Beruflich Dokumente

Kultur Dokumente

Juournal's Summary

Hochgeladen von

indun88Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Juournal's Summary

Hochgeladen von

indun88Copyright:

Verfügbare Formate

Research in social psychology has been valuable in providing key frameworks for

understanding the complex relationship between culture and human behavior. One of

the lessons learned from the field is that cultural variations have a significant impact on

the way individuals view the world, which ultimately affects their behavior (Shweder,

1991; Manstead, 1997).

Without

any significant differences, researches by Bristow and Asquith (1999), Gurhan-Canli and

Maheswaran (2000), Chudry and Pallister (2002) and de Mooji and Hofstede (2002)

suggest that consumers from different cultural background express some significant

differences, which may warrant differentiated marketing efforts.

Determinant factors of customers bank selection

Kaufman (1967)

found that the most influential factors in customers selection of a bank were convenient location to

home or place of business, length of bank-customers relationships and quality of services offered by the bank.

Mason and Mayer (1974)

suggested that among otherimportant selection criterions used by the customer, convenient location came on the top

the priority, followed by other important factors like friendly personnel, favorable loan

experience, advice of friends and influence of relatives opinion.

(Martenson, 1985)

Findings of various studies reveal that consumer choice of bank depends on a multiple set of criterions

including bank location, availability of loans and the default salary account of a particular bank.

Arora et al. (1985)

found that customer selection of banking services is mainly determined by dependability of

institutions, accessibility, easiness of processes for transactions, variety of services offered and availability of

loans at competitive interest rates.

Laroche et al. (1986)

Found that friendliness of staff plays the major role in the bank decision process, followed by hours of operations,

size of waiting lines, convenience of location and efficiency of personnel.

Determinant factors of a customers selection of an Islamic Bank

Halim and Nordin (2001), Ahmad and Haron (2002), Bley and Kuehn (2004), Zainuddin et al. (2004),

Worthington (2005), Okumu (2005), Dusuki and Abdullah (2007), Rashid and Hassan

(2009), Khan and Khanna (2010) also

support the argument that religious believes serveas main motivation to select an Islamic Bank for Muslim

customers

Contradictory, there is a point of view that religious beliefs are not the sole reason to

Islamic bank (Erol and El-Bdour, 1989; Gerrard and Cunningham, 1997; Zaher and Hassan, 2001). Dusuki and

Abdullah (2007) argued that:

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Charles Schwab Summary AgreementDokument2 SeitenCharles Schwab Summary AgreementSteve Oreo100% (2)

- Global FinanceDokument49 SeitenGlobal FinanceAnisha JhawarNoch keine Bewertungen

- FactSet Bank TrackerDokument9 SeitenFactSet Bank TrackerBrianNoch keine Bewertungen

- Introduction To Vault CoreDokument25 SeitenIntroduction To Vault CoreUni QloNoch keine Bewertungen

- 0809 B&E SeptDokument118 Seiten0809 B&E Septhsrivastava703Noch keine Bewertungen

- Rules andDokument30 SeitenRules andBabaji BautistaNoch keine Bewertungen

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDokument6 SeitenFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Noch keine Bewertungen

- Amex CaseDokument25 SeitenAmex Caseankit2104Noch keine Bewertungen

- Federal Reserve Account StructureDokument16 SeitenFederal Reserve Account Structurecamwills2100% (1)

- Sale, Lease and Credit Agreements 2009Dokument3 SeitenSale, Lease and Credit Agreements 2009qanaqNoch keine Bewertungen

- Boa Tos RFBTDokument6 SeitenBoa Tos RFBTMr. CopernicusNoch keine Bewertungen

- KeemekDokument3 SeitenKeemekAshwani KhandelwalNoch keine Bewertungen

- Wachovia Case StudyDokument12 SeitenWachovia Case Studyvivekb67100% (1)

- Priya KapilDokument93 SeitenPriya KapilaamritaaNoch keine Bewertungen

- 2012 Jiao vs. NLRCDokument2 Seiten2012 Jiao vs. NLRCMa Gabriellen Quijada-Tabuñag100% (1)

- SBP Market OperationsDokument26 SeitenSBP Market OperationsAnas JameelNoch keine Bewertungen

- Format For Company Bank Account OpeningDokument2 SeitenFormat For Company Bank Account OpeningLeo PrabhuNoch keine Bewertungen

- Jose Antonio Maravall - Estado Moderno y Mental Id Ad Social (Summary)Dokument7 SeitenJose Antonio Maravall - Estado Moderno y Mental Id Ad Social (Summary)Curran O'ConnellNoch keine Bewertungen

- Preparing FinancialDokument18 SeitenPreparing FinancialAbhishek VermaNoch keine Bewertungen

- Indian Banking SystemDokument10 SeitenIndian Banking SystemSony ChandranNoch keine Bewertungen

- Banking Finals Samplex Sample Answers (Ver.2)Dokument2 SeitenBanking Finals Samplex Sample Answers (Ver.2)Florence RoseteNoch keine Bewertungen

- Accounting Systems For Thrift Co-Operatives Promoted by Co-OperativeDokument42 SeitenAccounting Systems For Thrift Co-Operatives Promoted by Co-OperativemadhanagopalNoch keine Bewertungen

- Maude Hoc Bong 2017Dokument6 SeitenMaude Hoc Bong 2017Le Quang Vu KeNoch keine Bewertungen

- Recruitment of Officers and Executives in Cent Bank Home Finance Limited - 2015-16Dokument10 SeitenRecruitment of Officers and Executives in Cent Bank Home Finance Limited - 2015-16JeshiNoch keine Bewertungen

- PERE - Private Equity Real EstateDokument1 SeitePERE - Private Equity Real EstatePereNoch keine Bewertungen

- Industry 4.0 TenderDokument58 SeitenIndustry 4.0 TenderSoumya Ranjan SubudhiNoch keine Bewertungen

- Oblicon Case DoctrinesDokument101 SeitenOblicon Case DoctrinesImmah SantosNoch keine Bewertungen

- Cash & Cash EquivalentsDokument5 SeitenCash & Cash EquivalentsVanessa DozonNoch keine Bewertungen

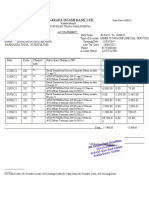

- Al-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VDokument2 SeitenAl-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VRaju AhamedNoch keine Bewertungen

- ONGC - EPP - Apple Offer - 03-10-22Dokument3 SeitenONGC - EPP - Apple Offer - 03-10-22sameer bakshiNoch keine Bewertungen