Beruflich Dokumente

Kultur Dokumente

108 Finance and Finance Reporting (Actuarrial)

Hochgeladen von

benthemusiclover1512Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

108 Finance and Finance Reporting (Actuarrial)

Hochgeladen von

benthemusiclover1512Copyright:

Verfügbare Formate

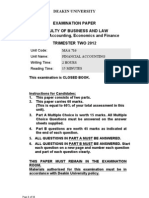

Faculty of Actuaries Institute of Actuaries

EXAMINATIONS

13 April 2000 (pm)

Subject 108 Finance and Financial Reporting

Time allowed: Three hours

INSTRUCTIONS TO THE CANDIDATE

1. Write your surname in full, the initials of your other names and your

Candidates Number on the front of the answer booklet.

2. Mark allocations are shown in brackets.

3. Attempt all 19 questions, beginning your answer to each question on a

separate sheet.

Graph paper is not required for this paper.

AT THE END OF THE EXAMINATION

Hand in BOTH your answer booklet and this question paper.

In addition to this paper you should have available

Actuarial Tables and an electronic calculator.

! Faculty of Actuaries

108A2000 ! Institute of Actuaries

1082

For questions 15 indicate in your answer booklet which one of the answers A, B, C or D

is correct.

1 In certain circumstances the Stock Exchange may grant a quotation for a

company even though the company is not making any new shares or existing

shares available to the market.

This method of obtaining a quotation is known as:

A A placing

B A tender issue

C An introduction

D A prospectus issue [2]

2 The following information relates to the ordinary shares of F plc:

Earnings per share 50p

Dividend cover 2.5 times

Published dividend

yield

3.2%

The price of F plcs ordinary shares implied by the above data is:

A 78p

B 625p

C 1563p

D 3906p [2]

1083 PLEASE TURN OVER

The following information relates to questions 3 and 4.

X Ltds Balance sheet as at 31 December 1999 included the following items:

Total assets less current liabilities 125,000

9% Debentures (repayable 2004) 20,000

105,000

Ordinary shares of 50p each 50,000

10% Preference shares of 1 each 20,000

Reserves 35,000

105,000

3 X Ltds profit before interest and taxation for the year to 31 December 1999

was 40,000.

X Ltds companys Return on Capital employed for the year ended 31

December 1999 is:

A 32%

B 38%

C 44%

D 47% [2]

4 X Ltds interest cover is:

A 6.6 times

B 10.5 times

C 13.9 times

D 22.2 times [2]

1084

5 A companys ordinary shares have a current market price of 2. The company

is making a 2 for 5 rights issue at a price of 1.50.

What is the ex-rights price?

A 1.50

B 1.74

C 1.86

D 2.60 [2]

In questions 610 one or more of the options may be correct. Answer in your booklet by

selecting according to the following code:

A if I and II only are correct

B if II and III only are correct

C if I only is correct

D if III only is correct

6 Which of the following assets are not intangible fixed assets?

I Research costs

II Trade marks

III Development costs [2]

7 Which of the following is true:

I Depreciation adjustments are attempts to reflect the value of fixed

assets in the balance sheet.

II Depreciation is an application of the matching concept.

III Depreciation is a measure of the wearing out or consumption of a

fixed asset over time. [2]

8 Which of the following statements about preference shares is correct?

I Preference shares carry fixed dividend rights.

II Preference dividends can be suspended if the directors decide that the

company cannot afford to pay them.

III Preference shareholders never have any voting rights. [2]

9 An ordinary share may have a high dividend yield because:

I Dividend cover is high.

II It is cheap.

III Dividend growth prospects are poor. [2]

1085 PLEASE TURN OVER

10 Chargeable gains on the disposal of the following assets are not subject to

capital gains tax:

I Any residential properties.

II Private motor cars.

III British government securities. [2]

11 The directors of Sawburn plc have decided to investigate ways in which they

might improve their management of short and medium term finance. The

companys business involves irregular inflows and outflows of cash. The

directors have tended not to rely on bank overdraft in order to deal with cash

shortages, preferring to use short fixed term loans instead. They are now

considering a change to this policy because of the greater flexibility of

overdraft finance. They have decided that this might reduce finance costs

because interest is only paid on overdrafts on the amount by which the account

is actually overdrawn.

Describe the factors that the directors should take into account in making this

change of policy and explain whether overdraft is likely to be the most suitable

form of short term finance in these circumstances. Your answer should make

appropriate references to the alternatives to overdrafts. [8]

12 The directors of a company are planning to undertake a rights issue. Describe

the factors that should be taken into account in deciding whether to have this

issue underwritten. [6]

13 Explain what is meant by the term associate company and explain how

associates are treated on consolidation. [4]

14 Discuss the proposition that ratio analysis is considered to be a useful method

of interpreting financial statements, although it has some limitations. [6]

15 A company intends to acquire a factory and 600,000 of plant and machinery.

Explain the taxation implications of leasing these assets rather than

purchasing them outright. [6]

16 Describe the main features of merchant banks and discuss their influence on

the financial markets. [6]

1086

17 Explain how the Bank of England provides liquidity in the money markets. [4]

18 The following information has been extracted from the accounting records of

Tyler plc:

Trial Balance at 31 March 2000

000

Administration costs 800

Bank overdraft 700

Debtors 1,300

Factory cost 23,300

Factory depreciation 1,800

Factory running costs 1,200

Loan interest 1,680

Long term loans 12,000

Machinery cost 15,000

Machinery depreciation 8,000

Manufacturing wages 1,300

Materials consumed 1,600

Profit and loss account 380

Sales 13,000

Sales salaries 1,600

Share capital 12,000

Stock at 31 March 2000 700

Trade creditors 600

Notes:

(a) The corporation tax charge for the year has been estimated at

1,290,000.

(b) The directors have proposed a dividend of 1,400,000.

(c) At the year end the directors had the factory professionally revalued.

The valuers report estimates the value of the property at 25,000,000.

This value is to be incorporated into the balance sheet.

(d) During the year the company charged depreciation of 460,000 on the

factory and 2,000,000 on the machinery. The company purchased new

machinery at a cost of 2,700,000. There were no other transactions

involving fixed assets. All of these adjustments and transactions have

been incorporated into the above figures.

Prepare Tyler plcs profit and loss account for the year ended 31 March 2000

and the balance sheet as at that date. These should be in a form suitable for

publication. You should provide a note in respect of tangible fixed assets, but

you are not otherwise required to provide notes to the accounts. You should,

however, clearly show your workings. [20]

1087

19 The directors of Holt plc have introduced a formal system of investment

appraisal. Projects must have a positive net present value when discounted at

a cost of capital determined in relation to their systematic risk. The board is

presently considering two unrelated projects. One is for an investment in a

speculative research project. This is fraught with potential problems because

it is dependent on the successful application of a recent theoretical discovery

reported in the physics literature. Even if the technical problems can be

overcome, there is a serious risk that another company will offer the principal

scientists who are the leading specialists in their field more lucrative

contracts. The other project is a rather more predictable expansion of the

production facilities for an existing product line which has a well established

market.

The beta coefficient for the research project is 0.6 while that of the new

production facilities is 1.3. The risk free rate is 3% and the risk premium is

8%.

(a) Calculate the required rate of return for each of the projects. [4]

(b) Explain why it might be possible that an apparently risky project could

have a lower required rate of return than that for a less volatile project.

[6]

(c) Explain whether company directors are likely to accept the logic

underlying the capital asset pricing model (CAPM) in practice when

they are making investment decisions. [5]

(d) Outline alternative ways in which one might estimate the beta

coefficient of a project. [5]

[Total 20]

Faculty of Actuaries Institute of Actuaries

EXAMINATIONS

April 2000

Subject 108 Finance and Financial Reporting

EXAMINERS REPORT

Faculty of Actuaries

Institute of Actuaries

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 2

1 C

2 B

3 -

4 -

5 C

6 C

7 B

8 A

9 B

10 -

There were three small errors in questions in order to ensure no student was

unfairly penalised for this the paper was marked out of 94 and the three questions

were discounted. The remaining questions were answered well.

11 The directors should consider the cost of the different types of finance available to

them. Clearly, it is desirable to use the cheapest source unless it has some other

disadvantage. Different types of finance involve different levels of risk for the

lender and that will tend to result in different rates of interest.

The other major issue is the risks created for the company. A source of finance

might leave the company open to serious penalties if it is forced to default for any

reason. For example, a secured loan will tend to be relatively cheap but might

create serious problems for the company if the lender calls in the security.

Furthermore, the company will have a limited borrowing capacity for any given

type of finance. Exhausting this might restrict its ability to deal with future

problems.

Bank overdrafts do provide a flexible means of dealing with fluctuating

requirements. Most loans commit the company to the payment of interest

throughout the agreed term of the loan. Early repayment might not be permitted

by the agreement or could involve an additional charge. Overdraft facilities can

be agreed with the bank and then used and as and when the company requires.

The company can borrow up to its overdraft limit for as short a period as it

requires the funding. Interest will be charged on a daily basis on the actual

amount outstanding.

The rates of interest charged on overdrafts tend to be quite high and so it might

prove to be an expensive source of finance if the company is likely to be heavily

overdrawn for a large proportion of the time. Term loans might prove cheaper in

this situation because of lower rates, even though there might be short periods of

cash surplus during which the company does not actually require the funding.

