Beruflich Dokumente

Kultur Dokumente

Coffee Market Marex Spectron Jan 14

Hochgeladen von

Karl Wikland0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

216 Ansichten11 SeitenOutlook on Arabica Coffee Jan 2014

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenOutlook on Arabica Coffee Jan 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

216 Ansichten11 SeitenCoffee Market Marex Spectron Jan 14

Hochgeladen von

Karl WiklandOutlook on Arabica Coffee Jan 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

1

Coffee Market Report January 2014

2

Overview

3-4

Brazil

5

Colombia and Peru

6

Monthly Coffee Exports Mild Washed Arabica Producing Countries (60kg bags) 6

Central America and Mexico 7

Robusta

7

Vietnam Shipments (PHYTO)

8

Arbitrage

8

Stocks

8

Funds

9

ICE Market Commentary

9

LIFFE Market Commentary

10

The Balance Sheet Across 2013/14 and 2014/15

10

CONTENTS

3

Coffee Market Report

January 2014

COFFEE DESK

London

James Hearn

JHearn@marexspectron.com

Keith Buers

KBuers@marexspectron.com

Thanh Ly

TLy@marexspectron.com

Kiki Van der Gucht

KVandergucht@marexspectron.com

Steve Pollard

SPollard@marexspectron.com

+44 207 491 6700

New York

Cary Waldman

CWaldman@marexspectron.com

Eric Corigliano

ECorigliano@marexspectron.com

+1 212 584 3879

OVERVIEW

Q4 shipments from Brazil were about 8.5 million bags, supporting the

growing consensus that the crop was at the upper end of expectations. We

have raised our 2013/14 crop estimate to 54.5m million bags (of which 39m

bags Arabica). At the same time, predictions for the 2014/15 crop have come

down owing to aggressive pruning and lower yields. The range of forecasts is

presently wide but we consider a fair consensus to be 55 million bags.

Although these two changes reflect a net reduction in supply of 2.5m bags, the

two-year global balance remains in surplus. Whether this surplus will be in

Robusta or Arabica will depend largely on the arbitrage which has been

extremely volatile since our last report.

Producers ability to hold back from selling in the face of new contract lows,

no doubt aided by delayed harvests in Vietnam and Central America,

provided a further catalyst for the short-covering rally. Systems and

discretionary managed funds, who were short a record 10m bags of Arabica in

early November, bought a little over 5m bags of Arabica and 4m bags of

Robusta by the new year. Index fund rebalancing will add 1.0 - 1.25 m bags of

buying by mid-January.

The Brazilian Government is consulting on repeating its Put Program in

March 2015 and even extending it from 3m bags to 5 m bags. It is our

understanding that this would only become reality if there are few or no

deliveries against this years Put Program. That is to say, the cumulative effect

over two years would be 3 or 5m bags. While this is very significant to the

market, it would be insufficient to swing the two-year balance into deficit.

Colombian shipments in Q4 came in at just under 3 m bags. This is about

50% higher than the same period last year, reflecting a crop that is both

large and early. This rate of shipments is unsustainable and registrations have

started to decelerate in January. Colombian exports are nonetheless expected

to average 750k bags a month for the remainder of the crop year. State

financial support for coffee farmers will continue in a changed format. This

will ensure good husbandry and picking of the next crop which is expected to

grow slightly to 10.75 m bags.

New crop shipments from Central America have got off to a slow start owing

to a delayed harvest and low carry-in stocks. Recent reports have varied

greatly as to the impact of Roya on total production in the region, particularly

in Guatemala and Mexico. Our understanding is that while certain local areas

have been devastated, total production in the region will be down by less than

4

10%. This is because the biggest producer, Honduras, is likely to have an unchanged crop as new plantings

compensate for Roya loss. As early shipments have been so slow, exports from the region for the remainder

of the year are likely to be down by less than 100k bags a month compared to last year.

The Robusta market continues to suffer from an inverted price structure while stocks build in producer

hands and fall in consuming countries. This has been exacerbated by a delayed Vietnam harvest and

resistance by farmers to sell at low prices. The Vietnamese crop is big (28.8m of which 27.7 m is Robusta)

as are producer stocks. Shipments and deliveries to Ho Chi Minh have just started to accelerate. We would

expect monthly shipments from Vietnam to average 2.25 m bags for the remainder of the crop year. With

the upcoming Conillon crops (17m bags) and Indonesia (10.3 m bags of Robusta) fast approaching, we expect

the weight of hedge selling to pressure the market as H1 2014 progresses.

The short-covering rally has been the strongest since the start of the downtrend in 2011 and signals the

probable start of a bottoming phase. Index rebalancing should support prices in early January but we see

the Brazilian put level as a lid on the market (about 127/128 cts/lb NYC equivalent at todays differentials and

currency) and expect the weight of hedge selling to pressure the market as Q1 2014 progresses.

