Beruflich Dokumente

Kultur Dokumente

Chuyen de 1

Hochgeladen von

Tran Minh NguOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chuyen de 1

Hochgeladen von

Tran Minh NguCopyright:

Verfügbare Formate

Journal of Applied Corporate Finance

S P R I N G 1 9 9 9 V O L U M E 1 2 . 1

Estimating the Equity Risk Premium and Equity Costs:

New Ways of Looking at Old Data

by Laurence Booth,

University of Toronto

100

JOURNAL OF APPLIED CORPORATE FINANCE

ESTIMATING THE EQUITY

RISK PREMIUM AND

EQUITY COSTS:

NEW WAYS OF LOOKING

AT OLD DATA

by Laurence Booth,

University of Toronto

100

BANK OF AMERICA JOURNAL OF APPLIED CORPORATE FINANCE

2. R. G Ibbotson and R. A. Sinqufeld, Stocks, Bonds, Bills and Inflation: The

Past (1926-76) and the Future (1977-2000), Financial Analysts Research Founda-

tion, 1977. This is now updated annually by Ibbotson and Associates.

1. The Wealth of Nations, p. 136.

As a result it is impossible to ignore the impact of

investment horizon on the discount rate. It is gener-

ally acknowledged that the risk-free rate depends on

the time period over which the cash flows are being

valued. For example, the 30-day Treasury bill yield

reflects the risk free rate for a 30-day holding period,

but it is not a risk-free rate for an investor with an

investment horizon either longer or shorter than 30

days. Similarly, the 20-year Treasury yield reflects the

risk-free rate for a 20-year investment horizon. An

additional complication for long-term bond yields is

the reinvestment rate risk associated with reinvesting

the intermediate coupons. However, to the extent that

a similar reinvestment rate risk exists for project cash

flows, the long-term Treasury bond yield more closely

matches the investment horizon for typical capital

budgeting and valuation problems than does the

Treasury bill yield. As a result, in practice most equity

discount rate calculations start out with the long-term

Treasury bond yield as the appropriate risk-free rate.

The focus in calculating an equity discount rate

then quickly shifts to adding the appropriate risk

premium to the yield on long treasuries. In practice,

much of this effort focuses on the estimation of the

relevant risk or beta coefficient, with relatively little

time spent on the equity risk premium. Normally the

equity risk premium is taken to be the long-run

average excess return of equities over bonds taken

from the data compiled by Ibbotson and Sinquefeld.

2

For example, this is the common approach taken in

regulatory hearings to determine the equity discount

rate, with either a CAPM risk premium or average

utility risk premium added to the long bond yield.

demand extra profit or return in compensation for

bearing it, is a cornerstone of modern finance.

Further, it was the major factor in the award of the

Nobel prize in economics to William Sharpe and

Harry Markowitz for the development of modern

portfolio theory and the Capital Asset Pricing Model

(CAPM). Their contribution was to show that the risk

premium, or the extra rate of profit in Smiths

terminology, is related to the contribution of a

security to the risk of a diversified portfolio. Ever

since, required rates of profit or discount rates have

predominantly been determined by a three-step

procedure: (1) estimate the appropriate risk free rate;

(2) estimate the equity market, or average, risk

premium; and (3) adjust the equity risk premium for

the particular risk of the security or firm.

For the CAPM, this procedure amounts to

implementing the following equation:

K

j

= R

F

+ (E(R

e

) R

F

) *

j

(1)

where K

j

is the required return or discount rate for

security j, R

F

the risk-free rate, and the equity risk

premium (ERP) is just the difference between the

expected return on the market (E(R

e

)), ie., the

average of all securities, and the risk free rate, and

j

the securitys beta coefficient.

While the CAPM is a single period model,

most problems in finance involve multiple periods.

n The Wealth of Nations Adam Smith

states that The ordinary rate of profit

always rises more or less with the risk.

1

This idea that investors dislike risk, and

I

VOLUME 12 NUMBER 1 SPRING 1999

101

In this paper, I reverse this sequence of events.

Instead of focusing on beta coefficients, I focus

directly on estimating the equity return and then

consider, among other things, whether it makes

sense to estimate this by means of adding a constant

risk premium to the prevailing long Treasury yield.

Critical questions raised by this process are whether

the equity risk premium is stable, and whether the

common practice of adding a premium to the long

Treasury yield is better than just using the average

historic equity return directly and ignoring the

performance of the bond market entirely. I also

consider the question of which equity return should

be used: That is, is it better to estimate an average

nominal equity return and use that as a forecast of

future nominal returns, or should a real return be

estimated and then the current inflation rate be

added?

This paper shows that all of these approaches

are subject to potential bias of one kind or another,

and that there is thus no automatic right answer.

Instead, capital market evidence and knowledge of

economic events should guide the users choice

among these different estimation techniques.

ESTIMATION PRINCIPLES

The main source of data on the equity risk

premium comes from the seminal work of Ibbotson

and Sinqufeld, who have calculated holding period

return data from December 1925 to the present for

common equities, long-term government bonds,

Treasury bills, and the consumer price index. Ibbotson

and Sinquefeld claim that the equity risk premium

over Treasury bills follows a random walk and that,

for this reason, the historic average excess return is

the best forecast of the current equity risk premium.

3

To understand their conclusion, lets adopt their

assumption (an assumption I will question later) that

the equity risk premium is a random walk, as shown

in equation 2, with constant mean and constant,

independent and identically distributed error terms:

4

ERP

t

= +

t

(2)

where ERP

t

, is the actual excess return of equities

(Re,t) over 30-day Treasury bills at time t, which is

equal to the constant equity risk premium () plus

a random error term (

t

). The estimated average

value of equation (2) over T periods can then be

expressed as follows:

AERP = + (

T

t=1

t

)/T (3)

If the error terms are indeed independent and

identically distributed each period, then the average

from T period observations is simply the true equity

risk premium plus the average error term, which with

enough observations will eventually sum to zero. As

a result, with larger and larger time periods we can

be more and more confident that the estimated

average risk premium is equal to the constant

expected risk premium.

Ibbotson and Sinquefeld calculate the simple

average equity risk premium in the above manner

and suggest that this be added to the current 30-day

yield on a Treasury bill to estimate the current equity

discount rate. This suggestion is then dutifully fol-

lowed in almost every introductory finance textbook.

Leaving aside the problem that the 30-day

Treasury bill yield is not a useful risk-free rate for

most problems in finance, the astute reader might

wonder why the average equity market return is not

a better measure of the expected return on the

market? That is, if the return on equity follows the

same process as equation (2), why not estimate the

average equity return directly, rather than by adding

the average excess return to a Treasury bill yield?