One disadvantage of using the overdraft facility is that the banks are likely to

impose a restriction on the maximum amount that they are willing to advance in

this manner. Having the capacity to borrow up to the limit at short notice could

be useful if the company has an unexpected need for cash. If part of the facility

has been used up in the course of normal operations then the company will be

more severely constrained.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 3

There may be other sources of finance which would be more suitable for the

companys fluctuating needs. For example, debt factoring makes it possible to

raise cash immediately after a sale has taken place. This has the advantage of

bringing in more cash at busier times when the companys needs might be

greater and could offer many of the benefits of overdraft without using up any of

the actual overdraft facility.

This question was well answered by most candidates

12 The main advantage of underwriting a share issue is that there is no risk of the

company being left with unsold shares. If the rights issue proves unattractive to

shareholders then the company may have insufficient funds to finance the project

for which the shares were being issued. It may prove difficult and expensive to

raise additional long term finance by some other means.

The main disadvantage of underwriting the issue is that the company will have

to incur fees which may prove substantial. While this might be a worthwhile

investment, it is desirable to minimise such costs wherever possible.

The rights issue is likely to prove successful if the new shares are sold at a

reasonable discount. While any discount is likely to make the shares attractive,

the volatility of the stock market and of the company itself should be considered.

If the share price is likely to move rapidly then the rights price could exceed the

market price, thereby making he new shares unattractive.

The extent to which the company can persuade the markets that the new funds

will be invested profitably will also have some bearing on the need for an

underwriter. If the company has a viable project then the share price could rise

in response to that information and that will make the issue even more

attractive. The company should discuss the likely market perception of the

project with independent experts such as the companys merchant bankers.

This question was reasonably well answered by candidates

13 An associate company is one in which the holding company has an interest which

grants it some influence, but not outright control. This is normally implied by an

investment which exceeds 20% of share capital, but is less than 50%.

Associate companies are included in the consolidated profit and loss account by

including the groups share of their profits, regardless of whether those profits

have been distributed by way of dividend. The group share of net assets is

included in the consolidated balance sheet.

The first part of this question was well answered however candidates had little

idea of how the associate should be treated in the consolidation as a result the

marks were low.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 4

14 Many figures in the financial statements are difficult to interpret in isolation. For

example, it means very little to know how much profit a business made without

having some corresponding idea of the amount of capital that had to be invested

in order to generate this income.

Ratios provide a basis for comparing related figures and for identifying issues

that ought to be investigated. Management might, for example, monitor liquidity

by calculating the current ratio and would deal with any deviation from the

optimal relationship usually 2:1.

Trends in ratios can be particularly revealing. For example, a decreasing current

ratio is normally a more worrying sign than a ratio which appears to be low in

absolute terms.

Ratios do have a number of drawbacks. For example, they can be distorted by

wilful manipulation of the figures (e.g. window dressing or off-balance sheet

financing). They can also omit crucial information such as contingent liability

information.

This question was well answered

15 If the company purchases the assets then it will receive a writing down

allowance on both the industrial buildings and the plant and machinery. This

means that the tax benefits of the investment will not be received immediately

after the investment takes place. Instead, the company will have to offset the

cost against taxable profit in future years.

If the company borrows in order to finance the acquisition of the assets then it

will be able to claim tax on the interest payments.

Rental payments on property and lease payments on plant and machinery will

attract immediate tax relief, with the taxable profit being reduced by the

amounts of the cash flow in each year.

The companys ability to enjoy the tax relief on writing down allowances is

related to its ability to earn taxable profits. If the company is making a loss for

tax purposes then it will receive no benefit from the additional writing down

allowances. A lessor may be in a better position to take advantage of these reliefs

and this may well be reflected in the rentals.

This question was quite well answered by the majority of candidates.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 5

16 Merchant banks specialise in corporate finance. Their role is largely advisory.

Typically, merchant banks will provide advice on the following types of matter:

1. bid or defence strategies in a takeover

2. financial aspects of a merger

3. investment projects

4. raising capital

They also act as intermediaries in the issue of financial instruments:

1. issuing houses in share issues

2. underwriters of new issues

3. Eurobonds

Merchant banks also provide fund management services:

1. management of unit trusts, investment trusts and pension funds

2. organisation of the Eurobond market

Merchant banks are active in the money markets:

1. as guarantors of bills of exchange

2. as holders of Treasury bills and local authority bills

Occasionally, merchant banks provide finance to companies.

Candidates answered the first part of the question well but were unsure of

merchant banks influence on the market.

17 The Bank of England acts in a supporting role for the various institutions that

are active in the short-term money markets, particularly the discount houses.

The discount houses provide short term finance by borrowing cash surpluses that

might be available for as little as a few days and lending for a slightly longer

period. This difference in maturity between their assets and liabilities can leave

them exposed to the risk of being unable to repay their debts.

The risk of default is avoided because the Bank of England will always provide

the discount houses with support whenever they need it. This can take the

following forms:

1. The Bank will always be prepared to purchase Treasury or local authority

bills or bills of exchange from the discount houses in order to help them

through a cash crisis.

2. The Bank will act as a lender of last resort provided the discount houses

deposit bills as security.

3. The discount houses can sell a bill of exchange to the Bank and

simultaneously agree to repurchase it at a later date.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 6

This support is available because the discount houses are an important element

of the Banks mechanism for controlling short term interest rates. The discount

houses agree to buy the Treasury bills that the Bank sells at its weekly Treasury

bill auctions.

This question was well answered by most candidates.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 7

18 Tyler plc

Profit and loss account

for the year ended 31 March 2000

000 000

Turnover

Cost of sales - 4,100

Gross profit

Distribution costs - 1,600

Administrative expenses - 800

- 2,400

Operating profit

Interest payable - 1,680

Taxation - 1,290

Dividend - 1,400

Retained profit for the year

Retained profit brought forward

Retained profit carried forward 2,510

Tyler plc

Balance sheet as at 31 March 2000

000 000

Tangible fixed assets (note 1) 32,000

Current assets

Stock 700

Trade debtors 1,300

2,000

Creditors: amounts due within one year

Bank overdraft - 700

Trade creditors - 600

Taxation - 1,290

Proposed dividend - 1,400

- 3,990

Net current liabilities - 1,990

30,010

Long term liabilities - 12,000

18,010

Share capital 12,000

Revaluation reserve 3,500

Profit and loss 2,510

18,010

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 8

Note 1 Tangible fixed assets

Factory

Machinery

Total

000 000 000

Cost at 31 March 1999 23,300 12,300 35,600

Additions - 2,700 2,700

Adjustment on revaluation 1,700 - 1,700

Cost at 31 March 2000 25,000 15,000 40,000

Depreciation at 31 March 1999 1,340 6,000 7,340

Charge for year 460 2,000 2,460

Adjustment on revaluation - 1,800 - - 1,800

Depreciation at 31 March 2000 - 8,000 8,000

Net book value at 31 March 2000 25,000 7,000 32,000

Net book value at 31 March 1999 21,960 6,300 28,260

Cost of sales

Factory running costs 1,200

Manufacturing wages 1,300

Materials consumed 1,600

4,100

This question was badly answered very few candidates produced a note for

fixed assets and the formats were poor. Given that this is not one of the new

topics it was surprising how badly the question was answered.

19 (a) Required rate on the research project = 3+(8*.6) = 7.8%

Required rate on expansion = 3+(8*1.3) = 13.4%

(b) The total risk associated with an investment is not particularly important

in the context of a diversified portfolio. A significant proportion of the risk

in most investments can be diversified away. In other words, factors such

as movements in exchange rates will have an adverse effect on some

investments and a positive effect on others. The effect of investing in a

portfolio is to reduce the overall volatility of the returns.

Risk can be separated into two components: systematic and unsystematic.

Systematic risk is inherent in the political and economic environment and

is common to all companies. For example, a change in energy prices will

affect all companies to some extent. Unsystematic risk is specific to the

company. It encompasses a range of risks specific to the company such as

changes in market demand for its products, stability of industrial

relations, nature and location of its assets, and so on.

Subject 108 (Finance and Financial Reporting) April 2000 Examiners Report

Page 9

Systematic risk cannot be diversified away because it arises from factors

which will have an effect on all companies. Thus, an increase in interest

rates or oil prices is likely to have an adverse effect on all companies and

will depress returns from the market as a whole. Unsystematic risk can

be diversified away and, provided the investment is held in a properly

diversified portfolio, it can therefore be ignored.

It is possible that a highly speculative investment will not be affected by

general market conditions to any great extent. That means that it will not

have a high systematic risk. The volatility will, therefore, be due to

unsystematic factors that can be diversified away. That, in turn, suggests

that the investment may require a very low return.

(c) Company directors are in a rather different position from shareholders. A

shareholder can hold a diversified portfolio of investments and can,

therefore, reduce the risks associated with a particular investment. A

director will probably have only one principal employer and will,

therefore, be motivated more by total risk.

This different perspective might be evidenced by a tendency to invest in

relatively safe projects. This is because a disaster might be rather

catastrophic for the board even though it would have relatively little

impact on the shareholders.

Alternatively the board might be inclined to seek diversification for the

company even though the shareholders can diversify for themselves.

Given that diversification will have the effect of distracting management

from the core activities of the business, the overall effect will not be in the

shareholders interests.

(d) One approach is to use the companys own beta coefficient. That is only

relevant, however, if the project is subject to the same risks as the

company as a whole.