ICE spreads remain at full carry while the Liffe market continues in backwardation. The Liffe Exchanges

policy of intervention in the spot spread has been successful in ensuring orderly delivery periods but has

broken cash convergence - the consequence has been ever diminishing certified stocks. With certified

stocks currently standing at 2,820 lots, this problem is coming to a head. We currently have a natural,

modest, inversion, but to date this has proved insufficient to break the basis and bring fresh coffee to the

board. We believe that stocks will continue to draw over the coming weeks and months and may approach

zero. Under this scenario, even the exchange will be powerless in preventing either H/K or K/N inverting

further to effect full cash convergence. System fund buying started about two weeks earlier in Robusta than

in Arabica which caused extreme movements in the arbitrage. The second month arbitrage narrowed to

below 30 cts/lb before the flat price buying switched to Arabica and the arbitrage strengthened back to over

45 cts/lb.

5

Brazil

Q4 shipments were about 8.5 million bags supporting the growing consensus that the crop was at the

upper end of expectations. We have raised our 2013/14 crop estimate up to 54.5m million bags (of which

39 m bags Arabica) and anticipate total exports of 31.5 million bags.

Predictions for the 2014/15 crop, on the other hand, have come down significantly. Those who do field

surveys (and we do not) report more aggressive pruning in a low price environment. There is also evidence

of lower yields, despite good weather conditions, as the trees suffer fatigue following two bumper years. We

put the current consensus at 55 million bags, and will follow up-coming reports closely to see if a further

downward revision is necessary.

At the time of writing, it is still attractive for Brazilian producers to deliver to the Government in March at a

price of 343 R/bag. But the weaker Real and firmer farm gate prices are narrowing the gap between NYC and

the producer puts. We estimate that about 3m bags of hedge selling would enter the market if prices are in

the upper 120s in February.

The Government is consulting on repeating the Put program in March 2015 and even raising it from 3 million

bags to 5 million bags. The cumulative retention of 8 million bags would push our global balance of available

Arabica well into deficit. However, our understanding is that this second Put program is highly unlikely if

there are large deliveries in March 2014. That is to say, the cumulative impact would be unlikely to exceed 3

million bags over two years, which leaves the Arabica balance in surplus.

In the first few months of the crop year, the price spread between Brazilian qualities moved considerably,

with Fine Cup moving to a large premium over Good Cup and lower grade Arabicas becoming cheaper than

Conillon. While the premium for Fine Cup remains high. The other spreads have reverted to more

historically normal levels in December. At todays prices, we expect Conillon to regain share in the

domestic industry.

6

Colombia and Peru

Q4 exports from Colombia at just a fraction below 3 million bags were about 50% higher than the same

period in 2012 reflecting both a large and early crop. This rate of shipments is unsustainable and has

started to decelerate in January. Nonetheless, indications are for a big Mitaca and we estimate another 7.5

m bags will be shipped over the remaining 10 months of the coffee year.

The Government has announced that it has set aside the equivalent of USD 2 billion in its 2014 budget to

finance agriculture. Of this, 0.5 billion has been allocated to the coffee sector. The Finance Minister has

suggested that this subsidy be paid on a per hectare basis. This proposal would effectively penalise efficient

producers that have a higher yield per hectare but will prove popular amongst the many smaller farmers

ahead of the elections in May 2014.

Based on an annual production of 10.5 million bags, this subsidy equates to about 36 cts/lb which would be

slightly less than the present subsidy but would suffice to cover the marginal costs of production and would

ensure adequate husbandry. Our sources suggest that a crop in the region of 10.5 - 11 million bags is realistic

for 2014/15 which is considerably below figures we have heard from the FNC.

Source: Anacafe

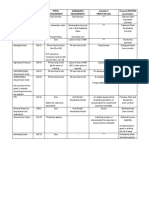

COLOMBIA PERU MONTHLY TOTAL COSTA RICA EL SALVADOR GUATEMALA HONDURAS MEXICO NICARAGUA DOM REP MONTHLY TOTAL

Oct-12 582,067 591,187 1,173,254 34,889 36,094 129,491 47,595 232,995 183,767 4,477 669,308

Nov-12 732,508 554,375 1,286,883 46,072 34,826 140,501 98,722 241,942 176,424 15,376 753,863

Dec-12 786,637 450,000 1,236,637 100,129 75,286 140,369 343,080 174,057 60,576 11,701 905,198

Jan-13 743,104 178,470 921,574 136,991 117,246 265,806 639,669 237,717 100,506 19,704 1,517,639

Feb-13 718,540 145,700 864,240 152,621 137,730 344,236 581,548 365,329 118,063 3,259 1,702,786

Mar-13 676,601 125,043 801,644 164,034 147,738 383,758 659,038 344,906 180,177 8,794 1,888,445

Apr-13 685,652 59,844 745,496 205,592 127,571 435,587 589,347 387,867 268,439 7,642 2,022,045

