Beruflich Dokumente

Kultur Dokumente

CAP2 Taxation II (ROI) Summer 2013 Paper - FINAL

Hochgeladen von

Xiaojie LiuOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CAP2 Taxation II (ROI) Summer 2013 Paper - FINAL

Hochgeladen von

Xiaojie LiuCopyright:

Verfügbare Formate

CAP2-TXR-S13 1 10/06/2013

CA Proficiency 2

PAPER 4 TAXATION II

REPUBLIC OF IRELAND

SUMMER 2013 (Tuesday 25

th

June 2013 - 9.30 a.m. to 1.20 p.m.)

INSTRUCTIONS TO CANDIDATES

1. The first 20 minutes of this examination is dedicated to reading time. During this time, candidates may

make notes on this examination paper. Extra pages are included at the back of this paper for you to

make notes on.

Candidates are NOT permitted to open their answer books until instructed to do so.

2. Answer Question 1 in Section A.

Answer Question 2 in Section B.

Answer ANY TWO of THREE Questions in Section C.

3. All workings should be shown.

4. Candidates should answer the paper in accordance with the appropriate provisions up to and including

the Finance Act 2012.

5. Answers should be illustrated with examples where appropriate.

6. Section A begins on Page 2 overleaf.

7. The following inserts are enclosed with this paper:

Schedule relating to Section A

Tax Reference Material

CAP2-TXR-S13 2 10/06/2013

SECTION A

CASE STUDY

Answer Question 1

QUESTION 1 (Compulsory)

Giant Gyms Limited (GIANT) is a trading company which operates high specification gyms throughout the

Republic of Ireland. GIANT is incorporated and tax resident in the Republic of Ireland and prepares its

accounts to 31 December each year. GIANT is a wholly owned subsidiary of a US incorporated company

Health Matters Inc. (HEALTH).

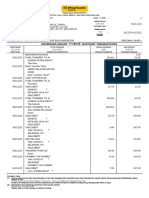

The Income Statement for GIANT for the year ended 31 December 2012, together with accompanying notes,

can be found in Schedule I (in the attachment provided.)

Zach Zucker is a Director of GIANT and has sole responsibility for the finance function of the company.

GIANT is considering acquiring a patent on a fitness programme which would be used in GIANTs gyms

throughout the Republic of Ireland.

A small local company, Fitness Limited (FITNESS), owns a number of gyms in the Galway area. A good

friend of Zachs, Josh Garnet, manages one of the FITNESS gyms. Josh and Zach recently met for a coffee.

Josh informed Zach that the gym equipment in his gym is old and that the policies and ethos of FITNESS are

outdated. As a result, FITNESS has not made a profit in a number of years and Josh is worried about his job

and indeed the future of FITNESS. Since his meeting with Josh, Zach has contacted HEALTH with a

proposal for GIANT to acquire FITNESS. Zachs intention is to bring FITNESS into the 21

st

century by

modernising its gyms and offering a more diverse range of equipment and services to customers. Zachs

ultimate goal for FITNESS would be to restore its profitability. In Zachs proposal to HEALTH, regarding the

acquisition of FITNESS, Zach mentioned that FITNESS will not have to pay any corporation tax on its trading

profits for a number of years due to the extent of trading losses it has incurred to date.

Zachs father, Carter (aged 78), was diagnosed with a terminal illness earlier this year. Carter is the sole

shareholder of Crazy Creations Limited (CRAZY). Zach and Carter recently had a chat about the future.

Carter was keen to sort out his affairs before it is too late. Carter told Zach that he is going to gift the family

home (with a market value of 700,000) to him now, before property prices begin to rise. Carter asked Zach

if he, Carter, could continue to live in the family home until the time comes for him to move into a nursing

home or hospice. Zach has been living in the family home with his father for the past four years and had no

problem with granting his fathers request. Zach does not own any other properties. CRAZY has a large

amount of cash on its statement of financial position, and Carter has informed Zach that he is going to gift

him 100,000 via CRAZY so that he can renovate the family home as he sees fit.