Another approach is to use the beta of a company which is engaged in the

same line of business as the project.

A third possibility is to use historical data to estimate the betas of

individual divisions or segments of the main company. These betas can

then be used as a surrogate for the coefficients of individual projects

which fall within their scope.

This question was very badly done by most candidates. Many candidates

correctly calculated the answer to part (a) and then demonstrated little

understanding of the theory required in the rest of the question. This is an

important area of finance and candidates should study the topic more

carefully.

Faculty of Actuaries Institute of Actuaries

EXAMINATIONS

14 September 2000 (pm)

Subject 108 Finance and Financial Reporting

Time allowed: Three hours

INSTRUCTIONS TO THE CANDIDATE

1. Write your surname in full, the initials of your other names and your

Candidates Number on the front of the answer booklet.

2. Mark allocations are shown in brackets.

3. Attempt all 18 questions, beginning your answer to each question on a

separate sheet.

Graph paper is not required for this paper.

AT THE END OF THE EXAMINATION

Hand in BOTH your answer booklet and this question paper.

In addition to this paper you should have available

Actuarial Tables and an electronic calculator.

Faculty of Actuaries

108S2000 Institute of Actuaries

1082

For questions 14 indicate in your answer booklet which one of the answers A, B, C or D

is correct.

1 Which of the following statements is incorrect:

A Companies can issue ordinary shares below the par value.

B Ordinary shares normally offer a higher expected return than other

classes of security.

C A companys authorised share capital will be laid down in its

Memorandum of Association.

D An appropriate way of valuing ordinary shares is to find the present value

of the future dividend stream. [2]

2 One of G plc's employees developed a new product. This has just been patented.

The development costs of this product were negligible, but the patent rights are

almost certainly worth many millions of pounds. Which accounting concept

would prevent the company from recognising the value of this patent as a fixed

asset in its balance sheet?

A Going concern

B Materiality

C Money measurement

D Prudence [2]

3 Which of the following is not true for a finance lease?

A The lease agreement has a primary period which covers all or most of the

useful economic life of the asset.

B The lessee is normally responsible for servicing and maintenance of the

asset.

C The lease payments will appear in the profit and loss account as an

expense.

D The lessee records the leased asset as a fixed asset in its balance sheet.

[2]

4 Which of the following best describes the effects of an increase in the risk

characteristics of a project when evaluating its net present value?

A The discount rate increases and the net present value increases.

B The discount rate increases and the net present value decreases.

C The discount rate remains constant, but the net present value decreases.

D The discount rate decreases and the net present value decreases.

[2]

1083 PLEASE TURN OVER

In questions 510 one or more of the options may be correct. Answer in your booklet by

selecting according to the following code:

A if I and II only are correct

B if II and III only are correct

C if I only is correct

D if III only is correct

5 Companies who wish to raise finance by issuing sterling commercial paper have

to meet certain minimum standards. They must:

I be listed on the London Stock Exchange

II have a minimum level of net assets of 50m

III have a minimum level of share capital of 50m [2]

6 When choosing between two mutually exclusive projects, the internal rate of

return can give a misleading decision. Which of the following may be reasons for

this?

I Projects can have more than one rate of return.

II Internal rate of return ignores the rates of return available from other

projects.

III Internal rate of return ignores the cost of capital. [2]

7 An increase in the value of a fixed asset due to revaluation would:

I increase the equity of a company

II make the balance sheet look stronger

III increase the profit of a company [2]

8 Which of the following would you normally expect to find in the external auditors

report to the shareholders:

I a certificate guaranteeing the truth and fairness of the financial

statements

II a statement that the directors were responsible for preparing the financial

statements

III a brief description of the work undertaken by the auditor prior to drafting

the report [2]

1084

9 A company might carry out a rights issue at a deep discount:

I to reduce the share premium account

II to avoid misunderstandings by unsophisticated shareholders

III to avoid having to pay underwriting costs [2]

10 Which of the following statements is true?

I Specific risk can be diversified away on a large, well spread portfolio.

II Systematic risk arises because of the volatility of the market as a whole.

III Diversification across a well diversified internationally-based portfolio will

remove systematic risk entirely. [2]

11 Explain the shareholder value approach to project evaluation. [6]

12 X Plc is planning an expansion and requires 500,000 in order to do so. The

directors are unsure whether to finance this by debt or equity. Discuss the

factors they should take into account including any taxation implications. [8]

13 Describe the accounting standard setting process in the UK and explain why

such a system is necessary. [8]

14 Describe the role life insurance offices play in the investment markets. [6]

15 Explain the taxation treatment of UK company dividends and also how franked

investment income is treated. [6]

16 Companies throughout the world raise finance by issuing Eurobonds. Describe

the main characteristics of Eurobonds and briefly explain their popularity. [6]

1085 PLEASE TURN OVER

17 The profit and loss accounts and balance sheets of two manufacturing companies

are shown below:

T Plc Y Plc

000 000 000 000

Sales 600 700

Cost of sales 240 210

Gross profit 360 490

Selling expenses 54 84

Administrative expenses 60 35

114 119

Net profit 246 371

Taxation 64 100

182 271

Dividend 80 110

102 161

Retained profit b/fwd 106 230

208 391

T Plc Y Plc

000 000 000 000

Fixed assets

Property - 500

Machinery 760 280

760 780

Current assets

Stock 48 26

Debtors 150 105

Bank 2 22

200 153

Current liabilities

Creditors (including Tax) 89 118

Net current assets 111 35

871 815

Share capital 663 424

Profit and loss 208 391

871 815

Compare these two companies in terms of their profitability and solvency.

Explain which company appears to be the better managed in respect of each of

these matters. You should support your answer with ratios. [20]

1086

18 Z plc is a large, long established manufacturing company. The company is

expanding and the directors are keen to identify new ways in which they might

obtain the necessary finance. The finance director has warned that the company

must obtain most of this new funding from the sale of new shares. The company

has borrowed very heavily in the past and the company's existing loan

agreements require it to seek the permission of existing lenders before obtaining

further debt.

Z plc is not quoted on the stock exchange. The family of the companys founders

owns most of the companys share capital. It is unlikely that these investors will

be able to invest the sums required to take advantage of the opportunities that

the directors have identified. It has been suggested that the company might seek

a stock exchange quotation.

(i) Explain the advantages and disadvantages to Z plc of issuing fresh share

capital. [6]

(ii) Explain the advantages and disadvantages of obtaining a stock exchange

quotation. [6]

(iii) Assuming that Z plc obtains a quotation, identify the most appropriate

method by which the company might issue fresh share capital and

describe the steps that are involved. Your answer should explain why you

have chosen this particular method. [8]

[Total 20]

Faculty of Actuaries Institute of Actuaries

EXAMINATIONS

September 2000

Subject 108 Finance and Financial Reporting

EXAMINERS REPORT

Faculty of Actuaries

Institute of Actuaries

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 2

1 A

2 C

3 C

4 B

5 A

6 C

7 A

8 B

9 D

10 A

Comment on Questions 1 to 10

There were no particular problems with the objective test questions, with most candidates

scoring a reasonable mark.

11 The shareholder value approach to project evaluation considers the net present

value of the project from the shareholders perspective.

In theory, investing in a positive NPV project will increase shareholders wealth

by the amount of that NPV. In practice, this change will only occur if the market

is aware of the investment and agrees with managements estimates of the

potential risks and rewards. It may be that the share price will not move in line

with expectations because the market is not convinced that the risk is justified or

even because the directors have withheld important information for the sake of

commercial sensitivity.

The directors would essentially attempt to apply the same valuation models used

by outside analysts and advisers in an attempt to determine how the

information that they intend to publish will impact the share price.

Comment on Question 11

Many candidates had clearly not understood that the shareholder value approach is a

clearly defined technique for project evaluation. A large number of answers were clearly

based on a sensible guess as to what the technique might comprise.

12 The directors should consider the current level of gearing. If the company is

already heavily financed by debt then it will be difficult for the directors to justify

borrowing more.

The use of one form of finance can have implications for the risks, and therefore

costs, associated with the other. Issuing fresh debt will expose the existing

shareholders to a greater risk of losing their investment if the company is forced

to default on its loans. This will mean that the cost of equity might increase.

Issuing fresh equity creates a broader buffer between assets and liabilities for

providing lenders with collateral and that might reduce the cost of debt.

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 3

Debt finance is usually cheaper than equity and so the company should consider

using it wherever possible. The lower cost is partly because the debt holders are

taking much less of a risk when they purchase debt stock and are, therefore,

willing to accept a lower rate of return.

The cost of debt is further reduced because interest is allowable as an expense for

tax purposes, whereas dividends on shares is not.

It might be difficult to sell 500,000 of share capital without incurring

disproportionate issue costs. Raising debt can be rather more flexible. The

company could, however, get round this by issuing rather more than 500,000

and using the additional sum raised to repay some of its existing debt.

Comment on Question 12

This question was generally answered well.

13 A body called the Financial Reporting Council (FRC) is responsible for the

standard setting process. The FRC concentrates on the management of the

process and delegates the real work of developing standards to the Accounting

Standards Board (ASB). The FRCs contribution to the process is largely

restricted to raising finance for the ASB and appointing its members.

The ASB develops documents called Financial Reporting Standards (FRSs).