May-13 854,772 175,343 1,030,115 180,480 128,974 467,439 503,050 316,641 221,615 7,866 1,826,065

Jun-13 664,641 324,987 989,628 148,522 101,969 424,720 453,115 334,899 212,988 8,694 1,684,907

Jul-13 786,346 523,087 1,309,433 127,254 124,699 375,054 230,720 280,711 163,760 5,747 1,307,945

Aug-13 930,509 710,743 1,641,252 63,918 83,132 356,865 144,258 231,208 159,861 5,781 1,045,023

Sep-13 673,851 654,559 1,328,410 37,672 45,030 243,082 49,879 198,248 82,561 5,623 662,095

Oct-12/Sep-13 8,835,228 4,493,338 13,328,566 1,398,174 1,160,295 3,706,908 4,340,021 3,346,520 1,928,737 104,664 15,985,319

COLOMBIA PERU MONTHLY TOTAL COSTA RICA EL SALVADOR GUATEMALA HONDURAS MEXICO NICARAGUA DOM REP MONTHLY TOTAL

Oct-13 877,482 658,805 1,536,287 31,972 37,487 80,771 39,015 168,338 39,775 8,722 406,080

Nov-13 1,062,000 574,583 1,636,583 41,275 19,066 74,560 56,349 200,000e 33,819 14,000 439,069

Dec-13 1,010,000 500,000e 1,510,000 64,784 na 137,589 344,094 na na na 546,467

Oct-13/Dec-13 2,949,482 1,733,388 4,682,870 138,031 56,553 292,920 439,458 368,338 73,594 22,722 1,391,616

Monthly Coffee Exports - Mild Washed Arabica Coffee Producing Countries (60kg bags)

7

Central America and Mexico

A delayed new crop and aggressive competition from Colombia has meant marketing of the 2013/14 crop

has got off to a slow start. While certain areas have been devastated by Roya, sources on the spot suggest

that total production in Guatemala and Mexico will not be impacted as much as some reports suggest and

that new plantings will keep Honduran production almost unchanged. Across the region, we continue to

work with a decrease in production of about 8% and reduction in exports of about 12%, owing to the lower

carry-in stocks.

Q4 shipments are about 40% down on 2012. Assuming total exports of about 14m bags, this would indicate

that the region would still be in a position to export 1.4 m bags in the remaining nine months of the coffee

year, which would be less than 100k bags below the same period in 2012/13.

Robusta

The Robusta market continues to suffer from an inverted price structure while stocks build in producer

hands and fall in consuming countries. Intervention by the Exchange has meant the spot month has

repeatedly reverted to a discount prior to delivery, effectively relieving the shorts of their contractual

obligation to deliver. While this policy has succeeded in ensuring orderly delivery periods, it has failed to

facilitate the transfer of stocks from producers and caused a prolongation of the inverse price structure. But

stocks are at critical levels and are set to fall still further. We believe that either H/K or K/N will invert further

in order to achieve full cash convergence and facilitate the transfer of stock from producer to consumer.

Rains in Vietnam and the resistance on the part of producers to sell at low prices have combined to delay

the arrival of physical coffee to the market. Vietnamese Q4 exports of just 4.3 m bags are down 1.6 m bags

on last year. The consensus suggests that this years Vietnam crop will be about 4.5 million bags larger than

2012/13 and this comes on top of high producer stocks. Shipments and deliveries to Ho Chi Minh have

started to accelerate rapidly with stocks at the port doubling from a very low level to 1.845 m bags in

December. This will continue at a high level for the rest of the year. More importantly, much of this physical

trade appears to be unpriced which is decidedly bearish for the futures price. On top of this selling, large

Robusta crops are expected in both Brazil (17m bags conillon) and Indonesia (10.3m bags).

We saw little evidence of Conillon taking advantage of the premium nearby months on Liffe to sell their

carry-over stocks and this has been confirmed by the Oct/Nov shipments of just 165k bags. We expect

shipments to pick up as the new crop arrives on top of the carry-over stocks. In contrast to Brazilian Arabica

farms, there does not appear to be the same heavy pruning or lower yields in the Conillon areas. New

plantings over the past 5 years have increased potential production to as much as 20 m bags. With excellent

weather so far this year, the consensus is for a crop of 17m bags, with some even higher.

8

Arbitrage

The second month arbitrage narrowed to less than 30 cts/lb before reverting to over 45 cts/lb as system

fund buying came first into the Robusta market and later into Arabica.

The question of substitution on the part of industry, and its impact on the Robusta and Arabica balance

sheets, remains a moving target. In Q4 2013 there will have been some substitution as lower grade Arabica

differentials and a narrow arbitrage made a switch away from Robusta attractive for some roasters. With

todays prices, this situation has reversed but this situation remains fluid.