The reason given by Ibbotson and Sinquefeld is

that the return from holding Treasury bills does not

follow the above process. Because T-bill yields

fluctuate with monetary policy, they are serially

correlated, and thus have clearly had different aver-

age values at different points in time. Further, if stock

market risk and the market price of risk (risk

aversion) have been constant over time, then the

equity risk premium will have followed a random

walk, and equity returns are generated by the

following process:

R

e,t

= R

30,t

+ +

t

(4)

where R

30,t

is the return on 30 day Treasury bills. A

simple average of equation (4) is then

4. This is a Random Walk 1 as discussed by J. Campbell, A. Lo and A. C.

Mackinlay, The Econometrics of Financial Markets, Princeton, 1997. We will use

the term random walk to mean the above process.

3. For example, Stocks, Bonds, Bills and Inflation 1986 Yearbook, Ibbotson

and Associates, Inc. 1986, p. 71.

102

JOURNAL OF APPLIED CORPORATE FINANCE

(

T

t=1

R

e,t

)/T = (

T

t=1

R

30,t

)/T + + (

T

t=1

t

)/T (5)

where the average equity return is equal to the

average T-bill yield plus the equity risk premium plus

the average error term. Even if equation (5) is

summed over very long periods, there is no reason

to believe that the average equity return will equal

the expected return; in fact, it will only do so if the

average T-bill yield is equal to the current T-bill yield.

This imparts what I will call a risk free rate bias to the

equity return estimate. For example, suppose the

average equity return is 10%, composed of an

average T-bill return of 6% and an equity risk

premium of 4%. If during the business cycle T-bill

yields go from 4% to 8%, then the use of the average

10% rate will overestimate equity costs when T-bill

yields are low and underestimate them when they

are high. The problem, of course, is that short-term

T-bill yields are extremely volatile, so that even if the

average T-bill yield over a business cycle is constant,

using equation (5) within a business cycle will cause

serious estimation errors.

Ibbotson and Sinquefelds justification for esti-

mating the equity risk premium and adding it to the

current Treasury Bill yield is correct, provided that

the process driving equity returns is that given in

equation (4). At its core the assumption is that equi-

librium asset prices are determined based on short-

term investment horizons and that the correct risk-

free rate is the return on a 30-day Treasury bill. An

equally plausible argument, however, is that the

correct risk-free rate for the equity market is a one-

year Treasury bond yield, since this is closer to the

implicit investment horizon, and thus the opportu-

nity cost, of the average investor.

5

More to the point,

it is the horizon over which most cash flows are

discounted for valuation purposes. However, even if

Ibbotson and Sinquefelds assumption is correct, the

resulting equity discount rate is not very useful for

valuation purposes, since the correct risk-free rate for

these purposes is closer to the long Treasury yield.

Assume more realistically that the correct risk-

free rate used for valuing equities is unknownand

lets call it Rm for a medium-term rate, but the point

is that we simply do not know what it is. In this case,

equities, long-term bonds, and Treasury bills are all

risky. However, since we are not interested in Trea-

sury bills, lets just consider the returns for equities,

R

e,t

= R

m,t

+ +

t

(6)

and long bonds,

R

l,t

= R

m,t

+ TP

t

+

t

(7)

where the long term bond return is equal not only

to the unknown risk-free rate plus an error term (

t

),

but also a term premium (TP

t

) to capture the fact that

long-term bonds are riskier than short-term bonds.

In this case, the average returns for both equity and

the long bond are subject to the same risk-free rate

problems as in equation (5), where the correct risk-

free rate is the Treasury Bill yield. However, if the

correct risk-free rate is a medium term rate, it is less

susceptible to the volatility due to monetary policy

than is the Treasury Bill rate, and the risk-free rate

bias is reduced.

The equity risk premium measured over long

bonds can then be expressed as follows:

R

e,t

R

l,t

= TP +

t

t

(8)

and the average equity risk premium estimated over

T periods is

AERP =

T

t=1

TP

t

/T +

T

t=1

(

t

t

)/T (9)

Equation 9 will produce an estimate of the risk

premium over the true risk-free rate that is biased

low, since long bonds are themselves risky and

hence command a term premium.

The implications from equations (6), (7), and (9)

are several. First, if the true risk-free rate is of a longer

term than the 30-day return on a 90-day T-bill, then

the risk free rate bias is reduced. In fact, there may

be no reason for using the risk premium approach

at all, depending on the behavior of medium-term

yields. Moreover, since the 30-day T-bill is also risky

for a longer investment horizon due to reinvestment

rate risk, there is nothing special about the statistical

properties of an equity risk premium estimated over

Treasury bills.

Second, an equity risk premium estimated over

long bonds is composed of three distinct compo-

nents: the true equity risk premium over the un-

known risk-free rate; the average term premium

attached to long term bonds; and the residual

5. The obsession with monthly data in finance is driven more by statistical

needs for enough current observations, than any fundamental economic reasons.

VOLUME 12 NUMBER 1 SPRING 1999

103

estimation error. This latter component critically

depends on the relationship between interest rate

risk and market risk. If the uncertainty in equity

returns is driven by a simple factor process such as

t = Inflation

t

+ production

t

+ default risk

t

+ t (10)

6

where uncertainty in long bond returns (

t

) arising

from interest rate changes is a factor driving the

equity market as well, then the error term attached

to the equity risk premium in equation (9) will be

smaller than directly estimating the average equity

return. Anything that lowers the estimation risk is

beneficial, since with normal standard errors the

estimated average returns are subject to considerable

estimation error.

7

Third, the risk premium estimated from equa-

tion (9) will only be accurate if the average term

premium is equal to the current term premium,

otherwise there will be what I will call a term

premium bias. Equity market returns distill the effect

of all risks, so that it might be reasonable to assume

that this overall market risk is constant. However,

bond market returns are driven mainly by interest

rate changes, and it is questionable to assume that

this term premium has remained constant over the

full time period.

Finally, although equation (6) assumes that

equity returns are generated as a risk premium over

a risk-free rate, an alternative longstanding assump-

tion in finance is that nominal returns are generated

as a premium over the expected inflation rate. In

equation (6), this would mean that instead of the risk-

free rate bias, we would have an inflation rate bias.

That is, using the nominal average return implicitly

assumes that the average inflation rate over the

estimation period is equal to the current inflation

rate. This bias can be removed by calculating the

average real return by deflating the nominal return

by the change in the consumer price index. The

assumption would then be that the real equity return

follows equation (2).