FRSs are intended to reduce the number of acceptable treatments for specific

items in the financial statements. One example of this is FRS 2 which deals with

group accounts. This standard defines the relationship between holding

companies and their subsidiaries and establishes a standard approach to their

incorporation into consolidated financial statements.

A typical standard would be set in the following manner:

ASB establishes a working party.

Working party drafts an exposure draft (ED).

ED published and comments invited.

Interested parties may lobby in defence of their interests.

There may be one or more rounds of revision to the ED.

FRS issued.

This process involves considerable openness, but it also creates the risk of the

standards being influenced by the actions of lobbyists.

This system is necessary because there have been many controversies over the

correct preparation of financial statements. These have led to problems with the

credibility of the profession. Standards also reduce processing and interpretation

costs for users because they can become more familiar with the specific

treatments adopted by all companies for particular items.

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 4

Comment on Question 13

Many candidates appeared to be writing everything that they knew about accounting in

the hope that this related to the question. The most common error was to write a detailed

explanation of the concepts underlying financial accounting, with no reference whatsoever

to the regulatory framework referred to in the question.

14 Life insurance companies are major institutional investors and, collectively, are

amongst the very largest institutions.

The companies collect cash from policy holders and invest this in the long term.

Policy holders will normally be offered the expectation of a future bonus based on

the profits of the company. This has the effect of requiring insurance companies

to seek out investment opportunities which both offer the prospect of maintaining

the real purchasing power of their deposits and also a realistic expectation of

capital growth.

Insurance companies are also subject to a number of regulatory constraints on

the nature of their investments. These are partly attributable to the need to

maintain solvency margins in accordance with DTI regulations.

Comment on Question 14

This question was generally answered well.

15 Franked investment income (FII) is the grossed-up value of dividends paid by UK

companies. The cash value of the dividend received is grossed up by the addition

of a tax credit which is currently 10%.

The tax credit is a reflection of the fact that the dividend has been paid out of

profits which have already been subject to corporation tax. Individuals who are

basic rate taxpayers will not normally pay any further tax on their FII. The FII

is added to their taxable income, but the tax credit will cancel the additional tax

that this would involve. Non taxpayers cannot, however, recover the tax credit

which has been notionally withheld by the company. Higher rate taxpayers may

have to pay some additional tax in order to satisfy their obligation to pay tax at

the higher rate.

Companies must also include their FII in their tax computation and will be liable

to tax on it. This income will, however, be taxed at a flat rate of 20% regardless

of the rate of corporation tax to which the company is subject.

Comment on Question 15

This question was generally answered well.

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 5

16 Eurobonds are bonds which are issued outside of the companys domicile. There

is a thriving market in such arrangements. The fact that the stocks are traded

in a country in which the host government has no particular interest can mean

that they are not subject to any legal or tax regulations. This lack of regulation

can reduce issuing costs and the possibility of freedom from taxes can even

reduce the coupon rates of debts. Eurobonds tend to be traded through banks

rather than recognised stock exchanges.

Eurobonds can be issued in almost any currency. They are redeemed at par with

coupon payments throughout the term of the bond. Almost all Eurobonds are

unsecured. Eurobonds are bearer documents.

Most Eurobonds offer a fixed coupon rate, although some offer a variable coupon

rate.

Comment on Question 16

This question was generally answered well.

17

T plc Y plc

ROCE 246 28 % 371 46 %

871 815

Gross profit % 360 60 % 490 70 %

600 700

Selling / sales 54 9 % 84 12 %

600 700

Admin / sales 60 10 % 35 5 %

600 700

Current ratio 200 2.2 :1 153 1.3 :1

89 118

Acid test ratio 152 1.7 :1 127 1.1 :1

89 118

Y plc is the more profitable company because it has a higher return on capital

employed. It appears to have achieved a higher return by virtue of three factors:

It can generate a higher gross profit from every of sales. Either it is selling

at a higher margin or it can obtain goods at a lower cost price.

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 6

Its sales appear to be supported by a higher spend on advertising. This has

enabled it to achieve higher sales despite having higher selling prices.

It manages to spend less on administration.

Y plc also appears to have better managed working capital. At first glance, T plc

has a textbook current ratio of 2:1. The company has a very high acid test

ratio, which appears to be due to very slow turnover of debtors. This means that

the company has a great deal of finance tied up in non-productive assets. These

are not necessarily available to meet short-term commitments.

Comment on Question 17

This question was generally answered well.

18 (i) Share capital is the most flexible form of finance. The payment of

dividend is entirely at the discretion of the directors. If the dividends are

withheld for any reason then the shareholders have no direct sanctions

against the company, other than the right to sell their shares on the open

market.

Issuing fresh share capital also makes it easier to raise further finance by

borrowing. This is because lenders are usually keen to see the company

maintain a sensible relationship between debt and equity. If the company

fails then the lenders must be repaid in full before the shareholders

receive anything. If the shareholders have financed a large proportion of

the share capital then this protects the lenders from the loss of their

principal.

Share capital tends to be a rather expensive form of finance. This is

because shareholders bear a much higher risk than lenders. They have to

be rewarded with a substantial return in order to motivate them to accept

this level of risk. In addition, the company does not receive any tax relief

on dividends whereas loan interest is tax deductible.

Issuing additional share capital will also tend to dilute the sense of

ownership and control enjoyed by the present shareholders. They might

be willing to forego the opportunity to expand if doing so would make

them accountable to outside shareholders.

(ii) A stock exchange quotation would provide a ready market for the sale of

shares. This would make it easier for the company to sell fresh shares on

the open market. It would also offer existing and future shareholders a

means of disposing of their shares.

The fact that an investment in the company could be liquidated more

easily would make it a more attractive prospect, thereby reducing the cost

of finance.

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 7

The availability of a ready market means that market forces will

determine an objective share price. This can be a useful piece of

information for shareholders and directors alike. There can be tax

problems associated with the gift of shares that cannot be easily valued.

Knowing the share price makes it easier to calculate the cost of capital.

The stock exchange imposes strict regulations on the behaviour of quoted

companies. The fact that a company is willing to accept this discipline

provides further confidence for both shareholders and lenders and so

should have the effect of further reducing finance costs.

There are, of course, substantial transaction costs associated with

obtaining a listing. Apart from professional fees and other direct costs, a

great deal of management time will be taken up.

The fact that the companys shareholders can sell their shares easily on

the market might encourage them to take a short-term outlook. This

could make the company vulnerable to take-over bids.

(iii) The company ought to consider an offer for sale. This would involve

selling new shares to the general public at a fixed price which was

determined by the directors. The advantage of this is that it raises

additional capital at the same time as introducing the company to the

stock exchange.

There is relatively little risk of this type of transaction going wrong

because the company would sell the shares via an issuing house. The

issuing house would act as an intermediary between the company and the

public. In the first instance, the issuing house would purchase the shares

from the company and then resell them to the public. This means that

the company knows in advance how much the issue will generate because

the issuing house is responsible for any lack of demand and will be left

holding any unsold shares.

The use of an issuing house also provides the company with a source of

experience and advice in the selection of other professionals and in the

coordination of their various efforts.

Well before the offer for sale, the company will engage an issuing house.

The issuing house will try to generate interest in the launch, e.g. by

publicising positive news that might be picked up by the financial press.

In the weeks before the launch, the issuing house will advise on the price

that should be set. This will normally be a reasonably conservative

figure, if only because a higher issue price would involve a greater risk for

the issuing house and that might result in higher fees and premia.

The company is required to publish a prospectus, which is a formal

document required by the stock exchange. This is a detailed document

containing a wealth of historical and forecast information, both financial

and non-financial. This information will also be supported by a number of

Subject 108 (Finance and Financial Reporting) September 2000 Examiners Report

Page 8

assurances from the companys external auditors. The prospectus will

also state the offer price for the shares.

The prospectus will be reproduced in at least one national newspaper and

may be distributed in other ways.

Anyone wishing to purchase shares can do so during the period

immediately after the publication of the prospectus. Hopefully, the offer

price was set at a level that would encourage investment and the issue

will be over-subscribed. This means that the issuing house will have to

decide on the most appropriate basis for the allocation of shares.

Finally, the successful applicants will receive letters of acceptance.

Official trading on the stock exchange can take place on the day after the

acceptance letters are posted.

Comment on Question 18

This question tended to be answered well in some parts, but not others. Parts (i) and (ii)

were generally answered well, although there was very little attempt to relate answers to

the facts of the scenario. Part (iii) tended to generate a checklist of mechanisms for issuing

shares instead of recommending one particular technique, as required by the question.