As previously discussed, we are friendly to nearby LIFFE structure and should New York come under pressure

in the short term, we would expect the arbitrage to tighten, and possibly sharply.

Stocks

The Green Coffee Association stocks show US stocks virtually unchanged on the year at 5 m bags. While

this figure is not broken down between Arabica and Robusta, we expect the increase in ICE certifieds to 2.7m

bags reflects a decrease in Robusta stocks in the US. At the same time, we estimate European stocks to have

fallen by about 1 m bags to 8.5m bags. Most of this decrease has been in Robusta which we estimate to be

just 1.8m bags in Europe, of which 0.5m bags are Liffe certified. Ho Chi Minh stocks are down 900k bags on

the year to 1.845m bags.

At the same time there has been a build-up in producing country stocks, particularly in Brazil and Vietnam.

While it is tempting to think there may be a structural change at play, whereby financially stronger producers

are choosing to carry coffee close to home, where the costs of carry are cheap, we think a more probable

scenario is that big shipments will take place before the end of the crop year leading to an increase in stocks

by about 3 m bags in Europe and Ho Chi Minh combined, while US stocks remain little changed. As most of

this coffee is as yet unpriced, it will have a negative impact on futures prices.

Vietnam Shipments (PHYTO)

2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14

Oct 1,166,667 1,000,000 808,333 1,360,183 790,383 1,010,428 1,116,667 970,217 1,964,747 1,203,893

Nov 1,000,000 916,667 1,166,667 1,050,000 950,000 1,075,837 1,277,883 1,238,167 1,869,625 1,180,313

Dec 1,500,000 1,333,333 1,666,667 1,646,667 2,316,667 1,699,412 1,600,000 1,983,883 2,079,168 1,909,823

Jan 1,500,000 1,083,333 2,716,667 2,019,633 2,016,667 1,807,217 2,000,000 1,927,088 2,719,750 0

Feb 1,333,333 1,000,000 1,750,000 1,416,667 2,083,333 1,366,667 1,400,000 2,749,075 1,734,117 0

Mar 1,666,667 1,666,667 2,250,000 1,583,333 2,316,667 1,889,167 2,314,833 2,651,817 2,355,063 0

Apr 1,416,667 1,333,333 2,039,150 1,450,000 1,900,000 1,833,333 2,423,717 2,283,333 1,725,437 0

May 1,333,333 1,666,667 1,732,100 1,354,750 1,405,500 1,541,003 1,727,150 2,788,047 1,972,423 0

Jun 1,250,000 1,250,000 1,389,533 1,200,333 1,333,333 1,531,262 1,335,293 2,123,333 1,354,288 0

Jul 1,250,000 833,333 1,343,900 1,123,667 1,067,983 1,342,600 1,217,771 1,970,610 1,599,033 0

Aug 1,166,667 1,583,333 1,179,233 972,433 1,074,783 1,400,000 1,287,977 1,796,358 1,533,960 0

Sep 916,667 750,000 937,850 857,450 1,019,250 1,169,733 1,209,117 1,518,967 1,179,268 0

15,500,000 14,416,667 18,980,100 16,035,117 18,274,567 17,666,660 18,910,408 24,000,895 22,086,880 4,294,030

*60kg Bags

9

Funds

After establishing a record net short position of about 10 m bags of Arabica at contract lows, systems and

discretionary managed funds bought back a little over half of this by early January. The number of fund

participants has now dropped to its lowest level in over two years.

In Robusta, funds bought about 4m bags to leave their net involvement (excluding Index Funds) about

square.

Much of the price development in Q1 2014 will depend on the actions of this sector. A sustained move

higher will require funds shifting to a net long position.

The fund position (excluding about 1.5m bags of Index fund longs) is about square on Liffe (we estimate

systems funds are about 1m bags long and discretionary funds are about 1m bags short). Of this position,

the systems are most price-sensitive which suggests they will compete with origin to sell in a falling market.

At the time of writing, we expect to see net buying of about 1.0 - 1.25m bags of Arabica from Index funds by

mid-January. This should ensure an increase in traded volumes and open interest. The price impact will

depend largely on how much buying other participants have already done in anticipation.

We expect Index funds to carry about 14-15m bags of Arabica in H1 2014 and about 1.3-1.7 m bags of

Robusta.

Market Outlook ICE

We believe that the market has broken the down trend and is entering a long drawn out bottoming phase,

whereby short-covering rallies offer selling opportunities and levels approaching the lows should provide

buying opportunities. This view is backed up by recent crop reports which have greatly reduced the physical

surplus.

On a short term view we expect, following a quiet December, that the Index fund rebalancing in January will

generate an upsurge in traded volume. This Index Fund buying, coming at the end of the longest short-

covering rally since the bear market started in 2011, should provide a good opportunity for origin to price

their coffee. We would expect strong resistance in the upper 120s as the Brazilian Put program, which was

originally designed as a floor to the market, will effectively become a ceiling.