The upshot of the above discussion is that it is

by no means certain that the equity return is better

estimated indirectly from a risk premium added to

a bond yield rather than directly from the proper-

ties of realized equity returns. All approaches in-

volve known biases and will be subject to estima-

tion error. It is a major theme of this paper that

which is the best approach can be determined only

after an analysis of the data and an understanding

of what economic events have occurred over the

estimation period. In contrast, the justification given

for the risk premium approach by Ibbotson and

Sinquefeld is based largely on assumption, not

analysis of the evidence.

WHAT THE DATA TELL US

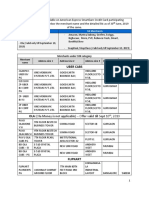

Table 1 gives various estimates of the average

realized returns on different security classes for the

overall period 1926-1997.

8

Before discussing the

data it is useful to digress on what is meant by an

average rate of return. The arithmetic mean (AM)

is the simple average of the annual rates of return.

The geometric mean (GM) is the compound rate of

return earned between December 1925 and Decem-

ber 1997. The OLS is the ordinary least squares

estimate of the annual growth rate in wealth invested

in each asset class.

9

TABLE 1

ANNUAL RATE OF RETURN

ESTIMATES 1926-1997

S&P Long US 90 Day Real Excess

Equities Treasury Treasury Bills CPI Return Return

AM 12.95 5.59 3.80 3.20 9.75 7.36

Standard error 2.38 1.07 0.38 0.53 2.41 2.43

GM 10.99 5.22 3.75 3.10 7.89 5.77

OLS 10.91 4.17 3.75 3.79 7.12 6.74

standard error 0.20 0.19 0.18 0.12 N./A N./A

6. See for example, N. Chen, R. Roll and S. Ross, Economic Forces and the

Stock Market, Journal of Business, 59, 1986.

7. The standard error of the estimated mean is calculated in the normal way

as the standard deviation divided by the square root of the number of observations,

that is, the time period. With 72 years of data and an average equity volatility of

20%, the standard error of the estimate is over 2%, since the time period can not

usually be changed anything that lowers the standard errors makes for a more

accurate estimate of the unknown true expected equity return.

8. Data for 1926-1995 are the Ibbotson and Sinquefeld data on the CRSP data

files with 1996 & 1997 data updated manually. The estimates are obtained starting

from December 1925 from the monthly total return indexes.

9. The OLS estimate is obtained by a log-linear regression of the logarithm of

the cumulative wealth index against time, with the resulting continuous growth rate

converted to an effective annual rate by the anti-log function eX. Note the standard

error of this estimate reflects the lesser variability of total wealth as compared to

the annual return.

All of the approaches to calculating equity costs are subject to potential bias of one

kind or another, and there is thus no automatic right answer. Instead, capital

market evidence and knowledge of economic events should guide the users choice

among these different estimation techniques.

104

JOURNAL OF APPLIED CORPORATE FINANCE

All three estimates of the average return are

valid and the choice between them depends on the

underlying reason for deriving the estimate. The GM

is the compound rate of return over the entire 72-year

period; essentially it is the single arithmetic return

that treats the whole period as a single period. In

contrast, the AM is the simple average of all the

annual rates of return. The AM always exceeds the

GM, and the difference increases by approximately

half the variance in the rate of return. As a result, the

difference between the AM and GM is greatest for the

common stock returns and smaller for the CPI and

90-day T-bill series. If the data is needed to assess

potential portfolio performance, and if the investors

holding period is between one and 72 years, then the

best estimator

10

is a weighted average of the AM

and GM with the weights depending on the particu-

lar holding period.

However, our concern is not with portfolio

performance, but with the estimation of the annual

rate of return required by an investor to discount

annual cash flows. For this purpose, the AM esti-

mated over annual holding periods is probably more

accurate, although the actual choice depends on the

unknown investment horizon.

The final estimate in Table 1 is the ordinary

least squares (OLS) estimate of the annual rate of

return, which (since it is assumed to be reinvested)

is also the growth rate in investors wealth. Unlike

the simple AM, which weights each annual return

equally, the OLS estimator minimizes the variance

in the forecast error. As a result, it should be a

statistically better estimator.

The message from the data in Table 1 seems to

be straightforward: common equities have earned

between 11-13% and long Treasuries 4-6%, on

average, depending on the estimation method. Thus,

the excess return of common stocks over long-term

government bonds has been in the range 6.7-7.4%

for annual holding periods, declining to 5.8% as the

holding period is lengthened. With long Treasury

yields at 6.0% in April 1998, adding the 6.7-7.4%

would yield a range of 12.7-13.4%. This estimate

would be at the top of the range derived from the

different estimates of the simple average nominal

equity return.

Over the same time period, the real equity

return has been between 7.1% and 9.8% for annual

holding periods with 7.9% for a longer horizon.

Note that the volatility of the inflation rate, particu-

larly in the 1930s, causes a significant difference

between the OLS and AM estimates of the average

real equity return. If a 2.5% inflation estimate is

added to the average real return estimates, the

nominal equity return would be in the 9.6%-12.2%

range, which is at the lower end of the range of

estimated simple nominal equity returns.

Clearly, the choice of estimation technique can

result in quite large differences in the estimate of

the expected equity return. This in turn would

mean large differences in estimates of the cost of

equity capital for different types of firms. Note also

that the standard error of the excess return esti-

mate is greater than the standard error of the

direct estimate, implying that the estimate of the

risk premium has not benefited from any interest

rate factor risk driving equity returns over the

whole period. The choice between the three

estimating techniques rests, therefore, on the

relative importance of the risk-free rate and

inflation rate biases of the direct estimates and

the term premium bias of the indirect risk

premium estimate.

One way of examining these potential biases is

to calculate annually updated averages from equa-

tions (6) and (9). Suppose, for example, that we

calculate the average from the first five observations

and then successively add additional observations.

If equation (6) holds for the equity return and the

risk-free and inflation rate biases are relatively

small, the estimated forward averagingprocess

will eventually zero in on the true mean.

Figure 1 illustrates this process, where the

rate of return is assumed to have a mean and

standard deviation of 12% and 20%, respectively.

For simplicity there are 72 observationsthe

same as for the time period in Table 1. Note that

while the average oscillates around 12%, the

fluctuation around the mean gets smaller and

smaller.

11

How much oscillation there is simply

depends on the initial random returns; large

outliers early on have a more dramatic effect

simply because they are averaged over fewer

observations. Surrounding the average are the

95% confidence bands for the estimate. Note that

the confidence bands get narrower, but since

10. See Marshall Blume, Unbiased Estimators of Long Run Expected Rates of

Return, Journal of the American Statistical Association, (September 1974).

11. Note that this was the result of one simulation, other simulations would

get different results.

