Beruflich Dokumente

Kultur Dokumente

Suggested Answers TO Questions Set at The Intermediate Examination MAY, 1996 GR. - II

Hochgeladen von

Karishma DoshiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Suggested Answers TO Questions Set at The Intermediate Examination MAY, 1996 GR. - II

Hochgeladen von

Karishma DoshiCopyright:

Verfügbare Formate

SUGGESTED ANSWERS

TO

QUESTIONS

SET AT THE

INTERMEDIATE EXAMINATION

MAY, 1996 GR. II

Question 1.

(a) A Company had incurred fixed expenses of 4,50,000, with sales of rs.15,00,000 and earned a

profit of Rs.,00,000 durin! the first half year. "n the second half, it suffered a loss of

Rs.1,50,000.

Calculate #

(.i) $he profit%&olume ratio, 'rea(%e&en%point and mar!in of safety for the first half year.

(ii) expected sales%&olume for the second half year assumin! that sellin! price and fixed

expenses remained unchan!ed durin! the second half year.

(iii) $he 'rea(%e&en point and mar!in of safety for the whole year.

(') A company manufactures and mar(ets three products ), * and +. All the three products are

made from the same set of machines. ,roduction is limited 'y machine capacity. -rom the data

!i&en 'elow, indicate priorities for products ), * and + with a &iew to maximisin! profits #

,roducts

) * +

Raw material cost per unit (Rs.) 11..5 1/..5 .1..5

0irect la'our cost per unit (Rs.) ..50 ..50 ..50

1ther &aria'le cost per unit (Rs.) 1.50 ...5 .55

2ellin! price per unit (Rs.) .5.00 0.00 5.00

2tandard machine time re3uired 4 .0 .5

.per unit in minutes

(c) An article passes throu!h fi&e operations as follows #

1peration 6o. $ime per article 7rade of wor( 8a!e rate per hour

1 15 minutes A Re.0./5

. .5 minutes 9 Re.0.50

10 minutes C Re. 0.40

4 0 minutes 0 Re.0.5

5 .0 minutes : Re.0.0

$he factory wor(s 40 hours a wee( and the production tar!et is /00 do;ens per wee(. ,repare a

statement showin! for each operation and in total the num'er of operators re3uired, the la'our

cost per do;en and the total la'our cost per wee( to produce the total tar!et output.

Anse! 1

(a) "i# $!o%it &o'u(e !)tio, *!e)+ e&en, -oint )n. ()!/in o% s)%et0 1

(for the first half year )

Contri'ution

,rofit <&olume ratio = ) 100

2ales

(-ixed :xpenses > ,rofit )

= ) 100

2ales

(Rs. 4,50,000 > Rs. ,00,000)

= ) 100

Rs. 15,00,000

= 50?

-ixed expenses

9rea( <e&en point =

,@& Ratio

Rs. 4,50,000

=

50?

= Rs. 4,00,000

Aar!in of 2afety = Actual sales %% 9rea( e&en sales

= Rs. 15,00,000 %% Rs. 4,00,000

= Rs. /,00,000.

(ii) E2-e3te. S)'es ,4o'u(e ( for the second half year assumin! that sellin! price and fixed

expenses remained unchan!ed durin! the second half year. )

-ixed expenses %% Boss

:xpected sales &olume =

,@& Ratio

Rs. 4,50,000 %% Rs. 1,50,000

=

50?

= Rs. /,00,000.

(iii) 5!e)+ e&en -oint )n. ()!/in o% s)%et0

(for the whole year)

-ixed expenses for the whole year

9rea( e&en point =

,@& Ratio

Rs. 4,00,000

= = Rs. 15,00,000

50?

,rofit for the year

Aar!in of safety =

,@& ratio

Rs. ,00,000 %% Rs. 1,50,000

=

50?

= Rs. ,00,000

A'te!n)ti&e Anse! 1

Aar!in of safety = 2ales a'o&e the 'rea( e&en point

= Actual sales %% 9rea( e&en sales

= CRs. 15,00,000 > Rs. /,00,000D %% Rs. 15,00,000

= Rs. ,00,000

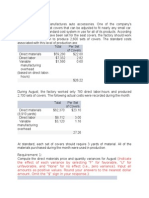

"*#

St)te(ent in.i3)tin/ -!io!ities %o! -!o.u3ts X, Y )n. 6

To ()2i(i7e -!o%its

,roducts ) * +

2ellin! price per unit (Rs.) .5.00 0.00 5.00

Bess # Earia'le cost per unit (Rs.) 15..5 .1.00 .F.0

(Refer to 8or(in! note)

Contri'ution per unit (Rs.) (A) 4.F5 4.00 F.F0

2td. Aachine time re3uired in

Ainutes per unit (9) 4.00 .0.00 .5.00

Contri'ution per minute (Rs.) (A) @ (9) 0..5 0.45 0..F5

,riorities for products """ " ""

Wo!+in/ Notes 1

4)!i)*'e 8ost -e! unit 1

,roducts

) * +

Rs. Rs. Rs.

Raw materials cost 11..5 1/..5 .1..5

0irect la'our cost ..50 ..50 ..50

1ther &aria'le cost 1.50 ...5 .55

$otal &aria'le cost per unit 15..5 .1.00 .F.0

(c)

St)te(ent s9oin/ tot)' nu(*e! o% o-e!)to!s !e:ui!e. ;

T9e ')*ou! 3ost -e! .o7en )n. t9e tot)' ')*ou! 3ost -)! ee+

To -!o.u3e t)!/ete. out-ut un.e! e)39 o-e!)tion

1peration 6o. of Ba'our Cost of Ba'our Cost per

6o. operators /00 do;ens

re3uired G per wee(

Rs. Rs.

1 45 1,1F0 1.45

( 45 ) 40 ) 0./5 p) (Rs. 1,1F0 @ /00)

. F5 1,500 ..50

(F5 ) 40 ) 0.50 p) ( Rs. 1,500@ /00)

0 450 0.50

(0 ) 40) 0.40p) (Rs. 450 @ /00 )

4 40 1,./0 ..10

(40 ) 40 ) 0.5p) (Rs. 1,./0 @ /000

5 /0 F.0 1..0

( /0 ) 40 ) 0.0p) ( Rs. F.0 @ /00 )

00 5,10 5.55

< Wo!+in/ Note

O-e!)tion No. No. o% o-e!)to!s !e:ui!e.

/00 do;ens ) 1. 15

1 ) = 45

40 /0

/00 do;ens ) 1. .5

. ) = F5

40 /0

/00 do;ens ) 1. 10

) = 0

40 /0

/00 do;ens ) 1. 0

4 ) = 40

40 /0

/00 do;ens ) 1. .0

5 ) = /0

40 /0

Question =.

(a) -rom the particulars !i&en 'elow, compute # Aaterial ,rice Eariance, Aaterial Hsa!e Eariance,

Ba'our Rate Eariance, "dle $ime Eariance and Ba'our :fficiency Eariance with full wor(in!

details #

1 tonne of material input yields a standard output of 1,00,000 units. $he standards price of

material is Rs..0 per (!. 6um'er of employees en!a!ed is .00. $he standard wa!e rate per

employee per day is Rs./. $he standard daily output per employee is 100 units. $he actual

3uantity of material used is 10 tonnes and the actual price paid is rs..1 per (!. Actual output

o'tained is 4,00,000 units. Actual num'er of days wor(ed is 50 and actual rate of wa!es paid is

Rs./.50 per day. "dle time paid for and included in a'o&e time is 1. day.