!"#$%&' )* +#&$",-./ 01/&-&$&. )* +#&$",-./

23+405+60758

5 ArII 200l (m)

8$9:.#& ;<= > !-1"1#. "1? !-1"1#-"% @.A),&-1B

!"#$ &''()$*+ !,-$$ ,(.-/

!"#$%&'$!("# $( $*+ ',"-!-,$+

01 2-"3$ 4(.- /.-5&#$ "5 6.''7 3,$ "5"3"&'/ (6 4(.- (3,$- 5&#$/ &5* 4(.-

8&5*"*&3$9/ :.#;$- (5 3,$ 6-(53 (6 3,$ &5/)$- ;((<'$31

=1 >&-< &''(?&3"(5/ &-$ /,()5 "5 ;-&?<$3/1

@1 A33$#B3 &'' 0C D.$/3"(5/1 E-(# D.$/3"(5 00 (5)&-*/ ;$F"5 $&?, &5/)$- (5 &

/$B&-&3$ /,$$31

./012 1013/ 45 678 /39:4/3; <7/ 8245 1013/=

A! !GH H:I JE !GH HKA>L:A!LJ:

G&5* "5 MJ!G 4(.- &5/)$- ;((<'$3 &5* 3,"/ D.$/3"(5 B&B$-1

L5 &**"3"(5 3( 3,"/ B&B$- 4(. /,(.'* ,&N$ &N&"'&;'$

A?3.&-"&' !&;'$/ &5* &5 $'$?3-(5"? ?&'?.'&3(-1

IncuIfy of AcfunrIos

l08A200l InsfIfufo of AcfunrIos

l08 A200l2

E(- D.$/3"(5/ 0O0P "5*"?&3$ "5 4(.- &5/)$- ;((<'$3 ),"?, (5$ (6 3,$ &5/)$-/ A7 M7 8 (- I

"/ ?(--$?31

; C Ic Is fo mnko n 3 for 5 rIghfs Issuo nf l20. If fho rIco of fho shnros on fho

dny fho nIIofmonf Ioffors woro osfod wns l40, whnf rIco wouId you oxocf for

fho shnros ox-rIghfs whon donIIngs commonco

A l2?.5

I l30

C l32.5

l40 |2]

C A koy dIfforonco bofwoon fho nof rosonf vnIuo fochnIquo nnd fho InfornnI rnfo of

rofurn fochnIquo for cnIfnI budgofIng Is:

A fhnf fho nof rosonf vnIuo Is onsIor fo cnIcuInfo

I fhnf fhoy uso dIfforonf cnsh fIows

C fhnf fhoy hnvo dIfforonf roInvosfmonf rnfo nssumfIons

fhnf fhoy nro roIovnnf fo fho shnrohoIdors |2]

D WhIch of fho foIIowIng wouId 576 bo IncIudod In n fIrm`s cnIfnI sfrucfuro

A rofnInod onrnIngs

I dIvIdonds

C cnIfnI surIus

convorfIbIo dobonfuros |2]

E WhIch of fho foIIowIng Is 576 n curronf nssof

A sfock

I crodIfors

C dobfors

cnsh |2]

F WhIch of fho foIIowIng Is 576 n mofhod of shorf form borrowIng

A commorcInI nor

I bIII of oxchnngo

C fncforIng

IonsIng |2]

l08 A200l3 GH2+82 6I@5 7J2@

K WhIch of fho foIIowIng nro IImIfod comnnIos 576 roquIrod fo roduco ns n

rosuIf of fho ComnnIos Acf

A chnIrmnn`s roorf

I dIrocfors` roorf

C bnInnco shoof

nudIfor`s roorf |2]

L WhIch of fho foIIowIng Is 576 n mofhod of brIngIng n socurIfy fo IIsfIng

A nn offor for snIo

I n scrI Issuo

C nn offor for subscrIfIon

nn InfroducfIon |2]

= A mnnufncfurIng comnny`s cnsh bnInncos hnvo run Iow. WhIch of fho foIIowIng

wouId Incronso cnsh In fho shorf form

A ross dobfors for romfor nymonf

I ny crodIfors moro quIckIy

C oncourngo snIos sfnff fo soII moro

doIny fho ncquIsIfIon of n Ioco of mnnufncfurIng oquImonf |2]

M WhIch of fho foIIowIng sfnfomonfs Is 576 fruo of soIf-ndmInIsforod onsIon

funds

A n fyIcnI fund Invosfs mnInIy In Indox IInkod gIIfs

I mosf oxIsfIng schomos nro dofInod bonofIf schomos

C nII fho schomos nro rosonsIbIo for fhoIr own Invosfmonf sfrnfogy

nImosf nII rIvnfo socfor schomos nro fundod |2]

;< WhIch of fho foIIowIng Is 576 nn InfnngIbIo nssof

A dovoIomonf cosfs

I nfonfs

C Invosfmonfs

goodwIII |2]

;; IxInIn fho dIfforoncos bofwoon nn Invosfmonf frusf nnd n unIf frusf. |8]

;C IxInIn why n comnny wouId sook n Sfock Ixchnngo quofnfIon. |8]

l08 A200l4

;D oscrIbo fho dIfforonf roorfs fho oxfornnI nudIfor cnn gIvo whon If Is ImossIbIo

fo oxross nn unqunIIfIod oInIon. |6]

;E OrdInnry shnros nro fho mosf Imorfnnf form of fInnncInI Insfrumonf usod by !K

comnnIos.

(I) oscrIbo fho mnIn chnrncforIsfIcs of ordInnry shnros. |6]

(II) IxInIn why ordInnry shnros nro moro mnrkofnbIo fhnn Ionn cnIfnI. |2]

|TofnI 8]

;F IxInIn why onsIon funds hnvo socInI roguInfIons govornIng fho form nnd

confonf of fhoIr fInnncInI sfnfomonfs. |4]

;K IxInIn why n comnny mIghf Issuo convorfIbIo socurIfIos Insfond of

sfrnIghfforwnrd dobf or oquIfy. |6]

;L IQ! Ic Is n hnrmncoufIcnI comnny. Tho comnny`s rosonrch donrfmonf hns

IdonfIfIod n comound fhnf cnn curo fho common coId wIfhouf nny sIdo offocfs.

!nforfunnfoIy, fho mnnufncfuro of fhIs comound roquIros fho comnny fo Invosf

honvIIy In n hIgh fochnoIogy fncfory whIch wIII uso n numbor of now fochnIquos,

somo of whIch nro unrovon. Tho comnny wIII nIso nood fo rocruIf nnd rofnIn

fho sorvIcos of n numbor of omInonf scIonfIsfs, onch of whom Is bofh vIfnI fo fho

rojocf nnd wouId bo IrroInconbIo.

IInnncIng fhIs rojocf wIII roquIro fho comnny fo borrow honvIIy. Tho comnny

Is unIIkoIy fo survIvo ns nn Indoondonf onfIfy If If Invosfs In fhIs rojocf nnd If

fnIIs. Tho dIrocfors hnvo boon ndvIsod fhnf fhoro Is nf Ionsf n 50 chnnco of n

cnfnsfrohIc fnIIuro.

Tho rojocf hns n bofn of 0.5. Tho rIsk froo rnfo Is 3 nnd fho oquIfy rIsk

romIum Is 8. Tho rojocf offors nn osfImnfod rofurn of 24.

!IQ!I!I:

(n) CnIcuInfo fho roquIrod rnfo of rofurn for fho rojocf. |2]

(b) IxInIn how InvosfIng In fhIs rojocf wouId nffocf fho wonIfh of IQ! Ic`s

shnrohoIdors. |5]

(c) IxInIn how nn nnronfIy rIsky rojocf cnn hnvo n roInfIvoIy Iow

roquIrod rnfo of rofurn. |?]

(d) IxInIn whofhor you boIIovo fhnf fho dIrocfors of IQ! Ic wIII Invosf In

fho rojocf. |6]

|TofnI 20]

l08 A200l5

;= MO Ic hns n numbor of dIfforonf busInoss Inforosfs. Tho dIrocfors of MO nro

Inforosfod In IdonfIfyIng mnnngors for romofIon fo sonIor osIfIons. As nrf of

fhIs rocoss, fhoy nro comnrIng fho orformnnco of fwo nufonomous dIvIsIons,

bofh of whIch urchnso goods In buIk for rosnIo fo smnII rofnIIors. Inch dIvIsIon

Is rosonsIbIo for n dIfforonf nrf of fho counfry, buf Is ofhorwIso ongngod In fho

snmo IIno of busInoss. Tho dIrocfors hnvo ronrod fho foIIowIng summnry

fInnncInI sfnfomonfs from fho comnny`s bookkooIng rocords:

H&/3$-5

*"N"/"(5

2$/3$-5

*"N"/"(5

Q-(6"3 /3&3$#$53/ R4$&- $5*$* @0 I$?$#;$- =PPPS TPPP TPPP

SnIos 800 l,400

Cosf of snIos 320 490

Cross rofIf 480 9l0

AdvorfIsIng nnd dIsfrIbufIon 80 l96

AdmInIsfrnfIon 64 56

OornfIng rofIf 336 658

Inforosf 24 ll

of rofIf 3l2 64?

M&'&5?$ /,$$3/ R&/ &3 @0 I$?$#;$- =PPPS TPPP TPPP

IIxod nssofs l,000 l,200

Curronf nssofs

Sfock 5l 5?

obfors 80 222

Innk l0 ?

l4l 286

Curronf IInbIIIfIos

CrodIfors 48 53

WorkIng cnIfnI 93 233

!ong form Ionns 200 l00

893 l,333

CnIfnI 893 l,333

(n) Comnro fho orformnnco of fho fwo dIvIsIons In forms of fhoIr

rofIfnbIIIfy, IIquIdIfy nnd mnnngomonf of sfock, dobfors nnd crodIfors.