VOLUME 12 NUMBER 1 SPRING 1999

105

they decline with the square root of the number

of observations (time), the effect of an increasing

time period decreases.

12

If the forward averaging exercise is repeated

with the actual data, we get the pattern shown in

Figure 2. There are three forward averaged series:

the nominal equity return, the real equity return,

and the excess return of equities over bonds.

Overall, all three series seem to exhibit a hump

in the middle years of 1950-1980, indicating in-

creasing returns and then decreasing equity re-

turns. This is particularly apparent with the real

equity and risk premium returns.

Although visual examination can be suspect,

since the variability in the equity return is so large,

there is little in the Figure 2 to suggest that one series

fits the random walk model better than another. If

anything, the simple average nominal equity return

seems to zero in on the average more quickly than

either the equity risk premium or the real equity

return average.

Another way to look at the data is to remember

that, from the random walk model of equation (6),

each years rate of return or risk premium is assumed

to be independent and drawn from the same distri-

bution. It follows that there is nothing special

about calculating an average starting out in 1926 and

then working forward to 1997. Instead, we can just

as well start from the average return for 1993-1997

and work backwards by adding historic data until

we again get the average for the full 72-year period.

(In fact, if the assumption that the return each year

is independent is not a valid one then, this process

may make more sense since it implicitly weights

current data more heavily.)

The pattern that results from this backwards

averaging process is shown in Figure 3. The last

observation at the right is for the period 1993-1997.

As one then moves towards the origin, progressively

older data is continuously added until the first

observation, marked 1926, adds the very first obser-

vation. This first (1926) observation thus represents

the overall average (and is the same as the last (1997)

observation in the forward average return graph

shown in Figure 2).

FIGURE 1

SIMULATED MEAN ESTIMATION: RANDOM WALK MODEL

FIGURE 2

FORWARD AVERAGING: 1926-1930 UNTIL 1926-1997

FIGURE 3

BACKWARDS AVERAGING: 1993-7 TO 1926-1997

12. With a 20% standard deviation of annual equity returns, the standard error

of the estimated average return is 6.3% with 10 observations, 2.0% with 100, and

1.4% with 200. We would have to wait 10,000 years to get an estimate accurate

within 20 basis points! Not many managers can wait this long.

The justification given for the risk premium approach by Ibbotson and Sinquefeld

is based largely on assumption, not analysis of the evidence.

106

JOURNAL OF APPLIED CORPORATE FINANCE

A partial explanation for the results for the risk

premium average can be gained by looking at the

trend (shown in Figure 4) in fixed income yields over

time. Both the yield on long Treasuries and 90-day

T-bills are available back to 1934 and, when com-

bined, they certainly bracket the true risk-free rate

used in equity pricing. A simple visual examination

reveals that yields were quite constant until the early

1950s, when they began their long upward trend that

finished in the early 1980s; since then, they have

consistently trended downwards. Since it is the

change in yields that generates the uncertainty in the

holding period returns for long bonds, it is clear that

actual returns were lower than anticipated from the

1950s through 1980, and higher than anticipated in

the last 15 years or so. It is also clear that interest rate

risk and the term premium have not been constant

over the entire period.

Understanding the behavior of interest rates

over the last 72 years makes it clear that trends in

average equity returns and average equity risk

premiums have been affected by the significant

changes that have occurred in the bond market. It is

a reflection on the volatility in equity returns that the

clear trend in bond market yields and returns does

not generate a clearer pattern in the average equity

risk premiumone that would allow us to conclu-

sively state that whether or not the equity risk

premium series has followed a random walk with a

constant mean. However, although the saucer

shape of the average equity risk premium in Figure

3 could have resulted randomly, knowledge of the

trend in monetary policy that caused the temporal

change in market interest rates provides a clear

indication that the equity risk premium series has a

significant term bias.

WHAT HAS HAPPENED TO BOND MARKET

RETURNS?

The previous averaging data indicated that

neither the averages nor their volatility have been

constant over time, and that changes in the bond

market were a likely source of some of the prob-

lems. One way of looking at this is to examine

rolling instead of updated averages to see whether

either the average return or the volatility has changed

over time.

FIGURE 4

FIXED INCOME YIELDS

13. Variance ratio tests and Q autocorrelation tests indicate the absence of

significant autocorrelation in annual returns over the whole time period.

The interesting point about the backwards av-

eraging graph in Figure 3 is that, for all three series,

the average decreases as you add older data until

about 1966 (or 1980, in the case of the risk premium

average). At this point, they all begin to increase

before zeroing in on the long run average. Contrast-

ing the forward and backward averages, it is difficult

not to conclude that the latest period has witnessed

higher equity returns than the earlier period. This

conclusion comes from the slow oscillation in the

backwards averaging graphparticularly for the risk

premium average, which shows a definite saucer

shape. For the earliest period, there is initially more

volatility (but, as will be discussed later, it was a delib-

erate decision to create the Ibbotson and Sinquefeld

data starting five years prior to the most extreme value

of allthe 1929 stock market crash). As a result, the

1925 start date was not chosen randomly and the for-

ward averaging from 1925 is inherently biased.

The conclusion drawn from the forward and

backward averaging graphs in Figures 2 and 3 is that

there is so much volatility in the equity return series

that it is difficult to state conclusively whether any of

the series fits the random walk model with a constant

mean and variability. In fact, none of the series seem

to be free of bias, with the risk premium series having

the more obvious problems.

13

This in turn implies

that none of the simple averages can be used as a

naive forward-looking estimate for calculating dis-

count rates. This conclusion is particularly apt for the

risk premium series.

VOLUME 12 NUMBER 1 SPRING 1999

107

Figure 5 shows the standard deviation (volatil-

ity) of actual equity and bond returns over a rolling

ten-year period starting in 1926-1935 and ending

with the period 1988-1997. The choice of a ten-year

window is arbitrary, but it should capture a long

enough period to include a full business cycle and

yet be short enough to capture changes over time.

Some immediate implications are apparent.

First, note that equity market risk peaked during the

1930s, when as we saw earlier the forward average

return suffered the most oscillation, and then seems

to have declined ever since, punctuated by in-

creases caused by periodic major market move-

ments. Although this is probably the result of choos-

ing the 1925 start date, there is little in the data to

indicate that equity market risk has increased. In

fact, the data suggest the oppositenamely, that

equity market risk has been on a long-run secular

decline since the 1930s.

Also note that, in contrast to the equity market,

bond market risk has undoubtedly increased. Bond

market risk seemed to have been moderate in the

1930s, before declining into the 1940s and 1950s, a

period during which interest rates were tightly

controlled. As a result, there was relatively little bond

market uncertainty until 1982, when interest rates

plummeted.