This phase could potentially last some time while demand slowly catches up with supply. The earliest visible

catalyst for change, barring a weather incident, would come if the Brazilian Government were to commit

unequivocally to a Put program of 5 m bags in March 2015.

At the time of writing we would look to sell the market, not because we are bearish but because we consider

the price to be in the upper end of a 105 130 cts/lb range for Q1 2014 basis the second month.

10

Market Outlook LIFFE

The window for Vietnam to price their sales before the arrival of the next Indonesian and Conillon crops is

narrowing and all three origins are expected to produce large crops. The fund position (excluding about

1.5m bags of Index fund longs) is about square on Liffe (we estimate systems funds are about 1m bags long

and discretionary funds are about 1m bags short). Of this position, the systems are most price-sensitive

which suggests they will compete with origin to sell in a falling market.

At the time of writing we consider the price to be in the upper end of a USD 1800 1400 range for H1 2014

basis the second month. However, the extremely low certified stocks mean the risk of a single-month spike

through the upper side of this range is a serious possibility. The market is difficult to read, in that we are

going from balance (but producers withholding stocks), into what should be a decent surplus, and current

prices are substantially above cost of production. With consumer stocks as low as they are, it is difficult for

us not to be constructive nearby, however, this view changes dramatically the further forward we go in time.

The Balance Sheet across 2013/14 and 2014/15

Supply

12/13

Supply

13/14

Supply

14/15

Brazil 55.25 54.5 55.0

Vietnam 24.25 28.8 26.7

Colombia 9.5 10.5 10.75

Costa Rica 1.6 1.4 1.4

Cote dIvoire 1.5 1.6 1.6

El Salvador 1.3 1.0 1.0

Ethiopia 4.7 5.2 5.0

Guatemala 3.6 3.3 3.5

Honduras 4.7 4.4 4.6

India 5.3 4.9 5.25

Indonesia 12 10.8 12.0

Malaysia 1.0 1.0 1.0

Mexico 4.5 4.2 4.2

Nicaragua 1.7 1.6 1.5

China 1.1 1.4 1.6

Tanzania 1.2 1.0 1.0

Papa New Guinea 0.7 1.1 1.1

Peru 4.3 4.2 4.4

Uganda 3.7 3.7 3.7

Others 8.9 8.4 8.2

Total: 150.8 153 153.5

Demand

12/13

Demand

13/14

Demand

14/15

Total 143.5 147.5 151.6

Balance +7.3 +5.5 +1.9

11

This report was approved and issued by Marex Financial Limited (MFL), a company within the Marex

Spectron group. MFL is incorporated under the laws of England and Wales (company no. 5613061 and VAT

registration no. GB 872 8106 13), is authorised and regulated by the Financial Services Authority (FSA

registration number 442767) and is a member of the London Stock Exchange. MFLs registered address is at

155 Bishopsgate, London, EC2M 3TQ.

Nothing in this report constitutes (i) an offer of services, (ii) an offer to purchase or sell investments or any

other product or (iii) investment, tax or legal advice.

For important information concerning the contents and usage of this report, please click here

http://www.marexspectron.com/CDD_Disclaimer/tabid/159/Default.aspx

Das könnte Ihnen auch gefallen

- Food Outlook: Biannual Report on Global Food Markets July 2018Von EverandFood Outlook: Biannual Report on Global Food Markets July 2018Noch keine Bewertungen

- Focus v16 n8 FNLDokument6 SeitenFocus v16 n8 FNLrichardck61Noch keine Bewertungen

- Food Outlook: Biannual Report on Global Food Markets. November 2017Von EverandFood Outlook: Biannual Report on Global Food Markets. November 2017Noch keine Bewertungen

- Global Feed Markets: November - December 2013Dokument8 SeitenGlobal Feed Markets: November - December 2013Milling and Grain magazineNoch keine Bewertungen

- Coffee: World Markets and TradeDokument26 SeitenCoffee: World Markets and TradeSanjay NarayanNoch keine Bewertungen

- All Nuts Market Report - May 2023 - FNL3Dokument10 SeitenAll Nuts Market Report - May 2023 - FNL3bonnetNoch keine Bewertungen

- Nedspice Pepper Crop Report 2015Dokument6 SeitenNedspice Pepper Crop Report 2015danielNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Global Feed Markets: November - December 2014Dokument9 SeitenGlobal Feed Markets: November - December 2014Milling and Grain magazineNoch keine Bewertungen

- USDA ERS Oil Crops Outlook February 2012Dokument11 SeitenUSDA ERS Oil Crops Outlook February 2012ixvivxi.netNoch keine Bewertungen

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDokument40 SeitenWorld Agricultural Supply and Demand Estimates: United States Department of AgricultureFranc LuisNoch keine Bewertungen

- Volume 16 Issue 39Dokument27 SeitenVolume 16 Issue 39TRIMURTI FR100% (1)