Zach sold an asset on 17 May 2012. The asset was a large site of land that Zach had purchased from his

uncle on 10 April 1980 for 35,000. The market value on that date was 60,000, while the current use value

of the land was 20,000. Zach sold the land on 17 May 2012 for 600,000. The costs arising in connection

with the purchase and disposal of the land were 1,500 and 5,000 respectively. The current value of the

land on 17 May 2012 was 300,000. Zach had capital losses of 22,500 carried forward at 1 January

2012. The losses had arisen on the disposal of Irish publicly quoted shares by Zach in 2011.

CAP2-TXR-S13 3 10/06/2013

QUESTION 1 (Contd)

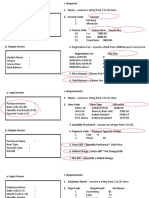

Requirement:

(a) Calculate the Case I profit and the corporation tax payable by GIANT for the year ended 31

December 2012. You are required to provide a brief explanation regarding your treatment of any

relevant item in the notes to the accounts in calculating the adjusted trading profit.

Ignore double tax relief.

16 marks

(b) Prepare a memo to Zach Zucker which addresses the following issues:

(i) The tax relief available for certain expenditure on intangible assets, in particular:

What expenditure qualifies for tax relief?

What tax relief is available for qualifying expenditure and how can it be claimed?

Would GIANT be entitled to claim tax relief in respect of the expenditure on the

acquisition of the patent for the fitness programme?

9 marks

(ii) The anti-avoidance legislation restricting the use of trading losses following a change of

ownership, in particular:

In what circumstances will losses carried forward be disallowed following a change of

ownership?

What impact will this legislation have on the trading losses in FITNESS if GIANT

acquires the company?

9 marks

(c) Prepare a file note which:

(i) Outlines the capital acquisitions tax and stamp duty implications of the gifts from Carter and

CRAZY to Zach. The file note should explain the potential capital acquisitions tax and stamp

duty liabilities arising and any reliefs that may be available, including an explanation of the

requirements to be satisfied in order to qualify for any relief identified.

Zach has not received any prior gifts or inheritances, other than those outlined above.

Zach and Carter are both Irish tax resident and domiciled.

Ignore the small gift exemption.

10 marks

(ii) Sets out the capital gains tax liability arising on the disposal of the land by Zach in May

2012.

Ignore the annual exemption.

6 marks

Total marks: 50 marks

CAP2-TXR-S13 4 10/06/2013

SECTION B

Answer Question 2

QUESTION 2 (Compulsory)

(a) Distributions paid by a company can take a variety of forms.

Requirement:

Name five types of transactions made by companies that are regarded as distributions. 5 marks

(b) Peter bought shares in Peter Pan Inc. on 1 August 2012 for 375,000. He filed a stamp duty return and

paid stamp duty on 15 December 2012.

Requirement:

(i) Calculate the stamp duty, interest and penalties (if any) payable on the above transaction. Interest

is payable at a rate of 0.0219% per day or part thereof on the late payment of stamp duty.

3 marks

(ii) Name any two types of transfers on which stamp duty is not payable. 2 marks

(c) On 6 June 2012, Martha died suddenly and her estate was valued at 634,000. Martha left 215,000

to her husband, Jack, and the remainder of her estate to their only child, Mary.

Mary has received previous benefits from Jack worth 100,000 on 10 December 1993 and from her

friend Joe worth 50,000 on 7 April 2000.

Jack, Mary and Martha are all Irish tax resident and domiciled.

Requirement:

Calculate the capital acquisitions tax (if any) payable by Jack and Mary on the inheritances received

from Martha. 5 marks

(d) Jimmy Johnston emigrated from Ireland to Australia on 10 April 2007. On 31 October 2011 Jimmy sold

his shareholding in Bia Limited (BIA) for 1,000,000 realising a gain of 850,000. Jimmy had

purchased his shareholding in BIA on 2 February 2003. Jimmy has now decided to return to Ireland

permanently either in May 2013 or February 2014.

Requirement:

(i) Briefly outline the capital gains tax implications for Jimmy should he decide to return to Ireland in May

2013 or February 2014. 3 marks

(ii) Normally the date of disposal is determined by the date of the contract for the transfer of an asset.

State any two exceptions to this rule. 2 marks

Total marks: 20 marks

CAP2-TXR-S13 5 10/06/2013

SECTION C

Answer ANY TWO of THREE questions

QUESTION 3

You are a Tax Senior in ABC, a small practice, in Cork. The Tax Partner has sent you the following email

summarising a number of issues for three of the practices clients.