14

From 1982 to 1997, the ten-year stan-

dard deviation of bond market returns was essen-

tially the same as the declining risk in the equity

market (even after the huge gains of 1982 rolled out

of the ten-year estimation window).

This change in bond market relative to equity

market risk raises questions about the assumption

(in equations (6) and (7)) that the error terms

generating equity and bond market uncertainty are

constant. In practice, it seems highly unlikely that

returns have been generated by processes with

constant error terms. A better working assumption

would be that the error term in equation (7) has

increased for bond market returns, while possibly

decreasing for the equity market. Moreover, if the

relative uncertainty has changed, it also seems likely

that investors have reacted by changing their ex-

pected return requirements. Why, for example,

would investors expect the same return from equi-

ties in the 1990s as in the 1930s, when equities have

been half as volatile? Moreover, why would investors

in the 1990s expect the same risk premium of equities

over long bonds as in the 1930s when stocks and

bonds had roughly the same level of riskas

compared to the 1930s when equities were six times

as volatile?

I will return to the equity market later, but there

are also more direct implications for the bond

market. If investors hold diversified portfolios, what

does the increased bond market risk mean for their

overall portfolio? That is, how much of the increased

interest rate risk is diversifiable?

Figure 6 shows the rolling bond market beta.

It is estimated from ten years of annual data (rather

than the normal five years of monthly data) to cap-

ture the effects of the assumed annual holding pe-

riod. What is immediately apparent is that the in-

crease in bond market volatility has been closely

associated with the levels of bond market betas. In

the 1930s, bond betas were of the order of 0.10, and

then they declined when interest rate controls were

imposed. They did not become significant again until

the 1980s. But, by 1990 (covering the period 1981-

1990), bond market betas had climbed to about 0.80!

Clearly, bond market uncertainty has had a system-

atic as well as an unsystematic component.

Figure 7 shows rolling bond market betas

estimated using a five-year window and monthly

rates of return. There is no reason risk should be the

same for a monthly as an annual investment hori-

FIGURE 5

UNCERTAINTY IN FINANCIAL MARKETS:

STANDARD DEVIATION OF RETURNS OVER ROLLING

TEN YEAR YEAR PERIODS

14. Note that higher interest income was offsetting capital losses on bonds as

interest rates increased. As a result, returns were less than anticipated, but bond

market volatility did not increase with the general level of interest rates. For

example, in 1979, 1980 and 1981 bond market returns were 1.2%, -3.9% and 1.9%,

in 1982 the return was 40.4% as higher interest income was combined with large

capital gains.

The choice of estimation technique can result in quite large differences in the

estimate of the expected equity return. Moreover, the standard error of the excess

return estimate is greater than the standard error of the direct estimate, implying

that the estimate of the risk premium has not benefited from any interest rate

factor risk driving equity returns over the whole period.

108

JOURNAL OF APPLIED CORPORATE FINANCE

zon, and a comparison of Figures 6 and 7 clearly

shows this. For example, although the beta esti-

mates show the same general patternlow esti-

mates initially, followed by a decline and then an

increase, as interest rates became increasingly more

volatilethere are differences. As the investment

horizon shortens, price volatility dominates income

volatility. Moreover, with a shorter window, ex-

treme unusual events pass out of the estimation

window more quickly. For example, the five-year

betas drop precipitously starting in October 1987.

The reason for this is the stock market crashed by

21.5%, and to prevent panic the Federal Reserve

lowered interest rates, causing a 6.2% bond market

return. This one negative correlation is so large that

all monthly estimates that include October 1987

show a break. As October 1987 passed out of the

five-year window in October 1992, beta estimates

started to increase again.

15

The above discussion of five-year versus ten-

year bond betas is important for two reasons. First,

it emphasizes the earlier conceptual problem with

investment horizons. Overall, 1987 was a good year

for the stock market, it actually went up by 5.2%,

while the bond market went down by 2.7%. As a

result, an investor with a one-year horizon would

look at 1987 differently from one with a one-month

horizon. Second, and more fundamental, risk doesnt

disappear just because an event has not happened

during a particular estimation period. Bond market

risk didnt increase in October 1992 simply because

there was no crash in the previous five-year period

and, as a result, no opportunity for bonds to demon-

strate their attributes as a safe harbor.

Even accounting for the subtleties of estimat-

ing bond market risk, it is clear from both the five-

and ten-year bond market betas, as well as the

volatility estimates, that bond market risk has sub-

stantially increased in the last third of the period

1926-1997. It is highly unlikely, as a result, that the

term premium demanded by long-term bond inves-

tors was the same in this latter period as in the

earlier period. As a result, the term premium bias

in using the equity risk premium over bond yield

method is likely to be substantial. For example, in

equation (8) the implicit term premium subtracted

from the estimated average risk premium will be

weighted 2/3rds for the period when the term

premium was very low and only 1/3rd for the latter

period, when it was high. This risk premium will

then be added to a current long-term bond yield

that fully reflects the current term premium. As a

result, the bond yield plus method will unambigu-

ously overestimate equity discount rates.

To put the same thing a little differently, if

interest rate risk is a factor in market risk (as the large

and significant bond market betas indicate), then

bonds should be priced according to the CAPM as

well as equities. In this case, the equity risk premium

over long term bonds is as follows:

ERP = (E(R

M

) R

F

) * (

e

l

) (11)

FIGURE 6

US TREASURY BETAS

FIGURE 7

BOND MARKET BETAS

15. In daily data, as an extreme, almost all the volatility is from price changes.

VOLUME 12 NUMBER 1 SPRING 1999

109

In the earlier period, where the bond market

risk was low (with bond betas of 0.1), the estimated

excess return of equities over long term bonds was

estimating almost the full equity risk premium. But,

in the later period when bond market risk was high

(with bond betas of 0.8) it is only estimating part of

the full risk premium. Adding an average of these

excess returns to the current risky long term bond

yield will produce an upward-biased equity cost. In

fact, if current bond beta estimates of 0.5-0.6 are

valid, the risk premium of low risk equities over long

term bonds should be close to zero. This has major

implications for low-risk stocks, like regulated utili-

ties, that have betas in the 0.5-0.6 range, and yet

estimate equity costs by the bond yield plus method.

WHAT HAS HAPPENED TO EQUITY MARKET

RETURNS

If the evidence from the bond market is that the

term premium bias in the average equity risk pre-

mium estimate is significant, what about the equity

market and the risk-free and inflation rate biases

discussed earlier? Here what is important is that, once

we recognize that the term premium bias invalidates

the average excess return over bonds (and that the

excess return over T-bills is not a meaningful num-

ber), we should then look objectively at the data on

equity market returns in isolation from the bond and

bill markets.

