Beruflich Dokumente

Kultur Dokumente

31 Tds Rules

Hochgeladen von

mail2piyushCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

31 Tds Rules

Hochgeladen von

mail2piyushCopyright:

Verfügbare Formate

Section Particulars Liability Exempt Upto Rate

PAN not

provided

Due date for Deposit

Certificate for TDS

and Time

Date of Deposite of

Return

Quarterly

Return Form

192 Salary At the time of Payment Basic Exmption Limit Slab Rate

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16 on or

before 31st May

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 24Q

193 Interest on Securities

Payment or Credit

whichever is earlier

In case of debenture Rs.

2,500

10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194A

Interest Other Than

Interest on Securities

Payment or Credit

whichever is earlier

Rs. 5,000,

if payer is a bank or

cooperative Society than -

Rs.10000

10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194B

Winnings From

Lotteries

Payment or Credit

whichever is earlier

Rs. 10,000. 30%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194BB

Winnings From

Horse Races

Payment or Credit

whichever is earlier

Rs. 5,000. 30%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194C

Payment to

Contractor

Payment or Credit

whichever is earlier

Single payment / credit

exceeds Rs. 30,000 or

Total credit/payment

exceeds Rs. 75,000

during the FY.

No TDS on Freight

Payment. Individual

or HUF - 1% Others

- 2%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194D

Insurance

Commission

Payment or Credit

whichever is earlier

Rs. 20,000 10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194G

Commission on Sales

of Lottery Tickets

Payment or Credit

whichever is earlier

Rs. 1,000 10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194H

Commission /

Brokerage other than

Insurance

Payment or Credit

whichever is earlier

Rs. 5,000 10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194I Rent

Payment or Credit

whichever is earlier

Rs. 180,000

Plant & Machinery -

2%

Otherwise - 10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

194J

Professional Fees or

Technical Services

Payment or Credit

whichever is earlier

Rs. 30,000 10%

7th of the next month in which deduction

is made and in case of deduction in the

month March, 30th April.

Form No.16A, 31st

July, 31st Oct., 31st

Jan., 31st May.

15th July, 15th Oct, 15th

Jan, 15th May

Form No. 26Q

TAX DEDUCTED AT SOURCE

I

f

P

A

N

i

s

n

o

t

p

r

o

v

i

d

e

d

,

r

a

t

e

o

f

T

D

S

s

h

a

l

l

b

e

2

0

%

o

r

a

p

p

l

i

c

a

b

l

e

r

a

t

e

,

w

h

i

c

h

e

v

e

r

i

s

h

i

g

h

e

r

Rules Applicable from 1st July, 2010

Prepared by R. R. Falod and Co.

Sub PasswordBreaker()

'Breaks worksheet password protection.

Dim i As Integer, j As Integer, k As Integer

Dim l As Integer, m As Integer, n As Integer

Dim i1 As Integer, i2 As Integer, i3 As Integer

Dim i4 As Integer, i5 As Integer, i6 As Integer

On Error Resume Next

For i = 65 To 66: For j = 65 To 66: For k = 65 To 66

For l = 65 To 66: For m = 65 To 66: For i1 = 65 To 66

For i2 = 65 To 66: For i3 = 65 To 66: For i4 = 65 To 66

For i5 = 65 To 66: For i6 = 65 To 66: For n = 32 To 126

ActiveSheet.Unprotect Chr(i) & Chr(j) & Chr(k) & _

Chr(l) & Chr(m) & Chr(i1) & Chr(i2) & Chr(i3) & _

Chr(i4) & Chr(i5) & Chr(i6) & Chr(n)

If ActiveSheet.ProtectContents = False Then

MsgBox "One usable password is " & Chr(i) & Chr(j) & _

Chr(k) & Chr(l) & Chr(m) & Chr(i1) & Chr(i2) & _

Chr(i3) & Chr(i4) & Chr(i5) & Chr(i6) & Chr(n)

Exit Sub

End If

Next: Next: Next: Next: Next: Next

Next: Next: Next: Next: Next: Next

End Sub

Das könnte Ihnen auch gefallen

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionVon EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNoch keine Bewertungen

- ITP Exam Preparation GuideDokument46 SeitenITP Exam Preparation GuideMyjudulNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- CA Aditya Maheshwari R. R. Falod & Co.: B. Com., A. C. A. Chartered AccountantsDokument1 SeiteCA Aditya Maheshwari R. R. Falod & Co.: B. Com., A. C. A. Chartered Accountantsmail2piyushNoch keine Bewertungen

- Compliance Calendar 2013-14Dokument1 SeiteCompliance Calendar 2013-14Amitmil MbbsNoch keine Bewertungen