(') 8rite short notes on #

(i) Hniform Costin!.

(ii) "nter%firm Comparison.

Anse! =

(a) 9asic data #

Actual 1utput # 4,00,000 units.

St)n.)!. D)t) A3tu)' .)t)

M)te!i)'s 1

Aaterial Rate Amount Aaterial RateAmount

Ity. (Rs.) (Rs.) Ity. (Rs.) (Rs.)

4,000 (! .0 1,50,000 10,000 (! .1.,10,000

>)*ou!

2td.6um'er Rate Amount 6o. of $ime "dle Rate Amount

1f man days per man employees in time per

day days in daysman day

Rs. Rs. Rs. Rs.

4,000 / 54,000 .00 50 J /.50 /5,000

Computation of &ariance #

Aaterials price &ariance = Actual 3ty 2td. Rate %% Actual rate

1f material per (! per (!

= 10,000 (! (Rs. .0 < Rs. .1)

= Rs. 10,000 (Ad&erse)

Aaterials usa!e &ariance = 2td. rate 2td. 3ty %% Actual

,er (! of of material 3ty. of material

material

= Rs. .0 ( 4,000 (!. < 10,000 (!.)

= Rs. .0,000 (Ad&erse)

Ba'our rate &ariance = Actual man 2td. rate %% Actual

0ays wor(ed per day rate per day

= 10,000 man days (Rs. / < Rs. /.50)

= Rs. 5,000 (Ad&erse)

"dle time &ariance = "dle man days ) 2td. rate per man day

= .00 men ) J days ) Rs. /.00

= Rs. /00 (Ad&erse)

Ba'our efficiency = 2td. rate 2td. no %% Actual no.

&ariance per man day of man of man

days days wor(ed

= Rs. / (4,000 < 4,400 )

= Rs. 5,400 (Ad&erse)

"*# (i) Uni%o!( 8ostin/ 1 "t has 'een defined 'y the "nstitute of cost and 8or(s Accountants of

:n!land as K$he use 'y se&eral underta(in!s of the same costin! principles and @or practicesL.

$hus when a num'er of underta(in!s, whether under the same mana!ement or not, decide to

adhere to one set of accepted costin! principles < especially in matters where there can 'e two

opinions < they are said to 'e followin! uniform costin!. "t ma(es inter firm comparison easy

and, of course, one of the aims of uniform costin! is to introduce inter < firm comparison. Hse of

uniform costin! is comparati&ely easy amon! concerns manufacturin! the same type of products.

A !reat deal of spade wor( is re3uired to 'e done 'efore the introduction of uniform costin! in an

industry. "ts introduction helps the firms to su'mit relia'le cost data to price fixin! 'odies to

determine the a&era!e cost and fixin! the fair sellin! prices of &arious products. "t ser&es as a

pre <re3uisite to cost audit.

(ii) Inte! %i!( 3o(-)!ison 1 "t is a techni3ue of e&aluatin! the performance, efficiency, costs and

profits of firms in an industry. "t consists of &oluntary exchan!e of information@data concernin!

costs, prices, profits, producti&ity and o&er all efficiency amon! firms en!a!ed in similar type of

operations of the purpose of 'rin!in! impro&ement in efficiency and indicatin! the wea(ness.

2uch a comparison will 'e possi'le where uniform costin! is in operation.

An inter < firm comparison indicates the efficiency of production and sellin!, ade3uacy of profit,

wea( spots in the or!anisations, etc. and thus demands from the firmMs mana!ement an

immediate suita'le action. "nter firm comparison may ena'le the mana!ement to challen!e the

standards which it has set for itself and to impro&e upon them in the li!ht of the current

information !athered from more efficient units. 2uch a comparison may 'e carried out in

electrical industry, printin! firms, cotton spinnin! firms, pharmaceuticals, cycle manufacturin! etc.

inter firm comparison de&elops cost consciousness amon! mem'ers of the industry. "t also

helps !o&ernment in effectin! price re!ulations.

Question ?.

(a) A company is ma(in! a study of the relati&e profita'ility of the two products < A and 9. "n

addition to direct cost, indirect sellin! and distri'ution costs to 'e allocated 'etween the two

products are as under #

Rs.

"nsurance chan!es for in&entory (finished) F5,000

2tora!e costs 1,40,000

,ac(in! and forwardin! char!es F,.0,000

2ales salaries 5,50,000

"n&oicin! costs 4,50,000

1ther details are #

,roduct A ,roduct 9

2ellin! price per unit (Rs.) 500 1,000

Cost per unit (exclusi&e of indirect

. sellin! and distri'ution costs) (Rs.) 00 /00

Annual sales in units 10,000 5,000

A&era!e in&entory (units) 1,000 500

6um'er of in&oices .,500 .,000

1ne unit of product A re3uires a stora!e space twice as much as product 9. $he cost to pac(

and forward one unit is the same for 'oth the products. 2alesmen are paid salary plus

commission N 5? on sales and e3ual amount of efforts are put forth on the sales of each of the

products.

Re3uired #

(.i) 2et up a schedule showin! the apportionment of the indirect sellin! and distri'ution costs

'etween the two products.

(ii) ,repare a statement showin! the relati&e profita'ility of the two products.

(') Oow would you threat the followin! in Cost Accounts P

(i) :mployee welfare costs

(ii) Research and de&elopment costs

(iii) 0epreciation.

Anse! ?

")# (i)

S39e.u'e s9oin/ t9e )--o!tion(ent o% t9e in.i!e3t se''in/

An. .ist!i*ution 3osts *eteen t9e to -!o.u3ts.

"tems 9asis of apportionment $otal ,roducts

A 9

Rs. Rs. Rs.

"nsurance A&era!e in&entory &alue F5,000 0,000 45,000

Char!es (1000 ) Rs. 500 ) # (500 ) Rs. 100)

2tora!e A&era!e in&entory stora!e 1,40,000 1,00,000 40,000

Costs space

(1000 ) . ) # ( 500 ) 1)

,ac(in! Q Annual sales in units F,.0,000 4,00,000 ,.0,000

-orwardin! (10000 ) # (5000)

char!es

2alesmen :fforts of salesmen 5,50,000 4,.5,000 4,.5,000

2alaries (1 # 1)

2alesmen Annual sales &alue /,50,000 .,50,000 4,00,000

Commission (5# 5)

"n&oicin! 6o. of in&oices 4,50,000 .,50,000 .,00,000

Costs (.500 # .000)

.5,55,000 14,55,000 14,,000

(ii)

St)te(ent s9oin/ t9e !e')ti&e -!o%it)*i'it0 o% t9e to -!o.u3ts

,roducts A 9

Rs. Rs.

Annual sales &alue 50,00,000 50,00,000

(10,000 units ) Rs. 500) (5,000 units ) Rs. 1000)

Bess# Cost of sales 0,00,0000 45,00,000

(10,000 units ) Rs. 00) (5,000 units ) Rs. /00 )

G!oss $!o%it 1 .0,00,000 .,00,000

Bess# "ndirect sellin! Q 14,55,000 14,,000

0istri'ution cost

RRefer to a (i) S

,rofit 5,45,000 1F,/F,000

,rofita'ility as percenta!e of sales 10.4? ...05?