From: taxpartner@ABC.ie

To: taxsenior@ABC.ie

Subject: Various client matters

Date: 25 September 2012

1) Aiveen and Pat Adams are the only shareholders of Perfect Pets Limited (PERFECT), a trading

company incorporated and tax resident in the Republic of Ireland. PERFECT specialises in behaviour

training for all household pets, from dogs to budgies, and operates throughout the Munster area.

PERFECT has only recently been incorporated. Aiveen and Pat are unsure how to extract cash from the

company as remuneration for their services. They have asked for some advice (to include a discussion

of the tax implications) on whether they should extract cash from PERFECT via salary, dividends or a

combination of both.

2) Christopher Casey disposed of the following capital items in the 2012 tax year:

Asset Proceeds Cost

Antique table 1,995 1,450 (May 2000)

Vase 3,400 1,650 (January 2003)

Painting 6,500 4,100 (June 2005)

Christopher has sought advice on the capital gains tax payable in respect of the above disposals.

3) Emma Fitzpatrick has asked for advice in relation to the capital acquisition tax liabilities arising on the

following gifts she is considering making:

(i) A rental property valued at 285,000 to her niece, Una,

(ii) A site of land valued at 275,000 to her brother, Tommy. The site does not qualify as agricultural

land, and

(iii) Quoted shares valued at 20,000 to her friend, Sheila.

Una has previously received an inheritance worth 15,000 from her grandmother, Mary, in 2004.

Tommy and Sheila have received no previous benefits.

The capital gains tax liabilities that will arise on the assets gifted by Emma will be 30,000 in respect of

the rental property and 2,500 on the shares. No capital gains tax liability will arise on the transfer of

the land.

Requirement:

Prepare a response to the above email which addresses the issues raised by each of the following clients:

(a) Aiveen and Pat Adams 5 marks

(b) Christopher Casey 5 marks

(c) Emma Fitzpatrick 5 marks

Total marks: 15 marks

CAP2-TXR-S13 6 10/06/2013

QUESTION 4

Cathal Cole founded Cole Carpets Limited (COLE CARPETS), a trading company, on 10 April 2001. The

total issued share capital was 1,000 1 ordinary shares, 955 of which were owned by Cathal and the

remainder by his wife, Marge. Both Cathal (aged 56 years) and Marge (aged 57 years) were appointed

directors of COLE CARPETS on 10 April 2001. Cathal has worked full-time for COLE CARPETS since 10

April 2001. Marge worked full-time for COLE CARPETS for its first three years, but then set up her own

business on 1 May 2004. Marge has worked substantially full-time in her own business since then.

Cathal and Marge have one son, Robert, who joined COLE CARPETS when he finished university in

September 2008. Cathal agreed to transfer 200 shares to Robert on completion of three years services with

COLE CARPETS. The market value of the shares when transferred to Robert in September 2011 was 200

per share.

With the entire family involved in the company, COLE CARPETS has gone from strength to strength and

now operates out of three retail properties. Two of the properties (Castlebar and Westport) are owned

personally by Cathal and one of the properties (Sligo) is owned by Marge.

Cathal has recently been approached by the owner of a large nationwide carpet business that is interested in

buying COLE CARPETS and the properties it trades from. Cathal is very hesitant about the deal but Robert

has persuaded him to at least consider the offer. The potential buyer has made an initial offer of 500 per

share, and the following amounts for each of the three properties that the business currently trades from:

Properties Owner Offer () Acquisition cost () Date acquired

14 Main Street, Castlebar Cathal 220,000 70,000 10 April 2001

2 High Street, Westport Cathal 175,000 115,000 August 2008

76 Church Street, Sligo Marge 150,000 75,000 October 2003

All assets owned by COLE CARPETS are business assets.

Requirement:

(a) Calculate the capital gains tax payable by Cathal, Marge and Robert in 2012 should they decide to

accept the offer and sell their shares in COLE CARPETS and the properties they own personally.

You should assume that all potential reliefs are claimed and that the sale of COLE CARPETS and the

three properties are the only capital disposals made in the 2012 tax year. The requirements or

conditions for any reliefs claimed should be clearly explained.