- Member Loan Application: This Form Is Not For SaleDokument3 SeitenMember Loan Application: This Form Is Not For SaleClaire RoxasNoch keine Bewertungen

- Quarterly Returns With Monthly Payment ScheDokument5 SeitenQuarterly Returns With Monthly Payment Schebikas kumarNoch keine Bewertungen

- CAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantDokument2 SeitenCAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantMahaveer DhelariyaNoch keine Bewertungen

- A. Eligibility and Opting For The Scheme: Quarterly Returns With Monthly Payment SchemeDokument5 SeitenA. Eligibility and Opting For The Scheme: Quarterly Returns With Monthly Payment SchemeKushal VermaNoch keine Bewertungen

- Tamilnadu State Accounting and Taxation Services Co-Operative Society Limited, Xnc-895Dokument6 SeitenTamilnadu State Accounting and Taxation Services Co-Operative Society Limited, Xnc-895Tax Co-operative CBENoch keine Bewertungen

- AO2015 ResultDokument25 SeitenAO2015 ResultSasanka BanerjeeNoch keine Bewertungen

- Sss Loan Form 2013Dokument3 SeitenSss Loan Form 2013John Carlo M. SamaritaNoch keine Bewertungen

- Acctstmt PDokument2 SeitenAcctstmt Pmaakabhawan26Noch keine Bewertungen

- Income Tax HandbookDokument26 SeitenIncome Tax HandbooknisarNoch keine Bewertungen

- Expenses Disallowed Under PGBPDokument6 SeitenExpenses Disallowed Under PGBPsubhash mandwalNoch keine Bewertungen

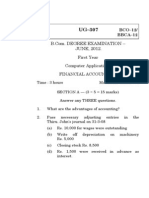

- UG307 BCO12-bbca12Dokument6 SeitenUG307 BCO12-bbca12Vignesh KumarNoch keine Bewertungen

- Interest under 234A, 234B, 234CDokument5 SeitenInterest under 234A, 234B, 234CMahaveer DhelariyaNoch keine Bewertungen

- A State Imposes A Sales Tax of 6 Percent The: Unlock Answers Here Solutiondone - OnlineDokument1 SeiteA State Imposes A Sales Tax of 6 Percent The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNoch keine Bewertungen

- Flipkart Axis Bank Credit Card Fee ChangesDokument4 SeitenFlipkart Axis Bank Credit Card Fee ChangesvarunchopNoch keine Bewertungen

- Session 2 and 3Dokument36 SeitenSession 2 and 3AARCHI JAINNoch keine Bewertungen

- Payment of Bonus Act, 1965 in Brief: TG TeamDokument5 SeitenPayment of Bonus Act, 1965 in Brief: TG TeamChinnaNoch keine Bewertungen

- Input Tax CreditDokument8 SeitenInput Tax Creditloey xafNoch keine Bewertungen

- Gpf-Bill-Form 40a Nam Ta 49Dokument2 SeitenGpf-Bill-Form 40a Nam Ta 49robert100% (1)

- Shriram Transport Intimation Letter A4Dokument1 SeiteShriram Transport Intimation Letter A4AdhiNoch keine Bewertungen

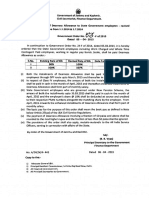

- J&K Govt Revises DA Rates for EmployeesDokument2 SeitenJ&K Govt Revises DA Rates for EmployeesShowkat Ahmad LoneNoch keine Bewertungen

- English MITC PDFDokument15 SeitenEnglish MITC PDFAmit ShuklaNoch keine Bewertungen

- Milton Form16Dokument4 SeitenMilton Form16sundar1111Noch keine Bewertungen

- TCS - in Income TaxDokument8 SeitenTCS - in Income TaxrpsinghsikarwarNoch keine Bewertungen

- TDS Rate Financial Year 13-14Dokument10 SeitenTDS Rate Financial Year 13-14Heena AgreNoch keine Bewertungen

- Go68 Aas in Rps 2015Dokument8 SeitenGo68 Aas in Rps 2015Ramachandra RaoNoch keine Bewertungen

- Compliance Calander FY23-24 - UJADokument5 SeitenCompliance Calander FY23-24 - UJAagrawal.rahul.00Noch keine Bewertungen

- Power Pack Revision Material Nov 2019 PDFDokument429 SeitenPower Pack Revision Material Nov 2019 PDFvarchasvini malhotraNoch keine Bewertungen

- Simplification of Pension Form CSR-25 (Revised)Dokument10 SeitenSimplification of Pension Form CSR-25 (Revised)optimist_24100% (1)

- Policy Protection PlanDokument36 SeitenPolicy Protection Plankrishna_1238Noch keine Bewertungen