Rs. 5,45,000 Rs. 1F,/F,000

) 100 ) 100

Rs. 50,00,000 Rs. 50,00,000

"*# "i# E(-'o0ee We'%)!e 3osts 1 "t includes those expenses, which are incurred 'y the employers on

the welfare acti&ities of their employees. $he welfare acti&ities on which these expenses are

usally incurred may include canteen, hospitalT play !rounds etc. these expenses should 'e

separately recorded as 8elfare 0epartment Costs. $hese Costs may 'e apportioned to

production cost centres on the 'asis of total wa!es or the num'er of men employed 'y them.

"ii# Rese)!39 )n. .e&e'o-(ent 8osts 1 "t is the cost@expenses incurred for searchin! new or

impro&ed products, production methods@techni3ues or plants@e3uipments. Research cost may

'e incurred for carryin! 'asic or applied research. 9oth 'asic and applied research relates ot

ori!inal in&esti!ations to !ain from new scientific or technical (nowled!e and understandin!,

which is not directed towards any specific practical aim (under 'asic research) and is directed

towards a specific practical aim or o'Uecti&e (under applied research).

T!e)t(ent in 8ost A33ounts 1 Cost of 9asic Research (if it is a continuous acti&ity) 'e char!ed

to the re&enues of the concern. "t may 'e spread o&er a num'er of years if research is not a

continuous acti&ity and amour is lar!e.

Cost of applied research, if relates to all existin! products and methods of production then it

should 'e treated as a manufacturin! o&erhead of the period durin! which it has 'een incurred

and a'sor'ed. 2uch costs are directly char!ed to the product, it is solely incurred for it.

"f applied research is conducted for searchin! new products or methods of production etc., then

the research costs treatment depends upon the outcome of such research. -or example, if

research findin! are expected to produce future 'enefits or if it appears that such findin!s are

!oin! to result in failure then the costs incurred may 'e Amortised 'y char!in! to the costin!

,rofit and Boss Account of one or more years dependin! upon the si;e of expenditure. "f

research pro&es successful, then such costs will 'e char!ed to the concerned product.

De&e'o-(ent 8osts 1 'e!ins with the implementation of the decision to produce a new or

impro&ed product or to employ a new or impro&ed method. $he treatment of de&elopment

expenses is same as that of applied research.

"iii# De-!e3i)tion 1 "t represents the fall in the asset &alue due to its use, wear and tear and passa!e

of time. 0epreciation is an indirect cost of production and operations. "t is an important element

of cost and without this true cost of production cannot 'e o'tained. "n costin! depreciation on

plant and machinery is normally treated as part of the factory o&erheads.

Question @.

(a) -rom the details !i&en 'elow, calculate #

(.i) Re%orderin! le&el

(ii) Aaximum le&el

(iii) Ainimum le&el

(i&) 0an!er le&el.

Re%orderin! 3uantity is to 'e calculated on the 'asis of followin! information #

Cost of placin! a purchase order is Rs..0

6um'er of units to 'e purchased durin! the year is 5,000.

,urchase price per unit inclusi&e of transportation cost is Rs.50.

Annual cost of stora!e per unit is Rs.5

0etails of lead time # A&era!e 10 days, maximum 15 days, Ainimum / days.

-or emer!ency purchases 4 days.

Rate of consumption # A&era!e # 15 units per day, Aaximum # .0 units.

(') $he input to a purifyin! process was 1/,000 (!s. 1f 'asic material purchased N Rs.1..0 per V!.

,rocess wa!es amounted to Rs.F.0 and o&erhead was applied N .40? of the la'our cost.

"ndirect materials of ne!li!i'le wei!ht introduced into the process at a cost of Rs./. $he actual

output from the process wei!ht 15,000 (!s. $he normal yield of the process is 4.?. Any

difference in wei!ht 'etween the input of 'asic material and output of purified material (product)

is sold N re.0.50 per (!.

$he process is operated under a licence which pro&ides for the payment of royalty N Re.0.15

per (!. 1f the purified material produced.

,repare #

(.i) ,urifyin! ,rocess Account

(ii) 6ormal 8asta!e Account

(iii) A'normal 8asta!e @ *ield Account

(i&) Royalty ,aya'le Account.

Anse! @

(a) 5)si3 .)t) 1

Co (1rderin! Cost per order ) = Rs. .0

2 (6um'er of units to 'e purchased annually) = 5,000 units

C1 ( ,urchase price per unit inclusi&e

of transportation cost ) = Rs. 50

iC1 (Annual cost of stora!e per unit ) = Rs. 5

8o(-ut)tion 1

(i) Re <orderin! le&el = Aaximum usa!e ) Aaximum re%order

(R1B) per period period

= .0 units per days ) 15 days

= 00 units

(ii) Aaximum le&el =R1B > R1I %% Ain rate ) Ain. re <order

of consumption period

(Refer to 8or(in!

6otes 1 Q . )

= 00 units > .00 units %% 10 units ) / days

per day

= 440 units

(iii) Ainimum le&el =R1B %% A&era!e rate ) A&era!e reorder

of consumption period

= 00 units %% (15 units per days ) 10 days )

= 150 units.

(i&) 0an!er le&el = A&era!e consumption ) Bead time for emer!ency

purchases

= 15 units per days ) 4 days

= /0 units

Wo!+in/ Notes 1

.2co . ) 5,000 units ) Rs. .0

1. R1I = =

iC1 Rs. 5

= .00 units

.. A&era!e rate of

consumption = Ainimum rate of consumption (x) > Aaximum rate

of consumption

.

x > .0 units per days

15 units per day =

.

or x = 10 units per day.

"*# (i)

$u!i%0in/ $!o3ess A33ount

0r. Cr.

Ity Rate Amount Ity Rate Amount

per (! per (!.

(!. Rs. Rs. (!. Rs. Rs.

$o 9asis materials 1/,000 1..0 14,.00 'y 6ormal 1,.50 0.50 /40

wasta!e

5? of 1/,000 (!.

$o 8a!es F.0 'y ,urified 15,000 1./0 .4,000

stoc(

$o 1&erhead .40? of

Rs. F.0 1,F.5

$o "ndirect materials /

$o Royalty paya'le .,.05

on normal yield

14,F.0 (! ) 0.15

$o A'normal .50 1./0 445

yield

1/,.50 .4,/40 1/,.50 .4,/40

(ii)

No!()' W)st)/e A33ount

0r. Cr.

Ity. Rate Amount Ity. Rate Amount

per (! per (!.

(!. Rs. Rs. (!. Rs. Rs.

$o ,urifyin! 1,.50 0.50 /40 'y ,urifyin! .50 0.50 140

process process

(6ormal wasta!e) (A'. *ield)

reduction

'y Cash sale 1,000 0.50 500

of wasta!e

1,.50 /40 1,.50 /40

(iii)

A*no!()' Yie'. A33ount

0r. Cr.

Ity. Rate Amount Ity. Rate Amount

per (! per (!.

(!. Rs. Rs. (!. Rs. Rs.

$o 6ormal 8asta!e A@c .50 0.50 140 'y ,urifyin!

,rocess A@c .50 1./0 445

$o Royalty paya'le (on

A'normal yield) 0.15 4.

$o 9alance ( ,rofit Q

Boss A@c ) .//

.50 445 .50 445

(i&)

Ro0)'t0 -)0)*'e A33ount

0r. Cr.

Ity. Rate Amount Ity. Rate Amount

per (! per (!.

(!. Rs. Rs. (!. Rs. Rs.

$o 9alance 15,000 0.15 .,.50 'y ,urifyin! 14,F.0 0.15 .,.05

process A@c

'y A'normal .50 0.15 4.

yield A@c

15,000 .,.50 15,000 445

Question A.