Your nnswor shouId bo suorfod by roIovnnf rnfIos, nIfhough fhoso

shouId form onIy nrf of your nnnIysIs. |l4]

(b) oscrIbo fho IImIfnfIons of your nnnIysIs In (n), oxInInIng why fho

dIrocfors shouId sook nddIfIonnI InformnfIon boforo mnkIng n fInnI

docIsIon nbouf fho suIfnbIIIfy of oIfhor dIvIsIonnI mnnngomonf fonm for

romofIon. |6]

|TofnI 20]

!"#$%&' )* +#&$",-./ 01/&-&$&. )* +#&$",-./

23+405+60758

ArII 200l

8$9:.#& ;<= > !-1"1#. "1? !-1"1#-"% @.A),&-1B

IXAMII!S` !IIO!T

IncuIfy of AcfunrIos

InsfIfufo of AcfunrIos

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 2

Suggosfod nnswors:

; C

C A

D I

E I

F

G A

H I

= A

I A

;< C

!"#"$%&&' %&& )*&+,-&" ./0,1" 2*"3+,0#3 4"$" %#34"$"5 10$$"1+&' 4,+/ +/" 6%70$,+' 08

1%#5,5%+"3 310$,#9 0:"$ ;<=

;; Invosfmonf frusfs nro comnnIos, mosf of whIch nro IIsfod on fho Sfock

Ixchnngo. Shnros In Invosfmonf frusfs cnn bo urchnsod nnd soId ns for nny

ofhor quofod comnny.

Unit trusts are not companies, but are trusts in the strict legal sense. They cannot,

thereIore, be quoted on the Stock Exchange. Units can only be bought Irom and sold to

the management company which organises the trust.

Invosfmonf frusfs fond fo socInIIso In Invosfmonfs In ofhor comnnIos, nIfhough

somo Invosf In gIIfs, roorfy nnd ovorsons comnnIos.

!nIf frusfs nro fnr moro honvIIy consfrnInod nnd roguInfod In forms of whnf fhoy

cnn Invosf In nnd fhoy fond fo rosfrIcf fhoIr Invosfmonfs fo quofod socurIfIos.

Invosfmonf frusfs cnn borrow In nddIfIon fo rnIsIng funds from Invosfors. !nIf

frusfs musf roIy on fho snIo of unIfs for fInnnco. ThIs monns fhnf Invosfmonf

frusfs cnn offor fhoIr shnrohoIdors fho bonofIfs of gonrIng whorons unIf frusfs

cnnnof.

!nIfs In unIf frusfs nro normnIIy rIcod by fnkIng fho mnrkof vnIuo of fho frusf`s

undorIyIng nssofs nnd dIvIdIng by fho numbor of unIfs. Tho mnnngomonf chnrgos

nIIod for runnIng fho fund nro nId for by nn InIfInI chnrgo IovIod on fho fund

Invosfod. Shnros In Invosfmonf frusfs nro normnIIy worfh Ioss fhnn fho mnrkof

vnIuo of fho nssofs dIvIdod by fho numbor of shnros. Tho mnIn ronson for fhIs Is

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 3

fhnf fho mnnngors fnko nn nnnunI foo for fhoIr mnnngomonf chnrgo nnd fhIs hns

fho offocf of dorossIng fho vnIuo of fho shnros roInfIvo fo fhoIr undorIyIng nssofs.

>/,3 ?*"3+,0# 4%3 %#34"$"5 :"$' 4"&& 4,+/ 603+ 1%#5,5%+"3 310$,#9 :"$' /,9/

6%$@3

;C A quofnfIon wIII hoI fo rnIso cnIfnI. If fho comnny Is quofod fhon If wIII bo nbIo fo

soII shnros fo n wIdo mnrkof nnd rnIso Inrgo sums chonIy. ThIs Is bocnuso fho

quofnfIon wIII rovIdo n froo socondnry mnrkof In fho comnny`s shnros.

IrovIdors of dobf wIII Iond moro hnIIy fo n quofod comnny ns fhoy know fhnf fho

comnny musf comIy wIfh fho Sfock Ixchnngo roquIromonfs on nn ongoIng bnsIs.

ShnrohoIdors wIII nIso bonofIf from fho fncf fhnf fho shnros wIII hnvo n rondIIy

obsorvnbIo mnrkof rIco whIch mny bo usofuI for fnx urosos nnd nIso for orffoIIo

mnnngomonf. Thoso ndvnnfngos wIII nIso hoI fho comnny fo rnIso funds.

Tho onso wIfh whIch shnros In quofod comnnIos cnn bo frndod monns fhnf

shnrohoIdors hnvo nn onsy oxIf roufo If fhoy ovor docIdo fo soII fhoIr Invosfmonf.

Tho fncf fhnf fhoy cnn do so monns fhnf fhoy wIII fooI fnr moro socuro whon buyIng

shnros.

Tho rondy nvnIInbIIIfy of n mnrkof rIco monns fhnf fho shnros nro fnr moro

nccofnbIo fo omIoyoos If fhoy nro grnnfod ns nrf of n shnro ofIon schomo. If wIII

bo ossIbIo fo nffrIbufo n vnIuo fo fho shnros or ofIons rocoIvod.

Tho fncf fhnf fho shnros nro IIsfod wIII nIso mnko fhom moro rondIIy nvnIInbIo fo

uso ns fho urchnso consIdornfIon In n fnkoovor sIfunfIon. ShnrohoIdors of fho

fnrgof comnny wIII hnvo n fnr cIonror ImrossIon of fho roInfIvo vnIuos of fho

shnros boIng offorod comnrod wIfh fho onos fhnf fhoy nIrondy hoId.

AB1"&&"#+ %#34"$3 C' 6%#' 1%#5,5%+"3= .%#5,5%+"3 4/0 /%5 3+*5,"5 +/" 10$"

$"%5,#9 80*#5 +/,3 ?*"3+,0# 3+$%,9/+80$4%$5!

;D Tho mosf common form of qunIIfIod oInIon Is fho oxcof for form. ThIs Is

nrorInfo whon fho nudIfor hns oncounforod n mnforInI dIsngroomonf ovor fho

fInnncInI sfnfomonfs or hns boon subjocf fo n mnforInI uncorfnInfy bocnuso fho

scoo of fho nudIf work hns boon rosfrIcfod. Tho oxcof for mnkos If cIonr fhnf fho

fInnncInI sfnfomonfs gIvo n fruo nnd fnIr vIow oxcof for fho chnngos fhnf wouId

hnvo boon nocossnry In ordor fo corrocf for fho dIsngroomonf or In rosonso fo fho

rosoIufIon of fho uncorfnInfy.

Thoro nro fwo moro oxfromo forms of qunIIfIod oInIon. Advorso oInIons nro usod

whon fho nudIfor dIsngroos wIfh fho ImrossIon cronfod by fho fInnncInI sfnfomonfs

so vIoIonfIy fhnf s/ho Is of fho oInIon fhnf fho fInnncInI sfnfomonfs do nof gIvo n

fruo nnd fnIr vIow. IscInImors of oInIon nro gIvon whon fho nudIfor Is fncod wIfh

such fundnmonfnI uncorfnInfy fhnf If Is ImossIbIo fo foII whofhor fho fInnncInI

sfnfomonfs gIvo n fruo nnd fnIr vIow. In fhIs Inffor cnso, fho nudIfor rofusos fo

oxross nn oInIon.

In onch of fho cnsos doscrIbod nbovo, fho nudIfor wIII doscrIbo fho robIoms fhnf

hnvo Iod fo fho nood for n qunIIfIod oInIon nnd wIII mnko fhoIr ImIIcnfIons cIonr

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 4

fo fho rondors. Thon fho roorf wIII cIonrIy sfnfo fho oInIon, mnkIng uso of ono of

fho roscrIbod forms of qunIIfIcnfIon.

>/,3 ?*"3+,0# 4%3 +/" 603+ -00$&' %#34"$"5 ,# +/" -%-"$D 1&"%$&' 603+ 1%#5,5%+"3

/%5 ,9#0$"5 +/,3 ,# +/" 10$" $"%5,#9= E 40*&5 "6-/%3,3 +/%+ %&& +0-,13 ,# +/" 10$"

$"%5,#9 %$" &,@"&' +0 C" "B%6,#"5 %#5 ,+ $"%&&' -%'3 +0 3+*5' %&& +/" %$"%3=

;E OrdInnry shnrohoIdors bonr fho rIsks nnd rownrds of ownorshI. Thoy nro Insf fo

bo ronId In fho ovonf fhnf fho comnny fnIIs. Thoy mny nIso rocoIvo IIffIo or no

dIvIdond nf dIffIcuIf fImos. On fho ofhor hnnd, fhoy wIII nIso bo onfIfIod fo nII of

fho rofIfs nffor fnx nnd nny roforonco dIvIdond. Thoy wIII normnIIy bo fho onIy

onos onfIfIod fo vofo nf gonornI moofIngs.

Ordinary shareholders will normally have a relatively volatile return Irom their

investment, but this will be compensated Ior by the possibility oI unrestricted

opportunity Ior capital growth. II the company is a massive success then the shareholders

may Iind that their stake increases in value beyond all recognition.

OrdInnry shnros nro bnckod by ronI frndIng nssofs. ThIs monns fhnf fhoy offor n

monsuro of rofocfIon ngnInsf InfInfIon. ThIs Is rofIocfod by fho fncf fhnf, on

nvorngo, ordInnry shnros hnvo gIvon n hIghor Iong form rofurn fhnn nny ofhor

Invosfmonf.