- MS 2012 Outlook: Softs: Cotton: Counting On The Global Production Response To Lower PricesDokument7 SeitenMS 2012 Outlook: Softs: Cotton: Counting On The Global Production Response To Lower Pricesz2009z2009Noch keine Bewertungen

- Jacha Inti DEC 23 Market UpdateDokument5 SeitenJacha Inti DEC 23 Market UpdateAlvaro PerezNoch keine Bewertungen

- Commodities - MARKETS OUTLOOK 1504Dokument6 SeitenCommodities - MARKETS OUTLOOK 1504Milling and Grain magazineNoch keine Bewertungen

- Market ReportDokument3 SeitenMarket Reportapi-311090769Noch keine Bewertungen

- Commodities: US SOYBEANSDokument4 SeitenCommodities: US SOYBEANSMilling and Grain magazineNoch keine Bewertungen

- Coffee: World Markets and Trade: Colombia's Diminished Production ContinuesDokument22 SeitenCoffee: World Markets and Trade: Colombia's Diminished Production ContinuesKoyel ChakrabortyNoch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesCharlie 'Sharif' BastaNoch keine Bewertungen

- Cotton Marketing NewsDokument2 SeitenCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Commodities - MARKETS OUTLOOKDokument8 SeitenCommodities - MARKETS OUTLOOKMilling and Grain magazineNoch keine Bewertungen

- ECOM Monthly-13MAY19Dokument13 SeitenECOM Monthly-13MAY19Sergio CoelhoNoch keine Bewertungen

- Commodities - MARKETS OUTLOOKDokument6 SeitenCommodities - MARKETS OUTLOOKMilling and Grain magazineNoch keine Bewertungen

- USDA Produção Agrícola Publicação de 2016Dokument57 SeitenUSDA Produção Agrícola Publicação de 2016brendawilkeNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Commodities - MARKETS OUTLOOK 1506Dokument6 SeitenCommodities - MARKETS OUTLOOK 1506Milling and Grain magazineNoch keine Bewertungen

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDokument40 SeitenWorld Agricultural Supply and Demand Estimates: United States Department of AgricultureAnkit AgarwalNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Wheat Follow Up Sept 23Dokument9 SeitenWheat Follow Up Sept 23Leonardo IntriagoNoch keine Bewertungen

- SanLucar Market Report Week 34-35 2022Dokument4 SeitenSanLucar Market Report Week 34-35 2022Andy Perez ChaconNoch keine Bewertungen

- Chilli Crop & Market Analysis: BST Agro ProductsDokument3 SeitenChilli Crop & Market Analysis: BST Agro ProductsA SNoch keine Bewertungen

- Doane Ag Insights WeeklyDokument7 SeitenDoane Ag Insights WeeklydoaneadvisoryNoch keine Bewertungen

- GCR - 44 - Nov2015 BrazilDokument4 SeitenGCR - 44 - Nov2015 BrazilocoffeebrNoch keine Bewertungen

- Cotton Marketing NewsDokument2 SeitenCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Daily Cocoa Commentary: Friday September 13, 2019Dokument5 SeitenDaily Cocoa Commentary: Friday September 13, 2019Paulo PeixinhoNoch keine Bewertungen

- Commodities - MARKETS OUTLOOK 1508Dokument6 SeitenCommodities - MARKETS OUTLOOK 1508Milling and Grain magazineNoch keine Bewertungen

- US Wheat Associates Road Trip 2015Dokument2 SeitenUS Wheat Associates Road Trip 2015Milling and Grain magazineNoch keine Bewertungen

- Focus v16 n7 FNLDokument10 SeitenFocus v16 n7 FNLrichardck61Noch keine Bewertungen

- CECAFE Monthly Coffee Report FEBRUARY 2019 PDFDokument19 SeitenCECAFE Monthly Coffee Report FEBRUARY 2019 PDFKaushalNoch keine Bewertungen

- Wasde 09 2011 AnalysisDokument40 SeitenWasde 09 2011 AnalysisDiego GervasNoch keine Bewertungen

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDokument40 SeitenWorld Agricultural Supply and Demand Estimates: United States Department of Agricultureapi-51572145Noch keine Bewertungen

- Coffee Annual Bogota Colombia 05-15-2021Dokument7 SeitenCoffee Annual Bogota Colombia 05-15-2021Rafa BorgesNoch keine Bewertungen

- Global Feed Markets: November - December 2011Dokument6 SeitenGlobal Feed Markets: November - December 2011Milling and Grain magazineNoch keine Bewertungen

- 2024 - USDA - World Agricultural SupplyDokument40 Seiten2024 - USDA - World Agricultural SupplyCristián Lescano VegaNoch keine Bewertungen

- Global Market Report November December 2022Dokument20 SeitenGlobal Market Report November December 2022puyehue123Noch keine Bewertungen