A company operates on historic Uo' cost accountin! system, which is not inte!rated with the

followin! accounts. At the 'e!innin! of a month, the openin! 'alances in cost led!er were #

Rs. (in la(hs)

2tores Bed!er Contract Account 50

8or(%in%,ro!ress Control Account .0

-inished 7oods Control Account 40

9uildin! Construction Account 10

Cost Bed!er Control Account 540

0urin! the month, the followin! transaction too( place #

Aaterials %% ,urchased 40

"ssued to production 50

"ssued to !eneral maintenance /

"ssued to 'uildin! construction 4

8a!es %% 7ross wa!es paid 150

"ndirect wa!es 40

-or 'uildin! construction 10

8or(s 1&erheads %% Actual amount incurred (excludin!

. items shown a'o&e)

A'sor'ed in 'uildin! construction .0

Hnder a'sor'ed 5

Royalty paid 5

2ellin!, distri'ution and administration o&erheads. .5

2ales 450

At the end of the month, the stoc( of raw material and wor(%in%pro!ress was Rs.55 la(hs and

Rs..5 la(hs respecti&ely. $he loss arisin! in the raw material account is treated as factory

o&erheads. $he 'uildin! under construction was completed durin! the month. CompanyMs !ross

profit mar!in is .0? on sales.

,repare the rele&ant control accounts to record the a'o&e transactions in the cost led!er of the

company.

Anse! A

8ost 'e./e! 8ont!o' AB3

0r. Cr.

Rs. Rs.

$o Costin! , Q B A@c 450 9y 9alance '@d 540

$o 2tores Bed!er Control A@c 55 9y 2tores Bed!er Control A@c 40

$o 8", Control A@c .5 9y 8a!es Control A@c 150

$o 9uildin! Const. A@c 44 9y 8or(s 1&erhead Control A@c 1/0

$o -inished 7oods Control A@c 40. 9y 2ellin!, 0istri'ution .5

and Administration

1&erhead A@c

9y Costin! profit Q Boss A@c 5F

4FF 4FF

Sto!es >e./e! 8ont!o' AB3

0r. Cr.

Rs. Rs.

$o 9alance '@d 50 9y 8", Control A@c 50

$o Cost Bed!er Control A@c 40 9y8or(s 1&erhead Control A@c /

9y 9uildin! Const. A@c 4

9y Closin! 9alance 55

9y 8or(s 1&erhead Control A@c 5

(Boss)

1.0 1.0

Wo!+,in,$!o/!ess AB3

0r. Cr.

Rs. Rs.

$o 9alance '@d .0 9y -inished 7oods control A@c

$o 2tores Bed!er Control A@c 50 9y Closin! 9alance .5

$o 8a!e Control A@c 100

$o 8or(s 1&erhead Control A@c 15

$o Royalty A@c 5

55 55

Cinis9e. Goo.s 8ont!o' AB3

0r. Cr.

Rs. Rs.

$o 9alance '@d 40 9y Cost of 7oods sold A@c /0

(Refer to 8or(in! 6ote)

$o 8", Control A@c 9y 9alance 40

F/ F/

8ost o% S)'es AB3

0r. Cr.

Rs. Rs.

$o Cost of 7oods 2old A@c /0 9y Costin! , Q B A@c 55

$o 2ellin! , 0istri'ution .5

and administration o&erheads A@c

55 55

8ostin/ $ D > AB3

0r. Cr.

Rs. Rs.

$o Cost of 2ales A@c 55 9y Cost Bed!er Control A@c 450

$o 8or(s 1&erhead Control A@c 5

$o Cost Bed!er Control A@c 5F

(,rofit)

450 450

5ui'.in/ 8onst!u3tion AB3

0r. Cr.

Rs. Rs.

$o 9alance '@d 10 9y Cost led!er Control A@c 44

$o 2tores Bed!er Control A@c 4

$o 8a!e Control A@c 10

$o 8or(s 1&erhead Control A@c .0

44 44

Wo!+s O&e!9e). 8ont!o' AB3

0r. Cr.

Rs. Rs.

$o 2tores Bed!er Control A@c / 9y 9uildin! Construction A@c .0

$o 8a!e Control A@c 40 9y 8", Control A@c 15

$o Cost Bed!er Control A@c 1/0 9y9alance (Costin! , Q B A@c ) 5

$o 2tores Bed!er Control A@c (Boss) 5

.11 .11

W)/es 8ont!o' AB3

0r. Cr.

Rs. Rs.

$o Cost Bed!er Control A@c 150 9y8or(s 1&erhead Control A@c 40

9y 9uildin! Cons. A@c 10

9y 8", Control A@c 100

150 150

Ro0)'t0 AB3

0r. Cr.

Rs. Rs.

$o Cost Bed!er Control A@c 5 9y 8", Control A@c

5

5 5

8ost o% Goo.s So'. AB3

0r. Cr.

Rs. Rs.

$o -inished 7oods Control A@c /0 9y Cost of 2ales A@c /0

/0 /0

Se''in/, Dist!i*ution )n. A.(inist!)tion O&e!9e).s AB3

0r. Cr.

Rs. Rs.

$o Cost Bed!er control A@c .5 9y Cost of 2ales A@c

.5

.5 .5

(Rs. in la(hs)

T!i)' 5)')n3e

0r. Cr.

$o 2tores Bed!er Control A@c 55

$o 8", Control A@c .5

$o -inished 7oods Control A@c 40

$o Cost Bed!er AdUustment A@c 45

45 45

Wo!+in/ Note 1

"f 2.,. Rs. 100 then C.,. = Rs. 50

"f 2.,. is Rs. 450 then C.,. = Rs. 50@100 ) Rs. 450 = Rs. /0 la(hs.

Question 6.

(a) 8hat are the essential of a !ood Cost Accountin! 2ystem P

(') 6arrate the essential factors to 'e considered while desi!nin! and installin! a Cost Accountin!

2ystem.

Anse!

")# Essenti)'s o% ) Goo. 8ost A33ountin/ S0ste(

$he essential features of a !ood Cost Accountin! system are as follows #%

(i) $he Cost Accountin! 2ystem should 'e tailor made, practical, simple and capa'le of

meetin! the re3uirements of a 'usiness concern.

(ii) $he method of costin! should 'e suita'le to the industry and ser&e its o'Uecti&es.

(iii) $he Costin! 2ystem should recei&e co < operation and participation of executi&es from

&arious departments.

(i&) $he Cost of installin! and operatin! the system should Uustify the results.

(&) $he system of costin! should not sacrifice the utility 'y introducin! meticulous and

unnecessary details.

(&i) $he system should consider the or!anisational structure of the 'usiness and it should 'e

desi!ned as a su' < system of the o&erall or!anisation.

(&ii) $here should 'e a harmonious relationship 'etween costin! system and financial accounts.

Hnnecessary duplication should 'e a&oided. A sin!le inte!rated accountin! system would

'e ideal.

(&iii) $he system should pro&ide ade3uate chec(s on orderin!, receipts, stoc(in!, issuin! and

recordin! of materials. $he pricin! method and the issue of materials should 'e efficient.

(ix) $he costin! system should ensure proper recordin! of wor(erMs time and their wa!es. 8a!e

costs should 'e determined from wa!e analysis sheets. ,roper attention should 'e paid in

preparin! payrolls and in the payment of wa!es. $he treatment of idle time, o&er < time and

holiday < pay should not 'e o&erloo(ed.