- BFLS 2016 Registration FormDokument2 SeitenBFLS 2016 Registration FormManan TyagiNoch keine Bewertungen

- dpanAR 2017 2018 PDFDokument105 SeitendpanAR 2017 2018 PDFedlwunefNoch keine Bewertungen

- Goa Bye Laws 2012Dokument199 SeitenGoa Bye Laws 2012Abhijeet_Gehlo_3190Noch keine Bewertungen

- 2019fin MS19Dokument4 Seiten2019fin MS19ShanmukhamNoch keine Bewertungen

- 12062015fin Ms 68 - Implementation of Automatic Advancement SchemeDokument6 Seiten12062015fin Ms 68 - Implementation of Automatic Advancement Schemeapi-215249734Noch keine Bewertungen

- Central Goods and Services Tax (CGST) Rules, 2017, Part - B (FORMS)Dokument372 SeitenCentral Goods and Services Tax (CGST) Rules, 2017, Part - B (FORMS)Latest Laws TeamNoch keine Bewertungen

- MTP 2 Idt 2019Dokument10 SeitenMTP 2 Idt 2019kartikNoch keine Bewertungen

- I Got All These Questions Collected From Our MembersDokument15 SeitenI Got All These Questions Collected From Our MembersvishalNoch keine Bewertungen

- Most Important Terms & ConditionsDokument12 SeitenMost Important Terms & ConditionsshazanNoch keine Bewertungen

- P.P.T On Duties - Responsibilities of DDO For GSTDokument30 SeitenP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNoch keine Bewertungen

- Tax RatesDokument3 SeitenTax RatesAhmed RazaNoch keine Bewertungen

- Chinnaduran Form16Dokument4 SeitenChinnaduran Form16sundar1111Noch keine Bewertungen

- AP Govt Revises Interest Rate for Employee Insurance SchemeDokument6 SeitenAP Govt Revises Interest Rate for Employee Insurance SchemeSivareddy50% (2)

- SSS Salary Loan 02-2013Dokument3 SeitenSSS Salary Loan 02-2013Jon Allan Buenaobra100% (2)

- Mock Test Series 2 QuestionsDokument10 SeitenMock Test Series 2 QuestionsSuzhana The WizardNoch keine Bewertungen

- Kotaka Form16 41970Dokument4 SeitenKotaka Form16 41970sai_gsrajuNoch keine Bewertungen

- Telangana Govt Guidelines Disposal Pending Land ApplicationsDokument2 SeitenTelangana Govt Guidelines Disposal Pending Land ApplicationsmadirajunaveenNoch keine Bewertungen

- Interest Payable by The Tax Payer in IndiaDokument13 SeitenInterest Payable by The Tax Payer in Indiamail2quraishi3084Noch keine Bewertungen

- Taxation Chapter 3 RMH1Dokument22 SeitenTaxation Chapter 3 RMH1Fahim Ashab Chowdhury0% (1)

- GST UPDATESDokument17 SeitenGST UPDATESRaj ShuklaNoch keine Bewertungen

- Maharashtra Profession Tax FaqsDokument5 SeitenMaharashtra Profession Tax FaqsPrashant BedaseNoch keine Bewertungen

- QRMP Scheme Under GSTDokument7 SeitenQRMP Scheme Under GSTshraddhaNoch keine Bewertungen

- Guideline On ITDokument19 SeitenGuideline On ITmikekikNoch keine Bewertungen

- Briefing MADE EASY-LUCILLEDokument51 SeitenBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNoch keine Bewertungen

- ForexDokument20 SeitenForexmail2piyush0% (2)

- Prudential Norms Investment by Banks1Dokument16 SeitenPrudential Norms Investment by Banks1mail2piyushNoch keine Bewertungen

- 7 - Application Form For Family Pension On The Death of A Government ServantPensionerDokument2 Seiten7 - Application Form For Family Pension On The Death of A Government ServantPensionermail2piyushNoch keine Bewertungen

- Basel Iii PDFDokument26 SeitenBasel Iii PDFSubhagata MitraNoch keine Bewertungen

- 31 Tds RulesDokument2 Seiten31 Tds Rulesmail2piyushNoch keine Bewertungen

- Atal Pension Yojana-SchemeDokument9 SeitenAtal Pension Yojana-SchemeSaurabhNoch keine Bewertungen

- PrivateSecBanks 03-08-12Dokument9 SeitenPrivateSecBanks 03-08-12mail2piyushNoch keine Bewertungen

- Tax Deduction at Source on SalariesDokument112 SeitenTax Deduction at Source on SalariesArnav MendirattaNoch keine Bewertungen

- CAIIB Financial Module D MCQDokument7 SeitenCAIIB Financial Module D MCQRahul GuptaNoch keine Bewertungen