Data on the equity market has been pushed

back to 1802 by Schwert.

16

However, the earlier

period only includes railroads and financial firms.

In an article published in 1987, Wilson and Jones

17

cleaned up the original Cowles data set that

extends back to 1871. As Wilson and Jones explain,

this is data of comparable quality to the Ibbotson

and Sinquefeld data that starts in December 1925.

The only reason for starting in December 1925 was

Fisher and Lories

18

desire to capture at least a full

business cycle before the 1929 stock-market crash,

a practice followed by Ibbotson and Sinquefeld.

This in turn explains why the equity return series

does not start at a random point in time, instead it

deliberately starts five years prior to the great crash,

which biases both the volatility and average return

estimates. The Cowles data starts in 1871, when it

consisted of 31 railroads, 4 utilities, and 13 industri-

als; by 1925 it consisted of 29 railroads, 22 utilities,

and 207 industrials. The 1871 start date is random in

turns of subsequent return estimates, since it was

chosen for other reasons.

19

The forward averaging of the returns is re-

peated for the overall period in Figure 8. Note that

the nominal return does not seem to have a con-

stant mean. The series oscillates for the first 20 years

or so, but then increases almost continuously from

the low around 1890. In contrast, the forward

average of the real equity returns starts out higher

(since there was deflation almost throughout the

latter part of the 19th century), and finishes lower

(because of the more recent inflationary period).

The average of the real equity return looks more

like a random walk with a constant mean, since it

does not show a drift over time.

The backwards averaging is shown in Figure 9.

Again the last observation on the right is for the

period 1993-1997 and, as the data moves closer to the

origin, older data is added until the first observation

for 1871, which is the average for the whole period

1871-1997. Note that the averages again fall, reflect-

FIGURE 8

FORWARD AVERAGING: FROM 1871-1875 TO 1871-1997

16. G. William Schwert, Indexes of Common Stock Returns from 1802 to

1987, Journal of Business 63-3, 1990.

17. J. W. Wilson and C. P. Jones, A Comparison of Annual Common Stock

returns: 1871-1925 with 1926-1985, Journal of Business 60-2, 1987. This is also the

source of the early inflation data.

18. L. Fisher and J. Lorie, Rates of Return on Investments in Common Stocks,

Journal of Business 37-1, 1964.

19. The original Cowles data apparently started in 1871 for two main reasons:

first, prior to that date the market was basically railroad stocks; second there were

a large number of changes in both securities regulation and trading rules on the

NYSE introduced in the 1860s. Neither reason is cause for concern that the start

date was chosen specifically to include particular return observations.

If current bond beta estimates of 0.5-0.6 are valid, the risk premium of low risk

equities over long term bonds should be close to zero. This has major implications

for low-risk stocks, like regulated utilities, that have betas in the 0.5-0.6 range.

110

JOURNAL OF APPLIED CORPORATE FINANCE

ing the recent equity bull market, but that the

nominal average continues to fall almost continu-

ously through to 1871. In contrast, the average of the

real returns falls through to 1971, increases back to

1951, and then zeros in on the long-run average.

Again, of the two series, only the average of the real

equity return seems to be consistent with a random

walk model with a constant expected (real) return.

If the average real equity return seems to be the

only candidate for a simple estimate of the long-run

equity market return, we need to determine if the

long-run average hides obvious periods of vary-

ing returns. To see this, Figure 10 gives the rolling

ten-year average of the real equity return. Over the

whole time period, the average real equity return

was 9.02%, and the standard error of the estimate is

1.71%.

20

However, for an estimate from ten years of

data the standard error is 6.1%, so that we can

expect, with a 95% confidence interval, the ten-year

average real return estimate to be between about

13% and 21%! The actual mean estimates are just

within this range, but the significant point is that

there does not seem to be any trend across time.

Current average real equity returns are close to the

high teens that were experienced prior to the 1929

stock market crash and the high inflation period of

the 1970s, both of which subsequently saw much

lower real equity returns.

In Figure 11, the volatility of real equity market

returns is measured in the same way as a rolling ten-

year standard deviation of real returns. Similar to the

average equity return, the volatility is subject to

estimation error and fluctuates quite widely depend-

ing on whether or not an extreme value occurs

during the rolling ten-year period. For example the

standard deviation of real equity returns was about

19% until 1889, when the 57% gain of 1879 dropped

out of the estimation window. The volatility then

stayed around 12-13% until 1907 when the real

equity return was 30.8% followed by +47% in 1908.

Overall, between 1871 and 1997, the standard devia-

tion of real equity returns was 19.24%.

A final way of looking at the volatility of real

equity returns is to graph the absolute value of their

annual returns (see Figure 12). The reason for

FIGURE 9

BACKWARDS AVERAGING: FROM 1993-1997 TO 1871-1997

FIGURE 10

AVERAGE REAL EQUITY RETURNS: ROLLING 10 YEAR

AVERAGE

FIGURE 11

VOLATILITY IN REAL EQUITY: ROLLING 10 YEAR

ESTIMATE

20. The average nominal return was 11.04% with a standard error of 1.67%

VOLUME 12 NUMBER 1 SPRING 1999

111

looking at absolute values is that it is the magnitude

of the extreme returns that causes the fluctuation in

the volatility estimate and not their sign. Drawing

inferences as to whether the equity market has

become more volatile over the last 129 years from

Figure 12 is extremely difficult. Major market move-

ments seem to occur every 20 to 30 years and have

done so for the last 129 years. Also the Great Crash

of 1929 is an outlier, primarily because it was a

downwards correction, though annual returns of a

similar magnitude have occurred at other times in

the past.

21

In sum, the volatility figures shown above

suggest that Ibbotson and Sinquefelds choice of

1925-1997 data (with its start date so close to the

Great Crash) is largely responsible for the conclu-

sion that risk has decreased in the equity market. If

we instead use data going back to 1871, it becomes

much more difficult to justify a decreasing risk

conclusion. Instead, it is hard not to conclude that

the equity return is approximately driven by a real

return process with a mean of about 9.0% and a

constant error term.

CONCLUSION

Estimating discount rates is a critical part of

finance. The standard approach based on risk-based

pricing models, such as the CAPM, is to estimate

equity returns based on a risk-free rate plus a risk

premium. For conventional valuation and capital

budgeting purposes it is well accepted that the risk-

free rate should be a long Treasury yield. In contrast,

Ibbotson and Sinquefeld suggest that the equity risk

premium be estimated over Treasury bills, based on

the assumption that the equity risk premium, and not

the full equity return, follows a random walk with a

constant mean. This idea has also been adopted for

estimating equity returns as a premium over long

bond yields, with the implicit assumption that the

excess return of equities over long bond returns also

follows a random walk.