(x) $he cost accountin! system should ensure that o&erheads are collected, accumulated

apportioned and a'sor'ed and e3uita'ly.

"*# Essenti)' %)3to!s %o! .esi/nin/ ) 8ost A33ountin/ S0ste(.

$he essential factors to 'e considered while desi!nin! a Cost Accountin! 2ystem are as

follows#%

(i) A thorou!h understandin! of < or!anisational manufacturin! procedure and processT sellin!

and distri'ution procedureT and type of cost information re3uirement.

(ii) 2election of a suita'le costin! techni3ue (2tandard or actual, mar!inal or a'sorption)

(iii) ,ricin! method suita'le, for the material, to 'e issued to production.

(i&) Aethod suita'le for 'oo(in! la'our cost on Uo's.

(&) A sound plan should 'e de&ised for the collection, allocation, apportionment and a'sorption

of o&erheads.

(&i) 0ecidin! on ways of treatin! waste, scrap and idle time.

(&ii) 0esi!nin! of suita'le forms to 'e used for collectin! and dissemination of cost

data@information.

(&iii) "ntroduction of 'ud!etary control techni3ue so that actual performance may 'e compared

with 'ud!etary fi!ure, for measurin! efficiency of performance.

Essenti)' %)3to!s %o! inst)''in/ ) 8ost A33ountin/ S0ste(.

$he essential factors for installin! a Cost Accountin! system are listed as 'elow#%

(i) $he o'Uecti&es of installin! a Costin! 2ystem and the expectation of the mana!ement from

the system should 'e identified first.

(ii) "t is important to ascertain the si!nificant &aria'les of the manufacturin! unit which are

amena'le to control and affect the concern. -or example, 3uite after the production costs

control may 'e more important than control of its mar(etin! cost. Hnder such a situation,

the costin! system should de&ote !reater attention to control production cost.

(iii) A thorou!h study of the nature of 'usiness, its technical aspects, products, methods and

sta!es of production should 'e made. $his will help in selectin! a proper method of

costin!.

(i&) A study of the or!anisation structure, its si;e and layout etc., is also necessary. $his is

useful to mana!ement to determine the scope of responsi'ilities of &arious mana!ers.

(&) $he costin! system should 'e e&ol&ed in consultation with the staff and should 'e

introduced only after meetin! their o'Uections and dou'ts, if any. $he co < operation of staff

is essential for the successful operation of the system.

(&i) 0etails of the records to 'e maintained 'y the costin! system should 'e carefully wor(ed

out. $he de!ree of accuracy of the data to 'e supplied 'y the system should 'e

determined.

(&ii) $he forms to 'e used 'y foreman, wor(ers etc., should 'e standardised. $hese forms 'e

suita'ly desi!ned and must ensure minimum clerical wor( at all sta!es.

(&iii) 6ecessary arran!ements should 'e made for the flow of information@data to all concerned

mana!ers, at different le&els, re!ularly and promptly.

(x) $he costin! system to 'e installed should 'e easy to understand and simple to operate..

Question E

8rite short notes on #

(a) A9C Analysis

(') Ba'our $urno&er

(c) Cost Bed!er Control Account

(d) 1peration Costin!.

Anse!

")# A58 An)'0sis 1 "t is a system of in&entory control. "t exercises discriminatin! control o&er

different items of stores classified on the 'asis of the in&estment in&ol&ed. Hsually the items are

di&ided into three cate!ories accordin! to their importance, namely, their &alue and fre3uency of

replenishment durin! a period.

(i) WAM cate!ory of items consists of only a small percenta!e i.e., a'out 10? of the total items

handled 'y the stores 'ut re3uire hea&y in&estment a'out F0? of in&entory &alue, 'ecause

of their hi!h prices and hea&y re3uirement.

(ii) W9M cate!ory of items are relati&ely less importantT they may 'e .0? of the total items of

material handled 'y stores. $he percenta!e of in&estment re3uired is a'out .0? of the

total in&estment in in&entories.

(iii) WCM Cate!ory of items do not re3uire much in&estmentT it may 'e a'out 10? of total

in&entory &alue 'ut they are nearly F0? of the total items handled 'y store.

WAM cate!ory of items can 'e controlled effecti&ely 'y usin! a re!ular system which ensures

neither o&er < stoc(in! nor stora!e of materials for production. 2uch a system plans its total

material re3uirements 'y ma(in! 'ud!ets. $he stoc(s of materials are controlled 'y fixin!

certain le&els li(e maximum le&el, minimum le&el and re < order le&el. A reduction in in&entory

mana!ement costs is achie&ed 'y determinin! economic order 3uantities after ta(in! into

accountin! orderin! cost and carryin! cost. $o a&oid shorta!e and to minimi;e hea&y in&estment

in in&entories, the techni3ues of &alue analysis, &ariety reduction, standardisation etc., may 'e

used.

"n the case of W9M cate!ory of items, as the sum in&ol&ed is moderate, the same de!ree of control

as applied in WAM cate!ory of items is not warranted. $he orders for the items, 'elon!in! to this

cate!ory may 'e placed after re&iewin! their situation periodically.

-or WCM cate!ory of items, there is no need of exercisin! constant control. 1rders for items in this

!roup may 'e placed either after six months or once in a year, after ascertainin! consumption

re3uirements. "n this case the o'Uecti&e is to economise on orderin! and handlin! costs.

$he ad&anta!es of A9C analysis are the followin! #%

(i) "t ensures that, without there 'ein! any dan!er of interruption of production for want of

materials or stores, minimum in&estment will 'e made on in&entories of stoc(s of materials

or stoc(s to 'e carried.

(ii) $he cost of placin! orders, recei&in! !oods and maintainin! stoc(s is minimised specially if

the system is coupled with the determination of proper economic order 3uantities.

(iii) Aana!ement time is sa&ed since attention need 'e paid only to some of the items rather

than all the items as would 'e the case if the A9C system was not in operation.

"*# >)*ou! Tu!no&e! 1 "t is the rate of chan!e in the la'our force durin! a specified period measured

a!ainst a suita'le index. $he standard or usual la'our turno&er in the industry or locally or the

la'our turno&er rate for a past period may 'e ta(en as the index or norm a!ainst which actual

turno&er rate is compared. $he methods of calculatin! la'our turno&er are !i&en 'elow#

Ba'our $urno&er =

or

=

=

6um'er of employees replaced

A&era!e num'er of employees on roll

6um'er of employees separated durin! a year

A&era!e num'er of employees on rolls durin! the year

6o. of employees separated > 6o. of employees replaced

A&era!e num'er of employees on rolls durin! the period

8)uses o% ')*ou! tu!no&e! 1 $he main causes of la'our turno&er in an or!anisation@industry can

'e 'roadly classified under the followin! three heads #

(a) ,ersonal Causes

(') Hna&oida'le Causes, and

(c) A&oida'le Causes

,ersonal causes are those which includes or compel wor(ers to lea&e their Uo's such causes

includes the followin! #

(i) Chan!e of Uo's for 'etterment

(ii) ,remature retirement due to ill health or old a!e.

(iii) 0omestic pro'lem and family responsi'ilities.

(i&) 0iscontentment o&er the Uo's and wor(in! en&ironment.

"n all the a'o&e cases the employee lea&es the or!anisation at his will and, therefore, it is difficult

to su!!est any possi'le remedy in the first three cases. 9ut the last one can 'e o&ercome 'y

creatin! conditions leadin! to a healthy wor(in! en&ironment. -or this, officers should play a

positi&e role and ma(e sure that their su'ordinates wor( under healthy wor(in! conditions.