- Jaiib Legal Aspects of Banking CDDokument65 SeitenJaiib Legal Aspects of Banking CDrudra.souravNoch keine Bewertungen

- Balance Sheet For Exxon Mobil CorpDokument3 SeitenBalance Sheet For Exxon Mobil Corpmail2piyushNoch keine Bewertungen

- CaiibDokument90 SeitenCaiibmail2piyush100% (2)

- Charter Demands Submitted Indian Bank's AssociationDokument48 SeitenCharter Demands Submitted Indian Bank's Associationmail2piyushNoch keine Bewertungen

- 012 Pascual V CIRDokument2 Seiten012 Pascual V CIRkeith105Noch keine Bewertungen

- May PayDokument2 SeitenMay PayAravind Sammandham100% (1)

- Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2GDokument149 SeitenSpecifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2Gtim winkelmanNoch keine Bewertungen

- Form GSTR-3B: (See Rule 61 (5) )Dokument2 SeitenForm GSTR-3B: (See Rule 61 (5) )DHARMAVARAPU Bala sriramNoch keine Bewertungen

- Compensation Cess-050819Dokument1 SeiteCompensation Cess-050819shri ramcraftNoch keine Bewertungen

- Same-Day Worksheet 1010Dokument2 SeitenSame-Day Worksheet 1010Hans GadamerNoch keine Bewertungen

- CIR v. Isabela CulturalDokument4 SeitenCIR v. Isabela CulturalDiwata de LeonNoch keine Bewertungen

- Service Customer InvoiceDokument1 SeiteService Customer InvoiceSUNNYNoch keine Bewertungen

- ResolutionDokument2 SeitenResolutionnavaid.azizNoch keine Bewertungen

- Gratuity CalculationDokument4 SeitenGratuity CalculationmeetushekhawatNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokument1 SeiteIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRAMBABU KURUVANoch keine Bewertungen

- Tax Invoice DetailsDokument4 SeitenTax Invoice DetailsUttam kumarNoch keine Bewertungen

- RR 3-02Dokument6 SeitenRR 3-02matinikkiNoch keine Bewertungen

- Sol. Man. - Chapter 5 Employee Benefits 1Dokument2 SeitenSol. Man. - Chapter 5 Employee Benefits 1Nikky Bless LeonarNoch keine Bewertungen

- Membership Fee and ProcedureDokument2 SeitenMembership Fee and ProcedureAzhar RanaNoch keine Bewertungen

- No Plastic Packaging: Tax InvoiceDokument15 SeitenNo Plastic Packaging: Tax Invoicehiteshmohakar15Noch keine Bewertungen

- Pascual vs. DragonDokument2 SeitenPascual vs. DragonRussell John HipolitoNoch keine Bewertungen

- Tuition Statement Provides Tax InfoDokument2 SeitenTuition Statement Provides Tax InfoJonathan EllisNoch keine Bewertungen

- Large Taxpayers Regulations on Filing & Payment DatesDokument3 SeitenLarge Taxpayers Regulations on Filing & Payment DatesLady Ann CayananNoch keine Bewertungen

- Tutorial Chapter 4 - QDokument7 SeitenTutorial Chapter 4 - QParthiban BanNoch keine Bewertungen

- Supplier ContarctarDokument7 SeitenSupplier ContarctarAbdiaziz M. YusoufNoch keine Bewertungen

- Ann Julienne Aristoza Income Tax MatrixDokument5 SeitenAnn Julienne Aristoza Income Tax MatrixJul A.Noch keine Bewertungen

- Indian Income Tax Return Acknowledgement for FY 2019-20Dokument1 SeiteIndian Income Tax Return Acknowledgement for FY 2019-20Subhendu NathNoch keine Bewertungen

- CREATE Act summary: Key tax reforms and incentivesDokument10 SeitenCREATE Act summary: Key tax reforms and incentivesTreb LemNoch keine Bewertungen

- Chapter 8 Regular Income Tax - Exclusion From Gross IncomeDokument2 SeitenChapter 8 Regular Income Tax - Exclusion From Gross IncomeJason MablesNoch keine Bewertungen

- Employee Release Information FormDokument23 SeitenEmployee Release Information FormdenguNoch keine Bewertungen

- E-Filing of Taxes - A Research PaperDokument8 SeitenE-Filing of Taxes - A Research PaperRieke Savitri Agustin0% (1)

- Taxation Laws in IndiaDokument3 SeitenTaxation Laws in IndiasankalpmiraniNoch keine Bewertungen

- Joint Explanatory StatementDokument570 SeitenJoint Explanatory Statementacohnthehill50% (4)

- CBDT Condones Delay in Filing Form 108Dokument2 SeitenCBDT Condones Delay in Filing Form 108sandeep100% (1)