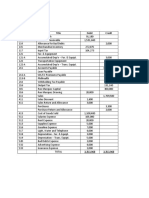

Handbook: U.S. Bureau of Labor Statistics). Passing the exam though is not easy. As seen in

the image below from the American Institute of CPAs for 3 out of 4 sections the passing rate is

less than 50%!

With this success rate one would think that the decline in candidates for the exam must be

attributed to the success rate. The results of that question through my research is inconclusive,

but one debate raging in the Accounting education circles is that the 150 hour requirement and

the effective use of that extra 30 hours may be an explanation. Some critics argue that the

additional hours involved keep prospective candidates away and that the 150 hour requirement is

not necessary. But a study published in Issues in Accounting Education (Gramling & Rosman,

2013, p. 504) points out that those who took the exam with 150 extra hours requirement

fulfilled outperformed those with only 120 hours. So it seems that if an accountant has the desire

to sit for the CPA exam the extra education is worth it.

After 120 to 150 hours of college education, the exams, the stress, and associated costs,

what are the potential employment opportunities for accountants? In life there are only two

things that are certain, Death and taxes. Since taxes are a certainty, and thanks to our federal

government, paying our share is one of the most complicated things we do as adults it is fair to

say that there will always be a need for accountants and CPAs. The Bureau of Labor Statistics

projects that the industry will grow 13% between now and 2022

(http://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm). Although the

journey will not be easy, I feel that this career will be a good fit for me. According to personality

studies done on accountants I fit the mold. According to a study published in Issues in

Accounting Education (Gramling & Rosman, 2013, p. 23), my personality type of ISTJ

(practical, sensible, decisive, logical, and dedicated. Management and administrative.) fit the

bill perfectly. Plus the money is not bad either.

As I have stated, accountants have a lot of responsibility, work long hours, and get paid

fairly well. With a lot of hard work and determination I can make this career choice a successful

one. I have the utmost confidence that I can be a successful accountant and one day make a

respected CPA.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Unit 2 - Making A Career in Accounting: Balance SheetDokument2 SeitenUnit 2 - Making A Career in Accounting: Balance SheetYessi StarsNoch keine Bewertungen

- Finance Overview:: Financial Accounting (Fi)Dokument38 SeitenFinance Overview:: Financial Accounting (Fi)Suraj MohapatraNoch keine Bewertungen

- 01 - Correction of ErrorsDokument4 Seiten01 - Correction of ErrorsMikaela SalvadorNoch keine Bewertungen

- Assessing and Responding To Fraud Risks: Concept Checks P. 281Dokument30 SeitenAssessing and Responding To Fraud Risks: Concept Checks P. 281Eileen HUANGNoch keine Bewertungen

- Latihan Soal With DiscussionDokument6 SeitenLatihan Soal With DiscussionNicolas ErnestoNoch keine Bewertungen

- Trial Balance February 28, 20X1Dokument3 SeitenTrial Balance February 28, 20X1Angelica MaeNoch keine Bewertungen

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Dokument150 SeitenGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANoch keine Bewertungen

- Configuring The General LedgerDokument7 SeitenConfiguring The General LedgerKui MangusNoch keine Bewertungen

- Review QsDokument92 SeitenReview Qsfaiztheme67% (3)

- Chapter 2 Conceptual Framework and Theoretical Structure of Financial Accounting and ReportingDokument11 SeitenChapter 2 Conceptual Framework and Theoretical Structure of Financial Accounting and ReportingMARIANoch keine Bewertungen

- Salosagcol atDokument7 SeitenSalosagcol atchimchimcoliNoch keine Bewertungen

- MGA C10 Lecture 10 - Completing The Audit II (1 Slide) PDFDokument41 SeitenMGA C10 Lecture 10 - Completing The Audit II (1 Slide) PDFAdriana limaNoch keine Bewertungen

- Mas Chap 13Dokument23 SeitenMas Chap 13Raz MahariNoch keine Bewertungen

- Internal and Governmental Financial Auditing and Operational AuditingDokument26 SeitenInternal and Governmental Financial Auditing and Operational AuditingNisa sudinkebudayaanNoch keine Bewertungen

- The Auditing and Assurance Standards CouncilDokument1 SeiteThe Auditing and Assurance Standards CouncilJaydie CruzNoch keine Bewertungen

- 15 Financial AccountsDokument111 Seiten15 Financial AccountsRenga Pandi100% (1)

- Final Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code GroupDokument2 SeitenFinal Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code Groupzarif zakwanNoch keine Bewertungen

- TM 6 - Tugas CGDokument2 SeitenTM 6 - Tugas CGauliaNoch keine Bewertungen

- Puntland DRM WB4 June 2021Dokument60 SeitenPuntland DRM WB4 June 2021Abdihafid Faraha AhmedNoch keine Bewertungen

- Introduction To Accounting: Discussion QuestionsDokument3 SeitenIntroduction To Accounting: Discussion QuestionsOfelia RagpaNoch keine Bewertungen

- GST Configuration in SAP FICODokument5 SeitenGST Configuration in SAP FICOKingpinNoch keine Bewertungen

- Accounting Cycle of A Merchandising BusinessDokument21 SeitenAccounting Cycle of A Merchandising Businesszedrick edenNoch keine Bewertungen

- Quiz 1 - With Answer PDFDokument12 SeitenQuiz 1 - With Answer PDFVerlyn ElfaNoch keine Bewertungen

- Practice Multiple Choice Questions For First Test PDFDokument10 SeitenPractice Multiple Choice Questions For First Test PDFBringinthehypeNoch keine Bewertungen

- Far 2 Exercise 5 Page 286Dokument5 SeitenFar 2 Exercise 5 Page 286Kay HispanoNoch keine Bewertungen

- Financial Accounting Weekly PlanDokument2 SeitenFinancial Accounting Weekly PlanASMARA HABIBNoch keine Bewertungen

- Subs Testing Proc BBBDokument28 SeitenSubs Testing Proc BBBRosario Garcia CatugasNoch keine Bewertungen

- Chapter 16 Advanced Accounting Solution ManualDokument94 SeitenChapter 16 Advanced Accounting Solution ManualVanessa DozonNoch keine Bewertungen

- Student Handbook Sep 2021 V2Dokument61 SeitenStudent Handbook Sep 2021 V2Nguyen Thi Van Anh (Swinburne HN)Noch keine Bewertungen

- AAB E-Brochure Aug15Dokument21 SeitenAAB E-Brochure Aug15Partho DhakaNoch keine Bewertungen