Hna&oida'le causes are those under which it 'ecomes o'li!atory on the part of mana!ement to

as( some or more of their employees to lea&e the or!anisation, such causes are summed up as

listed 'elow#

(i) 2easonal nature of the 'usinessT

(ii) 2horta!e of raw material, power, slac( mar(et for the product etc T

(iii) Chan!e in he plant locationT

(i&) 0isa'ility, ma(in! a wor(er unfit for wor(T

(&) 0isciplinary measuresT

(&i) Aarria!e (!enerally in the case of women)

A&oida'le causes are those which re3uire the attention of mana!ement on continuous 'asis so

as to (eep the la'our turno&er ratio as low as possi'le. $he main causes under this case are

indicated 'elow #

(1) 0issatisfaction with Uo', remuneration, hours of wor(, wor(in! conditions, etc.

(.) 2trained relationship facilities and promotional a&enuesT

() Bac( of trainin! facilities and promotional a&enuesT

(4) Bac( of recreational and medical facilitiesT

(5) Bow wa!es and allowances.

,roper and timely mana!ement action can reduce the la'our turno&er apprecia'ly so far as

a&oida'le causes are concerned.

E%%e3ts 1 $he effect of la'our turno&er on cost of production is that is that hi!h la'our turno&er

increases the cost of production in the followin! ways #

(i) :&en flow of production is distur'edT

(ii) :fficiency of new wor(ers is lowT producti&ity of new 'ut experienced wor(ers is low in the

'e!innin!T

(iii) $here is increased cost of trainin! and inductionT

(i&) 6ew wor(ers cause increased 'rea(a!e of tools, wasta!e of materials etc.

"n some companies, the la'our turno&er rates is as hi!h as 100?T it means that on the a&era!e,

all the wor( is 'ein! done 'y new and inexperienced wor(ers. $his is 'ound to lower efficiency

and production and increases the cost of production.

Re(e.i)' ste-s to (ini(ise ')*ou! tu!no&e!1

$he followin! steps are useful for minimisin! la'our turno&er,.

1. E2ist Inte!&ie 1 An inter&iew may'e arran!ed with each out!oin! employee to ascertain

the reasons of his lea&in! the or!anisation.

.. Fo* )n)'0sis )n. e&)'u)tion 1 9efore recruitin! wor(ers, Uo' analysis and e&aluation may

'e carried out to ascertain the re3uirements of each Uo'.

. S3ienti%i3 S0ste( o% !e3!uit(ent, -')3e(ent )n. -!o(otion 1 $he or!anisation should

ma(e use of a scientific system of recruitment selection, placement and promotion for

employees.

4. En'i/9tene. )ttitu.e o% ()n)/e(ent 1 $he mana!ement should introduce the followin!

steps for creatin! a healthy wor(in! atmosphere.

(i) 2er&ice rules should 'e framed, discussed and appro&ed amon! mana!ement and

wor(ers, 'efore their implementation.

(ii) ,ro&ide facilities for education and trainin! of wor(ers.

(iii) "ntroduce a procedure for settlin! wor(ers !rie&ance.

5. Use o% 8o((ittee 1 "ssues li(e control o&er wor(ers handlin! their !rie&ances etc., may 'e

dealt 'y a committee, comprisin! of mem'ers from mana!ement and wor(ers.

"3# 8ost >e./e! 8ont!o' A33ount 1 $his control account is also popularly (nown as W7eneral

Bed!er AdUustment statement AccountM is opened in Cost Bed!er to complete dou'le < entry. All

items of income and expenditure ta(en from financial accounts and all transfers from cost

accounts to financial 'oo(s are recorded in this account. 2ince the purpose of this account is to

complete dou'le entry in the cost led!er, therefore all transactions in the cost led!er must 'e

recorded throu!h the WCost Bed!er Control AccountM. $he 'alance in this account will always 'e

e3ual to the total of all the 'alances of the impersonal accounts.

".# O-e!)tion 3ostin/ 1 "t is defined as the refinement of process costin!. "t is concerned with the

determination of the cost of each operation rather than the process. "n those industries where a

process consists of distinct operations, the methods of costin! applied or use is called operation

costin!. 1peratin! costin! offers 'etter scope for control. "t facilitates the computation of unit

operation cost at the end of each operation 'y di&idin! the total operation cost 'y total output

units. "t is the cate!ory of the 'asic costin! method, applica'le, where standardised !oods or

ser&ices result from a se3uence of repetiti&e and more or less continuous operations, or

processes to which costs are char!ed 'efore 'ein! a&era!e o&er the units produced durin! the

period. $he two costin! methods included under this head are process costin! and ser&ice

costin!.

Das könnte Ihnen auch gefallen

- Practice Problems Standard CostDokument5 SeitenPractice Problems Standard Costlulughosh100% (1)

- Acct 303 Chapter 4Dokument39 SeitenAcct 303 Chapter 4prasad_kcpNoch keine Bewertungen

- Marvel Parts Cost AnalysisDokument40 SeitenMarvel Parts Cost Analysisyuikokhj0% (2)

- Basic Pay 1000 12000 DA 200 2400 Bonus 240 2880 120 1440 Other Allowance 250 3000 1810 21720 Employer's Contribution To PFDokument15 SeitenBasic Pay 1000 12000 DA 200 2400 Bonus 240 2880 120 1440 Other Allowance 250 3000 1810 21720 Employer's Contribution To PFParth VijayNoch keine Bewertungen

- Costing QN PaperDokument5 SeitenCosting QN PaperAJNoch keine Bewertungen

- 2 Cost System, Raw Material & Direct LabourDokument4 Seiten2 Cost System, Raw Material & Direct LabourDinda Amelia KusumastutiNoch keine Bewertungen

- I. Reduce Costs and Enhance ValueDokument10 SeitenI. Reduce Costs and Enhance Valuehana_kimi_91Noch keine Bewertungen

- Image0 (8 Files Merged)Dokument8 SeitenImage0 (8 Files Merged)Fatima Ansari d/o Muhammad AshrafNoch keine Bewertungen

- Solution To Question 1Dokument7 SeitenSolution To Question 1Gopinath SorenNoch keine Bewertungen

- Accounting Assignment CardiffDokument12 SeitenAccounting Assignment CardiffpavanihirushaNoch keine Bewertungen

- f5 Class Test 1Dokument5 Seitenf5 Class Test 1Emon D' CostaNoch keine Bewertungen

- Ac Solve PaperDokument59 SeitenAc Solve PaperHaseeb ShadNoch keine Bewertungen

- Kasus Beauvellie Furniture-SendDokument5 SeitenKasus Beauvellie Furniture-Send06. Ni Komang Ayu Trisia Dewi0% (1)

- Chap 4 - Solutions To in Class ExercisesDokument4 SeitenChap 4 - Solutions To in Class Exerciseslauravertelcanada2023Noch keine Bewertungen

- UNIT 7-STANDARD COSTINGDokument5 SeitenUNIT 7-STANDARD COSTINGkevin75108Noch keine Bewertungen

- ECO 101 Problem Set #4 Short-Run Costs & Factor InputsDokument6 SeitenECO 101 Problem Set #4 Short-Run Costs & Factor InputsSanaa2510Noch keine Bewertungen