OrdInnry shnros nro normnIIy IrrodoomnbIo. Indood, fhoro nro rovIsIons fhnf nro

dosIgnod fo onsuro fhnf shnrohoIdors cnnnof hnvo fhoIr cnIfnI rofurnod.

ShnrohoIdors normnIIy rocoIvo n dIvIdond, nIfhough fho nmounf of fhIs wIII bo nf

fho dIscrofIon of fho dIrocfors. Tho nmounfs wIII bo nffocfod by fho comnny`s

orformnnco nnd nIso by fho bonrd`s dosIro fo rofnIn funds for fufuro oxnnsIon.

OrdInnry shnros fond fo bo mnrkofnbIo bocnuso fhoro Is nn ncfIvo socondnry

mnrkof In fho shnros of quofod comnnIos. ThIs Is nssIsfod by fho fncf fhnf fho

shnros fond fo bo Issuod In Inrgo, homogonous bIocks, mnkIng fho cronfIon of n

mnrkof worfhwhIIo. Ofhor Insfrumonfs nro moro IIkoIy fo bo Issuod In smnIIor,

moro frngmonfod frnnchos nnd so fhoro Is Ioss scoo for offorIng n IIquId

socondnry mnrkof.

F9%,# %#34"$"5 4"&&=

;F IonsIon funds offor n vohIcIo for Invosfmonf, In oxncfIy fho snmo mnnnor ns nny

ofhor form of commorcInI onfIfy. Thoro nro, howovor, sIgnIfIcnnf fonfuros whIch

mnkos fhoIr nccounfIng rIncIIos dIfforonf:

IonsIonors hnvo fnr Ioss scoo for dIvorsIfIcnfIon In fhoIr onsIons fhnn In nny

ofhor fyo of InvosfIng ncfIvIfy. ThIs monns fhnf fhoy hnvo fo bo kof

Informod nbouf fho sfownrdshI of fhoIr fund fo roduco fho rIsk of fhom boIng

Ioff oxosod fo fho Ioss of fhoIr onsIons.

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 5

IonsIon funds hnvo vory Iong form commIfmonfs fo onsIonors nnd musf

domonsfrnfo fhnf fhoy nro boIng mnnngod for fho Iong form.

Tho Ioss of n onsIon mny bo fnr moro sorIous fhnn fho Ioss of nny ofhor fyo

of Invosfmonf. IonsIonors mny bo fnr moro vuInornbIo bocnuso fhoy nro

unIIkoIy fo hnvo fho cnncIfy fo onrn suffIcIonf Incomo fo mnko u for nny

Ioss.

Thoso fncfors como fogofhor fo cronfo n nood for mombors of n onsIon fund fo

rocoIvo ndoqunfo nccounfIng InformnfIon fo onnbIo fhom fo monsuro fho

sfownrdshI nnd orformnnco of fho fund. Tho rondors mny bo roInfIvoIy

unsohIsfIcnfod nnd roquIro ovon gronfor rofocfIon fhnn fhnf offorod fo fho rondors

of fho fInnncInI sfnfomonfs of IImIfod comnnIos.

)03+ -0,#+3 6"#+,0#"5 C' 1%#5,5%+"3 D /04":"$ &,++&" 6"#+,0# 08 %110*#+,#9

,#80$6%+,0# ,# 603+ %#34"$3=

;G ConvorfIbIos nro nffrncfIvo fo Issuors whon If Is foIf fhnf fho rIco of fho ordInnry

shnros Is nbnormnIIy Iow. ThIs mIghf hnon In fho cnso of n sfnrf-u or n busInoss

whIch Is donIIng wIfh consIdornbIo fomornry uncorfnInfy. IssuIng frosh shnros

undor such cIrcumsfnncos wouId dIIufo fho oquIfy of oxIsfIng shnrohoIdors. Thoro

wIII sfIII bo somo dIIufIon whon fho dobonfuros nro convorfod, buf fhIs wIII

hoofuIIy bo Ioss fhnn wouId nrIso If fho shnros hnd boon Issuod whon fho comnny

wns nf n frnnsIfIonnI sfngo.

Tho comnny hns fo bo ronsonnbIy confIdonf fhnf fho shnro rIco Is onIy

fomornrIIy dorossod, ofhorwIso fho dobonfuro hoIdors wouId nof convorf. In

fhnf cnso fho comnny wouId hnvo fo fInd cnsh In ordor fo moof fho rodomfIon.

ConvorfIbIos nro ossonfInIIy n monns of rnIsIng oquIfy durIng dIffIcuIf orIods. Thoy

cnn bo rofornbIo fo sfrnIghf Ionn sfock bocnuso fhoy nro soIf-IIquIdnfIng nnd cnn bo

Issuod nf n sIIghfIy Iowor couon rnfo. Thoy mIghf nffrncf n nrfIcuInr grou of

Invosfors who nro IookIng for n gunrnnfood shorf form Incomo Ius fho ossIbIIIfy of

n cnIfnI gnIn nf n Infor dnfo.

>/,3 ?*"3+,0# 4%3 -00$&' %#34"$"5D 6%#' 1%#5,5%+"3 5"31$,C"5 10#:"$+,C&"3 C*+

4"$" %+ % &033 +0 3*99"3+ 4/' 106-%#,"3 6,9/+ 4,3/ +0 ,33*" +/"6= E+ 40*&5 C"

C"#"8,1,%& ,8 1%#5,5%+"3 10*&5 %--&' +/" 10$" $"%5,#9 +0 5,88"$"#+ 3,+*%+,0#3 $%+/"$

+/%# 3,6-&' 6"60$,3,#9 8%1+3=

;H (n) Tho roquIrod rnfo of rofurn Is rIsk froo rnfo + (bofn x oquIfy rIsk romIum).

!oquIrod rnfo of rofurn = 3 + (0.5 x 8) = ?.

(b) InvosfIng In fhIs rojocf wouId Incronso fho shnrohoIdors` wonIfh. Tho

roquIrod rnfo of rofurn, fnkIng rIsk Info nccounf, Is onIy ?. Tho rojocf

ncfunIIy offors 24. ThIs monns fhnf fho rojocf hns n osIfIvo nof rosonf

vnIuo (IV) nnd fho vnIuo of fhoIr shnros wIII Incronso by fho IV of fhIs

rojocf.

Tho Incronso wIII, howovor, onIy occur If fho sfock mnrkof hns suffIcIonf

InformnfIon fo form n vIow on Ifs IIkoIy oufcomo. If musf nIso ngroo wIfh

mnnngomonf`s ovnIunfIon of fho rojocf. If shnrohoIdors nro Ioss ofImIsfIc

fhnn fho bonrd fhon fho shnro rIco wIII nof rIso by ns much.

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 6

(c) Tho rIsks nssocInfo wIfh Invosfmonfs nro sIIf Info fhoso fhnf cnn bo

dIvorsIfIod nwny nnd fhoso fhnf cnnnof. Tho rIsks fhnf cnn bo dIvorsIfIod

nwny cnn bo Ignorod bocnuso nny rnfIonnI Invosfor wIII hoId n brond orffoIIo

of nssofs. Somo of fho Invosfmonfs wIII do bndIy buf fhIs wIII bo comonsnfod

by fho fncf fhnf ofhors wIII do woII. Ovor fho orffoIIo ns n whoIo fho Invosfor

shouId oxocf fo hnvo n rofurn fhnf fonds fownrds fhnf offorod by fho

mnrkof ns n whoIo.

If fho orffoIIo hns boon woII consfrucfod, fho onIy vnrInfIon from mnrkof

rofurns shouId bo bocnuso of nny doIIbornfo sfrucfurIng of fho orffoIIo fo

Ionvo fho shnrohoIdor oxosod fo moro or Ioss of fho rIsks fncod by fho

mnrkof ns n whoIo. Thoso rIsks cnnnof ovor bo dIvorsIfIod nwny bocnuso fhoy

nffocf nII comnnIos fo somo oxfonf or nnofhor. Ior oxnmIo, nn Incronso In

Inforosf rnfos wIII ush down mosf shnro rIcos fo somo oxfonf nnd so nII

Invosfmonfs wIII suffor.

!ookIng nf IQ! Ic`s rojocf from fho shnrohoIdors` orsocfIvo, mnny of fho

rIsks nro vory socIfIc fo fho Invosfmonf. Tho rIsk fhnf fho fochnoIogy wIII

nof work or fhnf fho sfnff wIII Ionvo cnn bo counforod by InvosfIng In n

suffIcIonf srond of ofhor socurIfIos fo cnncoI fho hIghs nnd Iows on fhIs

rojocf wIfh fhoso obfnInod from ofhors. Tho rojocf mIghf nof bo

nrfIcuInrIy sonsIfIvo fo fncfors fhnf nffocf fho mnrkof ns n whoIo nnd so If

nood nof roquIro n hIgh rnfo of rofurn.

(d) In fhoory fho dIrocfors shouId onIy bo concornod wIfh fho shnrohoIdors`

wonIfh. Thnf monns fhnf fhoy shouId Invosf In fhIs rojocf bocnuso If hns n

osIfIvo IV. Tho fncf fhnf If mIghf fhronfon fho comnny`s oxIsfonco wouId

nof mnffor bocnuso fhoIr orffoIIos wIII IncIudo somo comnnIos fhnf wIII fnII

nnd ofhors fhnf wIII fhrIvo.