13 marks

(b) Briefly explain the self-assessment rules in relation to capital gains tax. In addition state the date any

capital gains tax arising on the disposal of the shares and properties will become payable if a contract

for the sale of property and shares is signed in July 2012.

2 marks

Total marks: 15 marks

CAP2-TXR-S13 7 10/06/2013

QUESTION 5

Keith Branson inherited his fathers estate on his fathers death on 15 April 2006. The estate included a

large farmhouse, gardens surrounding the farmhouse (consisting of 3 acres), 80 acres of farmland near

Clonmel, Co. Tipperary, and a substantial shareholding in an Irish public quoted company. The farmhouse

and gardens were valued at 815,000 at date of his fathers death with the farmhouse itself valued at

800,000 and the gardens valued at 5,000 per acre.

In 2002 Keiths father was suffering from ill health and was unable to devote himself full time to the farming of

the land. Keith decided to move into the farmhouse with his father and also assisted in the running of the

farming business. Since the inheritance in 2006 Keith continued to farm the land until his own death.

Just before his fathers death, an offer of 9,000 per acre was received for the farmland (its agricultural

value and market value at that time) and 80,000 was offered for the livestock and farm machinery. Keiths

father did not accept the offer. The farm was inherited by Keiths father on 4 March 1970.

The shares originally purchased by Keiths father on 29 May 1975 for 10,000 were valued at 500,000 on

15 April 2006.

Keith did not own or have any interest in any other assets at the time of his fathers death.

Keith died on 23 June 2012 (which is also the valuation date) and left the following estate:

(i) Keith left the farmland to his nephew, Mark. Mark had worked on the farm with Keith on a full-time

basis since 2006. Mark owns his own home, which was valued at 400,000 in June 2012. The

mortgage outstanding on the property is currently 200,000. The land was valued at 17,500 per

acre on 23 June 2012. Mark incurred legal and other costs of 8,000 relating to the inheritance of

the farm.

(ii) Keiths grandson, Jimmy (aged 17 years) received the shares in the Irish public quoted company.

The value of the shares on 23 June 2012 was 275,000. Jimmys father, Eoin, died in 2009. Eoin

was Keiths son from his first marriage.

(iii) The farmhouse and gardens were left to Alan, Keiths civil partner. The farmhouse including one

acre of garden was valued at 1,000,000 on 23 June 2012. The remaining two acres of garden were

valued at 20,000 on the same date.

On 13 January 2007 Keith took out a Revenue approved insurance policy to cover any capital acquisitions

tax that would become payable on his death. The policy was well funded and paid out 20,000 on Keiths

death in June 2012. The balance (if any), remaining on the insurance policy after the capital acquisitions tax

liabilities are paid, was left to his grandson, Jimmy.

Mark, Jimmy and Alan have received no previous benefits.

Requirement:

(a) Calculate the capital acquisitions tax payable on the inheritance of the estate by Keith Branson from

his father in April 2006. You should base your calculations on current legislation and clearly state the

conditions for any reliefs being claimed.

6 marks

(b) Calculate the capital acquisitions tax payable on Keith Bransons death in June 2012. Clearly state the

conditions for any reliefs being claimed. 9 marks

All of the above parties are Irish tax resident and domiciled.

Total marks: 15 marks

CAP2-TXR-S13 8 10/06/2013

NOTES

CAP2-TXR-S13 9 10/06/2013

NOTES

CAP2-TXR-S13 10 10/06/2013

NOTES

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Withholding Tax ProcedureDokument22 SeitenWithholding Tax ProcedureDinesh BabuNoch keine Bewertungen

- Payment Registration SlipDokument1 SeitePayment Registration SlipDaniel Kyeyune MuwangaNoch keine Bewertungen

- Maybank Statement BankDokument4 SeitenMaybank Statement BankFakruul HaZmin0% (1)

- Disbursement VoucherDokument1 SeiteDisbursement VoucherGeorgina Intia100% (1)

- Account Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, BangladeshDokument1 SeiteAccount Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, Bangladeshshohag ranaNoch keine Bewertungen

- Tolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Dokument7 SeitenTolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Jennilyn Gulfan YaseNoch keine Bewertungen