- KrishnaDokument21 SeitenKrishnaKrishna GandhiNoch keine Bewertungen

- Comprehensive Case 2 Chapters 5-10Dokument10 SeitenComprehensive Case 2 Chapters 5-10Ato SumartoNoch keine Bewertungen

- Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDokument11 SeitenComputer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitysanagavarapuNoch keine Bewertungen

- Job Costing Problem (Generic Corporation)Dokument2 SeitenJob Costing Problem (Generic Corporation)Philip DyNoch keine Bewertungen

- P8-2A Bolus Computer Parts Inc. Cost Analysis and PricingDokument3 SeitenP8-2A Bolus Computer Parts Inc. Cost Analysis and PricingkskimblerNoch keine Bewertungen

- BA 213 Test 3 Review (Ch10, 13-14Dokument14 SeitenBA 213 Test 3 Review (Ch10, 13-14megafieldNoch keine Bewertungen

- Managerial Accounting Final ExamDokument14 SeitenManagerial Accounting Final ExamatifNoch keine Bewertungen

- Standard Costing / Variance Analysis: Paper F2, Management Accounting Lecture By: Mr. Farrukh AbbasDokument3 SeitenStandard Costing / Variance Analysis: Paper F2, Management Accounting Lecture By: Mr. Farrukh AbbassnadminNoch keine Bewertungen

- Advanced Diploma Examination, 2011: 220. Cost Management & Practical AuditingDokument4 SeitenAdvanced Diploma Examination, 2011: 220. Cost Management & Practical AuditingAachal SinghNoch keine Bewertungen

- Ma QuestionsDokument2 SeitenMa QuestionsnaxahejNoch keine Bewertungen

- Job and Batch CostingDokument7 SeitenJob and Batch CostingDeepak R GoradNoch keine Bewertungen

- Akuntansi Biaya FOHDokument21 SeitenAkuntansi Biaya FOHSilvia RamadhaniNoch keine Bewertungen

- ACTIVITY BASED COSTING AND ACTIVITY BASED MANAGEMENT - No AudioDokument19 SeitenACTIVITY BASED COSTING AND ACTIVITY BASED MANAGEMENT - No AudioAlexis Kaye DayagNoch keine Bewertungen

- Chapter 13Dokument77 SeitenChapter 13mas_999Noch keine Bewertungen

- Process CostingDokument11 SeitenProcess CostingGargi SharmaNoch keine Bewertungen

- Expected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHDokument5 SeitenExpected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHiceds01Noch keine Bewertungen

- Cost Accounting Problems and SolutionsDokument25 SeitenCost Accounting Problems and SolutionsAimee AimeeNoch keine Bewertungen

- Chapter 4 ExerciseDokument7 SeitenChapter 4 ExerciseJoe DicksonNoch keine Bewertungen

- Cost Accounting and Financial Management: All Questions Are CompulsoryDokument4 SeitenCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNoch keine Bewertungen

- Marginal Costing Numericals PDFDokument7 SeitenMarginal Costing Numericals PDFSubham PalNoch keine Bewertungen

- Cost Accounting 2013Dokument3 SeitenCost Accounting 2013GuruKPO0% (1)

- Determining Unit Costs and Relevant Range for Candy ProductionDokument2 SeitenDetermining Unit Costs and Relevant Range for Candy ProductionAtika Dewi OktantiNoch keine Bewertungen

- Cost - and - Management - Accounting June 23 - Assignment AnswersDokument5 SeitenCost - and - Management - Accounting June 23 - Assignment AnswersKhushiNoch keine Bewertungen

- 3.1 PM_Throughput and TOC_260622Dokument18 Seiten3.1 PM_Throughput and TOC_260622abhijit tikekarNoch keine Bewertungen

- Inventory Accounting Methods ExplainedDokument12 SeitenInventory Accounting Methods ExplainedSina GolkarNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh Gusain100% (1)

- Sales: 1,400 Units: A Ltd. Production Budget April - June 2008 Particulars Number of UnitsDokument3 SeitenSales: 1,400 Units: A Ltd. Production Budget April - June 2008 Particulars Number of UnitslulughoshNoch keine Bewertungen

- Chapter 2 Homework Manufacturing Economics and Computation Exercise With Solution CompressDokument8 SeitenChapter 2 Homework Manufacturing Economics and Computation Exercise With Solution Compressngxbao0211suyaNoch keine Bewertungen

- Cost ManagementDokument9 SeitenCost ManagementVikkuNoch keine Bewertungen

- Ministry of Micro - Small & Medium EnterprisesDokument4 SeitenMinistry of Micro - Small & Medium EnterprisescbhattNoch keine Bewertungen

- Standard Costing and Variance AnalysisDokument38 SeitenStandard Costing and Variance AnalysisAlexis Kaye DayagNoch keine Bewertungen

- Cost Concept and Segregation MethodsDokument1 SeiteCost Concept and Segregation MethodssatyaNoch keine Bewertungen

- MFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Dokument9 SeitenMFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Mohan sunderNoch keine Bewertungen

- Limiting Factor AnalysisDokument5 SeitenLimiting Factor AnalysisFaizan MotiwalaNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh GusainNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh GusainNoch keine Bewertungen

- Productivity - NotesDokument16 SeitenProductivity - Notesjac bnvstaNoch keine Bewertungen

- Budgetary Control and Production Cost EstimationDokument15 SeitenBudgetary Control and Production Cost EstimationAnimesh KalitaNoch keine Bewertungen

- Labor Demand Marginal Product RevenueDokument18 SeitenLabor Demand Marginal Product RevenueRegalado Tricia Pauline AndromedaNoch keine Bewertungen

- Cost and Management AccountingDokument23 SeitenCost and Management AccountingSarvar PathanNoch keine Bewertungen

- Process Costing 1Dokument32 SeitenProcess Costing 1errNoch keine Bewertungen

- Calculating Material, Labor and Overhead VariancesDokument7 SeitenCalculating Material, Labor and Overhead VariancesNikhil KasatNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationVon EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNoch keine Bewertungen

- 7Dokument6 Seiten7Karishma DoshiNoch keine Bewertungen

- New Microsoft Office PowerPoint PresentationDokument1 SeiteNew Microsoft Office PowerPoint PresentationGbsReddyNoch keine Bewertungen

- 2014 Burmese CensusDokument17 Seiten2014 Burmese CensusGatekeeper170Noch keine Bewertungen

- XXXXX PDFDokument27 SeitenXXXXX PDFVipul PaliwalNoch keine Bewertungen

- 634250566243553750Dokument49 Seiten634250566243553750Karishma DoshiNoch keine Bewertungen

- Marketing Channel Strategies in Rural India: Lessons From D.light DesignDokument31 SeitenMarketing Channel Strategies in Rural India: Lessons From D.light DesignKarishma DoshiNoch keine Bewertungen

- Assignment 1 OmDokument1 SeiteAssignment 1 OmKarishma DoshiNoch keine Bewertungen

- Assignment 1 OmDokument1 SeiteAssignment 1 OmKarishma DoshiNoch keine Bewertungen

- Assignment 1 OmDokument1 SeiteAssignment 1 OmKarishma DoshiNoch keine Bewertungen

- What Does The GDP Tell Us?: Larger Expanding Smaller ShrinkingDokument15 SeitenWhat Does The GDP Tell Us?: Larger Expanding Smaller ShrinkingKarishma DoshiNoch keine Bewertungen