In this paper, the assumptions underlying these

estimation techniques have been investigated. Three

specific models have been examinednamely, that

(1) the nominal equity return, (2) the real equity

return and (3) the equity risk premium over long

bonds each follows a random walk with a constant

mean. All of these models cannot be true simulta-

neously, and a priori none of them is expected to be

true. If nominal returns are determined as a true risk-

free rate plus a constant equity risk premium, there

will be a risk-free rate bias to using the nominal

equity return as an estimate of future equity returns.

Similarly, if the nominal return is determined as a

constant real rate over the expected inflation rate,

then there will be an inflation rate bias to the average

nominal return. In this case, the bias can be removed

by looking at realized real equity returns. Finally, if

the riskiness of equity or bonds has changed over

time, the equity risk premium will be distorted by a

term premium bias.

The main conclusions of this paper are as

follows:

(1) Examination of bond market performance

and market interest rates experienced since 1925

make it abundantly clear that the term premium

bias is significant. As a result, the long- run realized

excess equity return over long-term bonds cannot

be used as a risk premium to add to current long-

term bond yields.

(2) Total bond market risk (as measured by

standard deviation of returns) has significantly in-

creased over the last 20 years, and at times has been

almost equal to that of the equity market. This

indicates that the equity risk premium over long term

bonds is unlikely to have been constant.

FIGURE 12

ABSOLUTE ANNUAL RETURNS

21. Note all the return estimates are simple annual rates of return, they are not

the log relative, which would follow from a continuous time lognormal model of

stock prices.

Ibbotson and Sinquefelds choice of 1925-1997 data (with its start date

so close to the Great Crash) is largely responsible for the conclusion that

risk has decreased in the equity market. If we instead use data going back to 1871,

the equity return appears to be driven by a real return process with a mean of

about 9.0% and a constant error term.

112

JOURNAL OF APPLIED CORPORATE FINANCE

(3) Bond market betas, whether measured based

on ten-year annual returns or five-year monthly

returns, have increased from the negligible level

prior to the 1970s to the 0.40-0.80 range by 1990s.

As a result, conventional risk premiums over long-

term bond yields that may have been valid in

earlier periods are excessive in the current interest

rate environment.

(4) With bond market betas of 0.40-0.80, risk

premiums for lower risk equity securities, such as

utilities, should be close to zero.

(5) When equity market data back to 1871 is

examined, the nominal equity return has clearly not

followed a random walk with a constant mean. As a

result, it is not reasonable to take an average nominal

equity return over even a very long period as a proxy

for expected nominal equity returns. The inflation

rate bias indicates that this average nominal return

will only by coincidence be an accurate estimate of

future nominal equity returns.

(6) The real equity return, in contrast to the nominal

equity return, seems to show no major drift over time,

whether it is averaged forwards or backwards.

(7) The standard error of the real return estimate

of 1.71% means that estimating the average return

over short time periods (say ten years) is subject to

considerable estimation risk. Indeed, estimating the

average equity return to within 1.0% of the true mean,

if it is in fact constant, will take about 400 years.

(8) The standard deviation of real equity returns

has averaged about 19%, and fluctuated between

12% and 30%, based on ten-year estimates. The

estimates are critically dependent on the timing of

periodic major market movements and whether or

not they happen to fall within the estimation win-

dow. Overall, there is little to suggest that over the

whole period 1871-1997 stock market risk has changed

significantly . There is evidencefocusing only on

the Ibbotson and Sinquefeld period that starts in

1925that equity risk has declined. However, this

conclusion is due to the extreme stock market

volatility at the time of the Great Crash of 1929, which

determined the start point of their time period in the

first place!

The above conclusions are broad and impor-

tant, but the central message is simple: The familiar

approach of adding a constant equity risk premium

to the long-term bond yield is suspect, as long as the

equity risk premium is mechanically estimated as a

simple average of past excess returns. Instead,

examining the broad scope of stock market history

would suggest that a better forecasting method is to

add a current inflation expectation to the average

real equity return of about 9.00%. At the current point

in time, this would probably indicate an equity return

of just over 11.0%, rather than the 13% plus obtained

from adding an historic equity risk premium to a

current long Treasury yield.

LAURENCE BOOTH

holds the Newcourt Chair in Structured Finance at the University

of Torontos Rotman School of Management.

Journal of Applied Corporate Finance (ISSN 1078-1196 [print], ISSN

1745-6622 [online]) is published quarterly on behalf of Morgan Stanley by

Blackwell Publishing, with ofces at 350 Main Street, Malden, MA 02148,

USA, and PO Box 1354, 9600 Garsington Road, Oxford OX4 2XG, UK. Call

US: (800) 835-6770, UK: +44 1865 778315; fax US: (781) 388-8232, UK:

+44 1865 471775, or e-mail: subscrip@bos.blackwellpublishing.com.

Information For Subscribers For new orders, renewals, sample copy re-

quests, claims, changes of address, and all other subscription correspon-

dence, please contact the Customer Service Department at your nearest

Blackwell ofce.

Subscription Rates for Volume 17 (four issues) Institutional Premium

Rate* The Americas

$330, Rest of World 201; Commercial Company Pre-

mium Rate, The Americas $440, Rest of World 268; Individual Rate, The

Americas $95, Rest of World 70, 105

; Students**, The Americas $50,

Rest of World 28, 42.

*Includes print plus premium online access to the current and all available

backles. Print and online-only rates are also available (see below).

Customers in Canada should add 7% GST or provide evidence of entitlement

to exemption

Customers in the UK should add VAT at 5%; customers in the EU should also

add VAT at 5%, or provide a VAT registration number or evidence of entitle-

ment to exemption

** Students must present a copy of their student ID card to receive this

rate.

For more information about Blackwell Publishing journals, including online ac-

cess information, terms and conditions, and other pricing options, please visit

www.blackwellpublishing.com or contact our customer service department,

tel: (800) 835-6770 or +44 1865 778315 (UK ofce).

Back Issues Back issues are available from the publisher at the current single-

issue rate.

Mailing Journal of Applied Corporate Finance is mailed Standard Rate. Mail-

ing to rest of world by DHL Smart & Global Mail. Canadian mail is sent by

Canadian publications mail agreement number 40573520. Postmaster

Send all address changes to Journal of Applied Corporate Finance, Blackwell

Publishing Inc., Journals Subscription Department, 350 Main St., Malden, MA

02148-5020.