- Vat Bar ExamDokument4 SeitenVat Bar Examblue_blue_blue_blue_blueNoch keine Bewertungen

- CAP2 Summer 2013 Financial Reporting Paper - FINALDokument11 SeitenCAP2 Summer 2013 Financial Reporting Paper - FINALXiaojie LiuNoch keine Bewertungen

- Cap2 Sfma Summer Paper 2013 - FinalDokument6 SeitenCap2 Sfma Summer Paper 2013 - FinalXiaojie LiuNoch keine Bewertungen

- CAP2 SFMA Summer Paper 2013 Schedule To Section A - FINALDokument3 SeitenCAP2 SFMA Summer Paper 2013 Schedule To Section A - FINALXiaojie Liu100% (1)

- CAP 2 Audit Summer Paper 2013 - FINALDokument9 SeitenCAP 2 Audit Summer Paper 2013 - FINALXiaojie LiuNoch keine Bewertungen

- CAP2 Tax Reference Material (ROI) - 2013 ExamsDokument15 SeitenCAP2 Tax Reference Material (ROI) - 2013 ExamsXiaojie LiuNoch keine Bewertungen

- MEGAclear™ KitDokument12 SeitenMEGAclear™ KitXiaojie LiuNoch keine Bewertungen

- LIGHTrun Brochure GATCDokument4 SeitenLIGHTrun Brochure GATCXiaojie LiuNoch keine Bewertungen

- AKUPREPSLPWDokument1 SeiteAKUPREPSLPWuzrabaig111Noch keine Bewertungen

- Accommodation at Vivekananda Kendra Kanyakumari - Vivekananda Kendra HyderabadDokument7 SeitenAccommodation at Vivekananda Kendra Kanyakumari - Vivekananda Kendra HyderabadPrabhat JainNoch keine Bewertungen

- Integ02 ADokument2 SeitenInteg02 ARonald CorunoNoch keine Bewertungen

- Smetka Za Karta PDFDokument1 SeiteSmetka Za Karta PDFMence PendevskaNoch keine Bewertungen

- Invoice PDFDokument1 SeiteInvoice PDFDhingra shellyNoch keine Bewertungen

- Power of Commissioner Penalties PDFDokument14 SeitenPower of Commissioner Penalties PDFKomal JaiswalNoch keine Bewertungen

- ZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceDokument1 SeiteZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceNairo Julian Rodriguez BallesterosNoch keine Bewertungen

- Bir Form 2307Dokument8 SeitenBir Form 2307Alex CalannoNoch keine Bewertungen

- Standing Order - GeneralDokument1 SeiteStanding Order - GeneralMZALENDO.NETNoch keine Bewertungen

- TaxDetails PDFDokument1 SeiteTaxDetails PDFsujitsaha1Noch keine Bewertungen

- CurrentBillDownload 1 PDFDokument1 SeiteCurrentBillDownload 1 PDFАлександр ТимофеевNoch keine Bewertungen

- Cap & Gown OrderDokument2 SeitenCap & Gown OrderΝίκος Μυρογιάννης-ΚούκοςNoch keine Bewertungen

- Upi Response CodesDokument20 SeitenUpi Response Codesletihi9143Noch keine Bewertungen

- Oct 2023Dokument5 SeitenOct 2023AnkitNoch keine Bewertungen

- Taxation (Botswana) : Tuesday 12 June 2012Dokument11 SeitenTaxation (Botswana) : Tuesday 12 June 2012true100% (1)

- Shoe Factory Plant Manager: Gross Salary ElementsDokument2 SeitenShoe Factory Plant Manager: Gross Salary ElementsSukaina SalmanNoch keine Bewertungen

- Hard Activity On JavaDokument5 SeitenHard Activity On JavaMilbertNoch keine Bewertungen

- Emaran Bill at TarangDokument6 SeitenEmaran Bill at TarangKamakhya MallNoch keine Bewertungen

- New StatementDokument15 SeitenNew Statementankitks53Noch keine Bewertungen

- Statement Jan 2024Dokument7 SeitenStatement Jan 2024Kiran TejaNoch keine Bewertungen

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDokument2 SeitenTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalNoch keine Bewertungen

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Dokument176 SeitenInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNoch keine Bewertungen