- Analysis & Comments: Livestock Marketing Information CenterDokument6 SeitenAnalysis & Comments: Livestock Marketing Information CenterBeata StepienNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- USDA Agricultural Demands ReportDokument40 SeitenUSDA Agricultural Demands ReportAustin DeneanNoch keine Bewertungen

- Grain and Feed Annual Brasilia Brazil 04-01-2021Dokument49 SeitenGrain and Feed Annual Brasilia Brazil 04-01-2021gicorpbrasilNoch keine Bewertungen

- The Sauer ReportDokument29 SeitenThe Sauer ReportSampada DeoNoch keine Bewertungen

- Usda 2011 LatestDokument40 SeitenUsda 2011 LatestsuperclonefanNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsMorgan IngramNoch keine Bewertungen

- World Agricultural Supply and Demand Estimates: United States Department of AgricultureDokument40 SeitenWorld Agricultural Supply and Demand Estimates: United States Department of Agricultureapi-78654247Noch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesMayankNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNoch keine Bewertungen

- Kantar FMCG Pulse March 2023Dokument9 SeitenKantar FMCG Pulse March 2023ChinmayNoch keine Bewertungen

- Brazil: Date: GAIN Report NumberDokument3 SeitenBrazil: Date: GAIN Report Numberapi-109061352Noch keine Bewertungen

- Coffee Demand and Supply AnalysisDokument3 SeitenCoffee Demand and Supply Analysisltian21Noch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Microeconomic Theory Review Questions: Exam #3 Exam 3 Will Cover Chapters: Profit Maximization Through MonopolyDokument1 SeiteMicroeconomic Theory Review Questions: Exam #3 Exam 3 Will Cover Chapters: Profit Maximization Through MonopolyAnonymous 7Un6mnqJzNNoch keine Bewertungen

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDokument3 SeitenAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNoch keine Bewertungen

- Cash Receipt Template 3 WordDokument1 SeiteCash Receipt Template 3 WordSaqlain MalikNoch keine Bewertungen

- SID - DWS Global Agribusiness Offshore FundDokument28 SeitenSID - DWS Global Agribusiness Offshore FundpvmoneyNoch keine Bewertungen

- Patagonia Apparrels Case StudyDokument12 SeitenPatagonia Apparrels Case Studyodiliah mghoiNoch keine Bewertungen

- Problem Set 9Dokument2 SeitenProblem Set 9nikhil gangwarNoch keine Bewertungen

- Installment Deferred Payment Method of Reporting IncomeDokument2 SeitenInstallment Deferred Payment Method of Reporting IncomeJennifer RueloNoch keine Bewertungen

- ECO724 Nigerian Financial SystemDokument187 SeitenECO724 Nigerian Financial SystemTimi MarquisNoch keine Bewertungen

- Evaluating A Firms Financial Performance3767Dokument17 SeitenEvaluating A Firms Financial Performance3767Yasser MaamounNoch keine Bewertungen

- Accounting For Inventory - 1Dokument4 SeitenAccounting For Inventory - 1ZAKAYO NJONYNoch keine Bewertungen

- Entrepreneurship Business Plan DR John ProductDokument11 SeitenEntrepreneurship Business Plan DR John ProductsuccessseakerNoch keine Bewertungen

- Exam 1Dokument41 SeitenExam 1Yogi BearNoch keine Bewertungen

- Anandrathi Share Broking ProposalDokument20 SeitenAnandrathi Share Broking Proposalmohammedakbar88Noch keine Bewertungen

- Micro-U4L2A45-The Derived Demand For A ResourceDokument2 SeitenMicro-U4L2A45-The Derived Demand For A ResourceAdvika PunjeNoch keine Bewertungen

- Lecture 6 1567834793996Dokument52 SeitenLecture 6 1567834793996Jay ShuklaNoch keine Bewertungen

- Oxfam Programme Quality Standards: Cash Transfer Programmes (CTPS)Dokument13 SeitenOxfam Programme Quality Standards: Cash Transfer Programmes (CTPS)Abdullah MutaharNoch keine Bewertungen

- Sample Business PlanDokument9 SeitenSample Business PlanReinan Shinenon100% (1)

- Government of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryDokument2 SeitenGovernment of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryBidhan DuttaNoch keine Bewertungen

- Functional FibreDokument10 SeitenFunctional Fibresofia NunesNoch keine Bewertungen

- Chapter 3 - Investment IncomeDokument26 SeitenChapter 3 - Investment IncomeRyan YangNoch keine Bewertungen

- Marketing Strategies of RAK Ceramics LimitedDokument20 SeitenMarketing Strategies of RAK Ceramics LimitedMonsur Habib50% (2)

- SLIM - DDM - Module 2 - Class 2 - Nov 2019Dokument62 SeitenSLIM - DDM - Module 2 - Class 2 - Nov 2019Nisal WickramasingheNoch keine Bewertungen