Tho dIrocfors cnnnof, howovor, dIvorsIfy In quIfo fho snmo mnnnor. Mosf of

fhoIr Incomo wIII como from fhIs ono comnny nnd fhoIr orsonnI

roufnfIons wIII bo nssocInfod wIfh Ifs succoss or fnIIuro. Thoy wIII,

fhoroforo, hnvo n gronf donI fo Ioso If fhoy uf fho shnrohoIdors` Inforosfs

fIrsf. Tho dIrocfors mIghf nIso fooI n mornI rosonsIbIIIfy fownrds fho ofhor

omIoyoos fo onsuro fhnf fho comnny survIvos In ordor fo koo fhom In

omIoymonf.

Tho dIrocfors mIghf nIso bo concornod fhnf mnny Invosfors wIII nof

nrocInfo fho Imorfnnco of InnnIng fhoIr Invosfmonfs on n orffoIIo bnsIs.

Thoy mIghf crIfIcIso fho dIrocfors for fnkIng n rIsk fhnf Is, In fncf, jusfIfIod by

fho rofurns offorod. If fhoy do nof nccof fhnf mnny of fho rIsks nro socIfIc

fo fho rojocf nnd cnn bo dIvorsIfIod nwny fhoy mIghf nccuso fho dIrocfors of

mIsmnnngomonf.

G%$+ % 4%3 4"&& %#34"$"5 D +/" $"6%,#,#9 -%$+3 08 +/" ?*"3+,0# 4"$" -00$&'

%#34"$"5D 603+ 1%#5,5%+"3 /%5 &"%$#"5 8%1+3 C*+ 80*#5 ,+ 5,88,1*&+ +0 %--&'

+/"3" +0 -$%1+,1%& 3,+*%+,0#3=

Subject 108 (Finance and Financial Reporting) April 2001 Examiners' Report

Page 7

;= (a)

Eastern Western

Return on capital employed 31224

893200

31 64711

1333100

46

ProIit margin 336

800

42 658

1,400

47

Gross proIit 480

800

60 910

1400

65

Advertising " sales 80

800

10 196

1400

14

Administration / sales 64

800

8 56

1400

4

Asset turnover 800

1000

0.8 times 1400

1200

1.2 times

Current ratio 141

48

2.9 times 286

53

5.4 times

Quick ratio 141 51

48

1.9 times 286-57

53

4.3 times

Stock turnover 51 x365

320

58 days 57 x 365

490

42 days

Debtors turnover 80

800

37 days 222

1400

58 days

Creditors turnover 48

320

55 days 53

490

39 days

Wosforn hns n hIghor rofurn on cnIfnI omIoyod. Thnf Is onough In IfsoIf fo

IndIcnfo fhnf If Is fho moro rofIfnbIo of fho fwo comnnIos.

Wosforn nonrs fo hnvo sonf moro on ndvorfIsIng wIfh n vIow fo sookIng n

hIghor soIIIng rIco or unIf. ThIs mny hnvo confrIbufod fo n hIghor ovornII

rofIfnbIIIfy. Tho comnny hns nIso mnnngod fo snvo consIdornbIy on

ndmInIsfrnfIon cosfs, sondIng onIy 4 of furnovor ns oosod fo 8. IInnIIy,

Wosforn hns mnnngod fo obfnIn n hIghor nssof furnovor.

Wosforn hns nIso mnnngod IIquIdIfy moro offocfIvoIy. Tho comnny hns Ionnor

curronf nnd quIck nssof rnfIos. Insforn nonrs fo bo honvIIy ovor Invosfod In

unroducfIvo nssofs.

IInnIIy, Wosforn nIso nonrs fo hnvo n boffor sfrnfogy for fho mnnngomonf of

sfock, dobfors nnd crodIfors. If Is furnIng sfock ovor rnIdIy, fhoroby mnnngIng

cnsh fIows. If hns mnnngod fo offor dobfors n ronsonnbIo orIod of crodIf, ossIbIy

jusfIfyIng Ifs romIum rIcIng oIIcy. If Is nIso nyIng crodIfors wIfhIn n ronIIsfIc

orIod, fhoroby mnInfnInIng Ifs crodIf rnfIng.

(b)

Thoro Is nIwnys n rIsk fhnf nccounfIng fIguros nro nof comnrnbIo. Tho

nccounfIng oIIcIos couId bo dIfforonf or fho comnnIos` nccounfnnfs couId hnvo

mndo dIfforonf osfImnfos nnd nssumfIons.

Wosforn Is nIso 50 Inrgor In forms of furnovor. Thnf mIghf mnko fho comnny

nonr fo bo moro offIcIonf, whon If Is ncfunIIy onjoyIng oconomIos of scnIo. Thoso

oconomIos couId mnsk nn undorIyIng wonknoss In mnnngomonf.

Thoro couId bo ofhor sfrucfurnI ronsons why Wosforn onjoys gronfor succoss. Tho

comnny couId, for oxnmIo, soII fo n dIfforonf, moro rofIfnbIo mnrkof sogmonf.

InrrIors fo onfry mIghf mnko If ImossIbIo for Insforn fo comofo dIrocfIy.

H"&& %#34"$"5 C' 603+ 1%#5,5%+"3=

!"#$%&' )* +#&$",-./ 01/&-&$&. )* +#&$",-./

23+405+60758

ll Sofombor 200l (m)

8$9:.#& ;<= > !-1"1#. "1? !-1"1#-"% @.A),&-1B

!"#$ &''()$*+ !,-$$ ,(.-/

!"#$%&'$!("# $( $*+ ',"-!-,$+

01 2-"3$ 4(.- /.-5&#$ "5 6.''7 3,$ "5"3"&'/ (6 4(.- (3,$- 5&#$/ &5* 4(.-

8&5*"*&3$9/ :.#;$- (5 3,$ 6-(53 (6 3,$ &5/)$- ;((<'$31

=1 >&-< &''(?&3"(5/ &-$ /,()5 "5 ;-&?<$3/1

@1 A33$#B3 &'' 0C D.$/3"(5/1 E-(# D.$/3"(5 00 (5)&-*/ ;$F"5 $&?, &5/)$- (5 &

/$B&-&3$ /,$$31

./012 1013/ 45 678 /39:4/3; <7/ 8245 1013/=

A! !GH H:I JE !GH HKA>L:A!LJ:

G&5* "5 MJ!G 4(.- &5/)$- ;((<'$3 &5* 3,"/ D.$/3"(5 B&B$-1

L5 &**"3"(5 3( 3,"/ B&B$- 4(. /,(.'* ,&N$ &N&"'&;'$

A?3.&-"&' !&;'$/ &5* &5 $'$?3-(5"? ?&'?.'&3(-1

IncuIfy of AcfunrIos

l08S200l (l5.2.0l) InsfIfufo of AcfunrIos

l08 S200l2

E(- D.$/3"(5/ 0O0P "5*"?&3$ "5 4(.- &5/)$- ;((<'$3 ),"?, (5$ (6 3,$ &5/)$-/ A7 M7 8 (- I

"/ ?(--$?31

; WhIch of fho foIIowIng Is subjocf fo fnxnfIon In fho !K

A socInI socurIfy bonofIfs

I wInnIngs from gnmbIIng

C rofIfs from nn ISA

dIvIdonds from n !K comnny |2]

C WhIch of fho foIIowIng sfnfomonfs Is 576 fruo of Invosfmonf frusfs

A nn Invosfmonf frusf Is n comnny

I fhoy rnIso oquIfy nnd dobf cnIfnI

C fhoy novor Invosf In fho shnros of ofhor !K comnnIos

mosf Invosfmonf frusfs nro IIsfod on fho sfock oxchnngo |2]

D Whon n fIrm nnnouncos n fwo-for-ono scrI Issuo Invosfors shouId oxocf fhnf, (In

fho nbsonco of ofhor now InformnfIon):

A onrnIngs or shnro wIII fnII buf fho sfock rIco wIII romnIn fho snmo

I fho sfock rIco wIII fnII buf fho onrnIngs or shnro wIII romnIn fho snmo

C bofh fho onrnIngs or shnro nnd fho sfock rIco wIII romnIn fho snmo

bofh fho onrnIngs or shnro nnd fho sfock rIco wIII fnII |2]

E Tho nomInnI vnIuo of n bond Is rocoIvod by fho bondhoIdor:

A nf fho fImo of urchnso

I nnnunIIy

C whonovor couon nymonfs nro mndo

nf mnfurIfy |2]

F Tho nof rosonf vnIuo mofhod of cnIfnI budgofIng nssumos fhnf cnsh fIows nro

roInvosfod nf:

A fho fIrm`s cosf of cnIfnI

I fho fIrm`s dIvIdond yIoId

C no rnfo fhoy nro nof roInvosfod

fho rnfo of rofurn of fho rojocf |2]

l08 S200l3 GH2+82 6I@5 7J2@

K Tho nybnck mofhod cnn Iond fo fho wrong docIsIon boIng mndo bocnuso:

A If Ignoros Incomo boyond fho nybnck orIod

I fho nybnck orIod Is dIffIcuIf fo cnIcuInfo

C fho rofurns In Infor yonrs nro uncorfnIn

of fho omhnsIs Incod on fho Inforosf fncfor |2]

L WhIch of fho foIIowIng chnngos In workIng cnIfnI wIII rosuIf In nn Imrovomonf

In n comnny`s nof cnsh InfIow from oornfIng ncfIvIfIos

A Incronso In crodIfors