- Electronic Presentations in Microsoft Powerpoint: Peter SecordDokument27 SeitenElectronic Presentations in Microsoft Powerpoint: Peter SecordKarishma DoshiNoch keine Bewertungen

- Business CyclesDokument19 SeitenBusiness CyclesKarishma DoshiNoch keine Bewertungen

- A Brief Introduction To Marketing and Customer Relationship BuildingDokument26 SeitenA Brief Introduction To Marketing and Customer Relationship BuildingKarishma DoshiNoch keine Bewertungen

- BCG and GE Analysis On Idea CellularDokument14 SeitenBCG and GE Analysis On Idea CellularMaverick_raj83% (6)

- Culture Morale ValuesDokument9 SeitenCulture Morale ValuesKarishma DoshiNoch keine Bewertungen

- Defining Marketing For The 21 Century: Powerpoint by Milton M. Pressley University of New OrleansDokument12 SeitenDefining Marketing For The 21 Century: Powerpoint by Milton M. Pressley University of New OrleansKarishma DoshiNoch keine Bewertungen

- Techno-Economic Feasibility Study - Super Efficiency in RefrigeratorsDokument78 SeitenTechno-Economic Feasibility Study - Super Efficiency in RefrigeratorsKarishma DoshiNoch keine Bewertungen

- Culture Morale ValuesDokument9 SeitenCulture Morale ValuesKarishma DoshiNoch keine Bewertungen

- Scan 0001Dokument1 SeiteScan 0001Karishma DoshiNoch keine Bewertungen

- Customer Satisfaction in HospitalsDokument23 SeitenCustomer Satisfaction in HospitalsanilsumanNoch keine Bewertungen

- Relationship Marketing StrategyDokument32 SeitenRelationship Marketing StrategyShanti PutriNoch keine Bewertungen

- KoshasDokument4 SeitenKoshasKarishma DoshiNoch keine Bewertungen

- Relationship Marketing StrategyDokument32 SeitenRelationship Marketing StrategyShanti PutriNoch keine Bewertungen

- 356W10WebSlidesCh8 17x16,031110Dokument105 Seiten356W10WebSlidesCh8 17x16,031110Karishma DoshiNoch keine Bewertungen

- B.E Lecture1Dokument19 SeitenB.E Lecture1Karishma DoshiNoch keine Bewertungen

- 2intro To Marketing 525 - MBADokument17 Seiten2intro To Marketing 525 - MBAKarishma DoshiNoch keine Bewertungen

- Corporate Governance, Bank Boards & DirectorsDokument39 SeitenCorporate Governance, Bank Boards & DirectorsKarishma DoshiNoch keine Bewertungen

- T Shirt CaseDokument2 SeitenT Shirt CaseKarishma DoshiNoch keine Bewertungen

- Corporate Governance, Bank Boards & DirectorsDokument39 SeitenCorporate Governance, Bank Boards & DirectorsKarishma DoshiNoch keine Bewertungen

- Taxation Paper 4: Income-tax Law Multiple Choice QuestionsDokument20 SeitenTaxation Paper 4: Income-tax Law Multiple Choice QuestionsKartik0% (1)

- A Simple Model: Integrating Financial StatementsDokument10 SeitenA Simple Model: Integrating Financial Statementssps fetrNoch keine Bewertungen

- Sesi 13 & 14Dokument10 SeitenSesi 13 & 14Dian Permata SariNoch keine Bewertungen

- Blended Vs Whole Family Child SupportDokument3 SeitenBlended Vs Whole Family Child Supportapi-19751851Noch keine Bewertungen

- Cheat Sheet For Financial AccountingDokument1 SeiteCheat Sheet For Financial Accountingmikewu101Noch keine Bewertungen

- HE21Round2Dokument8 SeitenHE21Round2Vartika VashistaNoch keine Bewertungen

- Corporate Accounting AssignmentDokument5 SeitenCorporate Accounting AssignmentMd.Mahmudul HasanNoch keine Bewertungen

- Quiz 3 CFS Subsequent To Date of AcquisitionDokument3 SeitenQuiz 3 CFS Subsequent To Date of AcquisitionJi Eun VinceNoch keine Bewertungen

- Cash Flow Statements IIDokument7 SeitenCash Flow Statements IIGood VibesNoch keine Bewertungen

- The Disparity Between Rich and Poor Has The Most Significant Impact On Economic Growth of PakistanDokument6 SeitenThe Disparity Between Rich and Poor Has The Most Significant Impact On Economic Growth of PakistanMuhammad Luqman AhmadNoch keine Bewertungen

- Hardhat Case - Rajesh Kumar NayakDokument12 SeitenHardhat Case - Rajesh Kumar NayakSandeep RawatNoch keine Bewertungen

- Originality Report 30%: Mpra - Ub.uni-Muenchen - deDokument5 SeitenOriginality Report 30%: Mpra - Ub.uni-Muenchen - deGraceNoch keine Bewertungen

- Update Income Tax Software for New or Old Tax SlabDokument29 SeitenUpdate Income Tax Software for New or Old Tax SlabSREERAMULA VENKATA PRASADNoch keine Bewertungen

- Feasib Chapter 4Dokument9 SeitenFeasib Chapter 4Red SecretarioNoch keine Bewertungen

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDokument3 SeitenActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNoch keine Bewertungen

- Module #03 - Financial Statements, Cash Flow, and TaxesDokument19 SeitenModule #03 - Financial Statements, Cash Flow, and TaxesRhesus UrbanoNoch keine Bewertungen

- QUIZ 4 - Income TaxDokument4 SeitenQUIZ 4 - Income TaxTUAZON JR., NESTOR A.Noch keine Bewertungen

- Accounting 5Dokument38 SeitenAccounting 5Shehara GamlathNoch keine Bewertungen

- CH 9 Flexible Budgets CompressedDokument36 SeitenCH 9 Flexible Budgets Compressedmuhammad fathoniNoch keine Bewertungen

- DLP Fs Analysis Concepts and FormatDokument14 SeitenDLP Fs Analysis Concepts and FormatDia Did L. RadNoch keine Bewertungen

- Income Tax: Ca - Cma - Cs Inter / EPDokument55 SeitenIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNoch keine Bewertungen

- Quiz#3 - SCFDokument3 SeitenQuiz#3 - SCF11 ABM 2A -TORREMOCHANoch keine Bewertungen

- Sigma Property ManagementDokument11 SeitenSigma Property ManagementMark Earl Santos100% (4)

- Student Allowance ParentsDokument12 SeitenStudent Allowance ParentsHinewai PeriNoch keine Bewertungen

- 9 Zamboanga Peninsula RDP 2017 2022Dokument262 Seiten9 Zamboanga Peninsula RDP 2017 2022jrymaguireNoch keine Bewertungen

- Fashion Business Plan Example - Clothes Business PlanDokument16 SeitenFashion Business Plan Example - Clothes Business Planfakhour nabil100% (1)

- Tugas 2Dokument2 SeitenTugas 2Silvia Fudjiyani79Noch keine Bewertungen

- Annual Financial Report: Your Company NameDokument3 SeitenAnnual Financial Report: Your Company NameKumar SinghNoch keine Bewertungen

- Investment 1Dokument18 SeitenInvestment 1Sujal BedekarNoch keine Bewertungen

- Implementation of A Negative Income Tax. Estimation of Net Cost and Poverty and Inequality EffectsDokument2 SeitenImplementation of A Negative Income Tax. Estimation of Net Cost and Poverty and Inequality EffectsGarrett BergNoch keine Bewertungen