- NiraparaDokument12 SeitenNiraparabasilNoch keine Bewertungen

- Question Bank Nism Equity DerivativeDokument13 SeitenQuestion Bank Nism Equity Derivativedev12_lokeshNoch keine Bewertungen

- Online Shopping 1 (AutoRecovered)Dokument5 SeitenOnline Shopping 1 (AutoRecovered)darshana gulhaneNoch keine Bewertungen

- Exam Prep (7-Eleven Case)Dokument4 SeitenExam Prep (7-Eleven Case)guifyciNoch keine Bewertungen

- Defensive StrategyDokument10 SeitenDefensive Strategysmile xiiiNoch keine Bewertungen

- Marathon's InvoiceDokument1 SeiteMarathon's InvoiceLily HuzdupNoch keine Bewertungen

- Neighborhood Laundry Marketing Plan (SWOT ANAYLYSIS)Dokument2 SeitenNeighborhood Laundry Marketing Plan (SWOT ANAYLYSIS)Den Mark Pallogan SilawonNoch keine Bewertungen

- Value Chain Definition Model Analysis and ExampleDokument9 SeitenValue Chain Definition Model Analysis and ExampleSR-Rain Daniel EspinozaNoch keine Bewertungen

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Von EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Bewertung: 4.5 von 5 Sternen4.5/5 (11)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Von EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Bewertung: 5 von 5 Sternen5/5 (1)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantVon EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantBewertung: 4 von 5 Sternen4/5 (387)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewVon EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (104)

- Generative AI: The Insights You Need from Harvard Business ReviewVon EverandGenerative AI: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceVon EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Summary of Richard Rumelt's Good Strategy Bad StrategyVon EverandSummary of Richard Rumelt's Good Strategy Bad StrategyBewertung: 5 von 5 Sternen5/5 (1)

- Sales Pitch: How to Craft a Story to Stand Out and WinVon EverandSales Pitch: How to Craft a Story to Stand Out and WinBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Small Business For Dummies: 5th EditionVon EverandSmall Business For Dummies: 5th EditionBewertung: 4.5 von 5 Sternen4.5/5 (10)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerVon EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerBewertung: 4 von 5 Sternen4/5 (121)

- Red Team: How to Succeed By Thinking Like the EnemyVon EverandRed Team: How to Succeed By Thinking Like the EnemyBewertung: 4 von 5 Sternen4/5 (15)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffVon EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffBewertung: 5 von 5 Sternen5/5 (61)

- The 10X Rule: The Only Difference Between Success and FailureVon EverandThe 10X Rule: The Only Difference Between Success and FailureBewertung: 4.5 von 5 Sternen4.5/5 (289)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeVon EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeBewertung: 4.5 von 5 Sternen4.5/5 (69)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessVon EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessBewertung: 4.5 von 5 Sternen4.5/5 (80)

- The Digital Transformation Playbook: Rethink Your Business for the Digital AgeVon EverandThe Digital Transformation Playbook: Rethink Your Business for the Digital AgeBewertung: 4.5 von 5 Sternen4.5/5 (48)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdVon EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Jim Collins' Good to Great Why Some Companies Make the Leap ... And Others Don’t SummaryVon EverandJim Collins' Good to Great Why Some Companies Make the Leap ... And Others Don’t SummaryBewertung: 4.5 von 5 Sternen4.5/5 (3)

- HBR Guide to Setting Your StrategyVon EverandHBR Guide to Setting Your StrategyBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Harvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsVon EverandHarvard Business Review Project Management Handbook: How to Launch, Lead, and Sponsor Successful ProjectsBewertung: 4.5 von 5 Sternen4.5/5 (15)

- Impact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeVon EverandImpact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeBewertung: 5 von 5 Sternen5/5 (8)

- Elevate: The Three Disciplines of Advanced Strategic ThinkingVon EverandElevate: The Three Disciplines of Advanced Strategic ThinkingBewertung: 4.5 von 5 Sternen4.5/5 (3)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffVon EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffBewertung: 4 von 5 Sternen4/5 (1)

- New Sales. Simplified.: The Essential Handbook for Prospecting and New Business DevelopmentVon EverandNew Sales. Simplified.: The Essential Handbook for Prospecting and New Business DevelopmentBewertung: 4.5 von 5 Sternen4.5/5 (44)

- 1-Page Strategic Plan: A step-by-step guide to building a profitable and sustainable farm businessVon Everand1-Page Strategic Plan: A step-by-step guide to building a profitable and sustainable farm businessBewertung: 5 von 5 Sternen5/5 (1)

- Your Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesVon EverandYour Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesBewertung: 4 von 5 Sternen4/5 (10)

- Hagakure: The Book of the SamuraiVon EverandHagakure: The Book of the SamuraiBewertung: 3.5 von 5 Sternen3.5/5 (311)