Journal of Applied Corporate Finance is available online through Synergy,

Blackwells online journal service which allows you to:

Browse tables of contents and abstracts from over 290 professional,

science, social science, and medical journals

Create your own Personal Homepage from which you can access your

personal subscriptions, set up e-mail table of contents alerts and run

saved searches

Perform detailed searches across our database of titles and save the

search criteria for future use

Link to and from bibliographic databases such as ISI.

Sign up for free today at http://www.blackwell-synergy.com.

Disclaimer The Publisher, Morgan Stanley, its afliates, and the Editor cannot

be held responsible for errors or any consequences arising from the use of

information contained in this journal. The views and opinions expressed in this

journal do not necessarily represent those of the Publisher, Morgan Stanley,

its afliates, and Editor, neither does the publication of advertisements con-

stitute any endorsement by the Publisher, Morgan Stanley, its afliates, and

Editor of the products advertised. No person should purchase or sell any

security or asset in reliance on any information in this journal.

Morgan Stanley is a full service nancial services company active in the securi-

ties, investment management and credit services businesses. Morgan Stanley

may have and may seek to have business relationships with any person or

company named in this journal.

Copyright 2004 Morgan Stanley. All rights reserved. No part of this publi-

cation may be reproduced, stored or transmitted in whole or part in any form

or by any means without the prior permission in writing from the copyright

holder. Authorization to photocopy items for internal or personal use or for the

internal or personal use of specic clients is granted by the copyright holder

for libraries and other users of the Copyright Clearance Center (CCC), 222

Rosewood Drive, Danvers, MA 01923, USA (www.copyright.com), provided

the appropriate fee is paid directly to the CCC. This consent does not extend

to other kinds of copying, such as copying for general distribution for advertis-

ing or promotional purposes, for creating new collective works or for resale.

Institutions with a paid subscription to this journal may make photocopies for

teaching purposes and academic course-packs free of charge provided such

copies are not resold. For all other permissions inquiries, including requests

to republish material in another work, please contact the Journals Rights and

Permissions Coordinator, Blackwell Publishing, 9600 Garsington Road, Oxford

OX4 2DQ. E-mail: journalsrights@oxon.blackwellpublishing.com.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 8603Dokument18 Seiten8603Charles100% (1)

- Year6 - GLO-BUS Decisions & Reports - ResultsDokument16 SeitenYear6 - GLO-BUS Decisions & Reports - ResultsYFAINNoch keine Bewertungen

- Careers in Financial Markets 2014 (Efinancialcareers)Dokument64 SeitenCareers in Financial Markets 2014 (Efinancialcareers)Cups upNoch keine Bewertungen

- 16 Rules For Investing - Sir John TempletonDokument20 Seiten16 Rules For Investing - Sir John Templetonjude55Noch keine Bewertungen

- Capital Market V/s Money MarketDokument23 SeitenCapital Market V/s Money Marketsaurabh kumarNoch keine Bewertungen

- New Companies Act 2013 Solved With ChartsDokument36 SeitenNew Companies Act 2013 Solved With ChartsRam IyerNoch keine Bewertungen

- Revision 1 AFIFI AnswersDokument7 SeitenRevision 1 AFIFI AnswersimieNoch keine Bewertungen

- Mortgage - S. 58 TPADokument3 SeitenMortgage - S. 58 TPAAbhinav SrivastavNoch keine Bewertungen

- Bloomberg Assessment Test Pre Course: 10 Hours in 10 ClassesDokument24 SeitenBloomberg Assessment Test Pre Course: 10 Hours in 10 ClassesShivgan JoshiNoch keine Bewertungen

- Accounting & Auditing Solved MCQsDokument444 SeitenAccounting & Auditing Solved MCQsSmile Ali92% (12)

- ZeeFreaks - Swing Trading vs. Trend FollowingDokument5 SeitenZeeFreaks - Swing Trading vs. Trend FollowingcyrenetpaNoch keine Bewertungen

- Quarterly Report Q3 2010 MJNADokument20 SeitenQuarterly Report Q3 2010 MJNAcb0bNoch keine Bewertungen

- Astral Records LTD., North America: Some Financial Concerns: October 2008Dokument11 SeitenAstral Records LTD., North America: Some Financial Concerns: October 2008MbavhaleloNoch keine Bewertungen

- Nigerian AMCON UpdateDokument7 SeitenNigerian AMCON UpdateOluwatosin AdesinaNoch keine Bewertungen

- Equity Notes PDFDokument119 SeitenEquity Notes PDFShäränyä SubramaniamNoch keine Bewertungen

- ACCA P2INT Notes J15 PDFDokument256 SeitenACCA P2INT Notes J15 PDFopentuitionID100% (1)

- Growth at A Reasonable Price - GARP Growth at A Reasonable Price - GARPDokument2 SeitenGrowth at A Reasonable Price - GARP Growth at A Reasonable Price - GARPnetra14520Noch keine Bewertungen

- Brookfield Letter To General Growth Re Reorganization PlanDokument7 SeitenBrookfield Letter To General Growth Re Reorganization PlanDealBookNoch keine Bewertungen

- Optimal Portfolio Jaggu ProjectDokument85 SeitenOptimal Portfolio Jaggu Projectvinodkumar8545Noch keine Bewertungen

- Cash Flow and Company Valuation Analysis PDFDokument20 SeitenCash Flow and Company Valuation Analysis PDFDHe DestyNoch keine Bewertungen

- Tax Planning of RelianceDokument35 SeitenTax Planning of RelianceDhaval DevmurariNoch keine Bewertungen

- Presented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantDokument17 SeitenPresented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantSagar ShahNoch keine Bewertungen

- Financial Performance Analysis On Dhaka Bank LTDDokument15 SeitenFinancial Performance Analysis On Dhaka Bank LTDনূরুল আলম শুভNoch keine Bewertungen

- C.A IPCC May 2008 Tax SolutionsDokument13 SeitenC.A IPCC May 2008 Tax SolutionsAkash GuptaNoch keine Bewertungen

- Ubs SBC MergerDokument10 SeitenUbs SBC Mergerachint1Noch keine Bewertungen

- Tilson Update of Berkshire's Intrinsic ValueDokument28 SeitenTilson Update of Berkshire's Intrinsic ValueCanadianValueNoch keine Bewertungen

- A Study On Financial Performance and Governance in Indian Aviation SectorDokument6 SeitenA Study On Financial Performance and Governance in Indian Aviation SectorFir BhiNoch keine Bewertungen

- Merchantlist PDFDokument201 SeitenMerchantlist PDFrahulNoch keine Bewertungen

- SSRN Id2607730Dokument84 SeitenSSRN Id2607730superbuddyNoch keine Bewertungen